North America Waterproofing Membranes Market

Market Size in USD Billion

CAGR :

%

USD

10.83 Billion

USD

15.51 Billion

2025

2033

USD

10.83 Billion

USD

15.51 Billion

2025

2033

| 2026 –2033 | |

| USD 10.83 Billion | |

| USD 15.51 Billion | |

|

|

|

|

What is the North America Waterproofing Membranes Market Size and Growth Rate?

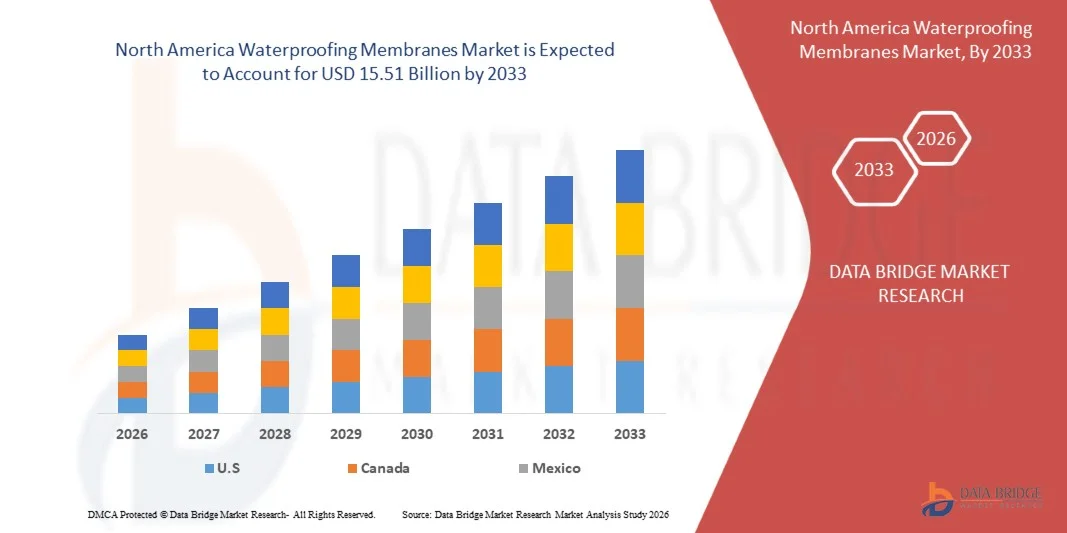

- The North America waterproofing membranes market size was valued at USD 10.83 billion in 2025 and is expected to reach USD 15.51 billion by 2033, at a CAGR of 4.6% during the forecast period

- Increasing construction and infrastructure activities, including commercial, residential, and industrial projects, are driving the demand for waterproofing membranes to protect structures from water ingress, moisture, and environmental degradation, thereby supporting market growth

- The high initial cost of premium membranes and installation, coupled with the need for skilled labor and specialized machinery, increases the overall project expenditure, which can limit adoption in small-scale or cost-sensitive projects

What are the Major Takeaways of Waterproofing Membranes Market?

- Advancements in waterproofing technologies, such as self-adhesive membranes, liquid-applied solutions, and high-performance synthetic sheets, are improving durability and ease of installation, presenting significant growth opportunities for market players

- Challenges such as leakage issues, improper installation, and maintenance requirements continue to impact cost efficiency and performance, posing key obstacles for widespread adoption of waterproofing membranes in North America

- U.S. dominated the North America waterproofing membranes market with a 36.2% revenue share in 2025, supported by widespread adoption of high-performance waterproofing solutions in commercial, residential, and infrastructure projects

- Canada is projected to register the fastest CAGR of 9.9% from 2026 to 2033, fueled by the adoption of advanced membrane technologies in commercial, residential, and civil construction projects

- The Sheet-Based Membranes segment dominated the market with a 45.6% revenue share in 2025, driven by ease of installation, consistent thickness, high tensile strength, and suitability for large-scale commercial and residential projects

Report Scope and Waterproofing Membranes Market Segmentation

|

Attributes |

Waterproofing Membranes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Waterproofing Membranes Market?

“Rising Demand for Sustainable and High-Performance Waterproofing Membrane”

- The waterproofing membranes market is witnessing a key trend of increasing adoption of eco-friendly, durable, and technologically advanced membrane solutions. This trend is driven by growing awareness of sustainable construction practices, energy efficiency, and environmental compliance, especially across North America

- For instance, companies such as Sika AG and GAF are developing high-performance membranes with enhanced UV resistance, longevity, and eco-friendly formulations to meet stringent building standards

- Rising demand for membranes that improve waterproofing efficiency, structural protection, and durability is accelerating adoption

- Manufacturers are integrating advanced polymer blends, self-adhesive technologies, and lightweight composite layers into waterproofing membranes to enhance performance and installation efficiency

- Increasing R&D in flexible materials, high-tensile components, and sustainable coatings is fostering innovation

- As builders and developers prioritize long-lasting, eco-friendly, and high-performance solutions, modern waterproofing membranes are expected to remain central to construction and infrastructure development

What are the Key Drivers of Waterproofing Membranes Market?

- Rising emphasis on sustainable construction, green building certifications, and compliance with environmental regulations is a major growth driver

- For instance, in 2025, GAF and SOPREMA S.A.S. launched eco-certified, high-durability membranes designed to reduce maintenance costs and environmental impact

- Growing demand for high-performance, multi-layer membranes is driving adoption in commercial, residential, and infrastructure projects

- Technological advancements in polymer formulation, self-sealing technology, and UV-resistant coatings are enabling manufacturers to produce more reliable and durable membranes

- Increased integration of membranes with easy-install systems, enhanced adhesion, and predictive performance analytics further supports market expansion

- With continued investment in R&D, sustainable materials, and high-performance formulations, the waterproofing membranes market is expected to maintain strong growth momentum in the coming years

Which Factor is Challenging the Growth of the Waterproofing Membranes Market?

- High initial investment for premium waterproofing membranes limits adoption, especially in small-scale and cost-sensitive projects

- For instance, during 2024–2025, fluctuations in raw material costs, polymer additives, and advanced coating components affected production and pricing for leading players

- Regulatory compliance for building codes, environmental certifications, and safety standards increases operational complexity and costs

- Limited awareness of advanced membrane technologies among contractors and builders hinders widespread adoption

- Competition from low-cost membranes, traditional bitumen sheets, and local substitutes creates pricing pressure and affects market penetration

- To address these challenges, manufacturers are focusing on cost-efficient production, installer training programs, eco-certified products, and innovative financing solutions to deliver high-quality, sustainable waterproofing membranes

How is the Waterproofing Membranes Market Segmented?

The market is segmented on the basis of type, raw material, grade, and application.

- By Type

On the basis of type, the Waterproofing Membranes market is segmented into Applied Membranes, Sheet-Based Membranes, Built-Up or Laminate Membranes, and Injectable Waterproofing. The Sheet-Based Membranes segment dominated the market with a 45.6% revenue share in 2025, driven by ease of installation, consistent thickness, high tensile strength, and suitability for large-scale commercial and residential projects.

Injectable Waterproofing is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing adoption in retrofit projects, leak repairs, and structural strengthening applications. Continuous innovation in flexible sheets, liquid-applied coatings, and self-adhesive systems further supports market expansion. Sheet-based solutions remain preferred due to durability, cost-effectiveness, and broad applicability in roofing, walls, and below-grade structures.

- By Raw Material

Based on raw material, the market is segmented into Modified Bitumen, PVC, EPDM, TPO, HDPE, LDPE, and Others. The Modified Bitumen segment dominated with 41.2% revenue share in 2025, owing to high thermal resistance, water impermeability, and widespread adoption in roofing and civil infrastructure.

TPO membranes are projected to grow at the fastest CAGR from 2026 to 2033, driven by environmental compliance, UV stability, ease of installation, and increasing preference for sustainable, single-ply roofing solutions. Manufacturers are focusing on lightweight, durable, and recyclable materials to meet performance standards and regulatory norms, supporting wider adoption across commercial and industrial applications.

- By Grade

On the basis of grade, the market is segmented into Grade-1, Grade-2, and Grade-3. The Grade-1 segment dominated with 47.5% revenue share in 2025, due to superior tensile strength, chemical resistance, and long service life, making it ideal for high-end commercial and industrial projects.

Grade-2 membranes are projected to grow at the fastest CAGR from 2026 to 2033, as mid-tier construction projects adopt cost-effective solutions with moderate durability and ease of installation. Rising focus on high-quality, certified membranes in urban construction and infrastructure is boosting adoption of Grade-1 solutions, while increasing mid-scale developments drive growth in Grade-2.

- By Application

Based on application, the market is segmented into Roofing & Walls, Building Structures, Waste & Water Management, Mining Applications, Tunnel Liners, Bridges & Highways, and Others. The Roofing & Walls segment dominated the market with a 52.3% revenue share in 2025, fueled by extensive urban construction, high-rise buildings, and demand for leak-proof, weather-resistant solutions.

Tunnel Liners are projected to grow at the fastest CAGR from 2026 to 2033, driven by infrastructure projects, subway expansion, and underground water management initiatives requiring durable, high-performance membranes. Advancements in high-strength, multi-layer membranes and adoption of sustainable installation practices are boosting overall market growth across all applications.

Which Region Holds the Largest Share of the Waterproofing Membranes Market?

- U.S. dominated the North America waterproofing membranes market with a 36.2% revenue share in 2025, supported by widespread adoption of high-performance waterproofing solutions in commercial, residential, and infrastructure projects. Advanced roofing systems, building envelopes, and industrial applications drive the demand for durable, energy-efficient, and sustainable membranes

- Government incentives for green building certifications, sustainable construction practices, and R&D investments contribute to regional leadership. Key players leverage innovations in self-adhesive sheets, liquid-applied membranes, and eco-friendly formulations to enhance installation efficiency and long-term performance

- Rising urbanization, infrastructure development, and industrial expansion, coupled with increasing adoption of multi-layer and high-performance membranes, further accelerate market growth across the country

Canada Waterproofing Membranes Market Insight

Canada is projected to register the fastest CAGR of 9.9% from 2026 to 2033, fueled by the adoption of advanced membrane technologies in commercial, residential, and civil construction projects. Developers increasingly deploy eco-friendly, durable, and weather-resistant waterproofing solutions to meet regulatory standards and environmental guidelines. Expansion of urban infrastructure, green building initiatives, and industrial projects drives sustained market growth in the country.

Which are the Top Companies in Waterproofing Membranes Market?

The waterproofing membranes industry is primarily led by well-established companies, including:

- SOPREMA S.A.S. (France)

- SOLMAX (Canada)

- RENOLIT SE (Germany)

- Flex Membranes International Corp. (U.S.)

- GAF (U.S.)

- LATICRETE International, Inc. (U.S.)

- GCP Applied Technologies Inc. (U.S.)

- Carlisle Construction Materials (A Subsidiary of Carlisle Companies, Inc.) (U.S.)

- Sika AG (Switzerland)

- Firestone Building Products (A Subsidiary of Bridgestone Americas, Inc.) (U.S.)

- KEMPER SYSTEM AMERICA Inc. (U.S.)

- DuPont (U.S.)

- CanSeal Protective Coatings (U.S.)

- Wacker Chemie AG (Germany)

- Johns Manville (U.S.)

What are the Recent Developments in North America Waterproofing Membranes Market?

- In March 2024, Mapei opened a new plant in Cantanhede, Portugal, with an investment of USD 13.89 million, featuring cutting-edge technology to expand production capacity, diversify the product range, and serve local customers. The facility also includes the Mapei Academy, offering free training events for retailers, designers, installers, and companies, strengthening market presence and expertise

- In March 2023, CertainTeed and GCP, part of the Saint-Gobain Group, launched a new integrated commercial waterproofing system that protects all six sides of a building, enhancing durability and reducing maintenance requirements, thereby providing a comprehensive solution for construction projects

- In August 2021, Tremco Incorporated introduced the S5 Spray Applied Hybrid Polyurea System, a 100% solid, flexible, two-component spray-applied waterproofing and coating solution suitable for concrete, metal, plastics, and other substrates with appropriate primers, enabling versatile and high-performance protection for multiple applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Waterproofing Membranes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Waterproofing Membranes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Waterproofing Membranes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.