Saudi Arabia Diesel Bus Market Analysis and Size

Saudi Arabia diesel bus market is fragmented in nature, as it consists of many Saudi Arabia players. These companies' presence produces competitive prices for diesel bus products across the country. Due to the presence of these players at regional and international levels, suppliers and manufacturers offer products with different specifications and characteristics for all budgets. Rapid urbanization and an increase in population across the country are driving the market growth. Moreover, growing government initiatives for public transport infrastructure, low fuel costs in the region, and rapid product development and launch by the market players are estimated to drive market growth.

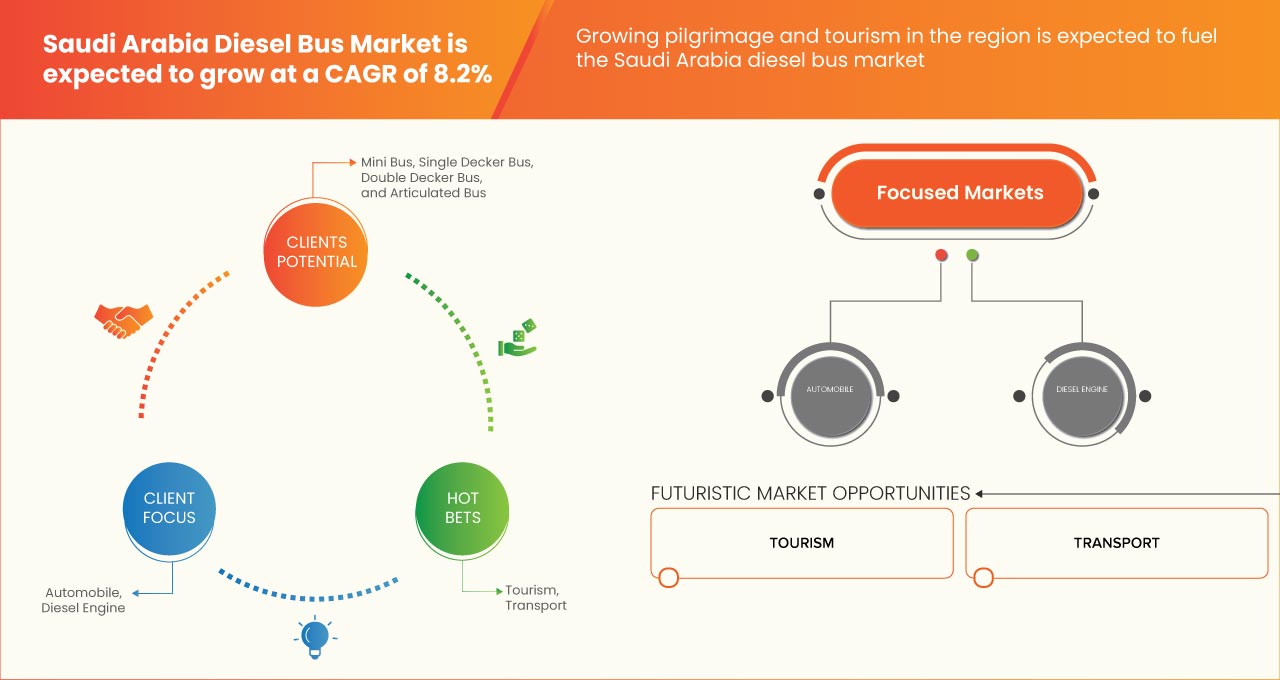

Data Bridge Market Research analyzes that the Saudi Arabia diesel bus market is expected to reach the value of USD 688.92 million by 2030, at a CAGR of 8.2% during the forecast period. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, and Pricing in USD |

|

Segments Covered |

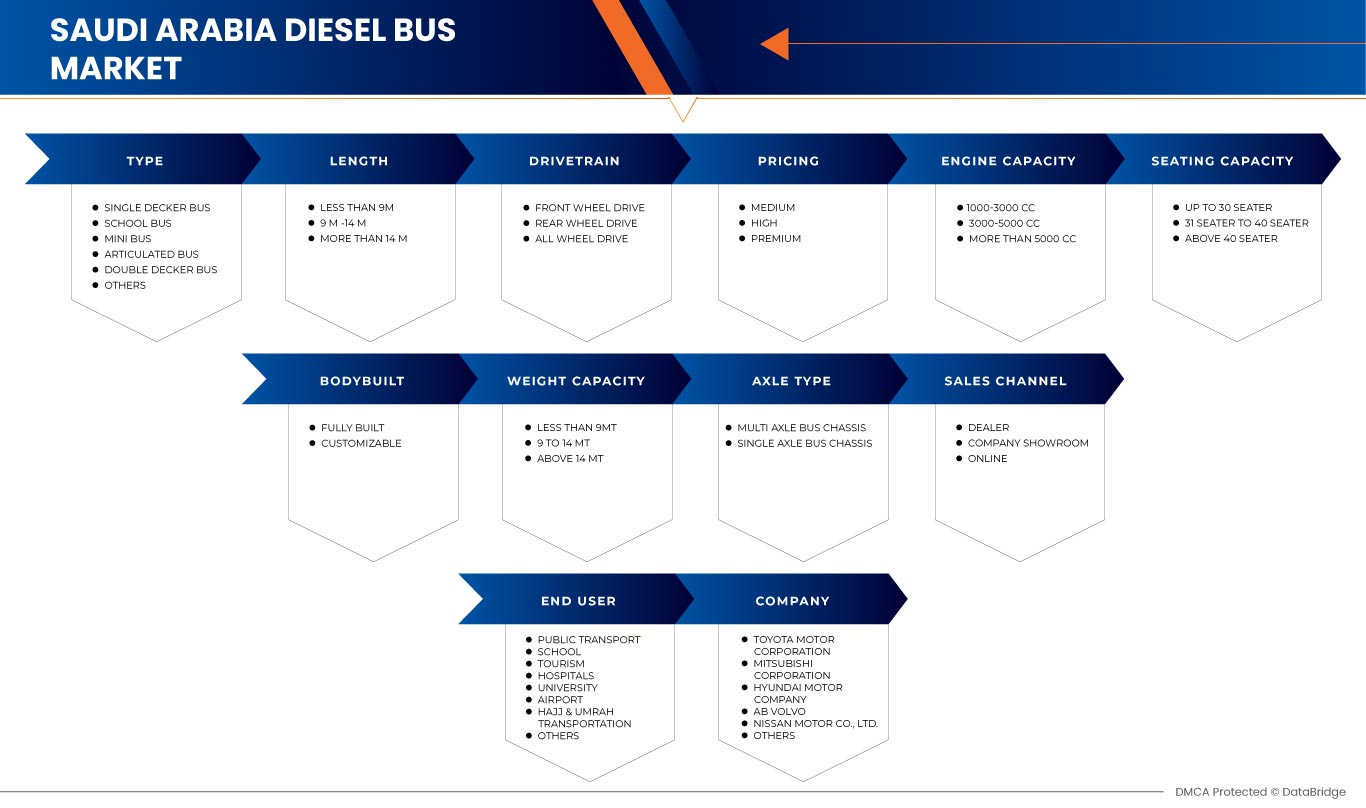

By Type (Mini Bus, Single Decker Bus, Double Decker Bus, Articulated Bus, School Bus, and Others), Length (Less Than 9 M, 9 M-14 M, and More Than 14 M), Drivetrain (Front Wheel Drive, Rear Wheel Drive, and All Wheel Drive), Pricing (Medium, High, and Premium), Engine Capacity (1000-3000 CC, 3000-5000 CC, and More Than 5000 CC), Seating Capacity (Up To 30 Seater, 31 Seater To 40 Seater, and Above 40 Seater), Body Built (Fully Built and Customizable), Weight Capacity (9 MT, 9 to 14 MT, and Above 14 MT), Axle Type (Multi Axle Bus Chassis and Single Axle Bus Chassis), Sales Channel (Dealer, Company Showroom, and Online), End User (Public Transport, Tourism, Airport, School, University, Hospitals, Hajj & Umrah Transportation, and Others) |

|

Countries Covered |

Saudi Arabia |

|

Market Players Covered |

TOYOTA MOTOR CORPORATION, Mitsubishi Corporation, Hyundai Motor Company, AB Volvo, Nissan Motor Co., Ltd., Xiamen King Long International Trading Co.,Ltd., Tata Motors, ASHOK LEYLAND, Scania, Foton Motor Inc., Zhongtong Bus Holding Co., Ltd., Eicher Motors Limited, Jiangxi Kama Business Bus Co., Ltd. (BONLUCK), and Golden Dragon among others |

Market Definition

Diesel buses are used for various tasks like public transport, school transport, tourism, hospital, and others. There is a wide market available in Saudi Arabia for diesel buses. The diesel bus works on a diesel engine. The diesel engine was named after Rudolf Diesel. It is an internal combustion (IC) engine in which ignition of the fuel is caused by the lifted temperature of the air in the cylinder because of high mechanical compression; hence the diesel engine is known as a compression-ignition engine.

Saudi Arabia Diesel Bus Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

- Growing Government Initiatives for Public Transport Infrastructure

Saudi Arabia has accelerated its infrastructure development efforts in recent years, spurred by a growing population and an increasingly diversified economy. This rapid progress has led to an array of new opportunities for both public and private sector enterprises. The government of Saudi Arabia is additionally fueling these opportunities by providing initiatives, and incentives for public and private businesses under various economic segments such as public transport.

For instance,

- According to a September 2021 report by SNC-Lavalin Group, the Kingdom of Saudi Arabia (KSA) is experiencing a period of transformation and investment being injected into the country.

- In July 2021, the Saudi Arabia government announced that USD 147 billion is set to fund the transport and logistics sectors over the next decade. If the targets are achieved, these sectors will contribute 10% of the country’s GDP by 2030, a 4% increase from current quotas. Other than bullet trains in densely populated areas, the government is focusing over bus rapid transit and regular buses. This is expected to positively affect market growth.

Rapid Urbanization and Increase in Population Across the Country

According to a report by World Bank, today, nearly about 56% of the world’s population – 4.4 billion inhabitants – live in cities. This trend is expected to continue, with the urban population more than doubling its current size by 2050, at which point nearly 7 of 10 people will live in cities. With more than 80% of Saudi Arabia GDP generated in cities, urbanization can contribute to sustainable growth through increased productivity and innovation if managed well. This rapid urbanization and increase in population are expected to boost and drive many markets including the Saudi Arabia diesel bus market.

OPPORTUNITY

- Growing Pilgrimage and Tourism in the Region

Saudi Arabia has been working to develop its tourism industry in recent years. The Saudi government has been investing in tourism infrastructure, including the construction of hotels, resorts, and other tourist facilities. The government has also been working to promote the country as a tourist destination by lifting restrictions on tourism, such as allowing women to travel without a male guardian's permission. Additionally, the government has been working to diversify its economy, which is heavily dependent on oil, by promoting the tourism industry as an alternative source of revenue.

RESTRAINT/CHALLENGE

- Stringent Emission Regulations

There is no significant difference in chemical makeup between the engine exhaust of the smallest diesel car and the engine exhaust of the largest diesel truck. The technologies used to control the pollutants contained in that exhaust are also similar. Most manufacturers use a combination of in-cylinder controls that affect the proportions of pollutant compounds that are left over from combustion and enter the exhaust stream and after-treatment devices that remove pollutants from the exhaust after it has exited the engine. In order to lower carbon emissions, the government of Saudi Arabia has implemented regulations. These regulations to reduce emissions from the transportation sector may increase the cost of owning a diesel bus and operating it and make it difficult for operators to comply. This is acting as a restraint for market growth.

Post-COVID-19 Impact on Saudi Arabia Diesel Bus Market

COVID-19 created a negative impact on the Saudi Arabia diesel bus market due to the shutdown of the Saudi Arabia manufacturing sector, logistics and transportation, and lack of testing for the product.

The COVID-19 pandemic has negatively impacted the market upto an extent. However, rapid product launch and product expansion by market players and the advantages of diesel buses over other types of buses is expected to act as a driving factor for market growth and also has helped the market to grow during and after the pandemic. Also, the growth has been high since the market opened after COVID-19, and it is expected that there would be considerable growth in the sector. The market players are conducting multiple R&D activities to improve the technology involved in the product. With this, the companies will bring advancement and innovation to the market. In addition, government funding for AGM batteries has led to market growth.

Recent Developments

- In January 2023, TOYOTA MOTOR CORPORATION announced that the company had participated in the World Future Energy Summit 2023 in Abu Dhabi. In this event, the company showcased a hydrogen-powered Toyota Mirai Fuel Cell Electric Vehicle (FCEV) and a Fuel Cell Forklift throughout the three-day event. Through this, the company has showcased its technological capabilities and has promoted its product portfolio under the Saudi Arabia diesel bus market

- In December 2022, Tata Motors announced that the company has decided to increase the price of its commercial vehicles up to 2% from January 2023. This step is expected to allow the company to coup up with inflation in the price of raw materials and to continue providing services under the Saudi Arabia diesel bus market

Saudi Arabia Diesel Bus Market Scope

Saudi Arabia diesel bus market is segmented into eleven notable segments based on type, length, drivetrain, pricing, engine capacity, seating capacity, body built, weight capacity, axle type, sales channel, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- MINI BUS

- SINGLE DECKER BUS

- DOUBLE DECKER BUS

- ARTICULATED BUS

- SCHOOL BUS

- OTHERS

Based on type, the market is segmented into mini bus, single decker bus, double decker bus, articulated bus, school bus, and others

Length

- LESS THAN 9M

- 9 M-14 M

- MORE THAN 14 M

Based on length, the market is segmented into less than 9 m, 9 m-14 m, and more than 14 m

Drivetrain

- FRONT WHEEL DRIVE

- REAR WHEEL DRIVE

- ALL WHEEL DRIVE

Based on the drivetrain, the market is segmented into front wheel drive, rear wheel drive, and all wheel drive

Pricing

- MEDIUM

- HIGH

- PREMIUM

Based on pricing, the market is segmented into medium, high, and premium

Engine Capacity

- 1000-3000 CC

- 3000-5000 CC

- MORE THAN 5000 CC

Based on engine capacity, the market is segmented into 1000-3000 CC, 3000-5000 CC, and more than 5000 CC

Seating Capacity

- UP TO 30 SEATER

- 31 SEATER TO 40 SEATER

- ABOVE 40 SEATER

Based on seating capacity, the market is segmented into up to 30 seater, 31 seater to 40 seater, and above 40 seater

Body Built

- FULLY BUILT

- CUSTOMIZABLE

Based on body built, the market is segmented into fully built and customizable

Weight Capacity

- LESS THAN 9MT

- 9 TO 14 MT

- ABOVE 14 MT

Based on weight capacity, the market is segmented into less than 9 MT, 9 to 14 MT, above 14 MT

Axle Type

- MULTI AXLE BUS CHASSIS

- SINGLE AXLE BUS CHASSIS

Based on axle type, the market is segmented into multi axle bus chassis and single axle bus chassis

Sales Channel

- DEALER

- COMPANY SHOWROOM

- ONLINE

Based on sales channel, the market is segmented into dealer, company showroom, and online

End User

- PUBLIC TRANSPORT

- TOURISM

- AIRPORT

- SCHOOL

- UNIVERSITY

- HOSPITALS

- HAJJ AND UMRAH TRANSPORTATION

- OTHERS

Based on end user, the market is segmented into public transport, tourism, airport, school, university, hospitals, Hajj and Umrah transportation, and others

Saudi Arabia Diesel Bus Market Regional Analysis/Insights

Saudi Arabia diesel bus market is analyzed and market size insights and trends are provided by country, type, distribution channel, demographics, and price range as referenced above. The market is expected to grow as there is growing pilgrimage and tourism in the region, the harsh climate across the country is favorable for the market, and an increase in partnership, collaboration, and acquisition by the market players are providing opportunities for market growth. The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Saudi Arabia brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Saudi Arabia Diesel Bus Market Share Analysis

Saudi Arabia diesel bus market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, Saudi Arabia presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the Saudi Arabia diesel bus market are TOYOTA MOTOR CORPORATION, Mitsubishi Corporation, Hyundai Motor Company, AB Volvo, Nissan Motor Co., Ltd., Xiamen King Long International Trading Co.,Ltd., Tata Motors, ASHOK LEYLAND, Scania, Foton Motor Inc., Zhongtong Bus Holding Co., Ltd., Eicher Motors Limited, Jiangxi Kama Business Bus Co., Ltd. (BONLUCK), Golden Dragon, and others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SAUDI ARABIA DIESEL BUS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 END USER COVERAGE GRID

2.8 MULTIVARIATE MODELLING

2.9 TYPE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.2 TECHNOLOGICAL TRENDS

4.3 REGULATORY STANDARDS

4.4 PRICING ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.6 COMPANY COMPARATIVE ANALYSIS

4.7 SALES AND PRODUCTION DATA

4.8 GOVERNMENT STRATEGY AND PLAN FOR BUS SEGMENT

4.9 LIST OF DEALERS ALONG WITH THEIR PRODUCT RANGE

4.1 CURRENT AND UPCOMING TRENDS IN RELATION TO THE EV BUS

4.11 LOCAL PRODUCTION PLANT FOR BUSES IN KSA

4.12 SCENARIO OF CNG BUSES IN KSA

4.13 LIST OF CUSTOMERS IN KSA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RAPID URBANIZATION AND INCREASE IN POPULATION ACROSS THE COUNTRY

5.1.2 GROWING GOVERNMENT INITIATIVES UNDER PUBLIC TRANSPORT INFRASTRUCTURE

5.1.3 RAPID PRODUCT DEVELOPMENT AND LAUNCH BY MARKET PLAYERS

5.1.4 LOW FUEL COST IN THE REGION

5.2 RESTRAINT

5.2.1 STRINGENT EMISSION REGULATIONS

5.3 OPPORTUNITIES

5.3.1 GROWING PILGRIMAGE AND TOURISM IN THE REGION

5.3.2 HARSH CLIMATE ACROSS THE COUNTRY

5.3.3 CONSTANT PARTNERSHIP AND COLLABORATION AMONG MARKET PLAYERS

5.4 CHALLENGE

5.4.1 HIGH DEPENDENCY ON IMPORT AND LESS NUMBER OF LOCAL MANUFACTURERS IN THE MARKET

6 SAUDI ARABIA DIESEL BUS MARKET, BY TYPE

6.1 OVERVIEW

6.2 SINGLE DECKER BUS

6.3 SCHOOL BUS

6.4 MINI BUS

6.5 ARTICULATED BUS

6.6 DOUBLE DECKER BUS

6.7 OTHERS

7 SAUDI ARABIA DIESEL BUS MARKET, BY LENGTH

7.1 OVERVIEW

7.2 LESS THAN 9M

7.3 9M-14M

7.4 MORE THAN 14M

8 SAUDI ARABIA DIESEL BUS MARKET, BY DRIVETRAIN

8.1 OVERVIEW

8.2 REAR WHEEL DRIVE

8.3 FRONT WHEEL DRIVE

8.4 ALL WHEEL DRIVE

9 SAUDI ARABIA DIESEL BUS MARKET, BY PRICING

9.1 OVERVIEW

9.2 MEDIUM

9.3 HIGH

9.4 PREMIUM

10 SAUDI ARABIA DIESEL BUS MARKET, BY ENGINE CAPACITY

10.1 OVERVIEW

10.2 3000-5000 CC

10.3 MORE THAN 5000 CC

10.4 1000-3000 CC

11 SAUDI ARABIA DIESEL BUS MARKET, BY SEATING CAPACITY

11.1 OVERVIEW

11.2 UP TO 30 SEATER

11.3 31 SEATER TO 40 SEATER

11.4 ABOVE 40 SEATER

12 SAUDI ARABIA DIESEL BUS MARKET, BY BODY BUILT

12.1 OVERVIEW

12.2 FULLY BUILT

12.3 CUSTOMIZABLE

13 SAUDI ARABIA DIESEL BUS MARKET, BY WEIGHT CAPACITY

13.1 OVERVIEW

13.2 LESS THAN 9MT

13.3 9 TO 14MT

13.4 ABOVE 14MT

14 SAUDI ARABIA DIESEL BUS MARKET, BY AXLE TYPE

14.1 OVERVIEW

14.2 SINGLE AXLE BUS CHASSIS

14.3 MULTI AXLE BUS CHASSIS

14.3.1 LESS THAN 14M

14.3.2 MORE THAN 14M

15 SAUDI ARABIA DIESEL BUS MARKET, BY SALES CHANNEL

15.1 OVERVIEW

15.2 DEALER

15.3 COMPANY SHOWROOM

15.4 ONLINE

16 SAUDI ARABIA DIESEL BUS MARKET, BY END USER

16.1 OVERVIEW

16.2 PUBLIC TRANSPORT

16.3 SCHOOL

16.4 TOURISM

16.5 HOSPITAL

16.6 UNIVERSITY

16.7 AIRPORT

16.8 HAJJ AND UMRAH TRANSPORTATION

16.9 OTHERS

17 SAUDI ARABIA DIESEL BUS MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA (2020)

17.2 COMPANY SHARE ANALYSIS: SAUDI ARABIA (2021)

17.3 COMPANY SHARE ANALYSIS: SAUDI ARABIA (2022)

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 TOYOTA MOTOR CORPORATION

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENT

19.2 MITSUBISHI CORPORATION

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENTS

19.3 HYUNDAI MOTOR COMPANY

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 AB VOLVO

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENT

19.5 NISSAN MOTOR CO., LTD.

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENTS

19.6 ASHOK LEYLAND

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENT

19.7 EICHER MOTORS LIMITED

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENT

19.8 FOTON MOTOR INC.

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENTS

19.9 GOLDEN DRAGON

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 JIANGXI KAMA BUSINESS BUS CO., LTD. (BONLUCK)

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENTS

19.11 SCANIA

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENT

19.12 TATA MOTORS

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENT

19.13 XIAMEN KING LONG INTERNATIONAL TRADING CO.,LTD.

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 ZHONGTONG BUS HOLDING CO. LTD. HOLDING CO., LTD.

19.14.1 COMPANY SNAPSHOT

19.14.2 REVENUE ANALYSIS

19.14.3 PRODUCT PORTFOLIO

19.14.4 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 BUS DEALERS IN THE KINGDOM OF SAUDI ARABIA

TABLE 2 SAUDI ARABIA DIESEL BUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 SAUDI ARABIA DIESEL BUS MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 4 SAUDI ARABIA DIESEL BUS MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 5 SAUDI ARABIA DIESEL BUS MARKET, BY DRIVETRAIN, 2021-2030 (USD MILLION)

TABLE 6 SAUDI ARABIA DIESEL BUS MARKET, BY PRICING, 2021-2030 (USD MILLION)

TABLE 7 SAUDI ARABIA DIESEL BUS MARKET, BY ENGINE CAPACITY, 2021-2030 (USD MILLION)

TABLE 8 SAUDI ARABIA DIESEL BUS MARKET, BY SEATING CAPACITY, 2021-2030 (USD MILLION)

TABLE 9 SAUDI ARABIA DIESEL BUS MARKET, BY BODY BUILT, 2021-2030 (USD MILLION)

TABLE 10 SAUDI ARABIA DIESEL BUS MARKET, BY WEIGHT CAPACITY, 2021-2030 (USD MILLION)

TABLE 11 SAUDI ARABIA DIESEL BUS MARKET, BY AXLE TYPE, 2021-2030 (USD MILLION)

TABLE 12 SAUDI ARABIA MULTI AXLE BUS CHASSIS IN DIESEL BUS MARKET, BY ENGINE CHASSIS LENGTH, 2021-2030 (USD MILLION)

TABLE 13 SAUDI ARABIA DIESEL BUS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 14 SAUDI ARABIA DIESEL BUS MARKET, BY END USER, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 SAUDI ARABIA DIESEL BUS MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA DIESEL BUS MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA DIESEL BUS MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA DIESEL BUS MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA DIESEL BUS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA DIESEL BUS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SAUDI ARABIA DIESEL BUS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 SAUDI ARABIA DIESEL BUS MARKET: END USER COVERAGE GRID ANALYSIS

FIGURE 9 SAUDI ARABIA DIESEL BUS MARKET: SEGMENTATION

FIGURE 10 RAPID URBANIZATION AND AN INCREASE IN POPULATION ACROSS THE COUNTRY IS EXPECTED TO BE KEY DRIVERS FOR SAUDI ARABIA DIESEL BUS MARKET IN THE FORECAST PERIOD

FIGURE 11 SINGLE DECKER BUS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SAUDI ARABIA DIESEL BUS MARKET FROM 2023 TO 2030

FIGURE 12 KSA DIESEL BUS MARKET, CONSUMER SHARE (%)

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SAUDI ARABIA DIESEL BUS MARKET

FIGURE 14 EXPECTED GROWTH IN THE POPULATION OF SAUDI ARABIA (2021-2030)

FIGURE 15 ADMINISTERED AND MARKET GASOLINE PRICES SET AT THE MARGINAL VALUE FROM 2013 TO 2026

FIGURE 16 SAUDI ARABIA DIESEL BUS MARKET: BY TYPE, 2022

FIGURE 17 SAUDI ARABIA DIESEL BUS MARKET: LENGTH, 2022

FIGURE 18 SAUDI ARABIA DIESEL BUS MARKET: BY DRIVETRAIN, 2022

FIGURE 19 SAUDI ARABIA DIESEL BUS MARKET: BY PRICING, 2022

FIGURE 20 SAUDI ARABIA DIESEL BUS MARKET: BY ENGINE CAPACITY, 2022

FIGURE 21 SAUDI ARABIA DIESEL BUS MARKET: BY SEATING CAPACITY, 2022

FIGURE 22 SAUDI ARABIA DIESEL BUS MARKET: BY BODY BUILT, 2022

FIGURE 23 SAUDI ARABIA DIESEL BUS MARKET: BY WEIGHT CAPACITY, 2022

FIGURE 24 SAUDI ARABIA DIESEL BUS MARKET: BY AXLE TYPE, 2022

FIGURE 25 SAUDI ARABIA DIESEL BUS MARKET: BY SALES CHANNEL, 2022

FIGURE 26 SAUDI ARABIA DIESEL BUS MARKET: BY END USER, 2022

FIGURE 27 SAUDI ARABIA DIESEL BUS MARKET: COMPANY SHARE 2020 (%)

FIGURE 28 SAUDI ARABIA DIESEL BUS MARKET: COMPANY SHARE 2021(%)

FIGURE 29 SAUDI ARABIA DIESEL BUS MARKET: COMPANY SHARE 2022(%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.