North America Trauma Devices Market

Market Size in USD Billion

CAGR :

%

USD

3,788.50 Billion

USD

7,116.81 Billion

2022

2030

USD

3,788.50 Billion

USD

7,116.81 Billion

2022

2030

| 2023 –2030 | |

| USD 3,788.50 Billion | |

| USD 7,116.81 Billion | |

|

|

|

North America Trauma Devices Market Analysis and Size

Trauma is one of the major health problems that the people are facing globally. The market growth has increased with growing incidence of degenerative bone disease worldwide in the past few years. Serious fracture cases caused due to falls and mishaps among the geriatric population are estimated to contribute to the increasing demand for fracture fixators. Around 6 of every 10 men and 5 of every 10 women suffer at least one trauma in their lives. Numerous research studies are currently in the development phase, which are expected to offer manufacturers with a competitive advantage in developing innovative trauma products.

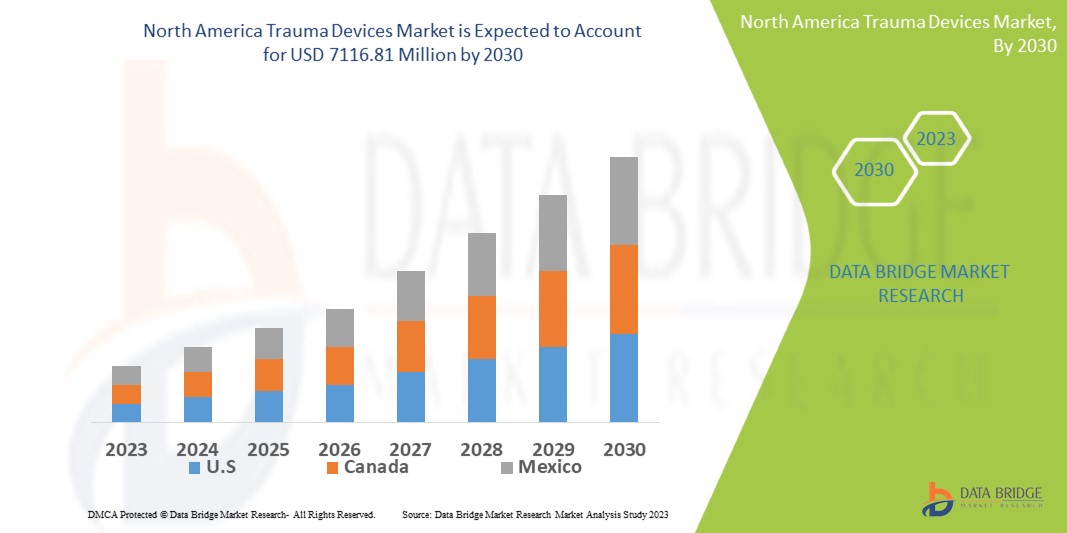

Data Bridge Market Research analyses a growth rate in the trauma devices market in the forecast period 2023-2030. The expected CAGR of trauma devices market is tend to be around 8.20% in the mentioned forecast period. The market is valued at USD 3788.5 million in 2022, and it would grow upto USD 7116.81 million by 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Trauma Devices Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Internal Fixators Devices, External Fixators Devices and Others), Surgical Site (Lower Extremities and Upper Extremities), Tissue Type (Hard Tissue and Soft Tissue), Material Type (Non-Absorbable and Bio-Absorbable), Patient Age (Adults and Paediatric), End Use (Hospitals and Clinics, Burn Centers, Research Institutes, Home Care, Others) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Shanghai Kinetic Medical Co. Ltd (China), Weigao group (China), MicroPort Scientific Corporation (China), Orthofix US LLC (U.S.), CONMED Corporation (U.S.), Wright Medical Group N.V. (U.S.), NuVasive, Inc (U.S.), Corin Group (U.S.), Enovis (U.S.), OsteoMed (U.S.), Invibio Ltd. (U.S.), Medtronic (Ireland), Smith+Nephew (U.K.), Integra LifeSciences (U.S.), B. Braun SE (Germany), Stryker (U.S.) |

|

Market Opportunities |

|

Market Definition

Trauma devices are one of the clinical methods that are used in trauma care based on injury severity. Trauma devices can be widely used to treat either hard tissue injury or soft tissue injury. Trauma is known as any form of physical injury caused by some external source, such as dislocations, fractures, sprains and strains and burns. The other areas covered in the trauma devices includes upper extremities and lower extremities such as joint, knee, leg, spine, and others.

North America Trauma Devices Market Dynamics

Drivers

- Incidence of Trauma Injuries

The trauma fixation devices market is anticipated to be mainly driven by growing trauma injuries in this region. For instance, in the U.S., injury result for more than 150,000 deaths and above 3 million non-fatal injuries every year. In 2015 and 2016, 484 U.S. citizens died in vehicle crashes in foreign countries (28% of non-natural deaths). Furthermore, around 312 died of suicide (18%); 309 were victims of homicide (18%), and 307 drowned or died due to boating incident (17%). Around 60% of men and 50% of women experience at least one trauma in their lives. It has been witnessed over the years that women are more likely to suffer from sexual assault and child sexual abuse. Thus, all these injuries demand for trauma devices and thus this factor increases the market growth.

- Growing Technological Advancements

The market is boosted by technological advancements, with top market players launching an array of products through extensive research capabilities and increasing their segment portfolio through partnerships with other market players. For instance, Cardinal Health acquired the patient recovery business from Medtronic for USD 6.1 billion in 2017. The acquisition assisted the company to expand Cardinal Health’s portfolio by adding 23 product categories, which includes top market brands such as Curity, Kangaroo, Kendall, Dover, and Argyle. Thus, this boosts the market growth.

Opportunities

- Rising Demand of External Fixators

There is a growing demand for external fixators that help grow the market. The external fixators segment is anticipated to show the highest growth during the forecast period 2023-2030. External fixator stabilizes damaged bones, thus increasing the healing process. The procedure is usually performed during the open fracture treatments. Additionally, external fixators are recommended in case of fractures in children since permanent internal fixators are not feasible in growing bones. Thus, this factor boost the growth of the market.

- Increased R&D Activities

Several market players are investing in R&D activities associated with trauma devices. In addition, some of the major market players are opting to acquire smaller players to increase market growth. For instance, Smith & Nephew acquired Adler Mediequip Pvt. Ltd. in May 2013. The deal was done with the goal to provide the company with an entry point in the booming Indian market.

Restraints/Challenges

- High cost and Delayed Approvals of Trauma Devices

The increasing cost of trauma products, allergies associated with internal fixation devices, and the risk of infection are anticipated to grow market expansion, because of price fluctuations and a scarcity of experienced experts. Furthermore, government authorities do not rapidly approve the materials used to produce trauma products. The material used to make these implants is anticipated to be biocompatible and highly inert. Therefore, receiving permission for these devices is difficult for businesses. These factors are expected to hinder the market growth.

This trauma devices market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the trauma devices market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2020, Orthofix received the U.S. Food and Drug Administration (FDA) and CE Mark approval for its product 'JuniOrtho plating system'. This device is designed particularly for pediatric patients for advanced deformity and trauma reconstruction of the lower extremities.

North America Trauma Devices Market Scope

The trauma devices market is segmented on the basis of product, surgical site, tissue type, material type, patient age, end user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Internal Fixators

- Plates and Screws

- Rods and Pins

- Others

- External Fixators

- Uniplanar and Biplanar Fixators

- Circular Fixators

- Hybrid Fixators

Surgical Site

- Upper Extremity

- Hand and Wrist

- Shoulder

- Arm

- Elbow

- Lower Extremity

- Hip and Pelvis

- Lower Leg

- Foot and Ankle

- Knee

- Thigh

Tissue Type

- Hard Tissue

- Soft Tissue

Material Type

- Non-Absorbable

- Bio-Absorbable

Patient Age

- Adults

- Paediatric

End User

- Hospitals and Clinics

- Burn Centers

- Research Institutes

- Home Care

- Others

Trauma Devices Market Regional Analysis/Insights

The trauma devices market is analyzed and market size insights and trends are provided by product, surgical site, tissue type, material type, patient age, end user and distribution channel as referenced above.

The major countries covered in the trauma devices market report are U.S., Canada and Mexico.

U.S. is dominating the market because of large number of companies, R&D capabilities and increasing adoption of minimally invasive surgical procedures. Furthermore, motorization and automation have changed the economy of many nations, but it has also brought benefit with a price.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Trauma Devices Market Share Analysis

The trauma devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to trauma devices market.

Key players operating in the trauma devices market include:

- Shanghai Kinetic Medical Co. Ltd (China)

- Weigao group (China)

- MicroPort Scientific Corporation (China)

- Orthofix US LLC (U.S.)

- CONMED Corporation (U.S.)

- Wright Medical Group N.V. (U.S.)

- NuVasive, Inc (U.S.)

- Corin Group (U.S.)

- Enovis (U.S.)

- OsteoMed (U.S.)

- Invibio Ltd. (U.S.)

- Medtronic (Ireland)

- Smith+Nephew (U.K.)

- Integra LifeSciences (U.S.)

- B. Braun SE (Germany)

- Stryker (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.