North America Treasury Software Market Analysis and Size

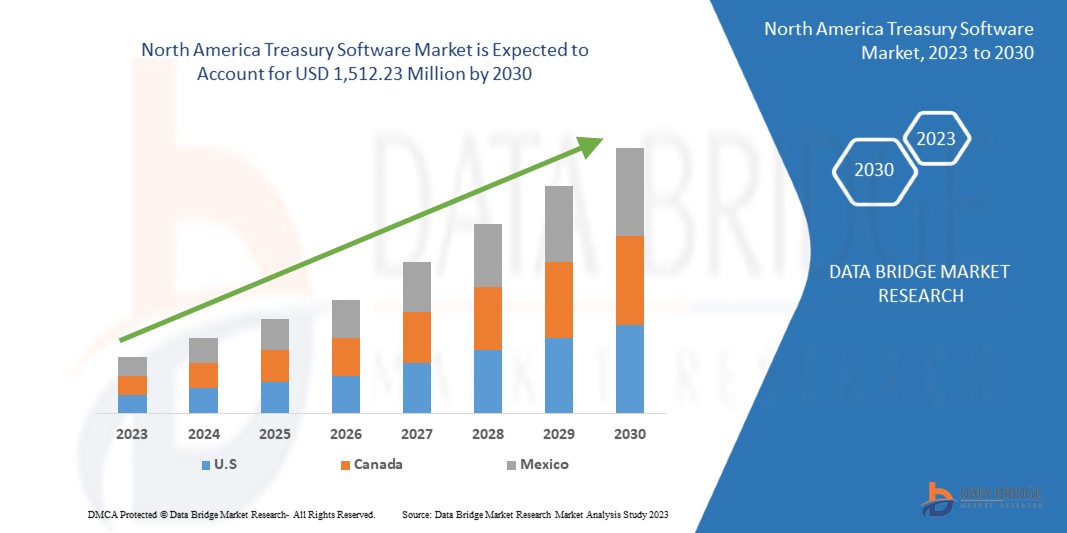

North America treasury software market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.3% in the forecast period of 2023 to 2030 and is expected to reach USD 1,512.23 million by 2030. Increase in the requirement of quick-decision making process in biotechnology is e expected to drive the growth of the market significantly.

North America treasury software market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact Data Bridge Market Research for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020-2016) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

Operating System (Windows, Linux, IOS, Android, MAC), Application (Liquidity And Cash Management, Investment Management, Debt Management, Financial Risk Management, Compliance Management, Tax Planning, Others), Deployment Mode (On Premise, Cloud), Organization Size (Large Enterprises And Small And Medium Sized Enterprises), Vertical (Banking, Financial Services And Insurance, Government, Manufacturing, Healthcare, Consumer Goods, Chemicals, Energy, and Others) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX S.A.S, EdgeVerve Systems Limited (A wholly owned subsidiary of Infosys), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD and among others |

Market Definition

Treasury software is an application that automates a company's financial activities like cash flow, assets, and investments. It provides a treasury management system that tracks the ability of a business to convert assets into cash to meet a financial obligation. Financial managers and accounts use Treasury management software to monitor liquidity and the ability to convert assets into cash to meet financial obligations. The software automates and streamlines treasury management functions, reducing financial and reputational risks, saving costs, and improving operational efficiency and effectiveness. The greater visibility, analytics, and forecasting that the treasury management system provides improves decision-making and helps to create organizational financial strategies.

North America Treasury Software Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Growing demand for advanced treasury management systems for enhancing customer experience

Treasury management systems (TMS) are software that helps to automate manual treasury processes. Offering greater visibility into cash and liquidity while gaining control over bank accounts, maintaining compliance, and managing financial transactions has enhanced customer satisfaction. The treasury management system basically offers seven core benefits in the organization that can enhance the capabilities, including,

- Boost productivity

- Real-time and precise data availability

- Reduction in manual entry and calculation errors

- Limit redundant banking and FX costs

- Detailed activity monitoring

- Bank and connectivity flexibility

- Regulatory compliance and risk mitigation

According to Coupa Software Inc., adopting TMS solutions can get affected by various factors such as FX volatility by 52%, cash flow & financial risk exposure by 43%, cash repatriation by 40%, inadequate treasury infrastructure by 30%, North America tax reform impacts by 24%, operational and fraud risk due to traditional methods by 20%, treasury operational cost 12% and other factors 12%.

- Heaving adoption of artificial intelligence in treasury management

Artificial intelligence in recent times has played a vital role in strengthening and transforming industries around the globe. From governmental bodies, and large organizations to small online businesses, artificial intelligence (AI) is being used by multiple entities over multiple platforms across the globe.

In 2020, according to the survey conducted by NewVantage, 91.5% of top businesses were investing heavily in AI. Although companies with investments in AI are using AI technologies at a modest rate, just 14.6 % of them use AI technology extensively within their organization. Out of which, more than half of that, which is 51.2%, have AI deployed to limited production, and 26.8 % is piloting it. This signifies the growing cardinal of AI technologies and surges amongst businesses for adopting them.

Artificial intelligence (AI) has already shown its incredible potential for cash management and forecasting in treasury management. AI attempts to solve problems that were previously believed to be only solved by human intervention.

Opportunities

- Penetration of advanced analytics solutions in the banking sector

Nowadays, banks are increasingly using analytics to gain a competitive advantage and to form conclusions and insights based on the information and data collection. Advanced analytics can be used to predict customer behavior and preferences and to improve risk assessment. Sometimes data generated by banking and finance industries are of large scale, and these are not possible for the bank to handle with their traditional database. Therefore, analytics have paved a path for financial industries to handle a large amount of data at a time.

Furthermore, the digital world has made a revolution in the banking industry. Most of the advanced analytics solutions for banking are comprised of four different components: reporting, descriptive analytics, predictive analytics, and prescriptive analytics. Financial institutions can now target and engage customers on a continuous basis, and not just when they go into a branch. Their reach now includes customers who use mobile apps, ATMs, and online banking apps. Banks also can use analytics to offer customized products, services, and deals to customers based on their profiles and histories. Moreover, analytics in the banking world also helps to identify and prevent fraud. Banks use advanced analytics to compare customer usage patterns against their own fraud indicators and can immediately take action when potentially fraudulent activity is detected. The overall penetration of analytics in banking is still relatively low compared to its usage in other industries. However, the penetration of analytics in the banking sector is creating a lot of opportunities for the treasury software market to grow.

Restraints/Challenges

- Increasing cyber threats and data breaches

Due to the COVID-19, cybercrime and cybersecurity issues increased by 600% in 2020. Flaws in network security are exploited by hackers to perform unauthorized actions within a system.

According to Purple Sec LLC, in 2018, mobile malware variants for mobile increased by 54%, out of which 98% of mobile malware target various smart android devices. 25% of businesses are estimated to have been victims of crypto-jacking. The businesses include banking, financial management team of various businesses/industries.

In recent times businesses/industries are adopting digitization heavily. Banking, shopping, travel, and others, are moving towards digital models to enhance consumer experiences. Digitization generates a huge amount of customer data and information. This raises security concerns, and this data has always been at a higher risk of cyber-attacks and data breaches. Through this information and data, it becomes easy for fraudsters and cyber attackers to mimic or steal the identity of an individual, which can be used for various crimes.

According to an S&P North America study on the share of North America cyber-attacks incidents across the industries in the past five years from 2016 to 2021, financial institutions have topped the list with 26% cybersecurity incidents followed by healthcare 11%, software and technology services at 7% and retail at 6%.

Post-COVID-19 Impact on North America Treasury Software Market

The COVID-19 pandemic has had a significant impact on the North America Treasury Software market. The pandemic has caused major disruptions to North America supply chains, financial markets, and economic activities, leading to a shift in the priorities and strategies of treasury departments worldwide.

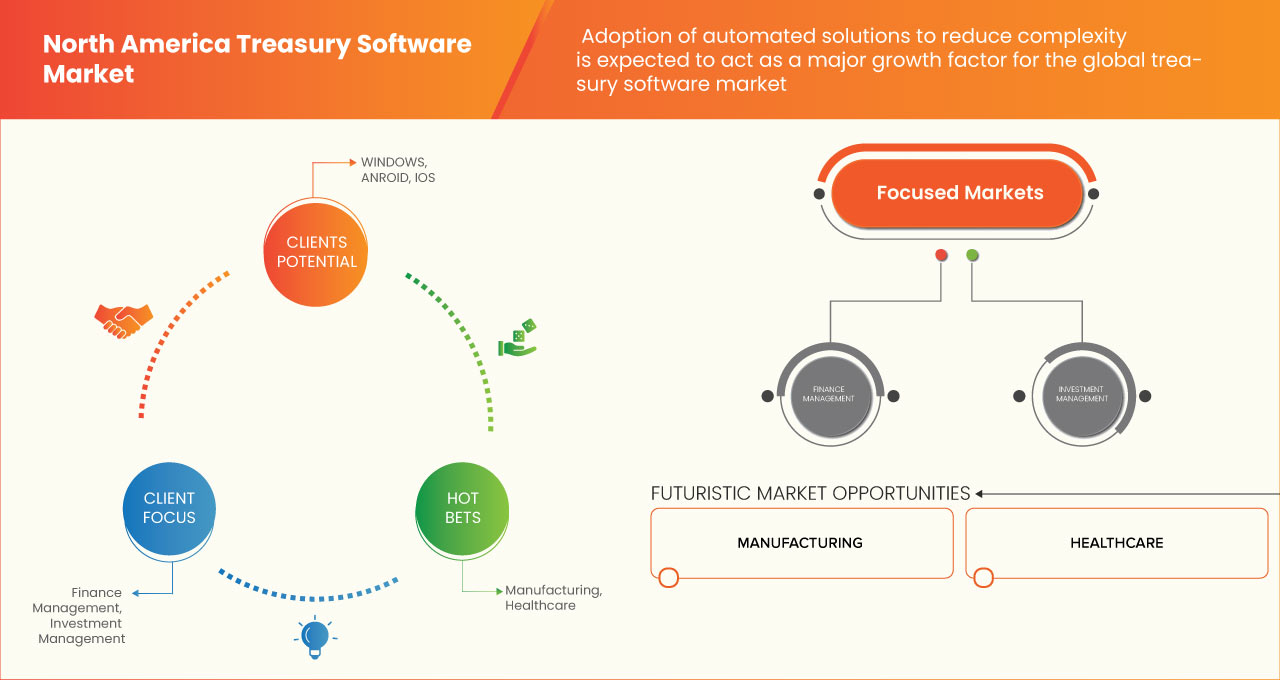

One of the most significant impacts of the pandemic on the treasury software market has been the increased demand for cloud-based solutions. The pandemic forced many organizations to quickly transition to remote work, which highlighted the importance of having secure, accessible, and scalable cloud-based treasury solutions. As a result, there has been a significant increase in demand for cloud-based treasury software solutions.

Another impact of the pandemic on the treasury software market is the increased focus on cash forecasting and liquidity management. The pandemic has created significant uncertainties and risks for businesses, making accurate cash forecasting and liquidity management critical for survival. Treasury software solutions that can provide accurate and real-time cash forecasting, liquidity management, and risk assessment have become increasingly essential.

Overall, the COVID-19 pandemic has accelerated the adoption of digital treasury solutions, leading to significant growth in the North America treasury software market. The demand for cloud-based solutions, cash forecasting and liquidity management, and advanced automation and integration capabilities is expected to continue in the post-pandemic world as organizations seek to improve their agility, resilience, and efficiency.

Recent Developments

- In March 2022, Lease Accounting Software for IFRS-16 was provided to Redington Gulf by ZenTreasury and their local partner MCA. Now Customers are not required to import data from many sources and store it on various platforms. Everything is completed with one software

- In September 2022, TIS and Delega collaborated to provide customers with next-generation automated multi-bank signatory rights management. Customers of TIS and Delega can take advantage of NextGen electronic bank account management thanks to the agreement (eBAM)

North America Treasury Software Market Scope

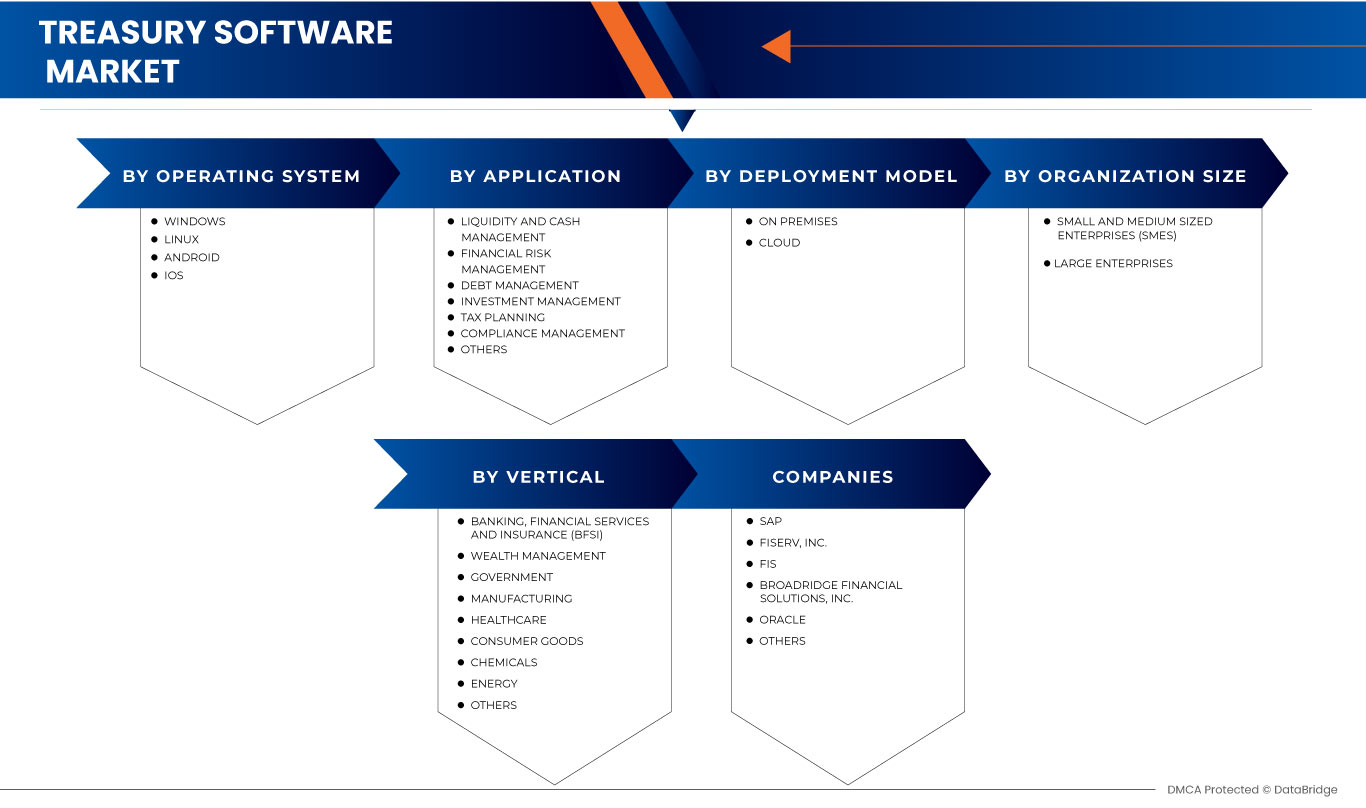

The North America treasury software market is segmented on the basis of operating system, application, deployment model, organization size, and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

NORTH AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM

- MAC

- WINDOWS

- IOS

- ANDROID

- LINUX

On the basis of operating system, the North America treasury software market is segmented into windows, linux, MAC, android, and iOS.

NORTH AMERICA TREASURY SOFTWARE MARKET, BY APPLICATION

- LIQUIDITY AND CASH MANAGEMENT

- FINANCIAL RISK MANAGEMENT

- DEBT MANAGEMENT

- INVESTMENT MANAGEMENT

- TAX PLANNING

- COMPLIANCE MANAGEMENT

- OTHERS

On the basis of application, the North America treasury software market is segmented into liquidity and cash management, investment management, debt management, financial risk management, compliance management, tax planning, and others

NORTH AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL

- ON PREMISES

- CLOUD

On the basis of deployment mode, the North America treasury software market is segmented into cloud and on premises.

NORTH AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE

- SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- LARGE ENTERPRISES

On the basis of organization size, the North America treasury software market is segmented into large enterprises and small and medium enterprises.

NORTH AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL

- BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

- WEALTH MANAGEMENT

- GOVERNMENT

- MANUFACTURING

- HEALTHCARE

- CONSUMER GOODS

- CHEMICALS

- ENERGY

- OTHERS

On the basis of vertical, the North America treasury software market is segmented into banking, financial services and insurance (BFSI), government, manufacturing, healthcare, consumer goods, chemicals, energy, and others.

North America Treasury Software Market Regional Analysis/Insights

The North America treasury software market is analysed and market size insights and trends are provided by country, operating system, application, deployment model, organization size, and vertical as referenced above.

The countries covered in the North America treasury software market report are the U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America region due to the high adoption of advanced technology and the presence of major players in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Treasury Software Market Share Analysis

North America treasury software market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to North America treasury software market.

Some of the major players operating in the North America treasury software market areFinastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX S.A.S, EdgeVerve Systems Limited (A wholly owned subsidiary of Infosys), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD and among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TREASURY SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OPERATING SYSTEM TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 KEY PRIMARY INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF SMART ELECTRONIC PAYMENT MANAGEMENT TOOLS

5.1.2 GROWING DEMAND FOR ADVANCED TREASURY MANAGEMENT SYSTEM FOR ENHANCING CUSTOMER EXPERIENCE

5.1.3 HEAVING ADOPTION OF ARTIFICIAL INTELLIGENCE IN TREASURY MANAGEMENT

5.1.4 ADOPTION OF CLOUD BASED SOLUTION IN TREASURY MANAGEMENT

5.2 RESTRAINTS

5.2.1 INCREASING CYBER THREATS AND DATA BREACHES

5.2.2 HIGH COST ASSOCIATED WITH TREASURY MANAGEMENT SYSTEMS

5.2.3 CONTINUOUS CHANGES IN REGULATORY FRAMEWORK IN TREASURER MANAGEMENT

5.3 OPPORTUNITIES

5.3.1 PENETRATION OF ADVANCED ANALYTICS SOLUTIONS IN THE BANKING SECTOR

5.3.2 ADOPTION OF AUTOMATED SOLUTIONS TO REDUCE COMPLEXITY

5.3.3 RISE IN STRATEGIC PARTNERSHIP & COLLABORATION AMONG THE ORGANIZATION

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS REGARDING THE BENEFITS OF TREASURY SOFTWARE

5.4.2 FACTORS LIKE COMPLEXITIES, INADEQUATE INFRASTRUCTURE, AND FX VOLATILITY HAMPERS TMS EFFICIENCY

6 IMPACT OF COVID-19 ON THE NORTH AMERICA TREASURY SOFTWARE MARKET

7 NORTH AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM

7.1 OVERVIEW

7.2 WINDOWS

7.3 LINUX

7.4 MAC

7.5 ANDROID

7.6 IOS

8 NORTH AMERICA TREASURY SOFTWARE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 LIQUIDITY AND CASH MANAGEMENT

8.3 INVESTMENT MANAGEMENT

8.4 DEBT MANAGEMENT

8.5 FINANCIAL RISK MANAGEMENT

8.6 COMPLIANCE MANAGEMENT

8.7 TAX PLANNING MANAGEMENT

8.8 OTHERS

9 NORTH AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

10 NORTH AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL

10.1 OVERVIEW

10.2 CLOUD

10.2.1 PUBLIC

10.2.2 HYBRID

10.2.3 PRIVATE

10.3 ON-PREMISES

11 NORTH AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

11.2.1 WEALTH MANAGEMENT

11.2.2 BANKING

11.2.3 CAPITAL MARKET

11.2.4 OTHERS

11.3 GOVERNMENT

11.4 MANUFACTURING

11.5 HEALTHCARE

11.6 CONSUMER GOODS

11.7 CHEMICALS

11.8 ENERGY

11.9 OTHERS

12 NORTH AMERICA TREASURY SOFTWARE MARKET , BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA TREASURY SOFTWARE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILING

15.1 SAP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 APPLICATION PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 FISERV, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 FIS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SOLUTION PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BROADRIDGE FINANCIAL SOLUTIONS, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SOLUTION PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ORACLE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ABM CLOUD

15.6.1 COMPANY SNAPSHOT

15.6.2 SERVICE PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ACCESS SYSTEMS (UK) LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTION PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ADENZA

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CAPIX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 CASHANALYTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 COUPA SOFTWARE INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 DATALOG FINANCE

15.12.1 COMPANY SNAPSHOT

15.12.2 SOLUTION PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 EDGEVERVE SYSTEMS LIMITED (A WHOLLY OWNED SUBSIDIARY OF INFOSYS)

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 EMPHASYS SOFTWARE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 ERNST & YOUNG

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 FINASTRA

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 FINANCIAL SCIENCES CORP.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 ION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 MUREX S.A.S

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 NOMENTIA

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 SOLOMON SOFTWARE

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SS&C TECHNOLOGIES, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 TREASURY INTELLIGENCE SOLUTIONS

15.23.1 COMPANY SNAPSHOT

15.23.2 SERVICE PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 TREASURY SOFTWARE CORP

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 ZENTREASURY LTD

15.25.1 COMPANY SNAPSHOT

15.25.2 SOLUTION PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA WINDOWS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA LINUX IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA MAC IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA ANDROID IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA IOS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA TREASURY SOFTWARE MARKET, APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA LIQUIDITY AND CASH MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA INVESTMENT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA DEBT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA FINANCIAL RISK MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA COMPLIANCE MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA TAX PLANNING MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA LARGE ENTERPRISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA SMALL AND MEDIUM SIZED ENTERPRISES (SMES) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA CLOUD IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA ON-PREMISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA GOVERNMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA MANUFACTURING IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTHCARE IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA CHEMICALS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ENERGY IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TREASURY SOFTWARE MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 41 U.S. TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 U.S. TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 43 U.S. CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 45 U.S. TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 46 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 CANADA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 48 CANADA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 CANADA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 50 CANADA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CANADA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 52 CANADA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 53 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 MEXICO TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 55 MEXICO TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 MEXICO TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 57 MEXICO CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 MEXICO TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 59 MEXICO TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 60 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TREASURY SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TREASURY SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TREASURY SOFTWARE MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA TREASURY SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TREASURY SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TREASURY SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA TREASURY SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA TREASURY SOFTWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 11 SURGING UTILITY IN THE MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE NORTH AMERICA TREASURY SOFTWARE MARKET IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TREASURY SOFTWARE MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA TREASURY SOFTWARE MARKET

FIGURE 14 MOBILE PAYMENTS SHARE (%) BY COUNTRY

FIGURE 15 FACTORS AFFECTING THE TMS AND CUSTOMER EXPERIENCE

FIGURE 16 THREE WAYS ARTIFICIAL INTELLIGENCE IS TRANSFORMING TREASURY

FIGURE 17 CYBER-ATTACKS INCIDENTS ACROSS INDUSTRIES FROM 2016 TO 2021

FIGURE 18 CYBER-ATTACKS INCIDENTS BY COUNTRY AND REGION IN 2020

FIGURE 19 TREASURY DEPARTMENT CURRENTLY USING

FIGURE 20 ANALYTICS ADOPTION BY SECTOR, FROM THE YEAR 2019 TO 2021 AT INDIAN FIRMS

FIGURE 21 NORTH AMERICA TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM, 2022

FIGURE 22 NORTH AMERICA TREASURY SOFTWARE MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA TREASURY SOFTWARE MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 24 NORTH AMERICA TREASURY SOFTWARE MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 25 NORTH AMERICA TREASURY SOFTWARE MARKET: BY VERTICAL, 2022

FIGURE 26 NORTH AMERICA TREASURY SOFTWARE MARKET : SNAPSHOT (2022)

FIGURE 27 NORTH AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2022)

FIGURE 28 NORTH AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 NORTH AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 NORTH AMERICA TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM (2023 & 2030)

FIGURE 31 NORTH AMERICA TREASURY SOFTWARE MARKET: COMPANY SHARE 2022(%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.