South East Asia Swine Vaccines Market

Market Size in USD Billion

CAGR :

%

USD

1.06 Billion

USD

1.73 Billion

2024

2032

USD

1.06 Billion

USD

1.73 Billion

2024

2032

| 2025 –2032 | |

| USD 1.06 Billion | |

| USD 1.73 Billion | |

|

|

|

|

Swine Vaccines Market Size

- The South East Asia Swine Vaccines Market size was valued at USD 1.06 billion in 2024 and is expected to reach USD 1.73 billion by 2032, at a CAGR of 6.3% during the forecast period

- This growth is driven by factors such as the rising incidence of swine diseases

Swine Vaccines Market Analysis

- Swine vaccines play a crucial role in the South East Asia Swine Vaccines Market, serving as vital tools for preventing diseases in swine populations. These vaccines help improve livestock health and productivity, supporting the region's agricultural industry and ensuring food security. They are particularly important for controlling outbreaks and minimizing economic losses

- The demand for these microscopes is significantly driven by rising incidence of swine diseases, higher pork consumption across southeast Asian countries

- China is expected to dominate the swine vaccines market with a share of 45.24%, due to its expanding livestock industry and increasing adoption of advanced veterinary healthcare practices

- China is expected to be the fastest growing region in the swine vaccines market during the forecast period due to increasing demand for effective vaccination solutions and growing awareness of swine health management

- Virus segment is expected to dominate the market with a market share of 66.58% to its high prevalence and the growing demand for effective vaccination solutions to prevent viral diseases in swine populations

Report Scope and Swine Vaccines Market Segmentation

|

Attributes |

Swine Vaccines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

South East Asia

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Swine Vaccines Market Trends

“Advancements in Vaccination Technologies & Delivery Methods”

- A prominent trend in the evolution of the South East Asia swine vaccines market is the increasing development of innovative vaccine formulations and delivery methods

- These advancements improve immunization efficacy by providing broader protection and more efficient administration, thereby enhancing overall herd health management in the region

- For instance, modern vaccine development and delivery techniques in the South East Asia swine vaccines market offer enhanced immune response and broader herd immunity, facilitating better disease control and prevention

- These advancements are transforming swine health management, improving overall livestock productivity, and driving the demand for next-generation vaccines with improved efficacy and innovative administration methods

Swine Vaccines Market Dynamics

Driver

“Rising Incidence of Swine Diseases”

- The rising incidence of swine diseases, particularly African Swine Fever (ASF), Porcine Reproductive and Respiratory Syndrome Virus (PRRSV), and Porcine Epidemic Diarrhea Virus (PEDV), has significantly impacted the pig industry across Southeast Asia

- As the growing frequency and severity of swine disease outbreaks are driving urgent demand for effective vaccines, positioning the Southeast Asia swine vaccines market for substantial growth

- As more swine populations are vaccinated to prevent infectious diseases, the demand for effective vaccines increases, ensuring better herd health and reducing the risks associated with disease outbreaks in the South East Asia region

For instance,

- In July 2020, according to the article published by NCBI, the rising incidence of swine diseases such as African swine fever virus (ASFV), PRRSV, PEDV, and FMDV continues to severely impact Asia’s pig industry, which holds over 50% of the global pig population. Factors like diverse production systems, animal movement, and globalization fuel rapid disease spread, driving strong demand for effective swine vaccines in the South East Asia market

- As a result, the growing frequency and severity of swine disease outbreaks are driving urgent demand for effective vaccines, positioning the Southeast Asia swine vaccines market for substantial growth

Opportunity

“Innovations in Vaccine Technologies”

- Traditional vaccines have been complemented by novel approaches such as DNA and mRNA vaccines, which offer quicker development and adaptability to emerging pathogens. These next-generation vaccines promise enhanced safety and efficacy, with reduced production times and improved stability

- In addition, vector-based vaccines, which use harmless viruses to deliver antigens, are being explored for their ability to induce stronger immune responses. Adjuvants have also evolved, enhancing vaccine effectiveness by boosting the immune system's response

- Moreover, oral and needle-free vaccine delivery systems improve ease of administration and animal welfare. These advancements aim to control endemic diseases such as Porcine Reproductive and Respiratory Syndrome (PRRS) and improve overall herd health, thereby increasing productivity and profitability in the swine industry

For instance,

- In March 2025, as per an article published by MDPI paper highlights key innovations in African Swine Fever control, including development of live attenuated vaccines like ASFV-G-ΔI177L, rapid diagnostic tools such as RPA assays, and modeling herd immunity thresholds. These advances aim to improve prevention and containment strategies, especially for small-scale swine farms in Southeast Asia

- The region is witnessing a surge in vaccine development, particularly against PRRS, classical swine fever, and other endemic diseases. Government initiatives promoting biosecurity, along with farmer education on vaccination benefits, are driving market expansion

Restraint/Challenge

“Complexity Of Vaccination Protocols And Factors”

- A significant restraint in the Southeast Asia swine vaccine market is the complexity of vaccination protocols and the various factors that negatively impact vaccine efficacy

- These factors include stress, microbiome variations, and maternal-derived antibodies (MDAs), which interfere with immune responses. While some factors are well understood, many remain inadequately researched, creating uncertainty regarding vaccine effectiveness.

- This lack of comprehensive knowledge leads to skepticism among animal owners and veterinarians, undermining confidence in vaccines as a viable alternative to antibiotics

For instance,

- In August 2024, as per the article published by MDPI, the complexity of vaccination protocols, including the need for stringent biosecurity measures and comprehensive surveillance, impacts the efficacy of vaccines in Southeast Asia. As highlighted by WOAH’s concerns and the emergence of field vaccine-related viruses, improper vaccine application can result in significant challenges. The lack of standardized protocols and independent bodies for vaccine evaluation hinders effective disease control, acting as a restraint for the Southeast Asia swine vaccines market

- The complexity of vaccination protocols, compounded by factors such as stress, microbiome variations, and maternal-derived antibodies (MDAs), presents significant challenges to the effective application of vaccines in Southeast Asia’s swine industry

Swine Vaccines Market Scope

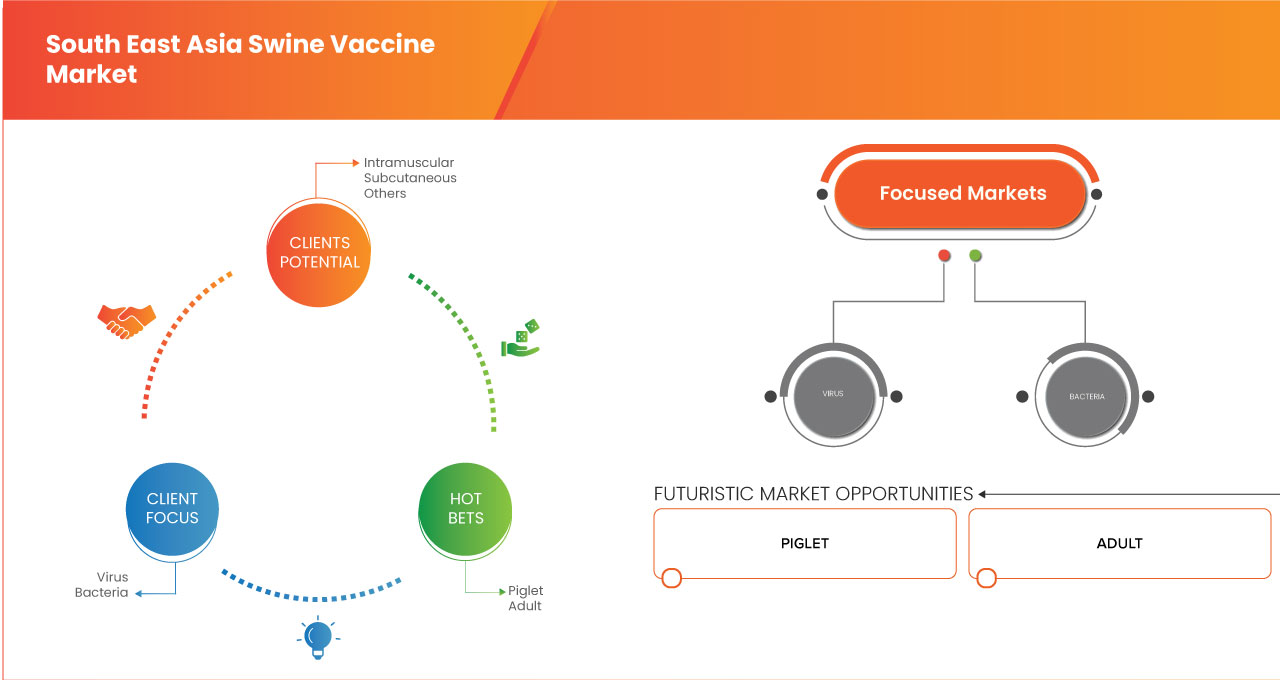

The market is segmented on the basis of pathogen, indication, technology, product, demographic, route of administration, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Pathogen |

|

|

By Indication |

|

|

By Product |

|

|

By Demographic

|

|

|

By Route of Administration |

|

|

By Distribution Channel

|

|

In 2025, the Virus is projected to dominate the market with a largest share in application segment

The virus segment is expected to dominate the swine vaccines market with the largest share of 66.58% in 2025 due to the high prevalence of viral diseases among swine populations and the growing demand for targeted vaccination solutions. As a critical measure for disease prevention, advancements in vaccine technology and immunization strategies are expected to improve efficacy and boost market growth. Rising awareness of animal health management and government programs further contribute to its market dominance.

The Porcine Reproductive and Respiratory Syndrome (PRRS) is expected to account for the largest share during the forecast period in technology segment

In 2025, the Porcine Reproductive and Respiratory Syndrome (PRRS) segment is expected to dominate the market with the largest market share of 24.29% due to its high prevalence and demand for effective vaccination solutions. As a major concern for swine health, advancements in vaccine development and immunization protocols are expected to enhance disease control, driving market growth. Increasing awareness of biosecurity measures and government initiatives further contribute to its market dominance.

Swine Vaccines Market Regional Analysis

“China Holds the Largest Share in the Swine Vaccines Market”

- China dominates the swine vaccines market with market share 45.24%, driven by expanding livestock populations, increasing investment in animal health infrastructure, and the presence of key regional market players

- The China holds a significant share due to rising awareness of swine disease management, government initiatives to improve livestock health, and the increasing prevalence of viral and bacterial infections among swine populations

- The availability of supportive policies for animal health and rising investments in research & development by pharmaceutical companies further strengthen the market.

- In addition, the growing demand for automated vaccination systems and improved biosecurity measures, along with rising industrial pig farming, are fueling market growth across the region

“China is Projected to Register the Highest CAGR in the Swine Vaccines Market”

- China is expected to witness substantial growth in the Swine Vaccines market, driven by increasing adoption of animal health management practices, expanding livestock industries, and rising awareness about disease prevention

- Countries such as Thailand, Vietnam, and Indonesia are emerging as key markets due to their growing pig populations, rising incidences of swine diseases, and government initiatives to improve animal health standards

- Vietnam and Thailand, with their expanding pig farming sectors and increasing investments in veterinary healthcare, are becoming important markets for swine vaccines. The focus on biosecurity and disease control measures continues to promote market expansion

- In addition, the rising demand for safe and effective vaccination programs, along with the presence of global pharmaceutical companies and improved veterinary infrastructure, further drive market growth across South East Asia

Swine Vaccines Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Boehringer Ingelheim International GmbH (Germany)

- Merck & Co., Inc. (U.S.)

- Zoetis Inc. (U.S.)

- Ceva (France)

- Pulike Biological Engineering Co., Ltd. (China)

- Elanco Animal Health Incorporated (U.S.)

- Biogénesis Bagó S.A. (Argentina)

- HIPRA, S.A. (Spain)

- Jinyu Bio-Technology Co., Ltd. (China)

- Shanghai Shen Lian Biomedical Corporation (China)

- China Animal Husbandry Industry Co., Ltd. (China)

- ESCO ASTER PTE. LTD. (Singapore)

- Shanghai Haili Biotechnology Co., Ltd. (China)

- AVAC Vietnam Joint Stock Company (Vietnam)

- Bimeda Biologicals Ltd. (Ireland)

- Harbin Harvac Biotechnology Co., Ltd. (China)

- Virbac S.A. (France)

Latest Developments in South East Asia Swine Vaccines Market

- In November 2024, Boehringer Ingelheim’s vaccine for Leptospirosis in dogs is designed to protect against the bacteria Leptospira that cause the disease. This vaccine provides immunity against the most common strains of Leptospira, which can lead to severe liver and kidney damage, and can even be fatal. By vaccinating dogs, pet owners can significantly reduce the risk of infection from environmental exposure to contaminated water or soil. The vaccine promotes long-lasting protection, contributing to overall dog health and preventing the spread of the disease to other animals or humans, ensuring safer environments for pets and their families

- In November 2024, Boehringer Ingelheim launches Vetmedin Oral Solution for dogs with congestive heart failure (CHF). This new formulation offers an easy-to-administer solution to improve heart function in dogs suffering from CHF, a condition often caused by mitral valve disease or dilated cardiomyopathy. Vetmedin works by enhancing the heart’s ability to pump blood and reducing symptoms like coughing, fatigue, and difficulty breathing. This solution provides a convenient treatment option, helping to improve the quality of life and longevity of affected dogs, making heart failure management more effective and accessible for pet owners and veterinarians alike

- In September, Merck Animal Health has received EU marketing authorization for PORCILIS PCV M Hyo ID, an intradermal, needle-free swine vaccine protecting against PCV2 and M. hyo. Delivered via IDAL technology, it offers efficient, low-volume administration with enhanced animal welfare. Launching in Q1 2025, the vaccine supports sustainability, co-administration with other vaccines, and improved disease protection for piglets

- In July 2020, Zoetis has acquired Fish Vet Group from Benchmark Holdings to enhance its Pharmaq aquaculture business. The acquisition expands Pharmaq’s diagnostic and environmental testing capabilities across key markets, including the UK, Norway, Ireland, and Chile. Fish Vet Group’s services support sustainable aquaculture by aiding disease management, environmental compliance, and site assessments, strengthening Zoetis’ position in global fish health solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SOUTH EAST ASIA SWINE VACCINE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 DRUG TREATMENT RATE BY MATURED MARKETS

4.4 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.5 PATIENT FLOW DIAGRAM

4.6 KEY PRICING STRATEGIES

4.7 KEY PATIENT ENROLLMENT STRATEGIES

4.8 MARKETED DRUG ANALYSIS

4.9 AVERAGE PRICED PAID FOR A VACCINE DOSE

4.1 HEALTHCARE TARIFFS IMPACT ANALYSIS

4.10.1 OVERVIEW

4.10.2 TARIFF STRUCTURES

4.10.2.1 GLOBAL VS. REGIONAL TARIFF STRUCTURES

4.10.2.2 UNITED STATES: MEDICARE/MEDICAID TARIFF POLICIES, CMS PRICING MODELS

4.10.2.3 EUROPEAN UNION: CROSS-BORDER TARIFF REGULATIONS, REIMBURSEMENT POLICIES

4.10.2.4 ASIA-PACIFIC: GOVERNMENT-IMPOSED TARIFFS ON IMPORTED MEDICAL PRODUCTS

4.10.2.5 EMERGING MARKETS: CHALLENGES IN TARIFF IMPLEMENTATION

4.10.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

4.10.3.1 IMPORT DUTIES ON PRESCRIPTION DRUGS VS. GENERICS

4.10.3.2 IMPACT ON DRUG AFFORDABILITY AND ACCESS

4.10.3.3 KEY TRADE AGREEMENTS AFFECTING PHARMACEUTICAL TARIFFS

4.10.4 IMPACT OF HEALTHCARE TARIFFS ON PROVIDERS AND PATIENTS

4.10.4.1 COST BURDEN ON HOSPITALS AND HEALTHCARE FACILITIES

4.10.4.2 EFFECT ON PATIENT AFFORDABILITY AND INSURANCE COVERAGE

4.10.4.3 TARIFFS AND THEIR ROLE IN MEDICAL TOURISM

4.10.5 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

4.10.5.1 WTO REGULATIONS ON HEALTHCARE TARIFFS

4.10.5.2 IMPACT OF TRADE WARS ON THE HEALTHCARE SUPPLY CHAIN

4.10.5.3 ROLE OF FREE TRADE AGREEMENTS (FTAs) IN REDUCING TARIFFS

4.10.6 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.10.7 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

5 EPIDEMIOLOGICAL OVERVIEW OF KEY SWINE DISEASES IN THE SOUTH EAST ASIA (SEA) SWINE VACCINE MARKET:

5.1 PORCINE REPRODUCTIVE AND RESPIRATORY SYNDROME (PRRS)

5.2 PORCINE CIRCOVIRUS ASSOCIATED DISEASE (PCV/PCVD)

5.3 FOOT-AND-MOUTH DISEASE (FMD)

5.4 AFRICAN SWINE FEVER (ASF)

5.5 CLASSICAL SWINE FEVER (CSF)

5.6 PORCINE PARVOVIRUS (PPV)

5.7 PORCINE PNEUMONIA

5.8 GLAESSERELLA PARASUIS (GLÄSSER’S DISEASE)

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 RISING INCIDENCE OF SWINE DISEASES.

6.1.2 HIGHER PORK CONSUMPTION ACROSS SOUTHEAST ASIAN COUNTRIES.

6.1.3 INCREASE IN PORK EXPORTS FROM SOUTHEAST ASIA.

6.2 RESTRAINT

6.2.1 COMPLEXITY OF VACCINATION PROTOCOLS AND FACTORS AFFECTING EFFICACY AS A RESTRAINT

6.2.2 LACK OF ADEQUATE COLD CHAIN LOGISTICS.

6.3 OPPORTUNITIES

6.3.1 INNOVATIONS IN VACCINE TECHNOLOGIES

6.3.2 URGENT NEED FOR ENHANCED DISEASE PREVENTION IN SWINE PRODUCTION

6.3.3 IMPROVED DIAGNOSTICS AND MONITORING

6.4 CHALLENGES

6.4.1 COMPETITION FROM ALTERNATIVE DISEASE MANAGEMENT STRATEGIES

6.4.2 LOW INVESTMENT IN DISEASE SURVEILLANCE FOR SWINE IN ASIA

7 SOUTH EAST ASIA SWINE VACCINES MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 INACTIVATED VACCINES

7.3 RECOMBINANT VACCINES

7.4 LIVE ATTENUATED VACCINES

7.5 TOXOID VACCINES

7.6 OTHERS

8 SOUTH EAST ASIA SWINE VACCINES MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 INGELVAC

8.2.1 PARVORUVAX

8.2.2 ENTEROPORC COLI AC

8.2.3 NAVET-ASFVAC & AVAC ASF LIVE

8.2.4 COGLAPIX

8.3 PORCILIS

8.3.1 CSF LIVE

8.3.2 APP

8.3.3 AR-T

8.3.4 GLASSER

8.3.5 PARVO

8.3.6 PORCOLI DF

8.3.7 BEGONIA

8.4 IMPROVAC

8.5 PREVACENT

8.6 ENTERISOL

8.7 CIRBLOC M HYO

8.8 BIOAFTOGEN

8.9 ENRADIN

8.1 YUAN KE XIN

8.11 CIRCOVAC

8.12 HYOGEN

8.13 SALMOPORC

8.14 ECOPORC

8.15 PARVORUVAX

8.16 ENTEROPORC COLI AC

8.17 NAVET-ASFVAC & AVAC ASF LIVE

8.18 COGLAPIX

8.19 PROGRESSIS

8.2 RUILAN

8.21 VEPURED

8.22 SUIGEN

8.23 SHIELD

8.23.1 PARVO SHIELD

8.23.2 PARA SHIELD

8.23.3 RHINI SHIELD

8.23.4 PILI SHIELD

8.24 RUIFUTE-WANG

8.25 REFUTE

8.26 RUIYUANSHU

8.27 CLEAR THE FALSE SPIRIT

8.28 OTHERS

9 SOUTH EAST ASIA SWINE VACCINES MARKET, BY PATHOGEN

9.1 OVERVIEW

9.2 VIRUS

9.3 BACTERIA

10 SOUTH EAST ASIA SWINE VACCINES MARKET, BY INDICATION

10.1 OVERVIEW

10.2 PORCINE REPRODUCTIVE AND RESPIRATORY SYNDROME (PRRS)

10.3 PORCINE CIRCOVIRUS ASSOCIATED DISEASE (PCV/PCVD)

10.4 SWINE FEVER

10.4.1 CLASSICAL SWINE FEVER (CSF)

10.4.2 AFRICAN SWINE FEVER (ASF)

10.5 FOOT-AND-MOUTH DISEASE (FMD)

10.6 PORCINE PNEUMONIA

10.7 PORCINE PAROVIRUS

10.8 GLAESSERELLA PARASUIS

10.9 OTHERS

11 SOUTH EAST ASIA SWINE VACCINE MARKET, BY DEMOGRAPHIC

11.1 OVERVIEW

11.2 PIGLET

11.3 ADULT

12 SOUTH EAST ASIA SWINE VACCINES MARKET, BY ROUTE OF ADMINISTRATION,

12.1 OVERVIEW

12.2 INTRAMUSCULAR

12.3 SUBCUTANEOUS

12.4 OTHERS

13 SOUTH EAST ASIA SWINE VACCINES MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 HOSPITALS AND CLINICS

13.3 RETAIL PHARMACIES

13.4 E-COMMERCE PLATFORMS

13.5 OTHERS

14 SOUTH EAST ASIA SWINE VACCINES MARKET, BY COUNTRY

14.1 SOUTH EAST ASIA

14.1.1 CHINA

14.1.2 THAILAND

14.1.3 VIETNAM

14.1.4 PHILIPPINES

14.1.5 SOUTH KOREA

14.1.6 TAIWAN

14.1.7 REST OF SOUTH EAST ASIA

15 SOUTH EAST ASIA SWINE VACCINES MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: SOUTH EAST ASIA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 BOEHRINGER INGELHEIM GMBH

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 MERCK & CO., INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT/NEWS

17.3 ZOETIS SERVICES LLC.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 JINYU BIOTECHNOLOGY CO., LTD

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 CEVA

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 BIMEDA BIOLOGICALS

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT UPDATES

17.7 BIMEDA BIOLOGICALS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT UPDATES

17.8 BIOGÉNESIS BAGÓ

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATES

17.9 CHINA ANIMAL HUSBANDRY INDUSTRY CO., LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 ELANCO

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT/NEWS

17.11 ESCO ASTER PTE. LTD.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATES

17.12 HARBIN HARVAC BIOTECHNOLOGY CO. LTD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 HIPRA

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATES

17.14 PULIKE BIOLOGICAL ENGINEERING

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 SHANGHAI SHEN LIAN BIOMEDICAL CORPORATION

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 SHANGHAI HAILI BIOTECHNOLOGY CO., LTD.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATES

17.17 VIRBAC

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR SWINE VACCINE

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE – GLOBAL SWINE VACCINE MARKET

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE – GLOBAL SWINE VACCINE MARKET

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE – GLOBAL SWINE VACCINE MARKET

TABLE 5 EPIDEMIOLOGY OF SWINE DISEASES IN SOUTHEAST ASIA

TABLE 6 SOUTH EAST ASIA SWINE VACCINES MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 7 SOUTH EAST ASIA SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 8 SOUTH EAST ASIA INGELVAC IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 9 SOUTH EAST ASIA PORCILIS IN SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 10 SOUTH EAST ASIA SHIELD IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 11 SOUTH EAST ASIA SWINE VACCINES MARKET, BY PATHOGEN, 2018-2032 (USD MILLION)

TABLE 12 SOUTH EAST ASIA SWINE VACCINES MARKET, BY INDICATION, 2018-2032 (USD MILLION)

TABLE 13 SOUTH EAST ASIA SWINE FEVER IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 14 SOUTH EAST ASIA SWINE VACCINE MARKET, BY DEMOGRAPHIC, 2018-2032 (USD MILLION)

TABLE 15 SOUTH EAST ASIA SWINE VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 16 SOUTH EAST ASIA SWINE VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 17 SOUTH EAST ASIA SWINE VACCINES MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 18 SOUTH EAST ASIA SWINE VACCINES MARKET, BY PATHOGEN, 2018-2032 (USD MILLION)

TABLE 19 SOUTH EAST ASIA SWINE VACCINES MARKET, BY INDICATION, 2018-2032 (USD MILLION)

TABLE 20 SOUTH EAST ASIA SWINE FEVER IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 21 SOUTH EAST ASIA SWINE VACCINES MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 22 SOUTH EAST ASIA SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 23 SOUTH EAST ASIA INGELVAC IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 24 SOUTH EAST ASIA PORCILIS IN SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 25 SOUTH EAST ASIA SHIELD IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 26 SOUTH EAST ASIA SWINE FEVER IN SWINE VACCINES MARKET, BY DEMOGRAPHIC, 2018-2032 (USD MILLION)

TABLE 27 SOUTH EAST ASIA SWINE VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 28 SOUTH EAST ASIA SWINE VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 29 CHINA SWINE VACCINES MARKET, BY PATHOGEN, 2018-2032 (USD MILLION)

TABLE 30 CHINA SWINE VACCINES MARKET, BY INDICATION, 2018-2032 (USD MILLION)

TABLE 31 CHINA SWINE FEVER IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 32 CHINA SWINE VACCINES MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 33 CHINA SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 34 CHINA INGELVAC IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 35 CHINA PORCILIS IN SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 36 CHINA SHIELD IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 37 CHINA SWINE FEVER IN SWINE VACCINES MARKET, BY DEMOGRAPHIC, 2018-2032 (USD MILLION)

TABLE 38 CHINA SWINE VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 39 CHINA SWINE VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 40 THAILAND SWINE VACCINES MARKET, BY PATHOGEN, 2018-2032 (USD MILLION)

TABLE 41 THAILAND SWINE VACCINES MARKET, BY INDICATION, 2018-2032 (USD MILLION)

TABLE 42 THAILAND SWINE FEVER IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 43 THAILAND SWINE VACCINES MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 44 THAILAND SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 45 THAILAND INGELVAC IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 46 THAILAND PORCILIS IN SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 47 THAILAND SHIELD IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 48 THAILAND SWINE FEVER IN SWINE VACCINES MARKET, BY DEMOGRAPHIC, 2018-2032 (USD MILLION)

TABLE 49 THAILAND SWINE VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 50 THAILAND SWINE VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 51 VIETNAM SWINE VACCINES MARKET, BY PATHOGEN, 2018-2032 (USD MILLION)

TABLE 52 VIETNAM SWINE VACCINES MARKET, BY INDICATION, 2018-2032 (USD MILLION)

TABLE 53 VIETNAM SWINE FEVER IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 54 VIETNAM SWINE VACCINES MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 55 VIETNAM SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 56 VIETNAM INGELVAC IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 VIETNAM PORCILIS IN SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 58 VIETNAM SHIELD IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 VIETNAM SWINE FEVER IN SWINE VACCINES MARKET, BY DEMOGRAPHIC, 2018-2032 (USD MILLION)

TABLE 60 VIETNAM SWINE VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 61 VIETNAM SWINE VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 62 PHILIPPINES SWINE VACCINES MARKET, BY PATHOGEN, 2018-2032 (USD MILLION)

TABLE 63 PHILIPPINES SWINE VACCINES MARKET, BY INDICATION, 2018-2032 (USD MILLION)

TABLE 64 PHILIPPINES SWINE FEVER IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 65 PHILIPPINES SWINE VACCINES MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 66 PHILIPPINES SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 67 PHILIPPINES INGELVAC IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 68 PHILIPPINES PORCILIS IN SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 69 PHILIPPINES SHIELD IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 70 PHILIPPINES SWINE FEVER IN SWINE VACCINES MARKET, BY DEMOGRAPHIC, 2018-2032 (USD MILLION)

TABLE 71 PHILIPPINES SWINE VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 72 PHILIPPINES SWINE VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 73 SOUTH KOREA SWINE VACCINES MARKET, BY PATHOGEN, 2018-2032 (USD MILLION)

TABLE 74 SOUTH KOREA SWINE VACCINES MARKET, BY INDICATION, 2018-2032 (USD MILLION)

TABLE 75 SOUTH KOREA SWINE FEVER IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 76 SOUTH KOREA SWINE VACCINES MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 77 SOUTH KOREA SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 78 SOUTH KOREA INGELVAC IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 SOUTH KOREA PORCILIS IN SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 80 SOUTH KOREA SHIELD IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 81 SOUTH KOREA SWINE FEVER IN SWINE VACCINES MARKET, BY DEMOGRAPHIC, 2018-2032 (USD MILLION)

TABLE 82 SOUTH KOREA SWINE VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 83 SOUTH KOREA SWINE VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 84 TAIWAN SWINE VACCINES MARKET, BY PATHOGEN, 2018-2032 (USD MILLION)

TABLE 85 TAIWAN SWINE VACCINES MARKET, BY INDICATION, 2018-2032 (USD MILLION)

TABLE 86 TAIWAN SWINE FEVER IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 87 TAIWAN SWINE VACCINES MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 88 TAIWAN SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 89 TAIWAN INGELVAC IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 TAIWAN PORCILIS IN SWINE VACCINES MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 91 TAIWAN SHIELD IN SWINE VACCINES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 92 TAIWAN SWINE FEVER IN SWINE VACCINES MARKET, BY DEMOGRAPHIC, 2018-2032 (USD MILLION)

TABLE 93 TAIWAN SWINE VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 94 TAIWAN SWINE VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 95 REST OF SOUTH EAST ASIA SWINE VACCINES MARKET, BY PATHOGEN, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 SOUTH EAST ASIA SWINE VACCINE MARKET: SEGMENTATION

FIGURE 2 SOUTH EAST ASIA SWINE VACCINE MARKET: DATA TRIANGULATION

FIGURE 3 SOUTH EAST ASIA SWINE VACCINE MARKET: DROC ANALYSIS

FIGURE 4 SOUTH EAST ASIA SWINE VACCINE MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 SOUTH EAST ASIA SWINE VACCINE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SOUTH EAST ASIA SWINE VACCINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SOUTH EAST ASIA SWINE VACCINE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 SOUTH EAST ASIA SWINE VACCINE MARKET: SEGMENTATION

FIGURE 9 SOUTH EAST ASIA SWINE VACCINE MARKET EXECUTIVE SUMMARY

FIGURE 10 STRATEGIC DECISIONS

FIGURE 11 RISING INCIDENCE OF SWINE DISEASES IS EXPECTED TO BOOST THE SOUTH EAST ASIA SWINE VACCINE MARKET GROWTH IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 12 VIRUS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SOUTH EAST ASIA SWINE VACCINE MARKET IN 2025 & 2032

FIGURE 13 DROC ANALYSIS

FIGURE 14 SOUTH EAST ASIA SWINE VACCINES MARKET: BY TECHNOLOGY, 2024

FIGURE 15 SOUTH EAST ASIA SWINE VACCINES MARKET: BY TECHNOLOGY, 2025-2032 (USD MILLION)

FIGURE 16 SOUTH EAST ASIA SWINE VACCINES MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 17 SOUTH EAST ASIA SWINE VACCINES MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 18 SOUTH EAST ASIA SWINE VACCINES MARKET: BY PRODUCT, 2024

FIGURE 19 SOUTH EAST ASIA SWINE VACCINES MARKET: BY PRODUCT, 2025-2032 (USD MILLION)

FIGURE 20 SOUTH EAST ASIA SWINE VACCINES MARKET: BY PRODUCT, CAGR (2025-2032)

FIGURE 21 SOUTH EAST ASIA SWINE VACCINES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 22 SOUTH EAST ASIA SWINE VACCINES MARKET: BY PATHOGEN, 2024

FIGURE 23 SOUTH EAST ASIA SWINE VACCINES MARKET: BY PATHOGEN, 2025-2032 (USD MILLION)

FIGURE 24 SOUTH EAST ASIA SWINE VACCINES MARKET: BY PATHOGEN, CAGR (2025-2032)

FIGURE 25 SOUTH EAST ASIA SWINE VACCINES MARKET: BY PATHOGEN, LIFELINE CURVE

FIGURE 26 SOUTH EAST ASIA SWINE VACCINES MARKET: BY INDICATION, 2024

FIGURE 27 SOUTH EAST ASIA SWINE VACCINES MARKET: BY INDICATION, 2025-2032 (USD MILLION)

FIGURE 28 SOUTH EAST ASIA SWINE VACCINES MARKET: BY INDICATION, CAGR (2025-2032)

FIGURE 29 SOUTH EAST ASIA SWINE VACCINES MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 30 SOUTH EAST ASIA SWINE VACCINE MARKET: BY DEMOGRAPHIC, 2024

FIGURE 31 SOUTH EAST ASIA SWINE VACCINE MARKET: BY DEMOGRAPHIC, 2025-2032 (USD MILLION)

FIGURE 32 SOUTH EAST ASIA SWINE VACCINE MARKET: BY DEMOGRAPHIC, CAGR (2025-2032)

FIGURE 33 SOUTH EAST ASIA SWINE VACCINE MARKET: BY DEMOGRAPHIC, LIFELINE CURVE

FIGURE 34 SOUTH EAST ASIA SWINE VACCINES MARKET: BY ROUTE OF ADMINISTRATION, 2024

FIGURE 35 SOUTH EAST ASIA SWINE VACCINES MARKET: BY ROUTE OF ADMINISTRATION E, 2025-2032 (USD MILLION)

FIGURE 36 SOUTH EAST ASIA SWINE VACCINES MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2025-2032)

FIGURE 37 SOUTH EAST ASIA SWINE VACCINES MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 38 SOUTH EAST ASIA SWINE VACCINES MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 39 SOUTH EAST ASIA SWINE VACCINES MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 40 SOUTH EAST ASIA SWINE VACCINES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 41 SOUTH EAST ASIA SWINE VACCINES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 42 SOUTH EAST ASIA SWINE VACCINES MARKET: SNAPSHOT (2024)

FIGURE 43 SOUTH EAST ASIA SWINE VACCINES MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.