North America Ventilator Market

Market Size in USD Billion

CAGR :

%

USD

1.00 Billion

USD

1.85 Billion

2024

2032

USD

1.00 Billion

USD

1.85 Billion

2024

2032

| 2025 –2032 | |

| USD 1.00 Billion | |

| USD 1.85 Billion | |

|

|

|

|

North America Ventilator Market Size

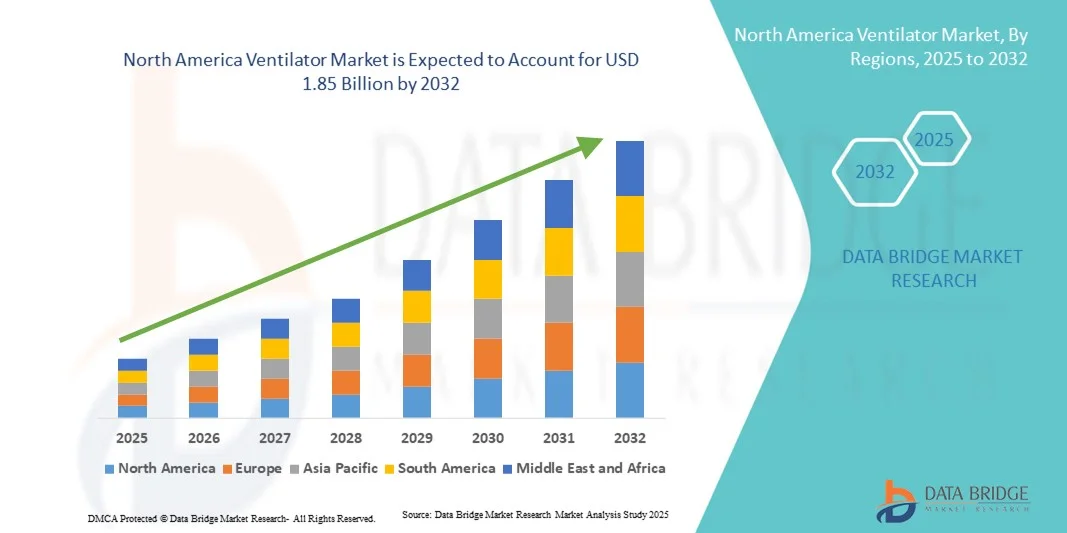

- The North America ventilator market size was valued at USD 1.00 billion in 2024 and is expected to reach USD 1.85 billion by 2032, at a CAGR of 7.90% during the forecast period

- The market growth is largely fueled by technological advancements in ventilator systems, including AI and IoT integration, which enhance device functionality and patient monitoring, as well as the rising prevalence of respiratory disorders and demand for homecare solutions

- Furthermore, increasing adoption of portable and non-invasive ventilators, along with smart ventilators featuring advanced sensors and connectivity, is establishing these devices as essential solutions in both hospital and homecare settings, thereby significantly boosting the industry's growth

North America Ventilator Market Analysis

- Ventilators, providing mechanical breathing support for patients with respiratory conditions, are increasingly essential in hospitals, intensive care units, and homecare settings due to their critical role in patient survival, monitoring capabilities, and integration with advanced healthcare technologies

- The escalating demand for ventilators is primarily fueled by the rising prevalence of respiratory disorders, increasing geriatric population, and growing adoption of home-based healthcare solutions, coupled with technological advancements such as AI-enabled and connected ventilator systems

- The United States dominated the North America ventilator market with the largest revenue share of 84.7% in 2024, characterized by a well-established healthcare infrastructure, high healthcare expenditure, and a strong presence of key industry players

- Canada is expected to be the fastest growing country in the North America ventilator market during the forecast period due to increasing investment in healthcare infrastructure and rising prevalence of chronic respiratory diseases

- Intensive Care Ventilators segment dominated the North America ventilator market with a market share of 48.2% in 2024, driven by their critical role in intensive care settings and the ongoing trend of upgrading to advanced, feature-rich ventilator systems

Report Scope and North America Ventilator Market Segmentation

|

Attributes |

North America Ventilator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Ventilator Market Trends

Advancements in AI-Enabled and Connected Ventilator

- A significant and accelerating trend in the North America ventilator market is the integration of artificial intelligence (AI) and IoT-enabled connectivity, allowing real-time monitoring of patient vitals and automated adjustment of ventilation settings

- For instance, the Hamilton-C6 ventilator integrates AI algorithms to optimize ventilation parameters based on patient-specific lung mechanics, improving clinical outcomes and reducing manual intervention

- AI integration in ventilators enables predictive alerts, adaptive support modes, and enhanced patient safety, while connected features allow clinicians to monitor multiple patients remotely. For instance, Philips Respironics ventilators use cloud-based connectivity to enable telemonitoring of ICU and homecare patients

- The seamless integration of ventilators with hospital information systems and remote monitoring platforms facilitates centralized patient management, enabling clinicians to adjust settings and track trends through a single interface

- This trend towards smarter, connected, and automated ventilator systems is reshaping expectations for respiratory care, with companies such as ResMed developing AI-enabled ventilators capable of adaptive ventilation and remote clinician notifications

- The demand for ventilators with AI and connectivity features is growing rapidly across hospitals and homecare setups, as healthcare providers increasingly prioritize patient safety, operational efficiency, and remote care capabilities

North America Ventilator Market Dynamics

Driver

Rising Respiratory Disease Prevalence and Homecare Demand

- The increasing incidence of chronic respiratory disorders, combined with the growing need for home-based and critical care solutions, is a major driver of ventilator demand in North America

- For instance, in 2024, Medtronic introduced advanced homecare ventilators equipped with remote monitoring to support patients with chronic respiratory illnesses, boosting adoption rates

- As hospitals and homecare providers face rising patient loads, ventilators offer life-saving respiratory support, continuous monitoring, and data-driven treatment optimization, making them essential equipment

- Furthermore, the growing geriatric population and increasing awareness of respiratory health are expanding the ventilator user base and supporting long-term market growth

- The convenience of portable ventilators, telemonitoring capabilities, and smartphone-controlled management are key factors driving adoption in both hospital and homecare settings, while healthcare infrastructure improvements further accelerate growth

- Increasing government initiatives and reimbursement schemes for home-based ventilator care are providing additional incentives for adoption, reducing financial barriers for patients and providers

- Technological collaborations between ventilator manufacturers and digital health companies are enabling innovation, such as remote diagnostics and predictive maintenance, enhancing overall system efficiency

Restraint/Challenge

High Costs and Regulatory Compliance Complexity

- The high initial cost of advanced ventilators, including AI-enabled and portable models, remains a significant challenge to widespread adoption, particularly for smaller healthcare providers and homecare patients

- For instance, costly ICU ventilators with integrated monitoring systems can be prohibitive for rural hospitals and budget-conscious care facilities, limiting accessibility

- Strict regulatory requirements and the need for FDA approvals for ventilators, especially novel AI-driven devices, add complexity and time to product launches

- While prices are gradually decreasing for portable and homecare ventilators, premium models with advanced features such as adaptive ventilation and remote connectivity still command higher costs

- Overcoming these challenges through cost-effective design, streamlined regulatory pathways, and enhanced training for healthcare providers will be vital to sustain market growth and expand accessibility

- Dependence on electricity and connectivity infrastructure for advanced ventilators can limit their usability in remote or resource-constrained areas

- Ensuring cybersecurity for connected ventilators is crucial, as vulnerabilities in networked systems could expose patient data and compromise device functionality, potentially undermining trust in these technologies

North America Ventilator Market Scope

The market is segmented on the basis of mobility, interface, type, oxygen delivery into the lungs, mode, and end user.

- By Mobility

On the basis of mobility, the ventilator market is segmented into intensive care ventilators and portable/transportable ventilators. The intensive care ventilators segment dominated the market with the largest revenue share of 48.2% in 2024, owing to their critical role in hospital ICUs where continuous and precise respiratory support is required for severely ill patients. These ventilators are equipped with advanced monitoring, multiple ventilation modes, and high reliability, making them indispensable for acute respiratory cases. Hospitals prioritize these devices due to the high dependency of ICU patients on mechanical ventilation and the ability to support diverse patient populations. The segment also benefits from increasing investments in hospital infrastructure and ICU expansions across North America. In addition, ongoing technological upgrades in ICU ventilators, including AI-assisted monitoring and connectivity, further strengthen their demand and adoption.

The portable/transportable ventilators segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand in emergency medical services, homecare, and patient transport scenarios. Their compact design, battery operation, and ease of mobility make them ideal for field use, ambulances, and home-based critical care. Technological advancements in lightweight, AI-enabled portable ventilators further support their adoption. Increasing awareness about homecare respiratory support and the trend toward decentralized patient care contribute significantly to the segment's rapid growth. Moreover, government initiatives to improve emergency healthcare response and increasing investment in patient transport technologies also boost market expansion.

- By Interface

On the basis of interface, the ventilator market is segmented into invasive ventilation and non-invasive ventilation. The invasive ventilation segment dominated the market in 2024 due to its essential use in ICU and critical care settings, particularly for patients with severe respiratory distress who require endotracheal or tracheostomy support. These ventilators provide precise control over tidal volume, oxygen concentration, and airway pressures, ensuring optimal patient outcomes. Hospitals and specialty clinics often prioritize invasive ventilators for their versatility across different patient conditions and their integration with monitoring systems. The segment is also supported by growing chronic respiratory disease prevalence and COVID-19-related ICU expansions. Continuous R&D in invasive ventilator technology, including AI-driven monitoring and automated alarm systems, reinforces its dominant position in the market.

The non-invasive ventilation segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing use in homecare, emergency care, and step-down hospital units. Non-invasive ventilators reduce the risk of infections, are more comfortable for patients, and can be easily deployed outside ICU settings. Technological improvements, such as mask-based adaptive ventilation and integration with telemonitoring platforms, are driving their adoption. Rising patient preference for less intrusive ventilation and supportive insurance coverage for homecare devices further accelerate growth. Increasing collaboration between device manufacturers and telehealth providers also enhances non-invasive ventilator deployment and efficiency.

- By Type

On the basis of type, the ventilator market is segmented into adult/pediatric ventilators and infant/neonatal ventilators. The adult/pediatric ventilators segment dominated the market in 2024 due to the larger patient base and higher demand across hospitals, ICUs, and emergency care units. These ventilators are capable of providing multiple ventilation modes and settings suitable for diverse respiratory conditions in both adults and older children. Hospitals prioritize this segment due to the need for flexible, multi-patient applications, supporting both routine and acute care scenarios. Increasing incidence of chronic respiratory diseases and higher ICU occupancy rates further drive demand. Continuous product innovation and integration with AI monitoring tools also reinforce the segment’s dominance.

The infant/neonatal ventilators segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising neonatal care investments, increasing premature births, and advancements in gentle ventilation technologies tailored for fragile lung systems. The segment benefits from higher adoption in neonatal ICUs and maternity hospitals, where specialized care and precise respiratory support are critical. Innovations such as portable neonatal ventilators and advanced monitoring features further boost market growth. Expanding government initiatives to improve infant survival rates and increasing awareness among parents and healthcare providers also support growth.

- By Oxygen Delivery into the Lungs

On the basis of oxygen delivery into the lungs, the ventilator market is segmented into positive pressure mechanical ventilators and negative pressure mechanical ventilators. The positive pressure mechanical ventilators segment dominated the market in 2024 due to their widespread use in hospital ICUs, emergency care, and homecare setups. These ventilators provide controlled airflow into the lungs, supporting critically ill patients with compromised respiratory function. Their compatibility with advanced ventilation modes, monitoring systems, and alarm features make them indispensable in acute care. Increasing prevalence of respiratory diseases and high ICU admissions reinforce the segment’s market share. Continuous technological innovation, including AI-assisted ventilation adjustments, strengthens its dominance.

The negative pressure mechanical ventilators segment is expected to witness the fastest CAGR from 2025 to 2032, driven by innovations in non-invasive, patient-friendly respiratory support and rehabilitation settings. The segment benefits from rising interest in alternatives to traditional invasive ventilation, offering less risk of ventilator-associated complications. Increased adoption in homecare and long-term patient support also fuels growth. Growing awareness of patient comfort and rising adoption in rehabilitation and outpatient settings further accelerate expansion. Technological advancements in wearable negative pressure systems also contribute to this segment’s growth.

- By Mode

On the basis of mode, the ventilator market is segmented into combined-mode ventilation, volume-mode ventilation, pressure-mode ventilation, and others. The combined-mode ventilation segment dominated the market in 2024 due to its ability to provide flexibility by switching between volume and pressure-controlled ventilation, making it suitable for critical care patients with changing respiratory needs. Hospitals prioritize these ventilators for ICU and emergency applications, as they improve patient outcomes and reduce complications. High adoption in tertiary care hospitals and advanced healthcare centers strengthens the segment. Integration with AI for adaptive ventilation and real-time monitoring further reinforces dominance.

The pressure-mode ventilation segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its use in homecare and non-invasive ventilation. Pressure-mode ventilators help minimize lung injury, are easier to manage in portable devices, and are increasingly preferred for patients with chronic respiratory disorders. The segment also benefits from technological advancements such as AI-assisted pressure adjustments and telemonitoring features. Rising patient preference for non-invasive ventilation and the expanding homecare market contribute to rapid adoption. Collaboration between ventilator manufacturers and digital health providers also supports growth in this segment.

- By End User

On the basis of end user, the ventilator market is segmented into hospitals and clinics, homecare, ambulatory care centers, and emergency medical services. The hospitals and clinics segment dominated the market in 2024 due to the critical need for ventilators in ICU, emergency, and specialized care units. High patient inflow, chronic respiratory disease prevalence, and healthcare infrastructure development drive this segment’s revenue. Hospitals prefer advanced ventilators capable of supporting multiple patient types and modes to ensure effective treatment outcomes. Strong investment in hospital ICU expansions and rising acute care admissions reinforce market dominance. Continuous R&D in hospital-grade ventilators further strengthens adoption.

The homecare segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing patient preference for home-based respiratory care, advancements in portable ventilators, and supportive reimbursement policies. Rising awareness about chronic respiratory disease management, aging population, and telehealth integration further boost adoption in homecare settings. Portable, user-friendly ventilators with connectivity features are particularly appealing to this segment. Expansion of insurance coverage for homecare devices and growing patient preference for decentralized care accelerate growth. Collaboration between ventilator manufacturers and telehealth providers further enhances market potential in the homecare segment.

North America Ventilator Market Regional Analysis

- The United States dominated the North America ventilator market with the largest revenue share of 84.7% in 2024, characterized by a well-established healthcare infrastructure, high healthcare expenditure, and a strong presence of key industry players

- Healthcare providers in the region prioritize ventilators with AI-enabled monitoring, remote connectivity, and multiple ventilation modes to ensure optimal patient outcomes in both hospitals and homecare settings

- This widespread adoption is further supported by high healthcare expenditure, strong government initiatives for critical care and home-based respiratory support, and ongoing investment in technological advancements, establishing ventilators as essential medical devices for acute and chronic respiratory care

U.S. Ventilator Market Insight

The U.S. ventilator market captured the largest revenue share of 84.7% in 2024 within North America, fueled by the increasing prevalence of respiratory diseases, rising demand for ICU and homecare ventilators, and advanced healthcare infrastructure. Hospitals and homecare providers are prioritizing ventilators with AI-enabled monitoring, telehealth integration, and multiple ventilation modes to improve patient outcomes. The growing emphasis on home-based respiratory care and emergency preparedness further propels the market. Moreover, government initiatives, insurance reimbursement policies, and continuous investment in ventilator R&D are significantly contributing to the market’s expansion.

Canada Ventilator Market Insight

The Canada ventilator market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising respiratory disease incidence and increased adoption of homecare ventilators. The country’s well-developed healthcare system and strong focus on critical care infrastructure are fostering the adoption of advanced ventilators. Canadian hospitals and clinics are also increasingly deploying portable and non-invasive ventilators to meet emergency and homecare needs. Government support for healthcare innovation, coupled with growing awareness of chronic respiratory conditions, is further boosting market growth.

Mexico Ventilator Market Insight

The Mexico ventilator market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing investments in healthcare infrastructure and rising awareness about respiratory health. The demand for both hospital-grade and homecare ventilators is growing due to higher incidences of chronic respiratory disorders and acute respiratory infections. Mexico’s adoption of modern ventilators with remote monitoring and AI-assisted features is also accelerating market expansion. In addition, increasing urbanization and a growing middle-class population are contributing to higher ventilator penetration in hospitals and clinics.

North America Ventilator Market Share

The North America Ventilator industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Koninklijke Philips N.V. (U.S.)

- ResMed (U.S.)

- GE HealthCare. (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- Air Liquide (France)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Hill-Rom Holdings, Inc. (U.S.)

- ZOLL Medical Corporation (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Getinge AB (Sweden)

- Hamilton Medical (Switzerland)

- Vyaire Medical, Inc. (U.S.)

- Inspiration Healthcare Group plc. (U.S.)

- WEINMANN Emergency Medical Technology GmbH (Germany)

- VEXOS (Canada)

- Broan-NuTone LLC (U.S.)

- Aero Healthcare AU Pty Ltd (Australia)

What are the Recent Developments in North America Ventilator Market?

- In August 2025, ResMed expanded its portfolio in the ventilator market, focusing on enhancing respiratory care solutions. The company's strategic initiatives aim to address the growing demand for advanced ventilatory support in North America

- In November 2024, CorVent Medical announced that its RESPOND ventilator received U.S. FDA 510(k) clearance. Designed as a cost-effective solution, the RESPOND ventilator aims to provide simple, safe, and smart ventilation, expanding access to quality care for healthcare systems, providers, and patients

- In October 2024, Nihon Kohden America launched the NKV-440 ventilator system, offering invasive ventilation, non-invasive ventilation, and high-flow oxygen therapy in a single device. The system operates without wall air or compressors, featuring a turbine-driven design that enhances portability and cost-efficiency, addressing modern healthcare challenges

- In April 2024, Philips finalized a settlement with the U.S. Justice Department and FDA regarding the recall of its Respironics ventilators. The agreement requires Philips Respironics to prioritize the remediation of affected devices recalled in June 2021 due to potential risks from degrading internal sound-dampening foam. The focus will primarily be on U.S. operations, including several manufacturing and service centers in Pennsylvania. Philips

- In February 2024, Dräger was honored with Frost & Sullivan's 2024 Best Practices Award for its innovation in mechanical ventilators. The company also announced a research collaboration with STIMIT to investigate ventilator-induced diaphragmatic dystrophy (VIDD), focusing on non-invasive diaphragm stimulation to preserve diaphragm thicknes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.