North America X Ray Systems Market

Market Size in USD Billion

CAGR :

%

USD

2.97 Billion

USD

3.73 Billion

2024

2032

USD

2.97 Billion

USD

3.73 Billion

2024

2032

| 2025 –2032 | |

| USD 2.97 Billion | |

| USD 3.73 Billion | |

|

|

|

|

North America X-Ray Systems Market Size

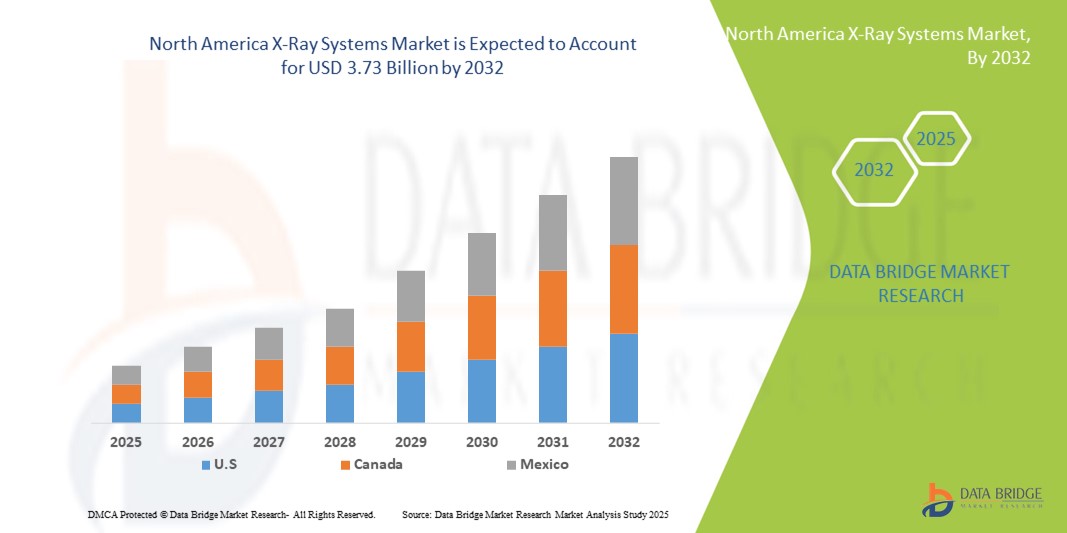

- The North America X-ray systems market size was valued at USD 2.97 billion in 2024 and is expected to reach USD 3.73 billion by 2032, at a CAGR of 2.89% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced diagnostic imaging technologies, rising prevalence of chronic diseases, and ongoing healthcare infrastructure development across the region

- Furthermore, growing demand for high-quality, efficient, and portable X-ray systems in hospitals, clinics, and diagnostic centers is positioning X-ray technology as a critical tool for accurate and timely medical diagnosis. These converging factors are accelerating the adoption of X-ray solutions, thereby significantly driving the market’s expansion

North America X-Ray Systems Market Analysis

- X-ray systems, providing advanced imaging solutions for medical diagnostics, are increasingly vital components of modern healthcare infrastructure in hospitals, diagnostic centers, and specialty clinics due to their high accuracy, efficiency, and integration with hospital information systems

- The escalating demand for X-ray systems is primarily fueled by the rising prevalence of chronic diseases, increasing patient volumes, and growing adoption of advanced imaging technologies such as digital radiography and portable X-ray units

- The United States dominated the North America X-ray systems market with the largest revenue share of 53.2% in 2024, characterized by well-established healthcare infrastructure, high healthcare expenditure, and the presence of major imaging technology providers, with substantial growth in X-ray system installations, particularly in outpatient and specialty care facilities, driven by innovations in AI-assisted imaging and low-dose radiation technologies

- Canada is expected to be the fastest growing country in the North America X-ray systems market during the forecast period due to expanding healthcare facilities, increasing investments in medical imaging technologies, and rising demand for diagnostic services

- Digital X-Ray segment dominated the North America X-ray systems market with a market share of 46% in 2024, driven by its superior image quality, reduced radiation exposure, and faster processing compared to conventional analog systems

Report Scope and North America X-Ray Systems Market Segmentation

|

Attributes |

North America X-Ray Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America X-Ray Systems Market Trends

Advancements in AI-Enabled Imaging and Portable X-Ray Solutions

- A significant and accelerating trend in the North America X-ray systems market is the integration of artificial intelligence (AI) and machine learning algorithms into imaging workflows, enhancing diagnostic accuracy, workflow efficiency, and early disease detection capabilities

- For instance, GE Healthcare’s Revolution XRd system leverages AI to optimize image quality while reducing radiation exposure, and Canon Medical’s RadPRO software uses AI to assist radiologists in identifying anomalies more quickly and accurately

- AI integration enables features such as automated image analysis, predictive diagnostics, and intelligent alert systems for radiologists, improving patient outcomes and operational efficiency. Portable X-ray units, such as Fujifilm’s FDR Xair, allow bedside imaging and rapid diagnostics in emergency and outpatient settings

- The integration of AI-enabled X-ray systems with hospital information systems and PACS platforms facilitates centralized data management, streamlined reporting, and easier collaboration among healthcare professionals, improving overall clinical workflow

- This trend towards smarter, faster, and more interconnected X-ray solutions is reshaping expectations for medical imaging, with companies such as Siemens Healthineers developing AI-assisted and portable X-ray systems to support low-dose imaging and rapid deployment in diverse clinical environments

- The demand for AI-enabled and portable X-ray systems is growing rapidly across hospitals, diagnostic centers, and specialty clinics, driven by the need for high-quality, efficient, and accessible imaging solutions

North America X-Ray Systems Market Dynamics

Driver

Increasing Demand Due to Rising Chronic Disease Burden and Advanced Diagnostics

- The rising prevalence of chronic diseases, such as cardiovascular disorders and cancer, along with growing patient volumes, is a significant driver for the heightened demand for X-ray systems in North America

- For instance, in March 2024, Hologic, Inc. announced the expansion of its diagnostic imaging solutions with AI-enhanced X-ray systems to improve breast and skeletal health screening efficiency, reflecting the trend of continuous technological innovation

- X-ray systems offer advanced diagnostic capabilities, including digital radiography, low-dose imaging, and portable solutions, making them a preferred choice for hospitals and clinics over conventional analog systems

- Furthermore, the increasing adoption of electronic medical records and integration with PACS platforms is making X-ray systems an integral part of modern diagnostic workflows, offering faster image access, enhanced reporting, and remote consultations

- The demand for faster, accurate, and user-friendly imaging solutions, coupled with rising healthcare expenditure in the U.S. and Canada, is propelling the adoption of X-ray systems across multiple clinical settings

Restraint/Challenge

High Equipment Costs and Regulatory Compliance Hurdles

- The relatively high initial cost of advanced X-ray systems, particularly AI-enabled and portable units, can be a barrier to adoption, especially for smaller clinics or budget-constrained healthcare providers

- For instance, high-end systems from Siemens Healthineers or Canon Medical often require substantial capital investment, limiting accessibility in certain regions or smaller facilities

- Compliance with stringent regulatory standards, such as FDA approvals, IEC certifications, and radiation safety norms, poses additional challenges for manufacturers and healthcare providers. Ensuring adherence to these regulations while maintaining system performance and affordability requires careful planning

- Additionally, concerns regarding data privacy, cybersecurity of networked imaging devices, and integration with hospital IT infrastructure can slow adoption rates

- Overcoming these challenges through cost-effective product development, robust regulatory compliance strategies, and enhanced cybersecurity measures will be essential for sustained growth in the North America X-ray systems market

North America X-Ray Systems Market Scope

The market is segmented on the basis of type, technology, price, portability, system, application, mobility, and end user.

- By Type

On the basis of type, the North America X-ray systems market is segmented into analog X-ray and digital X-ray. The digital X-ray segment dominated the market with the largest revenue share of 46% in 2024, driven by superior image quality, faster processing, and lower radiation exposure compared to analog systems. Hospitals and diagnostic centers increasingly prefer digital X-ray systems due to their seamless integration with PACS and EMR platforms, streamlining workflow and reporting. Digital X-ray systems also support AI-assisted image analysis, improving diagnostic accuracy and operational efficiency. The growing demand for remote diagnostics and teleradiology further accelerates digital X-ray adoption. In addition, continuous advancements in flat-panel detectors and image processing technology reinforce the segment’s dominance.

The analog X-ray segment is expected to witness the fastest growth during the forecast period in smaller clinics and rural healthcare facilities. Analog systems remain relevant due to their lower initial investment and simpler maintenance requirements. They are often used as backup or secondary imaging systems, especially in regions with limited IT infrastructure. The affordability and durability of analog units attract budget-conscious healthcare providers. Some hospitals adopt analog units for educational or low-volume diagnostic purposes. Additionally, analog X-ray systems are still used in developing regions where digital infrastructure is limited.

- By Technology

On the basis of technology, the market is segmented into computed radiography (CR) and direct radiography (DR). The DR segment dominated in 2024 due to faster image acquisition, higher resolution, and reduced radiation dose, making it suitable for hospitals and high-volume diagnostic centers. DR systems allow immediate image viewing and integration with hospital information systems, improving operational efficiency. They also support AI-based enhancements and remote diagnostics, making them ideal for modern radiology workflows. Emergency rooms and outpatient departments particularly benefit from DR systems due to rapid imaging and diagnosis. The continuous innovation in flat-panel detector technology and low-dose imaging reinforces DR’s leading market position.

The CR segment is expected to witness the fastest growth during the forecast period as it provides a cost-effective transition from analog to digital systems. CR allows healthcare providers to upgrade existing analog infrastructure without heavy capital investment. It is widely used in small to mid-sized clinics that cannot afford full DR solutions. CR systems are valued for their reliability, moderate image quality, and compatibility with existing PACS systems. Increasing awareness of digital advantages among healthcare providers is encouraging CR adoption. Retrofitting analog X-ray systems with CR technology is becoming a popular growth strategy.

- By Price

On the basis of price, the market is segmented into low-end, mid-range, and high-end digital X-ray systems. High-end digital X-ray systems dominated in 2024, driven by hospitals and specialty clinics demanding advanced features such as AI-assisted diagnostics, high-resolution imaging, and portable capabilities. These systems offer improved patient throughput, reduced radiation exposure, and integration with hospital IT infrastructure. Large healthcare facilities invest in high-end units to support multiple clinical applications efficiently. Advanced imaging features such as automatic exposure control, 3D reconstruction, and dose optimization reinforce market dominance. Additionally, high-end systems are preferred for emergency care, oncology, and cardiology imaging due to their precision and reliability.

The mid-range digital X-ray systems segment is expected to witness the fastest growth during the forecast period, catering to mid-sized hospitals, diagnostic centers, and mobile imaging units. Mid-range systems balance affordability with essential features such as wireless connectivity, moderate portability, and PACS integration. They are increasingly adopted in outpatient clinics and community hospitals that require quality imaging without premium costs. The segment’s growth is also fueled by expanding mobile diagnostic services. Hospitals in semi-urban areas prefer mid-range solutions for cost efficiency while maintaining image quality. The increasing availability of mid-range models from multiple vendors supports this segment’s rapid expansion.

- By Portability

On the basis of portability, the market is segmented into fixed digital X-ray systems and portable digital X-ray systems. Fixed systems dominated in 2024 due to high throughput, superior imaging capabilities, and suitability for hospital radiology departments handling large patient volumes. These systems are typically integrated with PACS and EMR platforms, enabling centralized data storage, seamless reporting, and efficient workflow. Fixed units are preferred in high-volume centers requiring consistent image quality. Advanced features such as automated positioning, multi-angle imaging, and AI-assisted analysis reinforce their dominance. Hospitals value fixed systems for long-term investment due to durability and service support.

Portable digital X-ray systems are expected to witness the fastest growth during the forecast period, driven by rising demand for bedside imaging, emergency care, and mobile diagnostics. Portable units allow rapid deployment in ICU, outpatient clinics, and remote areas. They provide high-quality imaging comparable to fixed systems while offering flexibility and convenience. Increasing adoption in mobile imaging centers and emergency response services supports this trend. Portable X-ray systems are particularly critical in rural healthcare and home healthcare applications. Vendors are continuously innovating lightweight, battery-operated models to meet market needs.

- By System

On the basis of system, the market is segmented into retrofit digital X-ray systems and new digital X-ray systems. New digital X-ray systems dominated in 2024 as hospitals and imaging centers prefer fully integrated modern solutions with advanced imaging technology and higher operational efficiency. New systems reduce maintenance challenges, support AI-enabled diagnostics, and offer scalability for future upgrades. Large hospitals and diagnostic chains particularly favor new systems to maintain consistent imaging quality across departments. Features such as low-dose imaging, wireless connectivity, and automated workflow increase their adoption. The growing focus on smart hospital infrastructure reinforces the dominance of new systems.

The retrofit digital X-ray systems segment is expected to witness the fastest growth during the forecast period due to cost-effective upgrades of existing analog units. Retrofitting allows healthcare providers to adopt digital technology without complete system replacement. Smaller clinics and mid-sized hospitals benefit from reduced capital expenditure. Retrofit solutions often include digital detectors, PACS integration, and dose optimization features. Adoption is rising in regions with limited budgets but a need for modern imaging. Retrofitting is particularly popular in North America where legacy analog systems are still operational but need modernization.

- By Application

On the basis of application, the market is segmented into general radiography, dental applications, mammography, and fluoroscopy. The general radiography segment dominated in 2024 due to its wide applicability in hospitals, diagnostic centers, and outpatient clinics. It covers musculoskeletal, chest, and abdominal imaging, making it the most versatile and frequently deployed X-ray system. Hospitals rely on general radiography for routine diagnostics, pre-operative imaging, and emergency assessments. Integration with PACS and AI-assisted tools enhances workflow efficiency. The segment benefits from continuous technological improvements in detectors and imaging software. General radiography remains the backbone of North America’s X-ray market.

The dental applications segment is expected to witness the fastest growth during the forecast period due to rising demand for dental imaging in private clinics, orthodontics, and preventive care. Compact, portable dental X-ray units allow high-quality imaging in small spaces. Technological advancements such as 3D dental imaging, cone-beam CT, and low-dose units increase adoption. The segment benefits from growing awareness of oral health and preventive care. Dental professionals are increasingly investing in modern X-ray systems for improved diagnosis and patient comfort. Expansion of dental care infrastructure in urban and semi-urban areas also supports this growth.

- By Mobility

On the basis of mobility, the market is segmented into stationary and mobile X-ray systems. Stationary systems dominated in 2024 due to high imaging capabilities, reliability, and suitability for high-volume hospital radiology departments. They integrate with PACS and EMR systems, facilitating centralized data management and reporting. Stationary units are preferred in large hospitals with continuous imaging needs. High-quality image acquisition, multi-angle capabilities, and AI-assisted processing reinforce their dominance. Hospitals prioritize stationary systems for long-term efficiency, durability, and multi-application use.

Mobile X-ray systems are expected to witness the fastest growth due to increasing demand for bedside imaging, mobile clinics, and emergency response diagnostics. Mobile units improve accessibility in ICUs, emergency rooms, and remote or underserved locations. They support portable, flexible imaging without compromising image quality. Expansion of home healthcare services and mobile imaging centers drives this segment. Lightweight, battery-operated, and wireless mobile units are attracting rapid adoption. Mobile systems are becoming critical for point-of-care diagnostics and telemedicine support.

- By End User

On the basis of end user, the market is segmented into diagnostic centers, hospitals, and mobile imaging centers. Hospitals dominated the market in 2024 with the largest revenue share due to high patient volumes, diversified imaging requirements, and investment in advanced imaging systems. Hospitals deploy both fixed and portable X-ray systems to manage inpatient and outpatient diagnostics efficiently. Integration with hospital IT infrastructure improves workflow and reporting. High-end imaging capabilities, multi-application support, and AI-assisted features drive hospital adoption. Hospitals also benefit from vendor service support and long-term maintenance contracts.

Mobile imaging centers are expected to witness the fastest growth during the forecast period, driven by demand for remote diagnostics, preventive health checkups, and emergency care. Mobile units provide cost-effective, flexible solutions for patients in rural and underserved areas. These centers often utilize portable digital X-ray systems integrated with cloud-based PACS. Increasing adoption of tele-radiology services further boosts the segment. The convenience, accessibility, and reduced need for hospital visits drive rapid expansion of mobile imaging services.

North America X-Ray Systems Market Regional Analysis

- The U.S. dominated the North America X-ray systems market with the largest revenue share of 53.2% in 2024, characterized by well-established healthcare infrastructure, high healthcare expenditure, and the presence of major imaging technology providers, with substantial growth in X-ray system installations, particularly in outpatient and specialty care facilities, driven by innovations in AI-assisted imaging and low-dose radiation technologies

- Hospitals, diagnostic centers, and specialty clinics in the region highly value high-resolution imaging, faster processing, and integration with PACS and EMR systems, which enhance workflow efficiency and diagnostic accuracy

- The widespread adoption is further supported by strong healthcare expenditure, a technologically advanced medical ecosystem, and the growing preference for AI-assisted and portable X-ray systems, establishing them as critical diagnostic tools across inpatient, outpatient, and emergency care settings

U.S. North America X-Ray Systems Market Insight

The U.S. X-ray systems market captured the largest revenue share of 81% in 2024 within North America, driven by the growing demand for advanced diagnostic imaging and rising prevalence of chronic diseases. Healthcare providers are increasingly prioritizing high-resolution, AI-assisted, and portable X-ray systems to improve diagnostic accuracy and patient throughput. The adoption of digital radiography, integration with PACS and EMR platforms, and the expansion of outpatient and specialty care centers are further propelling market growth. Additionally, the preference for mobile and bedside imaging solutions is enhancing accessibility and operational efficiency in hospitals and diagnostic facilities. Technological advancements, such as low-dose imaging and AI-enabled image analysis, continue to stimulate adoption across both inpatient and outpatient settings.

Canada X-Ray Systems Market Insight

The Canada X-ray systems market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing healthcare expenditure, growing patient volumes, and modernization of hospital infrastructure. Rising investments in advanced imaging technologies, including digital and AI-enabled X-ray systems, are fueling demand across hospitals and diagnostic centers. Canadian healthcare providers are also adopting portable and retrofit X-ray systems to improve accessibility in rural and remote areas. The focus on preventive healthcare and early disease detection further supports market growth. Additionally, government initiatives aimed at upgrading healthcare infrastructure and expanding diagnostic capabilities are expected to accelerate market adoption.

Mexico X-Ray Systems Market Insight

The Mexico X-ray systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of advanced diagnostic imaging and the expansion of private healthcare facilities. The rising incidence of chronic and lifestyle-related diseases is encouraging healthcare providers to invest in high-quality X-ray systems for accurate diagnosis. Demand for cost-effective, retrofit digital solutions is growing, enabling smaller clinics to adopt advanced imaging technologies without substantial capital expenditure. The integration of X-ray systems with hospital information networks and PACS platforms is also supporting market adoption. Furthermore, government efforts to improve healthcare access and diagnostic infrastructure in urban and semi-urban regions are expected to boost market growth.

North America X-Ray Systems Market Share

The North America X-Ray Systems industry is primarily led by well-established companies, including:

- Varex Imaging (U.S.)

- GE HealthCare (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (U.S.)

- Carestream Health, (U.S.)

- Shimadzu Corporation (U.S.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- FUJIFILM Corporation (U.S.)

- Hologic, Inc. (U.S.)

- Shanghai United Imaging Healthcare Co., LTD (U.S.)

- Teledyne Technologies Incorporated (U.S.)

- Peco InspX (U.S.)

- North Star Imaging, Inc. (U.S.)

- METTLER TOLEDO (U.S.)

- Nordson Corporation (U.S.)

- Rigaku Holdings Corporation (U.S.)

- Teledyne Digital Imaging Inc (U.S.)

- Hamamatsu Photonics K.K. (Japan)

- Pixium Vision (France)

What are the Recent Developments in North America X-Ray Systems Market?

- In July 2025, GE HealthCare announced the commercial availability of an advanced floor-mounted digital X-ray system designed to improve access and increase efficiency in high-throughput settings. This new system aims to streamline imaging workflows, reduce patient wait times, and enhance diagnostic capabilities, particularly in busy clinical environments. The introduction of this system reflects GE HealthCare's ongoing efforts to innovate and meet the evolving needs of healthcare providers

- In March 2025, Canon Medical Systems USA announced the U.S. market launch of the Adora DRFi, a hybrid imaging system that received FDA 510(k) clearance on December 23, 2024. The Adora DRFi combines radiographic and fluoroscopic imaging capabilities, offering a versatile solution for various diagnostic imaging needs. This launch underscores Canon's commitment to advancing imaging technology and providing healthcare professionals with innovative tools to enhance patient care

- In February 2025, the U.S. Food and Drug Administration (FDA) granted Breakthrough Device designation to Lumitron's HyperVIEW X-ray system for breast cancer imaging. This designation aims to expedite the development and review of medical devices that provide more effective treatment or diagnosis for life-threatening or irreversibly debilitating diseases. The HyperVIEW system is designed to enhance imaging capabilities, potentially improving early detection and patient outcomes in breast cancer diagnostics

- In December 2024, Micro-X, an Adelaide-based technology company, secured an USD 8.2 million contract from the U.S. Advanced Research Projects Agency for Health (ARPA-H) to develop a portable, full-body CT scanner. The contract includes an additional USD 8.2 million option for continued development over three more years leading to FDA submission. This initiative aims to create a lightweight, portable CT scanner, integrating advancements from previous projects with the U.S. Department of Homeland Security and the Australian Medical Research Futures Fund, to revolutionize X-ray imaging and secure strategic partnerships

- In April 2024, Shimadzu Medical Systems USA acquired California X-ray Imaging Services to expand its North American healthcare business. This strategic acquisition aims to enhance Shimadzu's service capabilities and strengthen its presence in the U.S. market. The move reflects the company's commitment to providing comprehensive imaging solutions and improving customer support across the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.