North America Underactive Bladder Market Analysis and Insights

North America underactive bladder market is driven by the factors such as rising incidences of neurogenic bladder infections, increasing research funding, development of novel therapies for Underactive Bladder (UAB), and pipeline products enhancing its demand along with rising investment in R&D leading to market growth. Currently, healthcare expenditure has increased across developed and emerging countries which is expected to create a competitive advantage for manufacturers to develop new and innovative products. Additionally, the surge in healthcare expenditure and increase in the prevalence of bladder disorders positively affect the market.

However, the high cost of treatment restricts patients to accommodate high-quality and effective solutions. Henceforth, the high cost of treatment procedures negatively impact the cost of overall treatment. Moreover, the drugs which are currently used for the treatment of UAB are not proven to satisfy clinically from the viewpoint of effectiveness and safety, which leads to the requirement for new therapeutic agents to develop.

North America underactive bladder market is expected to grow in the forecast period due to the rise in market players and the presence of novel pipeline drugs. Along with this, manufacturers are engaged in R&D activities for launching novel products in the market.

However, the high cost associated with the research and studies is expected to restrain market growth which can further impact the launch of new products in the market.

The increase in the number of R&D programs, and the rise in public-private partnerships for facilitating novel developments for innovative and effective treatment further influence the market.

North America underactive bladder market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyzes opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal. The scalability and business expansion of the retail units in the developing countries of various regions and partnership with suppliers for safe distribution of machine and drugs products are the major drivers which propelled the demand of the market in the forecast period.

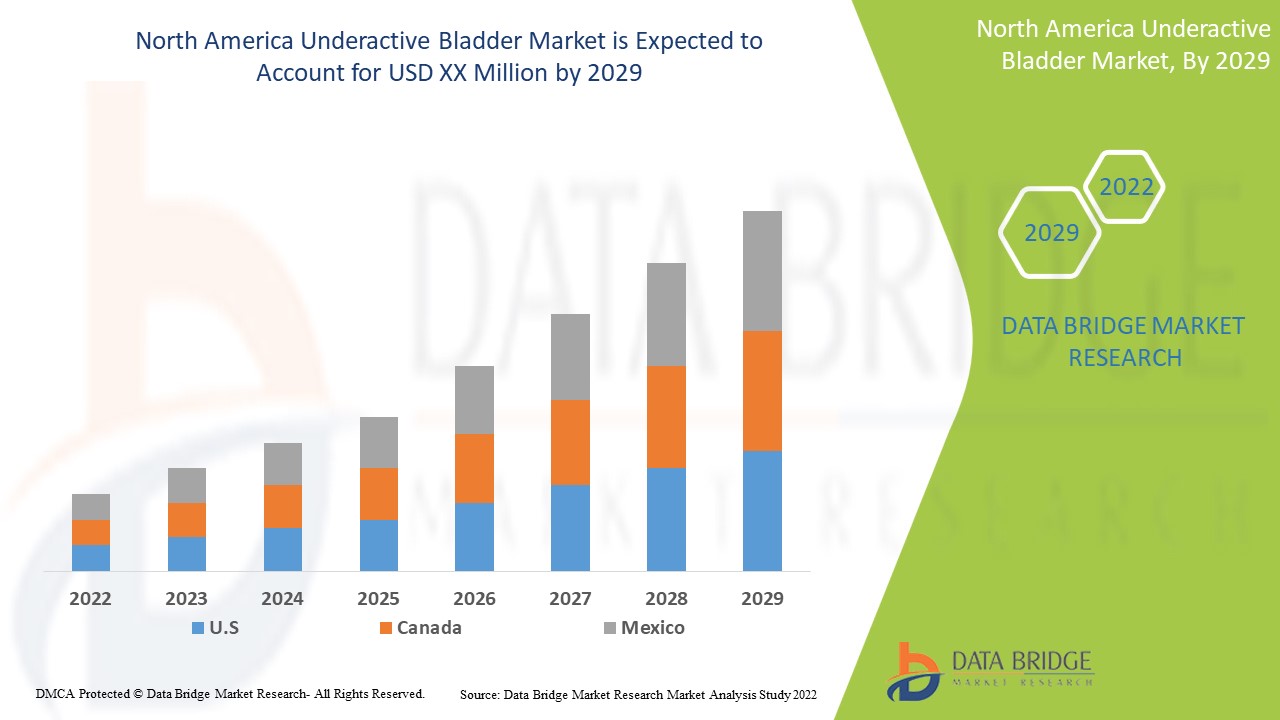

North America underactive bladder market is supportive and aims to reduce the progression of the disease. Data Bridge Market Research analyzes that North America underactive bladder market will grow at a CAGR of 5.3% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Type (Pharmacotherapy, Surgical Methods, Urethral Assist Device, and Stem Cell and Gene Therapies), Route of Administration (Oral, Parenteral, and Others), End User (Hospitals, Clinics, Academic and Research Institutes, and Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Astellas Pharma Inc., Aurobindo Pharma., Boehringer Ingelheim International GmbH, Macleods Pharmaceuticals Ltd., Orion Corporation, ONO PHARMACEUTICAL CO., LTD., Novartis AG, Pfizer Inc., Cipla Inc., Dr. Reddy’s Laboratories Ltd., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Almirall, S.A, Vesiflo, Inc., and Alkem Labs. among others |

Market Definition

Underactive Bladder (UAB) is a clinical condition in which urination disorder is developed as a result of reduction in the contraction of the detrusor muscle (a muscle of the bladder) during urination. It is characterized by the feeling of having to urinate immediately, and thus, this condition is different from the Overactive Bladder (OAB). The present invention provides a pharmaceutical composition useful for the prevention or treatment of UAB which has an effect of improving the urinary flow rate, an effect of improving the overdistension of the bladder (an effect of reducing bladder capacity), and is therefore, useful for the prevention or treatment of UAB.

Moreover, it is a disease state which is different from the OAB characterized by urinary urgency which has been attracting attention in recent years. Causes of UAB include autonomic neuropathy such as diabetes and alcoholism, pelvic surgery such as radical hysterectomy and radical rectal cancer, spinal cord diseases such as spina bifida, and disc herniation is also known. Patients suffering from severe and mild bladder disorder-associated problems need pharmacotherapy often cycled with multiple therapies and without adequate relief receiving continued treatments, which also creates an impact on healthcare expenditure.

North America Underactive Bladder Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of these are discussed in detail below:

Drivers

- Increasing prevalence of neurological disorder

UAB is a common neurological condition in which nerves and muscles do not work together very well resulting in prolonged urination time with or without a sensation of incomplete bladder emptying. In this condition, the detrusor muscles underperform for their contraction activity which is characterized by a slow urinary stream, hesitancy, and straining to void, with or without a feeling of incomplete bladder emptying, sometimes with storage symptoms even. Thus, the bladder either does not empty or empties only partially which is due to the bladder muscles being unable to release urine properly.

As a result, patients with UAB may have various urination symptoms and may be accompanied by a large amount of residual urine. Complications of urinary retention due to aggravation and Urinary Tract Infections (UTIs) due to chronic residual urine are often seen and have become a problem. Moreover, it is a disease state which is different from the OAB characterized by urinary urgency which has been attracting attention in recent years. Thus, the increasing prevalence of neurogenic bladder disorders is expected to drive market growth. This will lead to an increased demand for treatment that can detect patients as well, due to which there will be expected lucrative growth in the market.

- Rising health care expenditure

The instruments, manpower, and medical management in case of any harm to researchers, insurance, transportation, ethics committee fee, data processing, and other consumables lead to major cost involvement for the market players. The healthcare expenditure comprises all healthcare services, testing devices, family planning activities, and emergency aid designated for health. National Health Accounts provide many indicators based on expenditure collected within an internationally recognized framework. The factors determining any country's healthcare expenditure are income (per capita GDP), technological progress and variation in medical practice, and health systems characteristics.

The rise in healthcare expenditure simultaneously helps healthcare organizations and government bodies increase the research activities on menopause drugs, their upcoming clinical trials, and R&D activities. Also, the cost involved in the production and manufacturing of the new products, the market players require adequate allocation of funds and resources, hence, the government acts as a helping hand in this scenario. Growing healthcare expenditure is also beneficial for further economic development and growth of the healthcare sector. In addition, the increase in disposable income of the population is a favorable factor. Hence, rising healthcare expenditure is expected to drive market growth in the future.

Opportunity

- Rising urologic complications of diabetes

One of the known causes of UAB includes autonomic neuropathy such as diabetes. Moreover, diabetes is associated with an earlier onset and increased severity of urologic diseases that result in costly and debilitated urologic complications. These urologic complications, including bladder dysfunction and UTIs among others, have a profound effect on the quality of life of both men and women with diabetes. Diabetes and urologic diseases are very common health problems that markedly increase in prevalence and incidence with advancing age. Urologic complications of diabetes are an immediate effect. Diabetes is the most prominent disorder and has a high prevalence globally.

Diabetes-associated bladder complications can be due to an alternation in the detrusor smooth muscles, neuronal dysfunction, and urothelial dysfunction. Depending on the nerves involved, the effects of diabetic neuropathy can range from discomfort and numbness in the legs to complications with the digestive system, the urinary tract, the blood vessels, and the core. The rising data on diabetes will significantly increase the risk of urologic complications of diabetes worldwide. Thus, it is required to recommend future directions for research and clinical care for proper treatment of urologic complications of diabetes. Support from other organizations would also be required to reach the under-developed regions to tackle the neglected complications. Therefore, this signifies that the rise in urologic complications of diabetes is expected to act as an opportunity for market growth.

Restraint/Challenge

- High cost of Research and Development (R&D)

R&D is a prerequisite in modifying the procedure intended to treat different kinds of patients. The higher cost of R&D for new products demands deep research and clinical studies. The various clinical phases in R&D require huge investments which can affect market growth. The research cost involved in planning and execution of the studies, and research requires adequate allocation of funds and resources, which can affect new developments in the market. The cost of the product plays a major factor in the market. Many diagnostic options are available in the market, but due to their high cost, most people tend to avoid going for a diagnosis. Diagnostic approaches have come with greater sensitivity and specificity cost of the test also increased.

The high cost of the procedure is due to various checkpoints of treatments along with the use of high-tech modalities to perform such procedures. As cost of R&D for treatments is too high, it restricts accommodating high-quality and effective solutions. Henceforth, the high cost negatively impacts the cost of overall treatment. Consequently, it will constrict the future demand for treatment in low and middle-income countries. This suggests that the high cost associated with the research and studies is expected to restrain market growth which can further impact the launch of new products in the market.

Post-COVID-19 Impact on North America Underactive Bladder Market

COVID-19 has positively affected in the growth of the market as there is rise in the demand for products widely in the region. People have become more health conscious as there is rising prevalence of various bladder diseases in the region. Complications of urinary retention due to aggravation and UTIs due to chronic residual urine are often seen and have become a problem. Hence, COVID-19 has impacted positively on this market.

Recent Developments

- In June 2020, Vesiflo, Inc. announced the medicare coverage of inFlow urinary prosthesis, a magnetically coupled FDA-approved intraurethral valve-pump device which can be used for 29 days by adult women as an alternative to intermittent catheterization. This results in a contribution to the expansion of product business quickly with commercialization in the market.

- In April 2020, Astellas Pharma Europe Ltd. completed a clinical trial that was conducted on subjects for the treatment of underactive bladder. Currently, ASP8302 is under phase-2 clinical trial to investigate the safety and tolerability of the drug in patients with underactive bladder.

North America Underactive Bladder Market Scope

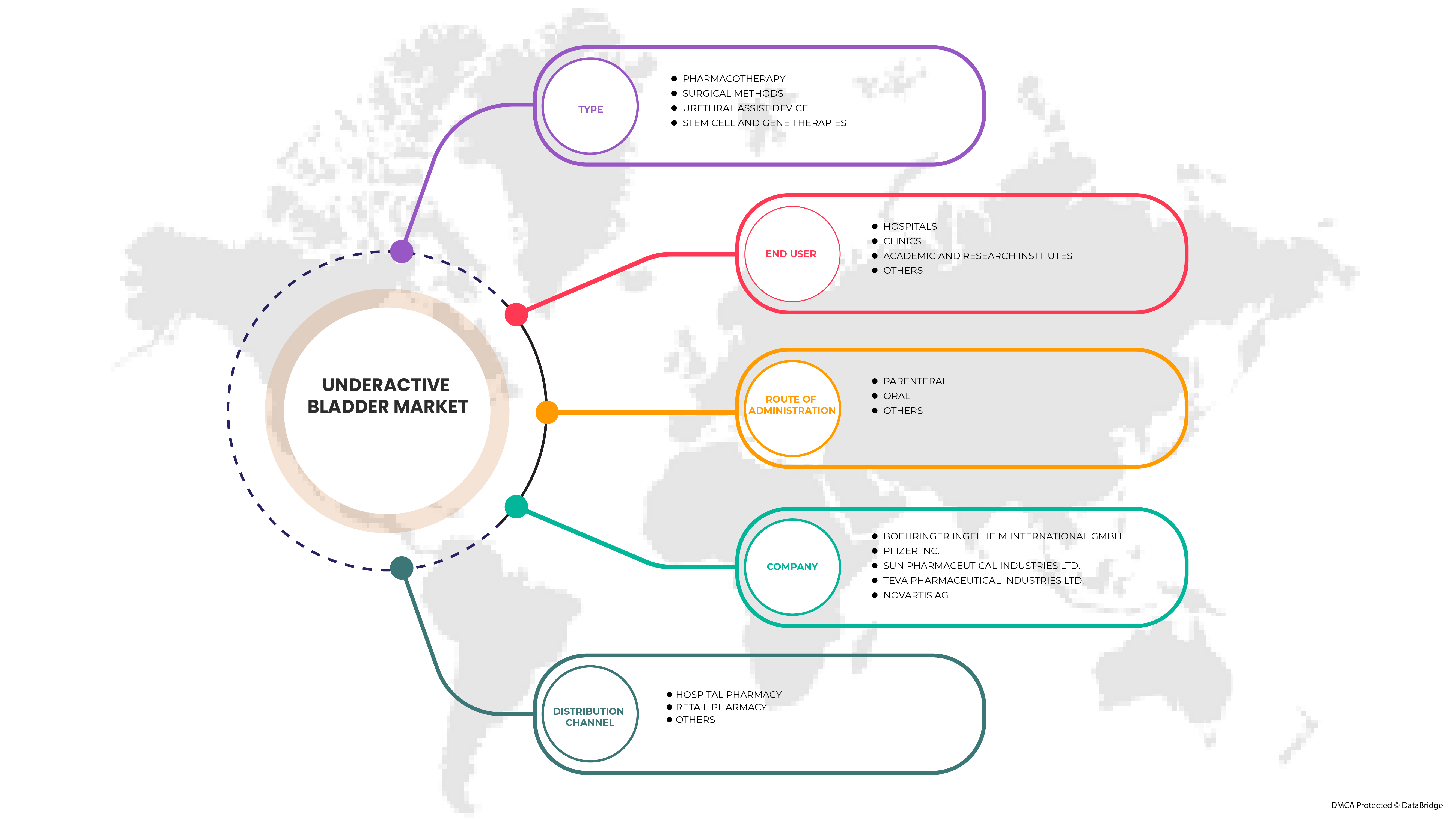

North America underactive bladder market is categorized into four notable segments based on type, route of administration, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Type

- Pharmacotherapy

- Surgical Methods

- Urethral Assist Device

- Stem Cell and Gene Therapies

Based on type, the market is segmented into pharmacotherapy, surgical methods, urethral assist device, and stem cell and gene therapies.

Route of Administration

- Oral

- Parenteral

- Others

Based on route of administration, the market is segmented into oral, parenteral, and others.

End User

- Hospitals

- Clinics

- Academic and Research Institutes

- Others

Based on end user, the market is segmented into hospitals, clinics, academic and research institutes, and others.

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Others

Based on distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and others.

North America Underactive Bladder Market Regional Analysis/Insights

North America underactive bladder market is analyzed and market size insights and trends are provided by type, route of administration, end user, and distribution channel as referenced above.

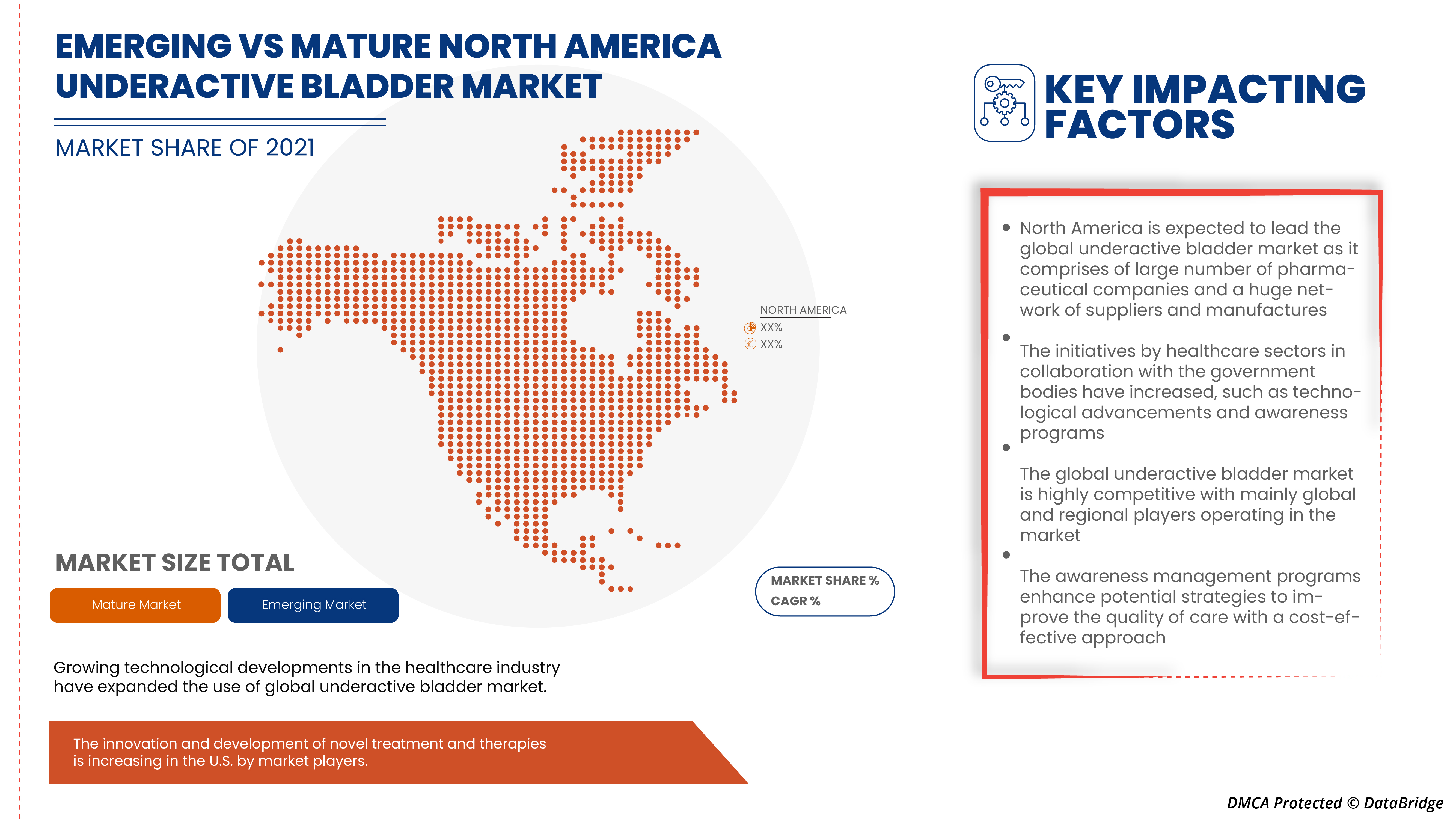

The countries covered in the North America underactive bladder market report are U.S., Canada, and Mexico.

- In 2022, North America underactive bladder disorders market is expected to grow due to the rise in incidence of bladder problems such as Urinary Incontinence (UI), UAB, and others. Moreover, the rise in geriatric population is also driving market growth as age increases the risk of bladder problems such as bladder control issues among others. The prevalence of UI and UAB also rises with age, and elderly people are the fastest growing segment of the population.

The U.S. is expected to dominate the region due to the presence of major players in the country and rising number of manufacturing facilities.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Underactive Bladder Market Share Analysis

North America underactive bladder market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the North America underactive bladder market.

Some of the major players operating in the market are:

- Astellas Pharma Inc.

- Aurobindo Pharma.

- Boehringer Ingelheim International GmbH

- Macleods Pharmaceuticals Ltd.

- Orion Corporation

- ONO PHARMACEUTICAL CO., LTD.

- Novartis AG

- Pfizer Inc.

- Cipla Inc.

- Dr. Reddy’s Laboratories Ltd.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Almirall, S.A

- Vesiflo, Inc.

- Alkem Labs.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America vs country, and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA UNDERACTIVE BLADDER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 EPIDEMIOLOGY

4.4 THE IMPORTANCE OF UNDERSTANDING PATENTS-

4.4.1 DOXAZOSIN

4.4.2 BETHANECHOL CHLORIDE

4.4.3 TAMSULOSIN HYDROCHLORIDE

4.5 CLINICAL TRIALS FOR UNDERACTIVE BLADDER

4.5.1 EU CLINICAL TRIALS REGISTER-

4.6 MERGER & ACQUISITION IN HEALTHCARE INDUSTRY

4.7 M&A DEALS IN 2021 BY TARGET COMPANY TERRITORY:

4.8 CROSS-BORDER DEALS:

4.9 OUTLOOK FOR 2022:

4.1 PATIENT ENROLMENT STRATEGIES

4.11 FACTORS AFFECTING PATIENT RECRUITMENT:

4.12 CHALLENGES:

4.13 PATIENT FUNNEL ANALYSIS:

4.14 RECOMMENDATIONS

4.14.1 USE OF TECHNOLOGY:

4.14.2 PARTICIPANT CHARACTERISTICS:

4.14.3 RECRUITER CHARACTERISTICS:

4.14.4 SYSTEMS & PROCEDURES:

4.14.5 LOCATION:

4.14.6 NATURE OF RESEARCH:

4.15 CONCLUSION:

4.16 UNDERACTIVE BLADDER PATIENT FLOW DIAGRAM

4.17 WHAT CAUSES UNDERACTIVE BLADDER?

4.17.1 CAUSES OF UNDERACTIVE BLADDER INCLUDE

4.17.2 TESTS TO EVALUATE UNDERACTIVE BLADDER

4.18 UNDERACTIVE BLADDER INVESTIGATIONAL PRODUCTS-

5 NORTH AMERICA UNDERACTIVE BLADDER MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF NEUROGENIC DISORDER

6.1.2 INCREASE IN RESEARCH AND DEVELOPMENT OF UNDERACTIVE BLADDER TREATMENT

6.1.3 FAVOURABLE REIMBURSEMENT SCENARIO

6.1.4 RISING HEALTHCARE EXPENDITURE

6.2 RESTRAINTS

6.2.1 HIGH COST OF RESEARCH AND DEVELOPMENT

6.2.2 STRINGENT GOVERNMENT REGULATIONS ON NEW PRODUCTS APPROVAL

6.3 OPPORTUNITIES

6.3.1 RISING UROLOGIC COMPLICATIONS OF DIABETES

6.3.2 PRESENCE OF NOVEL PIPELINE DRUGS

6.3.3 IMPROVING A BETTER HEALTHCARE SYSTEM

6.4 CHALLENGES

6.4.1 LACK OF PROPER TREATMENT

6.4.2 RISK INVOLVED DURING TREATMENT OF UNDERACTIVE BLADDER

7 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY TYPE

7.1 OVERVIEW

7.2 PHARMACOTHERAPY

7.2.1 ALPHA-BLOCKERS

7.2.2 MUSCARINIC AGONISTS

7.2.3 CHOLINESTERASE INHIBITOR

7.2.3.1 BY DRUGS

7.2.3.1.1 TAMSULOSIN

7.2.3.1.2 DOXAZOSIN

7.2.3.1.3 DISTIGMINE

7.2.3.1.4 BETHANECHOL

7.2.3.1.5 OTHERS

7.2.4 BY PRODUCT TYPES

7.2.4.1 GENERICS

7.2.4.2 BRANDED

7.2.4.2.1 FLOMAX

7.2.4.2.2 ALFADIL

7.2.4.2.3 GRAVITOR

7.2.4.2.4 URIVOID

7.2.4.2.5 OTHERS

7.3 SURGICAL METHODS

7.3.1 SURGICAL NERVE STIMULATION

7.3.2 REDUCTION CYSTOPLASTY

7.3.3 SURGERIES FOR BLADDER OBSTRUCTION

7.3.4 INJECTION INTO EXTERNAL SPHINCTER

7.3.5 OTHERS

7.4 URETHRAL ASSIS DEVICE

7.4.1 INFLOW INTRAURETHRAL VALVE PUMP

7.5 STEM CELL AND GENE THERAPIES

7.5.1 NERVE GROWTH FACTOR

7.5.2 GLIAL-CELL DERIVE NEUTOPHIC FACTORGLIAL

7.5.3 NEUTOPHIN-3 DERIVES FROM GLIALL CELLS

8 NORTH AMERICA UNDERACTIVE BLADDER MARKET,BY ROUTE OF ADMINISTRATION

8.1 OVERVIEW

8.2 PARENTERAL

8.3 ORAL

8.4 OTHERS

9 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY END USER

9.1 OVERVIEW

9.2 HOSPITALS

9.3 CLINICS

9.4 ACADEMIC AND RESEARCH

9.5 OTHERS

10 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 HOSPITAL PHARMACY

10.3 RETAIL PHARMACY

10.4 OTHERS

11 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA UNDERACTIVE BLADDER MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 PFIZER INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 SUN PHARMACEUTICAL INDUSTRIES LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 TEVA PHARMACEUTICAL INDUSTRIES LTD

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 NOVARTIS AG

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 DR. REDDY’S LABORATORIES LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 ASTELLAS PHARMA INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 ORION CORPORATION.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 ALKEM LABS.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 ALMIRALL, S.A

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 AUROBINDO PHARMA.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 CIPLA INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 GLENWOOD

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 MACLEODS PHARMACEUTICALS LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 ONO PHARMACEUTICAL CO., LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 VESIFLO, INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 TOTAL 40 DOXAZOSIN DRUGS WERE DISCONTINUED FROM THE MARKET

TABLE 2 TOTAL 38 DOXAZOSIN DRUGS ARE STILL IN THE MARKET

TABLE 3 TOTAL PRESCRIPTION AND DISCONTINUED DRUGS (DOXAZOSIN) BY COMPANY

TABLE 4 TOTAL 58 DRUGS DISCONTINUED

TABLE 5 TOTAL PRESCRIPTION AND DISCONTINUED DRUGS (BETHANECHOL CHLORIDE) BY COMPANY

TABLE 6 OUT OF 3,128 STUDIES ON BLADDER DISORDER, ONLY 22 STUDIES ARE ONGOING FOR THE UAB-

TABLE 7 THESE CLINICAL TRIALS ARE MOSTLY RECRUITING/ONGOING IN DIFFERENT REGIONS OF THE WORLD-

TABLE 8 TOP ACQUISITIONS OF 2021 RANKED BY TOTAL DEAL VALUE:

TABLE 9 FDA REQUIRES THE FOLLOWING SCENARIO BEFORE A DRUG IS APPROVED

TABLE 10 NORTH AMERICA UNDERACTIVE BLADDER MARKET, TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA STEM CELL AND GENE THERAPIES IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA PARENTERAL IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ORAL IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY END USER, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA HOSPITALS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA CLINICS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA ACADEMIC AND RESEARCH IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA UNDERACTIVE BLADDER MARKET , BY DISTRIBUTION CHANNEL , 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA HOSPITAL PHARMACY IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA RETAIL PHARMACY IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN UNDERACTIVE BLADDER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 39 NORTH AMERICA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 40 NORTH AMERICA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 41 NORTH AMERICA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 42 NORTH AMERICA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 43 NORTH AMERICA BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 44 NORTH AMERICA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 45 NORTH AMERICA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 46 NORTH AMERICA BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 47 NORTH AMERICA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 48 NORTH AMERICA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 49 NORTH AMERICA STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 50 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 51 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 52 NORTH AMERICA UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 53 U.S. UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 55 U.S. PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 56 U.S. BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 57 U.S. BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 58 U.S. BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 59 U.S. BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 60 U.S. BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 61 U.S. BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 62 U.S. BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 63 U.S. SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 64 U.S. URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 65 U.S. STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 66 U.S. UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 67 U.S. UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 68 U.S. UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 69 CANADA UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 CANADA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 71 CANADA PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 72 CANADA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 73 CANADA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 74 CANADA BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 75 CANADA BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 76 CANADA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 77 CANADA BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 78 CANADA BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 79 CANADA SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 80 CANADA URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 81 CANADA STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 82 CANADA UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 83 CANADA UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 84 CANADA UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 85 MEXICO UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 MEXICO PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 87 MEXICO PHARMACOTHERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 88 MEXICO BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 89 MEXICO BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 90 MEXICO BY DRUGS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 91 MEXICO BY PRODUCT TYPE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 92 MEXICO BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 93 MEXICO BRANDED IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 94 MEXICO BRANDED TYPES IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 95 MEXICO SURGICAL METHODS IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 96 MEXICO URETHRAL ASSIS DEVICE IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 97 MEXICO STEM CELL AND GENE THERAPY IN UNDERACTIVE BLADDER MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 98 MEXICO UNDERACTIVE BLADDER MARKET, BY ROUTE OF ADMINISTRATION, 2020- 2029 (USD MILLION)

TABLE 99 MEXICO UNDERACTIVE BLADDER MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 100 MEXICO UNDERACTIVE BLADDER MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA UNDERACTIVE BLADDER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA UNDERACTIVE BLADDER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA UNDERACTIVE BLADDER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA UNDERACTIVE BLADDER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA UNDERACTIVE BLADDER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA UNDERACTIVE BLADDER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA UNDERACTIVE BLADDER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA UNDERACTIVE BLADDER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA UNDERACTIVE BLADDER MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA UNDERACTIVE BLADDER MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF NEUROGENIC BLADDER INFECTIONS IS EXPECTED TO DRIVE THE NORTH AMERICA UNDERACTIVE BLADDER MARKET IN THE FORECAST PERIOD

FIGURE 12 TREATMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA UNDERACTIVE BLADDER MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA UNDERACTIVE BLADDER MARKET

FIGURE 14 NORTH AMERICA UNDERACTIVE BLADDER MARKET : TYPE, 2021

FIGURE 15 NORTH AMERICA UNDERACTIVE BLADDER MARKET : TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA UNDERACTIVE BLADDER MARKET : TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA UNDERACTIVE BLADDER MARKET : TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, 2021

FIGURE 19 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY END USER, 2021

FIGURE 23 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY END USER, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY END USER, LIFELINE CURVE

FIGURE 26 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA UNDERACTIVE BLADDER MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 30 NORTH AMERICA UNDERACTIVE BLADDER MARKET: SNAPSHOT (2021)

FIGURE 31 NORTH AMERICA UNDERACTIVE BLADDER MARKET: BY COUNTRY (2021)

FIGURE 32 NORTH AMERICA UNDERACTIVE BLADDER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 NORTH AMERICA UNDERACTIVE BLADDER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 NORTH AMERICA UNDERACTIVE BLADDER MARKET: BY TYPE (2022-2029)

FIGURE 35 NORTH AMERICA UNDERACTIVE BLADDER MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.