North America White Fused Alumina Market

Market Size in USD Million

CAGR :

%

USD

158.83 Million

USD

209.14 Million

2025

2033

USD

158.83 Million

USD

209.14 Million

2025

2033

| 2026 –2033 | |

| USD 158.83 Million | |

| USD 209.14 Million | |

|

|

|

|

North America White Fused Alumina Market Size

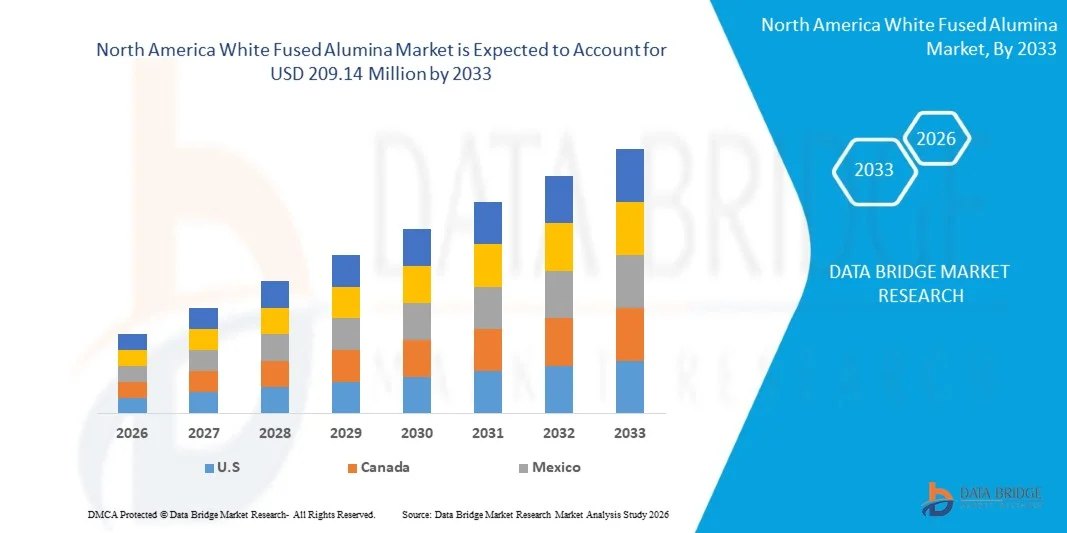

- The North America White Fused Alumina Market size was valued at USD 158.83 million in 2025 and is expected to reach USD 209.14 million by 2033, at a CAGR of 3.71% during the forecast period

- The North America White Fused Alumina Market refers to the market for a high-purity, synthetic form of aluminum oxide produced by melting high-quality alumina in an electric arc furnace at extremely high temperatures. White fused alumina is characterized by its hardness, thermal stability, and chemical inertness, making it suitable for abrasive applications, refractory materials, ceramics, polishing, and surface finishing. It is widely used across industries such as metals and metallurgy, automotive, construction, electronics, and aerospace, serving functions like cutting, grinding, lapping, and thermal or wear resistance enhancement.

- The growth of the North America White Fused Alumina Market is fueled by rising demand from key sectors such as construction, automotive, and industrial manufacturing, where high-quality abrasives, refractory materials, and polishing agents are essential. These industries depend on durable and efficient alumina-based solutions for applications like cutting, grinding, surface finishing, and thermal or wear resistance, driving widespread adoption and market expansion North America

North America White Fused Alumina Market Analysis

- Technological advancements such as energy-efficient electric arc furnaces, improved calcination and fusion processes, advanced impurity-removal techniques, and tighter particle-size control—are enhancing product purity, whiteness index, and consistency. These improvements are strengthening adoption across abrasives, refractories, ceramics, and precision polishing applications.

- Challenges remain, including volatility in alumina and energy prices, high power consumption during fusion, and stricter environmental and emissions regulations that increase operating costs. Dependence on reliable electricity infrastructure and competition from alternative abrasives such as brown fused alumina and synthetic substitutes also constrain growth.

- The U.S. is expected to dominate with 83.07% market share and is expected to grow with the highest CAGR of 3.86% in the forecast period of 2026 to 2033 due to strong manufacturing growth, large abrasives and refractories demand, expanding construction and metallurgy sectors, cost-competitive production, abundant raw materials, and rapid capacity.

- In 2026, the macrogrits segment is expected to dominate with 50.51% market share due to its extensive use in heavy-duty grinding, cutting, blasting, and refractory applications, where high strength, thermal stability, and consistent particle size are essential for industrial performance.

Report Scope and North America White Fused Alumina Market Segmentation

|

Attributes |

White Fused Alumina Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

North America White Fused Alumina Market Trends

“Adoption of advanced process automation and high-purity production technologies”

- Manufacturers are increasingly integrating automated electric arc furnace control systems, real-time process monitoring, and AI-assisted quality analytics to achieve consistent fusion temperatures, tighter grain-size distribution, and higher alumina purity, reducing batch variability and defects.

- This trend is driven by growing demand from abrasives, refractories, ceramics, and electronics industries for uniform, high-performance white fused alumina grades that meet stricter technical and regulatory specifications.AI-powered reconstruction algorithms are significantly lowering radiation dose while improving image quality, making PET-CT services safer and more accessible for a wider patient population.

- Advanced cooling, crushing, and classification technologies are improving yield efficiency and enabling the production of application-specific macrogrits and microgrits, enhancing overall product performance.

- Additionally, digitalized production planning, automated material handling, and predictive maintenance systems are helping producers manage energy-intensive operations, minimize downtime, and control operating costs.

North America White Fused Alumina Market Dynamics

Driver

“Increasing Demand from Iron & Steel Industry”

- Growing demand from the iron and steel industry is being recognized as one of the most influential drivers of the North America White Fused Alumina Market. White fused alumina is extensively utilized in refractory applications essential for steelmaking processes, including ladle linings, slide gate refractories, tundish nozzles and high-temperature wear-resistant components. As production volumes of crude steel continue to increase in major manufacturing economies and new capacity additions are announced across emerging regions, consumption of high-performance refractory raw materials is being reinforced. The shift toward higher-quality steel grades, extended furnace campaign life and reduced downtime has further intensified reliance on premium alumina-based refractories.

- It is concluded that the upward trajectory of North America crude steel production has played a decisive role in reinforcing white fused alumina consumption. As steel output expands, refractory wear rates rise proportionally, resulting in elevated replacement cycles for alumina-based refractories essential to furnace, ladle and tundish operations. Policy-driven capacity expansion, modernization of older steel mills and higher operational intensities have collectively strengthened the pull-through demand for WFA.

- The persistence of production growth in leading steelmaking economies indicates that refractory requirements will remain structurally anchored to the steel sector’s expansion path. Consequently, rising steel output is expected to continue sustaining strong and predictable long-term demand for white fused alumina in North America metallurgical applications.

Opportunity

“Growth in Non-Ferrous Metals and Glass Industries”

- Robust growth in the non-ferrous metals and glass industries represents a significant opportunity for the North America White Fused Alumina Market, as white fused alumina is a critical raw material in refractories, abrasives, and industrial processing applications used by these expanding sectors. The surge in demand for non-ferrous metals such as aluminum, copper, and zinc driven by industrialization, electric vehicle production, renewable energy infrastructure, and construction activities fuels downstream requirements for polishing, grinding, and refractory solutions that depend on white fused alumina-based products.

- Similarly, the glass industry’s expansion, underpinned by rising construction, automotive, consumer goods, and packaging sector activities, supports increased consumption of high-quality abrasive media and refractory components in glass melting and finishing processes. Together, these trends bolster white fused alumina demand by linking raw material growth with end-use industry requirements, enhancing market prospects and justifying investment in production capacity and technology innovation across value chains.

- The continuing expansion of the non-ferrous metals and glass industries presents a meaningful opportunity for the North America White Fused Alumina Market by increasing demand for key end-use applications that utilize white fused alumina’s properties. As non-ferrous metal production grows driven by infrastructure development, electrification, and manufacturing diversification the need for high-performance refractories and abrasives tied to metal processing strengthens.

Restraint/Challenge

“Environmental Regulations and Compliance Costs”

- Environmental regulations and the associated compliance costs represent a key restraint on the growth of the North America White Fused Alumina Market, particularly given the material’s production through energy-intensive high-temperature processes and its link to mining raw bauxite and alumina feedstocks. Across jurisdictions, governments are tightening emission controls, water management standards, waste handling rules, and environmental impact assessment requirements, which increases operational expenditure for producers, elongates project approval timelines, and raises barriers to entry. Compliance requires installation of advanced emission control systems, continuous monitoring technologies, and adherence to stringent environmental clearances, all of which raise fixed and ongoing costs.

- For instance- in September 2025, Business Standard reported that Forest and Climate Change amended forest conservation rules to simplify mining approvals for critical minerals, requiring enhanced environmental monitoring and auditing frameworks that affect mining and mineral supply operations.

- Environmental regulations and compliance costs exert a significant restraining influence on the North America White Fused Alumina Market by increasing operational expenditures, prolonging permitting timelines, and introducing regulatory uncertainties. Governments worldwide are tightening environmental safeguards, imposing remediation obligations, and enforcing penalties that directly affect refineries, smelters, and mining operations tied to fused alumina production.

North America White Fused Alumina Market Scope

North America White Fused Alumina Market is categorized into six segments based on product type, manufacturing process, function, application end use, distribution channel.

- By Product Type

On the basis of product type, North America White Fused Alumina Market is segmented into macrogrits, microgrits & powders, specialty grades, and others. In 2026, the macrogrits segment is expected to dominate with 50.51% market share due to its extensive use in heavy-duty applications such as refractories, bonded abrasives, and metallurgical processes that require high hardness and thermal stability.

The microgrits & powders segment is expected to grow at a CAGR of 3.3% due to rising demand for precision finishing, polishing, lapping, and advanced ceramic applications, where fine particle size, uniformity, and superior surface quality are critical.

- By Manufacturing Process

On the basis of manufacturing process, the North America White Fused Alumina Market is segmented into electric arc furnace, crushing, grading & classification, post-treatment, and others. In 2026, the electric arc furnace segment is expected to dominate with 50.83% market share due to its ability to produce high-purity and consistent-grade white fused alumina with superior mechanical and thermal properties.

The post-treatment segment is expected to grow at a CAGR of 4.4% due to increasing focus on particle size optimization, surface treatment, impurity removal, and customized material specifications required for high-end abrasives, ceramics, and electronics applications.

- By Function

On the basis of function, the North America White Fused Alumina Market is segmented into cutting & grinding (abrasive), polishing & lapping, blasting & surface preparation, refractory function (thermal/wear resistance), ceramic additive/filler, anti-skid/anti-slip aggregate, and others. In 2026, the cutting & grinding segment is expected to dominate with 37.04% market share due to its widespread adoption in metal fabrication, automotive manufacturing, and precision engineering applications.

The polishing & lapping segment is expected to grow at a CAGR of 4.6% due to increasing demand for ultra-fine surface finishing in electronics, optics, automotive components, and precision machinery, where tight tolerances and smooth surface quality are essential.

- By Application

On the basis of application, the North America White Fused Alumina Market is segmented into abrasives, refractories, ceramics & advanced materials, polishing, lapping & finishing, and others. In 2026, abrasive’s segment is expected to dominate with 51.14% market share due to extensive utilization in grinding, cutting, and surface finishing operations across multiple industries.

The refractories segment is expected to grow at a CAGR of 4.0% due to increasing demand from steel, cement, glass, and non-ferrous metal industries for high-temperature-resistant materials used in furnaces, kilns, and thermal processing units.

- By End User

On the basis of end user, the North America White Fused Alumina Market is segmented into metals & metallurgy, automotive & transportation, aerospace & defense, electronics & semiconductors, machinery & heavy equipment, construction & infrastructure, energy (oil & gas, power generation), and others. In 2026, metals & metallurgy segment is expected to dominate with 23.63% market share due to its extensive consumption in steelmaking, aluminum processing, and foundry operations.

The electronics & semiconductors segment is expected to grow at a CAGR of 5.2% due to increasing use of high-purity white fused alumina in wafer polishing, electronic substrates, insulation components, and precision manufacturing processes that demand minimal contamination and superior material consistency.

- By Distribution Channel

On the basis of distribution channel, the North America White Fused Alumina Market is segmented into direct, indirect. In 2026, the direct segment is expected to dominate the with 65.54% market share due to large industrial buyers preferring direct procurement from manufacturers for assured quality, bulk pricing advantages, and customized product specifications.

The direct segment is expected to grow at the highest CAGR of 3.8% due to increasing long-term supply contracts, closer manufacturer–end-user collaboration, and growing demand for stable supply chains supporting large-scale industrial production.

North America White Fused Alumina Market Insight

The North America White Fused Alumina Market is experiencing steady and strong growth, driven by its well-established industrial base, advanced manufacturing capabilities, and early adoption of high-performance materials across key end-use industries. The region benefits from widespread use of white fused alumina in abrasives, refractories, and metallurgical applications, supported by strong demand from steel, aerospace, automotive, and precision machining sectors. Continuous technological advancements in electric arc furnace processes, strict quality standards, and emphasis on high-purity materials further enhance market development. Additionally, ongoing infrastructure modernization, investments in energy-efficient production, rising demand for advanced ceramics, and strong participation from major manufacturers reinforce North America’s competitive and stable market position during the forecast period.

U.S. North America White Fused Alumina Market Insight

The U.S. is the dominant country in the North American North America White Fused Alumina Market, accounting for 83.07% of the region’s share in 2026, and is projected to grow at a strong CAGR of 3.86% from 2026 to 2033, due to its strong steel and manufacturing industries, advanced abrasive and refractory production, and high demand from aerospace, automotive, and construction sectors. Robust infrastructure investment, technological leadership, and presence of major producers further support market leadership.

Canada North America White Fused Alumina Market Insights

Canada holds 10.72% of the North America White Fused Alumina Market in 2026 and is expected to grow at a CAGR of 3.19% from 2026 to 2033, due to its strong metallurgical and mining base, reliable access to high-quality alumina and energy resources, and well-developed industrial infrastructure. The country supports consistent production of high-purity white fused alumina for abrasives and refractories, driven by demand from metals processing, construction, and manufacturing industries.

North America White Fused Alumina Market Share

The North America White Fused Alumina Market is primarily led by well-established companies, including:

- Washington Mills (USA)

- Motim (Slovakia)

- CUMI (India)

- Henan Ruishi Renewable Resources Group Co.,Ltd. (China)

- U.S. Electrofused Minerals, Inc. (USA)

- Qinai New Materials (China)

- Zhengzhou Yufa Abrasive Group Co., Ltd. (China)

- Fused Minerals Industries LLP (India)

- HarbisonWalker International (HWI) (USA)

- Henan Hongtai Kiln Refractory Co., Ltd. (China)

- Algrain Products Private Limited (India)

- Imerys (France)

- LP Impex (India)

- Shandong Zhongji Metal Products Co., Ltd. (China)

- Alteo Alumina (France)

- Orient Abrasives Ltd. (India)

- Shandong Bosheng New Materials Co., Ltd. (China)

- JSR International (India) Pvt. Ltd. (India)

- Luoyang Hongfeng Abrasives Co., Ltd. (China)

- Zhengzhou Xinli Wear-resistant Materials Co., Ltd. (China)

- Nanping Yi Ze Abrasives & Tools Tech Co (China)

- RUSAL Group (Russia)

- Shandong Honrel Co., Ltd. (China)

- Saint-Gobain (France)

- Cerablast (Germany)

- Sunrise Refractory (Yingkou) Co., Ltd. (China)

- Quarzwerke GmbH (Germany)

- Kuhmichel Abrasiv GmbH (Germany)

- Wedge India (India)

- Zibo Jucos Co., Ltd. (China)

Latest Developments in North America White Fused Alumina Market

- In December 2025, HWI, a member of Calderys, completed construction of its new lightweight monolithics production facility at the Rotary Kiln complex in Fulton, Missouri. The state-of-the-art plant increases lightweight monolithics output capacity by nearly 60 %, incorporates advanced automation (new furnace, robotic packaging and material-handling systems), and is expected to enhance product availability and shorten lead times for customers across the Americas.

- In July 2025, HWI entered a strategic manufacturing partnership with Electrified Thermal Solutions to co-develop and produce electrically conductive firebricks (E-bricks) for Electrified Thermal’s Joule Hive Thermal Battery. The collaboration combines Electrified Thermal’s high-temperature thermal-storage technology with HWI’s refractory expertise to support decarbonized industrial heat applications; the first commercial-scale demonstration was projected for 2025 with a longer-term goal of deploying 2 GW of electrified thermal power by 2030.

- In October 2024, Niche Fused Alumina was acquired by Alteo and integrated into the group as “Alteo Fused Alumina,” following approval of Alteo’s takeover bid by the Commercial Court of Chambéry. The acquisition was positioned as a strategic expansion of Alteo’s specialty alumina operations, reinforcing its North America leadership and supporting sustainable industrial growth with a continued focus on innovation and environmental responsibility.

- In February 2024, Alteo has officially joined the European Cluster of Ceramics based in Limoges, France. This collaboration aims to strengthen Alteo’s presence across key high-tech and industrial sectors — including aerospace, defence, electronics, energy, luxury goods and healthcare — by leveraging the cluster’s network for innovation and industrial development in specialty alumina and technical ceramics markets.

- In September 2024, CUMI completed the acquisition of 100% equity in Silicon Carbide Products LLC (SCP), a U.S.-based firm specializing in advanced ceramics and silicon‑carbide materials. This strategic move strengthens CUMI’s North America presence in the high-performance ceramics and abrasives market, enhancing its technological capabilities and access to North American customers.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE ANALYSIS

4.2 BRAND OUTLOOK

4.3 CONSUMER BUYING BEHAVIOUR

4.4 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.4.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.4.1.1 JOINT VENTURES

4.4.1.2 MERGERS AND ACQUISITIONS

4.4.1.3 LICENSING AND PARTNERSHIP

4.4.1.4 TECHNOLOGY COLLABORATIONS

4.4.1.5 STRATEGIC DIVESTMENTS

4.4.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.4.3 STAGE OF DEVELOPMENT

4.4.4 TIMELINES AND MILESTONES

4.4.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.4.6 RISK ASSESSMENT AND MITIGATION

4.4.7 FUTURE OUTLOOK

4.5 PRICING ANALYSIS

4.6 RAW MATERIAL COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7.4 CONCLUSION

4.8 TECHNOLOGICAL ADVANCEMENTS

4.9 VALUE CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 RAW MATERIAL PROCUREMENT

4.9.3 PRODUCTION / FUSION

4.9.4 PROCESSING & SURFACE TREATMENT

4.9.5 PACKAGING

4.9.6 LOGISTICS & DISTRIBUTION

4.9.7 INDUSTRIAL APPLICATIONS/ END USER DEMAND

4.9.8 CONCLUSION

4.1 VENDOR SELECTION CRITERIA

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING DEMAND FROM IRON & STEEL INDUSTRY

7.1.2 EXPANDING INDUSTRIAL END USE DEMAND OF WHITE FUSED ALUMINA

7.1.3 RISING INDUSTRIALIZATION AND INFRASTRUCTURE INVESTMENTS IN EMERGING MARKETS

7.1.4 RISING DEMAND FROM THE ELECTRONICS SECTOR

7.2 RESTRAINTS

7.2.1 ENVIRONMENTAL REGULATIONS AND COMPLIANCE COSTS

7.2.2 VOLATILITY IN RAW MATERIAL AND ENERGY COST

7.3 OPPORTUNITIES

7.3.1 GROWTH IN NON-FERROUS METALS AND GLASS INDUSTRIES

7.3.2 TECHNOLOGICAL ADVANCEMENTS IN REFRACTORY MANUFACTURING

7.3.3 DEVELOPMENT OF ADVANCED AND SPECIALIZED GRADES

7.4 CHALLENGES

7.4.1 SUPPLY CHAIN DISRUPTIONS AND LOGISTICS CONSTRAINTS

7.4.2 INTENSE COMPETITION AMONG REGIONAL MANUFACTURERS

8 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

8.2.1 MACROGRITS

8.2.2 MICROGRITS & POWDERS

8.2.3 SPECIALTY GRADES

8.2.4 OTHERS

8.3 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

8.3.1 FEPA F

8.3.2 FEPA P

8.3.3 ANSI

8.4 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

8.4.1 COARSE GRADES (F12–F46)

8.4.2 MEDIUM GRADES (F54–F80)

8.4.3 FINE GRADES (F90–F220)

8.5 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

8.5.1 UNTREATED

8.5.2 SILANE/COATED

8.6 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.6.1 ASIA-PACIFIC

8.6.2 EUROPE

8.6.3 NORTH AMERICA

8.6.4 SOUTH AMERICA

8.6.5 MIDDLE EAST & AFRICA

8.7 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

8.7.1 FEPA F MICRO

8.7.2 JIS

8.8 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

8.8.1 10–60 ΜM

8.8.2 1–10 ΜM

8.8.3 SUB-MICRON (D50 < 1 ΜM)

8.9 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

8.9.1 LAPPING

8.9.2 CMP/POLISHING

8.1 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.10.1 ASIA-PACIFIC

8.10.2 EUROPE

8.10.3 NORTH AMERICA

8.10.4 SOUTH AMERICA

8.10.5 MIDDLE EAST & AFRICA

8.11 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

8.11.1 ≥ 99.5% AL2O3

8.11.2 99.0%–99.4% AL2O3

8.11.3 98.0%–98.9% AL2O3

8.12 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

8.12.1 LOW-SODA (NA2O ≤ 0.05%)

8.12.2 ULTRA-LOW-SODA (NA2O ≤ 0.02%)

8.13 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

8.13.1 HIGH-WHITENESS

8.13.2 STANDARD-WHITENESS

8.14 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.14.1 ASIA-PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

8.15 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.15.1 ASIA-PACIFIC

8.15.2 EUROPE

8.15.3 NORTH AMERICA

8.15.4 SOUTH AMERICA

8.15.5 MIDDLE EAST & AFRICA

9 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS

9.1 OVERVIEW

9.2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

9.2.1 ELECTRIC ARC FURNACE

9.2.2 CRUSHING, GRADING & CLASSIFICATION

9.2.3 POST-TREATMENT

9.2.4 OTHERS

9.3 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

9.3.1 FIXED/STATIONARY FURNACE

9.3.2 TILTING FURNACE

9.4 NORTH AMERICA FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 CONTROLLED COOLING (BLOCKY, DENSE)

9.4.2 RAPID QUENCH (MORE FRIABLE)

9.5 NORTH AMERICA TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.5.1 CONTROLLED COOLING (BLOCKY, DENSE)

9.5.2 RAPID QUENCH (MORE FRIABLE)

9.6 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

9.6.1 HIGH-PURITY CALCINED ALUMINA

9.6.2 TABULAR/SEEDING ADDITIVES

9.7 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 NORTH AMERICA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.8.1 SECONDARY PROCESSING

9.8.2 PRIMARY CRUSHING

9.9 NORTH AMERICA SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.9.1 AIR CLASSIFICATION

9.9.2 BALL MILLING

9.9.3 MAGNETIC SEPARATION

9.1 NORTH AMERICA PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.10.1 JAW/IMPACT CRUSHING

9.10.2 ROLLER MILLING

9.11 NORTH AMERICA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA-PACIFIC

9.11.2 EUROPE

9.11.3 NORTH AMERICA

9.11.4 SOUTH AMERICA

9.11.5 MIDDLE EAST & AFRICA

9.12 NORTH AMERICA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.12.1 ACID WASHING/IMPURITY REMOVAL

9.12.2 HEAT TREATMENT/ANNEALING

9.12.3 SURFACE MODIFICATION/COATING

9.13 NORTH AMERICA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.13.1 ASIA-PACIFIC

9.13.2 EUROPE

9.13.3 NORTH AMERICA

9.13.4 SOUTH AMERICA

9.13.5 MIDDLE EAST & AFRICA

9.14 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.14.1 ASIA-PACIFIC

9.14.2 EUROPE

9.14.3 NORTH AMERICA

9.14.4 SOUTH AMERICA

9.14.5 MIDDLE EAST & AFRICA

10 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

10.2.1 CUTTING & GRINDING (ABRASIVE)

10.2.2 REFRACTORY FUNCTION (THERMAL/WEAR RESISTANCE)

10.2.3 CERAMIC ADDITIVE/FILLER

10.2.4 POLISHING & LAPPING

10.2.5 BLASTING & SURFACE PREPARATION

10.2.6 ANTI-SKID/ANTI-SLIP AGGREGATE

10.2.7 OTHERS

10.3 NORTH AMERICA CUTTING & GRINDING (ABRASIVE) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.3.1 ASIA-PACIFIC

10.3.2 EUROPE

10.3.3 NORTH AMERICA

10.3.4 SOUTH AMERICA

10.3.5 MIDDLE EAST & AFRICA

10.4 NORTH AMERICA REFRACTORY FUNCTION (THERMAL/WEAR RESISTANCE)) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.4.1 ASIA-PACIFIC

10.4.2 EUROPE

10.4.3 NORTH AMERICA

10.4.4 SOUTH AMERICA

10.4.5 MIDDLE EAST & AFRICA

10.5 NORTH AMERICA CERAMIC ADDITIVE/FILLER IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 ASIA-PACIFIC

10.5.2 EUROPE

10.5.3 NORTH AMERICA

10.5.4 SOUTH AMERICA

10.5.5 MIDDLE EAST & AFRICA

10.6 NORTH AMERICA POLISHING & LAPPING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.6.1 ASIA-PACIFIC

10.6.2 EUROPE

10.6.3 NORTH AMERICA

10.6.4 SOUTH AMERICA

10.6.5 MIDDLE EAST & AFRICA

10.7 NORTH AMERICA BLASTING & SURFACE PREPARATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 EUROPE

10.7.3 NORTH AMERICA

10.7.4 SOUTH AMERICA

10.7.5 MIDDLE EAST & AFRICA

10.8 NORTH AMERICA ANTI-SKID/ANTI-SLIP AGGREGATE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.8.1 ASIA-PACIFIC

10.8.2 EUROPE

10.8.3 NORTH AMERICA

10.8.4 SOUTH AMERICA

10.8.5 MIDDLE EAST & AFRICA

10.9 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 EUROPE

10.9.3 NORTH AMERICA

10.9.4 SOUTH AMERICA

10.9.5 MIDDLE EAST & AFRICA

11 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.2.1 ABRASIVES

11.2.2 REFRACTORIES

11.2.3 CERAMICS & ADVANCED MATERIALS

11.2.4 POLISHING, LAPPING & FINISHING

11.2.5 OTHERS

11.3 NORTH AMERICA ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 BONDED ABRASIVES

11.3.2 COATED ABRASIVES

11.3.3 BLASTING MEDIA

11.4 NORTH AMERICA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.4.1 VITRIFIED BONDED

11.4.2 RESINOID BONDED

11.5 NORTH AMERICA COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.5.1 BELTS/DISCS/SHEETS

11.5.2 SANDPAPER

11.6 NORTH AMERICA BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.6.1 DRY BLASTING

11.6.2 WET/SLURRY BLASTING

11.7 NORTH AMERICA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.7.1 ASIA-PACIFIC

11.7.2 EUROPE

11.7.3 NORTH AMERICA

11.7.4 SOUTH AMERICA

11.7.5 MIDDLE EAST & AFRICA

11.8 NORTH AMERICA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.8.1 UN-SHAPED/CASTABLES

11.8.2 SHAPED REFRACTORIES

11.9 NORTH AMERICA UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 LOW-CEMENT / ULTRA-LOW CEMENT (LCC/ULCC)

11.9.2 GUNNABLE/RAMMABLE

11.1 NORTH AMERICA SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.10.1 BRICKS

11.10.2 PREFORMS

11.11 NORTH AMERICA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.11.1 ASIA-PACIFIC

11.11.2 EUROPE

11.11.3 NORTH AMERICA

11.11.4 SOUTH AMERICA

11.11.5 MIDDLE EAST & AFRICA

11.12 NORTH AMERICA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.12.1 TECHNICAL CERAMICS

11.12.2 THERMAL SPRAY/PLASMA SPRAY POWDERS

11.13 NORTH AMERICA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.13.1 ASIA-PACIFIC

11.13.2 EUROPE

11.13.3 NORTH AMERICA

11.13.4 SOUTH AMERICA

11.13.5 MIDDLE EAST & AFRICA

11.14 NORTH AMERICA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.14.1 METALS & ALLOYS

11.14.2 GLASS, CRYSTAL, STONE

11.15 NORTH AMERICA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.15.1 ASIA-PACIFIC

11.15.2 EUROPE

11.15.3 NORTH AMERICA

11.15.4 SOUTH AMERICA

11.15.5 MIDDLE EAST & AFRICA

12 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY END USE

12.1 OVERVIEW

12.2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

12.2.1 METALS & METALLURGY

12.2.2 AUTOMOTIVE & TRANSPORTATION

12.2.3 MACHINERY & HEAVY EQUIPMENT

12.2.4 CONSTRUCTION & INFRASTRUCTURE

12.2.5 ENERGY (OIL & GAS, POWER GENERATION)

12.2.6 AEROSPACE & DEFENSE

12.2.7 ELECTRONICS & SEMICONDUCTORS

12.2.8 OTHERS

12.3 NORTH AMERICA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.3.1 STEEL & FOUNDRY

12.3.2 NON-FERROUS METALS

12.4 NORTH AMERICA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.4.1 ASIA-PACIFIC

12.4.2 EUROPE

12.4.3 NORTH AMERICA

12.4.4 SOUTH AMERICA

12.4.5 MIDDLE EAST & AFRICA

12.5 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.5.1 AFTERMARKET/MAINTENANCE

12.5.2 OEM

12.6 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.6.1 ASIA-PACIFIC

12.6.2 EUROPE

12.6.3 NORTH AMERICA

12.6.4 SOUTH AMERICA

12.6.5 MIDDLE EAST & AFRICA

12.7 NORTH AMERICA MACHINERY & HEAVY EQUIPMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.7.1 ASIA-PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

12.8 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.8.1 ASIA-PACIFIC

12.8.2 EUROPE

12.8.3 NORTH AMERICA

12.8.4 SOUTH AMERICA

12.8.5 MIDDLE EAST & AFRICA

12.9 NORTH AMERICA ENERGY (OIL & GAS, POWER GENERATION) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.9.1 ASIA-PACIFIC

12.9.2 EUROPE

12.9.3 NORTH AMERICA

12.9.4 SOUTH AMERICA

12.9.5 MIDDLE EAST & AFRICA

12.1 NORTH AMERICA AEROSPACE & DEFENSE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.10.1 ASIA-PACIFIC

12.10.2 EUROPE

12.10.3 NORTH AMERICA

12.10.4 SOUTH AMERICA

12.10.5 MIDDLE EAST & AFRICA

12.11 NORTH AMERICA ELECTRONICS & SEMICONDUCTORS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.11.1 ASIA-PACIFIC

12.11.2 EUROPE

12.11.3 NORTH AMERICA

12.11.4 SOUTH AMERICA

12.11.5 MIDDLE EAST & AFRICA

12.12 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.12.1 ASIA-PACIFIC

12.12.2 EUROPE

12.12.3 NORTH AMERICA

12.12.4 SOUTH AMERICA

12.12.5 MIDDLE EAST & AFRICA

13 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

13.2.1 DIRECT

13.2.2 INDIRECT

13.3 NORTH AMERICA DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.3.1 MANUFACTURER TO END-USER

13.3.2 MANUFACTURER TO REFRACTORY INSTALLATION COMPANIES

13.3.3 MANUFACTURER TO EPC / ENGINEERING FIRMS

13.4 NORTH AMERICA DIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.4.1 ASIA-PACIFIC

13.4.2 EUROPE

13.4.3 NORTH AMERICA

13.4.4 SOUTH AMERICA

13.4.5 MIDDLE EAST & AFRICA

13.5 NORTH AMERICA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.5.1 DISTRIBUTORS / WHOLESALERS

13.5.2 RETAILERS / DEALERS

13.5.3 ONLINE SALES / E-COMMERCE PLATFORMS

13.6 NORTH AMERICA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.6.1 ASIA-PACIFIC

13.6.2 EUROPE

13.6.3 NORTH AMERICA

13.6.4 SOUTH AMERICA

13.6.5 MIDDLE EAST & AFRICA

14 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA WHITE FUSED ALUMINA MARKET

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 COMPANY PROFILES

16.1 MANUFACTURER

16.1.1 IMERYS S.A.

16.1.1.1 COMPANY SNAPSHOT

16.1.1.2 REVENUE ANALYSIS

16.1.1.3 COMPANY SHARE ANALYSIS

16.1.1.4 PRODUCT PORTFOLIO

16.1.1.5 RECENT DEVELOPMENT

16.1.2 WASHINGTON MILLS

16.1.2.1 COMPANY SNAPSHOT

16.1.2.2 COMPANY SHARE ANALYSIS

16.1.2.3 PRODUCT PORTFOLIO

16.1.2.4 RECENT DEVELOPMENT

16.1.3 SAINT-GOBAIN

16.1.3.1 COMPANY SNAPSHOT

16.1.3.2 REVENUE ANALYSIS

16.1.3.3 COMPANY SHARE ANALYSIS

16.1.3.4 PRODUCT PORTFOLIO

16.1.3.5 RECENT DEVELOPMENT

16.1.4 RUSAL

16.1.4.1 COMPANY SNAPSHOT

16.1.4.2 REVENUE ANALYSIS

16.1.4.3 PRODUCT PORTFOLIO

16.1.4.4 RECENT DEVELOPMENT

16.1.5 HWI

16.1.5.1 COMPANY SNAPSHOT

16.1.5.2 PRODUCT PORTFOLIO

16.1.5.3 RECENT DEVELOPMENT

16.1.6 ALGRAIN

16.1.6.1 COMPANY SNAPSHOT

16.1.6.2 PRODUCT PORTFOLIO

16.1.6.3 RECENT DEVELOPMENT

16.1.7 ALTEO FUSED ALUMINA

16.1.7.1 COMPANY SNAPSHOT

16.1.7.2 PRODUCT PORTFOLIO

16.1.7.3 RECENT DEVELOPMENT

16.1.8 CERABLAST

16.1.8.1 COMPANY SNAPSHOT

16.1.8.2 PRODUCT PORTFOLIO

16.1.8.3 RECENT DEVELOPMENT

16.1.9 CUMI

16.1.9.1 COMPANY SNAPSHOT

16.1.9.2 REVENUE ANALYSIS

16.1.9.3 PRODUCT PORTFOLIO

16.1.9.4 RECENT DEVELOPMENT

16.1.10 FUSED MINERALS INTERNATIONAL

16.1.10.1 COMPANY SNAPSHOT

16.1.10.2 PRODUCT PORTFOLIO

16.1.10.3 RECENT DEVELOPMENT

16.1.11 HENAN HONGTAI KILN REFRACTORY CO.,LTD.

16.1.11.1 COMPANY SNAPSHOT

16.1.11.2 PRODUCT PORTFOLIO

16.1.11.3 RECENT DEVELOPMENT

16.1.12 HENAN RUISHI RENEWABLE RESOURCES GROUP CO., LTD.

16.1.12.1 COMPANY SNAPSHOT

16.1.12.2 PRODUCT PORTFOLIO

16.1.12.3 RECENT DEVELOPMENT

16.1.13 JSR INTERNATIONAL(INDIA) PRIVATE LIMITED

16.1.13.1 COMPANY SNAPSHOT

16.1.13.2 PRODUCT PORTFOLIO

16.1.13.3 RECENT DEVELOPMENT

16.1.14 KUHMICHEL ABRASIV GMBH

16.1.14.1 COMPANY SNAPSHOT

16.1.14.2 PRODUCT PORTFOLIO

16.1.14.3 RECENT DEVELOPMENT

16.1.15 LP IMPEX

16.1.15.1 COMPANY SNAPSHOT

16.1.15.2 PRODUCT PORTFOLIO

16.1.15.3 RECENT DEVELOPMENT

16.1.16 LUOYANG HONGFENG ABRASIVES CO., LTD

16.1.16.1 COMPANY SNAPSHOT

16.1.16.2 PRODUCT PORTFOLIO

16.1.16.3 RECENT DEVELOPMENT

16.1.17 LUOYANG SUNRISE ABRASIVES CO., LTD.

16.1.17.1 COMPANY SNAPSHOT

16.1.17.2 PRODUCT PORTFOLIO

16.1.17.3 RECENT DEVELOPMENT

16.1.18 MOTIM

16.1.18.1 COMPANY SNAPSHOT

16.1.18.2 PRODUCT PORTFOLIO

16.1.18.3 RECENT DEVELOPMENT

16.1.19 NANPING YI ZE ABRASIVES & TOOLS TECH CO., LTD.

16.1.19.1 COMPANY SNAPSHOT

16.1.19.2 PRODUCT PORTFOLIO

16.1.19.3 RECENT DEVELOPMENT

16.1.20 ORIENT CERATECH LIMITED

16.1.20.1 COMPANY SNAPSHOT

16.1.20.2 REVENUE ANALYSIS

16.1.20.3 PRODUCT PORTFOLIO

16.1.20.4 RECENT DEVELOPMENT

16.1.21 QUARZWERKE GMBH

16.1.21.1 COMPANY SNAPSHOT

16.1.21.2 PRODUCT PORTFOLIO

16.1.21.3 RECENT DEVELOPMENT

16.1.22 QINAI NEW MATERIALS CO. LTD.

16.1.22.1 COMPANY SNAPSHOT

16.1.22.2 PRODUCT PORTFOLIO

16.1.22.3 RECENT DEVELOPMENT

16.1.23 SHANDONG BOSHENG NEW MATERIALS CO., LTD.

16.1.23.1 COMPANY SNAPSHOT

16.1.23.2 PRODUCT PORTFOLIO

16.1.23.3 RECENT DEVELOPMENT

16.1.24 SHANDONG HONREL CO., LTD

16.1.24.1 COMPANY SNAPSHOT

16.1.24.2 PRODUCT PORTFOLIO

16.1.24.3 RECENT DEVELOPMENT

16.1.25 SHANDONG ZHONGJI METAL PRODUCTS CO., LTD

16.1.25.1 COMPANY SNAPSHOT

16.1.25.2 PRODUCT PORTFOLIO

16.1.25.3 RECENT DEVELOPMENT

16.1.26 U.S. ELECTROFUSED MINERALS, INC.

16.1.26.1 COMPANY SNAPSHOT

16.1.26.2 PRODUCT PORTFOLIO

16.1.26.3 RECENT DEVELOPMENT

16.1.27 WEDGE INDIA

16.1.27.1 COMPANY SNAPSHOT

16.1.27.2 PRODUCT PORTFOLIO

16.1.27.3 RECENT DEVELOPMENT

16.1.28 ZHENGZHOU XINLI WEAR-RESISTANT MATERIALS CO. LTD.

16.1.28.1 COMPANY SNAPSHOT

16.1.28.2 PRODUCT PORTFOLIO

16.1.28.3 RECENT DEVELOPMENT

16.1.29 ZHENGZHOU YUFA ABRASIVE GROUP CO., LTD.

16.1.29.1 COMPANY SNAPSHOT

16.1.29.2 PRODUCT PORTFOLIO

16.1.29.3 RECENT DEVELOPMENT

16.1.30 ZIBO JUCOS CO.,LTD.

16.1.30.1 COMPANY SNAPSHOT

16.1.30.2 PRODUCT PORTFOLIO

16.1.30.3 RECENT DEVELOPMENT

16.2 DISTRIBUTOR

16.2.1 CALDERYS DISTRIBUTION.

16.2.1.1 COMPANY SNAPSHOT

16.2.1.2 PRODUCT PORTFOLIO

16.2.1.3 RECENT DEVELOPMENT

16.2.2 HWI DISTRIBUTION GROUP.

16.2.2.1 COMPANY SNAPSHOT

16.2.2.2 PRODUCT PORTFOLIO

16.2.2.3 RECENT DEVELOPMENT

16.2.3 LUOYANG ZHONGSEN REFRACTORY CO., LTD.

16.2.3.1 COMPANY SNAPSHOT

16.2.3.2 PRODUCT PORTFOLIO

16.2.3.3 RECENT DEVELOPMENT

16.2.4 PRATAP CORPORATION

16.2.4.1 COMPANY SNAPSHOT

16.2.4.2 PRODUCT PORTFOLIO

16.2.4.3 RECENT DEVELOPMENT

16.2.5 VESAVIUS

16.2.5.1 COMPANY SNAPSHOT

16.2.5.2 REVENUE ANALYSIS

16.2.5.3 PRODUCT PORTFOLIO

16.2.5.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTSR

List of Table

TABLE 1 PRICING ANALYSIS

TABLE 2 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 3 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 4 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 5 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 6 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 8 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 9 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 10 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 12 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 13 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 14 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 17 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 NORTH AMERICA FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 NORTH AMERICA TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 21 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 NORTH AMERICA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 NORTH AMERICA SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 NORTH AMERICA PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 NORTH AMERICA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 NORTH AMERICA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 NORTH AMERICA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 30 NORTH AMERICA CUTTING & GRINDING (ABRASIVE) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 NORTH AMERICA REFRACTORY FUNCTION (THERMAL/WEAR RESISTANCE)) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 NORTH AMERICA CERAMIC ADDITIVE/FILLER IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 NORTH AMERICA POLISHING & LAPPING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 NORTH AMERICA BLASTING & SURFACE PREPARATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 NORTH AMERICA ANTI-SKID/ANTI-SLIP AGGREGATE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 38 NORTH AMERICA ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 NORTH AMERICA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 NORTH AMERICA COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 NORTH AMERICA BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 NORTH AMERICA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 NORTH AMERICA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 NORTH AMERICA UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 NORTH AMERICA SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 NORTH AMERICA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 NORTH AMERICA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 NORTH AMERICA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 NORTH AMERICA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 NORTH AMERICA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 51 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 52 NORTH AMERICA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 NORTH AMERICA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 NORTH AMERICA MACHINERY & HEAVY EQUIPMENT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 57 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 58 NORTH AMERICA ENERGY (OIL & GAS, POWER GENERATION) IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 59 NORTH AMERICA AEROSPACE & DEFENSE IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 NORTH AMERICA ELECTRONICS & SEMICONDUCTORS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 61 NORTH AMERICA OTHERS IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 62 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 63 NORTH AMERICA DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 NORTH AMERICA DIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 65 NORTH AMERICA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 NORTH AMERICA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 67 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 68 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 69 NORTH AMERICA

TABLE 70 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 72 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 73 NORTH AMERICA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 74 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 75 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 76 NORTH AMERICA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 77 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 78 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 79 NORTH AMERICA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 80 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 81 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 NORTH AMERICA FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 NORTH AMERICA TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 NORTH AMERICA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 85 NORTH AMERICA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 NORTH AMERICA SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 NORTH AMERICA PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 NORTH AMERICA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 90 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 91 NORTH AMERICA ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 NORTH AMERICA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 NORTH AMERICA COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 NORTH AMERICA BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 NORTH AMERICA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 NORTH AMERICA UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 NORTH AMERICA SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 NORTH AMERICA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 NORTH AMERICA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 101 NORTH AMERICA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 104 NORTH AMERICA DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 NORTH AMERICA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 U.S. WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 U.S. MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 108 U.S. MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 109 U.S. MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 110 U.S. MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 111 U.S. MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 112 U.S. MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 113 U.S. SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 114 U.S. SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 115 U.S. SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 116 U.S. WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 117 U.S. ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 U.S. FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 U.S. TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 U.S. ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 121 U.S. CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 U.S. SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 U.S. PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 U.S. POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 U.S. WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 126 U.S. WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 127 U.S. ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 U.S. BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 U.S. COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 U.S. BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 U.S. REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 U.S. UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 U.S. SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 U.S. CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 U.S. POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 U.S. WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 137 U.S. METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 U.S. AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 U.S. WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 140 U.S. DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 U.S. INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 CANADA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 CANADA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 144 CANADA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 145 CANADA MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 146 CANADA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 147 CANADA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 148 CANADA MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 149 CANADA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 150 CANADA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 151 CANADA SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 152 CANADA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 153 CANADA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 CANADA FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 CANADA TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 CANADA ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 157 CANADA CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 CANADA SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 CANADA PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 CANADA POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 CANADA WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 162 CANADA WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 163 CANADA ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 CANADA BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 CANADA COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 CANADA BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 CANADA REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 CANADA UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 CANADA SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 CANADA CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 CANADA POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 CANADA WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 173 CANADA METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 CANADA AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 CANADA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 176 CANADA DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 CANADA INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 MEXICO WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 MEXICO MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 180 MEXICO MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SIZE DESIGNATIONS, 2018-2033 (USD THOUSAND)

TABLE 181 MEXICO MACROGRITS IN WHITE FUSED ALUMINA MARKET, BY SURFACE TREATMENT, 2018-2033 (USD THOUSAND)

TABLE 182 MEXICO MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY STANDARDS, 2018-2033 (USD THOUSAND)

TABLE 183 MEXICO MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY PARTICLE SIZE RANGE, 2018-2033 (USD THOUSAND)

TABLE 184 MEXICO MICROGRITS & POWDERS IN WHITE FUSED ALUMINA MARKET, BY POLISHING/FINISHING GRADES, 2018-2033 (USD THOUSAND)

TABLE 185 MEXICO SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY PURITY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 186 MEXICO SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY SODIUM CONTENT, 2018-2033 (USD THOUSAND)

TABLE 187 MEXICO SPECIALTY GRADES IN WHITE FUSED ALUMINA MARKET, BY COLOR/WHITENESS INDEX, 2018-2033 (USD THOUSAND)

TABLE 188 MEXICO WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2018-2033 (USD THOUSAND)

TABLE 189 MEXICO ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FURNACE TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 MEXICO FIXED/STATIONARY FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 MEXICO TILTING FURNACE IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 MEXICO ELECTRIC ARC FURNACE IN WHITE FUSED ALUMINA MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 193 MEXICO CRUSHING, GRADING & CLASSIFICATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 MEXICO SECONDARY PROCESSING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 MEXICO PRIMARY CRUSHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 MEXICO POST-TREATMENT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 MEXICO WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2018-2033 (USD THOUSAND)

TABLE 198 MEXICO WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 199 MEXICO ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 MEXICO BONDED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 MEXICO COATED ABRASIVES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 MEXICO BLASTING MEDIA IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 MEXICO REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 MEXICO UN-SHAPED/CASTABLES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 MEXICO SHAPED REFRACTORIES IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 MEXICO CERAMICS & ADVANCED MATERIALS IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 MEXICO POLISHING, LAPPING & FINISHING IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 MEXICO WHITE FUSED ALUMINA MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 209 MEXICO METALS & METALLURGY IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 MEXICO AUTOMOTIVE & TRANSPORTATION IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 MEXICO WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 212 MEXICO DIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 MEXICO INDIRECT IN WHITE FUSED ALUMINA MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA WHITE FUSED ALUMINA MARKET

FIGURE 2 NORTH AMERICA WHITE FUSED ALUMINA MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WHITE FUSED ALUMINA MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WHITE FUSED ALUMINA MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WHITE FUSED ALUMINA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WHITE FUSED ALUMINA MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA WHITE FUSED ALUMINA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA WHITE FUSED ALUMINA MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA WHITE FUSED ALUMINA MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA WHITE FUSED ALUMINA MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY: OVERVIEW

FIGURE 12 SIX SEGMENTS COMPRISE THE NORTH AMERICA WHITE FUSED ALUMINA MARKET: BY TYPE

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 INCREASING DEMAND FROM IRON & STEEL INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA WHITE FUSED ALUMINA MARKET IN THE FORECAST PERIOD (2026-2033)

FIGURE 15 THE MACROGRITS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WHITE FUSED ALUMINA MARKET IN 2026 AND 2033

FIGURE 16 DROC ANALYSIS

FIGURE 17 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY PRODUCT TYPE, 2025

FIGURE 18 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY MANUFACTURING PROCESS, 2025

FIGURE 19 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY FUNCTION, 2025

FIGURE 20 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY APPLICATION, 2025

FIGURE 21 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY END USE, 2025

FIGURE 22 NORTH AMERICA WHITE FUSED ALUMINA MARKET, BY DISTRIBUTION CHANNEL, 2025

FIGURE 23 NORTH AMERICA WHITE FUSED ALUMINA MARKET SNAPSHOTS

FIGURE 24 NORTH AMERICA WHITE FUSED ALUMINA MARKET: COMPANY SHARE 2025 (%)

North America White Fused Alumina Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America White Fused Alumina Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America White Fused Alumina Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.