North America Torque Vectoring Market

Market Size in USD Billion

CAGR :

%

USD

3.15 Billion

USD

11.79 Billion

2024

2032

USD

3.15 Billion

USD

11.79 Billion

2024

2032

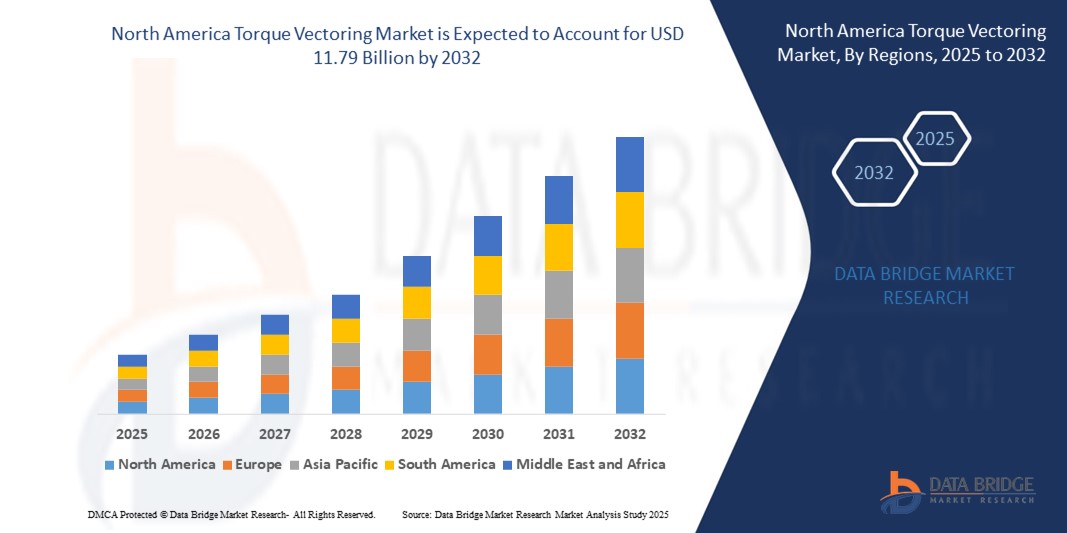

| 2025 –2032 | |

| USD 3.15 Billion | |

| USD 11.79 Billion | |

|

|

|

|

North America Torque Vectoring Market Size

- The North America torque vectoring market size was valued at USD 3.15 billion in 2024 and is expected to reach USD 11.79 billion by 2032, at a CAGR of 17.90% during the forecast period

- The market growth is largely fuelled by the rising demand for high-performance and fuel-efficient vehicles, along with growing adoption of advanced drivetrain technologies across both electric and internal combustion engine vehicles

- Increasing consumer inclination toward enhanced vehicle safety and control, especially in adverse weather conditions, is further propelling the demand for torque vectoring systems across the region

North America Torque Vectoring Market Analysis

- Technological advancements in automotive safety and handling dynamics are pushing automakers to integrate torque vectoring systems in a wide range of passenger and commercial vehicles

- The presence of major automotive manufacturers, along with increasing investments in electric vehicle (EV) development, is accelerating the adoption of torque vectoring solutions in the U.S. and Canada

- U.S. torque vectoring market held the largest revenue share of 79.5% in 2024 within North America, fueled by the country’s leadership in vehicle technology advancements and robust automotive sales

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America torque vectoring market due to increasing demand for all-wheel-drive vehicles, government incentives for electric mobility, and rising collaborations between local automotive suppliers and global players in powertrain innovation

- The hardware segment dominated the market with the largest revenue share in 2024, attributed to the high integration of electronic control units, sensors, and actuators in advanced powertrain systems. These components are essential for real-time torque distribution and play a critical role in ensuring vehicle stability and cornering precision. The demand for robust, performance-oriented vehicles is accelerating the deployment of such hardware across premium and mid-sized vehicles

Report Scope and North America Torque Vectoring Market Segmentation

|

Attributes |

North America Torque Vectoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

• BorgWarner Inc. (U.S.) |

|

Market Opportunities |

• Expansion of Electric and Hybrid Vehicles in Luxury Segment |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

North America Torque Vectoring Market Trends

Growing Integration of Torque Vectoring in Electric and All-Wheel Drive Vehicles

- The increasing electrification of vehicles and demand for improved handling dynamics are accelerating the adoption of torque vectoring technology across North America. As electric and hybrid vehicles often utilize dual or multiple motors, torque vectoring becomes a critical feature to manage power distribution efficiently, enhancing traction and driving experience

- The growing popularity of all-wheel drive (AWD) configurations in SUVs and performance vehicles is also contributing to the trend. Torque vectoring enables real-time power adjustments to individual wheels, ensuring better stability and cornering under various road conditions. This is particularly valuable in regions with variable climates, such as the U.S. and Canada

- Automakers are now integrating software-driven torque vectoring systems that allow customizable driving modes, offering drivers more control over handling and responsiveness. These systems not only elevate driving safety but also enhance user engagement, making them a preferred choice in both premium and mid-range vehicles

- For instance, in 2023, a leading U.S.-based electric vehicle manufacturer launched a new SUV model equipped with AI-assisted torque vectoring, enabling superior torque distribution and energy optimization for both on-road and off-road use

- While the shift toward EVs and AWD vehicles drives torque vectoring uptake, continuous improvements in sensor technologies and control algorithms are essential to ensure system accuracy and responsiveness. Manufacturers must invest in hardware-software integration and user-friendly interfaces to unlock the full potential of these systems

North America Torque Vectoring Market Dynamics

Driver

Rise in Performance-Oriented Vehicle Demand and Safety Regulations

• The demand for high-performance vehicles with enhanced safety and control features is fueling the adoption of advanced torque vectoring systems in the North American market. Consumers are increasingly seeking vehicles that offer better acceleration, cornering, and braking, especially in sports utility vehicles (SUVs) and premium sedans. Torque vectoring delivers these benefits by dynamically adjusting torque to each wheel

• Regulatory agencies in North America, such as the National Highway Traffic Safety Administration (NHTSA), have heightened safety mandates, encouraging automakers to incorporate systems that offer improved vehicle stability and traction control. Torque vectoring complements electronic stability control systems and anti-lock braking systems, thereby aligning with evolving safety standards

• Automakers are also leveraging torque vectoring to meet fuel efficiency and emissions reduction targets. By distributing torque more effectively, these systems reduce unnecessary power loss and optimize engine performance. This dual benefit of performance and efficiency is particularly attractive in an increasingly competitive automotive landscape

• For instance, in 2024, a Canadian automotive firm collaborated with a drivetrain technology provider to develop cost-effective torque vectoring modules for integration into compact hybrid crossovers, targeting both safety-conscious and environmentally aware consumers

• Despite growing awareness and regulatory backing, there remains a need for greater consumer education and training among service technicians to support widespread adoption. Manufacturers should focus on simplifying integration processes and offering post-sale support to ensure sustained market growth

Restraint/Challenge

High System Costs and Complex Integration with Existing Drivetrains

• One of the primary restraints in the North America torque vectoring market is the high cost associated with system components and integration. Advanced electronic control units, sensors, actuators, and software packages significantly increase the vehicle's overall production cost, limiting adoption in low- to mid-range models

• Retrofitting torque vectoring systems into conventional drivetrains is also technically challenging. Most traditional vehicles are not designed to accommodate such dynamic power management systems, leading to compatibility issues and costly engineering efforts. These challenges can delay time-to-market and reduce scalability

• The complexity of torque vectoring technology also requires skilled technicians for installation, diagnostics, and maintenance. A lack of widespread training in automotive repair networks can lead to longer service times and increased consumer hesitance, particularly in rural or underserved areas

• For instance, in 2023, several U.S. dealerships reported delays in delivering newly launched EVs with torque vectoring due to integration issues with third-party drivetrain modules, highlighting the need for more streamlined manufacturing processes

• As automotive software and hardware ecosystems grow more sophisticated, it is critical for companies to invest in standardization, modular components, and collaboration with OEMs and suppliers to reduce costs, ensure seamless integration, and support long-term market viability.

North America Torque Vectoring Market Scope

The market is segmented on the basis of component, technology, clutch actuation type, driving wheel type, vehicle type, and propulsion type.

- By Component

On the basis of component, the torque vectoring market is segmented into hardware and services. The hardware segment dominated the market with the largest revenue share in 2024, attributed to the high integration of electronic control units, sensors, and actuators in advanced powertrain systems. These components are essential for real-time torque distribution and play a critical role in ensuring vehicle stability and cornering precision. The demand for robust, performance-oriented vehicles is accelerating the deployment of such hardware across premium and mid-sized vehicles.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising needs for system maintenance, software calibration, and real-time diagnostics. As vehicles become increasingly complex, automakers and service providers are offering subscription-based services and remote performance monitoring, ensuring system efficiency, safety, and compliance throughout the vehicle's lifespan.

- By Technology

On the basis of technology, the market is segmented into Active Torque Vectoring System (ATVS) and Passive Torque Vectoring System (PTVS). The ATVS segment held the largest revenue share in 2024, driven by its advanced functionality to dynamically distribute torque based on driving conditions, steering angle, and traction data. ATVS is widely adopted in electric and all-wheel-drive vehicles due to its enhanced safety, agility, and control

The PTVS segment is expected to witness the fastest growth rate from 2025 to 2032, primarily due to its cost-effectiveness and application in entry-level vehicles. While less responsive than active systems, passive torque vectoring still improves cornering stability and traction without complex electronic control, making it suitable for budget-conscious segments.

- By Clutch Actuation Type

On the basis of clutch actuation type, the market is segmented into electric and hydraulic. The hydraulic segment led the market in 2024, owing to its widespread use in traditional internal combustion engine vehicles and established reliability in high-performance applications. Hydraulic systems offer high force capacity, making them ideal for rapid torque adjustments during dynamic driving.

The electric segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rise of electrified vehicles and a shift toward more energy-efficient and responsive systems. Electric actuation also allows for more precise torque control and easier integration with software-based vehicle management systems, enhancing user experience and performance.

- By Driving Wheel Type

On the basis of driving wheel type, the market is categorized into Rear-Wheel Drive (RWD), Front-Wheel Drive (FWD), and All-Wheel Drive/Four-Wheel Drive (AWD/4WD). The AWD/4WD segment accounted for the largest share in 2024 due to growing demand for vehicles capable of handling diverse terrains and weather conditions. Torque vectoring significantly improves traction and control in these systems, enhancing their appeal in utility, off-road, and luxury vehicle categories.

The FWD segment is expected to witness the fastest growth rate from 2025 to 2032, especially in compact passenger cars where manufacturers are beginning to implement lightweight, simplified torque vectoring systems to improve performance and cornering without incurring substantial costs.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, commercial vehicles, and off-road vehicles. The passenger cars segment held the dominant share in 2024, attributed to strong consumer demand for advanced driving technologies and vehicle safety. Torque vectoring is increasingly incorporated in mid-size and premium car models to offer enhanced ride quality, fuel efficiency, and driving dynamics.

The off-road vehicles segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising interest in adventure and recreational vehicles. These vehicles require superior torque management to handle challenging terrains, making torque vectoring a critical feature for performance and safety.

- By Propulsion Type

On the basis of propulsion type, the market is divided into Diesel/Petrol/CNG and Electric Vehicle. The Diesel/Petrol/CNG segment dominated in 2024 due to the legacy vehicle base and widespread use in commercial and personal transport across North America. Torque vectoring systems are well-established in this category, particularly in sports and utility vehicles.

The electric vehicle segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the increasing shift toward electrification and the natural compatibility of torque vectoring with electric drivetrains. Dual-motor and multi-motor EV setups allow precise, software-controlled torque distribution, making torque vectoring an integral part of performance enhancement and energy optimization in electric mobility.

North America Torque Vectoring Market Regional Analysis

- U.S. torque vectoring market held the largest revenue share of 79.5% in 2024 within North America, fueled by the country’s leadership in vehicle technology advancements and robust automotive sales

- Consumers are increasingly drawn to performance-enhancing features, particularly in sports cars and luxury SUVs, where precise torque control contributes to improved cornering and stability

- Furthermore, rising demand for electric and hybrid vehicles equipped with dynamic control systems is accelerating the integration of torque vectoring technologies

- The market also benefits from the presence of major automakers and component suppliers actively investing in intelligent driveline solutions to cater to evolving performance and safety standards

Canada Torque Vectoring Market Insight

The Canada torque vectoring market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for electric vehicles and advanced driveline technologies. The Canadian government’s strong emphasis on sustainable mobility, along with incentives for electric and hybrid vehicle adoption, is fostering the deployment of intelligent torque distribution systems. Moreover, the country’s challenging weather conditions and varied terrains increase the demand for all-wheel-drive and enhanced traction control solutions, making torque vectoring systems a valuable component in both passenger and commercial vehicles.

North America Torque Vectoring Market Share

The North America Torque Vectoring industry is primarily led by well-established companies, including:

• BorgWarner Inc. (U.S.)

• Dana Incorporated (U.S.)

• American Axle & Manufacturing, Inc. (U.S.)

• Eaton Corporation (U.S.)

• JTEKT North America Corporation (U.S.)

• Linamar Corporation (Canada)

• Magna International Inc. (Canada)

• Timken Company (U.S.)

Latest Developments in North America Torque Vectoring Market

- In February 2023, American Axle & Manufacturing Holdings, Inc. entered into collaborative agreements with NIO and Mercedes to develop high-performance hybrid-electric systems and electric vehicle components. Featuring a P3 layout with the electric motor positioned on the rear axle, the system aims to enhance weight distribution and output torque. This advancement is expected to improve vehicle efficiency and performance, strengthening the company’s position in the evolving EV market

- In October 2022, Magna launched its 48-volt hybrid dual-clutch transmission, first integrated into vehicles such as the Jeep Renegade, Compass e-Hybrid, Tipo, and Fiat 500 X. This technology delivers improved fuel efficiency and vehicle performance. The rollout across multiple models reflects Magna’s dedication to expanding its sustainable mobility offerings and bolstering its presence in hybrid technology

- In December 2021, Magna introduced its EtelligentReach system, featuring vehicle dynamics controllers with a disconnect function and longitudinal torque vectoring. This innovation enhances efficiency and driving performance while lowering CO2 emissions. It underscores Magna’s continued investment in next-generation sustainable vehicle solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.