North America Welding Wire Market Analysis and Size

Welding is extensively used in the automotive industry to manufacture various vehicle parts. They are also used in the transportation industry to join rails in railway or metro projects as the welds provide a seamless, robust and durable joint. This has increased the use of welding as a fabrication process, thus increasing the demand for welding wires. The rising number of refineries and supply systems in the oil and gas industry and water treatment and supply facilities are expected to drive the growth of the North America welding wire market. Easy usability and good strength of joint act as a benefit for the potential buyers. The availability of a wide range of welding wires in the market for various types of welding further adds to the growth of the North America welding wire market.

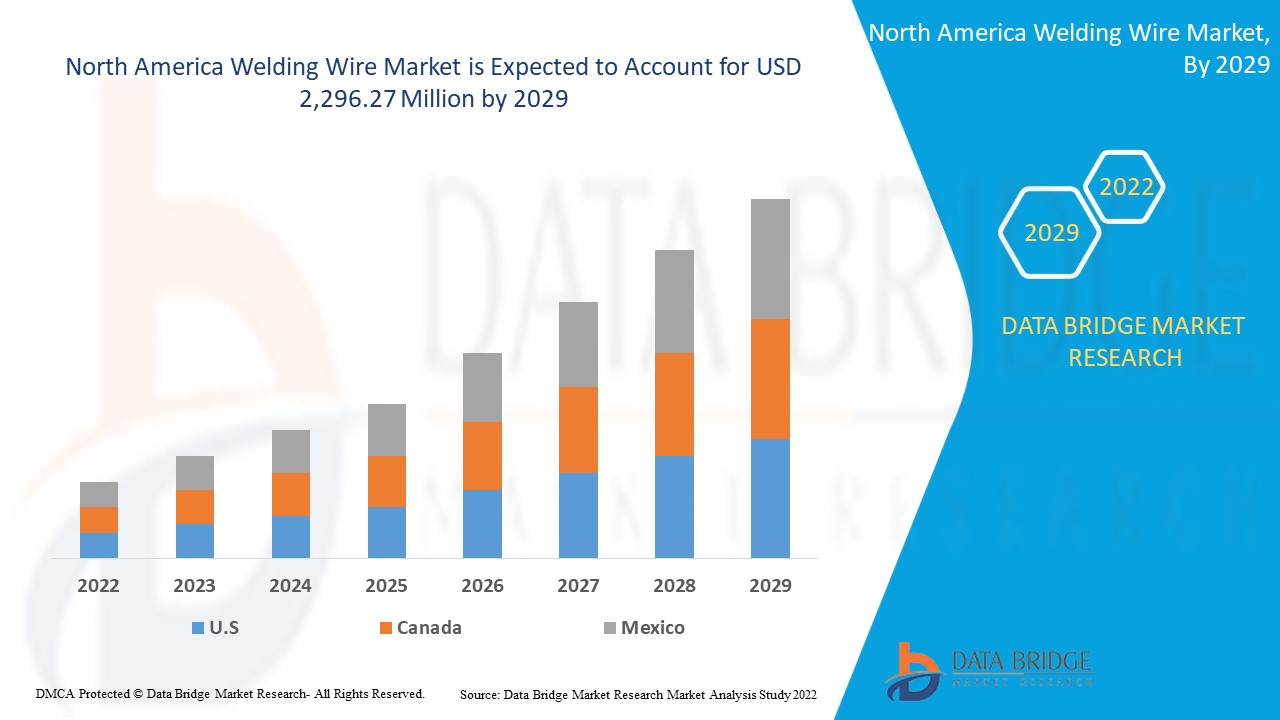

Data Bridge Market Research analyses that the North America welding wire market is expected to reach USD 2,296.27 million by 2029, at a CAGR of 2.7% during the forecast period. The welding wire market report also covers pricing analysis, patent analysis and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Kilo Tons, Pricing in USD |

|

Segments Covered |

By Type (Solid Gas Metal Arc Welding Wire, Composite Metal-Cored Wires and Gas-Shielded Flux-Cored Arc Welding Wire), Material (Alloys, Stainless Steel, Aluminium and Others), Application (Fabrication, Maintenance and Retrofit), End-Use (Automotive, Building & Construction, Aerospace, Defense, Oil & Gas, Shipbuilding and Others) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

voestalpine Böhler Welding Group GmbH, The Lincoln Electric Company, Berkenhoff GmbH, Saarstahl AG, U.S. Titanium Industry Inc., KOBE STEEL, LTD., ESAB, WeldWire, Venus Wire Industries Pvt. Ltd., National Standard, American Welding Products, Inc., LUVATA and Hobart Brothers LLC (A subsidiary of Illinois Tool Works Inc.) |

Market Definition

Welding wires, commonly referred to as welding consumables, are thin metallic rods that ignite when electricity is applied, creating a hot arc that is further used to fuse metal components. The welding wires melt while joining two metals to serve as a filler material, strengthen the junction and thereby protect the molten weld from various atmospheric containments. Since welding wires are a consumable product that is in high demand, therefore the welding wire market is anticipated to grow significantly over the forecasted years.

Welding Wire Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges.

Drivers

- Increasing construction and engineering activities across the region

The construction and engineering industries are responsible for creating all kinds of structures with varying sizes, levels of complexity and uses. ‘‘The structural integrity of the framework and component's durability, are the most important considerations in this industry. This is why the construction industry employs a huge quantity of metals. Welding technologies are widely used in construction, mainly for fabricating structurally sound metal frameworks by fusing various components. It is also used to create and maintain non-structural details. Therefore, increasing construction and engineering activities across the region are driving market growth.

- Technological advancements in consumables and welding wire

Nowadays, multiple wires are used to increase the productivity in the various welding processes, allowing a remarkably increased welding speed for steel, stainless steel and aluminum. Another new way to improve productivity is to use double filler wires. Both wires can be connected to the same power unit, which means they share a familiar arc. This method is also known as twin arc. Two-wire processes such as tandem welding and double welding wire are classified depending on whether one common or two separated potentials are applied to the wire. Over the past years, tandem welding has established itself as a reliable joining method in high-performance welding. It meets the demand for modern mechanized welding, thereby raising productivity. Such technological advancements are driving market growth.

Opportunity

- Increase in business development and expansion activities by organizations

Expanding the business could connect more people to the company's products and services. They will be able to convert more clients and boost their sales by expanding the customer base. As a result of this, profits may increase in the future. Customers are crucial to the success of any company, just like the team members are. Also, the company may be better positioned to get the required funding if it can successfully expand it. This capital might be a lifeline for the company during the expansion process and once the expansion has taken place, they can still rely on it. This helps make awareness and increase the organization's profit and creates scope for sustainable growth. Furthermore, this helps the company to get recognized in the premium market. An increasing number of business developments and expansion activities by organizations are creating many opportunities for the market players.

Restraint/Challenge

- Higher costs associated with welding wires and consumables

In today's world, fabricators have many choices in deciding the best welding process and consumables to use in a particular application. Many considerations are necessary, including welder skill, equipment, availability of the consumables, environmental issues and the economics of the process. When deciding on the implementation of any fabrication process, the welders always look for a feasible solution with a low-cost process. Moreover, pre-and post-weld activities, product flow, inventory management and the equipment affect the welding operations' quality, productivity and profitability. The filler metal is essential as it can create costs in many ways that may not be immediately apparent. These hidden costs can generate a lot of difference between maintaining a gainful, competitive welding operation and keeping up with the rest of the industry.

- Increase in labor costs in the welding process

Labour costs account for a significant amount of the total welding costs. A welder is compensated hourly and has a limited capacity to complete a set number of components per hour. Of course, this figure can vary depending on the welder's training and experience. Only a certain amount of welded material can be produced by a welder during the allotted working time. Since various requirements must be met for welding operations and laborer’s hourly wages are rising daily, welding expenses have naturally increased.

Post-COVID-19 Impact on Welding Wire Market

COVID-19 significantly impacted the welding wire market as almost every country has opted for the shutdown for every production facility except those dealing in producing the essential goods.

The COVID-19 pandemic has impacted the welding wire market to an extent a negative manner. So, the market has resulted in a lower estimated year-on-year growth rate as compared with 2019 because of the fewer activities in the sectors associated with the welding wire market. However, the growth has been high since the market opened after COVID-19 and it is expected that there will be considerable growth in the sector owing to increasing demand for automotive, building & construction industries.

Manufacturers & solution providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in welding wire. With this, the companies will bring advanced technologies to the market. In addition, government initiatives for electric vehicle usage have led to the market's growth.

Recent Developments

- In November 2021, Hobart Brothers LLC introduced its new gas-shielded flux-cored wire named FabCO 91K2-M. Without compromising on quality or mechanical properties, these new wires give operators the flexibility to work within a larger range of welding parameters. This will enhance the product portfolio of the company.

- In October 2019, voestalpine Böhler Welding Group GmbH introduced its first manufacturing facility in U.S. Local production is a crucial step for voestalpine Böhler Welding to expand further its product line in the U.S. This will increase the global reach of the company.

North America Welding Wire Market Scope

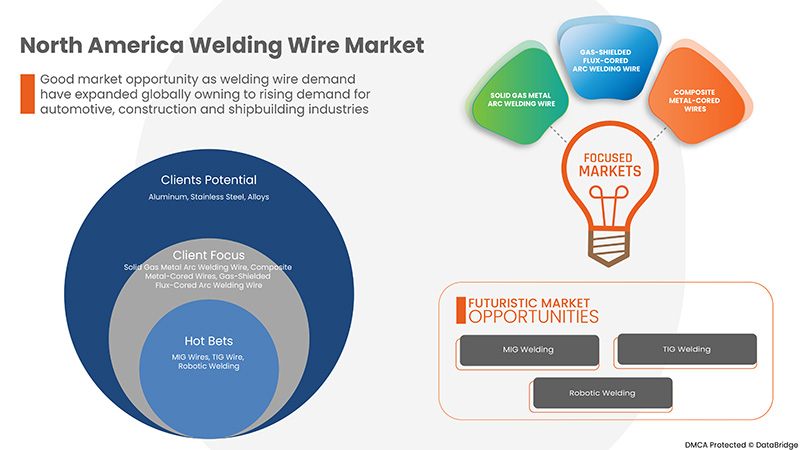

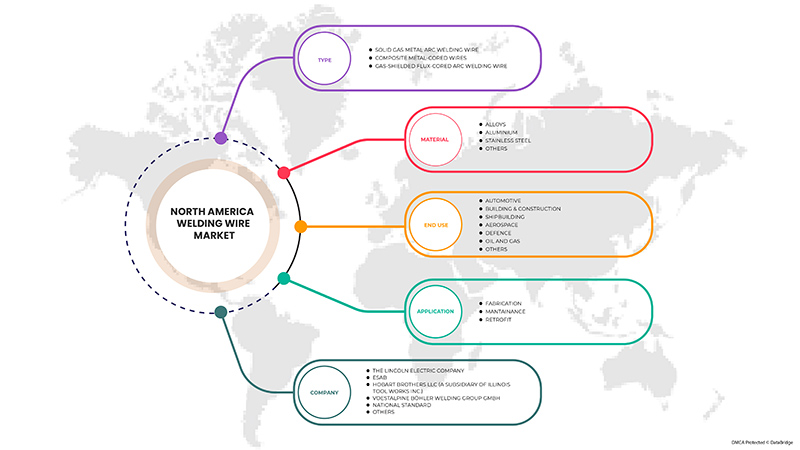

The welding wire market is segmented based on type, material, application and end-use.

The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Solid Gas Metal Arc Welding Wire

- Composite Metal-Cored Wires

- Gas-Shielded Flux-Cored Arc Welding Wire

On the basis of type, the North America welding wire market is segmented into solid gas metal arc welding wire, composite metal-cored wires and gas-shielded flux-cored arc welding wire.

Material

- Alloys

- Stainless Steel

- Aluminum

- Others

On the basis of material, the North America welding wire market has been segmented into alloys, stainless steel, aluminum and others.

Application

- Fabrication

- Repair & Maintenance

- Retrofit

On the basis of application, the North America welding wire market is segmented into fabrication, repair & maintenance and retrofit.

End-Use

- Automotive

- Building & Construction

- Aerospace

- Defense

- Oil & Gas

- Shipbuilding

- Others

On the basis of end-use, the North America welding wire market is segmented into automotive, building & construction, aerospace, defense, oil & gas, shipbuilding and others.

Welding Wire Market Regional Analysis/Insights

The welding wire market is analyzed and market size insights and trends are provided by country, material, type, application and end-use as referenced above.

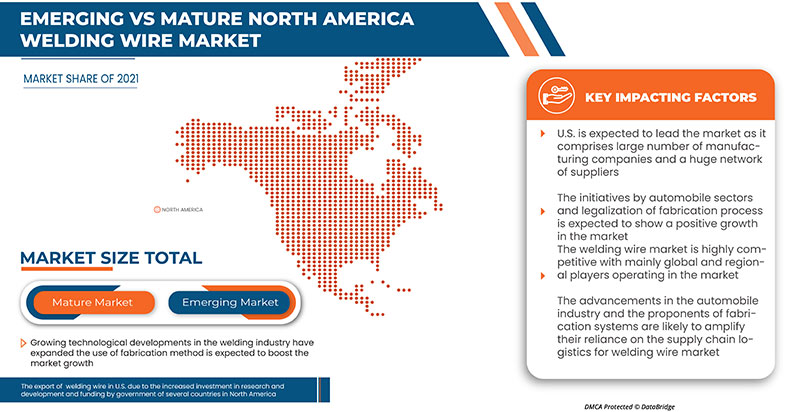

The countries covered in the welding wire market report are U.S., Canada and Mexico. The U.S. dominates the North America region owing to developed industrial infrastructure, government initiatives and investments in welding technology training programs.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Welding Wire Market Share Analysis

The North America welding wire market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to welding wire market.

Some of the major players operating in the North America welding wire market are voestalpine Böhler Welding Group GmbH, The Lincoln Electric Company, Berkenhoff GmbH, Saarstahl AG, U.S. Titanium Industry Inc., KOBE STEEL, LTD., ESAB, WeldWire, Venus Wire Industries Pvt. Ltd., National Standard, American Welding Products, Inc., LUVATA and Hobart Brothers LLC (A subsidiary of Illinois Tool Works Inc.) among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WELDING WIRE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MARKET END-USE COVERAGE GRID

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION-CONSUMPTION ANALYSIS

4.2 IMPORT-EXPORT SCENARIO

4.3 RAW MATERIAL PRODUCTION COVERAGE

4.4 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.5 PRICE ANALYSIS

4.6 LIST OF KEY BUYERS

4.7 PORTER'S FIVE FORCE ANALYSIS

4.8 VENDOR SELECTION CRITERIA

4.9 PESTEL ANALYSIS

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT'S ROLE

5.4 ANALYST RECOMMENDATION

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING CONSTRUCTION AND ENGINEERING ACTIVITIES ACROSS THE REGION

7.1.2 TECHNOLOGICAL ADVANCEMENTS IN CONSUMABLES AND WELDING WIRE

7.1.3 RISE IN DEMAND FOR VARIOUS WELDING WIRES IN THE AUTOMOTIVE INDUSTRY

7.2 RESTRAINTS

7.2.1 HIGHER COSTS ASSOCIATED WITH WELDING WIRES AND CONSUMABLES

7.2.2 EMISSION OF HARMFUL GASES WHILE PERFORMING WELDING OPERATIONS

7.3 OPPORTUNITIES

7.3.1 INCREASE IN BUSINESS DEVELOPMENT AND EXPANSION ACTIVITIES BY ORGANIZATIONS

7.3.2 PENETRATION OF AUTOMATION IN VARIOUS WELDING PROCESS

7.3.3 GOVERNMENT INITIATIVES AND INVESTMENTS FOR WELDING PROFESSIONALS

7.4 CHALLENGES

7.4.1 LACK OF SKILLED WELDING PROFESSIONALS IN NORTH AMERICA

7.4.2 INCREASING LABOR COSTS IN THE WELDING PROCESS

8 NORTH AMERICA WELDING WIRE MARKET, BY TYPE

8.1 OVERVIEW

8.2 SOLID GAS METAL ARC WELDING WIRE

8.3 COMPOSITE METAL-CORED WIRES

8.4 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

9 NORTH AMERICA WELDING WIRE MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 ALUMINUM

9.3 STAINLESS STEEL

9.4 ALLOYS

9.5 OTHERS

10 NORTH AMERICA WELDING WIRE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FABRICATION

10.3 REPAIR & MAINTENANCE

10.4 RETROFIT

11 NORTH AMERICA WELDING WIRE MARKET, BY END-USE

11.1 OVERVIEW

11.2 AUTOMOTIVE

11.2.1 SOLID GAS METAL ARC WELDING WIRE

11.2.2 COMPOSITE METAL-CORED WIRES

11.2.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

11.3 BUILDING & CONSTRUCTION

11.3.1 SOLID GAS METAL ARC WELDING WIRE

11.3.2 COMPOSITE METAL-CORED WIRES

11.3.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

11.4 SHIPBUILDING

11.4.1 SOLID GAS METAL ARC WELDING WIRE

11.4.2 COMPOSITE METAL-CORED WIRES

11.4.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

11.5 AEROSPACE

11.5.1 SOLID GAS METAL ARC WELDING WIRE

11.5.2 COMPOSITE METAL-CORED WIRES

11.5.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

11.6 DEFENCE

11.6.1 SOLID GAS METAL ARC WELDING WIRE

11.6.2 COMPOSITE METAL-CORED WIRES

11.6.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

11.7 OIL & GAS

11.7.1 SOLID GAS METAL ARC WELDING WIRE

11.7.2 COMPOSITE METAL-CORED WIRES

11.7.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

11.8 OTHERS

11.8.1 SOLID GAS METAL ARC WELDING WIRE

11.8.2 COMPOSITE METAL-CORED WIRES

11.8.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

12 NORTH AMERICA

12.1 U.S.

12.2 CANADA

12.3 MEXICO

13 NORTH AMERICA WELDING WIRE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 THE LINCOLN ELECTRIC COMPANY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 ESAB

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 HOBART BROTHERS LLC (A SUBSIDIARY OF ILLINOIS TOOL WORKS INC.)

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENTS

15.4 VOESTALPINE BÖHLER WELDING GROUP GMBH

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 BRAND PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 NATIONAL STANDARD

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 VENUS WIRE INDUSTRIES PVT. LTD

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 SAARSTAHL AG (A SUBSIDIARY OF STAHL-HOLDING-SAAR (SHS) GROUP)

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTION PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AMERICAN WELDING PRODUCTS, INC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 BERKENHOFF GMBH

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 KOBE STEEL, LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 U.S. TITANIUM INDUSTRY INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 WELDWIRE

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 EXPORTS OF WELDING WIRES FROM THE U.S.

TABLE 2 AVERAGE PRICE RANGE OF WELDING WIRES IN THE U.S.

TABLE 3 HEALTH EFFECTS OF HAZARDOUS FUMES DURING WELDING

TABLE 4 NORTH AMERICA WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA WELDING WIRE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 6 NORTH AMERICA WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 8 NORTH AMERICA WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 10 NORTH AMERICA WELDING WIRE MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA WELDING WIRE MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 12 NORTH AMERICA AUTOMOTIVE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA BUILDING & CONSTRUCTION IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SHIPBUILDING IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA AEROSPACE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DEFENCE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OIL & GAS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA WELDING WIRE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA WELDING WIRE MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 21 U.S. WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 U.S. WELDING WIRE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 23 U.S. WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 24 U.S. WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 25 U.S. WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 U.S. WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 27 U.S. WELDING WIRE MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 28 U.S. WELDING WIRE MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 29 U.S. AUTOMOTIVE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.S. BUILDING & CONSTRUCTION IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 U.S. SHIPBUILDING IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. AEROSPACE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. DEFENCE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. OIL & GAS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 U.S. OTHERS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 CANADA WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 CANADA WELDING WIRE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 38 CANADA WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 39 CANADA WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 40 CANADA WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 CANADA WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 42 CANADA WELDING WIRE MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 43 CANADA WELDING WIRE MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 44 CANADA AUTOMOTIVE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 CANADA BUILDING & CONSTRUCTION IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 CANADA SHIPBUILDING IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 CANADA AEROSPACE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 CANADA DEFENCE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 CANADA OIL & GAS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 CANADA OTHERS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 MEXICO WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MEXICO WELDING WIRE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 53 MEXICO WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 54 MEXICO WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 55 MEXICO WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 MEXICO WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 57 MEXICO WELDING WIRE MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 MEXICO WELDING WIRE MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 59 MEXICO AUTOMOTIVE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 MEXICO BUILDING & CONSTRUCTION IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 MEXICO SHIPBUILDING IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO AEROSPACE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 MEXICO DEFENCE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 MEXICO OIL & GAS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO OTHERS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA WELDING WIRE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WELDING WIRE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WELDING WIRE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WELDING WIRE MARKET: REGIONAL VS. COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WELDING WIRE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WELDING WIRE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WELDING WIRE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA WELDING WIRE MARKET: MARKET END-USE COVERAGE GRID

FIGURE 9 NORTH AMERICA WELDING WIRE MARKET: SEGMENTATION

FIGURE 10 INCREASE IN CONSTRUCTION AND ENGINEERING ACTIVITIES IS EXPECTED TO DRIVE THE NORTH AMERICA WELDING WIRE MARKET IN THE FORECAST PERIOD

FIGURE 11 SOLID GAS METAL ARC WELDING WIRE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WELDING WIRE MARKET IN 2022 & 2029

FIGURE 12 U.S. WELDING MATERIAL CONSUMPTION

FIGURE 13 IMPORTS OF WELDING WIRES IN THE U.S. (2011-2021)

FIGURE 14 PRODUCTION OF IRON ORE IN THE U.S.

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WELDING WIRE MARKET

FIGURE 16 NORTH AMERICA WELDING WIRE MARKET, BY TYPE, 2021 (USD MILLION)

FIGURE 17 NORTH AMERICA WELDING WIRE MARKET, BY MATERIAL, 2021 (USD MILLION)

FIGURE 18 NORTH AMERICA WELDING WIRE MARKET, BY APPLICATION, 2021 (USD MILLION)

FIGURE 19 NORTH AMERICA WELDING WIRE MARKET, BY END-USE, 2021 (USD MILLION)

FIGURE 20 NORTH AMERICA WELDING WIRE MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA WELDING WIRE MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA WELDING WIRE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA WELDING WIRE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA WELDING WIRE MARKET: BY TYPE (2022-2029)

FIGURE 25 NORTH AMERICA WELDING WIRE MARKET: COMPANY SHARE 2021 (%)

North America Welding Wire Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Welding Wire Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Welding Wire Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.