Market Analysis and Size

A fishing vessel is a pontoon or ship used to catch fishes in the ocean, or on a lake or stream. A wide range of fishing vessels is utilized in commercial, recreational fishing, and artisanal. Collecting of aquatic resources and production is done either in the wild or in controlled situations in aquaculture. The rising demand for seafood products is increasing the demand for freezing fishing vessels solutions in the market. The South America freezing fishing vessels market is growing rapidly due to health benefits with seafood and demand for higher produce. The companies are even launching new products to gain a larger market share.

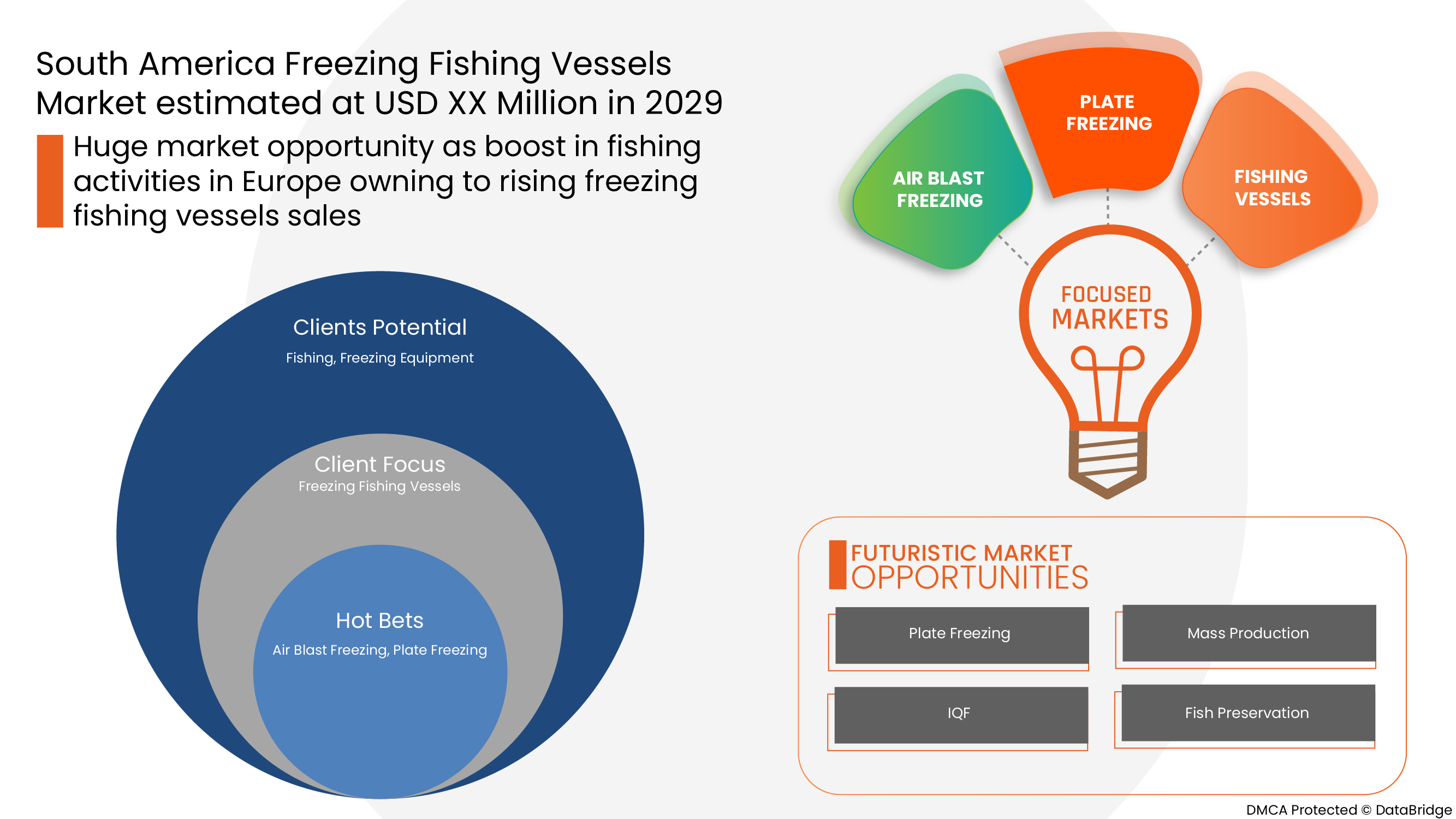

Data Bridge Market Research analyses that the South America freezing fishing vessels market is expected to reach the value of USD 3,013.81 million by 2029, at a CAGR of 3.9% during the forecast period. "Air blast freezing" accounts for the largest system segment in the freezing fishing vessels market. The freezing fishing vessels market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

USD Million |

|

Segments Covered |

By System (Air Blast Freezing, Plate Freezing, Brine, IQF (Individual Quick Frozen)), By Type (Commercial Fishing Vessels, Artisanal Fishing Vessels and Recreational Fishing Vessels), By Vessel Length (Less Than 20 M, 21 M-30 M, Above 40 M and 31 M-40 M), By Freezing Capacity (50 Tons to 150 Tons, 150 Tons to 300 Tons, Less Than 50 Tons and More Than 300 Tons) |

|

Countries Covered |

Peru, Chile, Ecuador and Rest of South America |

|

Market Players Covered |

Nordic Wildfish, Lerøy Havfisk, Nichols Bros Boat Builders, Master Boat Builders, Inc., Chantier de constructions navales Martinez, Astilleros Armon, Karstensens Skibsværft A/S, Green Yard Kleven, Ulstein Group ASA, HEINEN & HOPMAN, Marefsol B.V., Integrated Marine Systems, Inc., MMC FIRST PROCESS AS., Teknotherm, Damen Shipyards Group, Damen Shipyards Group, Wärtsilä, Kongsberg Gruppen ASA, Thoma-Sea Ship Builders, LLC, Rolls-Royce plc, MAURICE, ELLIOTT BAY DESIGN GROUP, Aresa Shipyard among others |

Market Definition

A fishing vessel is a pontoon or ship used to catch fishes in the ocean, or on a lake or stream. A wide range of sorts of fishing vessel is utilized in commercial, recreational fishing and artisanal. Collecting of aquatic resources and production is done either in the wild or in controlled situations in aquaculture. Both use a tremendous combination of innovations from distinctive to highly industrial, incorporating vessel and equipment just as fishing apparatuses and methods. For catching fisheries and aquaculture, utilization of innovative technologies such as fishing vessel and use of engineered filaments, hydraulic equipment and fish handling is in the current trends of the fishing vessel market. Besides, fish reaping in fishing vessel also incorporates gadgets for fish findings, satellite-based innovation for routes and correspondences, installed preservation and expanded utilization of detachable motors. The rising demand for fishing equipment in fishery technology is estimated to boost fishing vessel market across the globe.

South America Freezing Fishing Vessels Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Rise in popularity of recreational activities

There has been a rise in recreational activities, such as fishing and boating, across the globe, which has created rise in demand for fishing boats. The advanced features offered by fishing boats, such as long shelf life, durability, customization, and environment-friendliness, further attract more customers. Therefore, the demand for fishing boat is anticipated to further increase over the forecast period.

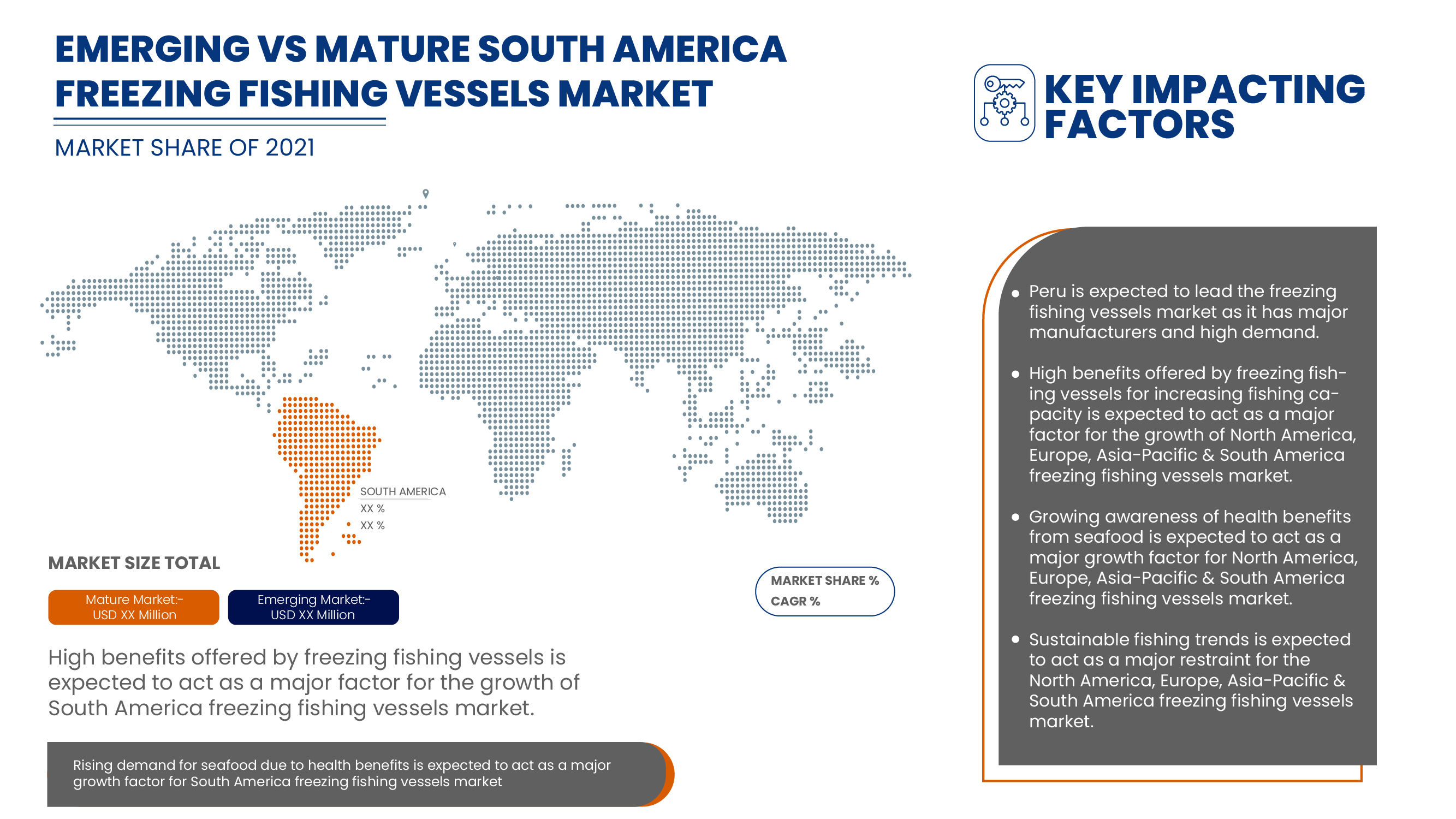

- Growth in awareness of the health benefits associated with seafood

Increase in demand for fishing globally and rise in awareness about the health benefits associated with seafood, such as tuna, ground-fish, and salmon, create more demand for the product. Outdoor participation along with the demand for seafood has tremendously fueled the fishing boat market and it is anticipated to drive further over the forecast period.

- Demand for sustainable development

A hindrance to the growth of this market could be the increasing demand for sustainable development. Fishing vessels often extract more from water bodies than can be replenished in a short span of time, eliminating stores of fish rapidly. But this effect can be buffered by bringing strict fishing and maritime regulations globally that ensure a steady supply of fish.

- High initial cost of investment

Freezing Fishing Vessels Market offers several beneficial factors such as health benefits, increased capacity, but all this comes with a high investment cost. The shipbuilding industry is a cost intensive affair and the project may span multiple years. This may restrain the growth of the Freezing Fishing Vessels Market.

Post COVID-19 Impact on Freezing Fishing Vessels Market

COVID-19 created a major impact on the freezing fishing vessels market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the freezing fishing vessels market is rising due to the government policies to boost international trade post COVID-19. Also, the benefits offered by freezing fishing vessels market for fishing market and seafood demand is rising the demand for freezing fishing vessels market in the market. However, factors such as congestion associated with trade routes and trade restrictions between some nations are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the freezing fishing vessels market. With this, the companies will bring advanced and accurate solutions to the market. In addition, the government initiatives to boost international trade has led to the market's growth.

Recent Developments

- In August 2021, Wärtsilä offered propulsion solutions for fishing vessels for ship builders Karstensens Shipyard. The key feature of this propulsion system was NOx Reducer emissions reduction system, the reduction gear, controllable pitch propeller, and ProTouch propulsion remote control system. This solution launch helped the company to expand its market.

- In June 2019, Rolls-Royce plc received the contract for the construction of 70-metre long stern trawler to be built for Engenes fiskeriselskap AS. The company offered ship design and an extensive range of equipment such as power and propulsion, deck machinery, electrical and automation systems. Through this company expanded its market and global presence.

South America Freezing Fishing Vessels Market Scope

The South America freezing fishing vessels market is segmented on the basis of system, type, vessel length and freezing capacity. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By System

- Air Blast Freezing

- Plate Freezing

- Brine

- IQF (Individual Quick Frozen)

On the basis of system, the North America, Europe, Asia-Pacific & South America freezing fishing vessels market is segmented into air blast freezing, plate freezing, brine and IQF (Individual Quick Frozen).

By Type

- Commercial Fishing Vessels

- Artisanal Fishing Vessels

- Recreational Fishing Vessels

On the basis of type, the North America, Europe, Asia-Pacific & South America freezing fishing vessels market has been segmented into commercial fishing vessels, artisanal fishing vessels and recreational fishing vessels.

By Vessel Length

- Less Than 20 M

- 21 M-30 M

- Above 40 M

- 31 M-40 M

On the basis of vessel length, the North America, Europe, Asia-Pacific & South America freezing fishing vessels market has been segmented into Less Than 20 M, 21 M-30 M, Above 40 M and 31 M-40 M.

By Freezing Capacity

- 50 Tons to 150 Tons

- 150 Tons to 300 Tons

- Less Than 50 Tons

- More Than 300 Tons

On the basis of freezing capacity, the North America, Europe, Asia-Pacific & South America Freezing Fishing Vessels Market has been segmented into 50 Tons to 150 Tons, 150 Tons to 300 Tons, Less Than 50 Tons and More Than 300 Tons.

Freezing Fishing Vessels Market Regional Analysis/Insights

The South America freezing fishing vessels market is analysed and market size insights and trends are provided by country, system, type, vessel length and freezing capacity as referenced above.

The countries covered in the freezing fishing vessels market report are Peru, Chile, Ecuador and Rest of South America.

Peru dominates the South America freezing fishing vessels market. Peru is likely to be the fastest-growing South America Freezing Fishing Vessels market. The rising infrastructure, commercial, and industrial developments in emerging countries such as Peru, Chile and Ecuador are credited with the market's dominance. Peru dominates the South America region due to the government initiatives and fishing activities for tuna fish.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of South America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Freezing Fishing Vessels Market Share Analysis

The South America freezing fishing vessels market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, South America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to freezing fishing vessels market.

Some of the major players operating in the freezing fishing vessels market are:

Nordic Wildfish, Lerøy Havfisk, Nichols Bros Boat Builders, Master Boat Builders, Inc., Chantier de constructions navales Martinez, Astilleros Armon, Karstensens Skibsværft A/S, Green Yard Kleven, Ulstein Group ASA, HEINEN & HOPMAN, Marefsol B.V., Integrated Marine Systems, Inc., MMC FIRST PROCESS AS., Teknotherm, Damen Shipyards Group, Damen Shipyards Group, Wärtsilä, Kongsberg Gruppen ASA, Thoma-Sea Ship Builders, LLC, Rolls-Royce plc, MAURICE, ELLIOTT BAY DESIGN GROUP, Aresa Shipyard among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SOUTH AMERICA FREEZING FISHING VESSELS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 PREMIUM INSIGHTS:

2.1 FISHING VESSEL CONSTRUCTION

2.2 OTHER DETAILS REGARDING FISHING VESSEL

2.2.1 FISHING VESSEL AVERAGE OPERATIONAL YEARS

2.2.2 TOTAL NUMBER OF FISHING VESSEL

3 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY SYSTEM

3.1 OVERVIEW

3.2 AIR BLAST FREEZING

3.3 PLATE FREEZING

3.3.1 VERTICAL PLATE FREEZING

3.3.2 HORIZONTAL PLATE FREEZING

3.4 BRINE

3.5 IQF (INDIVIDUAL QUICK FROZEN)

4 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY TYPE

4.1 OVERVIEW

4.2 COMMERCIAL FISHING VESSELS

4.3 ARTISANAL FISHING VESSELS

4.4 RECREATIONAL FISHING VESSELS

5 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH

5.1 OVERVIEW

5.2 LESS THAN 20 M

5.3 21 M-30 M

5.4 ABOVE 40 M

5.5 31 M-40 M

6 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY

6.1 OVERVIEW

6.2 50 TONS TO 150 TONS

6.3 150 TONS TO 300 TONS

6.4 LESS THAN 50 TONS

6.5 MORE THAN 300 TONS

7 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY REGION

7.1 SOUTH AMERICA

7.1.1 PERU

7.1.2 CHILE

7.1.3 ECUADOR

7.1.4 REST OF SOUTH AMERICA

8 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: SOUTH AMERICA

9 SWOT ANALYSIS

10 COMPANY PROFILE

10.1 ROLLS-ROYCE PLC

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 COMPANY SHARE ANALYSIS

10.1.4 PRODUCTS PORTFOLIO

10.1.5 RECENT DEVELOPMENTS

10.2 WÄRTSILÄ

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COMPANY SAHRE ANALYSIS

10.2.4 PRODUCTS PORTFOLIO

10.2.5 RECENT DEVELOPMENTS

10.3 DAMEN SHIPYARDS GROUP

10.3.1 COMPANY SNAPSHOT

10.3.2 COMPANY SHARE ANALYSIS

10.3.3 PRODUCTS PORTFOLIO

10.3.4 RECENT DEVELOPMENT

10.4 ULSTEIN GROUP ASA

10.4.1 COMPANY SNAPSHOT

10.4.2 COMPANY SHARE ANALYSIS

10.4.3 PRODUCTS PORTFOLIO

10.4.4 RECENT DEVELOPMENTS

10.5 KONGSBERG GRUPPEN ASA

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COMPANY SHARE ANALYSIS

10.5.4 PRODUCTS PORTFOLIO

10.5.5 RECENT DEVELOPMENTS

10.6 ARESA SHIPYARD

10.6.1 COMPANY SNAPSHOT

10.6.2 PRODUCTS PORTFOLIO

10.6.3 RECENT DEVELOPMENTS

10.7 ASTILLEROS ARMON

10.7.1 COMPANY SNAPSHOT

10.7.2 PRODUCTS PORTFOLIO

10.7.3 RECENT DEVELOPMENTS

10.8 CHANTIER DE CONSTRUCTIONS NAVALES MARTINEZ

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCTS PORTFOLIO

10.8.3 RECENT DEVELOPMENTS

10.9 ELLIOTT BAY DESIGN GROUP

10.9.1 COMPANY SNAPSHOT

10.9.2 PRODUCTS PORTFOLIO

10.9.3 RECENT DEVELOPMENTS

10.1 GREEN YARD KLEVEN

10.10.1 COMPANY SNAPSHOT

10.10.2 SERVICES PORTFOLIO

10.10.3 RECENT DEVELOPMENTS

10.11 HEINEN & HOPMAN

10.11.1 COMPANY SNAPSHOT

10.11.2 PRODUCTS PORTFOLIO

10.11.3 RECENT DEVELOPMENTS

10.12 INTEGRATED MARINE SYSTEMS, INC.

10.12.1 COMPANY SNAPSHOT

10.12.2 PRODUCTS PORTFOLIO

10.12.3 RECENT DEVELOPMENTS

10.13 KARSTENSENS SKIBSVÆRFT A/S

10.13.1 COMPANY SNAPSHOT

10.13.2 PRODUCTS PORTFOLIO

10.13.3 RECENT DEVELOPMENTS

10.14 LERØY HAVFISK

10.14.1 COMPANY SNAPSHOT

10.14.2 PRODUCTS PORTFOLIO

10.14.3 RECENT DEVELOPMENTS

10.15 MAREFSOL B.V.

10.15.1 COMPANY SNAPSHOT

10.15.2 PRODUCTS PORTFOLIO

10.15.3 RECENT DEVELOPMENTS

10.16 MASTER BOAT BUILDERS, INC.

10.16.1 COMPANY SNAPSHOT

10.16.2 PRODUCTS PORTFOLIO

10.16.3 RECENT DEVELOPMENTS

10.17 MAURICE

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCTS PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 MMC FIRST PROCESS AS.

10.18.1 COMPANY SNAPSHOT

10.18.2 PRODUCTS PORTFOLIO

10.18.3 RECENT DEVELOPMENT

10.19 NICHOLS BROS BOAT BUILDERS

10.19.1 COMPANY SNAPSHOT

10.19.2 PRODUCTS PORTFOLIO

10.19.3 RECENT DEVELOPMENTS

10.2 NORDIC WILDFISH

10.20.1 COMPANY SNAPSHOT

10.20.2 PRODUCTS PORTFOLIO

10.20.3 RECENT DEVELOPMENTS

10.21 TEKNOTHERM

10.21.1 COMPANY SNAPSHOT

10.21.2 PRODUCTS PORTFOLIO

10.21.3 RECENT DEVELOPMENTS

10.22 THOMA-SEA SHIP BUILDERS, LLC

10.22.1 COMPANY SNAPSHOT

10.22.2 PRODUCTS PORTFOLIO

10.22.3 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

List of Table

TABLE 1 FISHING VESSEL CONSTRUCTION DETAILS

TABLE 2 FISHING VESSEL AVERAGE OPERATIONAL YEARS WITH RESPECT TO THE TYPE

TABLE 3 FISHING VESSEL OWNERS REQUIRING FREEZING SYSTEMS

TABLE 4 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 5 SOUTH AMERICA AIR BLAST FREEZING IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 SOUTH AMERICA PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 SOUTH AMERICA PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 SOUTH AMERICA BRINE IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 SOUTH AMERICA IQF (INDIVIDUAL QUICK FROZEN) IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 SOUTH AMERICA COMMERCIAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 SOUTH AMERICA ARTISANAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 SOUTH AMERICA RECREATIONAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 15 SOUTH AMERICA LESS THAN 20 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 SOUTH AMERICA 21 M-30 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 SOUTH AMERICA ABOVE 40 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 SOUTH AMERICA 31 M-40 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 20 SOUTH AMERICA 50 TONS TO 150 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 SOUTH AMERICA 150 TONS TO 300 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 SOUTH AMERICA LESS THAN 50 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 SOUTH AMERICA MORE THAN 300 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 26 SOUTH AMERICA PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 29 SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 30 PERU FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 31 PERU PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 PERU FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 PERU FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 34 PERU FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 35 CHILE FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 36 CHILE PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 CHILE FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 CHILE FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 39 CHILE FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 40 ECUADOR FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 41 ECUADOR PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 ECUADOR FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 ECUADOR FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 44 ECUADOR FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 45 REST OF SOUTH AMERICA FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY SYSTEM, 2021

FIGURE 2 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY TYPE, 2021

FIGURE 3 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY VESSEL LENGTH, 2021

FIGURE 4 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY FREEZING CAPACITY, 2021

FIGURE 5 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: SNAPSHOT (2021)

FIGURE 6 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY COUNTRY (2021)

FIGURE 7 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 8 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 9 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: BY SYSTEM (2022-2029)

FIGURE 10 SOUTH AMERICA FREEZING FISHING VESSELS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.