South America Agriculture Drones Market

Market Size in USD Million

CAGR :

%

USD

55.60 Million

USD

135.84 Million

2024

2032

USD

55.60 Million

USD

135.84 Million

2024

2032

| 2025 –2032 | |

| USD 55.60 Million | |

| USD 135.84 Million | |

|

|

|

|

South America Agriculture Drone Market Size

- The South America agriculture drone market is expected to reach USD 135.84 million by 2032 from USD 55.60 million in 2024, growing with a substantial CAGR of 11.8% in the forecast period of 2025 to 2032

- The South America agriculture drone market is witnessing robust expansion, driven by rising adoption of precision farming practices, increasing demand for real-time crop monitoring, and the need to optimize resource utilization across large agricultural landscapes. The growing use of drones for crop spraying, soil analysis, field mapping, and livestock monitoring is supporting operational efficiency and boosting agricultural productivity across the region

- Market growth is further strengthened by government initiatives promoting technological integration in agriculture, advancements in drone sensor technologies, and growing investments from agritech startups and global drone manufacturers. In addition, increasing affordability of UAV systems and expanding training programs for farmers are accelerating adoption, positioning agricultural drones as a critical tool for modernizing South America’s farming sector.

South America Agriculture Drone Market Analysis

- Brazil, Argentina, and Colombia represent the leading markets within the South America agriculture drone market, driven by rapid adoption of precision agriculture, expanding commercial farming areas, and growing investments in smart farming technologies. Increasing demand for high-accuracy crop monitoring, automated spraying, and real-time field analytics is accelerating drone integration across large-scale soybean, sugarcane, coffee, and grain farms.

- Agriculture drones play a crucial role in enhancing farm efficiency, resource optimization, and sustainable production practices, enabling growers to achieve higher yields while reducing input costs and environmental impact. Their integration into digital farming strategies aligns with regional shifts toward climate-smart agriculture, data-driven decision-making, and environmentally responsible land management.

- Brazil remains the dominant contributor to the South America agriculture drone market, supported by its strong agricultural infrastructure, large-scale commercial crop production, and increasing adoption of advanced UAV solutions.

- In 2025, Brazil is expected to sustain a strong growth momentum, supported by government programs promoting agricultural digitalization, rising preference for precision spraying to mitigate crop losses, and the expansion of drone training, service, and maintenance networks across the region.

Report Scope and South America Agriculture Drone Market Segmentation

|

Attributes |

South America Agriculture Drone Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

South America Agriculture Drone Market Trends

“Integration of autonomous flight and swarm technology”

- South America agriculture drone market is witnessing rapid advancements in autonomous flight systems, enabling drones to perform complex agricultural tasks with minimal human intervention. These improvements enhance operational precision in activities such as crop scouting, field mapping, and automated spraying across large plantations.

- The adoption of swarm technology is accelerating, allowing multiple drones to operate simultaneously to cover vast agricultural areas faster and more efficiently. this trend is especially beneficial for large-scale farms in Brazil and Argentina, where coordinated drone fleets significantly reduce time and labor requirements.

- Enhanced onboard AI, machine vision, and real-time communication systems are improving drone-to-drone coordination and adaptive flight control. These technologies enable swarm drones to dynamically adjust flight paths, avoid obstacles, and respond to changing field conditions with high accuracy.

- Agricultural drone manufacturers are integrating advanced sensors, automated route planning software, and cloud-based analytics to support fully autonomous mission execution. These innovations improve reliability, reduce manual workload, and ensure consistent spraying uniformity, even in complex terrains.

South America Agriculture Drone Market Dynamics

Driver

“Rising adoption of precision agriculture”

- Farmers are increasingly using drones equipped with multispectral and thermal sensors to monitor crop health, detect pests and diseases early, and optimize irrigation, leading to higher yields and reduced crop losses.

- Precision agriculture enables targeted application of fertilizers, pesticides, and water, reducing wastage and lowering operational costs while improving environmental sustainability.

- Integration of drones with AI and analytics platforms allows farmers to gather real-time data, generate actionable insights, and make informed decisions on planting, harvesting, and crop management.

- The use of drones allows coverage of extensive farmland quickly and efficiently, supporting large-scale agricultural operations in countries like Brazil and Argentina, where farm sizes are often very large.

- For instances, in July 2023, according to an article published by Bennett, Coleman & Co. Ltd., precision farming technologies offer farmers the means to optimize resource utilization in today's ever-changing agricultural landscape. Farmers can streamline operations, reduce wastage, and improve overall efficiency by integrating data-driven insights and advanced agri-tech solutions. This approach not only enhances resource management but also promotes sustainability, higher yields, and cost savings, while the future promises even more innovations through integration with emerging technologies such as blockchain, robotics, and drones, revolutionizing food production

Restraint/Challenge

“Complex supply chain and material availability”

- Many critical drone parts, including high-precision sensors, cameras, and LiDAR systems, are imported, making the supply chain vulnerable to international trade disruptions and currency fluctuations.

- The region has a relatively small local manufacturing base for advanced UAV components, leading to longer lead times and higher costs for drone procurement and maintenance.

- Availability of specialized materials such as lightweight composites, high-capacity batteries, and conductive electronic components can be inconsistent, affecting production schedules and drone performance.

- Infrastructural constraints, including transportation inefficiencies and customs delays, can slow down the delivery of components and finished drones to farms, particularly in remote agricultural regions.

- For instances, in October 2024, Skydio, a major U.S. drone maker, announced that it had to ration batteries to one per drone for several months. This was because of reduced supply from its Chinese battery supplier following sanctions.

South America Agriculture Drone Market Scope

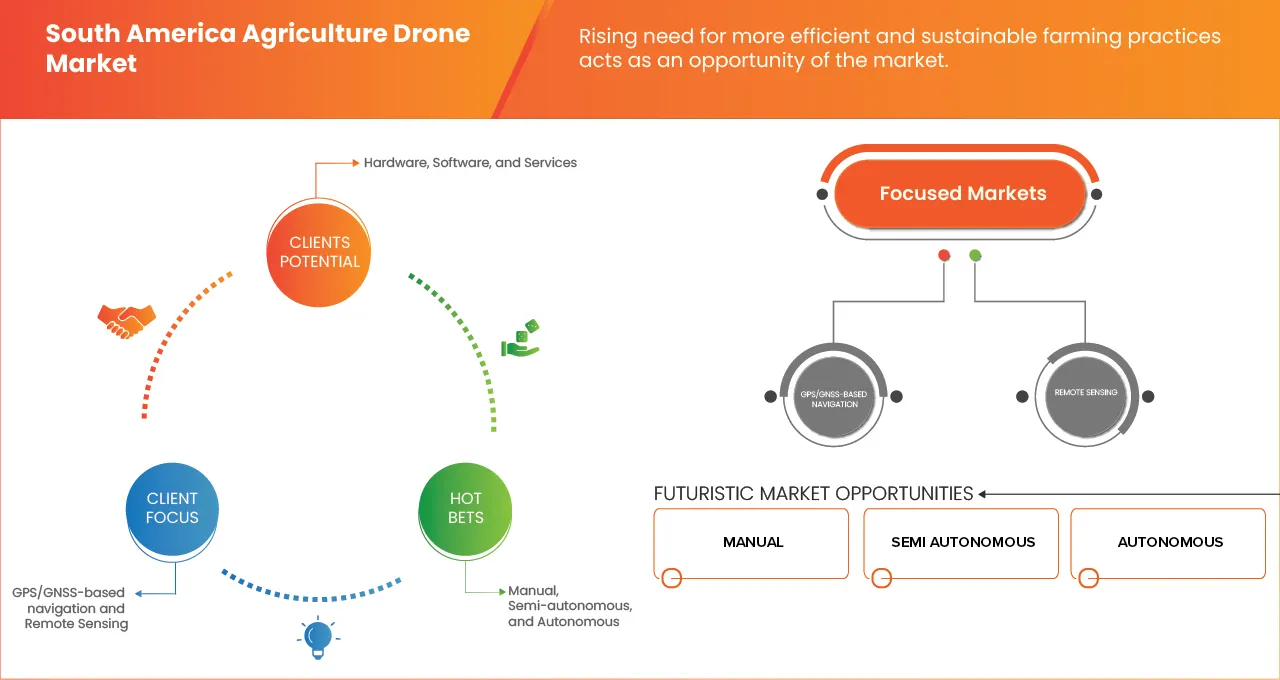

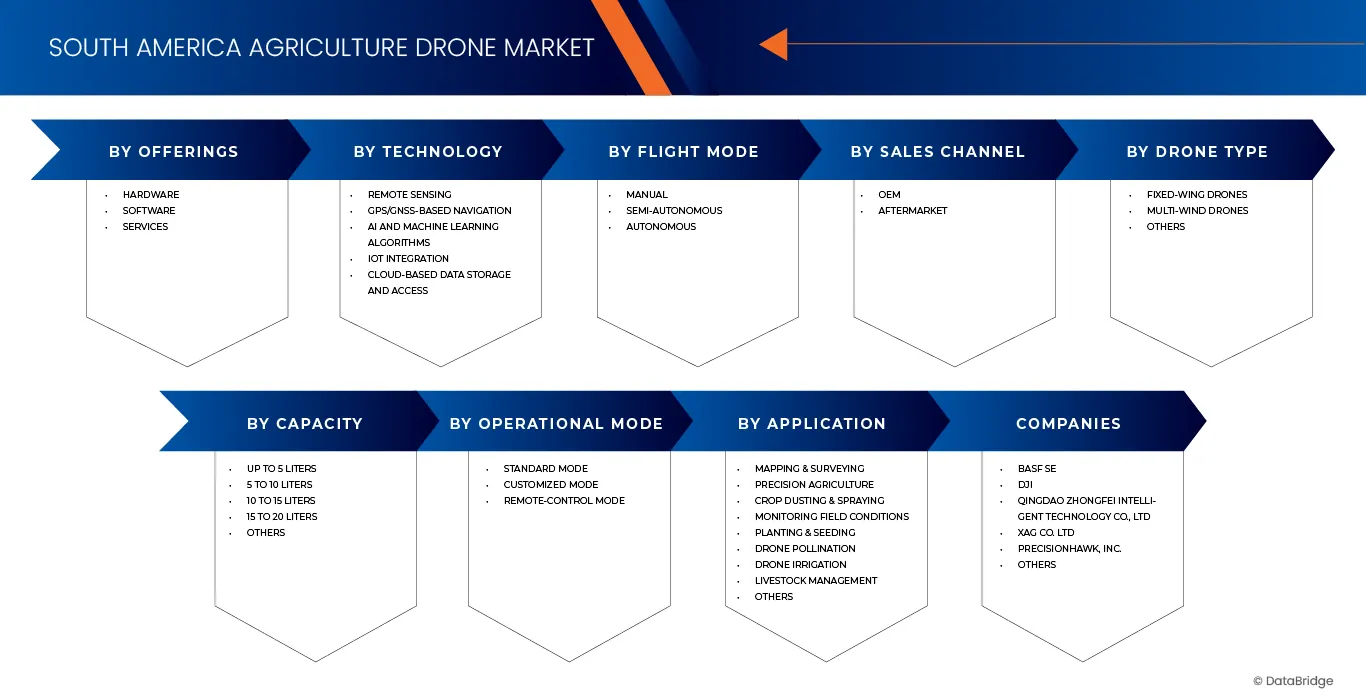

The South America agriculture drone market is segmented into offering, drone type, capacity, flight mode, operation mode, sales channel, and application.

By Offerings

On the basis of offering, the market is segmented into hardware, software and services. The hardware segment is further segmented into cameras, flight controller, battery, motors, sensors, GPS/GIS, pump, LED and others. In 2025, the hardware segment is expected to dominate the market with a 65.72% share as it encompasses the essential components such as drones, sensors, and cameras vital for precision farming.

The hardware segment is also expected to register the highest CAGR of 12.7%, driven by the continuous advancement in drone technologies, increasing integration of high-precision sensors, and rising demand for field monitoring tools that enable real-time decision-making. Additionally, the declining costs of components and the expanding adoption of mechanized farming practices across emerging and developed markets further support its strong growth trajectory.

By Drone Type

On the basis of drone type, the market is segmented into fixed-wing drones, multi-wing drones and others In 2025, The fixed-wing drone segment is expected to dominate the market with a 54.89% share as they are more efficient for large-scale agricultural operations due to longer flight times and coverage.

The fixed-wing drone segment is also expected to register the highest CAGR of 12.1%, as they can carry heavier payloads for advanced sensors and imaging equipment. The need for comprehensive, cost-effective data collection in precision farming drives this dominance.

By Technology

On the basis of technology, the market is segmented into remote sensing, GPS/GNSS-based navigation, AI and machine learning algorithms, IoT integration, cloud-based data storage and access. In 2025, the remote sensing segment is expected to dominate the market with 35.52% share market due to its critical role in providing accurate, real-time data for monitoring, analysis, and decision-making across industries such as agriculture, environmental management, defense, and infrastructure.

The remote sensing segment is also expected to register the highest CAGR of 12.4% driven by its ability to enhance the process of collection of detailed information about the Earth’s surface without physical contact, using satellites, drones, and sensors.

By Capacity

On the basis of Capacity, the market is segmented into upto 5 liters, 5 to 10 liters, 10 to 15 liters, 15 to 20 liters and others. In 2025, the 15 to 20 liters segment is expected to dominate the market with 45.84% share because of its versatility for various crop spraying applications. It strikes a balance between capacity and maneuverability, making it suitable for many farms.

The 15 to 20 liters segment is also expected to register the highest CAGR of 12.0% as it offers efficient pesticide and fertilizer distribution while remaining practical for a wide range of agricultural operations.

By Flight Mode

On the basis of flight mode, the market has been segmented into manual, semi-autonomous and autonomous. In 2025, The manual segment is expected to dominate the market with 65.48% share as it encompasses greater control and adaptability for precision farming tasks.

The manual segment is also expected to register the highest CAGR of 12.0% driven by the technical assistance to farmers. Farmers can respond to real-time conditions and make immediate adjustments during flights. This flexibility enhances the drone's utility in diverse agricultural applications.

By Operation Mode

On the basis of operation mode, the market is segmented into standard mode, customized mode and remote-control mode. In 2025, The standard mode segment is expected to dominate the market with a 52.30% share as it offers a user-friendly, consistent experience for a broad range of users.

The standard mode segment also is expected to register the highest CAGR of 12.1% driven by the fact that It caters to farmers with varying levels of technical expertise. This accessibility drives widespread adoption and ensures ease of integration into agricultural practice

By Sales Channel

On the basis of sales channel, the market has been segmented into OEM and aftermarket. In 2025, The OEM segment is expected to dominate the market with a 67.65% share because of its direct manufacturer-to-customer relationships, reducing costs and ensuring product authenticity.

The OEM segment is also expected to register the highest CAGR of 12.1% as It offers customization and technical support directly from the source, enhancing customer trust and satisfaction. This channel streamlines the procurement process, making it a preferred choice for agricultural drone buyers.

By Application

On the basis of application, the market is segmented into mapping & surveying, precision agriculture, crop dusting & spraying, monitoring field conditions, planting & seeding, drone pollination, drone irrigation, livestock management and others. The mapping & surveying segment is expected to dominate the market with 23.21% share because of its crucial role in precision agriculture.

The mapping & surveying segment is expected to register the highest CAGR of 12.3% as this segment provides essential insights for optimizing crop management, resource allocation, and overall farm productivity.

South America Agriculture Drone Market Regional Analysis

Brazil is expected to dominate the South America agriculture drone market due to its extensive commercial farmland, strong adoption of precision agriculture, and government initiatives promoting smart farming technologies. high demand for crop monitoring, automated spraying, and UAV-based field analytics drives market growth. Argentina and Colombia are also expanding rapidly, supported by agritech investments, growing awareness of sustainable farming practices, and the increasing availability of drone-as-a-service solutions.

Brazil Agriculture Drone Market Insight

The Brazil agriculture drone market is experiencing robust growth, driven by rising adoption of precision agriculture and automated farming solutions across large-scale soybean, sugarcane, and coffee plantations. the country’s strong agricultural infrastructure, coupled with government initiatives promoting smart farming technologies, is accelerating UAV integration for crop monitoring, spraying, and field analytics. increasing investments from agritech startups and collaborations between drone manufacturers, research institutions, and farm cooperatives are fostering innovations in autonomous flight, swarm technology, and ai-powered analytics. enhanced drone accessibility and service models further support efficiency, sustainability, and productivity, positioning Brazil as the regional leader in agricultural UAV adoption.

Argentina Agriculture Drone Market Insight

The Argentina agriculture drone market is witnessing significant growth, fuelled by increasing adoption of precision farming practices and the need to optimize crop yields across wheat, corn, and soybean farms. government initiatives supporting digital agriculture and rural technology adoption are enhancing drone penetration in the country. Agritech start-ups and UAV service providers are collaborating to offer drone-as-a-service solutions, enabling small and mid-sized farmers to access advanced monitoring and automated spraying technologies. integration of ai-powered analytics, multispectral imaging, and autonomous flight systems is improving operational efficiency, resource management, and sustainability, positioning Argentina as a key emerging market for agricultural drones in South America.

South America Agriculture Drone Market Share

The South America agriculture drone market industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- DJI (China)

- Qingdao Zhongfei Intelligent Technology Co., Ltd (China)

- XAG Co. Ltd (China)

- PrecisionHawk, Inc. (United States)

- Qualcomm Technologies, Inc. (United States)

- Sky-Drones Technologies LTD (United Kingdom)

- Eavision Technologies Co., Ltd. (New Zealand)

- Yamaha Motor Co., Ltd. (Japan)

- AgroDrone AI (United States)

- Aerodyne Group (Malaysia)

- AeroVironment, Inc. (United States)

Latest Developments in South America Agriculture Drone Market

- In September 2025, EagleNXT (formerly AgEagle) renewed key distributor agreements across Latin America, deepening its footprint in the region. The company extended partnerships with Geo Agri and Santiago & Cintra in Brazil, GESTECNER in Paraguay, and INNTAGRI and SYSMAP in Peru and Ecuador. These renewed alliances reinforce EagleNXT’s long-term growth strategy, helping ensure reliable access to its advanced fixed-wing drones and aerial sensors for precision agriculture and other applications.

- In May 2025, at Expointer, one of Latin America’s largest agricultural trade shows, Brazilian machinery leader Jacto launched the T100 drone in partnership with global UAV giant DJI, marking a significant milestone in Brazil’s agricultural technology sector. The collaboration combines Jacto’s extensive dealer network, local expertise, and support infrastructure with DJI’s advanced drone technology, offering farmers high-capacity and precision farming solutions.

- In April 2023, Aerodyne Group chose Citigroup Inc. as its funding partner as it aims to secure up to USD 200.00 million before its anticipated 2024 IPO. The fundraising may be conducted in stages, providing flexibility for the company's capital needs. This strategic move highlights Aerodyne's commitment to scaling its operations and market presence in the drone industry.

- In July 2023, Qualcomm Technologies, Inc. partnered with IdeaForge Technology Limited to enhance their drone solutions by integrating the Qualcomm Flight RB5 5G Platform. This collaboration will bolster the onboard computing capabilities of IdeaForge UAVs, enabling advanced applications such as object avoidance and path planning. IdeaForge aims to offer improved UAV performance across various applications, showcasing the potential of Indian companies in addressing real-world challenges through advanced technology solutions by combining their technology with Qualcomm's compute capabilities.

- In January 2023, Yamaha Motor Co., Ltd. invested in Nileworks Inc. to strengthen its drone business by integrating automation and digital agriculture technologies, aiming to expand beyond agriculture. Nileworks specializes in automated agricultural drones and data services. This partnership, part of a broader consortium effort, signifies Yamaha Motor's commitment to advancing Japanese drone and smart agriculture technologies, contributing to sustainable growth and addressing societal challenges.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

South America Agriculture Drones Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its South America Agriculture Drones Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as South America Agriculture Drones Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.