North America Warehouse Management System Market

Market Size in USD Billion

CAGR :

%

USD

1.24 Billion

USD

4.03 Billion

2024

2032

USD

1.24 Billion

USD

4.03 Billion

2024

2032

| 2025 –2032 | |

| USD 1.24 Billion | |

| USD 4.03 Billion | |

|

|

|

|

North America Warehouse Management System Market Size

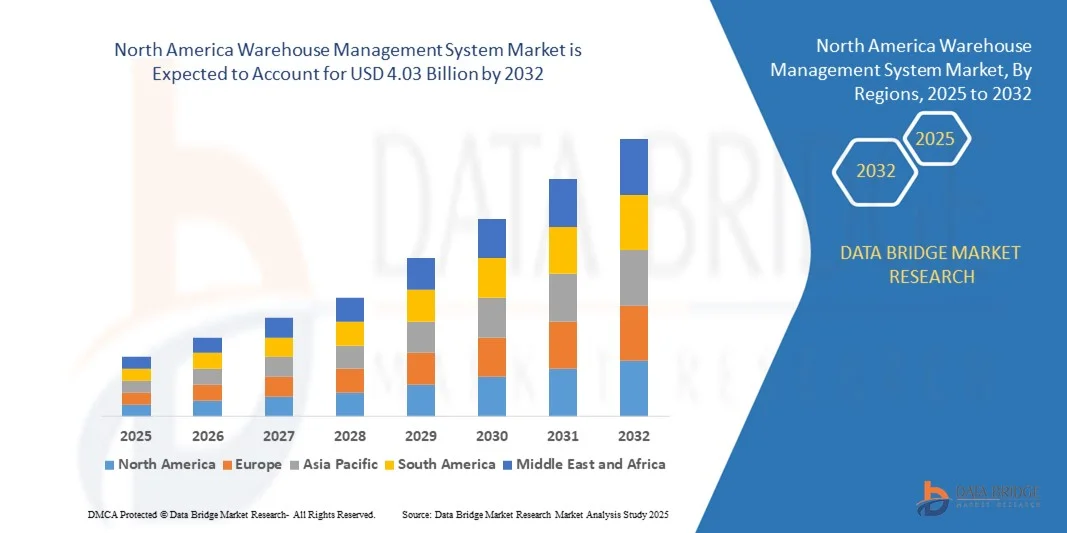

- The North America warehouse management system market size was valued at USD 1.24 billion in 2024 and is projected to reach USD 4.03 billion by 2032, growing at a CAGR of 15.90% during the forecast period

- Market growth is primarily driven by the rapid expansion of e-commerce, omnichannel distribution, and increasing demand for real-time inventory visibility and efficient supply chain operations

- Additionally, advancements in cloud-based WMS solutions and the integration of automation and robotics in warehouses are enhancing operational efficiency, thereby accelerating the adoption of WMS across various industries and propelling market expansion

North America Warehouse Management System Market Analysis

- Warehouse Management Systems (WMS), offering software solutions to optimize warehouse operations such as inventory tracking, order fulfillment, and labor management, are becoming essential in modern supply chains across both retail and industrial sectors due to their ability to improve accuracy, efficiency, and real-time data visibility

- The surging demand for WMS is primarily driven by the exponential growth of e-commerce, increasing consumer expectations for faster deliveries, and the need for scalable and automated warehouse solutions

- U.S. dominated the warehouse management system market with the largest revenue share of 35% in 2024, supported by the region’s advanced logistics infrastructure, early technology adoption, and strong presence of major e-commerce players; the U.S. led this growth, fueled by investments in warehouse automation, robotics, and AI-driven logistics technologies

- Canada is expected to be the fastest-growing region in the warehouse management system market during the forecast period, driven by rapid industrialization, booming online retail, and rising demand for modernized logistics capabilities

- The software segment dominated the market with the largest revenue share of 64.7% in 2024, driven by increasing reliance on cloud-based and on-premise WMS platforms for real-time visibility, order fulfillment, and automation

Report Scope and North America Warehouse Management System Market Segmentation

|

Attributes |

Warehouse Management System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Warehouse Management System Market Trends

Enhanced Efficiency Through AI, Automation, and Voice Technologies

- A significant and accelerating trend in the North America Warehouse Management System (WMS) Market is the deep integration of artificial intelligence (AI), automation, and emerging voice-directed warehouse technologies. These innovations are transforming warehouse operations by enhancing real-time decision-making, streamlining workflows, and improving labor productivity across logistics and fulfillment centers.

- For Instance, WMS platforms integrated with AI-powered analytics can forecast demand, optimize inventory placement, and reduce picking errors. Companies like Manhattan Associates and Blue Yonder offer AI-driven WMS modules that support dynamic slotting, labor forecasting, and predictive analytics to improve operational agility.

- Voice-directed warehousing solutions, such as those powered by Honeywell Voice or Lucas Systems, enable warehouse staff to receive picking and packing instructions via headsets, allowing for hands-free, eyes-up operation. This not only increases picking speed and accuracy but also enhances worker safety and mobility in fast-paced environments.

- AI capabilities in WMS can also learn from historical data to suggest optimal labor allocation, detect anomalies in warehouse operations, and automate repetitive tasks. For instance, some advanced WMS platforms now leverage machine learning to improve order batching and route optimization over time.

- The integration of voice and AI technologies into WMS platforms provides centralized control over complex warehouse functions—from inventory management to shipping—through intuitive, user-friendly interfaces and real-time dashboards. This unified control system ensures seamless coordination between human workers, robotics, and inventory data.

- As supply chains become more complex and demand more responsive, the adoption of intelligent WMS solutions that incorporate automation, AI, and voice control is rapidly increasing across North America. Organizations are prioritizing these technologies to meet rising consumer expectations, reduce operational costs, and remain competitive in a digitally driven logistics landscape.

North America Warehouse Management System Market Dynamics

Driver

Growing Need Due to Increasing Warehouse Automation and E-commerce Expansion

- The rising demand for efficient inventory management and the surge in e-commerce activities across North America are key drivers fueling the adoption of warehouse management systems (WMS). Businesses are increasingly focusing on optimizing warehouse operations to improve accuracy, reduce costs, and meet customer expectations for faster deliveries.

- For instance, in 2025, Manhattan Associates announced the launch of an AI-powered WMS module designed to enhance real-time inventory visibility and predictive analytics. Such innovations by leading WMS providers are expected to significantly contribute to market growth during the forecast period.

- As warehouses evolve into highly automated environments, WMS solutions offer critical functionalities such as real-time tracking, automated picking, and seamless integration with robotics and IoT devices, providing substantial improvements over traditional warehouse management methods.

- Additionally, the expanding popularity of omnichannel retailing and just-in-time delivery models is driving warehouses to adopt advanced WMS platforms that enable synchronized inventory flow across multiple channels and locations.

- The ability to streamline operations through centralized control, reduce human error, and gain actionable insights via data analytics are key factors propelling WMS adoption in both large-scale distribution centers and smaller warehouses. Furthermore, growing investment in cloud-based WMS solutions and mobile accessibility is encouraging adoption by mid-sized and small enterprises, supporting overall market expansion.

Restraint/Challenge

Concerns Regarding Implementation Complexity and High Upfront Costs

- The complexity of deploying and integrating WMS solutions with existing enterprise systems, such as ERP and transportation management systems (TMS), presents a significant challenge that may slow down market penetration. Warehouses often face operational disruptions during system implementation, which can deter potential adopters.

- For instance, reports of implementation delays and integration issues in large retail warehouses have caused some businesses to hesitate before committing to full-scale WMS adoption.

- To address these concerns, vendors such as SAP and Oracle emphasize scalable, modular solutions and offer professional services to streamline deployments and minimize disruptions. However, the high initial investment required for advanced WMS technologies—including software licenses, hardware, and training—can be a barrier for cost-sensitive companies, especially small to medium-sized enterprises (SMEs).

- Although cloud-based WMS models reduce capital expenditure by offering subscription-based pricing, the perceived cost and complexity remain a restraint for some potential users.

- Overcoming these challenges through improved user-friendly interfaces, standardized integration frameworks, and flexible pricing models will be crucial for accelerating WMS adoption and supporting long-term growth in the North American market.

North America Warehouse Management System Market Scope

The market is segmented on the basis of component, Deployment mode, tier type, function, and end use.

- By Component

On the basis of component, the North America warehouse management system market is segmented into software and services. The software segment dominated the market with the largest revenue share of 64.7% in 2024, driven by increasing reliance on cloud-based and on-premise WMS platforms for real-time visibility, order fulfillment, and automation. These systems integrate seamlessly with ERP, TMS, and supply chain platforms, enabling improved productivity and inventory accuracy across warehouses. As industries digitize operations, the demand for scalable and configurable software solutions continues to grow.

The services segment is projected to witness the fastest CAGR from 2025 to 2032, propelled by increasing investments in consulting, implementation, integration, and support. Businesses adopting WMS often require professional services for system configuration, staff training, and ongoing optimization. The growing trend of outsourcing warehouse operations and the complexity of modern logistics networks also contribute to the rising demand for managed services in the North American market.

- By Deployment Mode

On the basis of deployment mode, the North America WMS market is segmented into cloud and on premise. The cloud segment accounted for the largest revenue share of 70.1% in 2024, owing to its flexibility, scalability, and lower upfront infrastructure costs. Cloud-based WMS solutions are widely adopted by small and medium enterprises (SMEs) and 3PL providers, offering real-time visibility, remote accessibility, and seamless updates. Integration with IoT devices and AI analytics further enhances decision-making and warehouse efficiency, driving cloud adoption across industries.

The on-premise segment is expected to witness the fastest CAGR from 2025 to 2032, particularly among large enterprises and sectors like defense, pharmaceuticals, and automotive, where data control, customization, and regulatory compliance are critical. On-premise deployments offer more robust security and the ability to tailor solutions to complex workflows, making them ideal for legacy systems or high-security operations where internet connectivity may be limited or restricted.

- By Tier Type

On the basis of tier type, the North America WMS market is segmented into advanced, intermediate, and basic. The advanced segment led the market with the largest revenue share of 47.6% in 2024, driven by the demand for AI-powered automation, machine learning integration, robotics, and predictive analytics in warehouse operations. These systems cater to enterprises and large 3PLs seeking real-time optimization, dynamic slotting, and multi-site management, especially in e-commerce and manufacturing.

The intermediate segment is projected to witness the fastest CAGR from 2025 to 2032, as it balances robust functionality with affordability. Intermediate WMS offerings provide essential features like order management, barcode scanning, and inventory tracking, making them attractive to medium-sized businesses and regional warehouses. With cloud deployment and modular options, intermediate systems are increasingly chosen by growing organizations upgrading from legacy software or manual processes to enhance operational efficiency without heavy investment.

- By Function

On the basis of function, the North America WMS market is segmented into labour management system, analytics and optimization, billing management, inventory control, and yard/dock management. The inventory control segment dominated the market with a revenue share of 34.9% in 2024, as accurate stock management is the foundation of warehouse operations. Real-time inventory tracking helps reduce stockouts, streamline picking processes, and increase order accuracy, benefiting sectors such as retail, e-commerce, and manufacturing.

The analytics and optimization segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing need for data-driven decision-making in logistics. Companies are leveraging WMS analytics to monitor KPIs, forecast demand, optimize routes, and reduce operational costs. As warehouses become more automated, the integration of AI and machine learning for predictive analytics and workflow optimization is pushing this segment into rapid growth across North America.

- By End Use

On the basis of end use, the North America WMS market is segmented into 3PL, automotive, manufacturing, food & beverages, healthcare, e-commerce, chemicals, electricals & electronics, metals & machinery, and others. The e-commerce segment held the largest market revenue share of 19.8% in 2024, driven by rising online shopping and the demand for real-time fulfillment, inventory accuracy, and last-mile delivery optimization. E-commerce players heavily invest in warehouse automation, robotics, and scalable WMS platforms to manage peak season surges and rapid order cycles.

The healthcare segment is projected to record the fastest CAGR from 2025 to 2032, due to strict regulatory compliance, cold chain logistics, and the critical nature of medical supplies. Hospitals, pharmaceutical companies, and distributors rely on WMS for traceability, expiry tracking, and secure storage. The COVID-19 pandemic and subsequent emphasis on resilient healthcare supply chains have further accelerated WMS adoption in this sector across North America.

North America Warehouse Management System Market Regional Analysis

- U.S. dominated the warehouse management system (WMS) market with the largest revenue share of 35% in 2024, driven by the rapid adoption of automation technologies and increasing demand for efficient supply chain management across industries.

- Businesses in the region prioritize operational efficiency, real-time inventory visibility, and labor optimization, which are critical factors fueling the adoption of advanced WMS solutions.

- This widespread adoption is supported by well-established logistics infrastructure, high investment in digital transformation, and the presence of key market players focused on innovation. Additionally, increasing e-commerce penetration and the rise of omnichannel retailing further accelerate the demand for sophisticated warehouse management systems in both manufacturing and distribution sectors.

Canada Warehouse Management System Market Insight

The Canada warehouse management system market held a significant share of approximately 18% within North America in 2024, driven by increasing investments in logistics infrastructure and digital transformation across key industries such as retail, manufacturing, and e-commerce. The demand for enhanced supply chain visibility and real-time inventory management is propelling the adoption of WMS solutions. Additionally, Canadian companies are focusing on improving operational efficiency and compliance with stringent safety and regulatory standards. The country’s growing e-commerce sector and rising consumer expectations for faster delivery are further encouraging warehouse automation and integration of cloud-based WMS platforms, which offer scalability and flexibility. Government initiatives supporting smart logistics and Industry 4.0 adoption also play a crucial role in market expansion.

Mexico Warehouse Management System Market Insight

The Mexico warehouse management system market is anticipated to grow at a robust CAGR over the forecast period, fueled by the country’s expanding manufacturing base and increasing participation in global supply chains. The growing automotive, electronics, and consumer goods industries in Mexico demand efficient warehouse operations and inventory control, driving WMS adoption. Moreover, Mexico’s strategic geographic position as a trade hub with the U.S. and Canada facilitates investments in logistics modernization. Cost-effective labor and the rising trend of nearshoring are also key factors encouraging the implementation of advanced WMS solutions. Cloud-based deployments are gaining traction due to lower upfront costs and ease of scalability, making WMS accessible for small and medium enterprises in Mexico’s logistics and distribution sectors.

North America Warehouse Management System Market Share

The Warehouse Management System industry is primarily led by well-established companies, including:

- Manhattan Associates (U.S.)

- Blue Yonder Group, Inc. (U.S.)

- Oracle (U.S.)

- IBM (U.S.)

- SAP SE (Germany)

- ACL Digital (U.S.)

- Broadcom (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Hewlett Packard Enterprise Development LP (U.S.)

- Softeon (U.S.)

- Telco Systems (U.S.)

- NEC Corporation (Japan)

- Juniper Networks Inc. (U.S.)

- Infor (U.S.)

- Versa Networks Inc. (U.S.)

- Cisco Systems Inc. (U.S.)

What are the Recent Developments in North America Warehouse Management System Market?

- In April 2023, Manhattan Associates, a global leader in supply chain and warehouse management solutions, launched a next-generation WMS platform designed to optimize labor management and inventory accuracy for North American distribution centers. This strategic initiative emphasizes Manhattan Associates’ commitment to enhancing warehouse efficiency through AI-driven analytics and real-time visibility, addressing evolving industry demands for speed and flexibility.

- In March 2023, Blue Yonder, a key player in supply chain software, introduced its enhanced cloud-based warehouse management system tailored for the retail and e-commerce sectors. The new platform integrates machine learning capabilities to improve demand forecasting and automate replenishment processes, enabling warehouses to meet increasing consumer expectations for rapid order fulfillment.

- In March 2023, Oracle successfully deployed its Oracle Warehouse Management Cloud (WMS) for a major logistics provider in Canada, enabling seamless integration of warehouse operations with transportation and inventory systems. This deployment highlights Oracle’s focus on delivering scalable, cloud-native solutions to optimize operational workflows and reduce costs across complex supply chains.

- In February 2023, HighJump (now part of Körber Supply Chain) announced a strategic partnership with a leading North American third-party logistics (3PL) provider to implement its modular WMS solution. The collaboration aims to enhance warehouse automation, improve labor utilization, and streamline order management, reinforcing HighJump’s position as a trusted partner in warehouse digital transformation.

- In January 2023, JDA Software (now Blue Yonder) unveiled its updated warehouse labor management module at the ProMat Supply Chain event. The solution offers advanced analytics and real-time worker productivity tracking to boost warehouse throughput and reduce operational costs. This launch reflects Blue Yonder’s ongoing dedication to integrating cutting-edge technology into WMS offerings to drive efficiency and profitability for warehouse operators.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.