Singapore China Hong Kong And Taiwan Third Party Logistics Market

Market Size in USD Million

CAGR :

%

USD

265,902.06 Million

USD

462,107.01 Million

2022

2030

USD

265,902.06 Million

USD

462,107.01 Million

2022

2030

| 2023 –2030 | |

| USD 265,902.06 Million | |

| USD 462,107.01 Million | |

|

|

|

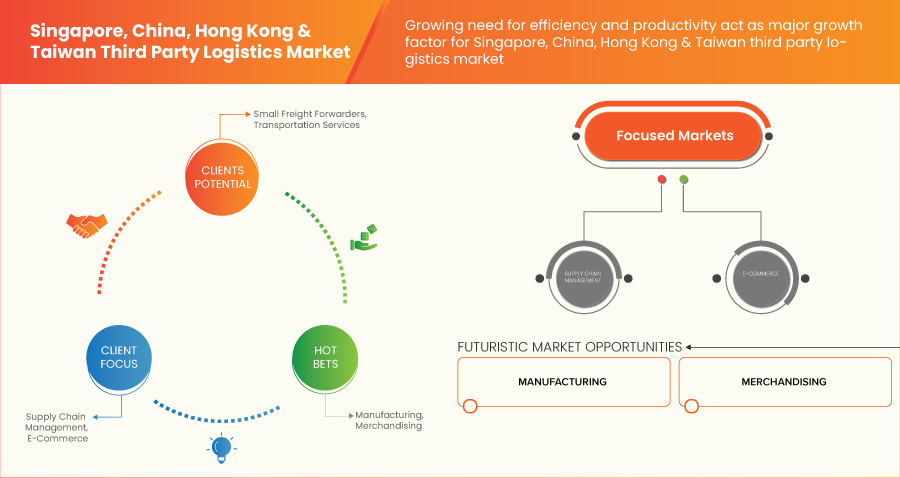

Singapore, China, Hong Kong and Taiwan Third Party Logistics Market Analysis and Size

The companies outsource third party logistics services to keep the focus on their main business, such as manufacturing by automotive companies. All the operational logistics for warehousing, transporting, forwarding, and maintaining inventory are outsourced to third party logistics players in the market. The primary advantage of using the third party logistics provider to address logistics, together with packaging, warehousing, and order Fulfilment goods distribution which, is price savings-for instance, the company no longer holds a warehouse or the team or workers to reveal supply chain operations. The documentation work and overall process of supply chain operations are all taken care of by the third party logistics players.

Third party logistics incorporates various services such as supply chain management, domestic transportation management (DTM), warehousing, Fulfilment and distribution (W&D), value-added services, international transportation management, and dedicated carriage or freight forwarding. Supply chain management service involves the management of supply chain activities to maximize customer value and achieve sustainable competitive advantage. It is based on two core ideas-first, every product that reaches an end-user represents the cumulative effort of multiple organizations, and the second idea is supply chains have existed for a long time which is the most important factor in the third party logistics industry. An increase in global trade and the high volume of trade flow has led to the requirement of third party logistics to make the trade flow more convenient and faster, thus boosting the growth of the Singapore, China, Hong Kong & Taiwan third party logistics market.

Data Bridge Market Research analyses that the China third party logistics market is expected to reach USD 462,107.01 million by 2030 from USD 265,902.06 million in 2022, growing with a CAGR of 7.2% in the forecast period of 2023 to 2030. Taiwan third party logistics market is expected to reach USD 10,349.33 million by 2030 from USD 7,630.55 million in 2022, growing with a CAGR of 3.9% in the forecast period of 2023 to 2030. Singapore third party logistics market is expected to reach USD 6,148.33 million by 2030 from USD 4,041.96 million in 2022, growing with a CAGR of 5.4% in the forecast period of 2023 to 2030. Hong Kong third party logistics market is expected to reach USD 4,791.97 million by 2030 from USD 3,752.94 million in 2022, growing with a CAGR of 3.1% in the forecast period of 2023 to 2030. Providers of third-party logistics (3PL) services have extensive supply chain management expertise, experience, and resources, which is increasing over the years.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Cutomisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD, Volume in Tons |

|

Segments Covered |

Service (Supply Chain Management, International Transportation Management (ITM), Domestic Transportation Management (DTM), Warehousing, Fulfillment& Distribution (W&D), Dedicated Contract Carriage (DCC)/ Freight Forwarding, Value-Added Logistics Services (VALS)), Product (Air Freight, Ocean Freight, Land Transport, Contract Logistics, Others), Providers (Companies Integrating & Offering Subcontracted Logistics, Courier Companies, Small Freight Forwarders, Transportation Services), application (SHIPPING, RECEIVING, RETURNS, PACKING), Business (B2B, B2C), Function (Supply Chain Management, Customer Management, In-Store Operations, Strategy & Planning, Merchandising), Vertical (Ecommerce, Retail, Manufacturing, Consumer Electronics, Healthcare, Automotive, Semicon/Solar, Aerospace & Defence), Retail Size (Medium, Small, Large)– |

|

Countries Covered |

Singapore, China, Hong Kong & Taiwan |

|

Market Players Covered |

DHL (Germany), Nippon Express Co., Ltd(Japan), FedEx (U.S.), NYK Line (Japan), CJ Logistics Corporation (Korea), C.H. Robinson Worldwide, Inc.(U.S.), DB Schenker (Germany), DSV (Denmark), KERRY LOGISTICS NETWORK LIMITED (Hong Kong), Kuehne+Nagel (Switzerland), Samudera Shipping Line Ltd (Singapore), SINOTRANS Limited (China), United Parcel Service of America, Inc. (U.S.), XPO, Inc. (U.S.), COSCO SHIPPING Logistics Supply Chain Co., Ltd. (China), CN Logistics International Holdings Limited (Hong Kong), NAF Logistics Group (Hong Kong), among others. |

Market Definition

Third Party Logistics (3PL) is a service that allows outsourcing operational logistics for warehousing all the way to delivery and ultimately enables to focus on the main core part of the business. Third party logistics companies provide a varied number of services in regard to the logistics of the supply chain, which includes transportation, warehousing, picking and packing, inventory forecasting, order Fulfilment, and freight forwarding. The primary advantage of third party logistics services such as packing, warehousing, and shipping reduces operating cost for companies and enable the organization to focus on their main business. A third party logistics service is likely to offer better performance on efforts such as shipping the products and helps the organization establish its strong presence in different countries. Suppose any company is selling its products internationally. In that case, third party logistics can take care of documentation, customs, duties, and other issues that come up at the borders that can delay shipments and result in high cost if not done thoroughly.

Singapore, China, Hong Kong & Taiwan Third Party Logistics Market Dynamics

This section deals with understanding the market application, supply chain, sourcing type and type. All of this is discussed in detail below:

DRIVERS

- High benefits offered by third-party logistics

Third party logistics is basically outsourced with operational logistics from warehousing to the delivery, which includes providing number of services in the supply chain such as freight forwarding, packaging, order fulfillment, inventory forecasting, picking and packing, warehousing and transportation. Third party logistics offer a wide range of benefits as it helps business owners to focus more on the other aspects of business, such as product development, marketing and sales. The high benefits offered by third party logistics are therefore acting as the major factor for boosting the growth of Singapore, China, Hong Kong & Taiwan third party logistics market. There are several benefits offered by third-party logistics:-

Expertise and Resources: Providers of third-party logistics (3PL) services have extensive supply chain management expertise, experience, and resources. They are well-versed in regulations, industry best practices, and technological advancements. Businesses can benefit from logistics operations that are both effective and optimized by making use of their expertise.

Cost Savings: Businesses can save a lot of money by outsourcing logistics to a 3PL provider. With transportation companies, warehousing facilities, and other service providers, 3PL providers frequently have established networks and relationships. They can negotiate better rates, consolidate shipments, and optimize routes using these networks, resulting in lower transportation costs.

Scalability and Flexibility: One of the vital benefits of utilizing a 3PL supplier is the capacity to scale strategies and tasks in light of business needs. Providers of third-party logistics (3PL) solutions offer adaptable options that can handle shifts in demand, seasonal variations, and market trends. Based on volume requirements, they have the infrastructure and resources to quickly scale up or down.

Improved Focus on Core Competencies: Businesses can free up internal resources and concentrate on their core competencies by outsourcing logistics functions to a third-party logistics provider. Companies can now devote more time, effort, and resources to strategic planning, product development, customer service, and marketing

- Rising growth in cross-border trade and globalization

Globalization can be referred to as the interdependence of the world’s economies, populations and cultures brought about by cross-border trade in technology, goods and services and flows of people, investment and information. Today, most of the country’s economy is highly dependent on buying and selling of goods among various countries. Asia-Pacific region has been the major player in global trade and has a high volume of trade flow that has increased the requirement of third party logistics to make the flow of trade more convenient and faster, thus boosting the growth of Singapore, China, Hong Kong & Taiwan third party logistics market.

OPPORTUNITY

- Increasing growth in e-commerce

The growth in digitalization has led to increased growth in the e-commerce industry, with large amounts of goods being transported at the door step of consumers. Amazon is the biggest company in an e-commerce company, delivering products at a faster rate. Consumers now rely on fast delivery of goods without any mismatch of products. This has increased the requirement for faster delivery through a wide distributor network, which is being provided by third party logistics companies, thus creating new growth of opportunities for Singapore, China, and Hong Kong & Taiwan third party logistics market. Here's an explanation of how this growth acts as an opportunity for the 3PL industry.

RESTRAINTS/CHALLENGES

- Congestion associated with trade routes

As traffic volumes and congestion increase on roadways and waterways, freight and transportation service operators face growing challenges in maintaining reliable schedules. This affects supply chains and truck-dependent businesses, each of which is of growing significance for both public coverage and private region operators. Moreover, several accidents on roads or oil spills at sea can act as an unexpected challenge for third party logistics. Here's an explanation of how congestion can affect the 3PL industry

Singapore, China, Hong Kong & Taiwan third party logistics market Scope

The global Third party logistics market is segmented into eight notable segments based service, product, providers, application, business type, function, vertical and retail size. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service

- Supply Chain Management

- International Transportation Management (ITM)

- Domestic Transportation Management (DTM)

- Warehousing, Fulfillment & Distribution (W&D)

- Dedicated Contract Carriage (DCC)/ Freight Forwarding

- Value-Added Logistics Services (VALS)

Product

- Air Frieght

- Ocean Freight

- Land Transport

- Contract Logistics

- Others

Providers

- Small Frieght Forwarders

- Courier Companies

- Companies Integrating & Offering Subcontracted Logistics

- Transportation Services

Application

- Receiving

- Picking

- Shipping

- Returns

Business Type

- B2B

- B2C

Function

- Supply Chain Management

- Merchandising

- In-Store Operations

- Strategy And Planning

- Customer Management

Vertical

- Ecommerce

- Retail

- Healthcare

- Automotive

- Manufacturing

- Aerospace & Defense

- Consumer Electronics

- Semicon/Solar

- Others

Retail Size

- Small

- Medium

- Large

Singapore, China, Hong Kong & Taiwan Third Party Logistics Market Regional Analysis/Insights

Singapore, China, Hong Kong & Taiwan third party logistics market is analysed, and market size insights and trends are provided by region, service, product, providers, application, business type, function, vertical and retail size as referenced above.

The Singapore, China, Hong Kong & Taiwan third party logistics market is expected to attain lucrative growth due to an upsurge in the adoption of advanced features for 3PL is expected to drive Singapore, China, Hong Kong & Taiwan third party logistics market.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Singapore, China, Hong Kong & Taiwan Third Party Logistics Market Share Analysis

Singapore, China, Hong Kong & Taiwan third party logistics market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the Singapore, China, Hong Kong & Taiwan third party logistics market.

Some of the major players operating in the Singapore, China, Hong Kong & Taiwan third party logistics market are DHL (Germany), Nippon Express Co., Ltd(Japan), FedEx (U.S.), NYK Line (Japan), CJ Logistics Corporation (Korea), C.H. Robinson Worldwide, Inc.(U.S.), DB Schenker (Germany), DSV (Denmark), KERRY LOGISTICS NETWORK LIMITED (Hong Kong), Kuehne+Nagel (Switzerland), Samudera Shipping Line Ltd (Singapore), SINOTRANS Limited (China), United Parcel Service of America, Inc. (U.S.), XPO, Inc. (U.S.), COSCO SHIPPING Logistics Supply Chain Co., Ltd. (China), CN Logistics International Holdings Limited (Hong Kong), NAF Logistics Group (Hong Kong), among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 SERVICE TIMELINE CURVE

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BENEFITS OF THIRD PARTY LOGISTICS

4.2 ECONOMIES OF SCALES

4.3 COMPETITIVE EDGE

4.4 WAREHOUSE RENT AND OVERHEADS

4.5 CUSTOMER SATISFACTION AND BRAND LOYALTY

4.6 TRENDS IN RETAIL LOGISTICS

4.6.1 ELASTIC LOGISTICS

4.6.2 BLOCKCHAIN

4.6.3 ARTIFICIAL INTELLIGENCE

4.6.4 IOT (INTERNET OF THINGS)

4.7 THIRD-PARTY LOGISTICS (3PL) COST MODEL

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH BENEFITS OFFERED BY THIRD-PARTY LOGISTICS

5.1.2 RISING GROWTH IN CROSS-BORDER TRADE AND GLOBALIZATION

5.1.3 SURGING NUMBER OF MANUFACTURING FACILITIES LEADING TO HIGHER NEED OF LOGISTICS

5.1.4 INCREASING GROWTH OF LOGISTICS THROUGH AIRWAYS AND WATER WAYS

5.2 RESTRAINT

5.2.1 CONGESTION ASSOCIATED WITH TRADE ROUTES

5.3 OPPORTUNITIES

5.3.1 INCREASING GROWTH IN E-COMMERCE

5.3.2 GROWING INCLINATION TOWARDS DIGITALIZATION

5.3.3 INCREASING GROWTH IN INVESTMENTS AND EXPANSIONS MADE BY THE MARKET PLAYERS

5.3.4 THE EMERGENCE OF NEW ADVANCED TECHNOLOGIES

5.4 CHALLENGES

5.4.1 SEVERAL GOVERNMENT REGULATIONS AND RESTRICTIONS

5.4.2 LACK OF TRAINING AND EDUCATION

6 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY SERVICE

6.1 OVERVIEW

6.2 SUPPLY CHAIN MANAGEMENT

6.3 INTERNATIONAL TRANSPORTATION MANAGEMENT (ITM)

6.4 DOMESTIC TRANSPORTATION MANAGEMENT (DTM)

6.5 WAREHOUSING, FULFILMENT & DISTRIBUTION (W&D)

6.5.1 INVENTORY

6.5.2 SHIPPING

6.5.3 TRACKING

6.5.4 PACKING

6.6 DEDICATED CONTRACT CARRIAGE (DCC)/ FREIGHT FORWARDING

6.7 VALUE-ADDED LOGISTICS SERVICES (VALS)

7 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 AIR FREIGHT

7.2.1 SUPPLY CHAIN MANAGEMENT

7.2.2 INTERNATIONAL TRANSPORTATION MANAGEMENT (ITM)

7.2.3 DOMESTIC TRANSPORTATION MANAGEMENT (DTM)

7.2.4 WAREHOUSING, FULFILMENT & DISTRIBUTION (W&D)

7.2.5 DEDICATED CONTRACT CARRIAGE (DCC)/ FREIGHT FORWARDING

7.2.6 VALUE-ADDED LOGISTICS SERVICES (VALS)

7.3 OCEAN FREIGHT

7.3.1 SUPPLY CHAIN MANAGEMENT

7.3.2 INTERNATIONAL TRANSPORTATION MANAGEMENT (ITM)

7.3.3 WAREHOUSING, FULFILMENT & DISTRIBUTION (W&D)

7.3.4 DEDICATED CONTRACT CARRIAGE (DCC)/ FREIGHT FORWARDING

7.3.5 VALUE-ADDED LOGISTICS SERVICES (VALS)

7.3.6 DOMESTIC TRANSPORTATION MANAGEMENT (DTM)

7.4 LAND TRANSPORT

7.4.1 SUPPLY CHAIN MANAGEMENT

7.4.2 DOMESTIC TRANSPORTATION MANAGEMENT (DTM)

7.4.3 WAREHOUSING, FULFILMENT & DISTRIBUTION (W&D)

7.4.4 INTERNATIONAL TRANSPORTATION MANAGEMENT (ITM)

7.4.5 DEDICATED CONTRACT CARRIAGE (DCC)/ FREIGHT FORWARDING

7.4.6 VALUE-ADDED LOGISTICS SERVICES (VALS)

7.5 CONTRACT LOGISTICS

7.5.1 SUPPLY CHAIN MANAGEMENT

7.5.2 WAREHOUSING, FULFILMENT & DISTRIBUTION (W&D)

7.5.3 DOMESTIC TRANSPORTATION MANAGEMENT (DTM)

7.5.4 INTERNATIONAL TRANSPORTATION MANAGEMENT (ITM)

7.5.5 DEDICATED CONTRACT CARRIAGE (DCC)/ FREIGHT FORWARDING

7.5.6 VALUE-ADDED LOGISTICS SERVICES (VALS)

7.6 OTHERS

8 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY PROVIDERS

8.1 OVERVIEW

8.2 COMPANIES INTEGRATING & OFFERING SUBCONTRACTED LOGISTICS

8.3 COURIER COMPANIES

8.4 SMALL FREIGHT FORWARDERS

8.5 TRANSPORTATION SERVICES

9 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SHIPPING

9.3 RECEIVING

9.4 RETURNS

9.5 PACKING

9.5.1 UNBRANDED BOXES

9.5.2 BUBBLE MAILERS

9.5.3 POLY BAGS

9.5.4 PACKING TAPE

9.5.5 DUNNAGE

9.5.6 PAPER BASED DUNNAGE

10 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY BUSINESS TYPE

10.1 OVERVIEW

10.2 B2C

10.3 B2B

11 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY FUNCTION

11.1 OVERVIEW

11.2 SUPPLY CHAIN MANAGEMENT

11.3 CUSTOMER MANAGEMENT

11.4 IN-STORE OPERATIONS

11.5 STRATEGY & PLANNING

11.6 MERCHANDISING

12 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY VERTICAL

12.1 OVERVIEW

12.2 ECOMMERCE

12.2.1 SUPPLY CHAIN MANAGEMENT

12.2.2 CUSTOMER MANAGEMENT

12.2.3 IN-STORE OPERATIONS

12.2.4 STRATEGY & PLANNING

12.2.5 MERCHANDISING

12.3 RETAIL

12.3.1 SUPPLY CHAIN MANAGEMENT

12.3.2 CUSTOMER MANAGEMENT

12.3.3 IN-STORE OPERATIONS

12.3.4 STRATEGY & PLANNING

12.3.5 MERCHANDISING

12.4 MANUFACTURING

12.4.1 SUPPLY CHAIN MANAGEMENT

12.4.2 CUSTOMER MANAGEMENT

12.4.3 IN-STORE OPERATIONS

12.4.4 STRATEGY & PLANNING

12.4.5 MERCHANDISING

12.5 CONSUMER ELECTRONICS

12.5.1 SUPPLY CHAIN MANAGEMENT

12.5.2 CUSTOMER MANAGEMENT

12.5.3 IN-STORE OPERATIONS

12.5.4 STRATEGY & PLANNING

12.5.5 MERCHANDISING

12.6 HEALTHCARE

12.6.1 SUPPLY CHAIN MANAGEMENT

12.6.2 CUSTOMER MANAGEMENT

12.6.3 IN-STORE OPERATIONS

12.6.4 STRATEGY & PLANNING

12.6.5 MERCHANDISING

12.7 AUTOMOTIVE

12.7.1 SUPPLY CHAIN MANAGEMENT

12.7.2 CUSTOMER MANAGEMENT

12.7.3 IN-STORE OPERATIONS

12.7.4 STRATEGY & PLANNING

12.7.5 MERCHANDISING

12.8 SEMICON/SOLAR

12.8.1 SUPPLY CHAIN MANAGEMENT

12.8.2 CUSTOMER MANAGEMENT

12.8.3 IN-STORE OPERATIONS

12.8.4 STRATEGY & PLANNING

12.8.5 MERCHANDISING

12.9 AEROSPACE & DEFENCE

12.9.1 SUPPLY CHAIN MANAGEMENT

12.9.2 CUSTOMER MANAGEMENT

12.9.3 IN-STORE OPERATIONS

12.9.4 STRATEGY & PLANNING

12.9.5 MERCHANDISING

12.1 OTHERS

12.10.1 SUPPLY CHAIN MANAGEMENT

12.10.2 CUSTOMER MANAGEMENT

12.10.3 IN-STORE OPERATIONS

12.10.4 STRATEGY & PLANNING

12.10.5 MERCHANDISING

13 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET, BY RETAIL SIZE

13.1 OVERVIEW

13.2 MEDIUM

13.3 SMALL

13.4 LARGE

14 CHINA THIRD PARTY LOGISTICS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: CHINA

14.2 COMPANY SHARE ANALYSIS: TAIWAN

14.3 COMPANY SHARE ANALYSIS: SINGAPORE

14.4 COMPANY SHARE ANALYSIS: HONG KONG

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 FEDEX

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 SERVICE PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 DHL

16.2.1 COMPANY SNAPSHOT

16.2.2 1.2.2 REVENUE ANALYSIS

16.2.3 SERVICE PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 COSCO SHIPPING LOGISTICS SUPPLY CHAIN CO., LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 SERVICE PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 KUEHNE+NAGEL

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 SERVICE PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 DSV

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 SERVICE PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 C.H. ROBINSON WORLDWIDE, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 SERVICE PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 CJ LOGISTICS CORPORATION

16.7.1 COMPANY SNAPSHOT

16.7.2 SERVICE PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CN LOGISTICS INTERNATIONAL HOLDINGS LIMITED

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 SERVICE PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 DB SCHENKER

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 KERRY LOGISTICS NETWORK LIMITED

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 SERVICE PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 NAF LOGISTICS GROUP

16.11.1 COMPANY SNAPSHOT

16.11.2 SERVICE PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 NIPPON EXPRESS CO., LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 SERVICE PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 NYK LINE

16.13.1 COMPANY SNAPSHOT

16.13.2 SERVICE PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 SAMUDERA SHIPPING LINE LTD

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SERVICE PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 SINOTRANS LIMITED

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 SERVICE PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 TOLL HOLDINGS LIMITED (A SUBSIDIARY OF JAPAN POST HOLDINGS CO., LTD.)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 SERVICE PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 UNITED PARCEL SERVICE OF AMERICA, INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 SERVICE PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 XIAMEN XIANGYU GROUP CO., LTD

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 SERVICE PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 XPO, INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 SERVICE PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 YUNDA LTD

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 SERVICE PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 WAREHOUSE RENT IN HONG KONG

TABLE 2 CHINA THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 3 TAIWAN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 4 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 5 HONG KONG THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 6 CHINA WAREHOUSING, FULFILLMENT& DISTRIBUTION (W&D) IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 7 TAIWAN WAREHOUSING, FULFILLMENT& DISTRIBUTION (W&D) IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 8 SINGAPORE WAREHOUSING, FULFILLMENT& DISTRIBUTION (W&D) IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 9 HONG KONG WAREHOUSING, FULFILLMENT& DISTRIBUTION (W&D) IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 10 CHINA THIRD PARTY LOGISTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 11 TAIWAN THIRD PARTY LOGISTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 12 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 13 HONG KONG THIRD PARTY LOGISTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 14 CHINA AIR FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 15 TAIWAN AIR FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 16 SINGAPORE AIR FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 17 HONG KONG AIR FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 18 CHINA OCEAN FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 19 TAIWAN OCEAN FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 20 SINGAPORE OCEAN FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 21 HONG KONG OCEAN FREIGHT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 22 CHINA LAND TRANSPORT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 23 TAIWAN LAND TRANSPORT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 24 SINGAPORE LAND TRANSPORT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 25 HONG KONG LAND TRANSPORT IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 26 CHINA CONTRACT LOGISTICS IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 27 TAIWAN CONTRACT LOGISTICS IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 28 SINGAPORE CONTRACT LOGISTICS IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 29 HONG KONG CONTRACT LOGISTICS IN THIRD PARTY LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 30 CHINA THIRD PARTY LOGISTICS MARKET, BY PROVIDERS, 2021-2030 (USD MILLION)

TABLE 31 TAIWAN THIRD PARTY LOGISTICS MARKET, BY PROVIDERS, 2021-2030 (USD MILLION)

TABLE 32 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY PROVIDERS, 2021-2030 (USD MILLION)

TABLE 33 HONG KONG THIRD PARTY LOGISTICS MARKET, BY PROVIDERS, 2021-2030 (USD MILLION)

TABLE 34 CHINA THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 TAIWAN THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 36 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 37 HONG KONG THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 38 CHINA PACKING IN THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 39 TAIWAN PACKING IN THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 40 SINGAPORE PACKING IN THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 HONG KONG PACKING IN THIRD PARTY LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 CHINA THIRD PARTY LOGISTICS MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 43 TAIWAN THIRD PARTY LOGISTICS MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 44 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 45 HONG KONG THIRD PARTY LOGISTICS MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 46 CHINA THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 47 TAIWAN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 48 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 49 HONG KONG THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 50 CHINA THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 51 TAIWAN THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 52 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 53 HONG KONG THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 54 CHINA ECOMMERCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 55 TAIWAN ECOMMERCE IN THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 56 SINGAPORE ECOMMERCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 57 HONG KONG ECOMMERCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 58 CHINA RETAIL IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 59 TAIWAN RETAIL IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 60 SINGAPORE RETAIL IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 61 HONG KONG RETAIL IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 62 CHINA MANUFACTURING IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 63 TAIWAN MANUFACTURING IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 64 SINGAPORE MANUFACTURING IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 65 HONG KONG MANUFACTURING IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 66 CHINA CONSUMER ELECTRONICS IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 67 TAIWAN CONSUMER ELECTRONICS IN THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 68 SINGAPORE CONSUMER ELECTRONICS IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 69 HONG KONG CONSUMER ELECTRONICS IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 70 CHINA HEALTHCARE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 71 TAIWAN HEALTHCARE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 72 SINGAPORE HEALTHCARE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 73 HONG KONG HEALTHCARE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 74 CHINA AUTOMOTIVE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 75 TAIWAN AUTOMOTIVE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 76 SINGAPORE AUTOMOTIVE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 77 HONG KONG AUTOMOTIVE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 78 CHINA SEMICON/SOLAR IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 79 TAIWAN SEMICON/SOLAR IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 80 SINGAPORE SEMICON/SOLAR IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 81 HONG KONG SEMICON/SOLAR IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 82 CHINA AEROSPACE & DEFENCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 83 TAIWAN AEROSPACE & DEFENCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 84 SINGAPORE AEROSPACE & DEFENCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 85 HONG KONG AEROSPACE & DEFENCE IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 86 CHINA OTHERS IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 87 TAIWAN OTHERS IN THIRD PARTY LOGISTICS MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 88 SINGAPORE OTHERS IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 89 HONG KONG OTHERS IN THIRD PARTY LOGISTICS MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 90 CHINA THIRD PARTY LOGISTICS MARKET, BY RETAIL SIZE, 2021-2030 (USD MILLION)

TABLE 91 TAIWAN THIRD PARTY LOGISTICS MARKET, BY RETAIL SIZE, 2021-2030 (USD MILLION)

TABLE 92 SINGAPORE THIRD PARTY LOGISTICS MARKET, BY RETAIL SIZE, 2021-2030 (USD MILLION)

TABLE 93 HONG KONG THIRD PARTY LOGISTICS MARKET, BY RETAIL SIZE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET: SEGMENTATION

FIGURE 2 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 CHINA THIRD PARTY LOGISTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 TAIWAN THIRD PARTY LOGISTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 6 SINGAPORE THIRD PARTY LOGISTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 7 HONG KONG THIRD PARTY LOGISTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 8 CHINA THIRD PARTY LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 9 TAIWAN THIRD PARTY LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 10 SINGAPORE THIRD PARTY LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 11 HONG KONG THIRD PARTY LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 12 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 13 CHINA THIRD PARTY LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 14 TAIWAN THIRD PARTY LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 15 SINGAPORE THIRD PARTY LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 16 HONG KONG THIRD PARTY LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 17 CHINA THIRD PARTY LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 18 TAIWAN THIRD PARTY LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 19 SINGAPORE THIRD PARTY LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 20 HONG KONG THIRD PARTY LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 21 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET: MULTIVARIATE MODELLING

FIGURE 22 CHINA THIRD PARTY LOGISTICS MARKET: SERVICE CURVE

FIGURE 23 TAIWAN THIRD PARTY LOGISTICS MARKET: SERVICE CURVE

FIGURE 24 SINGAPORE THIRD PARTY LOGISTICS MARKET: SERVICE CURVE

FIGURE 25 HONG KONG THIRD PARTY LOGISTICS MARKET: SERVICE CURVE

FIGURE 26 CHINA THIRD PARTY LOGISTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 27 SINGAPORE THIRD PARTY LOGISTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 28 SINGAPORE THIRD PARTY LOGISTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 29 HONG KONG THIRD PARTY LOGISTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 30 SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET: SEGMENTATION

FIGURE 31 HIGH BENEFITS OFFERED BY THIRD PARTY LOGISTICS ARE EXPECTED TO DRIVE CHINA THIRD PARTY LOGISTICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 32 RISING GROWTH IN CROSS-BORDER TRADE AND GLOBALIZATION IS EXPECTED TO DRIVE TAIWAN THIRD PARTY LOGISTICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 33 THE SURGING NUMBER OF MANUFACTURING FACILITIES LEADING TO HIGHER NEED OF LOGISTICS IS EXPECTED TO DRIVE SINGAPORE THIRD PARTY LOGISTICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 34 INCREASING GROWTH OF LOGISTICS THROUGH AIRWAYS AND WATER WAYS IS EXPECTED TO DRIVE HONG KONG THIRD PARTY LOGISTICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 35 SUPPLY CHAIN MANAGEMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF CHINA THIRD PARTY LOGISTICS MARKET IN 2021 & 2030

FIGURE 36 SUPPLY CHAIN MANAGEMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF TAIWAN THIRD PARTY LOGISTICS MARKET IN 2021 & 2030

FIGURE 37 SUPPLY CHAIN MANAGEMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SINGAPORE THIRD PARTY LOGISTICS MARKET IN 2021 & 2030

FIGURE 38 SUPPLY CHAIN MANAGEMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF HONG KONG THIRD PARTY LOGISTICS MARKET IN 2021 & 2030

FIGURE 39 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF SINGAPORE, CHINA, HONG KONG & TAIWAN THIRD PARTY LOGISTICS MARKET

FIGURE 40 LOGISTICS PERFORMANCE INDEX: OVERALL (1=LOW TO 5=HIGH) - SINGAPORE

FIGURE 41 MANUFACTURING, VALUE ADDED (CONSTANT LCU) - SINGAPORE

FIGURE 42 CONTAINER PORT TRAFFIC BY REGION

FIGURE 43 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 44 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 45 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 46 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 47 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 48 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 49 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 50 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 51 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 52 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 53 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 54 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 55 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 56 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 57 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 58 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 59 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 60 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 61 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 62 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 63 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 64 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 65 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 66 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 67 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 68 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 69 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 70 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 71 SINGAPORE THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 72 CHINA THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 73 HONG KONG THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 74 TAIWAN THIRD PARTY LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 75 CHINA THIRD PARTY LOGISTICS MARKET: COMPANY SHARE 2022(%)

FIGURE 76 TAIWAN THIRD PARTY LOGISTICS MARKET: COMPANY SHARE 2022 (%)

FIGURE 77 SINGAPORE THIRD PARTY LOGISTICS MARKET: COMPANY SHARE 2022 (%)

FIGURE 78 HONG KONG THIRD PARTY LOGISTICS MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.