Poultry Keeping Machinery Market

Market Size in USD Billion

CAGR :

%

USD

5.79 Billion

USD

8.30 Billion

2024

2032

USD

5.79 Billion

USD

8.30 Billion

2024

2032

| 2025 –2032 | |

| USD 5.79 Billion | |

| USD 8.30 Billion | |

|

|

|

|

Poultry Keeping Machinery Market Size

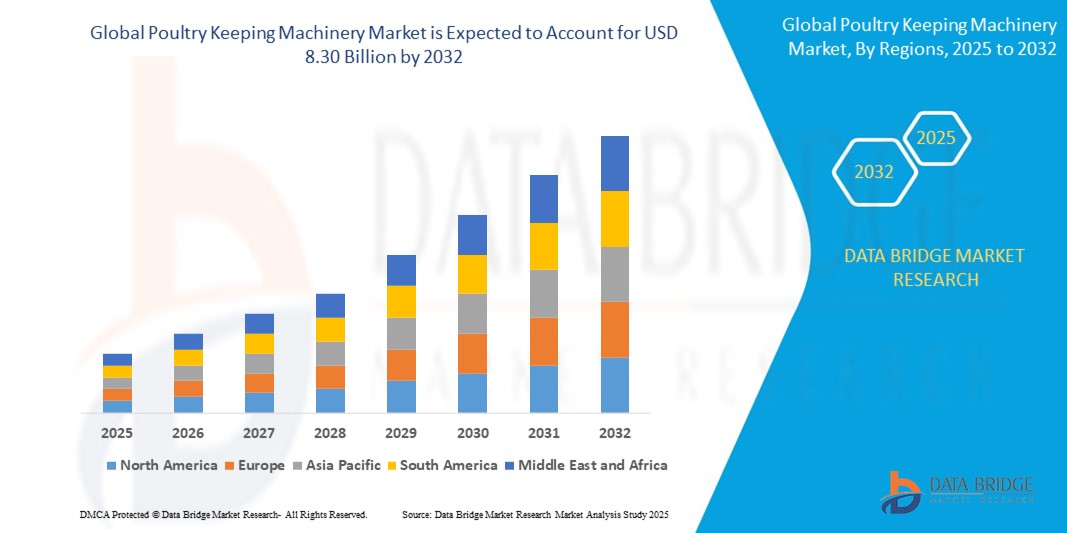

- The global poultry keeping machinery market size was valued at USD 5.79 billion in 2024 and is expected to reach USD 8.30 billion by 2032, at a CAGR of 4.6% during the forecast period

- The market growth is largely fueled by the increasing demand for automation and efficiency in poultry farming operations, driven by the rising global consumption of poultry products and the need to meet large-scale production requirements

- Furthermore, growing emphasis on animal welfare, biosecurity, and sustainability is prompting the adoption of advanced machinery that supports hygienic, energy-efficient, and cost-effective farming practices. These converging factors are accelerating the deployment of modern poultry keeping equipment, thereby significantly boosting the industry's growth

Poultry Keeping Machinery Market Analysis

- Poultry keeping machinery, encompassing automated systems for feeding, drinking, climate control, egg handling, and waste management, is becoming increasingly essential for modern poultry farming operations due to its ability to enhance productivity, reduce labor dependency, and maintain consistent animal welfare standards across both small-scale farms and large poultry factories

- The escalating demand for poultry keeping machinery is primarily fueled by the rising global consumption of poultry products, growing focus on sustainable and hygienic production practices, and the need for technologically advanced solutions to meet the efficiency and scale required by the evolving poultry industry

- North America dominated the poultry keeping machinery market with a share of 38.8% in 2024, due to the high concentration of commercial poultry operations, advanced farming practices, and growing demand for automation to improve efficiency and biosecurity

- Europe is expected to be the fastest growing region in the poultry keeping machinery market during the forecast period due to increasing investment in sustainable poultry production, animal welfare regulations, and modern farm automation

- Feeding chicken segment dominated the market with a market share of 66.9% in 2024, due to the dominant role of chicken in global poultry production, high consumer demand for chicken meat and eggs, and the widespread adoption of specialized machinery to support efficient, large-scale feeding operations. The segment benefits from extensive mechanization in broiler and layer farms, which enhances feed conversion efficiency, reduces mortality rates, and supports consistent growth cycles essential for meeting commercial output targets

Report Scope and Poultry Keeping Machinery Market Segmentation

|

Attributes |

Poultry Keeping Machinery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Poultry Keeping Machinery Market Trends

“Rising Automation in Poultry Keeping Machinery”

- A significant and accelerating trend in the global poultry keeping machinery market is the shift toward automation across core processes such as feeding, drinking, egg collection, climate control, and waste management. This transformation is enhancing efficiency, reducing manual labor, and enabling better control over production environments

- For instance, Big Dutchman offers fully automated feeding and climate control systems that optimize feed conversion ratios while maintaining consistent environmental conditions within poultry houses

- Automation in poultry equipment also supports improved biosecurity by minimizing human contact and reducing contamination risks. Advanced machinery with integrated sensors and programmable controls allows for real-time monitoring and adjustments, improving both animal welfare and operational outcomes

- Moreover, smart machinery integrated with data analytics and IoT technologies can collect performance data, helping farmers make informed decisions and improve overall productivity. Companies such as Vencomatic Group and Jansen Poultry Equipment are increasingly embedding smart features in their machinery to meet this rising demand

- The seamless automation of repetitive tasks increases farm output and also addresses labor shortages and ensures consistent quality. From egg-handling robots to automated broiler harvesting systems, equipment innovation is driving a fundamental shift in how poultry operations are managed globally

- This trend toward intelligent and interconnected machinery is reshaping poultry farming practices and setting new standards for efficiency and animal management. As a result, demand for such solutions continues to rise among both commercial poultry factories and small-to-mid-sized farms seeking competitive advantages

Poultry Keeping Machinery Market Dynamics

Driver

“Growing Demand for Poultry Products”

- The increasing global demand for poultry meat and eggs, driven by population growth, rising protein consumption, and shifting dietary preferences, is a major driver accelerating the adoption of poultry keeping machinery

- For instance, poultry remains one of the most consumed and affordable sources of animal protein worldwide, prompting producers to scale up operations and invest in automated systems to meet rising consumption efficiently and hygienically

- In addition, expanding commercial poultry farms and the need for standardized, high-output production environments are pushing the use of advanced equipment in areas such as feeding automation, egg handling, and slaughtering. Governments and agricultural bodies in countries such as China and India are also promoting mechanization to boost productivity and sustainability

- Technological advancements in machinery have also made it possible to maintain high production volumes while improving animal welfare and operational control, thus aligning with both commercial goals and regulatory standards

- The growing integration of modern equipment is also helping farmers address challenges related to disease control, environmental compliance, and consistent yield delivery, ultimately driving the poultry keeping machinery market forward

Restraint/Challenge

“High Initial Costs”

- The high upfront investment required for purchasing and installing advanced poultry keeping machinery poses a significant challenge, particularly for small and mid-sized farms in developing regions

- For instance, climate control systems, automatic feeders, and intelligent egg-handling equipment can represent substantial capital expenditure, deterring adoption among budget-conscious farmers despite the long-term cost savings

- Limited access to financing options, lack of technical know-how, and inadequate infrastructure further exacerbate the challenge of implementing modern machinery in rural or resource-constrained areas

- Moreover, frequent upgrades or maintenance requirements for high-tech equipment can add to operational costs. While large commercial farms can absorb these expenses, smaller farms may find it difficult to justify such investments without strong financial support or government subsidies

- Overcoming this restraint will require broader access to affordable equipment, innovative leasing or financing models, and increased awareness of long-term return on investment through improved productivity and efficiency

Poultry Keeping Machinery Market Scope

The market is segmented on the basis of product type, end-users, and application.

• By Product Type

On the basis of product type, the poultry keeping machinery market is segmented into feeding, drinking, climate control, incubator equipment, hatchery equipment, egg collection, handling and management equipment, broiler harvesting and slaughtering, residue and waste management, and others. The feeding equipment segment dominated market revenue share in 2024, primarily due to its critical role in ensuring consistent and efficient nutrient delivery across poultry farms. Automated feeding systems significantly reduce labor costs, minimize feed wastage, and support optimal bird growth, which is vital for maintaining high productivity in both broiler and layer operations. The integration of sensors and data analytics in modern feeding systems further enhances precision and control in feeding practices.

The climate control equipment segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by growing concerns over animal welfare, heat stress, and environmental regulation compliance. Advanced ventilation, heating, and cooling systems are becoming essential in both open and closed poultry housing to maintain ideal conditions for bird health and growth. The demand is further propelled by the rising trend toward fully automated, climate-regulated poultry houses that ensure year-round production efficiency regardless of external weather fluctuations.

• By End-Users

On the basis of end-users, the poultry keeping machinery market is segmented into farms and poultry factories. The farm segment accounted for the largest market revenue share in 2024, owing to the widespread presence of small to mid-sized poultry farms globally, especially in developing regions. These farms are increasingly adopting semi-automated and automated machinery to improve operational efficiency, reduce manual labor dependency, and meet growing consumer demand for poultry products.

The poultry factory segment is projected to register the fastest CAGR from 2025 to 2032, driven by the rapid industrialization of poultry production and the need for large-scale, integrated operations. Poultry factories heavily invest in advanced machinery to streamline hatching, feeding, slaughtering, and waste management processes, ensuring uniform product quality, biosecurity, and compliance with food safety standards.

• By Application

On the basis of application, the market is segmented into feeding chicken, feeding duck, and feeding geese. The feeding chicken segment held the largest market revenue share of 66.9% in 2024, driven by the dominant role of chicken in global poultry production, high consumer demand for chicken meat and eggs, and the widespread adoption of specialized machinery to support efficient, large-scale feeding operations. The segment benefits from extensive mechanization in broiler and layer farms, which enhances feed conversion efficiency, reduces mortality rates, and supports consistent growth cycles essential for meeting commercial output targets.

The feeding duck segment is expected to witness the fastest growth rate from 2025 to 2032, particularly in Asian countries where duck farming is expanding rapidly due to cultural dietary preferences and export potential. Advancements in duck-specific feeders that accommodate varied feeding behaviors and body sizes are supporting the mechanization of this niche, yet growing, sector.

Poultry Keeping Machinery Market Regional Analysis

- North America dominated the poultry keeping machinery market with the largest revenue share of 38.8% in 2024, driven by the high concentration of commercial poultry operations, advanced farming practices, and growing demand for automation to improve efficiency and biosecurity

- The region’s poultry producers prioritize equipment that enhances productivity and reduces labor dependency, supported by technological innovations and robust investment in modernizing farm infrastructure

- The U.S. and Canada exhibit a strong presence of integrated poultry production systems, with rising adoption of automated feeding, egg collection, and waste management solutions, strengthening North America’s market leadership

U.S. Poultry Keeping Machinery Market Insight

The U.S. poultry keeping machinery market captured the largest revenue share in 2024 within North America, propelled by large-scale poultry production facilities, rising demand for meat and eggs, and government support for automation in agriculture. The U.S. market benefits from strong technological integration, such as IoT-enabled climate control systems and precision feeding equipment, enhancing operational efficiency and ensuring animal welfare compliance across broiler and layer farms.

Asia-Pacific Poultry Keeping Machinery Market Insight

The Asia-Pacific poultry keeping machinery market is expected to grow at a substantial CAGR during the forecast period, driven by the rapid expansion of poultry production in countries such as China, India, and Indonesia. Increasing urbanization, rising income levels, and the growing demand for animal protein are pushing farms to adopt automated machinery for feeding, egg collection, and broiler processing. Government support for farm mechanization and the presence of regional manufacturers offering cost-effective solutions are accelerating adoption across the region.

China Poultry Keeping Machinery Market Insight

The China poultry keeping machinery market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by its position as the world’s largest poultry producer. Strong domestic demand, rising health and safety awareness, and the shift toward integrated farming systems are driving investments in high-performance machinery. Chinese producers are rapidly adopting automated climate control, incubator, and slaughtering systems to scale operations and meet growing consumption.

India Poultry Keeping Machinery Market Insight

The India poultry keeping machinery market is growing rapidly due to the expanding poultry sector and increased focus on farm efficiency. Rising consumption of poultry products, coupled with government initiatives promoting agricultural mechanization, is encouraging farmers to upgrade to automated feeding and hatchery systems. The availability of affordable, localized machinery and increased access to financing options are also supporting market growth across small and mid-scale farms.

Europe Poultry Keeping Machinery Market Insight

The Europe poultry keeping machinery market is projected to grow at the fastest CAGR during the forecast period, supported by increasing investment in sustainable poultry production, animal welfare regulations, and modern farm automation. The region’s focus on eco-friendly equipment, waste reduction, and improved hygienic standards is encouraging the replacement of outdated systems with advanced machinery. Rising consumer preference for ethically produced poultry and growing emphasis on food safety are accelerating technology upgrades across both traditional and industrial poultry setups.

U.K. Poultry Keeping Machinery Market Insight

The U.K. poultry keeping machinery market is expected to grow significantly, driven by the demand for high-efficiency systems that support sustainable farming and compliance with strict animal welfare norms. Producers are increasingly investing in automated feeding, climate control, and hatchery equipment to enhance productivity and meet rising domestic poultry demand. The ongoing modernization of agricultural practices and support for digital technologies in livestock farming are further fueling market growth.

Germany Poultry Keeping Machinery Market Insight

The Germany poultry keeping machinery market is anticipated to expand steadily, supported by a strong emphasis on precision livestock farming, biosecurity, and integration of energy-efficient technologies. German poultry farms are adopting smart feeding systems, automated waste handling, and environmental monitoring solutions to improve output while minimizing ecological impact. Government incentives for sustainable agriculture and consumer demand for traceable, high-quality poultry products are fostering further innovation.

Poultry Keeping Machinery Market Share

The poultry keeping machinery industry is primarily led by well-established companies, including:

- Ziggity Systems, Inc. (U.S.)

- Kishore Farm Equipments Pvt Ltd (India)

- A.P. POULTRY EQUIPMENTS (India)

- TECNO POULTRY EQUIPMENT Spa (Italy)

- Big Dutchman (Germany)

- Jansen Poultry Equipment (Netherlands)

- Vencomatic Group B.V. (Netherlands)

- HARTMANN GROUP (Germany)

- TEXHA PA LLC (Ukraine)

- Petersime (Belgium)

- GARTECH (India)

- LUBING Maschinenfabrik Ludwig Bening GmbH & Co. KG (Germany)

- Salmet (Germany)

- Henan Jinfeng Poultry Equipment Co,.Ltd. (China)

Latest Developments in Global Poultry Keeping Machinery Market

- In February 2024, AGCO Corporation, a global leader in agricultural machinery, expanded its market presence by merging with another agricultural equipment provider. This strategic move is expected to significantly influence the poultry keeping machinery market by broadening AGCO's product portfolio and enhancing its service capabilities. The merger supports innovation and service optimization across agricultural operations, which is likely to accelerate the adoption of advanced poultry machinery solutions and strengthen AGCO’s competitive position globally

- In June 2023, Vencomatic Group launched a new egg handling system designed to increase efficiency in layer farms. This technological advancement is poised to positively impact the poultry keeping machinery market by streamlining egg collection workflows, reducing labor costs, and improving animal welfare. By introducing automation and precision into the egg handling process, the system reinforces the market trend toward sustainable, high-performance equipment tailored to modern poultry farming needs

- In July 2021, AVICOLA FEREZ's new manufacturing facility in Abanilla, designed specifically for free-range hens, is set to expand its capacity with support from Tecno and Ingeniera Avcola. The Tecno Aviary VS224 facility, tailored for 8,000 free-range hens, marks a significant development in the industry, emphasizing enhanced poultry farming technology

- In March 2021, Big Dutchman introduced Barny, an innovative robot designed to address the issue of floor eggs. Currently in beta testing, Barny navigates the barn, encouraging hens to use nests for laying eggs. Test results indicate that Barny can reduce the number of floor eggs by up to 75%, showcasing its efficiency

- In March 2021, Vencomatic expanded its Prinzen product line with the introduction of the Prinzen Palletiser. This new addition is aimed at meeting the increasing demand for automated egg handling solutions. The Palletiser operates autonomously, connects to various farm packers, and efficiently handles up to 40,000 eggs per hour, or 110 cases, by moving four stacks of trays simultaneously

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Poultry Keeping Machinery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Poultry Keeping Machinery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Poultry Keeping Machinery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.