North America Walk In Refrigerators And Freezers Market

Market Size in USD Billion

CAGR :

%

USD

6.63 Billion

USD

10.18 Billion

2025

2033

USD

6.63 Billion

USD

10.18 Billion

2025

2033

| 2026 –2033 | |

| USD 6.63 Billion | |

| USD 10.18 Billion | |

|

|

|

|

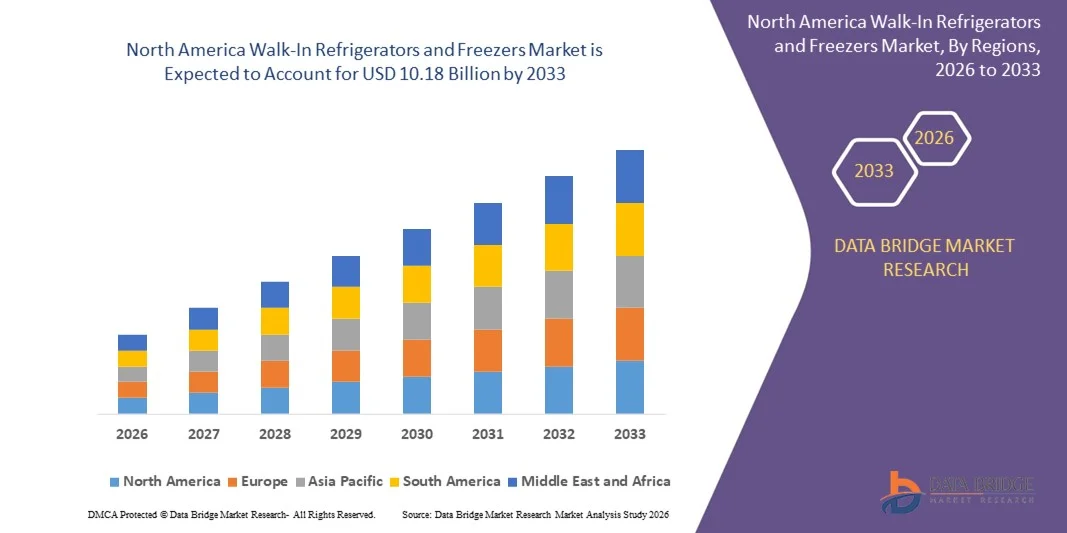

What is the North America Walk-In Refrigerators and Freezers Market Size and Growth Rate?

- The North America walk-in refrigerators and freezers market size was valued at USD 6.63 billion in 2025 and is expected to reach USD 10.18 billion by 2033, at a CAGR of 5.1% during the forecast period

- Technological advancements in compressor and cooling technologies are acting as a driver and boosting the demand for the North America walk-in refrigerators and freezers market

- The high energy consumption and large carbon footprint is hampering the demand for the North America walk-in refrigerators and freezers market

What are the Major Takeaways of Walk-In Refrigerators and Freezers Market?

- Urbanization and associated changes in consumer lifestyle are acting as an opportunity for the North America walk-in refrigerators and freezers market

- Stringent government regulation regarding the emission of CFCs is acting as a challenge for hampering the demand of the North America walk-in refrigerators and freezers market

- The U.S. dominated the North America walk-in refrigerators and freezers market with an 41.36% revenue share in 2025, driven by a strong food processing industry, high penetration of organized retail, widespread adoption of cold-chain infrastructure, and strict food safety and storage regulations across commercial, industrial, and healthcare facilities

- Canada is projected to register the fastest CAGR of 10.95% from 2026 to 2033 in the North America walk-in refrigerators and freezers market, driven by growth in frozen food consumption, expansion of grocery retail, and rising investments in modern cold storage infrastructure

- The Self-Contained segment dominated the market with an estimated 42.3% share in 2025, driven by easy installation, compact footprint, and suitability for small- to medium-sized commercial kitchens and retail outlets

Report Scope and Walk-In Refrigerators and Freezers Market Segmentation

|

Attributes |

Walk-In Refrigerators and Freezers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Walk-In Refrigerators and Freezers Market?

Rising Demand for Premium, Flavor-Enhanced, and Specialty Walk-In Refrigerators and Freezers

- The walk-in refrigerators and freezers market is witnessing growing adoption of premium, artisanal, and naturally flavored varieties, designed to offer authentic taste and gourmet experiences for consumers seeking high-quality dairy products

- Manufacturers are introducing specialty Walk-In Refrigerators and Freezers with clean-label ingredients, minimal additives, natural smoking processes, and unique regional flavor profiles to cater to evolving consumer preferences

- Rising interest in gourmet foods, artisanal cheese boards, and specialty culinary applications is accelerating the adoption of Walk-In Refrigerators and Freezers across retail, hospitality, and foodservice channels

- For instance, companies such as Arla Foods, Saputo, Sargento, Leprino Foods, and Dairygold are expanding their portfolios with smoked cheddar, gouda, mozzarella, and premium specialty blends

- Increasing popularity of restaurant-style home dining, cheese-based snacks, and premium retail offerings across the U.S., North America, and Asia-Pacific is driving market expansion

- As consumers prioritize bold flavors and premium experiences, Walk-In Refrigerators and Freezers remain a critical segment within the specialty cheese market

What are the Key Drivers of Walk-In Refrigerators and Freezers Market?

- Growing consumer preference for flavor-rich dairy products and premium cheese varieties is significantly driving walk-in refrigerators and freezers adoption

- For instance, during 2024–2025, companies such as Saputo, Arla Foods, and Sargento launched new SKUs and packaging formats tailored for retail, e-commerce, and foodservice segments

- Increasing demand for ready-to-eat meals, gourmet sandwiches, fusion cuisines, and cheese-based snacks is expanding the application of Walk-In Refrigerators and Freezers across households and commercial establishments

- Expansion of modern retail outlets, specialty cheese shops, and online grocery platforms enhances product accessibility and consumer reach

- Rising consumption in foodservice chains, quick-service restaurants, and casual dining establishments strengthens market growth

- Supported by higher disposable incomes, evolving taste preferences, and innovations in dairy processing, the Walk-In Refrigerators and Freezers market is projected to experience steady long-term growth

Which Factor is Challenging the Growth of the Walk-In Refrigerators and Freezers Market?

- Elevated production costs associated with natural smoking, premium milk sourcing, and extended maturation periods limit competitive pricing for walk-in refrigerators and freezers

- During 2024–2025, volatility in raw milk prices, energy, and logistics increased operational expenses for global manufacturers

- Shorter shelf life and strict cold-chain storage requirements restrict distribution, particularly in emerging markets

- Limited consumer awareness in developing regions regarding specialty Walk-In Refrigerators and Freezers slows adoption

- Competition from processed cheese, flavored spreads, and plant-based alternatives creates price and shelf-space pressure

- To address these challenges, companies are focusing on process optimization, innovative packaging solutions, expanded distribution networks, and consumer education to accelerate global adoption of Walk-In Refrigerators and Freezers

How is the Walk-In Refrigerators and Freezers Market Segmented?

The market is segmented on the basis of type, system type, door type, technology, curtain type, distribution channel, and end-user.

- By Type

On the basis of type, the walk-in refrigerators and freezers market is segmented into Self-Contained, Remote Condensing, Multiplex Condensing, and Others. The Self-Contained segment dominated the market with an estimated 42.3% share in 2025, driven by easy installation, compact footprint, and suitability for small- to medium-sized commercial kitchens and retail outlets. Self-contained units offer integrated compressors, simplified maintenance, and lower upfront costs, making them popular among cafés, restaurants, and convenience stores.

The Multiplex Condensing segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing deployment in large supermarkets, hotels, and industrial cold storage facilities. Multiplex systems provide scalability, energy efficiency, and centralized management capabilities, allowing operators to manage multiple refrigeration units simultaneously, driving adoption in high-capacity commercial environments.

- By System Type

On the basis of system type, the market is segmented into Remote Systems, Pre-Assembled Remote Systems, Standard Top-Mount, Side-Mount Refrigeration System, Saddle Mount, Penthouse, Roll Up, and Others. The Remote Systems segment dominated with a 38.7% share in 2025, driven by superior cooling efficiency, flexibility in placement, and suitability for high-capacity walk-in units.

Pre-Assembled Remote Systems are projected to grow at the fastest CAGR from 2026 to 2033, supported by faster installation, lower labor costs, and minimal on-site assembly requirements. Increasing adoption in chain supermarkets, commercial kitchens, and foodservice facilities accelerates growth in pre-assembled solutions.

- By Door Type

Based on door type, the market is segmented into Single Door, Double Door, Triple Door, and Others. The Double Door segment dominated with a 44.1% share in 2025, offering improved accessibility, energy efficiency, and compatibility with high-traffic commercial kitchens.

The Triple Door segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by demand from large restaurants, hotels, and cold storage operators requiring multiple compartments for simultaneous access and efficient inventory management.

- By Technology

On the basis of technology, the market is segmented into Manual, Semi-Automatic, and Fully Automatic Walk-In Refrigerators and Freezers. The Semi-Automatic segment dominated with a 47.5% share in 2025, providing a balance between operational control, reliability, and energy efficiency.

Fully Automatic systems are projected to grow at the fastest CAGR from 2026 to 2033, supported by rising adoption of IoT-enabled refrigeration, smart monitoring, and automated temperature control across commercial and industrial facilities.

- By Curtain Type

The market is segmented into Strip Curtains and Air Curtains. The Strip Curtains segment held the largest market share of 63.2% in 2025, driven by ease of installation, energy savings, and prevention of cold air loss in walk-in units.

The Air Curtains segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by demand in premium retail, foodservice chains, and industrial cold storage facilities requiring advanced airflow management and hygiene compliance.

- By Distribution Channel

On the basis of distribution, the market is segmented into Direct Sales/B2B, E-Commerce, Specialty Stores, and Others. The Direct Sales/B2B channel dominated with a 52.8% share in 2025, fueled by bulk orders from supermarkets, hotels, and commercial kitchens.

E-Commerce is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing online procurement by small restaurants, specialty retailers, and home-based businesses seeking convenient ordering and doorstep delivery.

- By End-User

Based on end-user, the market is segmented into Commercial, Residential, and Others. The Commercial segment dominated with a 58.4% share in 2025, supported by extensive use in restaurants, cafés, hotels, and industrial cold storage.

The Residential segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising adoption of home-based gourmet cooking, premium kitchen setups, and expanding demand for large-format residential refrigeration in urban households.

Which Region Holds the Largest Share of the Walk-In Refrigerators and Freezers Market?

- The U.S. dominated the North America walk-in refrigerators and freezers market with an 41.36% revenue share in 2025, driven by a strong food processing industry, high penetration of organized retail, widespread adoption of cold-chain infrastructure, and strict food safety and storage regulations across commercial, industrial, and healthcare facilities

- Rising demand from supermarkets, hypermarkets, foodservice chains, pharmaceutical storage providers, and large-scale cold warehouses is significantly boosting adoption of energy-efficient, high-capacity walk-in refrigeration and freezing systems across the region

- Strong domestic manufacturing capabilities, continuous technological advancements, early adoption of smart refrigeration systems, and sustained investments by global and regional manufacturers continue to reinforce North America’s leadership in the walk-in refrigerators and freezers market

Canada Walk-In Refrigerators and Freezers Market Insight

Canada is projected to register the fastest CAGR of 10.95% from 2026 to 2033 in the North America walk-in refrigerators and freezers market, driven by growth in frozen food consumption, expansion of grocery retail, and rising investments in modern cold storage infrastructure. Adoption of eco-friendly refrigerants, compliance with sustainability regulations, and increasing demand from foodservice and pharmaceutical sectors continue to accelerate market expansion.

Which are the Top Companies in Walk-In Refrigerators and Freezers Market?

The walk-in refrigerators and freezers industry is primarily led by well-established companies, including:

- Lancer Worldwide (U.S.)

- Haier Inc. (China)

- Foster Refrigerator (U.K.)

- BSH Hausgeräte GmbH (Germany)

- AB Electrolux (Sweden)

- Precision Refrigeration Ltd (U.K.)

- Hussmann Corporation (Panasonic) (U.S.)

- Danfoss A/S (Denmark)

- Kolpak (Welbilt, Inc.) (U.S.)

- Master-Bilt (U.S.)

- Norlake, Inc. (U.S.)

- Amerikooler LLC (U.S.)

- Imperial Brown (U.S.)

- Thermo-Kool (U.S.)

- Bally Refrigerated Boxes, Inc. (U.S.)

- USA Cooler (U.S.)

What are the Recent Developments in Global Walk-In Refrigerators and Freezers Market?

- In August 2025, Everidge introduced its Cool on the Move mobile cold storage line, offering units in 6x8, 6x12, and 6x16 foot configurations that function as both coolers and freezers and operate using standard 120V outlets or generators. Designed for sectors such as catering, healthcare, and emergency services, these units enable reliable cold storage during transportation and on-site operations. This launch highlights the growing demand for flexible and mobile cold storage solutions across multiple industries

- In June 2025, Amerikooler launched the AK Series 3 Quick Ship Walk-In, a walk-in cooler engineered for rapid delivery and installation while maintaining high energy efficiency. Equipped with R-29 compressor-grade AK-XPS insulation, a durable steel floor pan, and an integrated digital monitoring system, the solution targets customers requiring fast deployment without compromising performance. This development underscores the market’s focus on speed, efficiency, and operational reliability

- In November 2024, KPS Global unveiled DEFENDOOR, an advanced protection system designed to enhance door durability and reduce maintenance costs for walk-in coolers and freezers in high-traffic environments. By minimizing door damage and extending product lifespan, the system supports retail and foodservice operators seeking long-term cost efficiency. This innovation reflects increasing emphasis on durability and lifecycle value in cold storage infrastructure

- In January 2024, Hussmann, a Panasonic company, launched Evolve Technologies to support low Global Warming Potential refrigeration solutions using sustainable refrigerants such as R-744 (CO₂) and R-290 (propane). The initiative addresses regulatory pressures and environmental concerns while improving refrigeration sustainability. This launch demonstrates the industry’s shift toward eco-friendly and future-ready refrigeration technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.