North America Wax Emulsion Market

Market Size in USD Million

CAGR :

%

USD

714.04 Million

USD

869.99 Million

2024

2032

USD

714.04 Million

USD

869.99 Million

2024

2032

| 2025 –2032 | |

| USD 714.04 Million | |

| USD 869.99 Million | |

|

|

|

|

North America Wax Emulsion Market Size

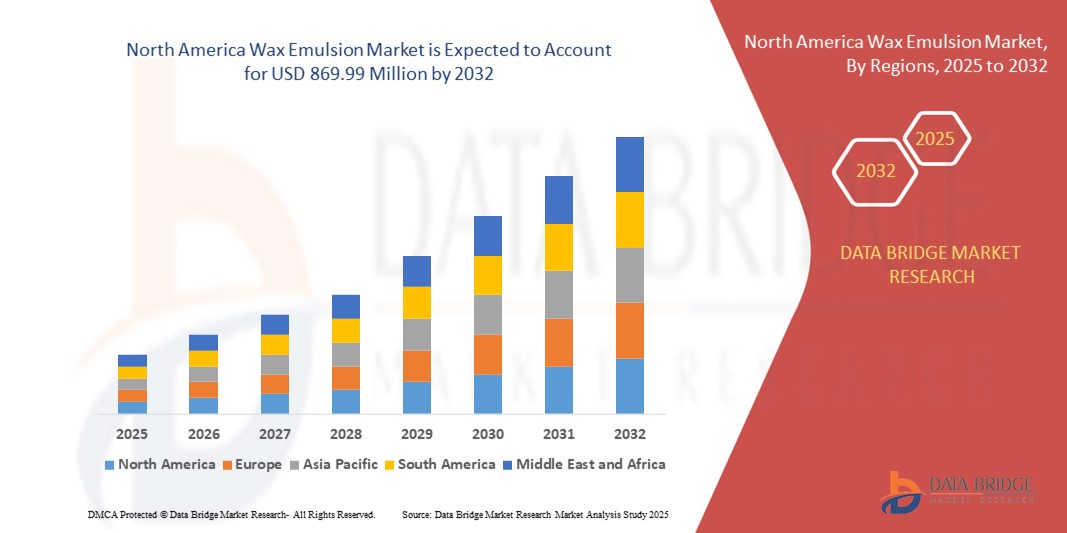

- The North America wax emulsion market size was valued at USD 714.04 million in 2024 and is expected to reach USD 869.99 million by 2032, at a CAGR of 2.50% during the forecast period

- The market growth is largely fuelled by the rising demand for sustainable, water-based coatings and formulations across industries such as paints, packaging, textiles, and adhesives, as manufacturers shift toward eco-friendly alternatives over solvent-based systems

- Increasing use of wax emulsions in construction chemicals, coupled with advancements in emulsion technology offering enhanced durability, gloss, and water resistance, is further boosting product adoption across multiple end-use sectors

North America Wax Emulsion Market Analysis

- The North America wax emulsion market is witnessing steady growth driven by rising applications in industrial coatings, wood finishing, and paper packaging, as industries increasingly prioritize performance efficiency and sustainability

- Continuous R&D investments and technological advancements in emulsion polymerization processes are enabling the development of customized wax emulsion products tailored to specific industrial requirements, enhancing market competitiveness and product performance

- U.S. captured the largest revenue share in 2024 within North America, driven by the rapid adoption of sustainable materials across packaging, construction, and woodworking applications

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America wax emulsion market due to increasing demand for eco-friendly and food-grade packaging solutions, rising investments in construction and automotive sectors, and growing adoption of sustainable wax emulsions across cosmetics, coatings, and industrial applications

- The Synthetic Base Wax Emulsion segment accounted for the largest market revenue share in 2024, driven by its cost-effectiveness, consistent quality, and widespread applications in paints, coatings, and packaging materials. Its durability and water-repellent properties make it a preferred choice for industrial-scale production

Report Scope and North America Wax Emulsion Market Segmentation

|

Attributes |

North America Wax Emulsion Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Wax Emulsion Market Trends

Shift Toward Eco-Friendly and Sustainable Formulations

- The rising demand for environmentally friendly and water-based coatings is driving the adoption of bio-based wax emulsions across industries, particularly in packaging and textiles. Manufacturers are replacing solvent-based systems with low-VOC, sustainable alternatives to meet stringent environmental regulations and growing consumer preferences for eco-conscious products

- Increasing awareness about sustainability among end-users has accelerated the use of wax emulsions in paper & packaging for food-grade applications. These eco-friendly coatings enhance barrier properties, extend shelf life, and align with global efforts to minimize plastic usage while supporting recyclability and compostability initiatives across the value chain

- The growing shift toward green chemistry practices has prompted manufacturers to invest heavily in R&D for plant-derived and synthetic ester-based wax emulsions. This enables improved coating performance, reduced carbon footprint, and compatibility with existing manufacturing processes without sacrificing cost efficiency or product quality

- For instance, in 2023, several packaging companies in North America introduced compostable paper cups coated with bio-based wax emulsions. These solutions offered moisture resistance, enhanced biodegradability, and compliance with food-safety standards, providing a competitive edge in sustainable packaging markets

- While sustainability is a key growth driver, manufacturers must balance cost-effectiveness, scalability, and performance optimization to ensure large-scale adoption. Industry players are exploring regional raw material sourcing and process automation to maintain profitability in the evolving green manufacturing landscape

North America Wax Emulsion Market Dynamics

Driver

Rising Demand in Construction and Packaging Industries

- Expanding construction activities across North America are driving demand for wax emulsions in concrete curing, wood coatings, and adhesives. These emulsions improve surface protection, water resistance, and aesthetic appeal in building materials, thereby increasing durability and reducing maintenance costs for end-users

- The packaging industry is witnessing significant growth due to e-commerce expansion and rising demand for food packaging solutions. Wax emulsions are increasingly preferred for providing barrier coatings, grease resistance, and improved printability in paper-based packaging, ensuring functionality without environmental compromise

- Regulatory push for sustainable packaging materials has further encouraged manufacturers to develop food-safe and biodegradable wax emulsion coatings. Compliance with FDA and EPA guidelines is enabling broader applications in the food sector while meeting corporate sustainability targets across the supply chain

- For instance, in 2023, major packaging producers in the U.S. adopted FDA-approved wax emulsions for food-grade paper coatings. This development enhanced product safety, supported brand reputation, and strengthened competitiveness in the eco-friendly packaging materials market

- While construction and packaging remain primary growth drivers, the rising adoption of wax emulsions in textiles, automotive, and cosmetics industries further enhances market potential. Manufacturers are leveraging this trend by launching specialty-grade wax emulsions tailored for niche, high-performance applications

Restraint/Challenge

Price Volatility of Raw Materials and Limited Awareness in SMEs

- Fluctuating prices of raw materials such as paraffin, polyethylene, and natural waxes create cost uncertainties for manufacturers, affecting production planning, inventory control, and long-term pricing strategies. These fluctuations often disrupt profit margins and delay capacity expansion plans across the industry

- Small and medium-sized enterprises (SMEs) often lack technical awareness about advanced wax emulsions, limiting adoption in niche applications such as specialty coatings and industrial lubricants. This knowledge gap reduces opportunities for SMEs to transition toward high-value, eco-friendly product lines

- The availability of low-cost synthetic alternatives also hampers the growth of premium bio-based wax emulsions in price-sensitive markets. Customers facing budget constraints often prioritize cheaper substitutes despite the performance and sustainability benefits offered by advanced formulations

- For instance, in 2023, several SMEs in Mexico reported delays in shifting to sustainable wax emulsions due to higher costs compared to traditional coatings. This trend highlights the need for financial incentives and technical training programs for smaller industry players

- Market players must focus on raw material diversification, cost optimization, and awareness programs to overcome these barriers and ensure steady growth. Collaborative initiatives between suppliers, manufacturers, and policymakers are crucial to promoting affordable green technology adoption in emerging markets

North America Wax Emulsion Market Scope

The market is segmented on the basis of material base, emulsifier, and end-user industry.

- By Material Base

On the basis of material base, the North America wax emulsion market is segmented into Synthetic Base Wax Emulsion and Natural Base Wax Emulsion. The Synthetic Base Wax Emulsion segment accounted for the largest market revenue share in 2024, driven by its cost-effectiveness, consistent quality, and widespread applications in paints, coatings, and packaging materials. Its durability and water-repellent properties make it a preferred choice for industrial-scale production.

The Natural Base Wax Emulsion segment is expected to witness fastest growth rate from 2025 to 2032, fueled by increasing demand for bio-based and eco-friendly products across industries. Growing sustainability regulations and consumer preference for green materials are boosting the adoption of natural wax emulsions in food packaging and cosmetics applications.

- By Emulsifier

On the basis of emulsifier, the market is segmented into Non-Ionic Surfactants, Anionic Surfactants, and Cationic Surfactants. The Non-Ionic Surfactants segment dominated the market revenue share in 2024, supported by its excellent stability, compatibility with diverse formulations, and ability to deliver uniform coating properties across multiple end-user industries.

The Cationic Surfactants segment is expected to witness fastest growth rate from 2025 to 2032 due to its superior adhesion properties and rising use in construction and woodworking applications. These emulsifiers enhance water resistance and durability, making them suitable for industrial and specialty coatings.

- By End-User Industry

On the basis of end-user industry, the North America wax emulsion market is segmented into Paints and Coatings, Textiles, Cosmetics, Adhesives and Sealants, Construction and Woodworking, Food Industry, and Others. The Paints and Coatings segment held the largest market share in 2024, driven by increasing demand for protective and decorative coatings in residential, commercial, and industrial construction projects.

The Food Industry segment is expected to witness fastest growth rate from 2025 to 2032, supported by growing adoption of FDA-approved, food-safe wax emulsions for packaging applications. Rising demand for moisture-resistant and biodegradable coatings in food-grade paper products is further boosting market growth.

North America Wax Emulsion Market Regional Analysis

- The U.S. wax emulsion market captured the largest revenue share in 2024 within North America, driven by the rapid adoption of sustainable materials across packaging, construction, and woodworking applications

- The growing demand for FDA-approved, food-grade coatings and the shift toward bio-based emulsions for eco-friendly packaging are fueling market expansion

- Moreover, the U.S. market benefits from strong R&D investments, robust regulatory frameworks, and consumer preference for sustainable, high-performance materials

Canada Wax Emulsion Market Insight

The Canada wax emulsion market capt is expected to witness fastest growth rate from 2025 to 2032, driven by increasing demand for sustainable and eco-friendly coatings across the packaging, construction, and woodworking industries. The adoption of bio-based and FDA-approved food-grade wax emulsions is accelerating, fueled by regulatory support and growing consumer awareness of environmentally responsible materials. Moreover, investments in R&D, coupled with the rising use of wax emulsions in adhesives, paints, and textiles, are contributing to steady market growth and technological advancements in Canada.

North America Wax Emulsion Market Share

The North America Wax Emulsion industry is primarily led by well-established companies, including:

- Hexion (U.S.)

- Michelman, Inc. (U.S.)

- The Lubrizol Corporation (U.S.)

- PMC Group, Inc. (U.S.)

- Henry Company (U.S.)

- Micro Powders, Inc. (U.S.)

- SHAMROCK (U.S.)

- Paraffinwaxco, Inc. (U.S.)

Latest Developments in North America Wax Emulsion Market

- In December 2023, PetroNaft Co. highlighted the application of wax emulsions in personal care products, demonstrating their ability to enhance texture, stability, and moisturizing properties in creams, lotions, and hair care formulations. These emulsions also improve smoothness and longevity in cosmetics such as lipsticks and eyeshadows, ensuring better performance and user experience. The adoption of wax emulsions in cosmetic products is driving innovation, supporting premium product differentiation, and boosting demand within the North American personal care and cosmetics market

- In November 2022, Elsevier B.V. reported that fine-dispersed, homogeneous, and submicron wax emulsions have gained significant importance in the cosmetics and pharmaceutical sectors. These advanced emulsions enable better absorption, stability, and consistency in healing ointments and creams, enhancing product efficacy and consumer satisfaction. Their increasing use is encouraging R&D investments and expanding market opportunities for high-performance wax emulsions in healthcare and personal care applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Wax Emulsion Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Wax Emulsion Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Wax Emulsion Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.