North America Vegan Protein Market

Market Size in USD Billion

CAGR :

%

USD

3.77 Billion

USD

6.63 Billion

2024

2032

USD

3.77 Billion

USD

6.63 Billion

2024

2032

| 2025 –2032 | |

| USD 3.77 Billion | |

| USD 6.63 Billion | |

|

|

|

|

North America Vegan Protein Market Size

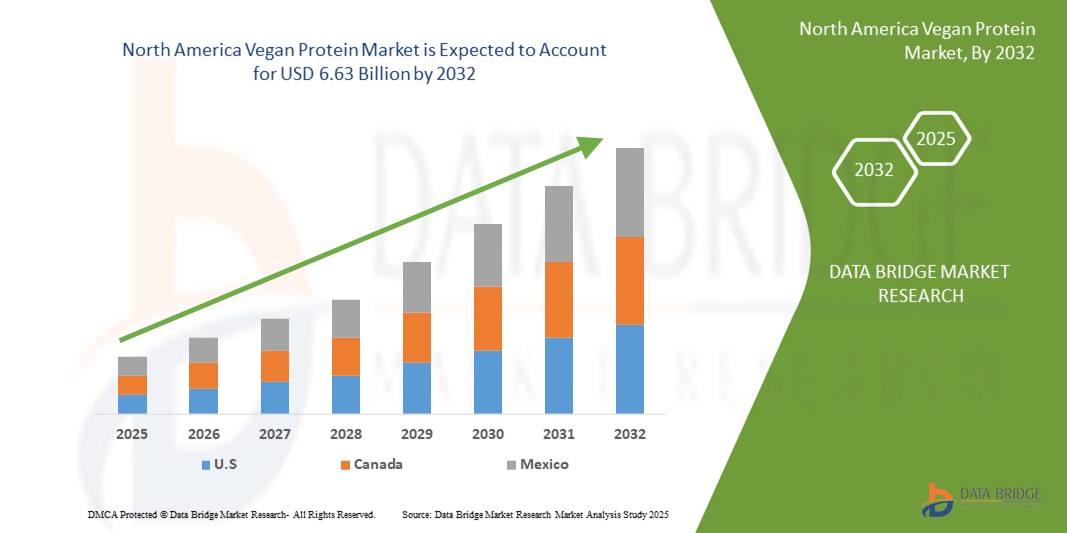

- The North America vegan protein market size was valued at USD 3.77 billion in 2024 and is expected to reach USD 6.63 billion by 2032, at a CAGR of 7.30% during the forecast period

- The market growth is largely fuelled by the rising adoption of plant-based diets, increasing consumer focus on health and wellness, and growing environmental and ethical awareness.

- The surge in demand for protein-enriched functional foods, beverages, and dietary supplements is further driving market expansion

North America Vegan Protein Market Analysis

- The rising adoption of plant-based diets and growing health consciousness among consumers are driving the demand for vegan protein products. Increasing awareness of the environmental and ethical benefits of plant-based proteins is further boosting market growth

- The surge in fitness and wellness trends, along with the expanding use of vegan protein in functional foods, nutraceuticals, and dietary supplements, is contributing to market expansion

- U.S. vegan protein market captured the largest revenue share in North America in 2024, fueled by high consumer awareness of plant-based diets, health, and sustainability. Consumers increasingly prioritize protein-enriched foods, beverages, and dietary supplements, driving demand for vegan powders, bars, and functional products

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America vegan protein market due to growing demand for sustainable food alternatives, expanding vegan population, and increasing investments in plant-based food innovation. Supportive government policies and rising adoption of vegan proteins in both retail and foodservice sectors are accelerating market growth

- The soy protein segment held the largest market revenue share in 2024, driven by its widespread use in food products, beverages, and dietary supplements. Soy protein is favored for its high nutritional value, versatile applications, and established supply chain across countries

Report Scope and North America Vegan Protein Market Segmentation

|

Attributes |

North America Vegan Protein Key Market Insights |

|

Segments Covered |

• By Source: Soy Protein, Pea Protein, Rice Protein, Hemp Protein, Spirulina, Quinoa Protein, Flaxseeds Protein, Chia Protein, Canola Protein, Pumpkin Seed, and Others |

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Vegan Protein Market Trends

Rising Adoption of Plant-Based Protein Solutions

- The increasing shift toward vegan protein products is transforming the food and nutraceutical landscape by providing plant-based, sustainable protein alternatives. These products enable consumers to meet daily protein requirements while reducing reliance on animal-derived sources, supporting both health and environmental goals. The growing consumer interest in ethical and eco-friendly food options further drives market acceptance

- The growing demand for convenient protein powders, bars, and supplements is accelerating the adoption of vegan protein solutions. These products are particularly effective in fitness and wellness segments, where consumers seek quick and nutritious options. The availability of ready-to-use and flavored products enhances consumer convenience and encourages frequent usage

- The affordability, variety, and ease of incorporation of vegan protein into daily diets are making these products attractive for households, gyms, and foodservice outlets. Frequent consumption improves dietary diversity and supports overall health and wellness trends. In addition, the trend toward functional and fortified plant-based proteins is expanding applications in everyday nutrition

- For instance, in recent years, several nutrition brands reported a surge in sales after launching new pea, rice, and soy protein powders catering to vegan and flexitarian consumers. These launches allowed for broader adoption and better consumer engagement. Marketing efforts highlighting sustainability, nutrition, and versatility further amplified product reach

- While vegan protein products are supporting health-conscious consumption and sustainable diets, their market growth depends on continued product innovation, taste optimization, and affordability. Manufacturers must focus on novel formulations, quality sourcing, and strategic marketing to fully capitalize on this rising demand. Enhanced packaging, shelf-stable formats, and multi-functional protein blends are also contributing to market momentum

North America Vegan Protein Market Dynamics

Driver

Increasing Health Awareness and Shift Toward Plant-Based Diets

- The rising health-conscious consumer base is pushing both manufacturers and retailers to prioritize plant-based protein products. Consumers are increasingly seeking alternatives to traditional animal proteins for cardiovascular health, weight management, and digestive wellness. The shift is further supported by the growing popularity of clean-label and natural food products

- Growing awareness of the environmental impact of animal farming is driving consumers toward vegan protein options. This trend is prompting brands to offer more diverse plant-based formulations and invest in sustainable sourcing practices. The emphasis on carbon footprint reduction and eco-friendly packaging is also strengthening consumer preference for plant-based proteins

- Governments, nutrition organizations, and wellness programs are promoting plant-based diets as part of public health campaigns. Educational initiatives and endorsements by fitness and health influencers are further boosting consumer adoption. Initiatives highlighting preventive nutrition and functional food benefits are contributing to consistent market growth

- For instance, several brands recently implemented awareness campaigns emphasizing the nutritional and environmental benefits of vegan proteins, resulting in increased product visibility and consumer interest. Cross-promotional campaigns with fitness, lifestyle, and wellness platforms have helped expand market reach

- While health awareness and sustainability are driving growth, product innovation, flavor optimization, and expanded distribution remain critical for continued market expansion. In addition, the development of hybrid proteins and fortified blends is enhancing the functional appeal of vegan protein products

Restraint/Challenge

High Cost of Premium Protein Formulations and Taste Preferences

- Premium plant-based protein powders, isolates, and blends are often priced higher than traditional protein sources, limiting adoption among price-sensitive consumers. This restricts widespread usage in emerging markets and among casual users. Cost-effective production and ingredient sourcing remain key challenges for manufacturers

- In many regions, consumers may perceive plant-based proteins as less palatable or less effective than animal-derived proteins. Taste, texture, and digestibility challenges continue to impact repeat purchase behavior. Brands are investing in flavor masking, texture enhancement, and protein combinations to overcome these barriers

- Supply chain constraints, such as sourcing high-quality soy, pea, rice, or other protein-rich ingredients, can lead to production bottlenecks and higher retail prices, affecting accessibility. Delays in raw material availability and fluctuations in global supply may also disrupt market stability

- For instance, several vegan protein brands recently revised their packaging, labeling, and nutritional claims to ensure accuracy and transparency, thereby increasing consumer trust and encouraging repeat purchases. Such initiatives also included educational campaigns to clarify protein quality and benefits

- While vegan protein products continue to evolve in formulation and taste, addressing cost, sensory preferences, and supply chain challenges remains vital. Stakeholders must focus on affordable, high-quality, and palatable solutions to sustain long-term growth potential. Investment in research, scalable production, and alternative protein sources can enhance accessibility and profitability

North America Vegan Protein Market Scope

The market is segmented on the basis of source, protein type, level of hydrolysis, form, nature, function, and application.

- By Source

On the basis of source, the North America vegan protein market is segmented into soy protein, pea protein, rice protein, hemp protein, spirulina, quinoa protein, flaxseeds protein, chia protein, canola protein, pumpkin seed, and others. The soy protein segment held the largest market revenue share in 2024, driven by its widespread use in food products, beverages, and dietary supplements. Soy protein is favored for its high nutritional value, versatile applications, and established supply chain across countries.

The pea protein segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing consumer preference for allergen-free, plant-based protein sources. Pea protein is particularly popular in protein powders, snacks, and functional foods due to its neutral taste, high digestibility, and suitability for clean-label formulations.

- By Protein Type

On the basis of protein type, the North America vegan protein market is segmented into isolates, concentrates, and hydrolysates. The isolates segment held the largest revenue share in 2024 due to its high protein content, purity, and functional properties suitable for beverages and nutritional supplements.

The hydrolysates segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increased digestibility, rapid absorption, and suitability for sports nutrition and clinical applications. Hydrolysates are popular among consumers seeking quick and efficient protein utilization.

- By Level of Hydrolysis

On the basis of level of hydrolysis, the North America vegan protein market is segmented into intact, mildly hydrolyzed, and strongly hydrolyzed proteins. The intact segment dominated in 2024 due to its balanced nutritional profile and cost-effectiveness for regular dietary consumption.

The mildly hydrolyzed segment is expected to witness the fastest growth rate from 2025 to 2032, driven by improved solubility, functional performance, and digestibility, making it ideal for fortified beverages and specialized protein formulations.

- By Form

On the basis of form, the North America vegan protein market is segmented into dry and liquid proteins. The dry segment held the largest market revenue share in 2024 owing to its ease of storage, long shelf life, and applicability in protein powders, bars, and bakery products.

The liquid segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for ready-to-drink beverages, smoothies, and protein-enriched functional drinks among health-conscious consumers.

- By Nature

On the basis of nature, the North America vegan protein market is segmented into conventional and organic proteins. The conventional segment led the market in 2024, supported by well-established manufacturing infrastructure and affordability.

The organic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer preference for clean-label, non-GMO, and sustainably sourced plant-based proteins across North America.

- By Function

On the basis of function, the North America vegan protein market is segmented into solubility, emulsification, gelation, water binding, foaming, and others. The solubility segment held the largest market share in 2024 due to its importance in beverages, shakes, and functional foods.

The emulsification and gelation segments is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing use of vegan proteins in bakery, dairy alternatives, and processed food applications for texture and stability enhancement.

- By Application

On the basis of application, the North America vegan protein market is segmented into food products, beverages, nutraceuticals and dietary supplements, cosmetics and personal care, animal feed, pharmaceuticals, and others. The food products segment dominated in 2024 due to high incorporation of plant-based proteins in bakery, snacks, and confectionery.

The nutraceuticals and dietary supplements segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing adoption of protein-enriched functional foods, wellness supplements, and fortified beverages.

North America Vegan Protein Market Regional Analysis

- U.S. vegan protein market captured the largest revenue share in North America in 2024, fueled by high consumer awareness of plant-based diets, health, and sustainability. Consumers increasingly prioritize protein-enriched foods, beverages, and dietary supplements, driving demand for vegan powders, bars, and functional products

- The expanding presence of established vegan protein brands, combined with advanced distribution networks, is supporting consistent market growth. Growing interest in clean-label, allergen-free, and fortified products further accelerates adoption

- Marketing initiatives emphasizing nutritional benefits and environmental impact also contribute to consumer preference and sales expansion

Canada Vegan Protein Market Insight

The Canada vegan protein market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising health consciousness, increasing fitness trends, and growing awareness of sustainable diets. Consumers are seeking convenient plant-based protein products, such as powders, bars, and ready-to-drink beverages, for daily nutrition. Retail expansion, online platforms, and specialty stores are facilitating better accessibility and market penetration. The adoption of allergen-free and clean-label formulations is contributing to rapid growth. In addition, innovative product launches and marketing campaigns focusing on functional benefits support continued market expansion.

North America Vegan Protein Market Share

The North America vegan protein industry is primarily led by well-established companies, including:

- Beyond Meat (U.S.)

- Impossible Foods (U.S.)

- SunOpta (Canada)

- Vega (Canada)

- Naked Nutrition (U.S.)

- Garden of Life (U.S.)

- Bob’s Red Mill (U.S.)

- Orgain (U.S.)

- NOW Foods (U.S.)

- Manitoba Harvest (Canada)

Latest Developments in North America Vegan Protein Market

- In March 2023, the National Library of Medicine published a research article as part of its knowledge development initiative, focusing on the role of plant-based diets in improving health and reducing environmental impacts. The study highlighted the rising consumer demand for vegan proteins, driven by their nutritional benefits and sustainability advantages. This development is expected to encourage further adoption of plant-based proteins, creating new growth opportunities for manufacturers. The emphasis on health and eco-friendly consumption is likely to positively impact the vegan protein market by boosting awareness and strengthening consumer confidence in plant-based solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Vegan Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Vegan Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Vegan Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.