North America Trade Surveillance Market

Market Size in USD Billion

CAGR :

%

USD

0.74 Billion

USD

2.94 Billion

2024

2032

USD

0.74 Billion

USD

2.94 Billion

2024

2032

| 2025 –2032 | |

| USD 0.74 Billion | |

| USD 2.94 Billion | |

|

|

|

|

North America Trade Surveillance Market Size

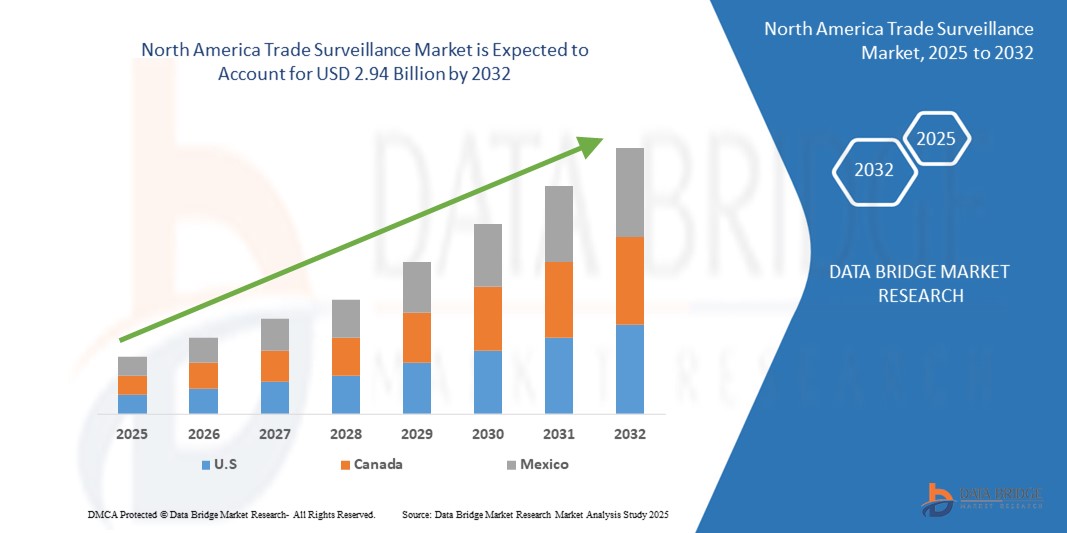

- The North America Trade Surveillance market size was valued at USD 0.74 billion in 2024 and is expected to reach USD 2.94 billion by 2032, at a CAGR of 18.9% during the forecast period

- The North America Trade Surveillance market is driven by increasing regulatory requirements, rising financial market complexities, and the growing adoption of AI and machine learning for real-time trade monitoring. Additionally, expanding financial sectors and improving technological infrastructure contribute significantly to market growth.

North America Trade Surveillance Market Analysis

- Trade surveillance systems in the North America region are becoming essential for monitoring, analysing, and detecting suspicious trading activities across diverse financial markets. These systems are replacing manual oversight processes in exchanges, investment firms, and banks, ensuring compliance with increasingly stringent regulatory requirements and maintaining market transparency. These systems are crucial for identifying risks such as market manipulation, insider trading, and fraudulent activities in real-time.

- The North America Trade Surveillance Market is driven by the rapid growth of digital trading platforms, the rise of fintech innovations, and increasingly complex regulatory frameworks. Enhanced surveillance capabilities powered by AI and machine learning are enabling financial institutions to better detect fraudulent activities, manage risk, and ensure compliance. The region's growing focus on cybersecurity and market integrity also fuels the market's expansion.

- U.S. is expected to emerge as a dominant player in the North America Trade Surveillance market. The country’s advanced financial infrastructure, progressive regulatory environment, and proactive stance on financial crime prevention make it a key player in the surveillance space. The Singaporean government’s commitment to fostering a robust financial services sector, alongside initiatives to implement advanced technologies such as blockchain and AI in monitoring, is expected to drive the market forward.

- U.S. is predicted to be the fastest-growing region in the North America Trade Surveillance market. The country’s rapidly expanding financial sector, increasing regulatory measures, and a push toward digital banking are key factors contributing to this growth. As financial institutions in India adopt more sophisticated monitoring tools, there is an increasing need for scalable surveillance systems to address issues such as fraudulent trading practices and cyber threats.

- The solution segment is expected to dominate the North America Trade Surveillance market, with a market share of 60.7% during the forecast period. The growing demand for integrated, real-time surveillance tools that offer advanced analytics, automated compliance tracking, and enhanced risk detection. These solutions are essential for financial institutions managing complex regulatory requirements.

Report Scope and North America Trade Surveillance Market Segmentation

|

Attributes |

North America Trade Surveillance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Trade Surveillance Market Trends

“Rise of Cloud-Based Surveillance Solutions for Scalability and Flexibility”

- The North America Trade Surveillance market is experiencing a shift toward cloud-based solutions that offer scalability and flexibility, enabling financial institutions to monitor vast and varied trade data in real time across multiple platforms and asset classes.

- Cloud-based systems facilitate seamless integration, faster data processing, and enhanced scalability, accommodating the rapid growth in trading volumes and the need for compliance across different jurisdictions. These systems are also helping reduce operational costs by eliminating the need for heavy on-premise infrastructure.

- For instance, in March 2025, several financial exchanges in North America adopted cloud-based surveillance systems to support high-frequency trading monitoring across multiple assets.

- The shift to cloud-based trade surveillance solutions in North America is driving efficiency and scalability. These systems provide real-time monitoring, enhance compliance, and lower operational costs, positioning financial institutions for better management of complex trading environments.

North America Trade Surveillance Market Dynamics

Driver

“Increasing Demand for Multi-Asset Surveillance Platforms”

- As the financial markets in North America evolve, the need for multi-asset surveillance platforms is growing. These platforms can monitor a wide range of asset classes, including equities, derivatives, commodities, and cryptocurrencies, all from a single integrated system.

- The expansion of digital asset trading, particularly in cryptocurrencies, has created a need for comprehensive surveillance systems capable of detecting market manipulation, fraudulent trading, and non-compliant activities across different trading environments.

- Financial institutions are now looking to integrate platforms that provide cross-asset monitoring, enhancing their ability to detect suspicious behaviors and comply with regulatory standards.

For instance,

- In January 2025, a major financial institution in Singapore integrated a multi-asset surveillance platform to track both traditional and digital assets.

- The demand for multi-asset surveillance platforms in North America is growing due to the need for comprehensive monitoring across diverse asset classes. These platforms enhance regulatory compliance and market integrity, providing financial institutions with better tools for detecting suspicious activities.

Opportunity

“Growth in Real-Time Risk Analytics and Automated Reporting”

- The North America Trade Surveillance market is being fueled by the increasing demand for real-time risk analytics and automated reporting systems, allowing financial firms to detect and address market abuse issues as they arise, with minimal delay.

- These solutions offer advanced capabilities for assessing risks, automating alerts, and ensuring regulatory compliance. Automated reporting also significantly reduces manual efforts, while real-time analytics improve market monitoring and decision-making.

For instance,

- In February 2025, a leading financial firm in Hong Kong launched an automated surveillance system capable of generating real-time compliance reports and risk assessments, reducing manual oversight requirements.

- The rise of real-time risk analytics and automated reporting in the North America Trade Surveillance market offers enhanced capabilities for risk detection, automated compliance, and operational efficiency. These systems reduce manual efforts, improve decision-making, and ensure timely regulatory compliance.

Restraint/Challenge

“Lack of Skilled Workforce for Surveillance System Implementation”

- Despite the growing demand for advanced trade surveillance solutions in Asia-Pacific, the shortage of skilled professionals to manage and operate these systems is a significant barrier. The complexity of trade surveillance tools requires a specialized workforce capable of handling the advanced technologies involved.

- • Financial institutions are struggling to recruit and train professionals with expertise in areas like AI, machine learning, and regulatory compliance. This skill gap is leading to delays in the adoption of surveillance systems and operational inefficiencies.

For instance,

- In February 2025, a regional bank in Australia delayed its trade surveillance system rollout due to the inability to hire qualified staff with the necessary technical expertise in machine learning and data analytics.

- The shortage of skilled professionals in North America is hindering the effective implementation of trade surveillance systems. Financial institutions are struggling to find qualified staff with expertise in AI, machine learning, and regulatory compliance, which delays system rollouts and creates inefficiencies.

North America Trade Surveillance Market Scope

The market is segmented on the basis component, deployment model, organization size and vertical.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment Model |

|

|

By Organization Size |

|

|

By Vertical |

|

In 2025, the solution is projected to dominate the market with a largest share in by component segment

The solution segment is expected to dominate the North America Trade Surveillance market, with a market share of 60.7% during the forecast period. The increasing demand for comprehensive surveillance tools. These solutions provide real-time alerts, analytics, and automated compliance tracking, enabling financial institutions to monitor market activities more effectively, improve risk management, and ensure regulatory compliance.

The Cloud is expected to account for the largest share during the forecast period in North America Trade Surveillance market

In 2025, the cloud segment in the North America Trade Surveillance Market is projected to hold the largest share of approximately 52.1%. The cloud segment in the North America Trade Surveillance market is gaining traction as financial institutions adopt scalable, flexible, and cost-efficient solutions. Cloud-based systems allow for seamless integration, faster data processing, and real-time monitoring across multiple platforms and asset classes. This transition is helping financial firms streamline compliance and reduce operational costs.

North America Trade Surveillance Market Regional Analysis

“U.S. Holds the Largest Share in the North America Trade Surveillance Market”

- U.S. dominates the North America Trade Surveillance market due to its advanced financial infrastructure, large-scale digital trading platforms, and significant investments in AI and machine learning technologies. The country’s financial sector is highly regulated, further boosting demand for sophisticated surveillance solutions.

- U.S. adoption of cutting-edge surveillance systems, including AI-driven analytics, ensures better market monitoring and compliance with evolving regulations.

- Government initiatives promoting digital finance and stricter enforcement of market integrity enhance China’s leading position in the trade surveillance landscape.

“U.S. is Projected to Register the Highest CAGR in the North America Trade Surveillance Market”

- U.S. is expected to experience the highest CAGR in the North America Trade Surveillance market, driven by increasing financial market complexity and rising digital asset trading.

- The country’s regulatory reforms, such as the adoption of stricter market oversight regulations, are stimulating demand for advanced surveillance systems.

- The growing emphasis on real-time surveillance and the integration of AI-powered tools to monitor cross-border financial activities contribute to India’s rapid market growth.

North America Trade Surveillance Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Software AG

- FIS

- SIA S.P.A.

- Celent, ACA Group.

- Scila AB

- CINNOBER FINANCIAL TECHNOLOGY

- Trapets AB.

- Abel Noser Holdings LLC

- CRISIL LIMITED

- Cognizant, IPC System, Inc.

- Aquis Exchange

- OneMarketData, LLC.

- b-next

- IBM

- Accenture

- Nasdaq, Inc.

Latest Developments in North America Trade Surveillance Market

- In January 2025, Cognizant launched a cloud-based trade surveillance solution in Asia-Pacific, utilizing AI to monitor high-frequency trades and detect suspicious activities in real time. This initiative aims to enhance compliance and market integrity across diverse financial markets.

- In March 2025, Accenture partnered with financial institutions in the North America region to implement a machine learning-powered trade surveillance system. The system is designed to proactively detect market abuse, ensuring regulatory compliance and improving trade transparency in volatile markets.

- In Septermber 2023, Bloomberg introduced advanced surveillance tools integrated with artificial intelligence capabilities to improve the monitoring of trading activities in the U.S. market. These tools leverage AI to enhance the accuracy and efficiency of detecting suspicious trading patterns, reducing false positives and enabling real-time compliance with regulatory requirements from bodies like the SEC and FINRA. This development reflects the growing demand for sophisticated, technology-driven solutions in the North America trade surveillance market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.