North America Weight Loss And Obesity Management Market

Market Size in USD Billion

CAGR :

%

USD

10.15 Billion

USD

20.97 Billion

2025

2033

USD

10.15 Billion

USD

20.97 Billion

2025

2033

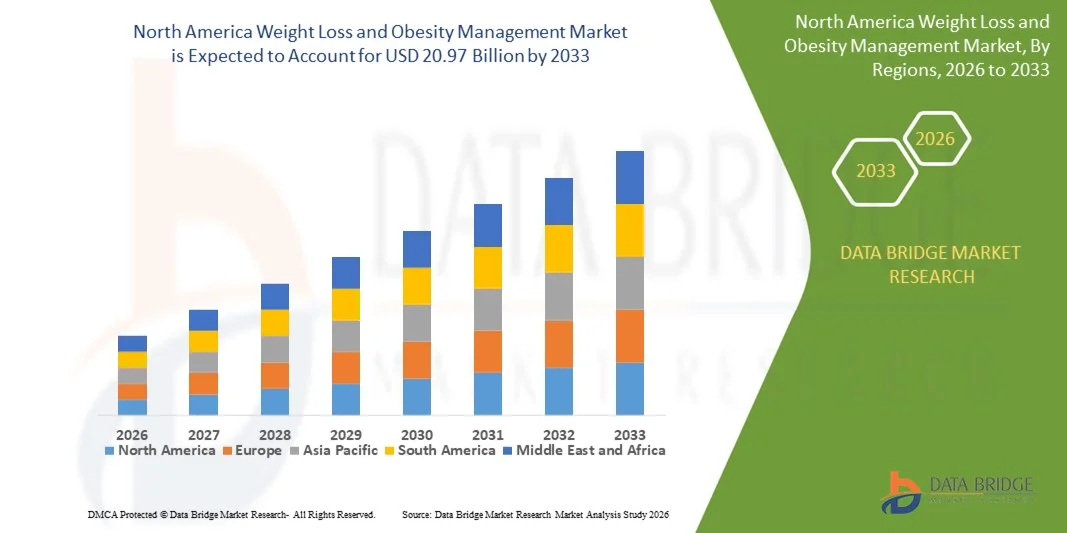

| 2026 –2033 | |

| USD 10.15 Billion | |

| USD 20.97 Billion | |

|

|

|

|

North America Weight Loss and Obesity Management Market Size

- The North America weight loss and obesity management market size was valued at USD 10.15 billion in 2025 and is expected to reach USD 20.97 billion by 2033, at a CAGR of 9.5% during the forecast period

- The market growth is largely fueled by the rising prevalence of obesity, growing consumer focus on health and fitness, and increasing adoption of both clinical and non‑clinical weight loss solutions, including bariatric procedures, diet programs, and online weight management services across the United States and Canada

- Furthermore, advancements in obesity management therapies, expanding digital health platforms, and a surge in demand for integrated and personalized weight loss solutions are positioning weight loss and obesity management approaches as essential components of preventive healthcare. These converging factors are accelerating the uptake of specialized weight loss programs and technologies, thereby significantly boosting the industry’s growth

North America Weight Loss and Obesity Management Market Analysis

- Weight loss and obesity management solutions, including dietary supplements, meal replacements, and other product types, are increasingly vital components of preventive healthcare and wellness strategies in both residential and commercial settings due to their ability to support personalized care, monitor progress, and integrate with broader health management ecosystems

- The escalating demand for weight loss and obesity management solutions is primarily fueled by the rising prevalence of obesity, growing health awareness, and increasing consumer preference for convenient, effective, and scientifically backed dietary and supplemental interventions

- The United States dominated the North America market with the largest revenue share of 73.7% in 2025, driven by high healthcare expenditure, widespread awareness of obesity-related health risks, and strong adoption of dietary supplements and meal replacements, particularly among adults aged 18–50 years. Innovations in clean-labelled products, enhanced formulations, and convenient product forms such as soft gels, powders, and premixes have further accelerated market growth

- Canada is expected to be the fastest growing country in the weight loss and obesity management market, supported by increasing consumer focus on preventive healthcare, rising demand for OTC and prescribed products, and expansion of both store-based and non-store-based distribution channels

- Dietary supplements segment dominated the market in North America with a market share of 43.9% in 2025, driven by their convenience, efficacy, and strong adoption across diverse demographic groups and distribution channels

Report Scope and North America Weight Loss and Obesity Management Market Segmentation

|

Attributes |

North America Weight Loss and Obesity Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Weight Loss and Obesity Management Market Trends

Rise of Personalized and AI-Driven Weight Management Solutions

- A significant and accelerating trend in the North America weight loss and obesity management market is the adoption of AI-driven digital platforms and personalized health apps that tailor diet, exercise, and supplement recommendations to individual user needs, enhancing convenience and engagement

- For instance, Noom’s AI-powered platform provides real-time behavioral insights and customized coaching, allowing users to adjust nutrition and activity goals based on daily habits and progress. Similarly, Kurbo offers personalized digital coaching for younger demographics to support healthier lifestyle changes

- AI integration in weight management enables features such as tracking user progress, predicting adherence patterns, and suggesting optimized diet or exercise plans. For instance, Lark Health utilizes AI to offer personalized nutrition and lifestyle recommendations, while sending alerts to encourage compliance and motivate behavioral change

- The integration of digital weight management solutions with wearable devices and health monitoring apps facilitates centralized tracking of fitness, caloric intake, and metabolic indicators, creating a comprehensive health management experience

- This trend toward more intelligent, customized, and tech-enabled weight management is reshaping consumer expectations for obesity interventions. Consequently, companies such as Weight Watchers are expanding AI-enabled coaching and personalized digital diet plans to improve adherence and outcomes

- The demand for solutions that combine personalization, AI insights, and integration with digital health tools is growing rapidly across adult and senior populations, as consumers increasingly prioritize convenience and data-driven health management

- An emerging trend is the integration of gamification and social engagement features in apps to increase adherence and user motivation for long-term lifestyle changes

North America Weight Loss and Obesity Management Market Dynamics

Driver

Rising Obesity Prevalence and Health Awareness

- The increasing prevalence of obesity and overweight populations in North America, coupled with heightened awareness of associated health risks, is a significant driver for the growing demand for weight loss and obesity management solutions

- For instance, in March 2025, Nutrisystem launched an AI-enabled weight management program targeting high-risk adults, aiming to integrate personalized diet plans with behavior-tracking technology. Such initiatives by key players are expected to drive market growth in the forecast period

- As consumers seek effective, clinically backed solutions to manage weight and improve overall health, dietary supplements, meal replacements, and digital coaching platforms provide convenient and evidence-based options

- Furthermore, the growing adoption of digital health technologies, telemedicine, and mobile apps is making weight management more accessible and integrated, enabling real-time monitoring and professional guidance

- The convenience of personalized coaching, structured meal programs, and app-based tracking, combined with consumer preference for scientifically validated interventions, is propelling adoption across diverse adult demographics and professional health services

- Increasing corporate wellness programs and employer-sponsored health initiatives are boosting adoption of weight management solutions in workplaces

- Rising consumer interest in preventive healthcare and chronic disease management is encouraging adoption of combined dietary, fitness, and digital solutions to control weight proactively

Restraint/Challenge

Regulatory Compliance and Consumer Skepticism

- Concerns surrounding regulatory approval, product safety, and effectiveness pose a significant challenge to broader market penetration in North America, particularly for dietary supplements and meal replacements

- For instance, reports of non-compliant supplement ingredients or exaggerated claims have made some consumers hesitant to adopt new weight management products, affecting trust in emerging brands

- Addressing these concerns through adherence to FDA guidelines, transparent labeling, and evidence-based clinical validation is crucial for building consumer confidence. Companies such as GNC and Herbalife emphasize verified formulations and quality standards in marketing to reassure potential buyers

- In addition, the relatively high cost of structured programs and AI-driven digital platforms compared to conventional dieting or exercise routines can be a barrier to adoption for price-sensitive consumers, particularly in middle-income segments

- Overcoming these challenges through regulatory compliance, consumer education on safety and efficacy, and development of cost-effective personalized programs will be vital for sustained market growth

- Variability in consumer responses to dietary supplements and program adherence may limit perceived effectiveness, affecting long-term retention and satisfaction

- Limited awareness or mistrust of AI-powered health solutions among older adults or less tech-savvy populations can slow market penetration despite growing digital adoption trends

North America Weight Loss and Obesity Management Market Scope

The market is segmented on the basis of product type, product form, nature, category, end-user demography, and distribution channel.

- By Product Type

On the basis of product type, the North America weight loss and obesity management market is segmented into dietary supplements and meal replacements. The dietary supplements segment dominated the market with the largest revenue share of 43.9% in 2025, driven by their convenience, efficacy, and widespread adoption across adult populations. Consumers prefer dietary supplements such as vitamins, minerals, herbal extracts, and protein formulations for daily weight management due to their ease of consumption and ability to complement diet and exercise routines. The segment benefits from increasing awareness of preventive healthcare and chronic disease management, with healthcare professionals often recommending supplements as part of holistic obesity interventions. Dietary supplements also appeal to tech-savvy consumers through integration with app-based tracking and personalized nutrition plans. Continuous innovation in formulations, including clean-labelled and plant-based ingredients, further reinforces market dominance. Moreover, the presence of established players and strong retail distribution channels enhances accessibility and trust among consumers.

The meal replacements segment is anticipated to witness the fastest growth rate of 10.8% from 2026 to 2033, fueled by rising demand for convenient, portion-controlled, and nutritionally balanced solutions. Meal replacements, including shakes, bars, and ready-to-drink beverages, provide time-efficient options for busy adults seeking weight management support. Innovations in taste, flavor variety, and nutrient fortification are attracting new users and encouraging repeat purchases. The segment also benefits from growing adoption among fitness enthusiasts and individuals with lifestyle-related health conditions. Increased awareness of clinical efficacy and guidance from dieticians or digital coaching platforms is boosting consumer confidence. Integration with subscription-based delivery models and digital platforms further accelerates growth by offering personalized recommendations and tracking.

- By Product Form

On the basis of product form, the market is segmented into soft gels, tablets, capsules, powders, gummies & jellies, premixes, liquids, and others. The powders segment dominated the market with the largest revenue share of 38.9% in 2025, largely due to their versatility in protein shakes, meal replacements, and functional beverages. Consumers prefer powders for their easy mixing, dosage flexibility, and ability to customize intake according to individual caloric and nutritional needs. The segment also benefits from compatibility with digital nutrition plans and app-based tracking for personalized intake recommendations. Powders are widely used in fitness and wellness programs, contributing to consistent demand. Strong availability across both store-based and online retail channels supports market penetration. Product innovations in flavor, solubility, and nutrient profiles further enhance adoption.

The gummies & jellies segment is expected to witness the fastest growth rate of 12.1% from 2026 to 2033, driven by their convenience, taste appeal, and appeal to younger demographics and busy adults. Gummies and jellies provide a user-friendly alternative to traditional pills and powders, making adherence easier. Companies are innovating with clean-labelled and plant-based formulations to attract health-conscious consumers. Integration with subscription services and digital wellness platforms enhances personalization and engagement. Marketing campaigns emphasizing taste, ease of use, and compliance are expanding the consumer base. The segment is increasingly popular among adults seeking enjoyable and convenient daily supplementation.

- By Nature

On the basis of nature, the market is segmented into conventional and clean-labelled products. The conventional segment dominated the market with a revenue share of 55.2% in 2025, supported by long-established dietary supplements and meal replacement products that are trusted by consumers and healthcare providers. Conventional products include traditional protein powders, capsules, and formulated shakes widely available in stores and online. Their broad adoption is reinforced by recognized brands and clinically validated formulations. Conventional offerings are typically cost-effective, accessible, and compatible with standard health and fitness regimens. Marketing campaigns emphasize reliability, efficacy, and scientific backing. Strong presence across retail chains, pharmacies, and fitness outlets ensures consistent availability.

The clean-labelled segment is expected to witness the fastest growth rate of 14.5% from 2026 to 2033, fueled by increasing health consciousness and demand for transparency in ingredients. Clean-labelled products avoid artificial additives, preservatives, and allergens, appealing to environmentally and health-conscious consumers. Growth is supported by trends in plant-based and organic formulations. Integration with digital platforms allows users to track ingredients and align with dietary goals. Rising awareness of ingredient safety and sustainability is encouraging adoption among millennials and Gen Z. Companies are innovating with packaging, flavor, and product form to enhance appeal and compliance.

- By Category

On the basis of category, the market is segmented into prescribed and over-the-counter (OTC) products. The OTC segment dominated the market with the largest revenue share of 61.8% in 2025, supported by the convenience of access, wide availability in pharmacies and online stores, and strong consumer awareness. OTC products include dietary supplements, meal replacements, and functional beverages accessible without a physician’s prescription. The segment benefits from the growing trend of self-managed weight loss, digital coaching apps, and lifestyle programs. Marketing campaigns highlight efficacy, convenience, and safety for general consumers. Healthcare professionals often recommend OTC options as complementary interventions. Accessibility across store-based and non-store-based channels ensures mass adoption.

The prescribed segment is expected to witness the fastest growth rate of 11.9% from 2026 to 2033, driven by the rising prevalence of obesity-related comorbidities and demand for clinically monitored interventions. Prescription products include pharmacological therapies and medical-grade meal replacements requiring supervision. Growth is supported by telemedicine and physician-guided digital programs. Increasing insurance coverage for obesity management medications and therapies also propels adoption. Clinical validation and evidence-based efficacy enhance trust among healthcare providers and patients. Emerging prescription solutions targeting personalized weight management further accelerate the segment’s growth.

- By End-User Demography

On the basis of end-user demography, the market is segmented into under 18 years, 18 to 35 years, 35 to 50 years, and above 50 years. The 18 to 35 years segment dominated the market with the largest revenue share of 44.6% in 2025, reflecting the adoption of fitness apps, dietary supplements, and meal replacements among young adults. This demographic is highly influenced by digital health platforms, social media, and personalized diet trends. Awareness of preventive healthcare and lifestyle diseases drives consumption of structured weight management solutions. Convenience and portability of products align with busy lifestyles. Integration with wearable devices, tracking apps, and subscription services enhances engagement. Marketing campaigns targeting this demographic emphasize personalization, tech-enabled support, and trend-driven nutrition.

The above 50 years segment is expected to witness the fastest growth rate of 9.8% from 2026 to 2033, fueled by increasing health consciousness and focus on managing age-related metabolic disorders. Older adults are adopting supplements, meal replacements, and guided nutrition programs to maintain healthy weight and prevent chronic diseases. Digital coaching and remote monitoring solutions are expanding accessibility for this segment. Rising disposable incomes and preventive healthcare initiatives encourage adoption. Physicians increasingly recommend structured programs tailored to seniors. Marketing strategies emphasize safety, efficacy, and clinically validated interventions for healthy aging.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into store-based and non-store-based channels. The store-based segment dominated the market with the largest revenue share of 52.4% in 2025, supported by accessibility in pharmacies, specialty stores, and supermarkets. Consumers prefer in-store purchases for trust, immediate availability, and ability to consult sales staff. Store-based channels also facilitate brand visibility and promotions. Established players leverage retail partnerships to enhance reach. Packaging and point-of-sale information influence purchase decisions. The segment benefits from traditional marketing campaigns and loyalty programs.

The non-store-based segment is expected to witness the fastest growth rate of 13.2% from 2026 to 2033, driven by e-commerce, subscription services, and direct-to-consumer platforms. Online channels offer convenience, home delivery, and access to a broader product range. Growth is fueled by digital health platforms, mobile apps, and AI-driven personalization. Increasing comfort with online purchasing among millennials and Gen Z accelerates adoption. Non-store-based channels allow real-time tracking, subscription management, and integration with digital coaching. Companies are investing in digital marketing, influencer campaigns, and app-based sales to expand reach.

North America Weight Loss and Obesity Management Market Regional Analysis

- The United States dominated the North America market with the largest revenue share of 73.7% in 2025, driven by high healthcare expenditure, widespread awareness of obesity-related health risks, and strong adoption of dietary supplements and meal replacements, particularly among adults aged 18–50 years

- Consumers in the region highly value personalized, convenient, and clinically backed weight management solutions, including AI-driven apps, telehealth programs, and structured nutrition plans that can be integrated into daily routines for effective lifestyle management

- This widespread adoption is further supported by high disposable incomes, a health-conscious population, and growing preference for preventive healthcare and chronic disease management, establishing weight loss and obesity management programs as a favored solution for adults across various age groups and professional segments

The U.S. Weight Loss and Obesity Management Market Insight

The U.S. weight loss and obesity management market captured the largest revenue share of 73.7% in 2025 within North America, fueled by the rising prevalence of obesity, growing health awareness, and increasing adoption of dietary supplements, meal replacements, and digital weight management solutions. Consumers are increasingly prioritizing personalized, clinically backed programs that combine nutrition, fitness, and AI-driven coaching. The growing preference for subscription-based and app-integrated programs further propels the market. Moreover, the expanding adoption of telehealth, wearable devices, and digital health platforms is significantly contributing to the market’s expansion by enabling real-time monitoring and customized interventions.

Canada Weight Loss and Obesity Management Market Insight

The Canada weight loss and obesity management market is projected to expand at a notable CAGR throughout the forecast period, primarily driven by government health initiatives, rising awareness of obesity-related chronic diseases, and increasing demand for preventive healthcare solutions. Canadians are drawn to convenient, personalized programs, including dietary supplements and meal replacements, that fit busy lifestyles. The market is witnessing growth across retail, clinical, and digital channels, with a particular focus on integrating digital coaching and lifestyle tracking. Expansion of e-commerce platforms and telemedicine services further supports adoption in both urban and semi-urban populations.

Mexico Weight Loss and Obesity Management Market Insight

The Mexico weight loss and obesity management market is expected to grow at a significant CAGR during the forecast period, driven by increasing urbanization, rising disposable incomes, and heightened awareness of healthy lifestyles. The prevalence of obesity and related metabolic disorders is motivating consumers to adopt structured dietary and supplemental interventions. Mexico’s growing digital penetration, particularly via mobile health apps and online wellness platforms, facilitates personalized weight management solutions. In addition, retail expansion and the availability of affordable dietary supplements and meal replacements are boosting market growth in both residential and commercial settings.

North America Weight Loss and Obesity Management Market Share

The North America Weight Loss and Obesity Management industry is primarily led by well-established companies, including:

- Noom, Inc. (U.S.)

- WW International, Inc. (U.S.)

- SlimFast (U.S.)

- Nutrisystem, Inc. (U.S.)

- Herbalife Nutrition Ltd. (U.S.)

- Medifast, Inc. (U.S.)

- USANA Health Sciences, Inc. (U.S.)

- Amway Corp. (U.S.)

- Abbott Laboratories (U.S.)

- Glanbia PLC (Ireland)

- GSK plc (U.K.)

- Nestlé (Switzerland)

- NutriSport Pharmacal, Inc. (U.S.)

- Bayer AG (Germany)

- GNC Holdings, LLC (U.S.)

- NOW Foods (U.S.)

- Pharmavite LLC (U.S.)

- Nature’s Way (U.S.)

- Plexus Worldwide (U.S.)

- SmartyPants Vitamins (U.S.)

What are the Recent Developments in North America Weight Loss and Obesity Management Market?

- In January 2026, Novo Nordisk began broad U.S. distribution of its oral weight‑loss drug Wegovy® pill, marking the launch of the first daily oral GLP‑1 obesity treatment available at more than 70,000 pharmacies across America and priced starting around $149/month to expand access beyond injectable options

- In December 2025, the U.S. Food and Drug Administration approved the first daily oral weight‑loss medication, Wegovy, developed by Novo Nordisk, marking a landmark shift from injectable to pill‑based obesity treatment and expanding accessible options for millions of Americans

- In November 2025, the U.S. government struck a deal with major drugmakers to lower the prices of GLP‑1 weight‑loss drugs, including Zepbound and other treatments, to improve accessibility and expand coverage for Medicare and Medicaid beneficiaries while accelerating approvals of new therapies

- In August 2025, the U.S. FDA authorized a generic version of the first‑generation GLP‑1 weight‑loss drug Saxenda, from Teva Pharmaceuticals, making a proven obesity treatment more affordable for obese adults and adolescents with related medical issues

- In June 2025, data revealed a substantial increase in prescriptions of GLP‑1 obesity medications among U.S. adolescents aged 12–17, reflecting broader adoption of pharmacological obesity management following expanded FDA approvals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Weight Loss And Obesity Management Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Weight Loss And Obesity Management Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Weight Loss And Obesity Management Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.