North America Transcritical Co2 Market

Market Size in USD Billion

CAGR :

%

USD

9.85 Billion

USD

18.71 Billion

2024

2032

USD

9.85 Billion

USD

18.71 Billion

2024

2032

| 2025 –2032 | |

| USD 9.85 Billion | |

| USD 18.71 Billion | |

|

|

|

|

Transcritical Co2 Market Size

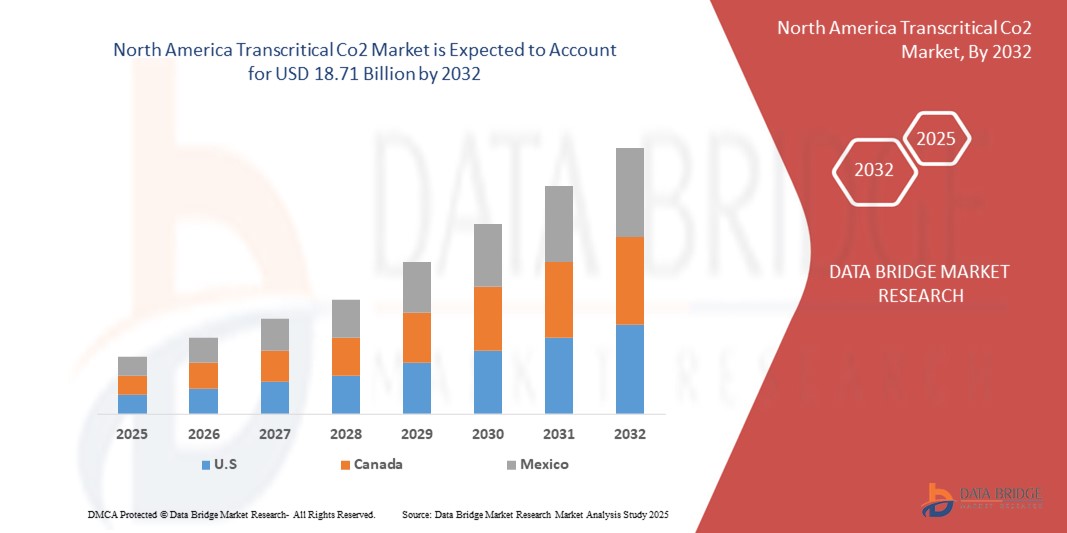

- The North America Transcritical CO₂ market size was valued at USD 9.85 billion in 2024 and is expected to reach USD 18.71 billion by 2032, growing at a CAGR of 8.23% during the forecast period.

- The market growth is driven by increasing adoption of low-GWP refrigerants, stringent environmental regulations such as the American Innovation and Manufacturing (AIM) Act, and the rising demand for sustainable cold chain infrastructure in retail and food processing sectors.

Transcritical Co2 Market Analysis

- Transcritical CO₂ systems are increasingly being adopted in North America across supermarkets, refrigerated warehouses, and industrial food processing plants, thanks to their energy efficiency and low environmental impact.

- The AIM Act in the United States, alongside Canada’s proactive phase-down of HFCs under the Kigali Amendment, has accelerated the transition to natural refrigerants like CO₂, propelling market adoption.

- The United States dominates the regional market due to the large-scale deployment in national retail chains, well-established cold chain logistics, and financial incentives for green technologies.

- Canada is emerging as a significant adopter of CO₂-based systems due to robust sustainability mandates in provinces like British Columbia and Quebec, especially across grocery and food distribution networks.

- The retail sector continues to be the largest consumer, driven by the transition of major grocery chains (e.g., Walmart, Kroger, Loblaws) toward net-zero operations and the growing demand for energy-efficient refrigeration in new retail outlets and retrofitted stores.

Report Scope and Transcritical Co2 Market Segmentation

|

Attributes |

Transcritical Co2 Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Transcritical Co2 Market Trends

“Retail Refrigeration Sector Driving Mass Adoption of Transcritical CO₂ Systems”

- A key trend in the North America Transcritical CO₂ market is the widespread adoption by grocery and retail giants, with companies increasingly investing in zero-emission stores and green refrigeration upgrades.

- For instance, Walmart announced in 2023 the roll-out of CO₂-based refrigeration systems in over 500 U.S. stores by 2027, in line with its goal to achieve zero emissions across operations by 2040.

- Similarly, Loblaws in Canada has retrofitted over 300 stores with Transcritical CO₂ systems and is investing in CO₂ heat reclaim technologies to improve HVAC efficiency.

- These initiatives, combined with regional and municipal rebates in California, New York, and Quebec, are pushing the commercial refrigeration ecosystem toward accelerated adoption of CO₂-based systems.

Europe Transcritical Co2 Market Dynamics

Driver

“Policy-Driven Transition to Low-GWP Refrigerants Across the U.S. and Canada”

- Both the U.S. Environmental Protection Agency (EPA) and Environment and Climate Change Canada (ECCC) have taken major steps to regulate and phase down the use of high-GWP refrigerants.

- Under the AIM Act, the U.S. aims to cut HFC use by 85% by 2036, prompting HVAC-R stakeholders to adopt CO₂ systems.

- In 2024, the California Air Resources Board (CARB) mandated that all new supermarket refrigeration systems must use refrigerants with a GWP below 150, effectively endorsing CO₂ as a preferred solution.

- These regulations are encouraging equipment manufacturers and end users to shift toward Transcritical CO₂, backed by incentives, pilot programs, and compliance grants.

Opportunity

“Rising Investment in Cold Chain Logistics and Urban Retail Expansion”

- The region’s growing e-commerce grocery sector, demand for fresh food delivery, and post-pandemic supply chain resilience strategies are driving massive investment in cold chain logistics.

- For instance, in 2024, the U.S. Department of Agriculture (USDA) approved $400 million in grants to support cold storage infrastructure in rural and underserved regions.

- Additionally, leading food retailers and logistics providers (e.g., UNFI, Sysco, Sobeys) are investing in green warehousing and CO₂-integrated logistics centers, creating fertile ground for Transcritical CO₂ adoption.

Restraint/Challenge

“High Installation Costs and Retrofitting Barriers in Legacy Infrastructure”

- While long-term energy savings and sustainability benefits are clear, upfront costs for deploying Transcritical CO₂ systems remain 25–40% higher than traditional HFC-based systems.

- Retrofitting existing supermarkets and warehouses is complex and capital-intensive, especially in older buildings with legacy HVAC-R systems.

- A 2023 report by the North American Sustainable Refrigeration Council (NASRC) highlighted that lack of trained technicians and standardized retrofit protocols continues to limit adoption, especially among independent retailers and rural operators.

Transcritical Co2 Market Scope

The market is segmented on the basis Function, End User.

|

Segmentation |

Sub-Segmentation |

|

By Function |

|

|

By End User |

|

In 2025, the Refrigeration is projected to dominate the market with a largest share in Function segment

The Refrigeration segment is expected to dominate the Transcritical Co2 market with the largest share of 56.12% in 2025 due to its widespread adoption in commercial and industrial applications. As businesses strive to meet stringent environmental regulations, the shift toward sustainable and energy-efficient refrigeration systems is accelerating. Technological advancements and government incentives further support the transition, while the growing need for eco-friendly cold chain solutions across food retail, logistics, and manufacturing continues to drive segment growth.

The Retail is expected to account for the largest share during the forecast period in End User market

In 2025, the Retail segment is expected to dominate the market with the largest market share of 51.11% due to increasing demand for energy-efficient refrigeration systems across supermarkets, hypermarkets, and convenience stores. The segment benefits from rising environmental awareness, regulatory pressure to phase out HFCs, and expansion of retail infrastructure in emerging economies. Retailers are increasingly investing in Transcritical CO₂ systems to lower operational costs and reduce carbon footprints, propelling market dominance across the North America region.

Transcritical Co2 Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Function dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Hillphoenix (U.S.)

- Emerson Electric Co. (U.S.)

- Danfoss (Denmark)

- Bitzer SE (Germany)

- GEA Group AG (Germany)

- Johnson Controls (Ireland)

- Baltimore Aircoil Company (U.S.)

- Carnot Refrigeration (Canada)

- Zero Zone, Inc. (U.S.)

- Güntner Group (Germany)

Latest Developments in North America Transcritical Co2 Market

- In November 2023, Hillphoenix, a leading North American manufacturer of commercial refrigeration systems, launched its AdvansorFlex Mini CO₂ system designed specifically for small-format retail applications. This compact transcritical CO₂ solution enhances flexibility in store layout and delivers high energy efficiency, supporting the region’s shift toward low-GWP refrigeration technologies.

- In July 2023, Zero Zone, Inc. announced the expansion of its transcritical CO₂ refrigeration product line to include rack systems optimized for high ambient temperatures, addressing a critical barrier for CO₂ adoption in southern U.S. climates. This development improves operational reliability and positions Zero Zone as a key player in accelerating CO₂ technology adoption in challenging North American climates.

- In May 2023, Walmart U.S. unveiled plans to convert over 100 stores to transcritical CO₂ refrigeration systems by 2026 as part of its sustainability strategy to achieve zero emissions by 2040. This large-scale transition highlights the growing trend among major North American retailers to invest in climate-friendly refrigeration infrastructure, driven by ESG commitments and tightening regulatory norms.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Transcritical Co2 Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Transcritical Co2 Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Transcritical Co2 Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.