Pain Management Devices Market

Market Size in USD Billion

CAGR :

%

USD

7.70 Billion

USD

14.31 Billion

2024

2032

USD

7.70 Billion

USD

14.31 Billion

2024

2032

| 2025 –2032 | |

| USD 7.70 Billion | |

| USD 14.31 Billion | |

|

|

|

|

Pain Management Devices Market Size

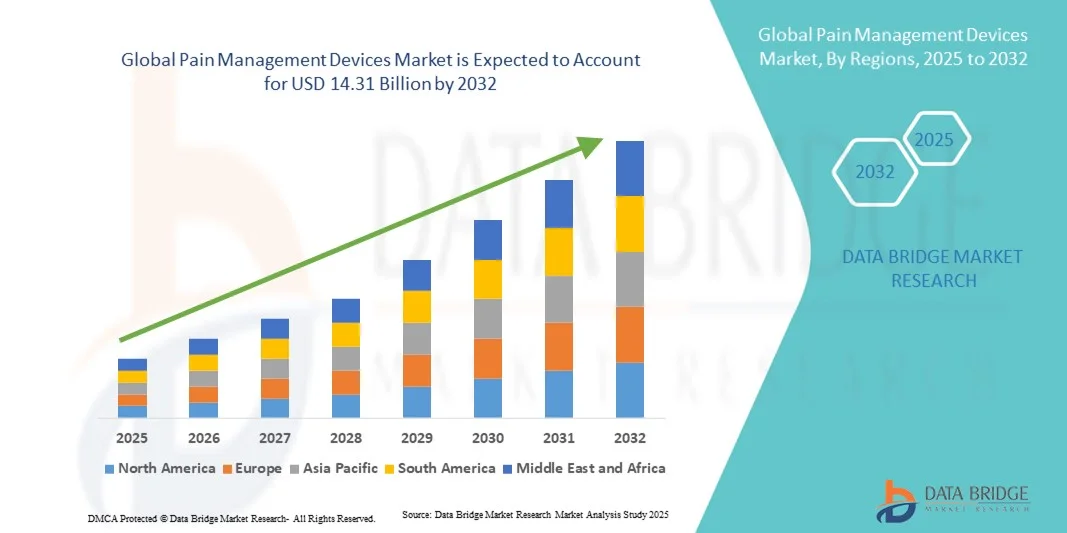

- The global pain management devices market size was valued at USD 7.70 billion in 2024 and is expected to reach USD 14.31 billion by 2032, at a CAGR of 8.06% during the forecast period

- The market growth is largely fueled by increasing prevalence of chronic pain conditions, rising geriatric population, and technological advancements in minimally invasive and non-invasive pain management devices, leading to improved patient outcomes and quality of life

- Furthermore, growing awareness among patients and healthcare providers about effective pain management therapies, coupled with rising demand for personalized and home-based treatment solutions, is positioning these devices as essential tools in modern healthcare. These converging factors are accelerating the adoption of pain management devices, thereby significantly boosting the industry's growth

Pain Management Devices Market Analysis

- Pain management devices, encompassing electrical, implantable, and non-invasive therapeutic solutions, are becoming increasingly essential in both hospital and home care settings due to their effectiveness in alleviating chronic and acute pain, improving patient comfort, and supporting rehabilitation

- The rising demand for pain management devices is primarily driven by the growing prevalence of chronic pain conditions, an aging global population, and increasing awareness among healthcare providers and patients regarding non-pharmacological pain relief options

- North America dominated the pain management devices market with the largest revenue share of 48.1% in 2024, supported by advanced healthcare infrastructure, high adoption of technologically advanced devices, and strong presence of leading market players. The U.S. witnessed significant growth in device adoption, particularly in implantable neurostimulation and wearable therapies, driven by innovations from both established medical device companies and emerging startups

- Asia-Pacific is expected to be the fastest-growing region in the pain management devices market during the forecast period, fueled by increasing healthcare investments, rising prevalence of musculoskeletal and neurological disorders, and growing patient awareness

- Neurostimulation dominated the pain management devices market with largest revenue share of 58.2% in 2024, driven by their proven efficacy in managing chronic pain and increasing preference for minimally invasive and targeted therapeutic options

Report Scope and Pain Management Devices Market Segmentation

|

Attributes |

Pain Management Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pain Management Devices Market Trends

Advancements in Wearable and AI-Enabled Pain Management Solutions

- A significant and accelerating trend in the global pain management devices market is the integration of wearable technology and artificial intelligence (AI) for personalized therapy monitoring and optimization. This combination is improving patient convenience, adherence, and outcomes

- For instance, wearable transcutaneous electrical nerve stimulation (TENS) devices now incorporate AI algorithms to adjust stimulation parameters based on patient activity and pain feedback, providing targeted relief. Similarly, neuromodulation systems with AI-enabled controllers can adapt therapy schedules automatically

- AI integration enables features such as predictive pain pattern analysis and personalized therapy recommendations, while wearable designs allow continuous monitoring and real-time feedback. For instance, some NeuroMetrix devices use AI to enhance signal interpretation and optimize stimulation efficacy

- The integration of pain management devices with mobile apps and telehealth platforms allows patients to track therapy progress, share data with healthcare providers, and manage treatment plans remotely, creating a connected and patient-centered care ecosystem

- This trend toward more intelligent, wearable, and connected devices is fundamentally reshaping patient expectations for pain management. Consequently, companies such as Boston Scientific are developing AI-enabled wearable neurostimulation products with adaptive therapy and remote monitoring capabilities

- The demand for wearable and AI-enabled pain management devices is growing rapidly across both clinical and home-care settings, as patients increasingly prioritize convenience, personalized therapy, and remote healthcare functionality

Pain Management Devices Market Dynamics

Driver

Increasing Prevalence of Chronic Pain and Geriatric Population

- The rising global prevalence of chronic pain conditions, coupled with an aging population, is a significant driver of the heightened demand for pain management devices

- For instance, in March 2024, Abbott Laboratories launched an advanced spinal cord stimulation system designed to target chronic back pain more effectively, demonstrating innovations that drive market growth

- As patients and healthcare providers seek effective, non-pharmacological alternatives for pain relief, devices such as neurostimulation systems, TENS units, and implantable pumps offer compelling therapeutic benefits over traditional treatments

- Furthermore, the growing awareness of pain management solutions and the need to improve patient quality of life are making these devices an integral component of modern healthcare, particularly in hospitals, clinics, and home-care environments

- The convenience of minimally invasive therapies, customizable treatment plans, and remote monitoring capabilities are key factors propelling adoption across both clinical and home settings. The trend toward patient-centered, technology-driven pain management further contributes to market growth

Restraint/Challenge

High Device Costs and Regulatory Compliance Hurdles

- The relatively high cost of advanced pain management devices, including implantable and AI-enabled neurostimulation systems, poses a significant challenge to broader adoption, particularly in price-sensitive regions

- For instance, high-priced spinal cord stimulation systems have limited access for some patients despite demonstrated clinical benefits, which can slow market penetration

- Addressing regulatory compliance and safety requirements for medical devices across multiple regions adds complexity and can delay product launches, affecting market expansion. Companies such as Medtronic emphasize rigorous clinical testing and adherence to international regulations to ensure device safety and efficacy

- In addition, concerns regarding potential side effects, device maintenance, and user training may hinder adoption, particularly among elderly patients or those unfamiliar with technology-based therapies. While cost-effective alternatives are emerging, premium devices with advanced features such as adaptive AI therapy or wireless connectivity remain expensive

- Overcoming these challenges through affordability strategies, regulatory support, and patient education on device usage and benefits will be critical for sustained market growth

Pain Management Devices Market Scope

The market is segmented on the basis of type, applications, mode of purchase, and end user.

- By Type

On the basis of type, the pain management devices market is segmented into electrical stimulators, ablation devices, analgesic infusion pumps, and neurostimulation. The neurostimulation segment dominated the market with the largest revenue share of 58.2% in 2024, driven by its proven efficacy in managing chronic and severe pain conditions such as neuropathic and musculoskeletal pain. Neurostimulation devices, including spinal cord stimulators and peripheral nerve stimulators, offer minimally invasive solutions with customizable therapy settings, enhancing patient adherence and clinical outcomes. Hospitals and pain clinics increasingly prefer neurostimulation due to its long-term effectiveness and reduced reliance on pharmacological treatments. The segment also benefits from technological advancements, such as AI-enabled adaptive stimulation and wearable controllers, which improve patient experience and therapy precision. Market adoption is further supported by reimbursement coverage in key regions such as North America and Europe, encouraging healthcare providers to integrate these devices into standard care protocols

The electrical stimulators segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising demand for non-invasive, home-use pain management solutions. Electrical stimulators, such as TENS and EMS devices, offer affordable, user-friendly therapy for musculoskeletal and post-operative pain. Increasing awareness of safe alternatives to opioid use, combined with the convenience of portable devices, drives strong adoption among patients managing chronic pain at home. In addition, integration with smartphone apps and wearable sensors enables personalized therapy plans and remote monitoring, further accelerating growth. Growth is particularly notable in emerging regions where access to hospital-based interventions is limited, highlighting the appeal of over-the-counter electrical stimulators.

- By Applications

On the basis of applications, the pain management devices market is segmented into musculoskeletal pain, facial pain and migraine, and others. The musculoskeletal pain segment dominated the market in 2024, owing to the high global prevalence of chronic back, neck, and joint pain. Pain management devices targeting musculoskeletal disorders, including neurostimulation and electrical stimulators, are widely adopted in hospitals, clinics, and home care due to their effectiveness and non-invasive nature. Increasing awareness among patients and healthcare providers about device-based pain therapies further strengthens this segment. Technological advancements such as wearable devices and remote monitoring systems enhance patient compliance and therapy efficiency. Musculoskeletal pain management also benefits from integration with physiotherapy and rehabilitation programs, providing a comprehensive approach to pain relief. The rising geriatric population, prone to musculoskeletal disorders, further underpins market dominance.

The facial pain and migraine segment is expected to witness the fastest growth during forecast period, driven by the increasing prevalence of migraine disorders and trigeminal neuralgia globally. Non-invasive neurostimulation devices, such as transcutaneous supraorbital nerve stimulators, are increasingly preferred for home-based migraine management. Advances in portable and wearable technologies allow patients to self-administer therapy conveniently and effectively. Awareness campaigns highlighting non-drug treatment alternatives are boosting adoption rates. Growth is further supported by increasing insurance coverage for migraine treatment devices in developed countries.

- By Mode of Purchase

On the basis of mode of purchase, the pain management devices market is segmented into over-the-counter (OTC) devices and prescription-based devices. The prescription-based devices segment dominated in 2024 due to the clinical requirement and regulatory approval for advanced neurostimulation and ablation devices. Hospitals, pain clinics, and specialized treatment centers predominantly prescribe these devices to ensure patient safety and therapy efficacy. The segment benefits from physician recommendations, insurance reimbursement, and the need for professional monitoring during treatment. Advanced features, such as programmable stimulation patterns and implantable designs, necessitate professional guidance, further consolidating the dominance of prescription-based devices.

The OTC devices segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing patient preference for self-administered, home-based therapies. Electrical stimulators and wearable analgesic devices are widely available as OTC products, providing convenient and affordable pain relief options. Integration with mobile apps and wearable monitoring systems enhances user engagement and adherence. Rising awareness about non-pharmacological pain management and the desire to avoid opioids further support OTC device adoption, particularly in regions with growing healthcare digitization.

- By End User

On the basis of end user, the pain management devices market is segmented into medical devices manufacturing companies and academic and research organizations. The medical devices manufacturing companies segment dominated the market in 2024 due to large-scale production, commercialization of innovative pain management solutions, and global distribution capabilities. Companies are investing heavily in R&D, clinical trials, and regulatory approvals to launch advanced neurostimulation, ablation, and infusion pump devices. Their strong marketing networks and collaborations with hospitals and clinics ensure widespread product adoption. The segment also benefits from strategic partnerships with healthcare providers and reimbursement programs that facilitate market penetration.

The academic and research organizations segment is expected to witness the fastest growth during forecast period, driven by increasing research activities focused on developing next-generation pain management devices. Rising investments in neuroscience, wearable technology, and AI-based therapeutic devices are accelerating innovation. Research institutes are collaborating with manufacturers to test and validate novel devices, contributing to faster commercialization and adoption. Growth is particularly strong in regions emphasizing medical research and innovation, such as North America, Europe, and parts of Asia-Pacific.

Pain Management Devices Market Regional Analysis

- North America dominated the pain management devices market with the largest revenue share of 48.1% in 2024, supported by advanced healthcare infrastructure, high adoption of technologically advanced devices, and strong presence of leading market players

- Patients and healthcare providers in the region highly value the efficacy, customization, and minimally invasive features offered by devices such as neurostimulation systems, electrical stimulators, and analgesic infusion pumps

- This widespread adoption is further supported by high healthcare expenditure, reimbursement coverage, and a strong presence of key industry players investing in research and development, establishing advanced pain management devices as preferred solutions across hospitals, clinics, and home-care settings

U.S. Pain Management Devices Market Insight

The U.S. pain management devices market captured the largest revenue share of 45% in 2024 within North America, fueled by the increasing prevalence of chronic pain conditions and the adoption of advanced pain management therapies. Patients and healthcare providers are increasingly prioritizing minimally invasive solutions, such as neurostimulation devices and electrical stimulators, for effective pain relief. The growing preference for home-based therapies, combined with strong insurance coverage and reimbursement policies, further propels market growth. Moreover, technological advancements, including AI-enabled wearable devices and telehealth integration, are significantly contributing to the expansion of the U.S. market.

Europe Pain Management Devices Market Insight

The Europe pain management devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of musculoskeletal and neuropathic pain and stringent healthcare standards. Increased awareness of non-pharmacological therapies and growing demand for minimally invasive treatments are fostering adoption. European healthcare systems emphasize patient-centric care, promoting the integration of advanced devices in hospitals, clinics, and rehabilitation centers. The region is experiencing significant growth across chronic pain management programs and home-based therapy applications, with pain management devices being incorporated into standard treatment protocols.

U.K. Pain Management Devices Market Insight

The U.K. pain management devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing demand for advanced, effective pain relief solutions and rising healthcare expenditure. Chronic pain prevalence and an aging population are encouraging the adoption of devices such as neurostimulation systems, TENS units, and infusion pumps. In addition, growing awareness of opioid alternatives and non-drug pain management therapies is stimulating demand. The country’s well-developed healthcare infrastructure, coupled with strong R&D and technological adoption, is expected to continue supporting market growth.

Germany Pain Management Devices Market Insight

The Germany pain management devices market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of chronic pain management and preference for technologically advanced solutions. Germany’s emphasis on innovation, quality healthcare, and patient safety promotes the adoption of neurostimulation, ablation, and infusion devices. Hospitals and specialized pain clinics are increasingly integrating these devices into therapy programs, particularly for musculoskeletal and neuropathic pain. Regulatory support, combined with high patient acceptance, is further enhancing market expansion.

Asia-Pacific Pain Management Devices Market Insight

The Asia-Pacific pain management devices market is poised to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by rising prevalence of chronic pain, increasing healthcare investments, and growing awareness of non-pharmacological therapies in countries such as China, Japan, and India. The region’s expanding healthcare infrastructure and telemedicine initiatives are driving adoption in both hospital and home-care settings. Furthermore, as APAC emerges as a manufacturing hub for medical devices, affordability and accessibility of pain management solutions are increasing, enabling wider market penetration.

Japan Pain Management Devices Market Insight

The Japan pain management devices market is gaining momentum due to the country’s aging population, high-tech healthcare environment, and demand for personalized and minimally invasive pain therapies. Japanese patients and providers increasingly adopt wearable neurostimulation devices and electrical stimulators for home-based chronic pain management. Integration with mobile health platforms and telemonitoring solutions is fueling market growth. Moreover, the focus on improving quality of life for the elderly population is expected to sustain strong demand across residential, hospital, and long-term care settings.

India Pain Management Devices Market Insight

The India pain management devices market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rising chronic pain prevalence, expanding healthcare infrastructure, and increasing awareness of advanced therapies. India is witnessing growing adoption of neurostimulation devices, TENS units, and analgesic infusion pumps in hospitals, clinics, and home-care settings. Government initiatives promoting digital health and telemedicine, along with affordable device options from domestic and international manufacturers, are key factors propelling market growth. Rapid urbanization and rising disposable incomes are further supporting the adoption of these solutions across the country.

Pain Management Devices Market Share

The pain management devices industry is primarily led by well-established companies, including:

- Medtronic (U.S.)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- Nevro Corp (U.S.)

- Saluda Medical Pty Ltd. (Australia)

- Nalu Medical, Inc. (U.S.)

- Mainstay Medical (Ireland)

- SPR Therapeutics (U.S.)

- NeuroMetrix, Inc. (U.S.)

- Stimwave Technologies, Inc. (U.S.)

- Neuronetics, Inc. (U.S.)

- LivaNova PLC (U.K.)

- Stryker Corporation (U.S.)

- Zimmer Biomet (U.S.)

- B. Braun SE (Germany)

- Baxter. (U.S.)

- Smiths Group plc (U.K.)

- Teleflex Incorporated (U.S.)

- Axonics Modulation Technologies (U.S.)

- NeuroPace, Inc. (U.S.)

What are the Recent Developments in Global Pain Management Devices Market?

- In August 2025, Nalu Medical introduced a compact wearable device for chronic pain therapy, enhancing comfort and expanding treatment options for patients with peripheral nerve stimulation needs. This development reflects a trend towards more discreet and patient-friendly pain management solutions, aiming to improve patient compliance and quality of life

- In June 2025, Researchers at the University of Southern California developed a groundbreaking ultrasound-based wireless implant aimed at reducing reliance on addictive painkillers. This device offers a personalized approach to chronic pain management, potentially transforming treatment paradigms by providing targeted, non-invasive therapy options

- In January 2025, The U.S. Food and Drug Administration (FDA) approved Journavx (suzetrigine), a novel non-opioid analgesic, for the treatment of moderate-to-severe acute pain in adults. This approval marks the first new class of pain medication in over two decades. Suzetrigine specifically targets sodium channels in pain-sensing nerves, offering an alternative to opioids and reducing the risk of addiction. It has shown effectiveness comparable to opioids in clinical trials, with minimal side effects

- In January 2024, Medtronic announced the FDA approval of its Inceptiv closed-loop spinal cord stimulator, designed to treat chronic pain. This device is the company's first to offer closed-loop functionality, sensing biological signals along the spinal cord and making real-time automatic adjustments to the stimulation. This capability aims to prevent overstimulation during activities such as laughing or sneezing, providing more consistent pain relief for patients

- In January 2022, Medtronic received FDA approval for its InterStim X spinal cord stimulation therapy to treat chronic pain resulting from diabetic peripheral neuropathy. This approval expanded the use of spinal cord stimulation technologies to a broader patient population, addressing a significant unmet need in managing diabetic-related pain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.