North America Wound Debridement Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.77 Billion

USD

4.47 Billion

2024

2032

USD

1.77 Billion

USD

4.47 Billion

2024

2032

| 2025 –2032 | |

| USD 1.77 Billion | |

| USD 4.47 Billion | |

|

|

|

|

North America Wound Debridement Devices Market Size

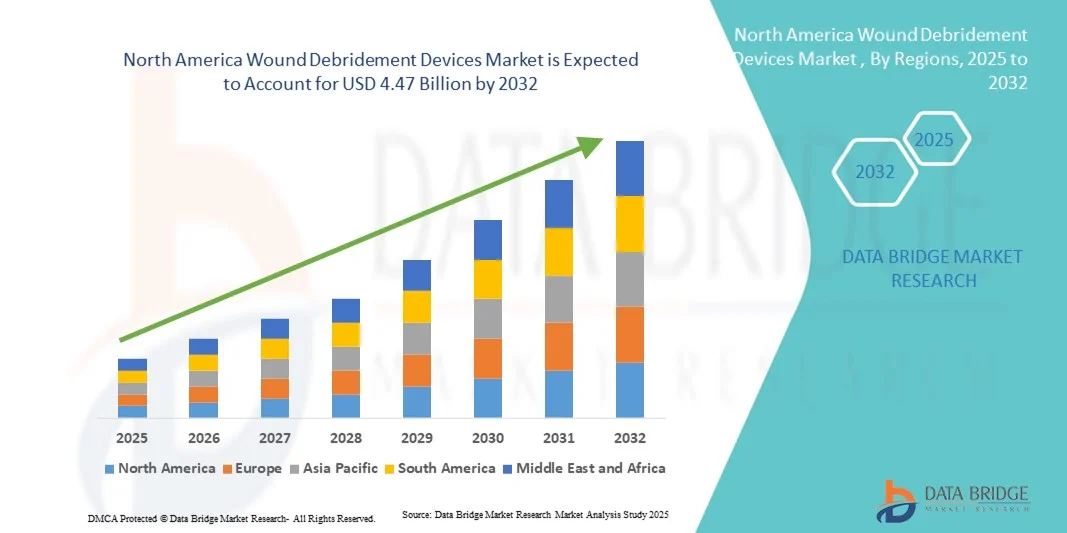

- The North America wound debridement devices market size was valued at USD 1.77 billion in 2024 and is expected to reach USD 4.47 billion by 2032, at a CAGR of 12.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic wounds, diabetic ulcers, and pressure sores, which are driving the demand for advanced wound care solutions

- Furthermore, advancements in wound debridement technologies, including ultrasonic, hydrosurgical, and mechanical devices, coupled with rising adoption in hospitals, specialty clinics, and homecare settings, are accelerating the uptake of wound debridement device solutions, thereby significantly boosting the industry's growth

North America Wound Debridement Devices Market Analysis

- Wound debridement devices, including mechanical, enzymatic, autolytic, and surgical tools, are increasingly vital components of modern wound care management in hospitals, clinics, and homecare settings due to their efficiency in removing necrotic tissue, preventing infections, and promoting faster healing

- The escalating demand for wound debridement devices is primarily fueled by the rising prevalence of chronic wounds, diabetes, and pressure ulcers, growing adoption of advanced wound care technologies, and increasing awareness among healthcare providers regarding patient outcomes and infection control

- U.S. dominated the North America wound debridement devices market with the largest revenue share of 81.5% in 2024, characterized by advanced healthcare infrastructure, high adoption of technologically advanced wound care solutions, and strong presence of key industry players, with experiencing substantial growth in wound debridement device usage across hospitals, specialty clinics, and outpatient centers

- Canada is expected to be the fastest growing country in the North America wound debridement devices market during the forecast period, driven by government initiatives to improve chronic wound management, increasing investment in homecare services, and rising awareness of advanced wound care solutions among clinicians

- The Diabetic Foot Ulcers segment dominated the North America wound debridement devices market with the largest market revenue share of 42.5% in 2024, driven by the growing diabetic population, high infection risk, and the critical need for timely intervention

Report Scope and Wound Debridement Devices Market Segmentation

|

Attributes |

Wound Debridement Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Wound Debridement Devices Market Trends

Rising Demand for Advanced Wound Care Solutions

- A significant and accelerating trend in the wound debridement devices market is the growing adoption of advanced wound care technologies, including mechanized debridement tools, ultrasonic devices, and hydrosurgical systems. These innovations are significantly improving clinical outcomes, reducing procedure times, and enhancing patient comfort

- For instance, mechanized wound debridement devices allow precise removal of necrotic tissue while minimizing damage to surrounding healthy tissue, enabling faster healing and reducing infection risks. Similarly, ultrasonic wound debridement devices provide efficient tissue removal, while also promoting localized blood flow and stimulating tissue regeneration

- Integration of these devices into hospital wound care protocols and homecare services is enhancing overall treatment efficiency and patient recovery rates. The trend toward minimally invasive, user-friendly, and highly effective debridement solutions is reshaping expectations in wound management practices

- Companies such as Smith & Nephew, Medline, and Mölnlycke are introducing innovative devices with improved ergonomics, portability, and enhanced precision, further accelerating adoption across hospitals, clinics, and homecare settings

- The demand for more advanced, efficient, and versatile wound debridement devices is rapidly increasing across both acute care and chronic wound management segments, as healthcare providers aim to reduce complications, improve patient outcomes, and optimize operational efficiency

North America Wound Debridement Devices Market Dynamics

Driver

Growing Prevalence of Chronic Wounds and Increasing Healthcare Expenditure

- The increasing prevalence of chronic wounds, diabetic ulcers, and pressure injuries globally is a significant driver for the rising demand for wound debridement devices. The aging population, combined with higher incidence of diabetes and vascular diseases, is escalating the need for effective wound care solutions

- For instance: In April 2024, Smith & Nephew launched a next-generation hydrosurgical debridement system designed to provide rapid and precise wound cleaning, demonstrating the growing investment by key companies in innovative technologies. Such initiatives are expected to propel market growth in the forecast period

- Healthcare providers are increasingly adopting mechanized and advanced debridement devices to reduce healing times, minimize hospital stays, and improve patient quality of life

- Furthermore, rising healthcare expenditure in developed and emerging markets, alongside the expansion of hospital networks and wound care centers, is fostering higher adoption of wound debridement devices

- The convenience, clinical efficiency, and safety offered by these devices for treating complex wounds are key factors driving adoption across hospitals, specialty clinics, and homecare services. The ongoing trend toward evidence-based wound management practices further supports market growth

Restraint/Challenge

High Costs and Limited Awareness in Developing Regions

- The relatively high cost of advanced wound debridement devices compared to conventional wound care methods poses a barrier to adoption, particularly in price-sensitive regions. This cost factor can limit widespread implementation in smaller clinics or low-resource healthcare settings

- Limited awareness and training among healthcare professionals regarding the proper use of mechanized and hydrosurgical debridement devices is another challenge, affecting adoption rates in certain markets

- Addressing these challenges through comprehensive training programs, awareness campaigns, and the development of more cost-effective devices is crucial for expanding the market. Leading companies such as Medline and Mölnlycke are emphasizing education initiatives and simplified device designs to improve accessibility and usability

- While prices are gradually decreasing for certain devices, the perceived premium for advanced wound debridement technology can still hinder adoption, especially where traditional manual methods are deeply entrenched

- Overcoming these barriers through reimbursement support, awareness programs, and technological innovation will be vital for sustained growth in the wound debridement devices market, ensuring broader accessibility and improved patient outcomes globally

North America Wound Debridement Devices Market Scope

The market is segmented on the basis of product, wound type, and end user.

- By Product

On the basis of product, the North America wound debridement devices market is segmented into Hydrosurgical Debridement Devices, Low Frequency Ultrasound Devices, Surgical Wound Debridement Devices, Mechanical Debridement Pads, Traditional Wound Debridement Devices, and Larval Therapy. The Hydrosurgical Debridement Devices segment dominated the largest market revenue share of 38.7% in 2024, driven by its precision in removing necrotic tissue while preserving healthy tissue, faster procedure times, and widespread adoption in hospitals and specialized wound care centers. The segment benefits from increasing clinician awareness about hydrosurgical advantages, regulatory approvals, improved ergonomics, and compatibility with multiple wound types. Hospitals prefer this method due to higher patient throughput, better infection control, and alignment with advanced wound care protocols. The availability of comprehensive training programs, growing reimbursement support, and incorporation into clinical guidelines for diabetic foot ulcers, burns, and pressure ulcers further reinforce its dominance. Increasing adoption in both acute and chronic wound management settings ensures continued growth and stable market leadership through 2024.

The Low Frequency Ultrasound Devices segment is anticipated to witness the fastest CAGR of 9.8% from 2025 to 2032, fueled by rising adoption in outpatient and homecare settings, chronic wound prevalence, and its ability to enhance tissue regeneration and perfusion. These devices are particularly effective for diabetic foot ulcers, pressure ulcers, and venous leg ulcers, where conventional debridement methods may be slower or less efficient. Technological advancements such as portable and handheld designs, user-friendly interfaces, and reduced procedure times support rapid adoption. Clinician awareness campaigns, growing patient demand for minimally invasive procedures, and expanding reimbursement coverage further accelerate growth. The segment is also benefiting from increasing clinical studies validating efficacy, enhanced product availability across hospitals and specialized clinics, and integration with telehealth platforms for follow-up care, positioning it as the fastest-growing product segment in North America.

- By Wound Type

On the basis of wound type, the North America wound debridement devices market is segmented into Diabetic Foot Ulcers, Venous Leg Ulcers, Pressure Ulcers, Burns, and Other Wounds. The Diabetic Foot Ulcers segment held the largest market revenue share of 42.5% in 2024, driven by the growing diabetic population, high infection risk, and the critical need for timely intervention. Hospitals and specialized clinics focus on advanced debridement to prevent complications, reduce amputations, and promote healing. Government healthcare programs, clinical guidelines, and insurance reimbursement for chronic wound management strengthen this segment’s dominance. The preference for combined treatment protocols, including surgical and hydrosurgical debridement, alongside innovations in wound dressings and monitoring devices, further supports leadership. Early diagnosis, integrated wound care teams, and patient education initiatives contribute to higher adoption rates. Increasing awareness among clinicians and patients ensures continuous demand across North America.

The Burns segment is expected to witness the fastest CAGR of 10.2% from 2025 to 2032, due to rising awareness of specialized burn care, increased prevalence of burn injuries in hospitals, and adoption of advanced debridement techniques suitable for severe skin trauma. Hospitals and burn units are adopting minimally invasive and precise debridement devices for better outcomes. Portable and handheld devices enhance accessibility in outpatient and homecare environments. Technological improvements, enhanced sterilization protocols, and integration with post-operative care plans further support segment growth. Expansion of pediatric and adult burn treatment centers, combined with increasing healthcare spending, contributes to rapid adoption. Rising clinical training programs, government support for burn management, and focus on faster patient recovery reinforce the Burns segment as the fastest-growing wound type.

- By End User

On the basis of end user, the North America wound debridement devices market is segmented into Hospitals, Ambulatory Surgical Centers, Specialized Clinics, Nursing Facilities, and Other End Users. The Hospitals segment dominated the largest market revenue share of 51.3% in 2024, driven by the high volume of chronic and acute wound cases, availability of skilled clinicians, and access to advanced debridement technologies. Hospitals benefit from structured wound care protocols, integration of multidisciplinary teams, and both inpatient and outpatient treatment options. Investments in state-of-the-art wound care units, insurance coverage, and comprehensive training for clinicians further strengthen dominance. Hospitals also adopt hydrosurgical and ultrasound devices for complex wounds, enhancing patient outcomes. The segment’s leadership is reinforced by hospital preference for evidence-based treatment, regulatory compliance, and higher adoption rates for expensive, high-efficiency devices. Government initiatives for chronic wound management and hospital-acquired infection control policies contribute to sustained growth and high market share.

The Ambulatory Surgical Centers segment is projected to witness the fastest CAGR of 9.5% from 2025 to 2032, driven by increasing outpatient wound care demand, cost-effectiveness compared to hospital settings, and patient preference for shorter, convenient procedures. Portable and minimally invasive debridement devices allow high-quality treatment in ambulatory environments. Expansion of outpatient services, growing awareness of advanced wound care techniques, and integration with telehealth for follow-up care support rapid adoption. Technological innovations, simplified training for clinicians, and faster procedure turnaround time contribute to segment growth. Rising insurance coverage for outpatient care, increased patient inflow, and growing prevalence of chronic wounds in non-hospital settings further reinforce Ambulatory Surgical Centers as the fastest-growing end-user segment in North America.

North America Wound Debridement Devices Market Regional Analysis

- U.S. dominated the North America wound debridement devices market with the largest revenue share of 81.5% in 2024, characterized by advanced healthcare infrastructure, high adoption of technologically advanced wound care solutions, and strong presence of key industry players, with experiencing substantial growth in wound debridement device usage across hospitals, specialty clinics, and outpatient centers

- Canada is expected to be the fastest growing country in the North America wound debridement devices market during the forecast period, driven by government initiatives to improve chronic wound management, increasing investment in homecare services, and rising awareness of advanced wound care solutions among clinicians

- High healthcare expenditure, well-established hospital networks, and increasing focus on improving patient outcomes are further supporting the widespread adoption of wound debridement devices across both acute and chronic wound care segments

U.S. Wound Debridement Devices Market Insight

The U.S. wound debridement devices market captured the largest revenue share of 81.5% in North America in 2024, fueled by advanced healthcare infrastructure, high adoption of innovative wound care technologies, and robust presence of leading industry players. Substantial growth is observed in hospitals, specialty clinics, and outpatient care centers, driven by increasing demand for efficient wound management solutions, rising prevalence of chronic wounds, and a focus on minimizing complications and accelerating patient recovery.

Canada Wound Debridement Devices Market Insight

The Canada wound debridement devices market is expected to be the fastest-growing country in the Wound Debridement Devices market during the forecast period, propelled by government initiatives to improve chronic wound management, rising investment in homecare services, and increasing clinician awareness regarding the benefits of advanced wound care technologies. Growth is further supported by expanding healthcare infrastructure and the adoption of innovative devices to enhance treatment efficiency and patient outcomes across hospitals and specialty care centers.

North America Wound Debridement Devices Market Share

The Wound Debridement Devices industry is primarily led by well-established companies, including:

- Smith+Nephew (U.K.)

- Medtronic (Ireland)

- Zimmer Biomet (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Abbott (U.S.)

- B. Braun SE (Germany)

- Mölnlycke Health Care AB (Sweden)

- Coloplast Group (Denmark)

- Organogenesis Inc. (U.S.)

- Bioventus LLC. (U.S.)

- Hollister Incorporated (U.S.)

- Lohmann & Rauscher GmbH & Co. KG (Germany)

- Arobella Medical (U.S.)

- Essity Aktiebolag (Sweden)

- Advanced Medical Solutions Group plc (U.K.)

- Brightwake Ltd (U.K.)

- BioMonde (U.K.)

- DeRoyal Industries, Inc. (U.S.)

- Italia Medica SRL (Italy)

- Söring GmbH (Germany)

- Olympus Corporation (Japan)

Latest Developments in North America Wound Debridement Devices Market

- In October 2022, Reprise Biomedical announced the U.S. launch of Miro3D, a three-dimensional resorbable wound matrix designed to treat deep and tunneling wounds. This biologic matrix aims to enhance healing by providing structural support and promoting tissue regeneration in complex wound sites

- In February 2023, researchers developed the first flexible, stretchable e-bandage capable of accelerating healing by 30%. The bandage delivers electrotherapy directly to the wound site and biodegrades once healing is complete, representing a breakthrough in advanced wound care

- In September 2024, Solventum launched the V.A.C. Peel and Place Dressing, an integrated dressing and drape that can be applied in less than two minutes and worn by patients for up to seven days. This innovation aims to streamline the application process and improve patient comfort during negative pressure wound therapy

- In May 2025, Summit Products Group officially launched, announcing a strategic alliance with NovaBone Products, a leading developer of regenerative medicine biomaterials. This collaboration focuses on transforming surgical and regenerative wound care by providing providers with new surgical options designed to support precision and regeneration in the operating room

- In September 2025, the Woundcare Offloading Through Automated Debridement (WOTAD) project was initiated in Denmark. The project aims to develop, produce, and test a robot for fully automatic debridement of chronic wounds. The Flash-Clean robot will provide water and laser treatment, offering a gentler alternative to surgical debridement and potentially accelerating the healing process

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.