Sia Pacific Specialty Gas Market

Market Size in USD Billion

CAGR :

%

USD

5.21 Billion

USD

9.03 Billion

2024

2032

USD

5.21 Billion

USD

9.03 Billion

2024

2032

| 2025 –2032 | |

| USD 5.21 Billion | |

| USD 9.03 Billion | |

|

|

|

|

Specialty Gas Market Size

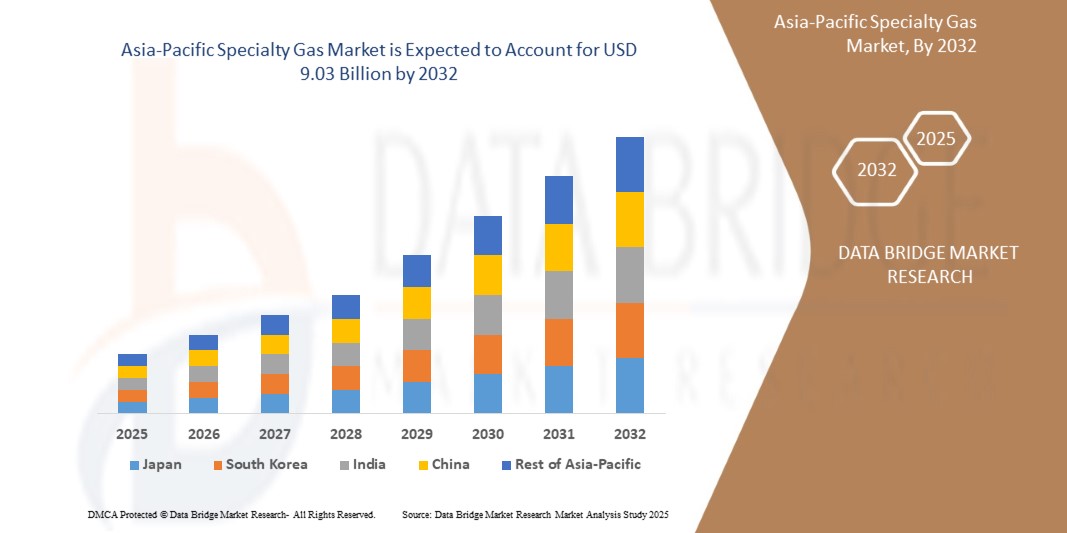

- The Asia-Pacific specialty gas market size was valued at USD 5.21 billion in 2024 and is projected to reach USD 9.03 billion by 2032, with a CAGR of 7.1% during the forecast period of 2025 to 2032.

- The increasing focus on renewable energy and sustainable solutions is driving the demand for hydrogen and other specialty gases, making it a key market driver. Moreover, the growing production of semiconductors and electronic components is significantly driving the demand for high-purity specialty gases.

Specialty Gas Market Analysis

- The Specialty Gas market in Asia-Pacific is witnessing robust growth driven by increasing demand from semiconductor manufacturing, electronics, healthcare, and environmental monitoring. Additionally, rising regional investments in green energy, local R&D infrastructure, and stricter purity standards in certain countries are contributing to market expansion.

- China is expected to dominate the Asia-Pacific Specialty Gas market with a projected market share of 29.1% in 2025. This is due to its large-scale electronics and semiconductor manufacturing ecosystem, extensive investments in R&D, and strong presence of high-tech industrial clusters.

- India is anticipated to hold a market share of 17.3%, supported by its rapidly growing healthcare and pharmaceutical sectors, government-backed initiatives for domestic electronics manufacturing (like PLI schemes), and expanding industrial gas consumption in sectors like steel, automotive, and chemicals.

- High purity gases accounted for 36.5% of the market share in the Asia-Pacific Specialty Gas market in 2025. This domination is attributed to their critical role in precision applications such as electronics manufacturing, pharmaceutical processing, and laboratory research, where ultra-high purity is essential to maintain product integrity and performance. Moreover, the same segment is expected to grow with a higher CAGR during the forecast period.

Report Scope and Specialty Gas Market Segmentation

|

Attributes |

Specialty Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Specialty Gas Market Trends

- “Rising Adoption of Specialty Gases in Semiconductor Manufacturing to Support Asia-Pacific's Technological Sovereignty”

- One prominent trend in the Asia-Pacific specialty gas market is the increasing adoption of ultra-high purity gases in the semiconductor and electronics industry, driven by regional ambitions to strengthen domestic chip production and reduce dependency on Western supply chains.

- Specialty gases such as nitrogen trifluoride (NF₃), silane (SiH₄), and high-purity ammonia (NH₃) are critical in processes like etching, deposition, and wafer cleaning, making them indispensable for advanced node manufacturing.

For instance, countries like China, Taiwan, and South Korea are heavily investing in semiconductor fabrication facilities under programs such as China’s “Made in China 2025” and South Korea’s K-Semiconductor Strategy, which are expected to significantly increase demand for process-critical specialty gases to support 5nm and 3nm chip technologies.

- This trend is accelerating the development of localized specialty gas supply chains, enhancing Asia-Pacific’s competitiveness in microelectronics, and fostering partnerships between gas producers and fabs to ensure purity, reliability, and regulatory compliance.

Specialty Gas Market Dynamics

Drivers

“Rising Demand in Electronics Industry”

- The growing production of semiconductors and electronic components is significantly driving the demand for high-purity specialty gases, making it a crucial market driver. These gases play an essential role in chip manufacturing, ensuring precision, efficiency, and contamination-free environments in fabrication processes.

- With the rising adoption of advanced technologies such as AI, 5G, and IoT, the demand for microchips and display panels is surging, further increasing the need for specialty gases such as nitrogen, argon, and helium-3.

For instance, China, South Korea, and Taiwan are making strategic investments in domestic semiconductor fabrication under respective national tech strategies, leading to heightened demand for precision gases used in cleanroom environments to maintain ultra-low contamination levels.

- In addition, the expansion of semiconductor manufacturing facilities across Asia-Pacific is fueling market growth, reinforcing the importance of specialty gases in achieving high-performance electronic components.

Opportunity

“Expanding Industrial and Manufacturing Sectors”

- The aerospace, automotive, and metallurgy industries present a significant market opportunity for specialty gases, as these sectors rely on them for critical processes such as welding, cutting, and material testing.

- Specialty gases such as argon, oxygen, and helium are widely used in precision welding and laser cutting applications, ensuring high-quality fabrication and structural integrity.

- In aerospace and automotive manufacturing, specialty gases play a crucial role in leak detection, heat treatment, and performance testing of components.

For instance, Japan and South Korea are home to major automotive and aerospace manufacturers such as Toyota, Honda, Hyundai, and Mitsubishi Heavy Industries. These companies increasingly utilize specialty gases in advanced manufacturing processes to meet strict performance and emission standards, thereby driving regional demand.

Restraint/Challenge

“Complex Storage and Handling Requirements”

- The transportation and storage of specialty gases require highly specialized solutions to maintain their purity, stability, and safety. Many of these gases are highly reactive, toxic, or require cryogenic storage, making their handling complex and costly. Improper storage or transportation conditions can lead to contamination, leaks, or hazardous reactions, posing risks to both human safety and the environment.

- In addition, strict regulations govern the transportation of specialty gases, increasing logistical challenges and costs for businesses.

For instance, in Asia-Pacific, countries like Japan and Singapore enforce stringent regulations around the transportation of hazardous and specialty gases, similar to ADR in Europe. Compliance with these frameworks requires continuous investment in secure transportation systems and trained personnel.

- As industries continue to expand their use of specialty gases, ensuring safe and efficient storage and transportation remains a significant challenge in the market.

Specialty Gas Market Scope

The market is segmented on the basis type, application, and ingredients.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Ingredients |

|

In 2025, the high purity gases segment is projected to dominate the market with a largest share in product segment

High purity gases accounted for 39.5% of the market share in the Asia-Pacific Specialty Gas market in 2025. This domination is attributed to their critical role in precision applications such as electronics manufacturing, pharmaceutical processing, and laboratory research, where ultra-high purity is essential to maintain product integrity and performance.

The Manufacturing segment is expected to account for the largest share during the forecast period in application segment

In 2025, the manufacturing segment is expected to dominate the market with the largest market share of 48.1%. This is attributed to the widespread use of specialty gases in welding, cutting, testing, and fabrication processes across automotive, aerospace, and industrial equipment production.

Active, Smart and Intelligent Packaging Market Regional Analysis

“China Holds the Largest Share in the Active, Smart and Intelligent Packaging Market”

- China dominates the Asia-Pacific Specialty Gas Market with the largest share of 29.1% in 2025, driven by the region's massive electronics and semiconductor manufacturing base, rapid industrialization, and government incentives for high-tech production.

- The country’s expanding healthcare infrastructure and significant demand for high-purity gases in medical and research applications further support market growth.

“India is Projected to Register the Highest CAGR in the Active, Smart and Intelligent Packaging Market”

- India is expected to register the highest growth rate in the Asia-Pacific Specialty Gas Market, driven by the expansion of automotive, electronics, and pharmaceutical industries.

- Government initiatives such as "Make in India" and rapid infrastructure development contribute to the region's high CAGR, a trend expected to continue through the forecast period.

Active, Smart and Intelligent Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Air Liquide (Japan, China, India)

- Linde India Ltd (India)

- Taiyo Nippon Sanso Corporation (Japan)

- Mitsui Chemicals (Japan)

- Air Water Inc. (Japan)

- Shanghai Baosteel Gases (China)

- Yingde Gases Group Company (China)

- Showa Denko K.K. (Japan)

- INOX Air Products (India)

- Daesung Industrial Gases Co. Ltd (South Korea)

Latest Developments in Asia-Pacific Active, Smart and Intelligent Packaging Market

- In June 2023, Linde announced plans to acquire three Air Separation Units (ASUs) from Wanhua, further strengthening its market position in China. Two of these ASUs are currently under construction and are expected to commence operations in 2024 and 2025. This acquisition is aimed at expanding Linde’s production capacity and enhancing its ability to meet the growing demand for industrial and specialty gases in the region. The deal aligns with Linde’s strategy to increase its footprint in the Chinese market

- In April 2023, Air Liquide India acquired EffecTech, a company specializing in calibration and testing services, to broaden its service offerings. The acquisition enables Air Liquide to enhance its precision-based solutions for existing and new customers in India. By integrating EffecTech’s expertise, Air Liquide aims to strengthen its capabilities in quality assurance and compliance. This move is expected to support the company’s long-term growth in the Indian specialty gas market

- In April 2023, Linde announced an expansion of its production capacity in Tangjeong, South Korea, to increase its supply of specialty industrial gases. The expansion is aimed at catering to the growing demand from Samsung Display, a major player in the display technology sector. By strengthening its gas production infrastructure, Linde seeks to support advanced manufacturing processes. This development highlights Linde’s commitment to serving the electronics industry with high-purity specialty gases

- In October 2022, Nippon Sanso launched CLifter, a high-pressure gas cylinder transport system designed to improve efficiency. This innovative system consumes less energy than conventional transportation methods, making it a more sustainable solution. CLifter enhances the safe and efficient handling of gas cylinders, reducing operational costs and environmental impact. With this product, Nippon Sanso aims to address challenges in gas logistics while supporting sustainability initiatives in the industry

- In August 2022, Merck entered into a joint venture with Micron for a research and development project focused on sustainable gas solutions. The partnership is aimed at developing environmentally friendly specialty gases for the semiconductor industry. By leveraging Merck’s expertise in chemicals and Micron’s semiconductor technology, the project seeks to enhance efficiency and reduce the environmental footprint of gas production. This collaboration aligns with the growing industry focus on sustainability and innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Sia Pacific Specialty Gas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Sia Pacific Specialty Gas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Sia Pacific Specialty Gas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.