Russia Cooktops Market

Market Size in USD Billion

CAGR :

%

USD

1.24 Billion

USD

1.82 Billion

2025

2033

USD

1.24 Billion

USD

1.82 Billion

2025

2033

| 2026 –2033 | |

| USD 1.24 Billion | |

| USD 1.82 Billion | |

|

|

|

|

Russia Cooktops Market Size

- The Russia cooktops market size was valued at USD 1.24 Billion in 2025 and is expected to reach USD 1.82 Billion by 2033, at a CAGR of 4.9% during the forecast period.

- Market growth is further supported by increasing focus on energy efficiency standards, rising consumer preference for durable and easy-to-maintain cooktops, and strong emphasis on household safety features such as flame failure protection and automatic shut-off systems. Additionally, technological advancements in cooktop design, growing adoption of induction and smart cooktops, and investments in modern kitchen infrastructure are enhancing user convenience and sustaining long-term market growth across Russia.

Russia Cooktops Market Analysis

- Russia’s Cooktops Market includes modern kitchen appliances that use electric, gas, and induction technologies to deliver efficient cooking performance, reducing energy waste, improving user convenience, and enhancing overall household safety standards.

- It plays an important role in urban housing trends, serving homeowners, property developers, and appliance retailers by supporting faster meal preparation and optimized space utilization across contemporary apartments.

- One of the primary trends in Russia’s Cooktops Market is the adoption of induction models, which efficiently heat cookware surfaces while reducing energy consumption and improving temperature control. The growing demand for compact modular kitchens is also driving the development of smart features and connected appliances designed to coordinate ventilation, safety monitoring, and power management within modern homes.

- In residential projects, this innovation is essential for design flexibility, user satisfaction, and long term durability, ensuring consistent performance and reduced maintenance costs for consumers nationwide across diverse income segments today.

- In 2025, the Gas Cooktops segment dominated the Russia cooktops market with a 48.65% market share due to widespread household gas infrastructure, affordability advantages, and consumer familiarity, providing a cost-effective cooking solution, reliable performance, and greater flexibility compared to electric and induction alternatives across urban and semi-urban households.

Report Scope and Russia Cooktops Market Segmentation

|

Attributes |

Russia Cooktops Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Russia Cooktops Market Trends

“Rapid Expansion of Smart and Energy-Efficient Cooktops Within the Broader Russia Kitchen Appliance Market”

- Increasing energy efficiency regulations and national standards are encouraging the adoption of modern gas, electric, and induction cooktops in residential and commercial kitchens, driving demand for compliant, low-consumption appliances amid ongoing urban housing developments.

- Growing preference for advanced technologies such as induction heating, touch controls, and smart connectivity features that enhance cooking precision, safety, and user convenience, alongside integrated sensors for temperature regulation and automatic shut-off functions.

- Expansion of urban residential construction and government-backed housing initiatives is accelerating demand for built-in and space-efficient cooktops, supporting the shift toward modular kitchen designs in high-density city apartments.

- Rising consumer awareness of sustainability is promoting eco-friendly and durable cooktop solutions, aligning with energy conservation goals and increasing interest in long-lasting appliances that reduce electricity and gas consumption over time.

Russia Cooktops Market Dynamics

Driver

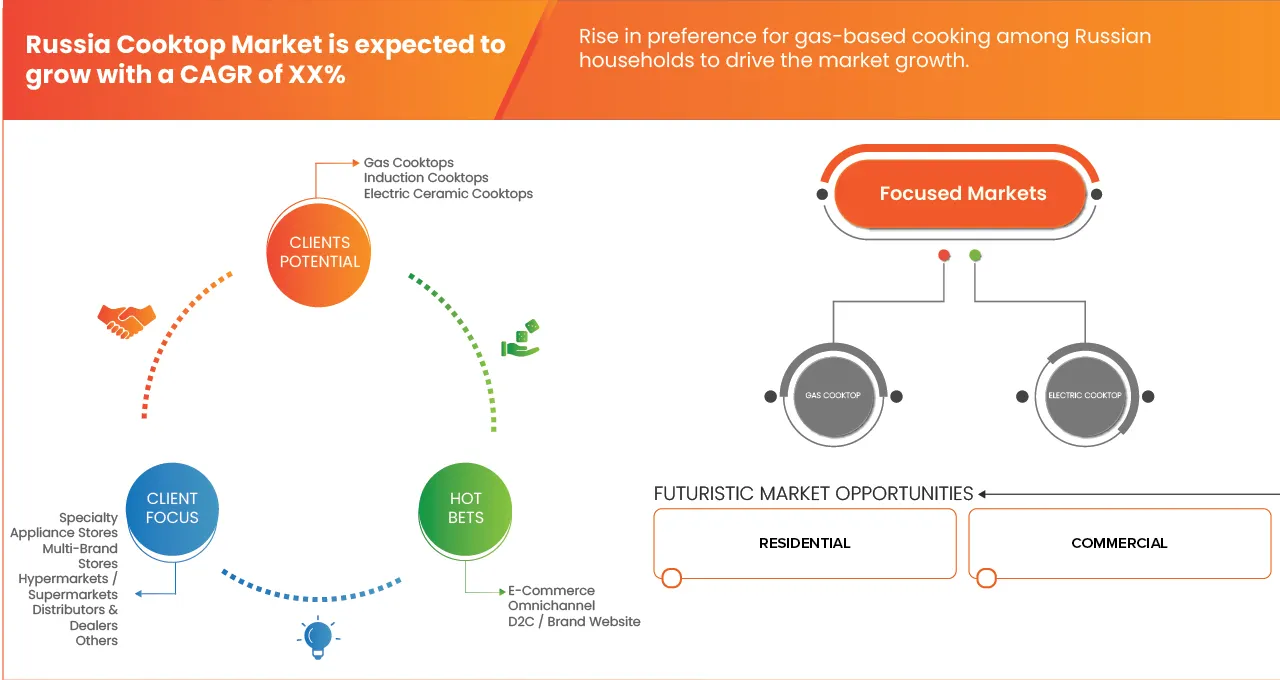

“Rise In Preference for Gas-Based Cooking Among Russian Households”

- Russia’s long-established residential gas distribution network has strongly influenced household cooking preferences, with centralized gas connections integrated into many apartment buildings across major cities and regional urban centers, ensuring continuous and reliable access for everyday cooking needs, particularly during extended winter periods when uninterrupted meal preparation is essential.

- Historical housing developments across Russia commonly included centralized gas infrastructure as a standard utility, enabling widespread adoption of gas cooktops and reinforcing their perception as a practical, dependable, and accessible cooking solution for urban households.

- Traditional cooking habits in Russian households have played a significant role in sustaining gas cooktop usage, as many home-prepared meals require precise flame control, adjustable heat levels, and compatibility with diverse cookware, making gas burners a preferred option for their instant heat response and visual control.

- Cost considerations have further strengthened the dominance of gas-based cooking, as gas is widely viewed as a more economical energy source compared to electricity for daily use, encouraging households to continue replacing and upgrading gas cooktops rather than fully transitioning to electric or induction alternatives.

Restraint

“Dependence on Imported Components and Technology”

- The Russia cooktops market has been significantly affected by its reliance on imported components such as precision burners, electronic ignition systems, induction coils, and advanced control panels, exposing manufacturers to global supply chain disruptions, currency fluctuations, and geopolitical uncertainties that often increase production costs and delay new product launches.

- Dependence on foreign research, development, and design expertise has limited domestic innovation, as advanced features like smart induction controls, touch-sensitive panels, and multi-zone heating systems are typically developed abroad, restricting the ability of local manufacturers to tailor products to regional cooking preferences and energy efficiency requirements.

- Regulatory compliance requirements for imported technologies, including certifications, testing, and safety approvals, have contributed to longer product development cycles and slower market entry for new cooktop models, reducing manufacturers’ flexibility in responding to evolving consumer demand.

- Disruptions in global trade, including sanctions, shipping delays, and fluctuating import duties, have impacted inventory management and pricing strategies, while reliance on foreign technical expertise for maintenance and repairs has further complicated after-sales support, collectively restraining production efficiency and technological progress in the Russian cooktops market.

Russia Cooktops Market Scope

The Russia cooktops market is segmented into one notable segment based on the product type.

• By Product Type

On the basis of product type, the Russia cooktops market is segmented into induction cooktops, electric ceramic cooktops, and gas cooktops. In 2026, gas cooktops are expected to dominate the market with a 48.37% share due to their widespread compatibility with Russia’s established residential gas infrastructure, cost efficiency, and strong consumer preference for precise flame control. Their reliability during voltage fluctuations and suitability for traditional cooking methods further support continued adoption across both urban and semi-urban households.

The gas cooktops segment is also projected to register the highest CAGR of 4.9%, driven by ongoing residential construction, renovation activities, and replacement demand for older appliances. Increasing consumer focus on energy-efficient gas burners, enhanced safety features, and modern built-in designs is encouraging upgrades, while affordability advantages over induction and electric ceramic alternatives continue to strengthen demand across diverse income groups.

Russia Cooktops Market Share

The Russia cooktops market is primarily led by well-established companies, including:

- Bosch (BSH Hausgeräte GmbH) (Germany)

- LG Electronics (South Korea)

- Comfee (China)

- Midea Group (China)

- Gorenje (Slovenia)

- Maunfeld Rus LLC (Russia)

- Samsung Electronics (South Korea)

- Haier Group (China)

- Gree Electric Appliances (China)

- Beko Group (Turkey)

- SMEG S.p.A. (Italy)

- Teka Group (Switzerland)

- Fotile (China)

- Vatti Corporation (China)

- Indesit (Whirlpool) (Italy)

Latest Developments in Russia Cooktops Market

- In September 2019, Bosch has advanced its induction hob technology by integrating DirectSelect touch controls for intuitive zone selection and power adjustment, alongside energy-efficient induction heating that delivers rapid, precise cooking. Key features include PowerBoost for faster heating, FlexInduction zones that adapt to cookware placement, and safety functions like residual heat indicators and child locks. These innovations enhance user convenience, cooking efficiency, and safety, reflecting Bosch’s focus on smart, interactive, and high-performance kitchen solutions.

- In November 2023, LG Electronics achieved a key development milestone by becoming the first appliance manufacturer to receive ENERGY STAR certification under the new residential electric cooking specifications for its induction cooktops and ranges. Multiple LG induction models met the updated criteria, delivering approximately 18% higher energy efficiency than standard electric cooktops while maintaining fast heating, precise temperature control, and advanced smart features. This development reinforces LG’s focus on energy-efficient electrification and sustainable kitchen appliance innovation.

- In September 2025 at IFA Berlin, Midea Group unveiled its XPRESS MASTER kitchen suite, a new range of cooking technologies designed to revolutionize everyday meal preparation by saving time without sacrificing quality. The suite’s induction cooktop uses XpressHeat technology to heat surfaces in seconds with intelligent controls that prevent boil-overs and overcooking. Complementary appliances such as a Dual-Zone Air Fryer, XpressGrill Steak Oven, Twin Convection Oven, and combination ovens further extend time-saving capabilities, enabling simultaneous and versatile cooking tasks with independent settings and advanced heating technologies. Across the XPRESS MASTER lineup, Midea delivers convenience-focused performance that aligns with busy routines, reinforcing its commitment to efficient and innovative kitchen solutions.

- In September 2025, Samsung advanced its premium built-in kitchen portfolio at IFA by introducing next-generation appliances designed for modern, open-plan kitchens. The company unveiled an Extractor Induction Hob that integrates powerful ventilation directly into the cooktop, eliminating the need for overhead hoods while ensuring efficient smoke and odor removal. Key features include Flex Zone Plus for adaptable cookware placement, a turbo-slim extraction system, and a durable matte glass surface with anti-fingerprint coating. Samsung also showcased its Bespoke AI Dishwasher, featuring a handle-free auto-open door, AI-powered wash cycles that automatically adjust to soil levels, and improved rack design for flexible loading. These innovations enhance space efficiency, user convenience, and performance, reinforcing Samsung’s focus on seamless design, intelligent automation, and premium built-in kitchen solutions.

- In January 2025, Gorenje strengthened its induction cooking portfolio in the Russian market by introducing new innovative induction cooktops designed to combine modern aesthetics with enhanced cooking flexibility and safety. The company launched advanced models featuring sleek black ceramic glass surfaces with a frameless design, supporting easy maintenance and seamless kitchen integration. Key innovations include AreaFlex technology, which allows multiple induction zones to merge into a larger cooking area for oversized cookware, PowerBoost for rapid heating, and intuitive SliderTouch controls for precise power adjustment. Additional functions such as Stop&Go pause, child lock protection, automatic overheat shut-off, and residual heat indicators further enhance user safety and convenience. These developments highlight Gorenje’s focus on efficient heat performance, adaptable cooking solutions, and contemporary built-in kitchen design.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF RUSSIA COOKTOPS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 END USE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES ANALYSIS

4.2 CLIMATE CHANGE SCENARIO

4.2.1 ENVIRONMENTAL CONCERNS

4.2.2 INDUSTRY RESPONSE

4.2.3 GOVERNMENT’S ROLE

4.2.4 ANALYST RECOMMENDATIONS

4.3 CONSUMER BEHAVIOUR ANALYSIS, BY PRODUCT TYPE

4.3.1 GAS COOKTOPS

4.3.1.1 COOKING HABITS

4.3.1.2 INFLUENTIAL FACTORS

4.3.1.3 EVOLVING PREFERENCES

4.3.2 ELECTRIC CERAMIC COOKTOPS

4.3.2.1 COOKING HABITS

4.3.2.2 INFLUENTIAL FACTORS

4.3.2.3 EVOLVING PREFERENCES

4.3.3 INDUCTION COOKTOPS

4.3.3.1 COOKING HABITS

4.3.3.2 INFLUENTIAL FACTORS

4.3.3.3 EVOLVING PREFERENCES

4.3.4 OVERALL CONSUMER BEHAVIOUR OUTLOOK

4.4 IMPORTS OF COOKTOPS BY CATEGORY IN RUSSIA, 2025 (IN VALUE & VOLUME)

4.4.1 INTRODUCTION

4.4.2 GAS COOKTOPS

4.4.3 INDUCTION COOKTOPS

4.4.4 ELECTRIC CERAMIC COOKTOPS

4.4.5 CONCLUSION

4.5 INDUSTRY ECOSYSTEM ANALYSIS

4.5.1 PROMINENT COMPANIES

4.5.2 SMALL & MEDIUM SIZE COMPANIES

4.5.3 END USERS

4.6 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.6.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.6.1.1 JOINT VENTURES

4.6.1.2 MERGERS AND ACQUISITIONS

4.6.1.3 LICENSING AND PARTNERSHIP

4.6.1.4 TECHNOLOGY COLLABORATIONS

4.6.1.5 STRATEGIC DIVESTMENTS.

4.6.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.6.3 STAGE OF DEVELOPMENT

4.6.4 TIMELINES AND MILESTONES

4.6.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.6.6 FUTURE OUTLOOK

4.7 RAW MATERIAL COVERAGE

4.7.1 INTRODUCTION

4.7.2 CLASSIFICATION OF RAW MATERIALS

4.7.2.1 STRUCTURAL AND BODY MATERIALS

4.7.2.2 HEATING AND ENERGY TRANSFER COMPONENTS

4.7.2.3 MECHANICAL AND CONTROL COMPONENTS

4.7.2.4 ELECTRICAL AND ELECTRONIC MATERIALS

4.7.2.5 THERMAL INSULATION AND SAFETY MATERIALS

4.7.2.6 SURFACE TREATMENT AND FINISHING MATERIALS

4.7.2.7 SURFACE TREATMENT AND FINISHING MATERIALS

4.7.2.8 RAW MATERIAL COST CONTRIBUTION (% APPROX.)

4.8 CONSUMER BUYING BEHAVIOUR

4.8.1 PRICE SENSITIVITY AND VALUE ORIENTATION

4.8.2 BRAND AWARENESS, TRUST, AND LOYALTY

4.8.3 BRAND AWARENESS, TRUST, AND LOYALTY

4.8.4 SHIFT TOWARD LOCAL AND REGIONAL PRODUCTS

4.8.5 TRADITIONAL VS. MODERN COOKING HABITS

4.8.6 COMPACT AND URBAN FIT

4.8.7 PURCHASING CHANNELS AND DIGITAL INFLUENCE

4.8.8 RISK PERCEPTION AND PRODUCT CONSIDERATIONS

4.8.9 CULTURAL AND CONTEXTUAL INFLUENCES

4.8.10 CONCLUSION

4.9 VENDOR SELECTION CRITERIA

4.1 TECHNOLOGICAL ADVANCEMENTS

4.10.1 INTRODUCTION

4.10.2 3D FLAME TECHNOLOGY PRECISION HEAT CONTROL REVOLUTIO

4.10.3 SMART INDUCTION TECHNOLOGY THE ENERGY-EFFICIENT POWERHOUSE

4.10.4 DIGITAL TIMER AND AUTO-CONTROL SYSTEMS

4.10.5 BUILT-IN DESIGN INNOVATION SPACE AND STYLE OPTIMIZATION

4.10.6 SAFETY AND EFFICIENCY FEATURES THAT MATTER

4.10.7 CONCLUSION

4.11 BRAND OUTLOOK

4.11.1 BOSCH

4.11.2 SMEG

4.11.3 NEFF

4.11.4 WEISSGAUFF

4.11.5 HANSA

4.12 RUSSIA COOKTOPS MARKET, TOP 20 BRAND SHARE ANALYSIS, BY CATEGORY, 2025 (IN %, VALUE & VOLUME)

4.12.1 INDUCTION COOKTOP

4.12.2 ELECTRIC CERAMIC COOKTOP

4.12.3 GAS COOKTOP

4.13 COOKTOPS – MODEL-WISE FEATURE AND SELLING POINT, USP & DISTRIBUTION MAPPING

4.14 PRICING ANALYSIS

4.15 SUPPLY CHAIN ANALYSIS

4.15.1 OVERVIEW

4.15.2 LOGISTIC COST SCENARIO

4.15.2.1 DISTANCE, MODE MIX, AND INLAND DISTRIBUTION

4.15.2.2 PORT PERFORMANCE AND INTERNATIONAL ROUTING

4.15.2.3 CUSTOMS PROCEDURES AND TECHNICAL COMPLIANCE

4.15.2.4 ENERGY, FUEL, AND ENVIRONMENTAL PASS-THROUGHS

4.15.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

4.15.3.1 COORDINATION OF MULTI-STAGE DISTRIBUTION NETWORKS

4.15.3.2 CUSTOMS, CERTIFICATION, AND REGULATORY NAVIGATION

4.15.3.3 HANDLING OF FRAGILE AND HIGH-VALUE APPLIANCES

4.15.3.4 AFTER-SALES AND LIFECYCLE LOGISTICS SUPPORT

4.16 VALUE CHAIN ANALYSIS

4.16.1 INTRODUCTION

4.16.2 RAW MATERIAL & COMPONENT SUPPLY

4.16.3 MANUFACTURING & ASSEMBLY

4.16.4 DISTRIBUTION & LOGISTICS

4.16.5 END-USE INDUSTRIES & SALES CHANNELS

4.16.6 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE (S) IN RUSSIA

5.2 KEY POINTS

5.3 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.3.1 GROWTH OF LOCAL PRODUCTION

5.3.2 RELIANCE ON IMPORTED COOKTOPS

5.3.3 STRATEGIC CONSIDERATIONS FOR THE MARKET

5.3.4 MARKET OUTLOOK AND FUTURE TRENDS

5.4 VENDOR SELECTION CRITERIA DYNAMICS

5.4.1 KEY DYNAMICS

5.4.2 INSIGHTS FOR VENDOR EVALUATION

5.5 IMPACT ON SUPPLY CHAIN

5.5.1 RAW MATERIAL PROCUREMENT

5.5.2 MANUFACTURING AND PRODUCTION

5.5.3 LOGISTICS AND DISTRIBUTION

5.5.4 PRICE PITCHING AND POSITION OF MARKET

5.6 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.6.1 SUPPLY CHAIN OPTIMIZATION

5.6.2 JOINT VENTURE ESTABLISHMENTS

5.7 IMPACT ON PRICES

5.8 REGULATORY INCLINATION

5.8.1 GEOPOLITICAL SITUATION

5.8.1.1 SANCTIONS AND TRADE ISOLATION

5.8.1.2 IMPORT SUBSTITUTION POLICIES

5.8.1.3 DIVERSIFICATION OF TRADE PARTNERSHIPS

5.8.1.4 DEPENDENCE ON IMPORTED TECHNOLOGY AND INPUTS

5.8.1.5 DOMESTIC ADAPTATION AND SUPPLY CHAIN RESILIENCE

5.8.1.6 LONG-TERM STRATEGIC SHIFTS

5.8.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.8.2.1 FREE TRADE AGREEMENTS

5.8.2.2 ALLIANCES ESTABLISHMENTS

5.8.3 STATUS ACCREDITATION (INCLUDING MFTN)

5.8.3.1 OVERVIEW OF MFN AND STATUS ACCREDITATION

5.8.3.2 RUSSIA’S WTO MEMBERSHIP AND MFN CONTEXT

5.8.3.3 IMPACT OF GEOPOLITICAL ACTIONS ON MFN TREATMENT

5.8.3.4 IMPLICATIONS FOR THE RUSSIA COOKTOPS MARKET

5.8.3.5 PREFERENTIAL AND NON‑PREFERENTIAL TREATMENT DYNAMICS

5.8.3.6 STRATEGIC CONSIDERATIONS FOR MANUFACTURERS AND IMPORTERS

5.8.4 DOMESTIC COURSE OF CORRECTION

5.8.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.8.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.2.1 EAC (EURASIAN CONFORMITY) CERTIFICATION — MANDATORY FOR RUSSIA/EAEU

6.2.2 GOST / NATIONAL STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN PREFERENCE FOR GAS-BASED COOKING AMONG RUSSIAN HOUSEHOLDS

7.1.2 AUGMENTATION IN APARTMENT RENOVATION AND KITCHEN MODERNIZATION ACTIVITIES

7.1.3 INCREASE IN ADOPTION OF BUILT-IN KITCHEN APPLIANCES

7.1.4 SURGE IN ADOPTION OF MULTI-BURNER AND HIGH-CAPACITY COOKTOPS

7.2 RESTRAINTS

7.2.1 DEPENDENCE ON IMPORTED COMPONENTS AND TECHNOLOGY

7.2.2 LIMITED CONSUMER AWARENESS REGARDING ADVANCED COOKTOP TECHNOLOGIES

7.3 OPPORTUNITIES

7.3.1 INCLINATION TOWARDS INDUCTION COOKTOPS IN URBAN MIDDLE-INCOME SEGMENTS

7.3.2 LOCALIZATION OF MANUFACTURING AND ASSEMBLY OPERATIONS

7.3.3 GROWTH OF E-COMMERCE AND APPLIANCE RETAIL PLATFORMS

7.4 CHALLENGES

7.4.1 HIGH PRICE SENSITIVITY AMONG A BROAD CONSUMER BASE

7.4.2 AFTER-SALES SERVICE AND INSTALLATION COMPLEXITY

8 RUSSIA COOKTOPS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 RUSSIA COOKTOPS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

8.2.1 GAS COOKTOPS

8.2.2 INDUCTION COOKTOPS

8.2.3 ELECTRIC CERAMIC COOKTOPS

8.3 RUSSIA COOKTOPS MARKET, BY PRODUCT TYPE, 2018-2033 (THOUSAND UNITS)

8.3.1 GAS COOKTOPS

8.3.2 INDUCTION COOKTOPS

8.3.3 ELECTRIC CERAMIC COOKTOPS

8.4 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY SALES CHANNELS, 2018-2033 (USD THOUSAND)

8.4.1 OFFLINE CHANNELS

8.4.2 ONLINE CHANNELS

8.5 RUSSIA OFFLINE CHANNELS IN COOKTOPS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.5.1 SPECIALTY APPLIANCE STORES

8.5.2 MULTI-BRAND STORES

8.5.3 HYPERMARKETS / SUPERMARKETS

8.5.4 DISTRIBUTORS & DEALERS

8.5.5 OTHERS

8.6 RUSSIA ONLINE CHANNELS IN COOKTOPS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 E-COMMERCE

8.6.2 OMNICHANNEL

8.6.3 D2C / BRAND WEBSITE

8.7 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

8.7.1 RESIDENTIAL

8.7.2 COMMERCIAL

8.8 RUSSIA RESIDENTIAL IN COOKTOPS MARKET, BY OVERVIEW & USAGE SCENERIO, 2018-2033 (USD THOUSAND)

8.8.1 APARTMENTS

8.8.2 INDIVIDUAL HOUSES

8.8.3 OTHERS

8.9 RUSSIA COMMERCIAL IN COOKTOPS MARKET, BY OVERVIEW & USAGE SCENERIO, 2018-2033 (USD THOUSAND)

8.9.1 RESTAURANTS

8.9.2 CAFES & CATERING

8.9.3 HOTELS

8.9.4 OTHERS

8.1 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY PRICE TIER, 2018-2033 (USD THOUSAND)

8.10.1 ECONOMY (UPTO $250)

8.10.2 MID-RANGE ($251-$750)

8.10.3 PREMIUM ($751 & ABOVE)

8.11 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY SAFTEY FEATURES, 2018-2033 (USD THOUSAND)

8.11.1 FLAME FAILURE PROTECTION

8.11.2 AUTO-IGNITION SAFETY SYSTEM

8.11.3 CHILD LOCK

8.11.4 GAS LEAK DETECTION

8.11.5 RESIDUAL HEAT INDICATOR

8.11.6 OTHERS

8.12 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY CONTROL SYSTEM, 2018-2033 (USD THOUSAND)

8.12.1 MECHANICAL CONTROL SYSTEM

8.12.2 ELECTRONIC CONTROL SYSTEM

8.12.3 DIGITAL CONTROL SYSTEM

8.12.4 OTHERS

8.13 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY SMART CONNETIVITY, 2018-2033 (USD THOUSAND)

8.13.1 NO CONNECTIVITY

8.13.2 BLUETOOTH-ENABLED

8.13.3 APP CONTROL

8.13.4 SMART HOME ECOSYSTEM INTEGRATION

8.13.5 OTHERS

8.14 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY FRAME DESIGN, 2018-2033 (USD THOUSAND)

8.14.1 FULL METAL FRAME

8.14.2 FRAMELESS DESIGN

8.14.3 PARTIAL FRAME

8.14.4 OTHERS

8.15 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY FUEL TYPE, 2018-2033 (USD THOUSAND)

8.15.1 NATURAL GAS

8.15.2 CONVERTIBLE

8.15.3 LPG

8.15.4 OTHERS

8.16 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY SIZE (WIDTH), 2018-2033 (USD THOUSAND)

8.16.1 MEDIUM SIZE (31 TO 36.9 INCHES)

8.16.2 SMALL SIZE (UP TO 24.9 INCHES)

8.16.3 LARGE SIZE (37 INCHES & ABOVE)

8.17 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

8.17.1 STAINLESS STEEL BODY

8.17.2 TEMPERED GLASS SURFACE

8.17.3 GLASS-CERAMIC SURFACE

8.17.4 OTHERS

8.18 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY BURNER COUNT, 2018-2033 (USD THOUSAND)

8.18.1 FOUR BURNER

8.18.2 THREE BURNER

8.18.3 DUAL BURNER

8.18.4 FIVE BURNER

8.18.5 SINGLE BURNER

8.18.6 SIX AND MORE BURNERS

8.19 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY COLOR, 2018-2033 (USD THOUSAND)

8.19.1 BLACK

8.19.2 SILVER

8.19.3 WHITE

8.19.4 OTHERS

8.2 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY SALES CHANNELS, 2018-2033 (USD THOUSAND)

8.20.1 OFFLINE CHANNELS

8.20.2 ONLINE CHANNELS

8.21 RUSSIA OFFLINE CHANNELS IN COOKTOPS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.21.1 SPECIALTY APPLIANCE STORES

8.21.2 MULTI-BRAND STORES

8.21.3 HYPERMARKETS / SUPERMARKETS

8.21.4 DISTRIBUTORS & DEALERS

8.21.5 OTHERS

8.22 RUSSIA ONLINE CHANNELS IN COOKTOPS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.22.1 E-COMMERCE

8.22.2 OMNICHANNEL

8.22.3 D2C / BRAND WEBSITE

8.23 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

8.23.1 RESIDENTIAL

8.23.2 COMMERCIAL

8.24 RUSSIA RESIDENTIAL IN COOKTOPS MARKET, BY OVERVIEW & USAGE SCENERIO, 2018-2033 (USD THOUSAND)

8.24.1 APARTMENTS

8.24.2 INDIVIDUAL HOUSES

8.24.3 OTHERS

8.25 RUSSIA COMMERCIAL IN COOKTOPS MARKET, BY OVERVIEW & USAGE SCENERIO, 2018-2033 (USD THOUSAND)

8.25.1 CAFES & CATERING

8.25.2 RESTAURANTS

8.25.3 HOTELS

8.25.4 OTHERS

8.26 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY PRICE TIER, 2018-2033 (USD THOUSAND)

8.26.1 MID-RANGE (USD 251–750)

8.26.2 ECONOMY (UP TO USD 250)

8.26.3 PREMIUM (USD 751+)

8.27 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY SAFTEY FEATURES, 2018-2033 (USD THOUSAND)

8.27.1 CHILD-LOCK SAFETY

8.27.2 OVERHEAT PROTECTION

8.27.3 RESIDUAL HEAT INDICATORS

8.27.4 AUTOMATIC PAN DETECTION

8.27.5 OTHERS

8.28 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY CONTROL SYSTEM, 2018-2033 (USD THOUSAND)

8.28.1 TOUCH CONTROL

8.28.2 BUTTON CONTROL

8.28.3 ROTARY CONTROL

8.28.4 OTHERS

8.29 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY SMART CONNETIVITY, 2018-2033 (USD THOUSAND)

8.29.1 NO CONNECTIVITY

8.29.2 APP CONTROL

8.29.3 SMART HOME INTEGRATION

8.29.4 BLUETOOTH-ENABLED

8.29.5 OTHERS

8.3 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY FRAME DESIGN, 2018-2033 (USD THOUSAND)

8.30.1 FRAMELESS DESIGN

8.30.2 PARTIAL FRAME

8.30.3 FULL METAL FRAME

8.30.4 OTHERS

8.31 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY FUEL TYPE, 2018-2033 (USD THOUSAND)

8.31.1 STANDARD AC ELECTRIC INDUCTION

8.31.2 HIGH-POWER INDUCTION

8.31.3 INVERTER-SUPPORTED INDUCTION

8.31.4 OTHERS

8.32 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY SIZE (WIDTH), 2018-2033 (USD THOUSAND)

8.32.1 MEDIUM SIZE (31 TO 36.9 INCHES)

8.32.2 SMALL SIZE (UP TO 24.9 INCHES)

8.32.3 LARGE SIZE (37 INCHES & ABOVE)

8.33 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

8.33.1 TEMPERED GLASS SURFACE

8.33.2 GLASS-CERAMIC SURFACE

8.33.3 STAINLESS STEEL BODY

8.33.4 OTHERS

8.34 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY BURNER COUNT, 2018-2033 (USD THOUSAND)

8.34.1 FOUR BURNER

8.34.2 THREE BURNER

8.34.3 DUAL BURNER

8.34.4 FIVE BURNER

8.34.5 SINGLE BURNER

8.34.6 SIX AND MORE BURNERS

8.35 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY COLOR, 2018-2033 (USD THOUSAND)

8.35.1 BLACK

8.35.2 SILVER

8.35.3 WHITE

8.35.4 OTHERS

8.36 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY SALES CHANNELS, 2018-2033 (USD THOUSAND)

8.36.1 OFFLINE CHANNELS

8.36.2 ONLINE CHANNELS

8.37 RUSSIA OFFLINE CHANNELS IN COOKTOPS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.37.1 SPECIALTY APPLIANCE STORES

8.37.2 MULTI-BRAND STORES

8.37.3 HYPERMARKETS / SUPERMARKETS

8.37.4 DISTRIBUTORS & DEALERS

8.37.5 OTHERS

8.38 RUSSIA ONLINE CHANNELS IN COOKTOPS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.38.1 E-COMMERCE

8.38.2 OMNICHANNEL

8.38.3 D2C / BRAND WEBSITE

8.39 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

8.39.1 RESIDENTIAL

8.39.2 COMMERCIAL

8.4 RUSSIA RESIDENTIAL IN COOKTOPS MARKET, BY OVERVIEW & USAGE SCENERIO, 2018-2033 (USD THOUSAND)

8.40.1 APARTMENTS

8.40.2 INDIVIDUAL HOUSES

8.40.3 OTHERS

8.41 RUSSIA COMMERCIAL IN COOKTOPS MARKET, BY OVERVIEW & USAGE SCENERIO, 2018-2033 (USD THOUSAND)

8.41.1 RESTAURANTS

8.41.2 CAFES & CATERING

8.41.3 HOTELS

8.41.4 OTHERS

8.42 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY PRICE TIER, 2018-2033 (USD THOUSAND)

8.42.1 MID-RANGE (USD 251–750)

8.42.2 ECONOMY (UP TO USD 250)

8.42.3 PREMIUM (USD 751+)

8.43 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY SAFTEY FEATURES, 2018-2033 (USD THOUSAND)

8.43.1 RESIDUAL HEAT INDICATORS

8.43.2 AUTOMATIC PAN DETECTION

8.43.3 OVERHEAT PROTECTION

8.43.4 CHILD-LOCK SAFETY

8.43.5 OTHERS

8.44 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY CONTROL SYSTEM, 2018-2033 (USD THOUSAND)

8.44.1 TOUCH CONTROL

8.44.2 BUTTON CONTROL

8.44.3 ROTARY CONTROL

8.44.4 OTHERS

8.45 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY SMART CONNETIVITY, 2018-2033 (USD THOUSAND)

8.45.1 NO CONNECTIVITY

8.45.2 APP CONTROL

8.45.3 SMART HOME INTEGRATION

8.45.4 BLUETOOTH-ENABLED

8.45.5 OTHERS

8.46 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY FRAME DESIGN, 2018-2033 (USD THOUSAND)

8.46.1 FRAMELESS DESIGN

8.46.2 PARTIAL FRAME

8.46.3 FULL METAL FRAME

8.46.4 OTHERS

8.47 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY FUEL TYPE, 2018-2033 (USD THOUSAND)

8.47.1 INDUCTION

8.47.2 RADIANT

8.47.3 COIL

8.48 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY SIZE (WIDTH), 2018-2033 (USD THOUSAND)

8.48.1 MEDIUM SIZE (31 TO 36.9 INCHES)

8.48.2 SMALL SIZE (UP TO 24.9 INCHES)

8.48.3 LARGE SIZE (37 INCHES & ABOVE)

8.49 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

8.49.1 GLASS-CERAMIC SURFACE

8.49.2 TEMPERED GLASS SURFACE

8.49.3 STAINLESS STEEL BODY

8.49.4 OTHERS

8.5 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY BURNER COUNT, 2018-2033 (USD THOUSAND)

8.50.1 FOUR BURNER

8.50.2 THREE BURNER

8.50.3 DUAL BURNER

8.50.4 FIVE BURNER

8.50.5 SINGLE BURNER

8.50.6 SIX AND MORE BURNERS

8.51 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY COLOR, 2018-2033 (USD THOUSAND)

8.51.1 BLACK

8.51.2 SILVER

8.51.3 WHITE

8.51.4 OTHERS

9 RUSSIA COOKTOPS MARKET: COMPANY LANDSCAPE

9.1 MANUFACTURER COMPANY SHARE ANALYSIS: RUSSIA

10 SWOT ANALYSIS

11 COMAPANY PROFILES MANUFACTURERS OF INDUCTION COOKTOPS

11.1 BSH HOME APPLIANCES CORPORATION

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 LG ELECTRONICS

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 PRODUCT PORTFOLIO

11.2.4 RECENT DEVELOPMENT

11.3 MIDEA

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 INDESIT (WHIRLPOOL CORPORATION)

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 RECENT DEVELOPMENT

11.5 SAMSUNG

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENT

12 COMAPANY PROFILES MANUFACTURERS OF ELECTRIC COOKTOPS

12.1 GORENJE

12.1.1 COMPANY SNAPSHOT

12.1.2 PRODUCT PORTFOLIO

12.1.3 RECENT DEVELOPMENT

12.2 MAUNFELD RUS LLC

12.2.1 COMPANY SNAPSHOT

12.2.2 PRODUCT PORTFOLIO

12.2.3 RECENT DEVELOPMENT

12.3 SAMSUNG

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 LG ELECTRONICS

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 BEKO (A SUBSIDIARY COMPANY OF ARÇELIK A.Ş.)

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT PORTFOLIO

12.5.3 RECENT DEVELOPMENT

13 COMAPANY PROFILES MANUFACTURERS OF GAS COOKTOPS

13.1 BEKO (A SUBSIDIARY COMPANY OF ARÇELIK A.Ş.)

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 SMEG S.P.A.

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 TEKA GROUP

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT DEVELOPMENT

13.4 HAIER INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 VATTI CORPORATION LIMITED

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 IMPORTS OF COOKTOPS BY CATEGORY IN RUSSIA, 2025 (IN VALUE & VOLUME)

TABLE 2 BILL OF MATERIALS (BOM)

TABLE 3 BREAKDOWN OF RAW MATERIAL COSTS IN COOKTOP MANUFACTURING (%)

TABLE 4 VENDOR SELECTION CRITERIA

TABLE 5 COMPARATIVE BRAND POSITIONING SUMMARY:

TABLE 6 RUSSIA INDUCTION COOKTOP MARKET: TOP 20 BRANDS BY VALUE AND VOLUME SHARE, 2025

TABLE 7 RUSSIA ELECTRIC CERAMIC COOKTOP MARKET: TOP 20 BRANDS BY VALUE AND VOLUME SHARE, 2025

TABLE 8 RUSSIA GAS COOKTOP MARKET: TOP 20 BRANDS BY VALUE AND VOLUME SHARE, 2025

TABLE 9 INDUCTION COOKTOPS – MODEL-WISE FEATURE AND SELLING POINT, USP & DISTRIBUTION MAPPING

TABLE 10 ELECTRIC CERAMIC COOKTOPS – MODEL-WISE FEATURES AND SELLING POINT, USPS & DISTRIBUTION MAPPING

TABLE 11 GAS COOKTOPS – MODEL-WISE FEATURES AND SELLING POINT, USPS & DISTRIBUTION MAPPING

TABLE 12 VALUE CHAIN OVERVIEW OF THE RUSSIA COOKTOPS MARKET

TABLE 13 RUSSIA IMPORT AND EXPORT TARIFF RATES:

TABLE 14 VENDOR SELECTION CRITERIA

TABLE 15 COOKTOP PRODUCT WITH TN VED CLASSIFICATION

TABLE 16 RUSSIA COOKTOPS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 RUSSIA COOKTOPS MARKET, BY PRODUCT TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 18 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY SALES CHANNELS, 2018-2033 (USD THOUSAND)

TABLE 19 RUSSIA OFFLINE CHANNELS IN COOKTOPS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 RUSSIA ONLINE CHANNELS IN COOKTOPS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 22 RUSSIA RESIDENTIAL IN COOKTOPS MARKET, BY OVERVIEW & USAGE SCENERIO, 2018-2033 (USD THOUSAND)

TABLE 23 RUSSIA COMMERCIAL IN COOKTOPS MARKET, BY OVERVIEW & USAGE SCENERIO, 2018-2033 (USD THOUSAND)

TABLE 24 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY PRICE TIER, 2018-2033 (USD THOUSAND)

TABLE 25 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY SAFTEY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 26 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY CONTROL SYSTEM, 2018-2033 (USD THOUSAND)

TABLE 27 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY SMART CONNETIVITY, 2018-2033 (USD THOUSAND)

TABLE 28 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY FRAME DESIGN, 2018-2033 (USD THOUSAND)

TABLE 29 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY FUEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY SIZE (WIDTH), 2018-2033 (USD THOUSAND)

TABLE 31 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 32 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY BURNER COUNT, 2018-2033 (USD THOUSAND)

TABLE 33 RUSSIA GAS COOKTOPS IN COOKTOPS MARKET, BY COLOR, 2018-2033 (USD THOUSAND)

TABLE 34 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY SALES CHANNELS, 2018-2033 (USD THOUSAND)

TABLE 35 RUSSIA OFFLINE CHANNELS IN COOKTOPS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 RUSSIA ONLINE CHANNELS IN COOKTOPS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 38 RUSSIA RESIDENTIAL IN COOKTOPS MARKET, BY OVERVIEW & USAGE SCENERIO, 2018-2033 (USD THOUSAND)

TABLE 39 RUSSIA COMMERCIAL IN COOKTOPS MARKET, BY OVERVIEW & USAGE SCENERIO, 2018-2033 (USD THOUSAND)

TABLE 40 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY PRICE TIER, 2018-2033 (USD THOUSAND)

TABLE 41 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY SAFTEY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 42 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY CONTROL SYSTEM, 2018-2033 (USD THOUSAND)

TABLE 43 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY SMART CONNETIVITY, 2018-2033 (USD THOUSAND)

TABLE 44 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY FRAME DESIGN, 2018-2033 (USD THOUSAND)

TABLE 45 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY FUEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY SIZE (WIDTH), 2018-2033 (USD THOUSAND)

TABLE 47 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 48 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY BURNER COUNT, 2018-2033 (USD THOUSAND)

TABLE 49 RUSSIA INDUCTION COOKTOPS IN COOKTOPS MARKET, BY COLOR, 2018-2033 (USD THOUSAND)

TABLE 50 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY SALES CHANNELS, 2018-2033 (USD THOUSAND)

TABLE 51 RUSSIA OFFLINE CHANNELS IN COOKTOPS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 RUSSIA ONLINE CHANNELS IN COOKTOPS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 54 RUSSIA RESIDENTIAL IN COOKTOPS MARKET, BY OVERVIEW & USAGE SCENERIO, 2018-2033 (USD THOUSAND)

TABLE 55 RUSSIA COMMERCIAL IN COOKTOPS MARKET, BY OVERVIEW & USAGE SCENERIO, 2018-2033 (USD THOUSAND)

TABLE 56 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY PRICE TIER, 2018-2033 (USD THOUSAND)

TABLE 57 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY SAFTEY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 58 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY CONTROL SYSTEM, 2018-2033 (USD THOUSAND)

TABLE 59 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY SMART CONNETIVITY, 2018-2033 (USD THOUSAND)

TABLE 60 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY FRAME DESIGN, 2018-2033 (USD THOUSAND)

TABLE 61 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY FUEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY SIZE (WIDTH), 2018-2033 (USD THOUSAND)

TABLE 63 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 64 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY BURNER COUNT, 2018-2033 (USD THOUSAND)

TABLE 65 RUSSIA ELECTRIC CERAMIC COOKTOPS IN COOKTOPS MARKET, BY COLOR, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 RUSSIA COOKTOPS MARKET

FIGURE 2 RUSSIA COOKTOPS MARKET: DATA TRIANGULATION

FIGURE 3 RUSSIA COOKTOPS MARKET: DROC ANALYSIS

FIGURE 4 RUSSIA COOKTOPS MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 RUSSIA COOKTOPS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 RUSSIA COOKTOPS MARKET: MULTIVARIATE MODELLING

FIGURE 7 RUSSIA COOKTOPS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 RUSSIA COOKTOPS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 RUSSIA COOKTOPS MARKET: MARKET END USE GRID

FIGURE 10 RUSSIA COOKTOPS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 RUSSIA COOKTOPS MARKET : SEGMENTATION

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISE IN PREFERENCE FOR GAS-BASED COOKING AMONG RUSSIAN HOUSEHOLDS IS EXPECTED TO DRIVE THE RUSSIA COOKTOPS MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 15 GAS COOKTOPS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE RUSSIA COOKTOPS MARKET IN 2026 & 2033

FIGURE 16 RUSSIA COOKTOPS MARKET, AVERAGE SELLING PRICE (USD/UNIT)

FIGURE 17 VALUE CHAIN ANALYSIS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES ANALYSIS OF RUSSIA COOKTOPS MARKET

FIGURE 19 RUSSIA COOKTOPS MARKET: BY PRODUCT TYPE, 2025

FIGURE 20 RUSSIA COOKTOPS MARKET: COMPANY SHARE 2025 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.