North America Venous Diseases Treatment Market Analysis and Insights

Venous disease includes blood clots in the legs, arms, brain, lungs or internal organs such as kidney, spleen, liver, deep vein thrombosis, chronic venous insufficiency, varicose veins, and veins, and ulcers in the veins. Treatment for this disease includes drug therapy, endogenous laser ablation or radiofrequency ablation (RFA), sclerotherapy, and surgery.

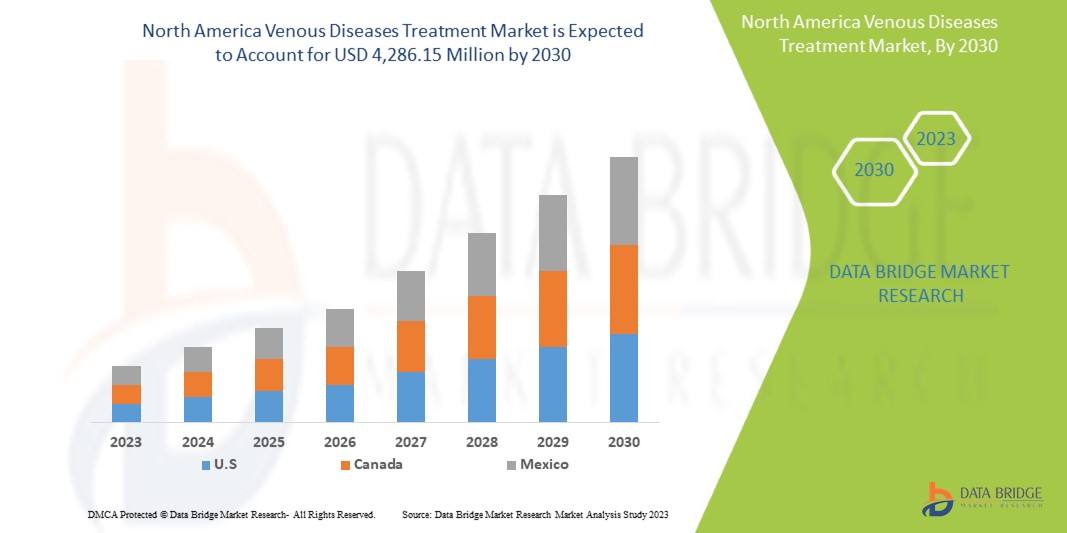

Data Bridge Market Research analyzes that the North America venous diseases treatment market is expected to reach the value of USD 4,286.15 million by 2030, at a CAGR of 7.4% during the forecast period. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020-1015) |

|

Quantitative Units |

Revenue in Million, Pricing in USD |

|

Segments Covered |

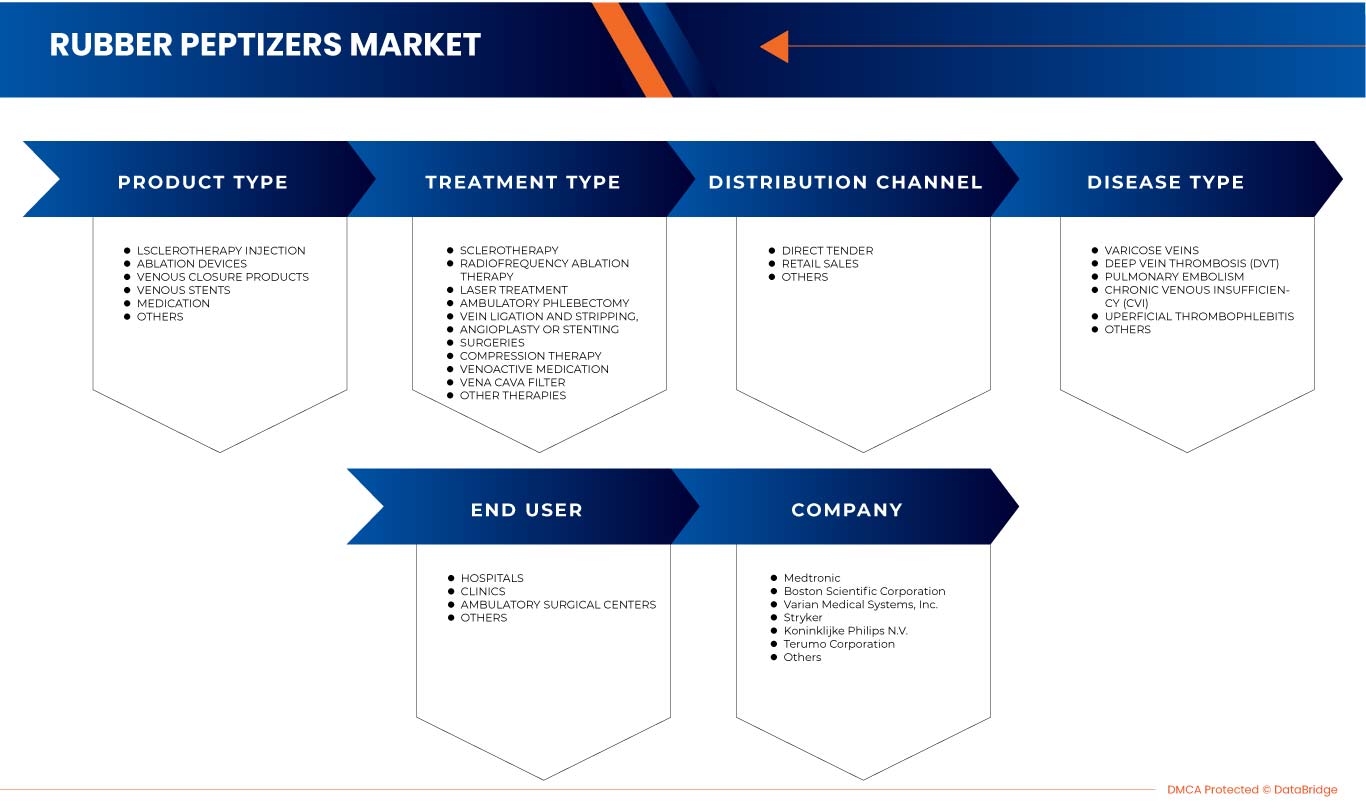

By Product Type (Sclerotherapy Injection, Ablation Devices, Venous Closure Products, Venous Stents, Medication and Others), Disease Type (Deep Vein Thrombosis (DVT), Chronic Venous Insufficiency (CVI), Pulmonary Embolism, Superficial Thrombophlebitis, Varicose Veins, and Others), Treatment Type (Sclerotherapy, Radiofrequency ablation therapy, Laser Treatment, Ambulatory Phlebectomy, Vein Ligation and stripping, Angioplasty or Stenting, Surgeries, Compression Therapy, Venoactive Medication, Vena Cava Filter and Others Therapies), End User (Hospitals, Clinics, Ambulatory Surgical Centers, and Others), Distribution Channel (Direct Tender, Retail Sales, and Others) |

|

Countries Covered |

U.S., Canada and Mexico. |

|

Market Players Covered |

Abbott, Imricor, Baylis Medical Company, Inc., Theraclion, Sonablate, plusmedica.de, Boston Scientific Corporation, Olympus Corporation, Smith + Nephew, Cook, Scitech, Carl Zeiss Meditec AG, Teleflex incorporated, Alma Lasers, BD, B.Braun SE, Medtronic, Stryker, Koninklijke Philips N.V., Varian Medical Systems, Candela Corporation, Teromo corporation, Angiodynamics, optimed Medizinische Instrumente GmbH, Merit Medical Systems and Bolitec Laser among others. |

North America Venous Diseases Treatment Market Definition

Heart attacks, and strokes are usually acute events, and are primarily caused by a blockage that blocks blood flow to the heart or brain. The most common cause is the build-up of fatty deposits in the lining of the blood vessels that supply the heart or brain. A stroke can be caused by bleeding or blood clots in a blood vessel in the brain.

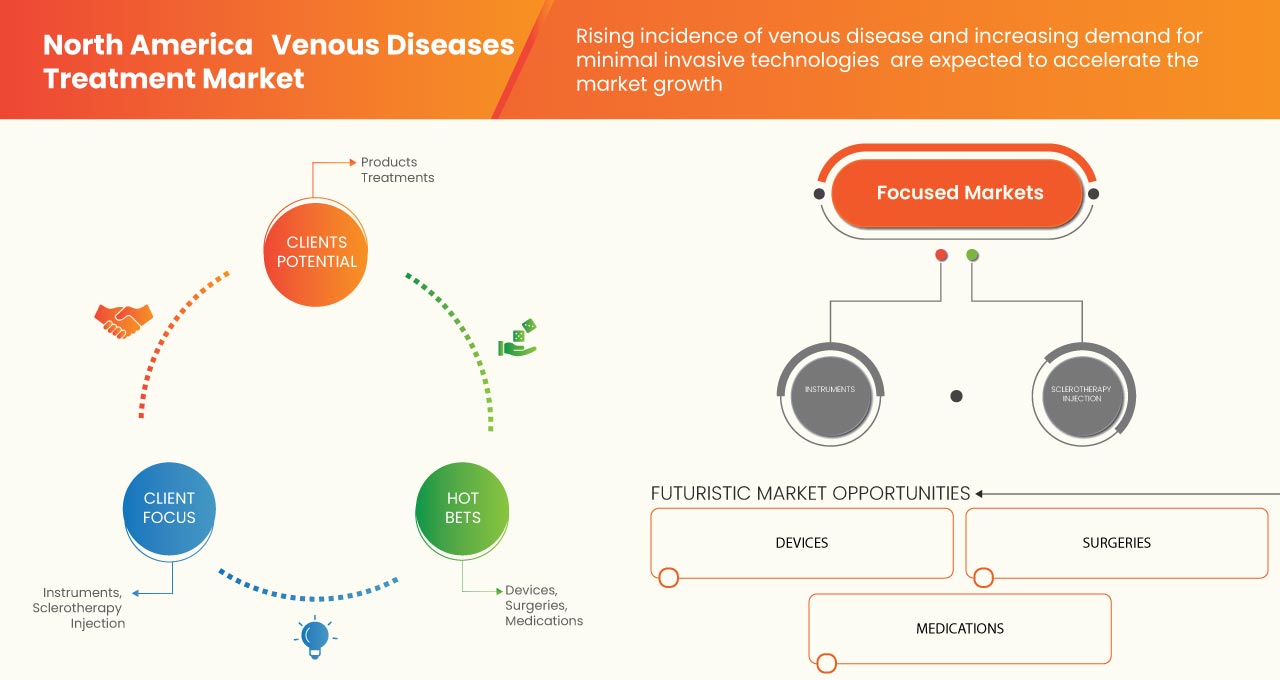

Technological advancements in vascular stents, increase in demand for minimally invasive procedures, and rise in geriatric population are driving the North America market. Moreover, the companies are expanding their product portfolio to offer the best services for venous diseases treatment. Medical devices such as ablation devices are used in minimally invasive procedures to remove or excise abnormal body tissues for therapeutic purposes. These systems use the heat generated by radio frequency, energy, extreme cold, or a laser to cause small burns. Rise in adoption of robotic technologies for product application expansion, and integration of cutting-edge technologies in ablation devices to improve patient safety, and procedural efficiency are expected to drive the market.

North America Venous Diseases Treatment Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rising incidences of venous diseases

Venous diseases are the conditions that damage veins in body. Damaged blood vessel walls prevent the circulatory system from working, causing blood to pool and reflux (backwards) when the muscles relax. This causes abnormally high pressure to build up in the veins. This build-up causes veins to tighten and twist, increased swelling, increased valve incompetence, slow blood flow, and possible blood clots. Finally, this condition can lead to various diseases known as venous diseases.

Due to various risk factors such as ageing, obesity, high blood pressure (hypertension) or family history of venous disease, patients with venous diseases are rising globally and becoming a significant socio-economic issue. Thus the rising number of patients with venous diseases increases the demand for venous diseases treatment which act as a driver in the North America venous diseases treatment market.

- Rapid changes in lifestyle leads to obesity resulting in venous diseases

Lifestyle changes such as smoking, unhealthy diet and physical inactivity lead to the development of chronic diseases, especially heart disease, stroke, diabetes, obesity and metabolic syndrome that can eventually result in venous diseases.

Physical activity is essential and many conditions are a direct result of a sedentary lifestyle. Sedentary lifestyle may result in gain weight, tire easily and have unexplained aches and pains that develop chronic condition, including cardiovascular and venous disease, ranging from moderate, severe or even life-threatening.

According to the article of ScienceDirect, venous disease was more clinically severe in the obese limbs than non-obese group. Thus due to increase in adoption of unhealthy lifestyle there is rapid increase in obese population with venous diseases rising. Thus the rapid changes in lifestyle leads to obesity resulting in venous diseases which increases the demand for venous diseases treatment and act as a driver in the North America venous diseases treatment market.

Restraint

- Lack of skilled and certified professionals

The requirement of skilled and certified professionals is a big restraint for venous diseases treatment market. The demand for venous disease treatment is increased due to increasing cases of venous diseases in the Europe but the less number of skilled professionals present in the healthcare center is hampering the growth of the market.

Chronic venous disease (CVD) is often overlooked by healthcare professionals because they do not understand the extent and impact of the problem, and the different manifestations of primary and secondary venous disease are not fully recognized. The importance of cardiovascular diseases is related to the number of patients and to the socio-economic effects of its more serious manifestations.

Opportunity

- Rising awareness towards venous disorders

Both medicinal procedures and lifestyle changes can be used to treat vein problems. Your veins can benefit from medication, exercise, and compression stockings, but occasionally vein problems necessitate more thorough therapy to restore the health and performance of your veins. The course of treatment is determined by the kind and severity of the venous disease. Patients with vascular disorders have increased dramatically over the past few decades, with diabetes serving as the most flagrant risk factor. Unlike other health problems, vascular disorders and vascular surgery are unknown to approximately 80% of the population. People's attitudes and behaviours about particular illnesses can change significantly as a result of increased health awareness.

There are several awareness programs are conducted by various societies, government institutes and others. These initiatives taken by them will increase awareness among people regarding their health and take early diagnosis for better cure and precaution. For this reason, rising awareness towards venous disorders are expected to act as an opportunity for growing the demand of the North America venous diseases treatment market.

Challenge

- High cost associated with venous disease treatment

More than 25 million persons in the United States alone suffer from chronic venous insufficiency (CVI), with more than 6 million having advanced venous illness. The US healthcare system is heavily burdened financially as a result of the high incidence of CVI and rising healthcare costs. Numerous widespread health issues are caused by poor venous circulation. Leg pain, edoema, and heaviness are some of the early signs of chronic venous disease (CVD), and they can be present all day long or become more pronounced in the evening. Patients frequently seek out initial therapy for symptoms that might occur with or without varicose veins, as well as for cosmetic varicose vein removal. The two main risk factors for CVD are advancing age and high body mass.

Post-COVID-19 Impact on North America Venous Diseases Treatment Market

The pandemic has had adverse impacts on the manufacturers as well as users. As varicose veins procedures are non-urgent, the volume of procedures declined drastically. Reduction in the surgeries or procedures for the treatment of varicose veins due to traveling restrictions also impacted the sales of the manufacturers.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launch and strategic partnerships to improve the technology and test results involved in the pet food flavors and ingredients market.

Recent Developments

- In July 2022, Smith+Nephew, the North America medical technology company has launches Clinical Support App to help reduce practice variation in wound care. The WOUND COMPASS Clinical Support App is a comprehensive digital support tool for health care professionals that aids wound assessment and decision-making to help reduce practice variation. This has helped the company to attract the healthcare customers and expand product portfolio

- In April 2022, Carl Zeiss Meditec has announced the acquisition of two manufacturers of surgical instruments (Kogent Surgical, LLC and Katalyst Surgical, LLC) to further strengthen its positioning as a solution provider. This has helped the company to expand their business

North America Venous Diseases Treatment Market Scope

North America venous diseases treatment market is segmented into product type, disease type, treatment type, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE

- ABLATION DEVICES

- VENOUS STENTS

- VENOUS CLOSURE PRODUCTS

- SCLEROTHERAPY INJECTION

- MEDICATIONS

- OTHERS

On the basis of product type, the North America venous diseases treatment market is segmented into ablation devices, venous stents, venous closure products, sclerotherapy injection, medications, and others

NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY DISEASE TYPE

- DEEP VEIN THROMBOSIS (DVT)

- CHRONIC VENOUS INSUFFICIENCY (CVI)

- PULMONARY EMBOLISM

- SUPERFICIAL THROMBOPHLEBITIS

- VARICOSE VEINS

- OTHERS

On the basis of disease type, the North America venous diseases treatment market is segmented into deep vein thrombosis (DVT), chronic venous insufficiency (CVI), pulmonary embolism, superficial thrombophlebitis, varicose veins, and others

NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY TREATMENT TYPE

- COMPRESSION THERAPY

- VENO ACTIVE MEDICATION

- SURGERIES

- SCLEROTHERAPY

- ANGIOPLASTY OR STENTING

- VEIN LIGATION AND STRIPPING

- VENA CAVA FILTER

- AMBULATORY PHLEBECTOMY

- RADIOFREQUENCY ABLATION THERAPY

- LASER TREATMENT

- OTHERS THERAPIES

On the basis of treatment type, the North America venous diseases treatment market is segmented into compression therapy, veno active medication, surgeries, scelrotherapy, angioplasty or stenting, vein legation, and stripping, vena cava filter, ambulatory phlebectomy, radiofrequency ablation therapy, laser treatment, and other therapies

NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY END USER

- HOSPITALS

- CLINICS

- AMBULATORY SURGICAL CENTERS

- OTHERS

On the basis of end user, the North America venous diseases treatment market is segmented into hospitals, clinics, ambulatory surgical centers, and others

NORTH AMERICA VENOUS DISEASES TREATMENTS MARKET, BY DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

- OTHERS

On the basis of distribution channel, the North America venous diseases treatment market is segmented into direct tender, retail sales, and others

North America Venous Diseases Treatment Market Regional Analysis/Insights

The North America venous diseases treatment market is analyzed and market size information is provided product type, disease type, treatment type, end user, and distribution channel.

The countries covered in this market report U.S., Canada and Mexico.

U.S. is dominating North America due to the presence of key market players in the largest consumer market with high GDP. U.S is expected to grow due to its latest advanced technology and inventions in the venous disease treatment.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Venous Diseases Treatment Market Share Analysis

North America venous diseases treatment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America venous diseases treatment market.

Some of the major players operating in the North America venous diseases treatment market are Abbott, Imricor, Baylis Medical Company, Inc., Theraclion, Sonablate, plusmedica.de, Boston Scientific Corporation, Olympus Corporation, Smith + Nephew, Cook, Scitech, Carl Zeiss Meditec AG, Teleflex incorporated, Alma Lasers, BD, B.Braun SE, Medtronic, Stryker, Koninklijke Philips N.V., Varian Medical Systems, Candela Corporation, Teromo corporation, Angiodynamics, optimed Medizinische Instrumente GmbH, Merit Medical Systems, Bolitec Laser among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA VENOUS DISEASES TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 INSTRUMENT BASED LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, INDUSTRY INSIGHTS

6 EPIDEMIOLOGY

7 REGULATORY FRAMEWORK

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING INCIDENCES OF VENOUS DISEASES

8.1.2 RAPID CHANGES IN LIFESTYLE LEAD TO OBESITY RESULTING IN VENOUS DISEASES

8.1.3 INCREASE IN THE GERIATRIC POPULATION

8.1.4 TECHNOLOGICALLY ADVANCEMENT IN THE TREATMENT OF VENOUS DISEASES

8.2 RESTRAINTS

8.2.1 LACK OF SKILLED AND CERTIFIED PROFESSIONALS

8.2.2 INADEQUATE REIMBURSEMENT COVERAGE

8.3 OPPORTUNITIES

8.3.1 RISING AWARENESS TOWARDS VENOUS DISORDERS

8.3.2 NEED FOR PROPER DIAGNOSIS AND TREATMENT OF VENOUS DISEASES

8.3.3 GROWING PREFERENCE FOR MINIMALLY INVASIVE PROCEDURES

8.3.4 OCCUPATIONAL LIFESTYLE INCREASES THE NEED FOR VENOUS DISEASE TREATMENT

8.4 CHALLENGES

8.4.1 HIGH COST ASSOCIATED WITH VENOUS DISEASE TREATMENT

8.4.2 SIDE EFFECTS AND RISK ASSOCIATED WITH DIFFERENT TREATMENT MODES

9 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 SCLEROTHERAPY INJECTION

9.2.1 SCLEROTHERAPY, BY TYPE

9.2.1.1 INTRAVENOUS

9.2.1.2 INTRADERMAL

9.2.1.3 SUBCUTANEOUS

9.2.2 SUBCUTANEOUS, BY APPLICATION

9.2.2.1 MALFORMED LYMPHED VESSELS

9.2.2.2 HEMORRHOIDS

9.2.2.3 HYDROCELES

9.2.2.4 OTHERS

9.3 ABLATION DEVICES

9.3.1 THERMAL ABLATION

9.3.1.1 RADIOFREQUENCY

9.3.1.1.1 CATHETER MANIPULATION SYSTEMS

9.3.1.1.2 TEMPERATURE CONTROLLED

9.3.1.1.3 FLUID COOLED

9.3.1.2 LIGHT

9.3.1.2.1 EXCIMER LASERS

9.3.1.2.2 COLD LASERS

9.3.1.3 ULTRASOUND

9.3.1.3.1 HIGH INTENSITY FOCUSED ULTRASOUND (HIFU)

9.3.1.3.2 SHOCK WAVE LITHOTRIPSY

9.3.1.3.3 MAGNETIC RESONANCE IMAGING GUIDED FOCUSED ULTRASOUND (MRI-FUS)

9.3.1.3.4 ULTRASONIC SURGICAL SYSTEMS

9.3.1.4 RADIATION

9.3.1.4.1 STEREOTACTIC BODY RADIATION THERAPY

9.3.1.4.2 INTENSITY-MODULATED RADIATION THERAPY

9.3.1.4.3 STEREOTACTIC RADIOTHERAPY & RADIOSURGERY

9.3.1.4.4 IMAGE GUIDED RADIATION THERAPY

9.3.1.4.5 INTRAVASCULAR BRACHYTHERAPY

9.3.1.4.6 PROTON BEAM THERAPY

9.3.1.5 ELECTRICAL

9.3.1.5.1 ELECTRICAL ABLATORS

9.3.1.5.2 ELECTRONIC BRACHYTHERAPY

9.3.1.6 MICROWAVE

9.3.1.7 HYDROTHERMAL

9.3.2 NON-THERMAL ABLATION

9.3.2.1 CRYOABLATION

9.3.2.1.1 EPIDERMAL AND SUBCUTANEOUS CRYOABLATION DEVICES

9.3.2.1.2 CRYOGEN SPRAY PROBE

9.3.2.1.3 TISSUE CONTACT PROBE

9.3.2.2 HYDROMECHANICAL ABLATION

9.4 VENOUS CLOSURE PRODUCTS

9.4.1 VENOUS CLOSURE PRODUCTS, BY PROCEDURE

9.4.1.1 INTERVENTIONAL CARDIOLOGY

9.4.1.2 INTERVENTIONAL RADIOLOGY

9.4.2 VENOUS CLOSURE PRODUCTS, BY TECHNOLOGY

9.4.2.1 FEMORAL ACCESS TECHNIQUE

9.4.2.2 RADIAL ACCESS TECHNIQUE

9.5 VENOUS STENTS

9.5.1 VENOUS STENTS, BY TECHNOLOGY

9.5.1.1 WALLSTENT TECHNOLOGY

9.5.1.2 ILIAC VEIN STENT TECHNOLOGY

9.5.2 VENOUS STENTS, BY APPLICATION

9.5.2.1 LEG

9.5.2.2 CHEST

9.5.2.3 ABDOMEN

9.5.2.4 OTHERS

9.6 MEDICATION

9.7 OTHERS

10 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY DISEASE TYPE

10.1 OVERVIEW

10.2 VARICOSE VEINS

10.3 DEEP VEIN THROMBOSIS (DVT)

10.4 PULMONARY EMBOLISM

10.5 CHRONIC VENOUS INSUFFICIENCY (CVI)

10.6 SUPERFICIAL THROMBOPHLEBITIS

10.7 OTHERS

11 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY TREATMENT TYPE

11.1 OVERVIEW

11.2 SCLEROTHERAPY

11.3 RADIOFREQUENCY ABLATION THERAPY

11.4 LASER TREATMENT

11.5 AMBULATORY PHLEBECTOMY

11.6 VEIN LIGATION AND STRIPPING

11.7 ANGIOPLASTY OR STENTING

11.8 SURGERIES

11.9 COMPRESSION THERAPY

11.1 VEINACTIVE MEDICATION

11.11 VENA CAVA FILTER

11.12 OTHER THERAPIES

12 NORTH AMERICA VENOUS TREATMENT DISEASES MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.3 CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 OTHERS

13 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 RETAIL SALES

13.4 OTHERS

14 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 MEDTRONIC

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 BOSTON SCIENTIFIC CORPORATION

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 VARIAN MEDICAL SYSTEMS, INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 STRYKER

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 KONINKLIJKE PHILIPS N.V.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 ABBOTT

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 ALMA LASERS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 ANGIODYNAMICS

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 B.BRAUN MELSUNGEN AG

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 BAYLIS MEDICAL COMPANY, INC

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 BD

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 CANDELA MEDICAL

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 CARL ZEISS MEDITEC AG

17.13.1 COMPANYSNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 COOK

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 IMRICOR

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.16 OLYMPUS CORPORATION

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOILIO

17.16.4 RECENT DEVELOPMENT

17.17 OPTIMED MEDIZINISCHE INSTRUMENTE GMBH

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PLUSMEDICA.DE

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 SCITECH

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 SMITH + NEPHEW

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

17.21 SONABLATE

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 THERACLION

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENT

17.23 TELEFLEX INCORPORATED

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 TERUMO CORPORATION

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 PRODUCT PORTFOLIO

17.24.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA ABLATION DEVICES IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA ABLATION DEVICES IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA RADIOFREQUENCY IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA LIGHT IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA ULTRASOUND IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA RADIATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA ELECTRICAL IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA NON-THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA CRYOABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA ILIAC VEIN STENT TECHNOLOGY IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA MEDICATION IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA VARICOSE VEINS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA DEEP VEIN THROMBOSIS (DVT) IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA PULMONARY EMBOLISM IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA CHRONIC VENOUS INSUFFICIENCY (CVI) IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA SUPERFICIAL THROMBOPHLEBITIS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA SCELEROTHERAPY IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA RADIOFREQUENCY ABLATION THERAPY IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA LASER TREATMENT IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA AMBULATORY PHELEBECTOMY IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA VEIN LIGATION AND STRIPPING IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA ANGIOPLASTY OR STENTING IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA SURGERIES IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA COMPRESSION THERAPY IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA VEINACTIVE MEDICATION IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA VENA CAVA FILTER IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA OTHER THERAPIES IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA HOSPITALS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA CLINICS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OTHERS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA DIRECT TENDER IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA RETAIL SALES IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA OTHERS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA ABLATION DEVICES IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA RADIOFREQUENCY IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA LIGHT IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA ULTRASOUND IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA RADIATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA ELECTRICAL IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA NON-THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA CRYOABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 72 U.S. VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 73 U.S. SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 U.S. SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 75 U.S. ABLATION DEVICES IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 76 U.S. THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 77 U.S. RADIOFREQUENCY IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 78 U.S. LIGHT IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 79 U.S. ULTRASOUND IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 80 U.S. RADIATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 81 U.S. ELECTRICAL IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 82 U.S. NON-THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 83 U.S. CRYOABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 84 U.S. VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 85 U.S. VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 86 U.S. VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 87 U.S. VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 88 U.S. VENOUS DISEASES TREATMENT MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 89 U.S. VENOUS DISEASES TREATMENT MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 90 U.S. VENOUS DISEASES TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 91 U.S. VENOUS DISEASES TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 92 CANADA VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 93 CANADA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 CANADA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 95 CANADA ABLATION DEVICES IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 96 CANADA RADIOFREQUENCY IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 97 CANADA LIGHT IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 98 CANADA ULTRASOUND IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 99 CANADA RADIATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 100 CANADA ELECTRICAL IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 101 CANADA NON-THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 102 CANADA CRYOABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 103 CANADA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 104 CANADA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 105 CANADA VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 106 CANADA VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 107 CANADA VENOUS DISEASES TREATMENT MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 108 CANADA VENOUS DISEASES TREATMENT MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 109 CANADA VENOUS DISEASES TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 110 CANADA VENOUS DISEASES TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 111 MEXICO VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 112 MEXICO SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 MEXICO SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 114 MEXICO ABLATION DEVICES IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 115 MEXICO THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 116 MEXICO RADIOFREQUENCY IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 117 MEXICO LIGHT IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 118 MEXICO ULTRASOUND IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 119 MEXICO RADIATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 120 MEXICO ELECTRICAL IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 121 MEXICO NON-THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 122 MEXICO CRYOABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 123 MEXICO VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 124 MEXICO VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 125 MEXICO VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 126 MEXICO VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 127 MEXICO VENOUS DISEASES TREATMENT MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 128 MEXICO VENOUS DISEASES TREATMENT MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 129 MEXICO VENOUS DISEASES TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 130 MEXICO VENOUS DISEASES TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: SEGMENTATION

FIGURE 11 GROWING AWARENESS ABOUT VENOUS DISEASES TREATMENTS AND INCREASING HEALTHCARE EXPENDITURE IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA VENOUS DISEASES TREATMENT MARKET FROM 2023 TO 2030

FIGURE 12 THE ABLATION DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA VENOUS DISEASES TREATMENT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA VENOUS DISEASES TREATMENT MARKET

FIGURE 14 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY DISEASE TYPE, 2022

FIGURE 19 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY DISEASE TYPE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY DISEASE TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY DISEASE TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY TREATMENT TYPE, 2022

FIGURE 23 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY TREATMENT TYPE, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY END USER, 2022

FIGURE 27 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 31 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: PRODUCT TYPE (2023-2030)

FIGURE 39 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.