North America Ventilators Market

Market Size in USD Million

CAGR :

%

USD

811.99 Million

USD

1,446.01 Million

2022

2030

USD

811.99 Million

USD

1,446.01 Million

2022

2030

| 2023 –2030 | |

| USD 811.99 Million | |

| USD 1,446.01 Million | |

|

|

|

|

North America Ventilators Market Analysis and Size

Over the years, due to technological breakthroughs such as improved portable ventilators and improvements in the sensor technologies used in ventilators, the ventilators market has grown tremendously. The ventilators market is largely influenced by the surging focus of key players towards technological advances in molecular diagnostics and indulging towards collaboration and partnerships with other organizations. Consequently, the market is being propelled forward with various growth determinants and is projected to show substantial growth over the forecasted period.

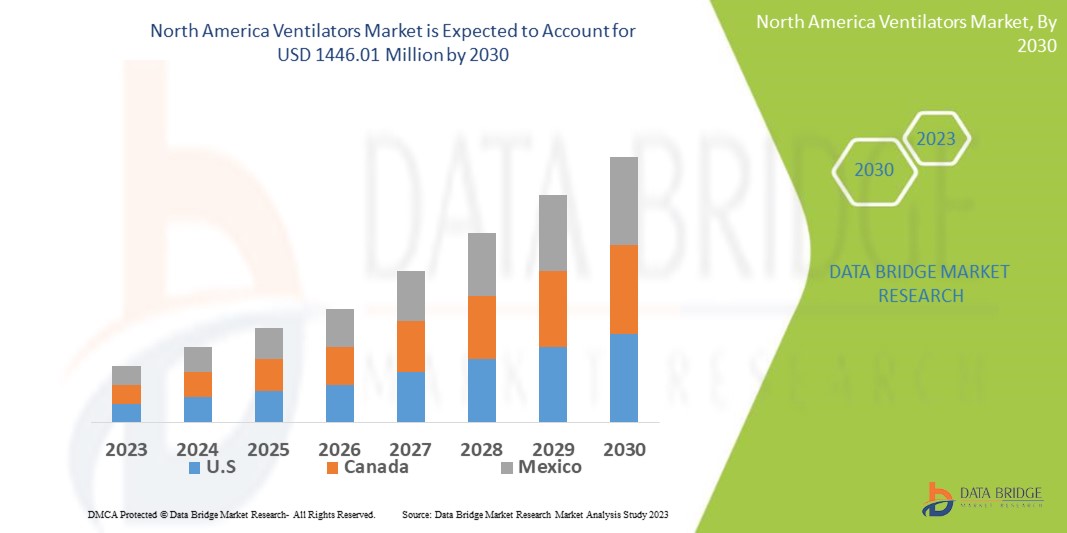

Data Bridge Market Research analyses that the Ventilators Market which was USD 811.99 million in 2022, would rocket up to USD 1446.01 million by 2030, and is expected to undergo a CAGR of 7.48% during the forecast period. This indicates that the market value. “intensive care ventilators” dominates the product type segment of the ventilators market owing to the rise in prevalence of respiratory disorder. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Ventilators Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Intensive Care Ventilators, Portable Ventilators, Neonatal Ventilators), Modality (Non-Invasive Ventilation and Invasive Ventilation), Type (Adult Ventilators, Neonatal Ventilators and Paediatric Ventilators), Mode (Combined-Mode Ventilation, Volume-Mode Ventilation, Pressure-Mode Ventilation, and Others), End User (Hospitals, Ambulatory Surgery Centres, Specialty Clinics, Long Term Care Centres, Rehabilitation Centres ,and Homecare Settings) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Koninklijke Philips N.V. (Netherlands), Getinge AB (Sweden), ResMed (U.S.), Medtronic (Ireland), Fisher & Paykel Healthcare Limited (New Zealand), Avasarala Technologies Limited (India), Allied Healthcare Products, Inc. (U.S.), Shenzhen Mindray Bio-Medical Electronics Co., Ltd, (China), Drägerwerk AG & CO. KGAA (Germany), Nihon Kohden Corporation (Japan), Asahi Kasei Corporation (Japan), Air Liquide (France), Vyaire (U.S.), General Electric Company (U.S.), Hamilton Medical (Switzerland), Smiths Group plc (U.K), aXcent Medical (Germany), Metran Co., Ltd (Japan), Airon Corporation (Florida), TRITON Electronic Systems Ltd. (Russia), Bio-Med Devices, (U.S.), Hill-Rom Holdings, Inc. (U.S.) and HEYER Medical AG (Germany) |

|

Market Opportunities |

|

Market Definition

The ventilator is basically an equipment which is used in intensive care units to help patients breathe when they are unable to do so on their own. Ventilators can be employed on the system either temporarily or permanently (as in long-term care) and are used across utilized in hospital settings, rehabilitation centres and at home. Mechanical ventilation, an endotracheal tube, and a nasogastric drain are the components of a ventilator. Ventilation devices remove carbon dioxide from the patient's body by supplying oxygen. It is used to keep people alive, but it is not used to treat illnesses or medical disorders. The mechanical ventilation system is used for patients with chronic diseases such as chronic obstructive pulmonary disease (COPD), asthma, brain traumas, and strokes.

North America Ventilators Market Dynamics

Drivers

- Surging Prevalence of Respiratory Disorders

The increasing prevalence of chronic obstructive pulmonary disease (COPD) and other respiratory disorders such as sleep apnea, acute lung injury, and hypoxemia are the most significant factors driving this market's growth. The increasing number of preterm births and rapid growth in the geriatric population are also expected to accelerate the market's overall growth. Moreover, the high prevalence of tobacco smoking which leads to respiratory disease will bolster the growth of the market.

- Increased Demand for Home Healthcare

There is a growing trend towards home-based care for chronic respiratory patients. Homecare ventilation allows patients to receive respiratory support in the comfort of their homes, reducing hospital stays and healthcare costs. The demand for portable and user-friendly ventilators suitable for homecare settings is expected to drive market growth.

- Increasing Surgical Procedures

Various surgical procedures, particularly those involving the chest or respiratory system, often require the use of ventilators during and after the surgery. The growing number of surgeries globally, including cardiac surgeries, organ transplants, and thoracic surgeries, is increasing the demand for ventilators. Which is expected to drive market growth.

- Government Initiatives and Healthcare Investments

The governments worldwide have recognized the significance of respiratory care and have increased investments in healthcare infrastructure. They have taken initiatives to improve healthcare access, especially in the developing countries, and have increased the availability of ventilators in the healthcare facilities. The government support through funding, policies, and collaborations with manufacturers helps in drive the market growth.

Opportunities

- Technological advancements

Advances in ventilator technology have greatly improved patient care and outcomes. Innovative features such as improved user interfaces, better synchronization with patient breathing, and the development of portable and transport ventilators have enhanced the efficiency and use of these devices. Technological advancements drive market growth by attracting healthcare providers to upgrade their equipment and invest in the latest ventilator models.

- Portable and Transport Ventilators

The demand for portable and transport ventilators is growing, driven by the need for respiratory support in various settings outside the traditional hospital environment. These include ambulances, emergency medical services, and homecare settings. The development of lightweight, compact, and battery-operated ventilators that offer advanced functionality. Which is expected to act as an opportunity for the market growth.

Restraints/Challenges

- High costs

Ventilators are complex medical devices that require advanced technology and engineering, leading to high manufacturing costs. The initial investment required to develop, produce, and maintain ventilators can be substantial. This high cost of ventilators can limit their accessibility, especially in resource-constrained healthcare settings or regions with limited healthcare budgets. Which act as a challenge for the market growth.

- Regulatory Compliance

Ventilators are subject to stringent regulatory requirements and must adhere to safety, performance, and quality standards. Compliance with these regulations can be time-consuming and expensive for manufacturers, particularly for new market entrants or smaller companies. Strict regulatory processes may delay product approvals, slowing down market entry and growth.

This Ventilators Market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more information on the Ventilators Market Contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In April 2020, Medtronic received approval for the use of PB560 in the U.S. through the FDA’s EUA authority. Previously, the company shipped around 300 ventilators per week. It was intended to raise production from 300 to 700 ventilators each week to battle the epidemic (this figure was expected to increase to 1,000 ventilators per week by the end of June 2020)

- In April 2020, Koninklijke Philips N.V., announced that the U.S. Government and they agreed to team up to increase the production of hospital ventilators in its manufacturing sites in the U.S. Philips plans to double the production by May 2020 and achieve a four-fold increase by the third quarter of 2020 for supply to the U.S. and global markets. Such ventilators are critical for the treatment of patients with the new coronavirus disease (COVID-19)

North America Ventilators Market Scope

The ventilators market is segmented on the basis of product type, modality, type, mode and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Intensive Care Ventilators

- Portable Ventilators

- Neonatal Ventilators

Modality

- Non-Invasive Ventilation

- Invasive Ventilation

Type

- Adult Ventilators

- Neonatal Ventilators

- Paediatric Ventilators

Mode

- Combined-Mode Ventilation

- Volume-Mode Ventilation

- Pressure-Mode Ventilation

- Other

End User

- Hospitals

- Ambulatory Surgery Centres

- Specialty Clinics

- Long Term Care Centres

- Rehabilitation Centres

- Homecare Settings

Ventilators Market Regional Analysis/Insights

The Ventilators Market is analysed and market size insights and trends are provided by country, product type, modality, type, mode and end user as referenced above.

The countries covered in the Ventilators Market report are the U.S., Canada, and Mexico.

The U.S. dominates the Ventilators Market because of the strong base of healthcare facilities, strong presence of major players in the market, increases cases of respiratory disorder and rising number of research activities in this region.

The U.S. is expected to witness significant growth during the forecast period of 2023 to 2030 due to the increase in government initiatives to promote awareness, rise in medical tourism, growing research activities in the region, availability of massive untapped markets, large population pool, and the growing demand for quality healthcare in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The Ventilators Market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for Ventilators Market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the Ventilators Market The data is available for historic period 2010-2020.

Competitive Landscape and Ventilators Market Share Analysis

The Ventilators Market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Ventilators Market.

Some of the major players operating in the Ventilators Market are:

- Koninklijke Philips N.V. (Netherlands)

- Getinge AB (Sweden)

- ResMed (U.S.)

- Medtronic (Ireland)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Avasarala Technologies Limited (India)

- Allied Healthcare Products, Inc. (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd, (China)

- Drägerwerk AG & CO. KGAA (Germany)

- Nihon Kohden Corporation (Japan)

- Asahi Kasei Corporation (Japan)

- Air Liquide (France)

- Vyaire (U.S.)

- General Electric Company (U.S.)

- Hamilton Medical (Switzerland)

- Smiths Group plc (U.K)

- aXcent Medical (Germany)

- Metran Co., Ltd (Japan)

- Airon Corporation (Florida)

- Bio-Med Devices, (U.S.)

- Hill-Rom Holdings, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA VENTILATORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE NORTH AMERICA VENTILATORS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 NORTH AMERICA VENTILATORS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 NORTH AMERICA VENTILATORS MARKET, BY TYPE

16.1 OVERVIEW

16.2 ELECTRONIC

16.3 MECHANICAL

16.4 PNEUMATIC

16.5 ELECTRO-PNEUMATIC

17 NORTH AMERICA VENTILATORS MARKET, BY PRODUCT TYPE

18 (NOTE: MARKET VALUE, VOLUME AND ASP ANALYSIS WOULD BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS OF PRODUCT)

18.1 OVERVIEW

18.2 INTENSIVE CARE VENTILATORS

18.2.1 HIGH-END ICU VENTILATORS

18.2.1.1. MARKET VALUE (USD MN)

18.2.1.2. MARKET VOLUME (UNITS)

18.2.1.3. AVERAGE SELLING PRICE (USD)

18.2.2 BASIC ICU VENTILATORS

18.2.3 MID-END ICU VENTILATORS

18.3 PORTABLE VENTILATORS

18.4 NEONATAL VENTILATORS

19 NORTH AMERICA VENTILATORS MARKET, BY VENTILATION MODE

19.1 OVERVIEW

19.2 NON-INVASIVE VENTILATION

19.2.1 VOLUME-CYCLED VENTILATORS

19.2.2 PRESSURE-CYCLED VENTILATORS

19.2.3 CONTINUOUS POSITIVE AIRWAY PRESSURE VENTILATORS

19.2.4 BI-LEVEL POSITIVE AIRWAY PRESSURE VENTILATORS

19.2.5 FLOW-CYCLED VENTILATORS

19.2.6 TIME-CYCLED VENTILATORS

19.3 INVASIVE VENTILATION

20 NORTH AMERICA VENTILATORS MARKET, BY MODALITY

20.1 OVERVIEW

20.2 PORTABLE

20.3 BENCHTOP

20.4 FIXED

21 NORTH AMERICA VENTILATORS MARKET, BY AGE GROUP

21.1 OVERVIEW

21.2 ADULT VENTILATORS

21.3 NEONATAL VENTILATORS

21.4 PEDIATRIC VENTILATORS

22 NORTH AMERICA VENTILATORS MARKET, BY MODE

22.1 OVERVIEW

22.2 COMBINED-MODE VENTILATION

22.3 VOLUME-MODE VENTILATION

22.4 PRESSURE-MODE VENTILATION

22.5 OTHER

23 NORTH AMERICA VENTILATORS MARKET, BY END USER

23.1 OVERVIEW

23.2 HOSPITALS

23.2.1 PUBLIC

23.2.1.1. BY LEVEL

23.2.1.1.1. TIER 1

23.2.1.1.2. TIER 2

23.2.1.1.3. TIER 3

23.2.2 PRIVATE

23.2.2.1. BY LEVEL

23.2.2.1.1. TIER 1

23.2.2.1.2. TIER 2

23.2.2.1.3. TIER 3

23.3 AMBULATORY SURGERY CENTERS

23.4 SPECIALTY CLINICS

23.5 LONG TERM CARE CENTERS

23.6 REHABILITATION CENTERS

23.7 HOMECARE SETTINGS

23.8 OTHERS

24 NORTH AMERICA VENTILATORS MARKET, BY DISTRIBUTION CHANNEL

24.1 OVERVIEW

24.2 DIRECT TENDERS

24.3 RETAIL SALES

24.4 OTHERS

25 NORTH AMERICA VENTILATORS MARKET, BY REGION

NORTH AMERICA VENTILATORS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

25.1 NORTH AMERICA

25.1.1 U.S.

25.1.2 CANADA

25.1.3 MEXICO

25.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

26 NORTH AMERICA VENTILATORS MARKET, SWOT AND DBMR ANALYSIS

27 NORTH AMERICA VENTILATORS MARKET, COMPANY LANDSCAPE

27.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

27.2 MERGERS & ACQUISITIONS

27.3 NEW PRODUCT DEVELOPMENT & APPROVALS

27.4 EXPANSIONS

27.5 REGULATORY CHANGES

27.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

27.7 COMPANY SHARE ANALYSIS: INTENSIVE CARE VENTILATORS, NORTH AMERICA SHARE ANALYSIS

27.8 COMPANY SHARE ANALYSIS: PORTABLE VENTILATORS, NORTH AMERICA SHARE ANALYSIS

27.9 COMPANY SHARE ANALYSIS: NEONATAL VENTILATORS, NORTH AMERICA SHARE ANALYSIS

28 NORTH AMERICA VENTILATORS MARKET, COMPANY PROFILE

28.1 KONINKLIJKE PHILIPS N.V.

28.1.1 COMPANY OVERVIEW

28.1.2 REVENUE ANALYSIS

28.1.3 GEOGRAPHIC PRESENCE

28.1.4 PRODUCT PORTFOLIO

28.1.5 RECENT DEVELOPMENTS

28.2 AIR LIQUIDE

28.2.1 COMPANY OVERVIEW

28.2.2 REVENUE ANALYSIS

28.2.3 GEOGRAPHIC PRESENCE

28.2.4 PRODUCT PORTFOLIO

28.2.5 RECENT DEVELOPMENTS

28.3 HAMILTON MEDICAL

28.3.1 COMPANY OVERVIEW

28.3.2 REVENUE ANALYSIS

28.3.3 GEOGRAPHIC PRESENCE

28.3.4 PRODUCT PORTFOLIO

28.3.5 RECENT DEVELOPMENTS

28.4 MEDTRONIC

28.4.1 COMPANY OVERVIEW

28.4.2 REVENUE ANALYSIS

28.4.3 GEOGRAPHIC PRESENCE

28.4.4 PRODUCT PORTFOLIO

28.4.5 RECENT DEVELOPMENTS

28.5 GETINGE AB

28.5.1 COMPANY OVERVIEW

28.5.2 REVENUE ANALYSIS

28.5.3 GEOGRAPHIC PRESENCE

28.5.4 PRODUCT PORTFOLIO

28.5.5 RECENT DEVELOPMENTS

28.6 DRÄGERWERK AG & CO. KGAA

28.6.1 COMPANY OVERVIEW

28.6.2 REVENUE ANALYSIS

28.6.3 GEOGRAPHIC PRESENCE

28.6.4 PRODUCT PORTFOLIO

28.6.5 RECENT DEVELOPMENTS

28.7 SCHILLER AMERICAS, INC.

28.7.1 COMPANY OVERVIEW

28.7.2 REVENUE ANALYSIS

28.7.3 GEOGRAPHIC PRESENCE

28.7.4 PRODUCT PORTFOLIO

28.7.5 RECENT DEVELOPMENTS

28.8 BUNNELL

28.8.1 COMPANY OVERVIEW

28.8.2 REVENUE ANALYSIS

28.8.3 GEOGRAPHIC PRESENCE

28.8.4 PRODUCT PORTFOLIO

28.8.5 RECENT DEVELOPMENTS

28.9 PENLON LIMITED

28.9.1 COMPANY OVERVIEW

28.9.2 REVENUE ANALYSIS

28.9.3 GEOGRAPHIC PRESENCE

28.9.4 PRODUCT PORTFOLIO

28.9.5 RECENT DEVELOPMENTS

28.1 RESMED

28.10.1 COMPANY OVERVIEW

28.10.2 REVENUE ANALYSIS

28.10.3 GEOGRAPHIC PRESENCE

28.10.4 PRODUCT PORTFOLIO

28.10.5 RECENT DEVELOPMENTS

28.11 VYAIRE

28.11.1 COMPANY OVERVIEW

28.11.2 REVENUE ANALYSIS

28.11.3 GEOGRAPHIC PRESENCE

28.11.4 PRODUCT PORTFOLIO

28.11.5 RECENT DEVELOPMENTS

28.12 ZOLL MEDICAL CORPORATION (SUBSIDIARY OF ASAHI KASEI)

28.12.1 COMPANY OVERVIEW

28.12.2 REVENUE ANALYSIS

28.12.3 GEOGRAPHIC PRESENCE

28.12.4 PRODUCT PORTFOLIO

28.12.5 RECENT DEVELOPMENTS

28.13 EVENT MEDICAL

28.13.1 COMPANY OVERVIEW

28.13.2 REVENUE ANALYSIS

28.13.3 GEOGRAPHIC PRESENCE

28.13.4 PRODUCT PORTFOLIO

28.13.5 RECENT DEVELOPMENTS

28.14 ALLIED MEDICAL LLC (A FLEXICARE COMPANY)

28.14.1 COMPANY OVERVIEW

28.14.2 REVENUE ANALYSIS

28.14.3 GEOGRAPHIC PRESENCE

28.14.4 PRODUCT PORTFOLIO

28.14.5 RECENT DEVELOPMENTS

28.15 GE HEALTHCARE

28.15.1 COMPANY OVERVIEW

28.15.2 REVENUE ANALYSIS

28.15.3 GEOGRAPHIC PRESENCE

28.15.4 PRODUCT PORTFOLIO

28.15.5 RECENT DEVELOPMENTS

28.16 NIHON KODEN CORPORATION

28.16.1 COMPANY OVERVIEW

28.16.2 REVENUE ANALYSIS

28.16.3 GEOGRAPHIC PRESENCE

28.16.4 PRODUCT PORTFOLIO

28.16.5 RECENT DEVELOPMENTS

28.17 AIRON CORPORATION

28.17.1 COMPANY OVERVIEW

28.17.2 REVENUE ANALYSIS

28.17.3 GEOGRAPHIC PRESENCE

28.17.4 PRODUCT PORTFOLIO

28.17.5 RECENT DEVELOPMENTS

28.18 BIO-MED DEVICES

28.18.1 COMPANY OVERVIEW

28.18.2 REVENUE ANALYSIS

28.18.3 GEOGRAPHIC PRESENCE

28.18.4 PRODUCT PORTFOLIO

28.18.5 RECENT DEVELOPMENTS

28.19 HILL-ROM SERVICES, INC. (BAXTER)

28.19.1 COMPANY OVERVIEW

28.19.2 REVENUE ANALYSIS

28.19.3 GEOGRAPHIC PRESENCE

28.19.4 PRODUCT PORTFOLIO

28.19.5 RECENT DEVELOPMENTS

28.2 NARANG MEDICAL LIMITED

28.20.1 COMPANY OVERVIEW

28.20.2 REVENUE ANALYSIS

28.20.3 GEOGRAPHIC PRESENCE

28.20.4 PRODUCT PORTFOLIO

28.20.5 RECENT DEVELOPMENTS

28.21 SKANRAY TECHNOLOGIES LTD

28.21.1 COMPANY OVERVIEW

28.21.2 REVENUE ANALYSIS

28.21.3 GEOGRAPHIC PRESENCE

28.21.4 PRODUCT PORTFOLIO

28.21.5 RECENT DEVELOPMENTS

28.22 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

28.22.1 COMPANY OVERVIEW

28.22.2 REVENUE ANALYSIS

28.22.3 GEOGRAPHIC PRESENCE

28.22.4 PRODUCT PORTFOLIO

28.22.5 RECENT DEVELOPMENTS

28.23 SHENZHEN COMEN MEDICAL INSTRUMENTS CO., LTD.

28.23.1 COMPANY OVERVIEW

28.23.2 REVENUE ANALYSIS

28.23.3 GEOGRAPHIC PRESENCE

28.23.4 PRODUCT PORTFOLIO

28.23.5 RECENT DEVELOPMENTS

28.24 PRUNUS MEDICAL

28.24.1 COMPANY OVERVIEW

28.24.2 REVENUE ANALYSIS

28.24.3 GEOGRAPHIC PRESENCE

28.24.4 PRODUCT PORTFOLIO

28.24.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

29 RELATED REPORTS

30 CONCLUSION

31 QUESTIONNAIRE

32 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.