North America Veterinary Ivf Market

Market Size in USD Million

CAGR :

%

USD

738.09 Million

USD

1,107.22 Million

2024

2032

USD

738.09 Million

USD

1,107.22 Million

2024

2032

| 2025 –2032 | |

| USD 738.09 Million | |

| USD 1,107.22 Million | |

|

|

|

|

North America Veterinary In vitro Fertilization (IVF) Market Size

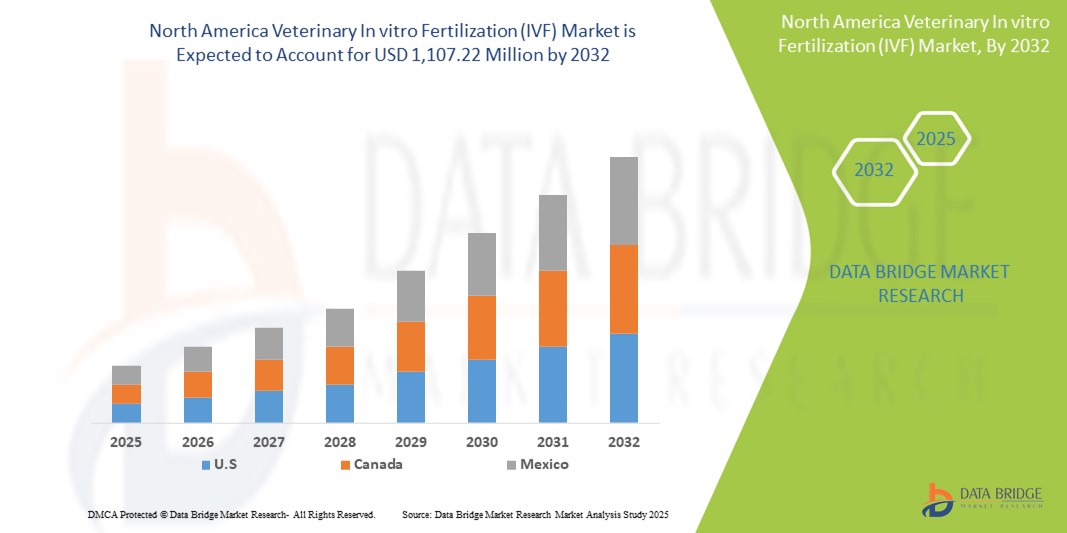

- The North America Veterinary in vitro fertilization (IVF) market size was valued at USD 738.09 million in 2024 and is expected to reach USD 1,107.22 million by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced reproductive technologies to boost livestock fertility and genetic outcomes across developed economies in the North America region. The presence of well-established veterinary infrastructure, strong academic research networks, and high awareness of animal fertility management are key drivers of market expansion in countries such as the U.S. and Canada

- Furthermore, the rising prevalence of fertility disorders in livestock, coupled with growing investments in private veterinary fertility clinics and animal biotechnology research, is promoting the uptake of in vitro fertilization (IVF) procedures. These converging factors are accelerating the utilization of veterinary IVF services, thereby significantly boosting the North America Veterinary In Vitro Fertilization (IVF) Market growth

North America Veterinary In vitro Fertilization (IVF) Market Analysis

- Veterinary in vitro fertilization (IVF) is becoming an essential tool in the North America region to enhance animal reproductive efficiency, particularly in livestock and companion animals, owing to its role in improving genetic quality, increasing fertility rates, and boosting productivity in the agricultural sector

- The growing demand for IVF procedures is primarily fueled by rising awareness of advanced breeding techniques, expanding livestock populations, and increasing efforts to preserve endangered species through assisted reproduction technologies

- U.S. dominated the North America veterinary in vitro fertilization (IVF) market with the largest revenue share of 81.2% in 2024, attributed to its highly developed veterinary healthcare infrastructure, widespread adoption of animal fertility services, and strong presence of major biotechnology firms. In addition, increased funding for animal research and the expansion of specialized veterinary clinics support continued market growth

- Canada is expected to be the fastest growing country in the North America veterinary in vitro fertilization (IVF) Market during the forecast period, driven by increasing investments in agricultural biotechnology, the growing importance of dairy and beef cattle productivity, and supportive government initiatives promoting animal health and fertility

- The reagents & kits segment dominated the North America veterinary in vitro fertilization (IVF) market with a market share of 48.6% in 2024, owing to their indispensable role in IVF procedures such as embryo transfer, ovum pickup, and artificial insemination. Their frequent use in both clinical and research settings is propelling segment growth

Report Scope and North America Veterinary In vitro Fertilization (IVF) Market Segmentation

|

Attributes |

Veterinary In vitro Fertilization (IVF) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Veterinary in Vitro Fertilization (IVF) Market Trends

“Rising Demand for Advanced Reproductive Technologies in Veterinary Applications”

- A significant and accelerating trend in the North America Veterinary in Vitro Fertilization (IVF) Market is the growing demand for advanced reproductive technologies to enhance animal breeding outcomes across livestock and companion animal segments. Countries such as China, India, Japan, and Australia are witnessing increasing adoption of IVF techniques to boost genetic quality, reproductive efficiency, and overall livestock productivity

- For instance, growing awareness among farmers and breeders regarding the benefits of in vitro fertilization, including controlled breeding cycles and higher conception rates, is driving market expansion. In addition, government-supported animal husbandry programs and initiatives to improve dairy and meat production are further catalyzing the use of IVF procedures in agricultural economies

- Rising disposable incomes and increasing pet ownership across urban centers in Asia-Pacific are also fueling demand for companion animal fertility solutions. Veterinary clinics in metropolitan areas are increasingly offering IVF and related ART services for pets such as dogs and cats, reflecting shifting cultural attitudes toward animal care and fertility

- Moreover, ongoing technological advancements in embryo transfer, artificial insemination, and ovum pickup techniques are improving success rates, encouraging wider adoption among both private and public veterinary institutions. The availability of veterinary IVF training and education is also expanding, equipping professionals across the region to implement these solutions effectively

- As Asia-Pacific continues to develop its veterinary infrastructure and invests in biotechnology and research, the region is poised to emerge as a key hub for veterinary IVF services. Collaborations between veterinary hospitals, agricultural universities, and biotech companies are expected to enhance accessibility and affordability of IVF treatments in rural and urban markets alike

- The market outlook remains strong with continued innovation, favorable government policies, and growing commercial demand for genetically superior livestock, making Asia-Pacific the fastest-growing region in the global veterinary in vitro fertilization (IVF) market

North America Veterinary in Vitro Fertilization (IVF) Market Dynamics

Driver

“Rising Demand Due to Increasing Livestock Productivity and Advancements in Reproductive Technologies”

- The growing focus on improving livestock productivity and genetic quality is a key driver for the adoption of veterinary IVF techniques across Asia-Pacific, particularly in countries with strong agricultural sectors such as India, China, and Australia

- For instance, government initiatives promoting artificial insemination and embryo transfer programs for cattle and other livestock are increasing the demand for IVF procedures, reagents, and equipment across both public and private veterinary institutions

- In addition, advancements in reproductive technologies—such as in vitro embryo production, ovum pickup, and embryo freezing—are enhancing the success rates of IVF treatments in animals. These innovations make the procedures more viable and cost-effective for widespread implementation

- The expanding companion animal population in urban areas and rising pet humanization trends are also contributing to a surge in IVF-related fertility treatments in veterinary clinics and specialty centers, particularly for high-value or endangered breeds

- Furthermore, the establishment of specialized veterinary IVF labs and increasing collaborations with research institutions are expected to create strong growth opportunities for equipment providers, reagent manufacturers, and IVF service companies in the region

Restraint/Challenge

“High Cost of Procedures and Limited Awareness Among Veterinary Professionals”

- The relatively high cost of veterinary IVF procedures, including equipment, reagents, and services, remains a significant barrier in several parts of the Asia-Pacific region, particularly in developing countries where veterinary budgets are constrained and cost sensitivity is high

- In many rural or resource-limited settings, access to advanced veterinary reproductive technologies is limited due to the lack of infrastructure, trained personnel, and awareness among veterinarians and animal owners

- Moreover, many small-scale farmers and animal owners remain unaware of the potential benefits of IVF in improving herd quality, leading to low adoption despite government support in some regions

- The lack of standardized protocols and insufficient technical expertise in embryo handling, cryopreservation, and transfer also hinder the success rates of IVF procedures, deterring further investment and implementation

- Addressing these challenges through targeted awareness campaigns, training programs for veterinary professionals, public-private partnerships, and subsidized IVF services in rural areas will be essential to unlock the full potential of the Asia-Pacific Veterinary IVF market

North America Veterinary in Vitro Fertilization (IVF) Market Scope

The market is segmented on the basis of products & services, animal type, technique, distribution channel, and end user.

• By Products & Services

On the basis of products & services, the Europe veterinary in vitro fertilization (IVF) market is segmented into equipment, reagents & kits, and services. The reagents & kits segment dominated the largest market revenue share of 48.6% in 2024, owing to their essential role in all IVF procedures and increasing usage in embryo transfer, ovum pickup, and artificial insemination protocols. These kits are vital for successful outcomes and are widely used in both research and clinical settings.

The services segment is projected to witness the fastest CAGR of 9.4% from 2025 to 2032, driven by the rising demand for outsourced fertility services and specialized veterinary clinics.

• By Animal Type

On the basis of animal type, the Europe veterinary in vitro fertilization (IVF) market is segmented into livestock animal and companion animal. The livestock animal segment accounted for the highest market revenue share of 64.1% in 2024, attributed to the high adoption of IVF techniques in cattle, sheep, and swine to enhance breeding, genetic diversity, and productivity.

The companion animal segment is expected to grow at the fastest CAGR of 8.7% during the forecast period, fueled by increasing pet ownership and rising demand for fertility solutions among high-value breeds.

• By Technique

On the basis of technique, the Europe veterinary in vitro fertilization (IVF) market is segmented into artificial insemination, embryo transfer, ovum pickup, and in vitro maturation. The artificial insemination segment dominated with a market share of 40.2% in 2024, due to its widespread accessibility, ease of procedure, and affordability.

The in vitro maturation segment is projected to expand at the fastest CAGR of 10.1% from 2025 to 2032, supported by advancements in embryo culture technology and increasing adoption in veterinary reproductive labs.

• By Distribution Channel

On the basis of distribution channel, the Europe veterinary in vitro fertilization (IVF) market is segmented into hospitals, dialysis centers, home care settings, and others. The hospitals segment held the largest market share of 52.8% in 2024, owing to high procedure volumes and well-established infrastructure.

The home care settings segment is anticipated to grow at a fastest CAGR of 7.9%, supported by portable IVF tools and rising adoption of in-home fertility support.

• By End User

On the basis of end user, the Europe veterinary in vitro fertilization (IVF) market is segmented into veterinary fertility clinics, veterinary hospitals, surgical centers, research laboratories, cryobanks, and others. The veterinary fertility clinics segment dominated with the highest revenue share of 37.4% in 2024, due to growing awareness and availability of IVF treatments in companion and livestock animals.

The cryobanks segment is anticipated to expand at the fastest CAGR of 9.8% from 2025 to 2032, supported by the increasing need for gamete and embryo preservation and the expansion of animal genetic resource banking.

North America Veterinary In Vitro Fertilization (IVF) Market Regional Analysis

- North America dominated the veterinary in vitro fertilization (IVF) market with a significant revenue share of 31.7% in 2024, driven by advanced veterinary healthcare infrastructure

- Widespread adoption of assisted reproductive technologies, and strong emphasis on livestock productivity improvement

- The presence of leading veterinary institutions, growing pet fertility services, and large-scale implementation of artificial insemination and embryo transfer programs in cattle and swine further propel market expansion across the region

U.S. Veterinary IVF Market Insight

The U.S. Veterinary In Vitro Fertilization (IVF) Market accounted for the largest revenue share of 81.2% in 2024 within North America, attributed to its highly developed veterinary services, extensive livestock farming practices, and increased demand for animal genetics enhancement. The country is witnessing rapid advancements in IVF techniques applied in both commercial livestock and companion animal breeding. In addition, a rise in pet fertility centers and academic research partnerships continues to fuel market growth.

Canada Veterinary IVF Market Insight

The Canada Veterinary In Vitro Fertilization (IVF) Market held a 13.6% share in 2024, supported by growing initiatives in genetic improvement for cattle and sheep, particularly in rural provinces. The country’s focus on sustainable livestock practices, combined with government support for agricultural innovation, drives the adoption of embryo transfer, in vitro maturation (IVM), and artificial insemination procedures across veterinary clinics and breeding facilities.

Mexico Veterinary IVF Market Insight

The Mexico Veterinary In Vitro Fertilization (IVF) Market accounted for 4.9% of the North America market share in 2024, fueled by increasing efforts to modernize the livestock sector and reduce genetic disorders in native animal breeds. With growing awareness of IVF technologies among veterinarians and breeders, especially in dairy and beef cattle, Mexico is experiencing gradual yet steady adoption of reproductive biotechnologies across public and private veterinary centers.

North America Veterinary In vitro Fertilization (IVF) Market Share

The North America veterinary in vitro fertilization (IVF) industry is primarily led by well-established companies, including:

- Hamilton Thorne, Inc (U.S.)

- Esco Medical (Estonia)

- Zoetis Services LLC (U.S.)

- IMV Technologies (France)

- Minitube (Germany)

- Agetech Inc (U.S.)

- Orgensen Laboratories (U.S.)

- Bovine Elite LLC (U.S.)

- Kruuse (Denmark)

- Equine Fertility Centre (UK)

- Veterinary Group (U.S.)

- Stateline Veterinary Service (U.S.)

- Trans Ova Genetics (U.S.)

- Tri-Mitsu Pharmaceuticals (Japan)

- Reproductive Services Inc. (U.S.)

- BioTracking LLC (U.S.)

- Vetoquinol USA (U.S.)

- Embryo Transfer Services, Inc. (U.S.)

- Agtech, Inc. (U.S.)

- ABS Global, Inc. (U.S.)

- Select Sires Inc. (U.S.)

- Sexing Technologies (U.S.)

Latest Developments in North America Veterinary In Vitro Fertilization (IVF) market

- In January 2024, ABS Global, Inc. (U.S.) invested in expanding its bovine IVF lab infrastructure across North America, with a focus on automation and digital monitoring systems. This investment reflects the increasing adoption of assisted reproductive technologies in livestock management and supports growing demand for scalable, high-efficiency IVF services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 CUSTOMIZATION

6 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: REGULATIONS

6.1 REGULATORY AUTHORITIES IN THE ASIA-PACIFIC REGION

6.2 NORTH AMERICA REGULATORY SCENARIO

6.3 EUROPE REGULATORY SCENARIO

7 VALUE CHAIN ANALYSIS OF VETERINARY INTRA-VITRO FERTILIZATION (IVF)

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASING LIVESTOCK PRODUCTION & BREEDING PROGRAMS

8.1.2 RISING DEMAND FOR COMPANION ANIMALS

8.1.3 INCREASE IN VETERINARY CLINICS OFFERING IVF SERVICES

8.1.4 INCREASING FOCUS ON ANIMAL WELFARE

8.2 RESTRAINTS

8.2.1 RISKS OF LOW SUCCESS RATES IN IVF

8.2.2 HIGH COST OF IN VITRO FERTILIZATION (IVF)

8.3 OPPORTUNITIES

8.3.1 INCREASE IN RESEARCH AND DEVELOPMENTAL EFFORTS

8.3.2 ADVANCEMENTS IN REPRODUCTIVE TECHNOLOGY

8.3.3 INCREASE IN PET OWNERSHIPS

8.4 CHALLENGES

8.4.1 RISK OF DISEASE TRANSMISSION DURING IVF PROCEDURES

8.4.2 LACK OF AWARENESS IN UNDERDEVELOPED MARKETS

9 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES

9.1 OVERVIEW

9.2 EQUIPMENT

9.2.1 IVF AND EMBRYO CULTURE INSTRUMENTS

9.2.2 LABORATORY EQUIPMENT

9.2.3 CRYOSYSTEMS

9.2.4 MONITORING DEVICES

9.2.5 IMAGING SYSTEMS

9.2.6 OVUM PICK UP SYSTEM

9.2.7 OVUM ASPIRATION PUMPS

9.2.8 CABINETS

9.2.9 OTHERS

9.2.9.1 MICROSCOPES

9.2.9.2 CO2 INCUBATORS

9.2.9.3 EMBRYO TRANSFER CATHETERS

9.2.9.4 LASER SYSTEMS

9.2.9.5 OTHERS

9.2.9.5.1 CENTRIFUGES

9.2.9.5.2 REFRIGERATORS AND FREEZERS

9.2.9.5.3 MICROFUGE TUBES AND PLATES

9.2.9.5.4 OTHERS

9.2.9.5.4.1 ANALYZERS

9.2.9.5.4.2 PH MONITORS

9.2.9.5.4.3 OTHERS

9.2.9.5.4.4 BENCHTOP

9.2.9.5.4.5 STANDALONE

9.3 REAGENTS & KITS

9.3.1 MEDIA

9.3.2 EMBRYO ASSAY

9.3.3 KITS

9.3.3.1 EMBRYO CULTURE MEDIA

9.3.3.2 BOVINE MEDIA

9.3.3.3 SERUM FREE CULTURE MEDIA

9.3.3.4 CRYOPRESERVATION MEDIA

9.3.3.5 EQUINE MEDIA

9.3.3.5.1 DEVITRIFICATION KIT

9.3.3.5.2 VERIFICATION COOLING KIT

9.3.3.5.3 VERIFICATION WARMING KIT

9.3.3.5.4 OTHERS

9.4 SERVICES

9.4.1 OOCYTE RETRIEVAL AND COLLECTION

9.4.2 EMBRYO CULTURE AND DEVELOPMENT

9.4.3 CRYOPRESERVATION

9.4.4 GENETIC SCREENING AND SELECTION

9.4.5 OTHERS

10 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE

10.1 OVERVIEW

10.2 LIVESTOCK ANIMAL

10.2.1 CATTLES

10.2.2 SHEEP

10.2.3 GOAT

10.2.4 OTHERS

10.3 COMPANION ANIMALS

10.3.1 HORSES

10.3.2 DOGS

10.3.3 CATS

10.3.4 OTHERS

10.3.4.1 EQUIPMENT

10.3.4.2 REAGENT

10.3.4.3 SERVICES

11 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE

11.1 OVERVIEW

11.2 ARTIFICIAL INSEMINATION

11.3 EMBRYO TRANSFER

11.4 OVUM PICKUP

11.5 IN VITRO MATURATION

12 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER

12.1 OVERVIEW

12.2 VETERINARY FERTILITY CLINICS

12.3 VETERINARY HOSPITALS

12.4 SURGICAL CENTERS

12.5 RESEARCH LABORATORIES

12.6 CRYOBANKS

12.7 OTHERS

13 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDERS

13.3 RETAIL SALES

13.4 ONLINE SALES

13.5 OTHERS

14 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 ZOETIS SERVICES LLC

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 ESCO MEDICAL

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 MINITÜB GMBH

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 IMV TECHNOLOGIES GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 HAMILTON THORNE

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT UPDATES

17.6 AGTECH, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT UPDATES

17.7 BOVINE ELITE

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT UPDATES

17.8 EQUINE FERTILITY CENTRE

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATE

17.9 JORGENSEN LABORATORIES

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT UPDATES

17.1 KRUUSE

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT UPDATE

17.11 PARAGON VETERINARY GROUP

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATE

17.12 STATELINE VETERINARY SERVICE

17.12.1 COMPANY SNAPSHOT

17.12.2 SERVICE PORTFOLIO

17.12.3 RECENT UPDATE

17.13 TRANS OVA GENETICS

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATES

17.14 TRI-MITSU PHARMACEUTICALS

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA OVERVIEW OF BOVINE IN VITRO PRODUCED (IVP) EMBRYO TRANSFER AND EXPORT TRENDS IN 2022 AND PROJECTED GROWTH FOR 2023 COUNTRY WISE

TABLE 2 BOVINE IN VIVO-DERIVED (IVD) EMBRYO COLLECTION BY REGION AND COUNTRY

TABLE 3 TRANSFER OF BOVINE IN VIVO DERIVED (IVD) EMBRYOS BY REGION AND COUNTRY

TABLE 4 VALUE CHAIN ANALYSIS

TABLE 5 DETAILS OF SELECTED COMMUNITY-BASED BREEDING PROGRAMS

TABLE 6 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 7 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 10 NORTH AMERICA IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 NORTH AMERICA LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 12 NORTH AMERICA MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 14 NORTH AMERICA REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 NORTH AMERICA REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 NORTH AMERICA MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 17 NORTH AMERICA KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 NORTH AMERICA SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 19 NORTH AMERICA SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 TABLE 1 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2024-2031 (USD THOUSAND)

TABLE 21 NORTH AMERICA LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 22 NORTH AMERICA LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 NORTH AMERICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 24 NORTH AMERICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 25 NORTH AMERICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 26 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 27 NORTH AMERICA ARTIFICIAL INSEMINATION IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 28 NORTH AMERICA EMBRYO TRANSFER IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 29 NORTH AMERICA OVUM PICKUP IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 30 NORTH AMERICA IN VITRO MATURATION IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 TABLE 1 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2024-2031 (USD THOUSAND)

TABLE 32 NORTH AMERICA VETERINARY FERTILITY CLINICS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 NORTH AMERICA VETERINARY HOSPITALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 34 NORTH AMERICA SURGICAL CENTERS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 35 NORTH AMERICA RESEARCH LABORATORIES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 NORTH AMERICA CRYOBANKS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 37 NORTH AMERICA OTHERS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 38 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 39 NORTH AMERICA DIRECT TENDERS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 40 NORTH AMERICA RETAIL SALES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 41 NORTH AMERICA ONLINE SALES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 42 NORTH AMERICA OTHERS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 43 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 44 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 45 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 46 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 47 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 48 NORTH AMERICA IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 NORTH AMERICA LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 NORTH AMERICA MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 NORTH AMERICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 52 NORTH AMERICA REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 NORTH AMERICA MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 NORTH AMERICA KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 55 NORTH AMERICA SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 57 NORTH AMERICA LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 58 NORTH AMERICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 59 NORTH AMERICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 60 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 61 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 62 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 63 U.S. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 64 U.S. EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 U.S. EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 66 U.S. EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 67 U.S. IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 U.S. LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 U.S. MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 U.S. EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 71 U.S. REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 U.S. MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 U.S. KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 74 U.S. SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 75 U.S. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 76 U.S. LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 77 U.S. COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 78 U.S. COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 79 U.S. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 80 U.S. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 81 U.S. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 82 CANADA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 83 CANADA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 84 CANADA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 85 CANADA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 86 CANADA IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 CANADA LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 CANADA MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 CANADA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 90 CANADA REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 91 CANADA MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 CANADA KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 CANADA SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 CANADA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 95 CANADA LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 96 CANADA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 CANADA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 98 CANADA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 99 CANADA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 100 CANADA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 101 MEXICO VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 102 MEXICO EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 MEXICO EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 104 MEXICO EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 105 MEXICO IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 106 MEXICO LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 107 MEXICO MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 108 MEXICO EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 109 MEXICO REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 MEXICO MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 111 MEXICO KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 MEXICO SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 MEXICO VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 MEXICO LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 115 MEXICO COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 116 MEXICO COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 117 MEXICO VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 118 MEXICO VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 119 MEXICO VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 INCREASING LIVESTOCK PRODUCTION & BREEDING PROGRAMS IS DRIVING THE GROWTH OF THE NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET FROM 2024 TO 2031

FIGURE 15 THE PRODUCTS & SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET IN 2024 AND 2031

FIGURE 16 DROC ANALYSIS

FIGURE 17 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY PRODUCTS & SERVICES, 2023

FIGURE 18 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY PRODUCTS & SERVICES 2024-2031 (USD THOUSAND)

FIGURE 19 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY PRODUCTS & SERVICES, CAGR (2024-2031)

FIGURE 20 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY ANIMAL TYPE, 2023

FIGURE 22 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY ANIMAL TYPE 2024-2031 (USD THOUSAND)

FIGURE 23 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY ANIMAL TYPE, CAGR (2024-2031)

FIGURE 24 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY ANIMAL TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TECHNIQUE, 2023

FIGURE 26 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TECHNIQUE 2024-2031 (USD THOUSAND)

FIGURE 27 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TECHNIQUE, CAGR (2024-2031)

FIGURE 28 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TECHNIQUE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY END USER, 2023

FIGURE 30 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY END USER 2024-2031 (USD THOUSAND)

FIGURE 31 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY END USER, CAGR (2024-2031)

FIGURE 32 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 33 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 34 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY DISTRIBUTION CHANNEL 2024-2031 (USD THOUSAND)

FIGURE 35 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 36 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: SNAPSHOT (2023)

FIGURE 38 NORTH AMERICA VETERINARY IN VITRO FERTILIZATION MARKET: COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.