Oceania Rotomolding Market

Market Size in USD Million

CAGR :

%

USD

20.29 Million

USD

27.11 Million

2024

2032

USD

20.29 Million

USD

27.11 Million

2024

2032

| 2025 –2032 | |

| USD 20.29 Million | |

| USD 27.11 Million | |

|

|

|

Oceania Rotomolding Market Analysis

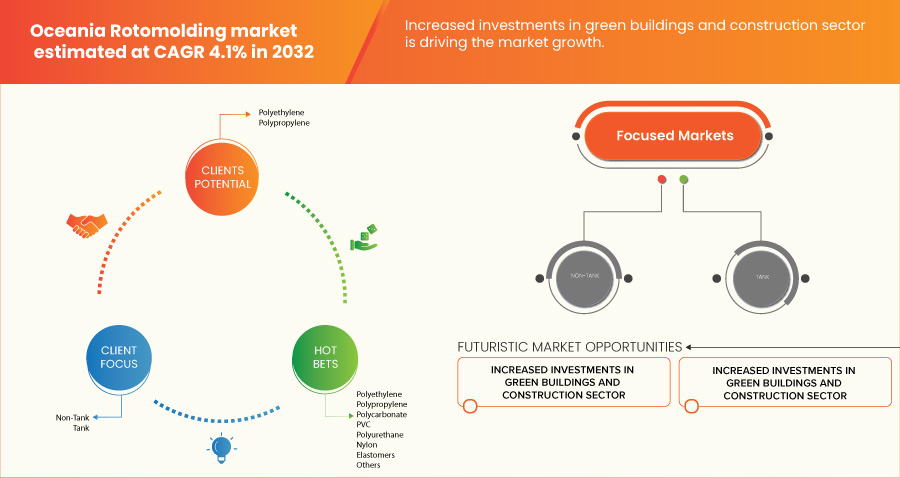

The rotomolding market is experiencing robust growth, driven by growing demand for durable and lightweight plastic products. As the Oceania rotomolding industry continues to expand, due to development of advanced materials and efficient rotational molding technologies are providing opportunities for the market. Market dynamics are also influenced by high energy consumption and cycle time. Overall, the market is expected to continue expanding, with a focus on innovation and sustainability to meet evolving industrial demands.

Oceania Rotomolding Market Size

Oceania rotomolding market size was valued at USD 20.29 million in 2024 and is projected to reach USD 27.11 million by 2032, with a CAGR of 4.1% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Oceania Rotomolding Market Trends

“Rotomolding Allows for High Levels of Customization and Flexibility in Product Design”

The ability of rotomolding to offer high levels of customization and design flexibility is a key driver behind its growing adoption in the Oceania rotomolding market. This versatility makes rotomolding a preferred manufacturing process across diverse industries, ranging from automotive and construction to consumer goods and recreation. The flexibility to create products in various shapes, sizes, and configurations without the constraints often found in other molding processes has contributed significantly to its popularity.

Rotomolding allows manufacturers to produce complex shapes and large hollow parts with ease. The process involves rotating a heated mold in multiple directions, ensuring an even distribution of plastic, which allows for greater design flexibility. This enables the production of products that are difficult or impossible to create using other methods. Examples include custom storage tanks, playground equipment, automotive parts, and consumer products like kayaks and furniture. This level of customization is particularly valuable in the Oceania market, where businesses require unique, specialized products tailored to specific industry needs.

In industries like automotive and construction, rotomolded parts can be designed to meet precise functional specifications. For example, lightweight rotomolded fuel tanks, interior panels, and exterior components in vehicles can be customized to suit different vehicle designs, helping manufacturers meet specific performance standards, weight limitations, and safety requirements. Rotomolding’s ability to handle both low-volume custom projects and high-volume production runs is another reason for its growing popularity in Oceania. The process is more cost-effective for smaller production batches compared to other methods, such as injection molding, which requires expensive tooling. This flexibility allows businesses to produce limited-edition or seasonal products (like custom agricultural equipment or bespoke recreational goods) without incurring significant upfront costs.

The flexibility inherent in rotomolding also enables manufacturers to quickly adapt to evolving market needs. As consumer preferences change or as industries evolve, rotomolding provides a fast and cost-effective way to update or modify designs, ensuring that businesses can remain competitive and responsive to shifting market demands.

For instance,

- In April 2023, according to an article by Roto Dynamics, Rotational molding offers several advantages over other plastic manufacturing methods. It provides enhanced design flexibility, enabling the creation of complex shapes. The process produces seamless, hollow products that are highly durable, impact-resistant, and weatherproof. Moreover, rotational molding is cost-effective, as it doesn’t require expensive molds and can efficiently produce both small and large quantities at lower costs. It also supports the production of prototypes and small batches at a fraction of the cost compared to other molding techniques

Rotomolding's capacity for high levels of customization and flexibility in product design is a powerful driver of growth in the Oceania rotomolding market. Its ability to produce complex shapes and bespoke designs, coupled with its suitability for both small and large production runs, allows businesses to meet the diverse needs of various industries. As consumer demand for personalized, tailored products continues to rise, and industries in Oceania seek to adapt quickly to market changes, rotomolding stands out as a key manufacturing process that offers both innovation and efficiency.

Report Scope and Market Segmentation

|

Attributes |

Oceania Rotomolding Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Australia, New Zealand, and Others |

|

Key Market Players |

Melbourne Rotomould (Australia), APR Tanks (Australia), Rota Moulding (Australia), Rotamould PTY.LTD. (Australia), Superior Group (Australia), Agboss Australia Pty Ltd (Australia), and Global Tanks (Australia) |

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oceania Rotomolding Market Definition

Rotomolding (Rotational Molding) is a manufacturing process used to create hollow plastic products. The process involves placing a powdered plastic material into a mold, which is then heated and slowly rotated along two perpendicular axes. As the mold heats up, the plastic powder melts and coats the interior surface of the mold. After cooling, the mold is removed, leaving a seamless, hollow part. Rotomolding is ideal for producing large, complex shapes with uniform wall thickness, such as tanks, containers, and toys. It offers advantages like design flexibility, low tooling costs, and the ability to produce durable, lightweight products with minimal wast.

Oceania Rotomolding Market Dynamics

Drivers

- Inclination towards Sustainable and Recyclable Materials

The increasing emphasis on sustainability and the growing global demand for recyclable materials are significant drivers propelling the growth of the rotomolding market in Oceania. As environmental concerns continue to take center stage, both consumers and industries in the region are pushing for eco-friendly solutions. The rotomolding process, known for its ability to use sustainable materials and produce recyclable plastic products, is uniquely positioned to meet this demand, contributing to its rise in popularity.

One of the key advantages of rotomolding is the use of recyclable materials, such as polyethylene (PE), which is one of the most commonly used plastics in the process. Polyethylene is widely accepted in recycling streams and can be reused at the end of a product’s life cycle. This aligns with the growing demand for circular economy practices, where products are designed to be reused, refurbished, and recycled. In regions like Australia and New Zealand, which are focusing on reducing plastic waste and boosting recycling rates, the ability to manufacture products using recyclable materials helps businesses meet both consumer demand and regulatory requirements.

Products such as water storage tanks, plastic bins, and recreational equipment made from rotomolded polyethylene can be recycled at the end of their life, reducing landfill waste and contributing to sustainability goals. This capability is particularly important as Oceania faces growing challenges related to plastic waste management. With consumers and businesses alike prioritizing sustainability, the demand for rotomolded products made from recyclable materials is expected to increase.

The rotomolding process itself is also more energy-efficient compared to other plastic manufacturing techniques like injection molding. The ability to produce high-quality products with minimal energy input makes rotomolding an attractive option for manufacturers looking to reduce their overall carbon footprint. This efficiency, combined with the use of recyclable materials, positions rotomolding as a green manufacturing process that aligns with the region’s focus on sustainable production.

For instance,

- In September 2023, according to an article by Elsevier B.V., highlights the growing inclination towards sustainable and recyclable materials in plastic manufacturing. It emphasizes the shift toward eco-friendly solutions, driven by increasing environmental concerns and regulations. Manufacturers are increasingly adopting biodegradable and recyclable plastics to reduce environmental impact and comply with sustainability goals

The growing inclination towards sustainable and recyclable materials is a major driver of the rotomolding market in Oceania. With increasing regulatory pressure, consumer demand for eco-friendly products, and the inherent recyclability of rotomolded products, the market is poised for continued growth. Rotomolding offers a sustainable manufacturing solution that addresses the environmental concerns of both businesses and consumers, ensuring its relevance in an increasingly sustainability-conscious marke.

- Rotomolding Allows for High Levels of Customization and Flexibility in Product Design

The ability of rotomolding to offer high levels of customization and design flexibility is a key driver behind its growing adoption in the Oceania rotomolding market. This versatility makes rotomolding a preferred manufacturing process across diverse industries, ranging from automotive and construction to consumer goods and recreation. The flexibility to create products in various shapes, sizes, and configurations without the constraints often found in other molding processes has contributed significantly to its popularity.

Unlike traditional molding techniques like injection molding or blow molding, rotomolding allows manufacturers to produce complex shapes and large hollow parts with ease. The process involves rotating a heated mold in multiple directions, ensuring an even distribution of plastic, which allows for greater design flexibility. This enables the production of products that are difficult or impossible to create using other methods. Examples include custom storage tanks, playground equipment, automotive parts, and consumer products like kayaks and furniture. This level of customization is particularly valuable in the Oceania market, where businesses require unique, specialized products tailored to specific industry needs.

In industries like automotive and construction, rotomolded parts can be designed to meet precise functional specifications. For example, lightweight rotomolded fuel tanks, interior panels, and exterior components in vehicles can be customized to suit different vehicle designs, helping manufacturers meet specific performance standards, weight limitations, and safety requirements. Rotomolding’s ability to handle both low-volume custom projects and high-volume production runs is another reason for its growing popularity in Oceania. The process is more cost-effective for smaller production batches compared to other methods, such as injection molding, which requires expensive tooling. This flexibility allows businesses to produce limited-edition or seasonal products (like custom agricultural equipment or bespoke recreational goods) without incurring significant upfront costs.

The flexibility inherent in rotomolding also enables manufacturers to quickly adapt to evolving market needs. As consumer preferences change or as industries evolve, rotomolding provides a fast and cost-effective way to update or modify designs, ensuring that businesses can remain competitive and responsive to shifting market demands.

For instance,

- In April 2023, according to an article by Roto Dynamics, Rotational molding offers several advantages over other plastic manufacturing methods. It provides enhanced design flexibility, enabling the creation of complex shapes. The process produces seamless, hollow products that are highly durable, impact-resistant, and weatherproof. Moreover, rotational molding is cost-effective, as it doesn’t require expensive molds and can efficiently produce both small and large quantities at lower costs. It also supports the production of prototypes and small batches at a fraction of the cost compared to other molding techniques

Rotomolding's capacity for high levels of customization and flexibility in product design is a powerful driver of growth in the Oceania rotomolding market. Its ability to produce complex shapes and bespoke designs, coupled with its suitability for both small and large production runs, allows businesses to meet the diverse needs of various industries. As consumer demand for personalized, tailored products continues to rise, and industries in Oceania seek to adapt quickly to market changes, rotomolding stands out as a key manufacturing process that offers both innovation and efficienc.

Opportunities

- Development of Advanced Materials and Efficient Rotational Molding Technologies

The ongoing development of advanced materials and efficient rotational molding technologies presents significant growth opportunities for the Oceania rotomolding market. As industries increasingly demand high-performance materials that offer superior strength, durability, and sustainability, the rotomolding process is evolving to meet these new requirements. At the same time, advances in technology are improving the overall efficiency and cost-effectiveness of the process, positioning rotomolding as a key solution for the region’s manufacturing needs.

The development of new and advanced materials is one of the most significant opportunities for growth in the rotomolding market. The introduction of high-performance resins and composite materials, such as polyethylene (PE), polypropylene (PP), nylon, and fiber-reinforced plastics, is expanding the range of applications for rotomolded products. These materials offer enhanced strength, UV resistance, impact resistance, and chemical stability, making rotomolded products suitable for more demanding environments, such as the automotive, aerospace, construction, and marine sectors.

In parallel with material advancements, rotational molding technologies are also becoming more efficient. The introduction of advanced control systems, automated processes, and energy-efficient equipment is improving the overall cycle times, precision, and energy consumption of the rotomolding process. Innovations in 3D printing and mold design technologies are enabling faster prototyping and product development, allowing manufacturers to bring products to market more quickly and with less waste. Additionally, the use of intelligent mold systems and temperature controls can significantly enhance the consistency and quality of rotomolded products, making the process more reliable and less costly over time.

The adoption of automated and semi-automated systems in the molding process is also reducing labor costs and improving productivity, which makes rotomolding more competitive with other manufacturing processes, such as injection molding or blow molding, for a broader range of applications. This development allows companies in Oceania to optimize production, lower operational costs, and increase their output, creating more opportunities to meet market demand efficiently.

For instance,

- In February 2024, according to an article by Plastics Engineering, The article emphasizes the role of robotic rotational molding in advancing precision, sustainability, and efficiency. Through the integration of advanced materials and robotics, manufacturers can achieve more accurate molding processes, reduce waste, and improve energy efficiency, paving the way for more sustainable and cost-effective production methods

The development of advanced materials and more efficient rotational molding technologies presents significant opportunities for the Oceania rotomolding market. With new materials offering improved performance characteristics and advancements in molding technology driving faster production cycles, cost reductions, and better product quality, rotomolding is poised to expand its reach across various industries. As manufacturers in Oceania continue to demand high-quality, sustainable, and cost-effective solutions, the advancements in these areas will enable rotomolding to meet the evolving needs of modern industries. With the right combination of innovation in materials and technology, the rotomolding sector in Oceania can capitalize on emerging market demands and enhance its position in the global manufacturing landscap.

- Increased Investments in Green Buildings and Construction Sector

The growing emphasis on sustainable construction and the rise in green building initiatives are significant opportunities for the Oceania rotomolding market. As the construction industry increasingly shifts towards eco-friendly and energy-efficient buildings, the demand for durable, lightweight, and recyclable materials has surged. Rotomolding, known for its ability to produce customizable, long-lasting, and environmentally friendly products, stands to benefit from this transition in the construction sector, particularly in the context of green buildings and sustainable infrastructure projects.

In recent years, there has been a marked increase in investments in green buildings and sustainable construction projects across Oceania. Governments, developers, and construction companies are prioritizing energy-efficient designs, sustainable materials, and low-carbon construction practices to meet environmental regulations and consumer demand for eco-conscious development. Rotomolded products made from recyclable materials such as polyethylene (PE) and polypropylene (PP) can play a crucial role in these projects due to their durability, lightweight properties, and minimal environmental impact.

Rotomolded components such as stormwater management systems, water tanks, insulation panels, outdoor furniture, and building facades can contribute to green building certifications, including LEED (Leadership in Energy and Environmental Design). These products are often more sustainable than traditional materials because they are lightweight, require less energy to transport, and are designed for recyclability at the end of their life cycle. The use of recyclable plastics in these applications is also aligned with growing calls for reducing construction waste and carbon footprints, which are central goals of green building initiatives.

Oceania is also experiencing a boom in infrastructure development, driven by increasing urbanization, population growth, and the need for sustainable public infrastructure. This includes the construction of hospitals, schools, transportation networks, and commercial buildings. As the need for specialized construction materials rises, rotomolding offers customizable solutions for complex, large-scale products such as underground utilities, drainage systems, public seating, and protective barriers. These products can be tailored to meet specific design requirements while also being durable and resistant to environmental factors like corrosion, UV radiation, and harsh weather conditions.

In addition to green building, the demand for smart cities and sustainable urban planning presents an opportunity for rotomolding. Smart cities often require innovative and sustainable materials for a wide range of applications, including street furniture, waste management systems, recreational spaces, and public utilities, all of which can be effectively produced through rotomolding.

For instance,

- According to an article by Application Solutions, global investment in green buildings reached over $400 billion, with green construction accounting for 40% of the global market. This shift is driven by growing demand for energy-efficient, sustainable buildings. The U.S. alone saw over $80 billion in green construction investments in 2021, reflecting a strong market trend

The increasing investments in green buildings and the construction sector in Oceania provide significant growth opportunities for the rotomolding market. As construction projects increasingly prioritize sustainability, energy efficiency, and the use of eco-friendly materials, rotomolding is well-positioned to meet the demand for durable, customizable, and recyclable products. From water tanks and stormwater systems to building components and public infrastructure, rotomolded products can play an essential role in the green building movement. As demand for sustainable construction continues to grow across Oceania, the rotomolding industry can capitalize on these trends, offering innovative solutions that align with the region’s environmental goals and construction sector need.

Restraints/Challenges

- Stiff Competition from other Molding Techniques

One of the biggest competitors to rotomolding is injection molding, particularly for high-volume production runs. Injection molding is known for its rapid cycle times and the ability to produce highly precise parts with excellent repeatability. In industries such as automotive, electronics, and consumer goods, where high-quality, mass-produced components are required, injection molding is often the preferred choice. It allows for faster production speeds and more precise control over product dimensions, making it suitable for high-volume manufacturing.

While rotomolding excels in producing large, complex, and hollow parts, it typically has longer cycle times and lower throughput than injection molding. As a result, manufacturers in the Oceania market that require high-volume production are more likely to opt for injection molding, particularly in industries where cost per unit is a critical factor. This competition can limit rotomolding's penetration in sectors where speed and efficiency are paramount.

In addition to injection molding, blow molding and extrusion molding present viable alternatives for producing plastic products, particularly in industries such as packaging, bottles, and tubes. Blow molding, for instance, is widely used in the production of hollow plastic products like bottles, containers, and tanks, offering faster cycle times and lower production costs for these specific applications. Extrusion molding, on the other hand, is used for continuous production of profiles and pipes, making it a strong competitor for certain types of industrial applications.

These alternatives to rotomolding are often more cost-effective for mass production of simpler parts, whereas rotomolding is better suited for more complex, custom designs. However, in industries where simple, high-volume products are needed, blow molding and extrusion molding have the edge in terms of production speed, cost efficiency, and scalability.

For instance,

- According to an article by HLH Rapid, Plastic injection molding is the most widely used method for producing various types of plastic parts, especially for large production runs. However, the tooling process can be costly and may involve longer lead times compared to other methods. For smaller batches and prototypes, there are faster and more cost-effective alternatives for producing plastic parts

Stiff competition from other molding techniques such as injection molding, blow molding, and extrusion molding represents a key restraint in the Oceania rotomolding market. While rotomolding offers distinct advantages in terms of customization, design flexibility, and the ability to produce large, hollow, and complex parts, it struggles to compete in high-volume, fast-paced production environments where other molding techniques provide better cost efficiency and faster cycle times. To overcome this challenge, manufacturers in Oceania must focus on highlighting the unique advantages of rotomolding for specialized applications and exploring innovative ways to improve production efficiency and reduce cost.

- Dependence and Fluctuations in Raw Material Prices

The Oceania rotomolding market faces several challenges that are intricately linked to the volatility of raw material prices and supply chain disruptions. These challenges can impact both the cost structure and the ability to meet production demands. A deeper analysis reveals how raw material dependence and price fluctuations have become significant barriers to growth and stability for the market.

Rotomolding, a process widely used for producing hollow plastic products, depends heavily on a few core raw materials, primarily polyethylene, polypropylene, and other resins. The cost of these raw materials is subject to global commodity price fluctuations, which can be driven by factors such as supply chain disruptions, geopolitical instability, and changes in demand patterns. In Oceania, where the market is often reliant on imports for raw materials, any increase in material costs directly impacts manufacturers’ production costs, leading to higher product prices. This can make the region’s products less competitive compared to those from markets where raw materials are sourced more cheaply.

Raw material prices in the plastic industry are inherently volatile due to fluctuations in oil prices (which affect the production of petrochemical-based resins), natural disasters disrupting manufacturing facilities, and international trade dynamics. For instance, the cost of polyethylene, a primary material in rotomolding, can fluctuate significantly in response to oil price changes or supply chain bottlenecks. Manufacturers in Oceania must constantly adjust their pricing strategies, and the unpredictability of these fluctuations makes long-term planning difficult. In some cases, manufacturers might be forced to absorb the increased costs to remain competitive, squeezing their profit margins.

As raw material prices fluctuate, manufacturers in the Oceania rotomolding market must either absorb the rising costs, potentially eroding their profit margins, or pass on the costs to consumers, which may reduce demand for products. This constant cycle of price adjustments creates instability and hinders market growth. Smaller manufacturers, in particular, struggle with these fluctuations due to limited financial reserves and a lack of bargaining power with suppliers.

For instance,

- According to Australian Bureau of Statistics, The recent rise in producer price indexes in Australia, as outlined in the December 2022 report, signals higher production costs across various sectors. This trend poses a challenge for the rotomolding market in both Australia and New Zealand, as increased input costs can affect the profitability of producing plastic products like containers and parts. The inflation in raw materials, energy, and transportation costs may lead to higher prices for rotomolded goods, affecting both manufacturers and consumers. The market will need to adapt by optimizing production or exploring cost-saving measures to remain competitive

The Oceania rotomolding market faces significant challenges due to its reliance on volatile raw material prices and supply chain disruptions. These fluctuations strain profitability, complicate long-term planning, and hinder growth, particularly for smaller manufacturers. To remain competitive, companies must adapt by exploring cost-saving strategies, diversifying supply sources, and enhancing production efficienc.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

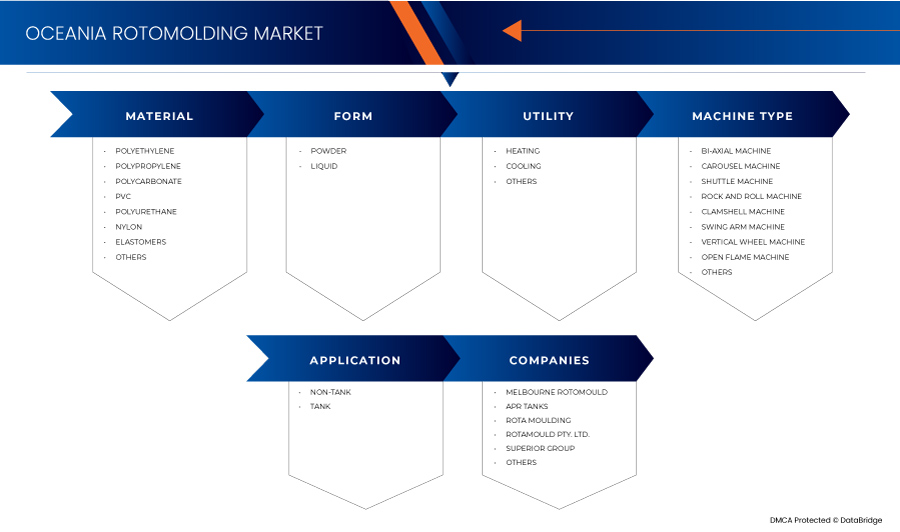

Oceania Rotomolding Market Scope

The market is segmented on the basis of material, form, utility, machine type, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material

- Polyethylene

- Polypropylene

- Polycarbonate

- PVC

- Polyurethane

- Nylon

- Elastomers

- Others

Form

- Powder

- Liquid

Utility

- Heating

- Cooling

- Others

Machine Type

- Bi-Axial Machine

- Carousel Machine

- Shuttle Machine

- Rock and Roll Machine

- Clamshell Machine

- Swing Arm Machine

- Vertical Wheel Machine

- Open Flame Machine

- Others

Application

- Non-Tank

- Tank

Oceania Rotomolding Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, material, form, utility, machine type, and application as referenced above.

The countries covered in the market are Australia, New Zealand, and Others.

Australia is expected to dominate the market due to rotomolding allows for high levels of customization and flexibility in product design.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Oceania Rotomolding Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Oceania Rotomolding Market Leaders Operating in the Market Are:

- Melbourne Rotomould (Australia)

- APR Tanks (Australia)

- Rota Moulding (Australia)

- Rotamould PTY.LTD. (Australia)

- Superior Group (Australia)

- Agboss Australia Pty Ltd (Australia)

- Global Tanks (Australia)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.6 PRICE INDEX

4.6.1 RAW MATERIAL COSTS AND ITS IMPACT ON PRICE

4.6.2 LABOR AND OPERATIONAL COSTS

4.6.3 DEMAND TRENDS AND PRODUCT PRICING

4.6.4 TECHNOLOGICAL ADVANCEMENTS AND EFFICIENCY GAINS

4.6.5 EXTERNAL ECONOMIC FACTORS AND EXCHANGE RATES

4.6.6 PRICE INDEX TRENDS AND MARKET FORECAST

4.7 PRODUCTION CAPACITY OVERVIEW

4.7.1 PRODUCTION CAPACITY AND KEY PLAYERS

4.7.2 TECHNOLOGICAL ADVANCEMENTS BOOSTING CAPACITY

4.7.3 MARKET DEMAND AND FLEXIBLE SCALING

4.7.4 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY

4.7.5 CHALLENGES FACING CAPACITY EXPANSION

4.7.6 FUTURE OUTLOOK AND CAPACITY EXPANSION PLANS

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.2.1 TRANSPORTATION OF RAW MATERIALS

4.8.2.2 INTERNAL TRANSPORTATION AND DISTRIBUTION

4.8.2.3 WAREHOUSING AND INVENTORY MANAGEMENT

4.8.2.4 EXPORT COSTS

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8.3.1 EXPERTISE IN HANDLING SPECIALIZED PRODUCTS

4.8.3.2 MANAGING SUPPLY CHAIN DISRUPTIONS

4.8.3.3 COST OPTIMIZATION

4.8.3.4 COMPLIANCE AND REGULATORY MANAGEMENT

4.8.3.5 TECHNOLOGICAL SUPPORT AND VISIBILITY

4.9 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.9.1 ADVANCEMENTS IN ROTOMOLDING MACHINERY

4.9.1.1 COMPUTERIZED AND AUTOMATED MACHINES

4.9.1.2 MULTI-STAGE HEATING SYSTEMS

4.9.1.3 ROBOTICS AND AUTOMATED HANDLING SYSTEMS

4.9.1.4 3D PRINTING FOR MOLD PROTOTYPING AND DESIGN INNOVATION

4.9.1.5 MATERIALS INNOVATION: NANOMATERIALS AND ADDITIVES

4.9.1.6 NANOMATERIALS AND ADVANCED FILLERS

4.9.1.7 UV STABILIZERS AND ANTI-UV ADDITIVES

4.9.1.8 SUSTAINABILITY AND THE USE OF RECYCLED AND BIO-BASED MATERIALS

4.9.1.9 RECYCLED POLYETHYLENE AND POLYPROPYLENE

4.9.1.10 BIO-BASED RESINS

4.9.1.11 SMART MANUFACTURING AND IOT INTEGRATION

4.9.1.12 ENERGY-EFFICIENT COOLING SYSTEMS

4.9.1.13 CONCLUSION

4.1 RAW MATERIAL SOURCING ANALYSIS

4.10.1 POLYETHYLENE (PE)

4.10.2 HIGH-DENSITY POLYETHYLENE (HDPE):

4.10.3 LINEAR LOW-DENSITY POLYETHYLENE (LLDPE):

4.10.4 POLYPROPYLENE (PP)

4.10.5 POLYVINYL CHLORIDE (PVC)

4.10.6 OTHER MATERIALS AND ADDITIVES

4.10.7 SUSTAINABILITY TRENDS AND RECYCLED MATERIALS

4.10.8 CONCLUSION

5 REGULATORY COVERAGE

5.1 CONCLUSION

6 CUSTOM DUTY PER COUNTRY/ORIGIN:

6.1 AUSTRALIA:

6.2 NEW ZEALAND:

6.3 OTHERS (FIJI):

6.4 CUSTOMERS NAME

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING DEMAND FOR DURABLE AND LIGHTWEIGHT PLASTIC PRODUCTS

7.1.2 INCLINATION TOWARDS SUSTAINABLE AND RECYCLABLE MATERIALS

7.1.3 ROTOMOLDING ALLOWS FOR HIGH LEVELS OF CUSTOMIZATION AND FLEXIBILITY IN PRODUCT DESIGN

7.2 RESTRAINTS

7.2.1 HIGH ENERGY CONSUMPTION AND CYCLE TIME

7.2.2 STIFF COMPETITION FROM OTHER MOLDING TECHNIQUES

7.3 OPPORTUNITIES

7.3.1 DEVELOPMENT OF ADVANCED MATERIALS AND EFFICIENT ROTATIONAL MOLDING TECHNOLOGIES

7.3.2 INCREASED INVESTMENTS IN GREEN BUILDINGS AND CONSTRUCTION SECTOR

7.4 CHALLENGES

7.4.1 DEPENDENCE AND FLUCTUATIONS IN RAW MATERIAL PRICES

7.4.2 STRINGENT ENVIRONMENTAL REGULATIONS AND PLASTIC RESTRICTIONS

8 OCEANIA ROTOMOLDING MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 POLYETHYLENE

8.3 POLYPROPYLENE

8.4 POLYCARBONATE

8.5 PVC

8.6 POLYURETHANE

8.7 NYLON

8.8 ELASTOMERS

8.9 OTHERS

9 OCEANIA ROTOMOLDING MARKET, BY FORM

9.1 OVERVIEW

9.2 POWDER

9.3 LIQUID

10 OCEANIA ROTOMOLDING MARKET, BY UTILITY

10.1 OVERVIEW

10.2 HEATING

10.3 COOLING

10.4 OTHERS

11 OCEANIA ROTOMOLDING MARKET, BY MACHINE TYPE

11.1 OVERVIEW

11.2 BI-AXIAL MACHINE

11.3 CAROUSEL MACHINE

11.4 SHUTTLE MACHINE

11.5 ROCK AND ROLL MACHINE

11.6 CLAMSHELL MACHINE

11.7 SWING ARM MACHINE

11.8 VERTICAL WHEEL MACHINE

11.9 OPEN FLAME MACHINE

11.1 OTHERS

12 OCEANIA ROTOMOLDING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 NON-TANK

12.3 TANK

13 OCEANIA ROTOMOLDING MARKET, BY COUNTRY

13.1 OCEANIA

13.1.1 AUSTRALIA

13.1.2 NEW ZEALAND

13.1.3 OTHERS

14 OCEANIA ROTOMOLDING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: OCEANIA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 MELBOURNE ROTOMOULD

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT DEVELOPMENT

16.2 APR TANKS

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 ROTA MOULDING

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 ROTAMOULD PTY.LTD.

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 SUPERIOR GROUP

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 AGBOSS AUSTRALIA PTY LTD

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 GLOBAL TANKS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 LIST OF CUSTOMERS NAME

TABLE 3 OCEANIA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 4 OCEANIA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 OCEANIA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 OCEANIA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 OCEANIA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 OCEANIA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 9 OCEANIA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 10 OCEANIA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 OCEANIA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 12 OCEANIA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 13 OCEANIA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 14 OCEANIA PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 15 OCEANIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 16 OCEANIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 17 OCEANIA AGRICULTURE IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 OCEANIA MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 19 OCEANIA FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 20 OCEANIA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 OCEANIA ROTOMOLDING MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 22 AUSTRALIA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 23 AUSTRALIA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 AUSTRALIA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 AUSTRALIA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 AUSTRALIA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 AUSTRALIA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 28 AUSTRALIA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 29 AUSTRALIA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 AUSTRALIA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 31 AUSTRALIA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 32 AUSTRALIA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 33 AUSTRALIA PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 34 AUSTRALIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 35 AUSTRALIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 36 AUSTRALIA AGRICULTURE IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 37 AUSTRALIA MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 38 AUSTRALIA FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 39 AUSTRALIA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NEW ZEALAND ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 41 NEW ZEALAND POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NEW ZEALAND POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NEW ZEALAND ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NEW ZEALAND OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NEW ZEALAND ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 46 NEW ZEALAND ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 47 NEW ZEALAND ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 NEW ZEALAND ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 49 NEW ZEALAND NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 50 NEW ZEALAND AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 51 NEW ZEALAND PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 52 NEW ZEALAND BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 53 NEW ZEALAND BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 NEW ZEALAND AGRICULTURE IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 55 NEW ZEALAND MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 56 NEW ZEALAND FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 57 NEW ZEALAND TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 OTHERS ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 59 OTHERS POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 OTHERS POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 OTHERS ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 OTHERS OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 OTHERS ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 64 OTHERS ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 65 OTHERS ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 OTHERS ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 OTHERS NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 68 OTHERS AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 69 OTHERS PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 70 OTHERS BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 71 OTHERS BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 72 OTHERS AGRICULTURE IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 OTHERS MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 74 OTHERS FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 75 OTHERS TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 OCEANIA ROTOMOLDING MARKET

FIGURE 2 OCEANIA ROTOMOLDING MARKET: DATA TRIANGULATION

FIGURE 3 OCEANIA ROTOMOLDING MARKET: DROC ANALYSIS

FIGURE 4 OCEANIA ROTOMOLDING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 OCEANIA ROTOMOLDING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 OCEANIA ROTOMOLDING MARKET: MULTIVARIATE MODELLING

FIGURE 7 OCEANIA ROTOMOLDING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 OCEANIA ROTOMOLDING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 OCEANIA ROTOMOLDING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 OCEANIA ROTOMOLDING MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 OCEANIA ROTOMOLDING MARKET: SEGMENTATION

FIGURE 12 OCEANIA ROTOMOLDING MARKET:- EXECUTIVE SUMMARY

FIGURE 13 EIGHT SEGMENTS COMPRISE THE OCEANIA ROTOMOLDING MARKET, BY MATERIAL

FIGURE 14 INCREASING CONCERNS OVER WATER POLLUTION IS EXPECTED TO DRIVE THE OCEANIA ROTOMOLDING MARKET IN THE FORECAST PERIOD

FIGURE 15 THE POLYETHYLENE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE OCEANIA ROTOMOLDING MARKET IN 2025 AND 2032

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 20 VENDOR SELECTION CRITERIA

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR OCEANIA ROTOMOLDING MARKET

FIGURE 22 OCEANIA ROTOMOLDING MARKET: BY MATERIAL, 2024

FIGURE 23 OCEANIA ROTOMOLDING MARKET: BY FORM, 2024

FIGURE 24 OCEANIA ROTOMOLDING MARKET: BY UTILITY, 2024

FIGURE 25 OCEANIA ROTOMOLDING MARKET: BY MACHINE TYPE, 2024

FIGURE 26 OCEANIA ROTOMOLDING MARKET: BY APPLICATION, 2024

FIGURE 27 OCEANIA ROTOMOLDING MARKET: SNAPSHOT (2024)

FIGURE 28 OCEANIA ROTOMOLDING MARKET: COMPANY SHARE 2024 (%)

Oceania Rotomolding Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Oceania Rotomolding Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Oceania Rotomolding Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.