North America Transradial Access Market

Market Size in USD Billion

CAGR :

%

USD

1.79 Billion

USD

3.13 Billion

2024

2032

USD

1.79 Billion

USD

3.13 Billion

2024

2032

| 2025 –2032 | |

| USD 1.79 Billion | |

| USD 3.13 Billion | |

|

|

|

|

North America Trans radial Access Market Size

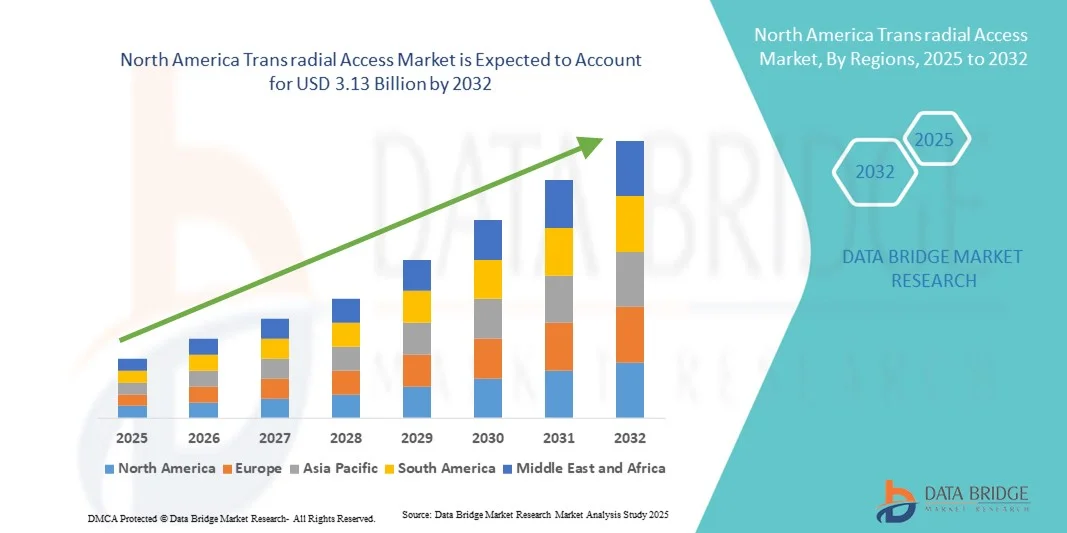

- The North America trans radial access market size was valued at USD 1.79 billion in 2024 and is expected to reach USD 3.13 billion by 2032, at a CAGR of 8.00% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases, rising demand for minimally invasive procedures, and technological advancements in interventional cardiology

- Furthermore, growing awareness among healthcare providers about the benefits of trans radial access for reducing patient recovery time, minimizing complications, and enhancing procedural efficiency is accelerating the uptake of Trans Radial Access solutions, thereby significantly boosting the industry's growth

North America Trans radial Access Market Analysis

- Transradial access, a minimally invasive approach for coronary and peripheral interventions, is increasingly being adopted due to its lower complication rates, quicker patient recovery, and higher patient comfort compared to transfemoral access

- The demand for transradial access is primarily fueled by the growing global burden of cardiovascular diseases, rising adoption of minimally invasive procedures, and continuous advancements in catheter technologies designed to improve procedural efficiency

- U.S. dominated North America trans radial access market with the largest revenue share of 81.7% in 2024, driven by high procedure volumes, early adoption of innovative catheter technologies, and the widespread presence of specialized interventional cardiologists. The country’s strong investment in healthcare digitization and advanced imaging integration further accelerated adoption across large hospital networks and research-driven medical centers

- Canada is expected to witness the fastest CAGR of 10.5% from 2025 to 2032 in North America trans radial access market, fueled by rising healthcare expenditure, government initiatives promoting minimally invasive interventions, and growing adoption of outpatient cardiac procedures. Increasing physician training programs in radial access techniques and rising demand for shorter recovery times are boosting market growth in the country

- The cardiology segment dominated the North America trans radial access market with the largest market revenue share of 49.7% in 2024, driven by the widespread adoption of trans radial access for coronary angiography and percutaneous coronary interventions (PCI)

Report Scope and Trans radial Access Market Segmentation

|

Attributes |

Trans radial Access Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Trans radial Access Market Trends

Rising Adoption of Minimally Invasive Techniques and Catheter-Based Interventions

- A significant and accelerating trend in the trans radial access market is the increasing adoption of minimally invasive procedures and catheter-based interventions over traditional femoral approaches. This shift is driven by the benefits of reduced patient recovery time, lower risk of bleeding complications, and improved procedural efficiency

- For instance, in 2023, several interventional cardiology centers in the U.S. reported a notable shift towards radial access for percutaneous coronary interventions (PCI), citing shorter hospital stays and enhanced patient comfort

- Medical professionals increasingly prefer trans radial access due to better post-procedural outcomes, including faster ambulation and reduced vascular complications. Hospitals are investing in training and infrastructure to support this approach, further accelerating adoption

- Clinical guidelines from bodies such as the American College of Cardiology and European Society of Cardiology are recommending radial access as a preferred method for certain procedures, reinforcing this trend

- The growing awareness among patients about safer and less invasive cardiac procedures is also boosting the demand for radial access interventions

- In addition, the expansion of healthcare infrastructure in emerging regions is enabling more hospitals and catheterization labs to adopt trans radial techniques, facilitating wider penetration globally

North America Trans radial Access Market Dynamics

Driver

Growing Preference for Minimally Invasive Cardiac Procedures

- The rising prevalence of cardiovascular diseases and increasing patient preference for less invasive interventions are driving the demand for trans radial access techniques

- For instance, in May 2024, Cleveland Clinic reported a 15% year-on-year increase in trans radial procedures for coronary interventions, highlighting the clinical shift and positive patient outcomes

- Minimally invasive procedures reduce complications such as hematoma formation and allow patients to recover faster, leading to shorter hospital stays and lower overall healthcare costs

- Hospitals are also motivated to adopt trans radial access due to its operational efficiency, allowing more procedures per day and optimizing cath lab utilization

- Training programs for interventional cardiologists focusing on radial access are increasing globally, facilitating higher adoption rates and improved procedural success

- The convenience for patients, along with clinical evidence demonstrating lower complication rates, positions trans radial access as a preferred approach, particularly in high-volume cardiac centers

- Healthcare policies promoting enhanced patient safety and shorter hospital stays are further boosting adoption of trans radial access in both developed and emerging markets

- Technological advancements, including better-designed catheters, guidewires, and hemostasis devices, are improving procedural outcomes and increasing confidence among clinicians

- Increasing awareness campaigns by cardiology societies about the benefits of radial access are encouraging more hospitals to adopt this approach as a standard practice

Restraint/Challenge

Technical Limitations and Skill-Dependent Outcomes

- The adoption of trans radial access is hindered by technical challenges and the requirement for specialized operator training, which may limit widespread implementation in certain regions

- For instance, a 2022 study published in the Journal of Interventional Cardiology highlighted that procedural success rates for radial access were closely correlated with operator experience, posing a barrier for centers with limited training resources

- Anatomical variations such as radial artery spasm or tortuosity can complicate procedures, leading some clinicians to prefer femoral access for complex interventions

- The availability of advanced radial access-compatible devices is still limited in some emerging markets, restricting the procedure's full adoption

- While overall patient outcomes are favorable, initial procedural time may be longer for less experienced operators, impacting workflow efficiency in busy hospitals

- Overcoming these challenges through expanded training programs, improved catheter technology, and increased clinical awareness will be crucial for sustained market growth and wider global adoption

- Financial constraints in smaller hospitals and outpatient centers may limit investment in radial access equipment and training, slowing adoption in certain regions

- Resistance to change from clinicians accustomed to femoral access procedures can slow the transition, requiring education and demonstration of long-term benefits

- Potential complications, though rare, such as radial artery occlusion or hematoma formation, may concern both patients and practitioners, impacting acceptance in some cases

North America Trans radial Access Market Scope

The market is segmented on the basis of product, application, usage, and end user

- By Product

On the basis of product, the North America trans radial access market is segmented into guide wires, guiding catheters, sheaths and sheath introducers, micro-catheters, intermediate catheters, and accessories. The guide wires segment dominated the largest market revenue share of 36.8% in 2024, attributed to their indispensable role in navigating complex vascular pathways during interventional procedures. Their high precision, flexibility, and compatibility with a wide range of catheters make them a cornerstone device in cardiology and neurovascular applications. The segment’s leadership is also driven by the increasing number of minimally invasive interventions and the technological advancements that enhance trackability and torque response, improving patient outcomes. The availability of hydrophilic-coated guide wires, offering superior lubricity and reduced vessel trauma, further strengthens demand. Hospitals and cath labs across North America prefer premium-grade guide wires to reduce complications and improve procedural success, ensuring this category remains the most widely adopted product.

The micro-catheters segment is expected to witness the fastest CAGR of 18.6% during 2025–2032, fueled by their growing adoption in neurovascular and peripheral vascular interventions. These devices offer exceptional precision in accessing small, tortuous vessels and are increasingly used in embolization, coiling, and drug delivery procedures. The rising prevalence of conditions such as aneurysms and ischemic strokes is expanding the need for micro-catheters in neuro-interventions. In addition, technological advancements in micro-catheter design, such as improved pushability, kink resistance, and compatibility with advanced imaging systems, are enhancing operator confidence. Their minimally invasive nature supports shorter recovery times and fewer complications, which resonates with the clinical push toward patient-centric care. Continuous R&D efforts by manufacturers to introduce next-generation micro-catheters tailored for specific anatomical challenges are also accelerating growth in this segment.

- By Application

On the basis of application, the North America trans radial access market is segmented into neurovascular, cardiology, peripheral vascular, and others. The cardiology segment dominated the largest market revenue share of 49.7% in 2024, driven by the widespread adoption of trans radial access for coronary angiography and percutaneous coronary interventions (PCI). The high prevalence of cardiovascular diseases in North America, along with strong clinical evidence supporting radial access for reduced bleeding complications and faster recovery, has fueled demand in this segment. Hospitals and clinics are prioritizing radial access in cardiology because it enhances patient comfort, lowers hospital stays, and improves throughput efficiency in catheterization labs. Supportive guidelines by cardiology associations and the availability of skilled interventional cardiologists across the region further solidify cardiology’s dominance. Increasing investment in advanced cath lab infrastructure and the continuous introduction of radial-specific devices also contribute to the sustained leadership of this application segment.

The neurovascular segment is projected to witness the fastest CAGR of 19.4% from 2025 to 2032, owing to the rising burden of ischemic strokes, aneurysms, and other cerebrovascular disorders in North America. The adoption of trans radial access in neuro-interventions is gaining traction due to lower complication rates, patient comfort, and the ability to treat complex cases with precision. Advances in radial-compatible neurovascular devices, such as aspiration catheters, micro-catheters, and embolic coils, are facilitating this growth. Clinical studies highlighting the safety and efficacy of radial approaches in stroke management are encouraging wider acceptance in top-tier hospitals and specialized centers. In addition, increasing awareness campaigns and training programs for neuro-interventionalists are boosting adoption. As demand for minimally invasive neuro procedures continues to rise, the neurovascular application segment is poised for rapid and sustained growth.

- By Usage

On the basis of usage, the North America trans radial access market is segmented into drug administration, fluid and nutrition administration, blood transfusion, and diagnostics and testing. The drug administration segment accounted for the largest revenue share of 41.5% in 2024, supported by its widespread application in delivering medications directly into the bloodstream during interventional and therapeutic procedures. Trans radial access enables accurate and safe drug delivery with fewer complications compared to traditional venous routes. It is especially valued in cardiac and oncology procedures where real-time drug administration is critical. Hospitals across North America increasingly utilize radial access drug delivery to reduce patient discomfort, shorten recovery periods, and improve clinical outcomes. Strong regulatory approvals and standardization of devices designed for radial drug administration have also accelerated growth in this segment.

The diagnostics and testing segment is expected to witness the fastest CAGR of 17.9% between 2025 and 2032, driven by its growing application in blood sampling, pressure monitoring, and real-time diagnostic procedures. Trans radial access provides clinicians with a reliable, less invasive method for conducting diagnostic evaluations, which is gaining preference in both hospitals and ambulatory centers. The rising demand for point-of-care testing and continuous monitoring in cardiac and critical care patients is contributing to this expansion. In addition, technological innovations such as integrated pressure monitoring catheters and devices that combine diagnostics with therapeutic capabilities are supporting adoption. As preventive healthcare and early disease detection become priorities in North America, diagnostic and testing usage through radial access will continue to expand at a strong pace.

- By End User

On the basis of end user, the North America trans radial access market is segmented into hospitals, clinics, ambulatory care centres, and others. The hospitals segment held the largest revenue share of 58.6% in 2024, owing to their well-established infrastructure, advanced cath lab facilities, and ability to manage high patient volumes. Hospitals remain the primary setting for complex interventional procedures requiring radial access, including cardiology and neurovascular interventions. The availability of skilled healthcare professionals, advanced imaging systems, and reimbursement support further reinforces hospitals’ dominance. In addition, hospitals are often the first adopters of new technologies, positioning them as key demand drivers for trans radial access devices. Growing patient trust in hospitals for advanced cardiac and neuro care continues to strengthen their market share.

The ambulatory care centres segment is projected to grow at the fastest CAGR of 18.2% during 2025–2032, propelled by the increasing shift toward outpatient procedures and the demand for cost-effective healthcare delivery models. Ambulatory centers are rapidly adopting trans radial access due to its minimally invasive nature, shorter recovery times, and reduced need for overnight hospital stays. The rising number of standalone surgical and cardiac centers in North America, coupled with favorable reimbursement policies for day-care procedures, is boosting adoption. These centers also benefit from radial access by optimizing procedural efficiency, minimizing complications, and enhancing patient turnover. Growing patient preference for outpatient care and the expansion of specialized ambulatory networks across urban and suburban areas will continue to drive this segment’s strong growth.

North America Trans radial Access Market Regional Analysis

- U.S. dominated North America trans radial access market with the largest revenue share of 81.7% in 2024, driven by high procedure volumes, early adoption of innovative catheter technologies, and the widespread presence of specialized interventional cardiologists. The country’s strong investment in healthcare digitization and advanced imaging integration further accelerated adoption across large hospital networks and research-driven medical centers

- Canada is expected to witness the fastest CAGR of 10.5% from 2025 to 2032 in North America trans radial access market, fueled by rising healthcare expenditure, government initiatives promoting minimally invasive interventions, and growing adoption of outpatient cardiac procedures

- This widespread adoption is further supported by continuous innovation in catheter technologies, expanding training programs for interventional cardiologists, and the increasing integration of digital healthcare systems across major hospitals, positioning North America as a global leader in transradial access adoption

U.S. Transradial Access Market Insight

The U.S. transradial access market captured the largest revenue share of 81.7% in 2024 within North America, driven by high procedure volumes, early adoption of innovative catheter technologies, and the widespread presence of specialized interventional cardiologists. The country’s strong investment in healthcare digitization and advanced imaging integration further accelerated adoption across large hospital networks and research-driven medical centers. In addition, increasing preference for outpatient interventions and robust collaborations between medical device companies and healthcare providers continue to strengthen the U.S. market’s dominance.

Canada Transradial Access Market Insight

The Canada transradial access market is expected to witness the fastest CAGR of 10.5% from 2025 to 2032 within North America, fueled by rising healthcare expenditure, government initiatives promoting minimally invasive interventions, and growing adoption of outpatient cardiac procedures. Increasing physician training programs in radial access techniques and rising demand for shorter recovery times are boosting market growth in the country. Furthermore, the ongoing expansion of cardiac care facilities and the availability of cost-effective advanced catheter systems are expected to further accelerate Canada’s position as the fastest-growing market in the region.

North America Trans radial Access Market Share

The Trans radial Access industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Terumo Corporation (Japan)

- Abbott (U.S.)

- Teleflex Incorporated (U.S.)

- Merit Medical Systems (U.S.)

- Cardinal Health (U.S.)

- B. Braun SE (Germany)

- Asahi Intecc Co., Ltd. (Japan)

- Nipro Medical Corporation (Japan)

- AngioDynamics, Inc. (U.S.)

Latest Developments in North America Trans radial Access Market

- In September 2021, Medtronic received CE Mark approval for its radial artery access portfolio, which includes the Rist 079 Radial Access Guide Catheter and the Rist Radial Access Selective Catheter. These devices are designed to facilitate access to the neurovasculature through the radial artery, offering advantages in navigating complex anatomical pathways. The CE Mark approval signifies compliance with European Union safety and performance standards, enabling Medtronic to market these products in EU countries and other regions accepting CE Mark certification

- In July 2023, Alvimedica announced the CE Mark approval and commercial launch of its Alvision Kaplan Curves Radial Portfolio for diagnostic procedures. This portfolio includes catheters designed with specialized curves to enhance stability and support during transradial access, particularly in challenging anatomical scenarios. The CE Mark approval allows Alvimedica to distribute these devices across European markets, aligning with the company's commitment to advancing interventional cardiology tools

- In February 2024, Medtronic reported the first neurointerventional case in Europe using its CE-marked Rist 6Fr Radial Access Catheter. This milestone demonstrates the catheter's suitability for neurovascular procedures via the radial artery, offering a less invasive alternative to traditional femoral access. The successful application underscores the growing adoption of radial access techniques in neurointervention, facilitated by advancements in catheter design and procedural expertise

- In April 2024, Teleflex and Arrow International initiated a Class I recall of over 300,000 ARROW QuickFlash Radial Artery and Radial Artery/Arterial Line Catheterization Kits. The recall was prompted by reports of increased resistance in the guidewire handle and chamber during use, which could lead to serious complications such as vessel injury or embolism. The U.S. Food and Drug Administration (FDA) recommended that healthcare facilities cease use of the affected kits and quarantine them to prevent patient harm

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.