North America Vehicle Motorized Door Market

Market Size in USD Billion

CAGR :

%

USD

6.10 Billion

USD

16.45 Billion

2024

2032

USD

6.10 Billion

USD

16.45 Billion

2024

2032

| 2025 –2032 | |

| USD 6.10 Billion | |

| USD 16.45 Billion | |

|

|

|

|

Vehicle Motorized Door Market Size

- The North America Vehicle Motorized Door Market size was valued at USD 6.1 Billion in 2024 and is expected to reach USD 16.45 Billion by 2032, at a CAGR of 13.20% during the forecast period

- This growth is driven by factors such as the advancements in smart door technologies, including biometric access and IoT-enabled controls, enhancing convenience and security in modern vehicles.

Vehicle Motorized Door Market Analysis

- A vehicle motorized door is a basically an electronically- powered automated door which allow the front passengers or the driver to lock or unlock all the doors.

- The vehicle motorized door is based on types of technologies used in the system which can be bluetooth, keypad, RFID, Wi-Fi connected, biometric among others.

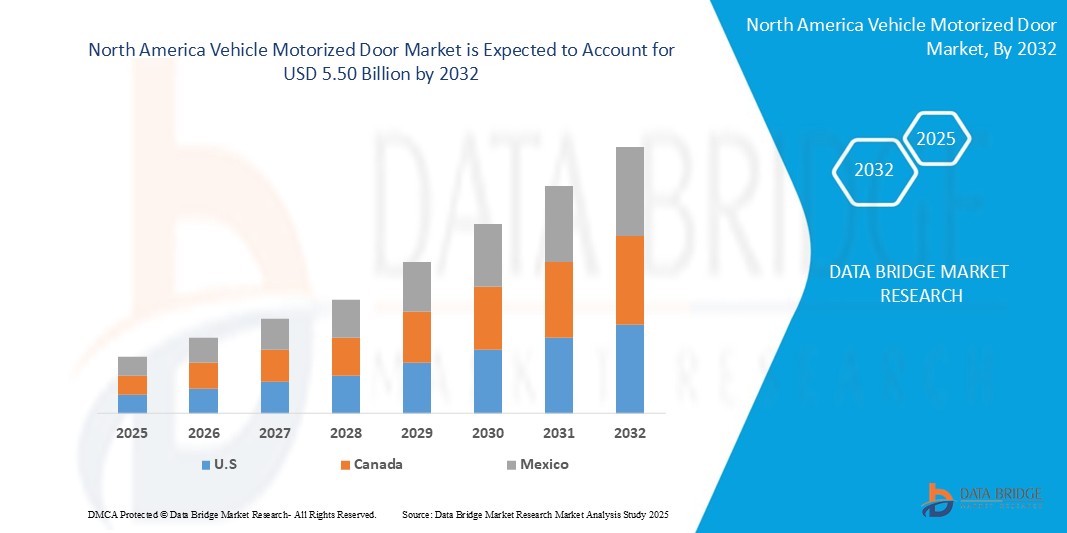

- U.S. is expected to dominate the Vehicle Motorized Doors market due to its strong automotive industry, high demand for innovative vehicle features, and a growing focus on electric and luxury vehicles.

- Canada is expected to be the fastest growing region in the Vehicle Motorized Door Market during the forecast period due to its strong automotive innovation, increasing adoption of electric vehicles, and a focus on advanced safety features.

- Soft Close segment is expected to dominate the market with a market share of 55.19% due to its ability to enhance user convenience, reduce noise, and improve the overall durability and safety of vehicle doors.

Report Scope and Vehicle Motorized Door Market Segmentation

|

Attributes |

Vehicle Motorized Door Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vehicle Motorized Door Market Trends

“Integration of Advanced Biometric and AI-Based Access Systems”

- In North America, the vehicle motorized door market is experiencing a significant transformation driven by the integration of advanced biometric and AI-based access systems. Consumers are increasingly seeking enhanced security, convenience, and personalization in their vehicles, prompting automakers to adopt cutting-edge technologies. Biometric systems such as fingerprint recognition, facial scanning, voice authentication, and iris recognition are being incorporated into vehicles to provide secure and seamless access without the need for traditional keys or fobs.

- Artificial intelligence plays a crucial role in these systems by enabling real-time data processing, learning user preferences, and adapting to individual behaviors, thereby enhancing user experience and security. This trend is particularly prominent in premium and luxury vehicle segments, where consumers are willing to invest in advanced features that offer both functionality and sophistication. The integration of AI and biometrics not only improves vehicle access but also contributes to the development of autonomous and connected vehicles, aligning with the broader shift towards smarter transportation solutions. As a result, the North American market for biometric vehicle access systems is projected to grow substantially, reflecting the increasing demand for intelligent and secure vehicle entry technologies.

- For instance, In January 2025, Continental unveiled its Intelligent Vehicle Experience Car at CES 2025, featuring advanced biometric technologies including facial recognition and movement analysis. This system allows for intuitive access, user personalization, and enhanced security against unauthorized access, demonstrating the integration of AI and biometrics in modern vehicles. The vehicle adapts to user preferences, offering a personalized driving experience.

Vehicle Motorized Door Market Dynamics

Driver

“Enhanced Safety and Security Features”

- In North America, the vehicle motorized door market is experiencing significant growth, primarily driven by the integration of advanced safety and security features. Manufacturers are increasingly incorporating technologies such as anti-pinch sensors, collision detection systems, and automatic door locking mechanisms to enhance passenger safety. For instance, Brose's next-generation door control units integrate all door functions, including window regulators and automatic door opening/closing, with collision detection capabilities. These systems use radar sensors to scan the surrounding environment in real-time, preventing potential collisions during door operation.

- Additionally, features like electric suction doors and automatic door opening and closing are being implemented to improve user convenience and vehicle accessibility. The trend towards integrating door control units with other vehicle systems, such as cameras and ambient lights, is also contributing to a more intelligent and secure vehicle access experience. As a result, the North American vehicle motorized door market is witnessing significant growth, with manufacturers prioritizing safety and security in their designs.

For instance,

- In February 2024, Brose introduced next-generation door control units that integrate all door functions, including window regulators and automatic door opening/closing, with collision detection capabilities. These systems use radar sensors to scan the surrounding environment in real-time, preventing potential collisions during door operation. This development enhances passenger safety and convenience, aligning with the growing demand for intelligent vehicle access solutions in the region.

Opportunity

“Integration of Smart and Touchless Access Technologies”

- The integration of smart and touchless access technologies presents a significant opportunity in the North American vehicle motorized door market. With growing consumer demand for convenience and hygiene, automakers are increasingly incorporating touchless entry systems into their vehicles. These systems, which include technologies such as gesture recognition, proximity sensors, and RFID (Radio Frequency Identification), offer seamless, hands-free access to vehicles. Touchless access eliminates the need for physical interaction with handles, reducing the spread of germs and enhancing the user experience.

- Additionally, smart systems can integrate with smartphones and wearable devices, allowing drivers to unlock and start their vehicles remotely using Bluetooth or Wi-Fi technology. This is particularly appealing in a post-pandemic world, where cleanliness and safety are top priorities. Moreover, as consumers adopt more connected lifestyles, the demand for integrated solutions that connect vehicle access with other smart devices continues to rise. This trend aligns with the broader move toward connected and autonomous vehicles, which is expected to further fuel the adoption of smart and touchless access technologies.

For instance,

- In April 2025, Hyundai launched an innovative touchless entry system in its latest vehicle models, allowing drivers to unlock their cars by simply approaching them with a smartphone. The system utilizes Bluetooth Low Energy (BLE) technology to establish a secure connection between the car and the driver’s device, eliminating the need to physically touch the car’s handle. This smart technology also syncs with other connected devices, such as home automation systems, for a seamless experience. The introduction of this feature is aimed at improving convenience, security, and hygiene, making it especially appealing in a post-COVID-19 era. Hyundai plans to roll out the technology across multiple models in 2025.

Restraint/Challenge

“High Manufacturing and Maintenance Costs”

- The high manufacturing and maintenance costs remain one of the significant challenges in the North American vehicle motorized door market. The production of advanced motorized doors, which incorporate features such as power-assisted opening, biometric systems, and touchless technology, requires high precision engineering and the use of expensive materials. These advanced components, including sensors, motors, and control systems, add substantial costs to the manufacturing process.

- Additionally, the ongoing maintenance of these motorized systems, which includes the replacement of sensors, motors, and other electronic components, can be costly for consumers and automotive manufacturers alike. As the complexity of vehicle door systems increases, so does the need for specialized technicians and repair services, further driving up costs. This results in higher overall vehicle prices, which could reduce the affordability of motorized doors, especially for budget-conscious consumers. In the long term, manufacturers also need to account for the costs associated with warranty coverage and repair services, which are often part of customer satisfaction guarantees.

For instance,

- In January 2025, Ford announced in January 2025 that it faced higher-than-expected production costs for its new range of motorized doors with touchless access and biometric features for the upcoming model year. The company cited the integration of advanced electronics and sensors into the door systems as a key factor in driving up production costs. While Ford is committed to innovation, the company is working to address these cost barriers by seeking alternatives in materials and exploring automation in the manufacturing process.

Vehicle Motorized Door Market Scope

The market is segmented on the basis component, technology, vehicle type.

|

Segmentation |

Sub-Segmentation |

|

Component |

|

|

Technology |

|

|

Vehicle type |

|

In 2025, the Soft Close is projected to dominate the market with a largest share in segment

In 2025, the Soft Close segment is projected to dominate the market with the largest share of 55.19%. This growth is driven by increasing consumer preference for premium features that enhance safety and convenience. Soft Close technology prevents slamming, reduces noise, and ensures doors are securely shut with minimal effort.

The Power Sliding is expected to account for the largest share during the forecast period in market

The Power Sliding segment is expected to account for the largest share of 46.21% during the forecast period due to its convenience and accessibility, especially in family and commercial vehicles. These doors offer easy, hands-free entry and exit, making them ideal for tight urban spaces and for users with mobility challenges.

Vehicle Motorized Door Market Regional Analysis

“Japan Holds the Largest Share in the Vehicle Motorized Door Market”

- Japan holds the largest share in the Vehicle Motorized Door Market, driven by its advanced automotive manufacturing capabilities and early adoption of smart vehicle technologies. Japanese automakers, known for their innovation and precision engineering, lead the integration of motorized door systems in both luxury and mainstream vehicles.

- The country's strong infrastructure and focus on safety and convenience have supported the widespread adoption of features like soft-close and power sliding doors. High consumer expectations for reliability, comfort, and modern features continue to drive demand in the domestic market.

- Additionally, Japan's aging population benefits from motorized doors that enhance accessibility and independence. Major automotive players such as Toyota, Honda, and Nissan are heavily investing in smart access technologies, reinforcing their market dominance. With a robust export presence, Japan’s innovations often set benchmarks globally. These combined factors firmly establish Japan as a global leader in the vehicle motorized door market

“China is Projected to Register the Highest CAGR in the Vehicle Motorized Door Market”

- China is projected to register the highest CAGR in the Vehicle Motorized Door Market due to its rapidly growing automotive sector and strong push towards electric and smart vehicles. The country's expanding middle class and rising demand for premium vehicle features are driving adoption of advanced door systems. Government policies promoting electric vehicles and local innovation have created a fertile ground for high-tech automotive components.

- Chinese consumers increasingly value convenience, safety, and automation, boosting demand for motorized doors. Major domestic automakers are integrating these features to stay competitive, while international brands are expanding their footprint in the Chinese market. The rise of urbanization and smart city initiatives is further accelerating interest in automated vehicle technologies. China’s leadership in EV production complements the adoption of smart door systems, making it a high-growth region. As a result, China is emerging as a key driver of global expansion in the motorized door segment.

Vehicle Motorized Door Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North Americapresence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- NXP Semiconductors,

- STRATTEC,

- ZF Friedrichshafen AG,

- Schaltbau Holding AG,

- Smartrac N.V.,

- Kiekert AG,

- WITTE Automotive,

- Johnson Electric Holdings Limited,

- Huf Hülsbeck & Fürst GmbH & Co. KG,

- Continental AG,

- Brose Fahrzeugteile GmbH & Co. KG,

- Valeo

Latest Developments in North America Vehicle Motorized Door Market

- In January 2025, NXP Semiconductors announced the acquisition of TTTech Auto, a leader in safety-critical systems for software-defined vehicles (SDVs). This strategic move aims to enhance NXP's capabilities in real-time, centralized vehicle control, supporting the growing demand for advanced motorized door systems that require high-performance, deterministic compute. The integration of TTTech Auto's MotionWise middleware will enable automakers to efficiently scale software across car models, streamlining safety integration and enhancing the performance of motorized door systems.

- During the Bharat Mobility Expo 2025, ZF introduced its X-by-Wire technology, enabling greater vehicle customization and enhanced safety features. This technology allows for the electronic control of vehicle functions, including motorized doors, reducing mechanical complexity and improving reliability. ZF's innovations in mobility solutions are contributing to the evolution of motorized door systems in the North American market.

- At CES 2025, Continental showcased its "Intelligent Vehicle Experience Car," featuring innovative interaction technologies, including touch-free access to the vehicle using biometrics. This demonstration highlights the integration of AI and sensor technology to enable intuitive, touch-free access to motorized doors, enhancing both security and user experience. Continental's advancements in biometric systems are setting new standards for vehicle access solutions in North America..

- In February 2025, At CES, Valeo presented several innovations, including the Valeo AssistXR software solution powered by Amazon Web Services, which extends the possibilities of remote assistance. This solution can be integrated with motorized door systems to provide efficient support for emergency situations, enhancing the safety and functionality of vehicle access. Valeo's contributions are shaping the future of motorized door technologies in North America.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Vehicle Motorized Door Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Vehicle Motorized Door Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Vehicle Motorized Door Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.