Philippines Architectural Coatings Market

Market Size in USD Million

CAGR :

%

USD

296.11 Million

USD

430.85 Million

2024

2032

USD

296.11 Million

USD

430.85 Million

2024

2032

| 2025 –2032 | |

| USD 296.11 Million | |

| USD 430.85 Million | |

|

|

|

|

Philippines Architectural Coatings Market Size

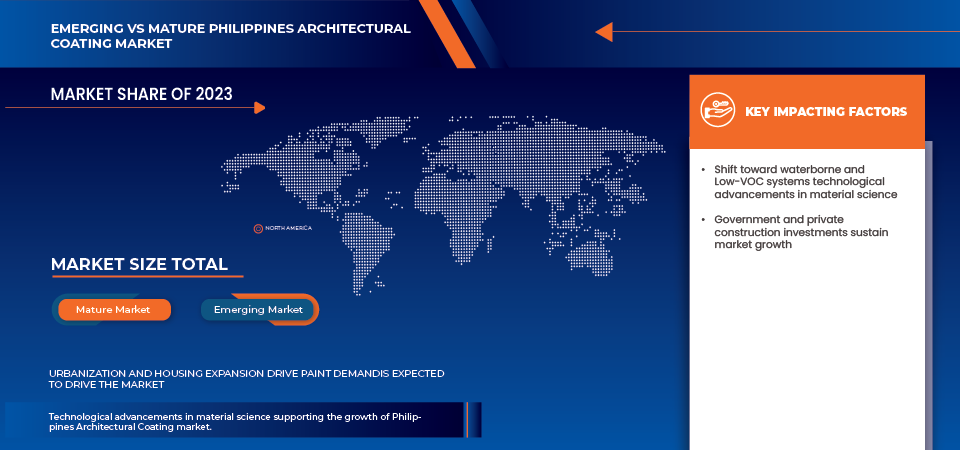

- The Philippines Architectural Coatings Market was valued at USD 296.11 million in 2024 and is expected to reach USD 430.85 million by 2032, at a CAGR of 4.74% during the forecast period

- Market growth is supported by robust construction activity, rising urbanization, and government infrastructure programs, alongside increasing consumer preference for aesthetic and durable coatings in residential and commercial applications.

- The shift toward eco-friendly, low-VOC, and high-performance coatings is also creating new opportunities for both international and domestic manufacturers.

Philippines Architectural Coatings Market Analysis

- The Philippines Architectural Coatings market is experiencing steady growth, driven by growing urbanization and increased adoption of healthy lifestyle, increasing consumption of canned and frozen food, increasing vegan population is expected to drive the market growth, and expansion of convenience stores.

- However, higher amount of vegetable and fruit wastage, lack of cold chain infrastructure remain key restraints, while digitalization of the retail industry, increasing number of initiatives taken by Philippines Architectural Coatings manufacturers, increasing demand for fruits and vegetables with longer self-life, advancements in freezing technology to retain the quality of fruits and vegetables present significant growth opportunities

- Luzon is expected to dominate the Philippines Architectural Coatings Market, accounting for the largest revenue share of 59.48% in 2025. This dominance is attributed to rapid urban development, large-scale infrastructure projects, and high residential and commercial construction activity across Metro Manila and neighboring provinces. The region’s concentration of industrial zones, modern retail spaces, and government-backed infrastructure investments further reinforce its market leadership.

- Mindanao is expected to be the fastest-growing region in the Philippines Architectural Coatings market during the forecast period with a CAGR of 4.99%, fueled by rising consumer demand for convenient and healthy food options, expansion of modern retail chains, increased investment in cold storage and processing facilities, and strong government support for the agribusiness sector.

- The Acrylics segment is expected to dominate the Philippines Architectural Coatings Market with a market share of 38.41% in 2025, driven by their wide availability, affordability, longer shelf life, and extensive use in daily meals and foodservice industries. The growing consumer preference for convenient, ready-to-cook, and nutrient-rich food options further supports the segment’s strong market position.

Report Scope and Philippines Architectural Coatings Market Segmentation

|

Attributes |

Architectural Coatings Key Market Insights |

|

Segments Covered |

|

|

States Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include regulation coverage, tariffs & impact on the market, innovation tracker and strategic analysis, value chain analysis, pricing analysis, industry ecosystem analysis, cost analysis breakdown, consumer buying behaviour, climate change scenario, supply chain analysis, profit margins scenario, vendor selection criteria, technological advancements, raw material coverage, patent analysis, brand outlook, porter’s five force model. |

Philippines Architectural Coatings Market Trends

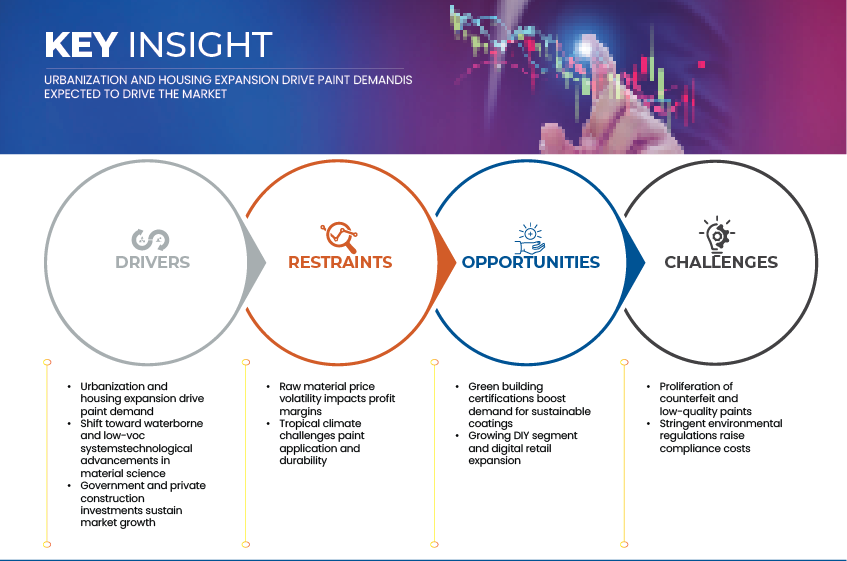

“Growing DIY Segment and Digital Retail Expansion”

- The growing do-it-yourself (DIY) segment and rapid digital retail expansion are creating significant opportunities for architectural coatings manufacturers in the Philippines. Increasing consumer interest in home improvement and renovation projects, coupled with greater access to online resources and tutorials, is driving demand for easy-to-use, ready-mixed paint products suitable for DIY applications.

- At the same time, the rise of e-commerce platforms and digital marketplaces has made it easier for consumers to browse, compare, and purchase architectural coatings from the convenience of their homes. This trend is particularly prominent among younger, tech-savvy homeowners and renters seeking convenience, variety, and personalized shopping experiences.

- On May 2021, Wilcon Depot, Inc. announced the launch of their online shopping store (shop.wilcon.com.ph) aimed at delivering home improvement and building‑materials products, including paints and coatings, nationwide.

- In October 2023, according to DIY International, retail chains like Wilcon Depot and Handyman expanded their online presence with integrated omnichannel strategies, offering seamless in-store pickup and delivery options tailored for DIY customers.

- In February 2024, a study by Google and Temasek reinforced the strength of the Philippine e-commerce market, noting a 24% growth in online sales of "Home & Living" categories, with platforms like Lazada and Shopee becoming primary destinations for bulky goods, including architectural coatings.

- The expanding DIY segment and rapid growth of digital retail channels are reshaping the architectural coatings market in the Philippines by empowering consumers with easier access to products, information, and personalized shopping experiences. The increasing popularity of home improvement projects among tech-savvy homeowners, combined with the rise of e-commerce platforms and omnichannel retail strategies, is driving higher demand for user-friendly, ready-to-use coatings suitable for DIY applications. Retailers and manufacturers are responding with innovative online offerings, interactive in-store experiences, and targeted marketing initiatives that cater to this growing consumer base. This dynamic shift not only broadens market reach but also fosters stronger customer engagement, ultimately presenting substantial growth opportunities for architectural coatings companies in the evolving Philippine market.

Philippines Architectural Coatings Market Dynamics

Driver

“Urbanization and Housing Expansion Drive Paint Demand”

- Urbanization and population growth are major forces shaping the demand for architectural coatings in the Philippines. The rapid increase in housing requirements, expansion of urban centers, and surge in commercial infrastructure projects have created sustained demand for decorative and protective coatings across both residential and non-residential segments. Rising disposable incomes, government infrastructure programs, and private sector investments have further accelerated construction activities—driving consistent market expansion for paints and coatings manufacturers.

- In February 2024, Crown Asia – A Vista Land Company cited data from the Philippine Statistics Authority (PSA) indicating that the country’s construction industry expanded by 8.5% year-on-year, driven by strong growth in private residential developments and public infrastructure projects under ongoing government programs.

- In February 2025, the Philippine Institute for Development Studies (PIDS) highlighted data from the Department of Human Settlements and Urban Development (DHSUD) showing that the Philippines currently faces a housing deficit of over 6.5 million units, which could rise to nearly 10 million by 2030 if interventions remain limited. This persistent housing gap underscores a sustained growth opportunity for residential construction materials, particularly architectural paints and coatings.

- The rising housing demand and growing urban population have not only increased the consumption of coatings for new construction but also for repainting and renovation of existing structures. Moreover, the boom in mixed-use developments and eco-friendly construction is driving demand for low-VOC, weather-resistant, and sustainable coating formulations.

- Thus, the combined momentum of urbanization, housing development, and a robust commercial construction pipeline is a critical factor propelling the growth of the Philippines architectural coatings market, fostering opportunities for both local and international manufacturers to expand their production and distribution capacities across the country

Restraints

“Raw Material Price Volatility Impacts Profit Margins”

- Fluctuating raw material prices remain a critical restraint for the Philippines architectural coatings market, directly influencing manufacturers’ production costs and overall profitability. The industry relies heavily on imported inputs such as resins (acrylics, alkyds, epoxies), titanium dioxide (TiO₂), solvents, and additives—materials whose global prices are sensitive to crude oil trends, supply chain disruptions, and foreign exchange volatility. Since the Philippines lacks large-scale domestic petrochemical production, coating formulators are exposed to price swings in international markets, particularly from suppliers in China, South Korea, and Malaysia.

- Currency depreciation against the U.S. dollar amplifies landed costs for imported chemicals, while shipping rate fluctuations and customs tariffs further strain margins. Smaller local manufacturers are disproportionately affected, as they lack the economies of scale and long-term supplier contracts that enable multinational brands to stabilize costs.

- In march 2024, according to ChemAnalyst, the average price of titanium dioxide increased by nearly 12% year-on-year, driven by higher energy costs and supply constraints from China and Europe.

- In 2023, the World Bank Commodity Price Data (Pink Sheet) recorded a 28% rise in crude oil-linked petrochemical feedstocks, increasing the cost base for solvent-borne and resin-based coatings.

- In March 2025, the Bangko Sentral ng Pilipinas (BSP) reported a 6.4% depreciation of the Philippine peso against the U.S. dollar, which raised import costs for key coating ingredients.

- In December 2024, A report from the ASEAN+3 Macroeconomic Research Office (AMRO) showing that “as of end-October 2024, the peso had depreciated by 4.6 percent against the U.S. dollar on a year-to-date basis”.

- In January 2025, According to FocusEconomics indicating the USD/PHP exchange rate ended 2024 at ~₱57.84 per USD, up from ~₱55.38 end-2023, implying depreciation and higher import costs for local producers.

- These cost pressures have led many producers to implement selective price adjustments, reduce packaging volumes, or shift to waterborne formulations with lower resin dependency. However, persistent volatility in global commodity markets continues to constrain profit margins and limit the ability of local manufacturers to invest in product innovation and sustainability transitions

Philippines Architectural Coatings Market Scope

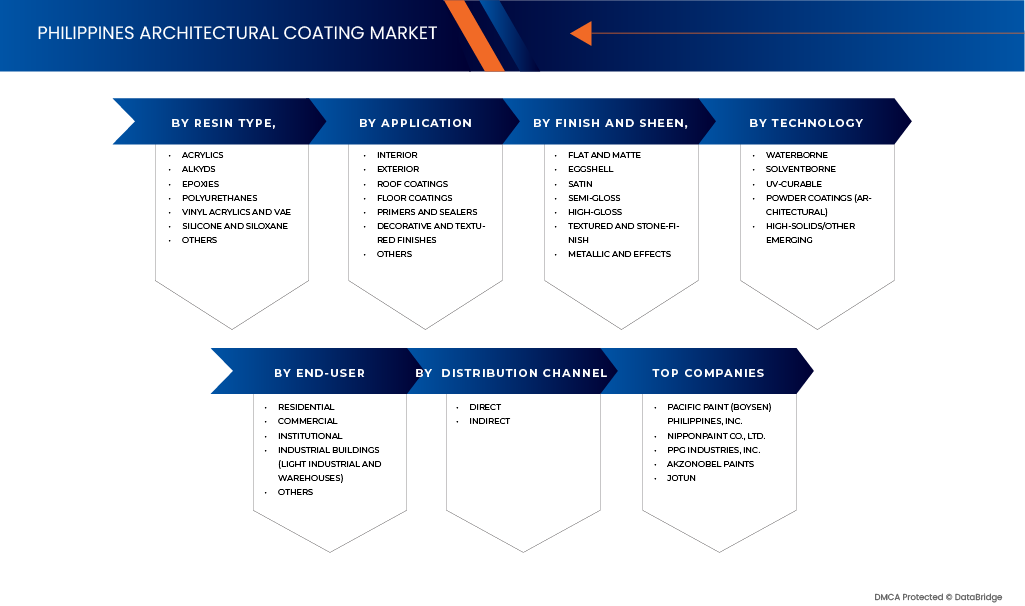

The market is segmented on the basis of resin type, technology, application, end use, finish & sheen, distribution channel.

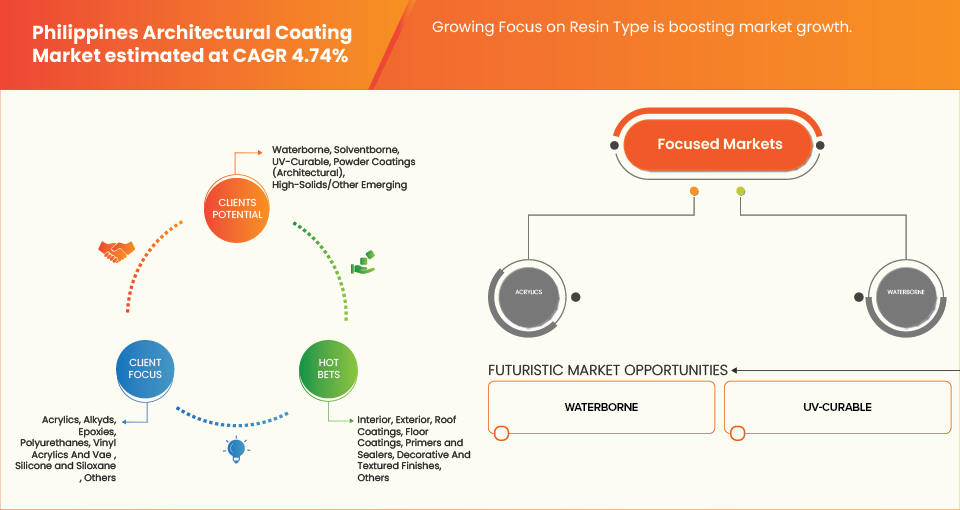

- By Resin Type

On the basis of resin type, the Philippines Architectural Coatings Market is segmented into Acrylics, Vinyl Acrylics and VAE, Alkyds, Polyurethanes, Epoxies, Silicone and Siloxane, and Others. In 2025, the Acrylics segment is expected to dominate the market with a market share of 38.41%, attributed to its wide availability, superior durability, cost-effectiveness, and ease of formulation. Acrylic-based coatings are preferred for both interior and exterior applications due to their excellent UV resistance, color retention, and quick-drying properties. The growing trend toward low-VOC, water-based coatings and the expanding residential and commercial construction sectors further reinforce the dominance of acrylic resins in the country’s architectural coatings market.

The Vinyl Acrylics and VAE segment is projected to be the fastest-growing resin type in the Philippines Architectural Coatings Market, registering the highest CAGR of 5.14% during the forecast period. This growth is driven by the rising preference for low-odor, low-VOC, and cost-effective coating formulations, along with the increasing adoption of water-based technologies in both residential and commercial applications. Vinyl Acrylic and VAE resins offer excellent adhesion, washability, and flexibility, making them suitable for interior wall paints, primers, and decorative finishes. Furthermore, the expansion of urban housing projects, modern retail spaces, and infrastructure renovation programs across the Philippines is fueling sustained demand for these versatile coating systems.

- By Technology

On the basis of technology, the Philippines Architectural Coatings Market is categorized into Solventborne, Waterborne, UV-Curable, Powder Coatings (Architectural), and High-Solids/Other Emerging Technologies. In 2025, the Solventborne segment is expected to dominate the market with a 47.87% share, supported by its widespread availability, cost-effectiveness, and established distribution networks. Solventborne coatings continue to be preferred in industrial and heavy-duty applications due to their high durability, superior adhesion, and resistance to harsh environmental conditions, particularly in tropical and humid climates prevalent across the Philippines.

the Powder Coatings (Architectural) segment is projected to record the fastest growth, expanding at a CAGR of 5.09% during the forecast period. The segment’s growth is driven by the shift toward sustainable, solvent-free, and low-emission coating technologies, coupled with rising adoption in metal facades, aluminum profiles, and decorative applications. Increasing awareness of eco-friendly coatings, supportive government environmental policies, and the expansion of green building initiatives are further accelerating the uptake of architectural powder coatings in the Philippines.

- By Application

On the basis of application, the Philippines Architectural Coatings Market is segmented into Interior and Exterior applications. In 2025, the Interior segment is projected to dominate the market with a 60.20% share, driven by the increasing demand for decorative and protective coatings used in residential, commercial, and institutional buildings. The segment benefits from rapid urbanization, rising household renovation activities, and aesthetic modernization trends across major Philippine cities. Interior coatings are favored for their ease of application, quick drying time, and low odor formulations, particularly among environmentally conscious consumers seeking low-VOC and waterborne alternatives.

the Interior segment is also expected to be the fastest-growing, registering a CAGR of 4.87% during the forecast period. Growth is supported by expanding construction of housing and commercial complexes, rising disposable incomes, and increasing adoption of premium decorative paints that enhance both visual appeal and surface protection. The continuous development of stain-resistant, antimicrobial, and washable interior paints is further strengthening market penetration across the Philippines.

- By End User

On the basis of end use, the Philippines Architectural Coatings Market is segmented into Residential, Commercial, Institutional, Industrial Buildings (Light Industrial and Warehouses), and Others. In 2025, the Residential segment is expected to dominate the market with a 47.75% share, driven by rapid urbanization, growing middle-class housing demand, and increased home renovation and remodeling activities. The segment also benefits from rising disposable incomes, government-backed affordable housing programs, and consumer inclination toward aesthetic and protective coatings that enhance indoor air quality and surface durability.

The Industrial Buildings (Light Industrial and Warehouses) segment is projected to be the fastest-growing, registering a CAGR of 4.91% during the forecast period. This growth is attributed to expanding manufacturing and logistics infrastructure, rising investments in industrial parks and warehousing facilities, and increasing adoption of high-performance, corrosion-resistant coatings to ensure long-term durability in harsh operational environments. Additionally, the growth of e-commerce and export-oriented industries in the Philippines is further boosting the demand for advanced architectural coatings in light industrial and warehouse applications.

- By Finish and Sheen

On the basis of finish and sheen, the Philippines Architectural Coatings Market is segmented into Flat and Matte, Eggshell, Satin, Semi-Gloss, Textured and Stone-Finish, High-Gloss, Metallic and Effects, and Others. In 2025, the Flat and Matte segment is expected to dominate the market with a 27.74% share, driven by its superior aesthetic appeal, ability to conceal surface imperfections, and widespread use in residential interiors and commercial spaces. These coatings are favored for their non-reflective finish, which provides a smooth, elegant appearance ideal for walls and ceilings. The segment also benefits from strong demand in housing renovations and cost-effective applications in new construction projects.

The Flat and Matte segment is also projected to be the fastest-growing, registering a CAGR of 5.58% during the forecast period. Growth is supported by the increasing popularity of contemporary matte aesthetics, rising adoption in minimalist and modern interior designs, and technological advancements in washable and durable matte formulations. Additionally, architects and designers are increasingly specifying matte coatings for their versatility in blending with both classic and modern décor themes, further driving the segment’s momentum in the Philippines market.

- By Distribution Channel

On the basis of distribution channel, the Philippines Architectural Coatings Market is segmented into Indirect and Direct channels. In 2025, the Indirect segment is expected to dominate the market with a 59.20% share, primarily due to the strong presence of hardware stores, paint retailers, distributors, and construction supply outlets across the country. These intermediaries play a crucial role in ensuring wide product availability, brand visibility, and competitive pricing for end users, including contractors and homeowners. Additionally, the trusted relationships between distributors and local applicators further strengthen this channel’s dominance in the market.

The Indirect segment is also projected to be the fastest-growing, registering a CAGR of 4.91% during the forecast period. This growth is driven by the expansion of organized retail and dealer networks, rising renovation and home improvement activities, and increasing promotional initiatives by manufacturers to enhance in-store brand engagement. Furthermore, the growing presence of multi-brand paint showrooms and improved logistics infrastructure are expected to enhance accessibility and convenience, reinforcing the segment’s leading position in the Philippines Architectural Coatings Market.

Philippines Architectural Coatings Market Regional Analysis

- Luzon is expected to dominate the Philippines Architectural Coatings Market, accounting for the largest revenue share of 59.48% in 2025. This dominance is attributed to strong construction activity, high concentration of residential and commercial developments, well-established distribution networks, and presence of major manufacturers and suppliers in the region. The region’s urban infrastructure growth, supported by ongoing public and private construction projects, continues to drive substantial demand for both interior and exterior coatings.

- Mindanao is projected to be the fastest-growing region in the Philippines Architectural Coatings Market during the forecast period, with a CAGR of 4.99%. Growth is fueled by rapid urbanization, expansion of commercial and industrial zones, and rising investments in infrastructure and housing projects. Additionally, government-backed programs promoting regional development and increased private sector participation are expected to enhance construction activity, thereby boosting coatings consumption.

- Furthermore, the expanding institutional infrastructure, including healthcare and educational facilities, along with increasing awareness of sustainable and durable coating solutions, is anticipated to further accelerate regional market growth.

Makati, Taguig, Pasig Architectural Coatings Market Insight

The Makati, Taguig, and Pasig segment represents a key growth hub within the Philippines Architectural Coatings Market, driven by high urbanization, dense concentration of commercial and residential developments, and rising investments in premium and sustainable construction projects. These cities host a large number of high-rise buildings, corporate offices, and mixed-use developments, fueling steady demand for decorative coatings, protective finishes, and green-certified paint systems. Furthermore, increasing adoption of smart building technologies, coupled with a growing preference for low-VOC and energy-efficient coatings, supports the market’s expansion. The presence of leading developers and architectural firms in these business districts continues to attract international coating brands and innovative material suppliers, positioning the area as a trendsetter in modern architectural finishes.

Manila Architectural Coatings Market Insight

The Manila Architectural Coatings Market is anticipated to witness steady growth, underpinned by robust infrastructure development, heritage building restorations, and public housing modernization programs. As the political and economic center of the Philippines, Manila benefits from strong institutional and government construction activities, ongoing urban renewal projects, and investments in sustainable and weather-resistant coatings. The city’s expanding residential base and rising consumer preference for durable, aesthetic, and low-maintenance finishes are driving demand for both interior and exterior architectural coatings. Additionally, retail availability through hardware chains and specialized distributors ensures consistent product accessibility, strengthening Manila’s position as a core market within the Greater Metro architectural coatings landscape.

The Major Market Leaders Operating in the Market Are:

- Pacific Paint (Boysen) Philippines, Inc. (Philippines),

- Nippon Paint (Coatings) Philippines, Inc. (Philippines),

- PPG Coatings Philippines (U.S.), Inc.,

- AkzoNobel N.V. (Netherlands),

- Jotun (Philippines), Inc. (Philippines),

- Asian Coatings Philippines, Inc. (brands: Welcoat, Rain or Shine) (Philippines),

- Island Premium Paints (Philippines),

- Sherwin-Williams Company (U.S.),

- Davies Paints Philippines, Incorporated (Philippines),

- SKK (Japan),

- Wilcon Depot Inc. (Philippines),

- Handyman Do it Best Philippines (Philippines),

- AHPI (Philippines),

- CW Home Depot (Philippines),

- Archify (Australia)

Latest Developments in Philippines Architectural Coatings Market

- In September 2025, BOYSEN showcased its colors, coatings, and paint innovations at Philconstruct Mindanao 2025, highlighting architectural paint solutions and interactive exhibits to inspire creativity in the construction industry

- In September 2025, Davies Paints was officially welcomed as a Platinum Industry Partner of the United Architects of the Philippines (UAP) National Conference 2025, reinforcing its leadership in architectural coatings.

- In May 2025, Island Premium Paints has expanded its product offerings with high-quality, eco-friendly interior and exterior architectural paints designed to meet the needs of Filipino homes and commercial spaces. They continue enhancing their portfolio by focusing on durable, sustainable coatings.

- In February 2025, Sherwin-Williams announced the acquisition of BASF's Brazilian architectural paints business "Suvinil" for USD 1.15 billion. This acquisition strengthens Sherwin-Williams’ presence in Latin America under the Consumer Brands Group.

- In May 2025, Davies Paints showcased its color innovations prominently at CONEX 2025, demonstrating advanced architectural paint solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 BARGAINING POWER OF SUPPLIERS:

4.1.3 BARGAINING POWER OF BUYERS:

4.1.4 THREAT OF SUBSTITUTES:

4.1.5 INDUSTRY RIVALRY:

4.2 RAND OUTLOOK

4.2.1 COMPANY VS BRAND OVERVIEW

4.2.2 BRAND POSITIONING AND MARKET PERCEPTION

4.2.2.1 PACIFIC PAINT (BOYSEN) PHILIPPINES, INC.

4.2.2.2 NIPPON PAINT CO., LTD.

4.2.2.3 PPG INDUSTRIES, INC.

4.2.2.4 AKZONOBEL PAINTS (DULUX PHILIPPINES)

4.2.3 JOTUN PAINTS PHILIPPINES, INC.

4.3 PATENT ANALYSIS– PHILIPPINES ARCHITECTURAL COATINGS MARKET

4.3.1 PATENT QUALITY AND STRENGTH

4.3.2 PATENT FAMILIES

4.3.3 LICENSING AND COLLABORATIONS

4.3.4 REGION PATENT LANDSCAPE

4.3.5 IP STRATEGY AND MANAGEMENT

4.4 RAW MATERIAL COVERAGE

4.4.1 TITANIUM DIOXIDE (TIO₂)

4.4.2 BINDERS/RESINS

4.4.3 SOLVENTS

4.4.4 FILLERS AND EXTENDERS

4.4.5 ADDITIVES

4.4.6 PIGMENTS (ORGANIC AND INORGANIC)

4.4.7 WATER (FOR WATER-BASED COATINGS)

4.5 TECHNOLOGICAL ADVANCEMENTS

4.5.1 SMART AND FUNCTIONAL COATING TECHNOLOGIES

4.5.2 ADVANCEMENTS IN RESIN AND POLYMER CHEMISTRY

4.5.3 DIGITALIZATION, AUTOMATION, AND SMART MANUFACTURING

4.5.4 SUSTAINABILITY AND GREEN COATING INNOVATIONS

4.5.5 NANOTECHNOLOGY AND ADVANCED MATERIAL INTEGRATION

4.5.6 ENERGY-EFFICIENT AND CLIMATE-RESILIENT COATING SYSTEMS

4.6 VENDOR SELECTION CRITERIA

4.6.1 QUALITY AND CONSISTENCY

4.6.2 TECHNICAL EXPERTISE

4.6.3 SUPPLY CHAIN RELIABILITY

4.6.4 COMPLIANCE AND SUSTAINABILITY

4.6.5 COST AND PRICING STRUCTURE

4.6.6 FINANCIAL STABILITY

4.6.7 FLEXIBILITY AND CUSTOMIZATION

4.6.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.7 PROFIT MARGINS SCENARIO

4.7.1 INTRODUCTION

4.7.2 COST MANAGEMENT AND MARGIN FORMATION

4.7.3 TECHNOLOGY DIFFERENTIATION AND PRODUCT STRATEGY

4.7.4 SUPPLY CHAIN AND DISTRIBUTION INFLUENCE

4.7.5 REGULATORY AND MACROECONOMIC INFLUENCES

4.7.6 EMERGING TRENDS AND STRATEGIC RESPONSES

4.7.7 CONCLUSION

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8.4 CONCLUSION

4.9 CLIMATE CHANGE SCENARIO

4.1 CONSUMER BUYING BEHAVIOUR

4.10.1 GROUP 1 PREMIUM HOMEOWNERS

4.10.2 GROUP 2 URBAN MIDDLE-CLASS BUYERS

4.10.3 GROUP 3 VALUE-CONSCIOUS BUYERS

4.10.4 GROUP 4 PRICE-SENSITIVE AND RURAL BUYERS

4.10.5 GROUP 5 PROFESSIONAL CONTRACTORS / INSTITUTIONAL BUYERS

4.10.6 GROUP 6 PREMIUM PROJECT DEVELOPERS / ARCHITECTS

4.11 COST ANALYSIS BREAKDOWN

4.11.1 INTRODUCTION

4.11.2 RAW MATERIAL AND MANUFACTURING COSTS

4.11.3 PACKAGING AND LOGISTICS COSTS

4.11.4 RESEARCH, QUALITY, AND REGULATORY COMPLIANCE COSTS

4.11.5 ENVIRONMENTAL, ENERGY, AND SUSTAINABILITY COSTS

4.11.6 EMERGING COST TRENDS

4.12 INDUSTRY ECOSYSTEM ANALYSIS

4.12.1 PROMINENT COMPANIES

4.12.2 SMALL & MEDIUM SIZE COMPANIES

4.12.3 END USERS

4.13 PRICING ANALYSIS

4.13.1 OVERVIEW

4.13.2 HISTORICAL PRICING TRENDS

4.13.3 FORECAST OUTLOOK (2025–2032)

4.13.4 MARKET IMPLICATIONS

4.13.5 SUMMARY

4.14 VALUE CHAIN ANALYSIS

4.15 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.15.1 INTRODUCTION

4.15.2 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.15.2.1 JOINT VENTURES

4.15.2.2 MERGERS AND ACQUISITIONS

4.15.2.3 LICENSING AND PARTNERSHIPS

4.15.2.4 TECHNOLOGY COLLABORATIONS

4.15.2.5 STRATEGIC DIVESTMENTS

4.15.3 NUMBER OF PRODUCTS IN DEVELOPMENT

4.15.4 STAGE OF DEVELOPMENT

4.15.5 TIMELINES AND MILESTONES

4.15.6 INNOVATION STRATEGIES AND METHODOLOGIES

4.15.7 RISK ASSESSMENT AND MITIGATION

5 TARIFFS & IMPACT ON THE MARKET

5.1 INTRODUCTION

5.2 CURRENT TARIFF RATE (S) IN PHILIPPINES & ASEAN CONTEXT

5.3 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.4 VENDOR SELECTION CRITERIA DYNAMICS

5.5 IMPACT ON SUPPLY CHAIN

5.5.1 RAW MATERIAL PROCUREMENT

5.5.2 MANUFACTURING AND PRODUCTION

5.5.3 LOGISTICS AND DISTRIBUTION

5.5.4 STAGE OF DEVELOPMENT

5.6 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.7 IMPACT ON PRICES

5.8 REGULATORY INCLINATION

6 REGULATION COVERAGE

6.1 INTRODUCTION

6.2 PRODUCT CODES

6.3 CERTIFIED STANDARDS

6.4 SAFETY STANDARDS

6.5 MATERIAL HANDLING & STORAGE

6.6 TRANSPORT & PRECAUTIONS

6.7 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 URBANIZATION AND HOUSING EXPANSION DRIVE PAINT DEMAND

7.1.2 SHIFT TOWARD WATERBORNE AND LOW-VOC SYSTEMS

7.1.3 GOVERNMENT AND PRIVATE CONSTRUCTION INVESTMENTS SUSTAIN MARKET GROWTH

7.2 RESTRAINTS

7.2.1 RAW MATERIAL PRICE VOLATILITY IMPACTS PROFIT MARGINS

7.2.2 TROPICAL CLIMATE CHALLENGES PAINT APPLICATION AND DURABILITY

7.3 OPPORTUNITIES

7.3.1 GREEN BUILDING CERTIFICATIONS BOOST DEMAND FOR SUSTAINABLE COATINGS

7.3.2 GROWING DIY SEGMENT AND DIGITAL RETAIL EXPANSION

7.4 CHALLENGES

7.4.1 PROLIFERATION OF COUNTERFEIT AND LOW-QUALITY PAINTS

7.4.2 STRINGENT ENVIRONMENTAL REGULATIONS RAISE COMPLIANCE COSTS

8 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY RESIN TYPE

8.1 OVERVIEW

8.2 ACRYLICS

8.2.1 SOLVENTBORNE

8.2.2 WATERBORNE

8.2.2.1 PURE ACRYLIC

8.2.2.2 STYRENE-ACRYLIC

8.2.2.3 OTHERS

8.2.3 UV-CURABLE

8.2.4 OTHERS

8.2.5 EXTERIOR-GRADE (ELASTOMERIC, WEATHERABLE)

8.2.6 INTERIOR-GRADE (LOW-VOC, ANTIMICROBIAL)

8.3 VINYL ACRYLICS AND VAE

8.3.1 WATERBORNE EMULSION

8.3.2 OTHERS

8.3.3 INTERIOR WALLS AND CEILINGS

8.3.4 PRIMING AND SEALING

8.4 ALKYDS

8.4.1 SOLVENTBORNE

8.4.2 WATERBORNE ALKYD (HYBRID)

8.4.3 WOOD AND METAL TRIMS

8.4.4 DOORS AND WINDOWS

8.4.5 OTHERS

8.5 POLYURETHANES

8.5.1 ACRYLIC POLYURETHANE

8.5.2 ALIPHATIC/AROMATIC PU

8.5.3 SOLVENTBORNE

8.5.4 WATERBORNE

8.6 EPOXIES

8.6.1 TWO-COMPONENT

8.6.2 WATER-BASED EPOXY

8.6.3 FLOOR COATINGS

8.6.4 PRIMING AND SEALING

8.7 SILICONE AND SILOXANE

8.7.1 WATER-REPELLENT COATINGS

8.7.2 BREATHABLE MINERAL COATINGS

8.7.3 OTHERS

8.8 OTHERS

9 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 SOLVENTBORNE

9.2.1 ALKYD

9.2.2 PU

9.2.3 OTHERS

9.2.4 CONVENTIONAL

9.2.5 HIGH SOLIDS

9.3 WATERBORNE

9.3.1 ACRYLIC LATEX

9.3.2 VINYL ACRYLIC

9.3.3 WATERBORNE ALKYD

9.3.4 OTHERS

9.3.5 LOW-VOC

9.3.6 CONVENTIONAL

9.3.7 ZERO-VOC

9.4 UV-CURABLE

9.5 POWDER COATINGS (ARCHITECTURAL)

9.5.1 ALUMINUM EXTRUSIONS

9.5.2 GALVANIZED STEEL

9.5.3 OTHERS

9.6 HIGH-SOLIDS/OTHER EMERGING

10 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 INTERIOR

10.2.1 WALL COATING

10.2.2 CEILING COATING

10.2.3 DECORATIVE AND TEXTURED FINISHES

10.2.4 FLOOR COATING

10.2.5 OTHERS

10.2.6 CONCRETE AND MASONRY

10.2.7 DRYWALL AND PLASTER

10.2.8 WOOD

10.2.9 FIBER CEMENT

10.2.10 ETALS

10.2.11 OTHERS

10.2.12 FLAT AND MATTE

10.2.13 EGGSHELL AND SATIN

10.2.14 SEMI-GLOSS AND HIGH-GLOSS

10.2.15 OTHERS

10.3 EXTERIOR

10.3.1 WALL COATING

10.3.2 ROOF COATING

10.3.3 DECORATIVE AND TEXTURED FINISHES

10.3.4 FLOOR COATING

10.3.5 OTHERS

10.3.6 CONCRETE AND MASONRY

10.3.7 DRYWALL AND PLASTER

10.3.8 WOOD

10.3.9 FIBER CEMENT

10.3.10 METALS

10.3.11 OTHERS

10.3.12 WEATHERPROOF AND UV-RESISTANT

10.3.13 THERMAL AND HEAT-REFLECTIVE (COOL ROOF)

10.3.14 MOLD AND MILDEW RESISTANT

10.3.15 OTHERS

11 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY END USE

11.1 OVERVIEW

11.2 RESIDENTIAL

11.2.1 SINGLE-FAMILY

11.2.2 MULTI-FAMILY

11.2.3 CONTRACTOR-LED

11.2.4 DIY

11.3 COMMERCIAL

11.3.1 OFFICES AND RETAIL

11.3.2 HOSPITALITY AND LEISURE

11.3.3 TRANSPORT HUBS

11.4 INSTITUTIONAL

11.4.1 HEALTHCARE

11.4.2 EDUCATION

11.4.3 GOVERNMENT AND INFRASTRUCTURE

11.5 INDUSTRIAL BUILDING (LIGHT INDUSTRIAL AND WAREHOUSES)

11.5.1 PROTECTIVE DECORATIVE

11.5.2 FLOOR SYSTEMS

11.6 OTHERS

12 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY FINISH AND SHEEN

12.1 OVERVIEW

12.2 FLAT AND MATTE

12.3 EGGSHELL

12.4 SATIN

12.5 SEMI-GLOSS

12.6 TEXTURED AND STONE-FINISH

12.7 HIGH-GLOSS

12.8 METALLIC AND EFFECTS

12.9 OTHERS

13 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 INDIRECT

13.2.1 SPECIALTY PAINT STORES

13.2.2 RETAIL CHAINS

13.2.3 E-COMMERCE

13.3 DIRECT

14 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY STATE

14.1 LUZON

14.2 VISAYAS

14.3 MINDANAO

15 PHILIPPINES ARCHITECTURAL COATINGS MARKET: COMPANY LANDSCAPE

15.1 MANUFACTURER COMPANY SHARE ANALYSIS: PHILIPPINES

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PACIFIC PAINT (BOYSEN) PHILIPPINES, INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENT

17.2 NIPPON PAINT (COATINGS) PHILIPPINES, INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 PPG INDUSTRIES, INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 AKZO NOBEL N.V. ( BRAND NAME DULUX)

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 BRAND PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 JOTUN

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 ASIAN COATINGS PHILS., INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 DAVIES PAINTS PHILIPPINES INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 ISLAND PAINTS

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 THE SHERWIN-WILLIAMS COMPANY

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 SKK

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 WILCON DEPOT INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 AHPI

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 HANDYMAN DO IT BEST PHILIPPINES

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 CW HOME DEPOT

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 ARCHIFY

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 COMPANY VS BRAND OVERVIEW

TABLE 3 ARCHITECTURAL COATINGS COST MODEL

TABLE 4 PHILLIPPINES TARIFF SNAPSHOT FOR KEY ARCHITECTURAL COATINGS

TABLE 5 REGIONAL REGULATORY COMPARISON FOR SOFT MAGNETIC MATERIALS

TABLE 6 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY RESIN TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 ACRYLICS IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 8 WATERBORNE IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 ACRYLICS IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY PERFORMANCE GRADE, 2018-2032 (USD THOUSAND)

TABLE 10 VINYL ACRYLICS AND VAE IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 11 VINYL ACRYLICS AND VAE IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY APPLICATION AREA, 2018-2032 (USD THOUSAND)

TABLE 12 ALKYDS IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 13 ALKYDS IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY APPLICATION AREA, 2018-2032 (USD THOUSAND)

TABLE 14 POLYURETHANES IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 POLYURETHANES IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 16 EPOXIES IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 EPOXIES IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY USE-CASE, 2018-2032 (USD THOUSAND)

TABLE 18 SILICONE AND SILOXANE IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY USE-CASE, 2018-2032 (USD THOUSAND)

TABLE 19 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 20 SOLVENTBORNE IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, RESIN SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 21 SOLVENTBORNE IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, VOC CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 22 WATERBORNE IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY RESIN SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 23 WATERBORNE IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, VOC CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 24 POWDER COATINGS (ARCHITECTURAL) IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, APPLICATION SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 25 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 26 INTERIOR IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 DECORATIVE AND TEXTURED FINISHES IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 FLOOR COATING IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 INTERIOR IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 30 INTERIOR IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 31 EXTERIOR IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 ROOF COATING IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 DECORATIVE AND TEXTURED FINISHES IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 FLOOR COATING IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 EXTERIOR IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 36 EXTERIOR IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 37 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 38 RESIDENTIAL IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY NEW CONSTRUCTION, 2018-2032 (USD THOUSAND)

TABLE 39 RESIDENTIAL IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY REPAINTING AND RENOVATION, 2018-2032 (USD THOUSAND)

TABLE 40 COMMERCIAL IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 INSTITUTIONAL IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 INSTITUTIONAL IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY FINISH AND SHEEN, 2018-2032 (USD THOUSAND)

TABLE 44 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 45 INDIRECT SEGMENT IN PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY STATE, 2018-2032 (USD THOUSAND)

TABLE 47 NATIONAL CAPITAL REGION (METRO MANILA) IN LUZON ARCHITECTURAL COATINGS MARKET, BY CITY, 2018-2032 (USD THOUSAND)

TABLE 48 LUZON ARCHITECTURAL COATINGS MARKET, BY RESIN TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 ACRYLICS IN LUZON ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 50 WATERBORNE IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 ACRYLICS IN LUZON ARCHITECTURAL COATINGS MARKET, BY PERFORMANCE GRADE, 2018-2032 (USD THOUSAND)

TABLE 52 VINYL ACRYLICS AND VAE IN LUZON ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 53 VINYL ACRYLICS AND VAE IN LUZON ARCHITECTURAL COATINGS MARKET, BY APPLICATION AREA, 2018-2032 (USD THOUSAND)

TABLE 54 ALKYDS IN LUZON ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 55 ALKYDS IN LUZON ARCHITECTURAL COATINGS MARKET, BY APPLICATION AREA, 2018-2032 (USD THOUSAND)

TABLE 56 POLYURETHANES IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 POLYURETHANES IN LUZON ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 58 EPOXIES IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 EPOXIES IN LUZON ARCHITECTURAL COATINGS MARKET, BY USE-CASE, 2018-2032 (USD THOUSAND)

TABLE 60 SILICONE AND SILOXANE IN LUZON ARCHITECTURAL COATINGS MARKET, BY USE-CASE, 2018-2032 (USD THOUSAND)

TABLE 61 LUZON ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 62 SOLVENTBORNE IN LUZON ARCHITECTURAL COATINGS MARKET, RESIN SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 63 SOLVENTBORNE IN LUZON ARCHITECTURAL COATINGS MARKET, VOC CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 64 WATERBORNE IN LUZON ARCHITECTURAL COATINGS MARKET, BY RESIN SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 65 WATERBORNE IN LUZON ARCHITECTURAL COATINGS MARKET, VOC CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 66 POWDER COATINGS (ARCHITECTURAL) IN LUZON ARCHITECTURAL COATINGS MARKET, APPLICATION SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 67 LUZON ARCHITECTURAL COATINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 INTERIOR IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 DECORATIVE AND TEXTURED FINISHES IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 FLOOR COATING IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 INTERIOR IN LUZON ARCHITECTURAL COATINGS MARKET, BY SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 72 INTERIOR IN LUZON ARCHITECTURAL COATINGS MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 73 EXTERIOR IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 ROOF COATING IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 DECORATIVE AND TEXTURED FINISHES IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 FLOOR COATING IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 EXTERIOR IN LUZON ARCHITECTURAL COATINGS MARKET, BY SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 78 EXTERIOR IN LUZON ARCHITECTURAL COATINGS MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 79 LUZON ARCHITECTURAL COATINGS MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 80 RESIDENTIAL IN LUZON ARCHITECTURAL COATINGS MARKET, BY NEW CONSTRUCTION, 2018-2032 (USD THOUSAND)

TABLE 81 RESIDENTIAL IN LUZON ARCHITECTURAL COATINGS MARKET, BY REPAINTING AND RENOVATION, 2018-2032 (USD THOUSAND)

TABLE 82 COMMERCIAL IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 INSTITUTIONAL IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 INDUSTRIAL BUILDING (LIGHT INDUSTRIAL AND WAREHOUSES) IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 LUZON ARCHITECTURAL COATINGS MARKET, BY FINISH AND SHEEN, 2018- 2032 (USD THOUSAND)

TABLE 86 LUZON ARCHITECTURAL COATINGS MARKET, BY DISTRIBUTIONAL CHANNEL, 2018- 2032 (USD THOUSAND)

TABLE 87 INDIRECT IN LUZON ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018- 2032 (USD THOUSAND)

TABLE 88 VISAYAS ARCHITECTURAL COATINGS MARKET, BY RESIN TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 ACRYLICS IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 90 WATERBORNE IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 ACRYLICS IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY PERFORMANCE GRADE, 2018-2032 (USD THOUSAND)

TABLE 92 VINYL ACRYLICS AND VAE IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 93 VINYL ACRYLICS AND VAE IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY APPLICATION AREA, 2018-2032 (USD THOUSAND)

TABLE 94 ALKYDS IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 95 ALKYDS IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY APPLICATION AREA, 2018-2032 (USD THOUSAND)

TABLE 96 POLYURETHANES IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 POLYURETHANES IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 98 EPOXIES IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 EPOXIES IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY USE-CASE, 2018-2032 (USD THOUSAND)

TABLE 100 SILICONE AND SILOXANE IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY USE-CASE, 2018-2032 (USD THOUSAND)

TABLE 101 VISAYAS ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 102 SOLVENTBORNE IN VISAYAS ARCHITECTURAL COATINGS MARKET, RESIN SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 103 SOLVENTBORNE IN VISAYAS ARCHITECTURAL COATINGS MARKET, VOC CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 104 WATERBORNE IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY RESIN SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 105 WATERBORNE IN VISAYAS ARCHITECTURAL COATINGS MARKET, VOC CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 106 POWDER COATINGS (ARCHITECTURAL) IN VISAYAS ARCHITECTURAL COATINGS MARKET, APPLICATION SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 107 VISAYAS ARCHITECTURAL COATINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 108 INTERIOR IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 DECORATIVE AND TEXTURED FINISHES IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 FLOOR COATING IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 INTERIOR IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 112 INTERIOR IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 113 EXTERIOR IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 ROOF COATING IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 DECORATIVE AND TEXTURED FINISHES IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 FLOOR COATING IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 EXTERIOR IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 118 EXTERIOR IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 119 VISAYAS ARCHITECTURAL COATINGS MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 120 RESIDENTIAL IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY NEW CONSTRUCTION, 2018-2032 (USD THOUSAND)

TABLE 121 RESIDENTIAL IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY REPAINTING AND RENOVATION, 2018-2032 (USD THOUSAND)

TABLE 122 COMMERCIAL IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 INSTITUTIONAL IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 INDUSTRIAL BUILDING (LIGHT INDUSTRIAL AND WAREHOUSES) IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 VISAYAS ARCHITECTURAL COATINGS MARKET, BY FINISH AND SHEEN, 2018- 2032 (USD THOUSAND)

TABLE 126 VISAYAS ARCHITECTURAL COATINGS MARKET, BY DISTRIBUTIONAL CHANNEL, 2018- 2032 (USD THOUSAND)

TABLE 127 INDIRECT IN VISAYAS ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018- 2032 (USD THOUSAND)

TABLE 128 MINDANAO ARCHITECTURAL COATINGS MARKET, BY RESIN TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 ACRYLICS IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 130 WATERBORNE IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 ACRYLICS IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY PERFORMANCE GRADE, 2018-2032 (USD THOUSAND)

TABLE 132 VINYL ACRYLICS AND VAE IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 133 VINYL ACRYLICS AND VAE IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY APPLICATION AREA, 2018-2032 (USD THOUSAND)

TABLE 134 ALKYDS IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 135 ALKYDS IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY APPLICATION AREA, 2018-2032 (USD THOUSAND)

TABLE 136 POLYURETHANES IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 POLYURETHANES IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 138 EPOXIES IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 EPOXIES IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY USE-CASE, 2018-2032 (USD THOUSAND)

TABLE 140 SILICONE AND SILOXANE IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY USE-CASE, 2018-2032 (USD THOUSAND)

TABLE 141 MINDANAO ARCHITECTURAL COATINGS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 142 SOLVENTBORNE IN MINDANAO ARCHITECTURAL COATINGS MARKET, RESIN SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 143 SOLVENTBORNE IN MINDANAO ARCHITECTURAL COATINGS MARKET, VOC CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 144 WATERBORNE IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY RESIN SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 145 WATERBORNE IN MINDANAO ARCHITECTURAL COATINGS MARKET, VOC CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 146 POWDER COATINGS (ARCHITECTURAL) IN MINDANAO ARCHITECTURAL COATINGS MARKET, APPLICATION SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 147 MINDANAO ARCHITECTURAL COATINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 148 INTERIOR IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 DECORATIVE AND TEXTURED FINISHES IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 FLOOR COATING IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 INTERIOR IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 152 INTERIOR IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 153 EXTERIOR IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 ROOF COATING IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 DECORATIVE AND TEXTURED FINISHES IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 FLOOR COATING IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 EXTERIOR IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY SUBSTRATE, 2018-2032 (USD THOUSAND)

TABLE 158 EXTERIOR IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 159 MINDANAO ARCHITECTURAL COATINGS MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 160 RESIDENTIAL IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY NEW CONSTRUCTION, 2018-2032 (USD THOUSAND)

TABLE 161 RESIDENTIAL IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY REPAINTING AND RENOVATION, 2018-2032 (USD THOUSAND)

TABLE 162 COMMERCIAL IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 INSTITUTIONAL IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 INDUSTRIAL BUILDING (LIGHT INDUSTRIAL AND WAREHOUSES) IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MINDANAO ARCHITECTURAL COATINGS MARKET, BY FINISH AND SHEEN, 2018- 2032 (USD THOUSAND)

TABLE 166 MINDANAO ARCHITECTURAL COATINGS MARKET, BY DISTRIBUTIONAL CHANNEL, 2018- 2032 (USD THOUSAND)

TABLE 167 INDIRECT IN MINDANAO ARCHITECTURAL COATINGS MARKET, BY TYPE, 2018- 2032 (USD THOUSAND)

List of Figure

FIGURE 1 PHILIPPINES ARCHITECTURAL COATINGS MARKET

FIGURE 2 PHILIPPINES ARCHITECTURAL COATINGS MARKET: DATA TRIANGULATION

FIGURE 3 PHILIPPINES ARCHITECTURAL COATINGS MARKET: DROC ANALYSIS

FIGURE 4 PHILIPPINES ARCHITECTURAL COATINGS MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 PHILIPPINES ARCHITECTURAL COATINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 PHILIPPINES ARCHITECTURAL COATINGS MARKET: MULTIVARIATE MODELLING

FIGURE 7 PHILIPPINES ARCHITECTURAL COATINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 PHILIPPINES ARCHITECTURAL COATINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 PHILIPPINES ARCHITECTURAL COATINGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 SEVEN SEGMENTS COMPRISE THE PHILIPPINES ARCHITECTURAL COATINGS MARKET, BY RESIN TYPE (2024)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 PHILIPPINES ARCHITECTURAL COATINGS MARKET: SEGMENTATION

FIGURE 14 URBANIZATION AND HOUSING EXPANSION DRIVE PAINT DEMAND IS EXPECTED TO DRIVE THE PHILIPPINES ARCHITECTURAL COATINGS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 THE ACRYLICS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE PHILIPPINES ARCHITECTURAL COATINGS MARKET IN 2025 AND 2032

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 PATENT ANALYSIS BY APPLICANTS

FIGURE 18 PATENT ANALYSIS BY COUNTRY

FIGURE 19 PATENT ANALYSIS BY YEAR

FIGURE 20 VENDOR SELECTION CRITERIA

FIGURE 21 PRICING ANALYSIS (2018-2032)

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF PHILIPPINES ARCHITECTURAL COATINGS MARKET

FIGURE 23 PHILIPPINES ARCHITECTURAL COATINGS MARKET: BY RESIN TYPE, 2024

FIGURE 24 PHILIPPINES ARCHITECTURAL COATINGS MARKET: BY TECHNOLOGY, 2024

FIGURE 25 PHILIPPINES ARCHITECTURAL COATINGS MARKET: BY APPLICATION, 2024

FIGURE 26 PHILIPPINES ARCHITECTURAL COATINGS MARKET: BY END USE, 2024

FIGURE 27 PHILIPPINES ARCHITECTURAL COATINGS MARKET: BY FINISH AND SHEEN, 2024

FIGURE 28 PHILIPPINES ARCHITECTURAL COATINGS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 29 PHILIPPINES ARCHITECTURAL COATINGS MARKET: COMPANY SHARE 2024 (%)

Philippines Architectural Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Philippines Architectural Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Philippines Architectural Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.