North America Utility Locator Market

Market Size in USD Billion

CAGR :

%

USD

2.33 Billion

USD

4.11 Billion

2024

2032

USD

2.33 Billion

USD

4.11 Billion

2024

2032

| 2025 –2032 | |

| USD 2.33 Billion | |

| USD 4.11 Billion | |

|

|

|

|

Utility Locator Market Size

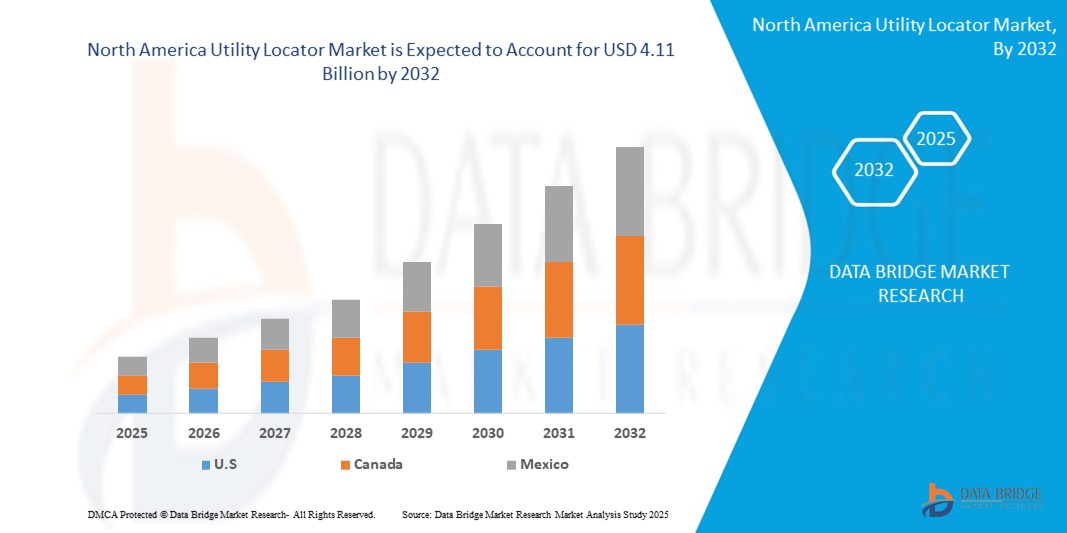

- The North America utility locator market size was valued at USD 2.33 billion in 2024 and is expected to reach USD 4.11 billion by 2032, at a CAGR of 7.3% during the forecast period

- The market growth is largely fueled by increasing investments in infrastructure development and the urgent need to prevent utility damages during excavation activities. Rising government regulations mandating the use of utility locators before digging is also enhancing market adoption across various sectors including construction, oil & gas, and telecommunications

- Furthermore, the growing integration of advanced technologies such as ground penetrating radar (GPR), electromagnetic field locators, and GPS-based mapping solutions is revolutionizing the way underground utilities are detected. These technological advancements are improving detection accuracy, boosting efficiency, and minimizing service disruptions—further driving the growth of the utility locator market in North America

Utility Locator Market Analysis

- Utility locators, which detect underground utilities such as water, gas, electricity, and telecommunication lines, are becoming indispensable tools for construction, oil & gas, and municipal projects due to their ability to prevent costly damage, ensure worker safety, and maintain regulatory compliance

- The rising demand for utility locators is primarily fueled by increasing infrastructure development projects, stringent government regulations requiring utility detection before excavation, and growing awareness about utility safety standards among contractors and municipalities

- The U.S. dominates the North America utility locator market with the largest revenue share in 2024, supported by massive investments in smart infrastructure, a mature construction industry, and enforcement of “Call Before You Dig” regulations. The presence of major players such as Radiodetection, Subsite Electronics, and Vivax-Metrotech further strengthens market growth in the U.S

- Canada is expected to be the fastest-growing country in the North America utility locator market during the forecast period, driven by rising infrastructure renewal initiatives, especially in urban transit and smart city development, along with growing adoption of advanced ground-penetrating radar and electromagnetic detection technologies

- Electromagnetic field (EMF) locators are expected to dominate the utility locator market with a substantial market share in 2024, due to their versatility, ease of use, and cost-effectiveness across a wide range of utility detection applications in both urban and rural environments

Report Scope and Utility Locator Market Segmentation

|

Attributes |

Utility Locator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Utility Locator Market Trends

“Digital Advancements through AI, GPS, and Augmented Reality (AR)”

- A significant and accelerating trend in the North America utility locator market is the integration of advanced digital technologies such as artificial intelligence (AI), GPS mapping, and augmented reality (AR) into utility locating equipment. This convergence is transforming the accuracy, efficiency, and safety of subsurface utility detection across sectors such as construction, energy, and telecommunications

- For instance, companies such as Radiodetection and Leica Geosystems are incorporating AI-powered data analytics and machine learning algorithms into their locators to better interpret electromagnetic signals and distinguish between multiple utility lines in congested underground environments. These smart systems can also learn from repeated scans to improve detection reliability over time.

- The use of GPS-enabled utility locators has become widespread across the U.S. and Canada, allowing operators to geo-tag utility locations with high precision. This capability supports real-time mapping and long-term utility record management, helping utilities and municipalities reduce future excavation risks. Subsite Electronics' TK RECON series, for example, integrates GPS with intuitive mapping to streamline field operations

- Augmented reality (AR) overlays are emerging as another transformative feature, with systems such as vGIS enabling technicians to visualize underground utilities using AR headsets or smartphones. This provides workers with a real-time, above-ground view of buried infrastructure, minimizing human error and reducing the chance of accidental strikes

- The fusion of these technologies into utility locator systems not only improves accuracy but also boosts productivity and enhances worker safety by reducing the need for manual probing or trial-and-error detection. Moreover, AI-driven platforms are being used for predictive maintenance of utilities by analyzing ground and usage data to anticipate potential service failures

- This trend toward smart, digitally enhanced locating solutions is reshaping how utility infrastructure is managed in North America. As municipalities, contractors, and utility providers increasingly adopt intelligent, connected equipment, demand is surging for integrated locator platforms that offer real-time data, enhanced user interfaces, and seamless connectivity with asset management systems

Utility Locator Market Dynamics

Driver

“Infrastructure Modernization and Mandates to Prevent Utility Strikes”

- The rising number of construction, urban development, and infrastructure rehabilitation projects across North America is a major driver for the growing demand for utility locators. With thousands of underground utility lines crisscrossing urban and rural areas, accurate utility detection has become essential for safe and compliant excavation

- For instance, in March 2024, the U.S. Department of Transportation (DOT) expanded its infrastructure safety guidelines under the Bipartisan Infrastructure Law, increasing enforcement of the “Call Before You Dig” protocol. These regulations have compelled contractors and utilities to adopt more advanced utility locating tools to avoid penalties and protect critical infrastructure

- Utility locators offer a vital solution to prevent utility damages, service disruptions, and costly project delays by enabling non-invasive detection of buried assets such as water, gas, power, and telecom lines

- The integration of high-precision GPS, ground penetrating radar (GPR), and cloud-based data logging capabilities enhances their utility, making them indispensable for public and private infrastructure stakeholders

- Moreover, insurance providers and regulatory agencies are increasingly requiring certified utility locating practices before issuing excavation permits, reinforcing their role as a standard part of construction workflows across the U.S. and Canada

Restraint/Challenge

“High Equipment Costs and Operator Skill Gaps”

- Despite their clear benefits, the high upfront cost of advanced utility locating equipment and the specialized skills required to operate them present notable challenges to broader market adoption. Many small to mid-sized contractors in North America find it difficult to justify investing in premium systems equipped with GPR or multi-sensor technologies

- For example, models such as the Leica DSX or Subsite 2550GR deliver high-resolution detection but come at a price that may not be accessible to smaller firms or municipalities with tight budgets

- In addition, the effectiveness of utility locators often depends on the operator’s ability to interpret signal feedback accurately. Lack of proper training or workforce shortages in skilled utility technicians can result in missed or misidentified utilities, undermining safety and efficiency

- Addressing this challenge requires increased investment in training programs, certifications, and easy-to-use interfaces that reduce reliance on highly specialized personnel. Companies such as Radiodetection are responding with user-friendly locator systems integrated with cloud-based support and step-by-step guides for field technicians

- Furthermore, cost-sharing models such as rental programs, third-party locating services, and government incentives for safety compliance could help make these tools more accessible and encourage broader industry uptake.

Utility Locator Market Scope

The market is segmented on the basis of technique, offering, target, end user industry, device type, and sales channel.

By Technique

On the basis of technique, the utility locator market is segmented into electromagnetic field, ground penetrating radar, and others. The electromagnetic field segment dominates the largest market revenue share in 2025, driven by its proven effectiveness in detecting metallic utilities with high accuracy. It is widely used in various utility mapping applications due to its portability, ease of use, and cost-effectiveness. This segment continues to see strong demand due to its operational simplicity and wide deployment across field operations

The ground penetrating radar segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its increasing application in detecting non-metallic utilities and deeper subsurface anomalies. GPR technology offers high-resolution imaging, making it suitable for complex underground infrastructure projects. The technology's ability to work in diverse soil conditions further contributes to its growing popularity across municipal and construction sectors

• By Offering

On the basis of offering, the utility locator market is segmented into equipment and services. The equipment segment held the largest market revenue share in 2025, driven by continual product advancements, integration of IoT features, and demand for accurate and efficient underground detection tools. Equipment such as portable and truck-mounted locators form the backbone of field operations, making them essential in regular utility detection tasks

The services segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising trend of outsourcing utility detection tasks to specialized service providers. These services help reduce operational risks and are gaining traction among utility companies and contractors who prefer expert support to avoid costly damages during excavation and planning activities.

• By Target

On the basis of target, the utility locator market is segmented into metallic and non-metallic. The metallic segment held the largest market revenue share in 2025, driven by the dominance of metal pipes and cables in utility networks and the maturity of technologies designed specifically to detect these structures. Electromagnetic field-based devices remain widely adopted due to their precision and reliability in tracing metallic utilities

The non-metallic segment is expected to witness the fastest CAGR from 2025 to 2032, favored by the increasing presence of plastic and composite materials in modern utility installations. As utility infrastructure evolves, the need to accurately locate non-metallic utilities such as PVC pipes and fiber optics is rising, thereby boosting demand for advanced detection methods such as ground penetrating radar

• By End User Industry

On the basis of end user industry, the utility locator market is segmented into telecommunication, electricity, water and sewage, oil and gas, transportation, and others. The electricity segment accounted for the largest market revenue share in 2024, driven by ongoing grid modernization, the need for underground cable detection, and increasing investment in urban infrastructure. Electric utilities rely heavily on precise detection to minimize outages and service disruptions

The telecommunication segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the global rollout of 5G infrastructure and the expansion of fiber optic networks. Accurate underground detection is crucial in preventing service disruptions and optimizing installation and maintenance operations

• By Device Type

On the basis of device type, the utility locator market is segmented into portable locators, truck-mounted locators, and handheld locators. The portable locators segment held the largest market revenue share in 2025, driven by their ease of transport, versatility, and cost-efficiency across various utility detection scenarios. These devices are widely preferred for daily utility surveys and short-term projects

The handheld locators segment is expected to witness the fastest CAGR from 2025 to 2032, driven by their compact design and growing use in rapid on-site assessments. Their user-friendliness and affordability make them ideal for technicians conducting frequent but low-complexity underground inspections

• By Sales Channel

On the basis of sales channel, the utility locator market is segmented into direct sales, distributors, and online sales. The direct sales segment captured the largest revenue share in 2025, fueled by strong relationships between manufacturers and end users, allowing for customized solutions and technical support. Utility companies and infrastructure firms prefer direct purchases for complex equipment needs

The online sales segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the expanding reach of e-commerce platforms and increasing digital adoption among small and medium enterprises. Online channels offer ease of access to product catalogs, competitive pricing, and doorstep delivery

Utility Locator Market Regional Analysis

U.S. Utility Locator Market Insight

The U.S. utility locator market captured the largest revenue share within North America in 2024, driven by ongoing infrastructure modernization, regulatory mandates, and the enforcement of utility safety protocols such as the “Call 811 Before You Dig” program. The rapid expansion of transportation, energy, and smart city projects is increasing the demand for accurate and efficient subsurface utility detection. Additionally, the adoption of advanced technologies such as ground-penetrating radar (GPR), electromagnetic field (EMF) locators, and GPS-integrated systems is accelerating. Key players such as Radiodetection, Subsite Electronics, and Vivax-Metrotech continue to innovate with AI-powered and cloud-enabled solutions, further enhancing the operational efficiency and safety compliance of utility detection workflows in the U.S.

Canada Utility Locator Market Insight

The Canada utility locator market is projected to expand at a notable CAGR throughout the forecast period, primarily fueled by growing infrastructure renewal initiatives and stricter excavation regulations across provinces. Rising investments in public transit, utilities, and smart urban development projects are driving demand for reliable utility locating systems. Canadian municipalities are increasingly mandating utility detection before excavation to prevent costly service disruptions and ensure worker safety. The country is witnessing growing adoption of digital utility maps and geospatial data platforms, along with the integration of electromagnetic and radar-based locators in both public and private sector projects. Supportive government policies and heightened awareness of underground asset protection are further contributing to market growth

Mexico Utility Locator Market Insight

The Mexico utility locator market is expected to grow at a steady pace over the forecast period, driven by increased urbanization and ongoing expansion of energy and telecommunications infrastructure. As construction activity continues to rise in key metropolitan regions, so does the need for accurate detection of underground utilities to reduce operational risks and delays. Mexican infrastructure companies are gradually shifting toward more sophisticated utility locator systems to comply with emerging safety standards and reduce project downtime. While the market is still developing compared to the U.S. and Canada, rising awareness of excavation safety and efforts to modernize municipal infrastructure are laying a strong foundation for the adoption of advanced utility locating technologies in the coming year

Utility Locator Market Share

The utility locator industry is primarily led by well-established companies, including:

- US Radar (U.S.)

- 3M (U.S.)

- Emerson Electric Co. (U.S.)

- Vermeer Corporation (U.S.)

- Stake Centre Locating (U.S.)

- Subsite Electronics (U.S.)

- USIC (U.S.)

- Ground Penetrating Radar Systems, LLC. (U.S.)

- RYCOM Instruments, Inc. (Canada)

- Penhall Company (U.S.)

- Vivax-Metrotech Corp. (U.S.)

- Guideline Geo. (Sweden)

- Radiodetection Ltd. (U.K.)

- Irth Solutions, L.L.C. (U.S.)

- Leica Geosystems AG (Switzerland)

Latest Developments in Global Utility Locator Market

- In April 1, 2025, Vermeer introduced the Verifier G1 utility locator, designed for contractors, utility owners, and municipalities. This device simplifies utility locating with a compact, waterproof design, eliminating complex menus and settings for ease of use. It delivers precise depth measurements with an accuracy of ±2.5% at 6.5 ft (2 m), enhancing efficiency and safety on job sites

- In January, 2025, AWP Safety announced the acquisition of Site Barricades (Fort Worth, Texas), Integrity Traffic (Sherwood, Oregon), and WS Barricade (Frederick, Colorado). This strategic move strengthens AWP Safety’s leadership in traffic management solutions across utility, broadband, and roadway infrastructure sectors in North America. The acquisitions expand AWP Safety’s footprint, enhancing its ability to serve high-growth regions such as Texas, Oregon, Colorado, and Nebraska

- In April 2022, Radiodetection Ltd. introduced the 1205CXB Metallic Cable Analyzer TDR, a high-precision Time Domain Reflectometer (TDR) designed to quickly and accurately locate faults in copper cables. This device features ultra-clean, low-noise signals, a large color display, and automatic scanning capabilities, making it one of the most user-friendly instruments in the industry. The 1205CXB also includes advanced connectivity options, such as a USB port for data export and battery charging

- In April 2022, Radiodetection Ltd. introduced the 1205CXB Metallic Cable Analyzer TDR, a high-precision Time Domain Reflectometer (TDR) designed to quickly and accurately locate faults in copper cables. This device features ultra-clean, low-noise signals, a large color display, and automatic scanning capabilities, making it one of the most user-friendly instruments in the industry. The 1205CXB also includes advanced connectivity options, such as a USB port for data export and battery charging

- In February 2021, RIDGID introduced the SeekTech ST-305R, a powerful and flexible multi-frequency transmitter designed to locate buried conductors such as pipes, cables, and wires. Compatible with RIDGID SeekTech and NaviTrack receivers, the ST-305R offers three operating modes—Direct Connect, Inductive Clamp, and Inductive—to ensure precise tracing. It supports low, medium, and high frequencies from 1 to 262 kHz and features audio confirmation for circuit validation. The ST-305R can be powered by an 18V Li-Ion rechargeable battery or six C-cell batteries, providing versatile power options for uninterrupted use

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Utility Locator Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Utility Locator Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Utility Locator Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.