North America Urinalysis Market

Market Size in USD Billion

CAGR :

%

USD

1,016.99 Billion

USD

1,958.79 Billion

2024

2032

USD

1,016.99 Billion

USD

1,958.79 Billion

2024

2032

| 2025 –2032 | |

| USD 1,016.99 Billion | |

| USD 1,958.79 Billion | |

|

|

|

|

North America Urinalysis Market Size

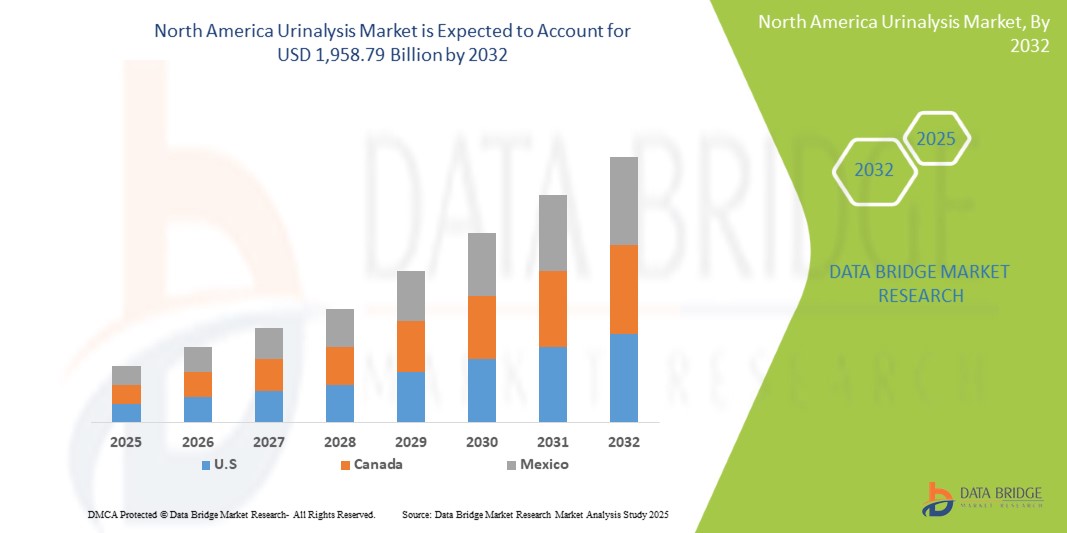

- The North America urinalysis market size was valued at USD 1,016.99 billion in 2024 and is expected to reach USD 1,958.79 billion by 2032, at a CAGR of 6.14% during the forecast period

- This growth is driven by factors such as the aging population, increasing prevalence of chronic conditions like diabetes and kidney disorders, and rising demand for early disease detection through non-invasive diagnostic methods

North America Urinalysis Market Analysis

- Urinalysis is a critical diagnostic tool used to detect and monitor a variety of conditions, including urinary tract infections, kidney disease, diabetes, and liver disorders, through the analysis of urine samples

- The demand for urinalysis is growing steadily due to the rising prevalence of chronic diseases, increasing geriatric population, and growing emphasis on early diagnosis and preventive healthcare

- U.S. is expected to dominate the North America urinalysis market with largest market share of approximately 33.4%, due to its advanced healthcare infrastructure, high healthcare expenditure, and widespread adoption of innovative diagnostic technologies

- Canada is expected to be the fastest growing region in the North America urinalysis market during the forecast period due to its expanding healthcare infrastructure, increasing prevalence of chronic diseases, and rising demand for early diagnostic solutions

- Consumables segment is expected to dominate the market with a largest market share of 78.57% due to the increasing demand and frequent purchases of reagents and dipsticks by clinical and hospital laboratories. Reagents are the most common type of consumable in urinalysis, accounting for the largest share of the market. Many major providers, such as Siemens Healthcare GmBH, Abbott, and Roche, provide high-quality consumables for urinalysis testing, which is expected to boost segment growth

Report Scope and North America Urinalysis Market Segmentation

|

Attributes |

North America Urinalysis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Urinalysis Market Trends

“Increasing adoption of automated and point-of-care (POC) testing Solutions”

- One prominent trend in the North America urinalysis market is the increasing adoption of automated and point-of-care (POC) testing solutions, which enhance diagnostic efficiency and reduce turnaround times for results

- These innovations are improving diagnostic accuracy and accessibility, particularly in remote healthcare settings, enabling patients to receive timely results without the need for extensive laboratory visits

- For instance, the integration of AI and machine learning algorithms in urinalysis devices is enabling more precise interpretation of results, offering deeper insights into chronic conditions such as kidney disease and diabetes

- These advancements are transforming urinalysis testing, increasing patient convenience, and driving the demand for next-generation diagnostic tools that support early disease detection and personalized healthcare management

North America Urinalysis Market Dynamics

Driver

“Increasing Prevalence of Chronic Diseases”

- The increasing prevalence of chronic diseases such as diabetes, kidney disorders, and urinary tract infections (UTIs) is significantly driving the demand for urinalysis tests in North America

- As the population ages and lifestyle-related conditions rise, the need for early detection and monitoring of these conditions is expanding, resulting in more frequent use of urinalysis as a routine diagnostic tool

- With more individuals requiring ongoing management for these conditions, the demand for urinalysis tests grows, contributing to improved healthcare outcomes and reduced long-term healthcare costs

For instance,

- In 2021, the Centers for Disease Control and Prevention (CDC) reported that nearly 10.5% of the U.S. population has diabetes, a leading cause of kidney disease, which is closely monitored using urinalysis

- As a result, the increasing prevalence of chronic diseases, along with a growing focus on early disease detection, is fueling the demand for urinalysis testing across North America

Opportunity

“Integration of Advanced Technologies”

- The integration of advanced technologies such as AI and machine learning in urinalysis devices presents significant opportunities to enhance diagnostic accuracy, speed, and efficiency, transforming the testing process

- AI-powered urinalysis systems can analyze large volumes of data, provide instant feedback, and detect early signs of diseases like diabetes, kidney disease, and urinary tract infections (UTIs), leading to better patient outcomes and early intervention

- Furthermore, the integration of AI can assist in automating routine testing processes, reducing human error, and enabling more efficient use of healthcare resources, particularly in remote and point-of-care settings

For instance,

- In 2024, according to a study published in the Journal of Clinical Chemistry, AI algorithms are being implemented in urinalysis devices to detect subtle patterns in urine samples that may be indicative of chronic diseases, helping physicians diagnose and treat conditions earlier

- The opportunity to enhance diagnostic capabilities with AI-driven solutions is expected to drive the demand for advanced urinalysis testing devices, improving healthcare delivery and patient outcomes across North America

Restraint/Challenge

“High Equipment Costs Hindering Market Penetration”

- The high cost of advanced urinalysis testing equipment and diagnostic devices is a significant challenge for the market, limiting the accessibility of these technologies, especially in smaller healthcare facilities and rural areas

- Urinalysis systems, particularly those incorporating AI or automated features, can be expensive, ranging from thousands to tens of thousands of dollars, which may restrict their adoption by clinics or laboratories with constrained budgets

- This financial barrier can result in healthcare providers relying on less efficient or outdated systems, leading to slower diagnostic processes and reduced patient care quality

For instance,

- In February 2024, according to an article published by the Journal of Clinical Diagnostic Research, the high cost of automated urinalysis systems is often cited as a key factor preventing their widespread use in smaller, budget-conscious healthcare centers. The adoption of such systems is further limited by the initial capital investment required, which affects overall healthcare accessibility

- As a result, these challenges can restrict the growth of the urinalysis market, particularly in regions where healthcare budgets are limited, impacting the adoption of cutting-edge diagnostic technologies

North America Urinalysis Market Scope

The market is segmented on the basis of testing type, product, test type, modality, application, end user, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Testing Type |

|

|

By Product |

|

|

By Modality |

|

|

By Application |

|

|

By End User |

|

|

By Distribution Channel

|

|

In 2025, the consumables is projected to dominate the market with a largest share in product segment

The consumables segment is expected to dominate the North America urinalysis market with the largest share of 78.57% due to the increasing demand and frequent purchases of reagents and dipsticks by clinical and hospital laboratories. Reagents are the most common type of consumable in urinalysis, accounting for the largest share of the market. Many major providers, such as Siemens Healthcare GmBH, Abbott, and Roche, provide high-quality consumables for urinalysis testing, which is expected to boost segment growth

North America Urinalysis Market Regional Analysis

“U.S. Holds the Largest Share in the North America Urinalysis Market”

- U.S. dominates the North America Urinalysis market, due to rising numbers of urinalysis procedures and the growing adoption of urinalysis for treating liver disease and urinary tract infections

- The U.S. holds the largest share of approximately 33.4%, due to increased demand for high-precision ophthalmic procedures, rising prevalence of eye disorders such as cataracts and glaucoma, and continuous advancements in surgical techniques

- Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data

“Canada is Projected to Register the Highest CAGR in the North America Urinalysis Market”

- Canada is projected to witness the highest CAGR in the North America urinalysis market during the forecast period, fueled by the rising aging population, growing focus on preventive healthcare, and increasing investment in diagnostic technologies

- Furthermore, the Canadian government's supportive health policies and initiatives to expand access to diagnostic services in underserved regions are contributing to market growth. The expanding adoption of point-of-care testing and integration of innovative urinalysis instruments also play a key role in boosting market expansion across the country

North America Urinalysis Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- ACON Laboratories, Inc. (U.S.)

- ARKRAY, Inc. (U.S.)

- Beckman Coulter, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Cardinal Health, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Quidel Corporation (U.S.)

- Siemens Healthineers AG (Germany)

- Sysmex Corporation (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- Becton, Dickinson and Company (BD) (U.S.)

- EKF Diagnostics Holdings PLC (UK)

- 77 Elektronika Kft. (Hungary)

- Waters Corporation (U.S.)

- Randox Laboratories Ltd. (UK)

- Nova Biomedical (U.S.)

- Medica Corporation (U.S.)

- Chembio Diagnostics, Inc. (U.S.)

- Urit Medical Electronic Group Co., Ltd. (China)

Latest Developments in North America Urinalysis Market

- In January 2023, Siemens Healthineers completed the acquisition of Acon Laboratories, a leading supplier of urinalysis consumables, significantly strengthening its portfolio in the urinalysis market. By acquiring Acon Laboratories, Siemens Healthineers aims to enhance its competitive edge and further solidify its market leadership in the rapidly evolving North America urinalysis market, where the demand for efficient, high-quality diagnostic solutions continues to grow

- In September 2022, Sysmex Corp. introduced the UF-1500 Fully Automated Urine Particle Analyzer, an advanced device designed for urine sediment testing, enhancing the efficiency and accuracy of urinalysis diagnostics. The efforts of Sysmex Corp. and the National Kidney Foundation align with the increasing need for advanced diagnostic technologies in North America, where early detection and monitoring of kidney disease and other chronic conditions are critical for improving patient outcomes

- In August 2021, myLAB Box, a leader in at-home testing-to-treatment services, launched an innovative at-home colorectal cancer screening test, designed to help physicians detect potential signs of colon cancer in both men and women. The introduction of this test is particularly relevant to the North America urinalysis market, as it reflects the broader trend of at-home diagnostic solutions gaining traction in the region, including urine-based testing for early detection of various health conditions

- In December 2024, Copan Diagnostics received FDA approval for its innovative urine collection and transport device, "UriSponge," which incorporates a new formulation of advanced preservatives to ensure enhanced specimen stability. The introduction of UriSponge aligns with the increasing demand for reliable, efficient, and cost-effective solutions in urine collection and transport, supporting healthcare providers in delivering more precise and timely diagnoses

- In June 2024, Community Health Center (CHC) Marwah unveiled a state-of-the-art digital urine and blood analyzer, designed to revolutionize diagnostic accuracy and efficiency. The introduction of this digital analyzer aligns with the increasing adoption of advanced diagnostic tools in healthcare settings, streamlining urine and blood analysis while improving diagnostic outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.