Southeast Asia Refrigerant Market

Market Size in USD Billion

CAGR :

%

USD

1.15 Billion

USD

1.78 Billion

2024

2032

USD

1.15 Billion

USD

1.78 Billion

2024

2032

| 2025 –2032 | |

| USD 1.15 Billion | |

| USD 1.78 Billion | |

|

|

|

|

Southeast Asia Refrigerant Market Size

- The Southeast Asia refrigerant market size was valued at USD 1.148 billion in 2024 and is expected to reach USD 1.783 billion by 2032, at a CAGR of 5.7% during the forecast period

- The market growth is largely fuelled by growth in cold chain logistics, pharmaceuticals, and food processing industries and increasing demand for energy-efficient and eco-friendly refrigeration solutions

- Furthermore, the market is expected to witness technological advancements in refrigerant systems and stringent environmental regulations promoting low- GWP refrigerants

Southeast Asia Refrigerant Market Analysis

- As economic development accelerates and urbanization expands across Southeast Asia, demand for efficient cooling systems is rising—driven by growing residential and commercial infrastructure, higher disposable incomes, and increasing climate-related heat stress. This is fuelling strong demand for advanced, environmentally friendly refrigerant solutions

- This market shift is accelerating the adoption of low-GWP (Global Warming Potential) refrigerants, natural alternatives like CO₂ and ammonia, and energy-efficient HVAC systems across industries such as retail, hospitality, data centers, and manufacturing

- Indonesia dominated the Southeast Asia refrigerant market in 2024, due to its large industrial base, rapid urbanization, growing demand for air conditioning and refrigeration, and increasing investments in eco-friendly refrigerant technologies

- Thailand is expected to witness the highest CAGR in the Southeast Asia refrigerant market during the forecast period, driven by its expanding industrial sector, strong regulatory support for environmentally friendly refrigerants, and increasing adoption of advanced cooling technologies

- The fluorocarbon refrigerant dominated the Southeast Asia refrigerant market with a 50.48% market share in 2024, driven by largely fuelled by growth in cold chain logistics, pharmaceuticals, and food processing industries and increasing demand for energy-efficient and eco-friendly refrigeration solutions

Report Scope and Southeast Asia Refrigerant Market Segmentation

|

Attributes |

Southeast Asia Refrigerant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Southeast Asia Refrigerant Market Trends

“Growing Regulatory Pressure Drives Transition to Eco-Friendly Refrigerants”

- As governments across the region implement stricter environmental regulations and commit to international climate agreements, businesses and consumers are increasingly prioritizing low-GWP refrigerants to reduce their carbon footprint—driving strong demand for sustainable cooling technologies

- This regulatory push is encouraging the phase-down of high-GWP hydrofluorocarbons (HFCs) and the adoption of natural refrigerants such as ammonia and CO₂, as well as energy-efficient HVAC systems that comply with new standards

- With increasing focus on sustainability, manufacturers and service providers are innovating to offer greener alternatives that meet both performance and environmental requirements, positioning the refrigerant market as a key player in regional climate goals

Southeast Asia Refrigerant Market Dynamics

Driver

“Innovation in Services of Skincare Treatment”

- The integration of cutting-edge technologies such as smart sensors, IoT-enabled monitoring, and advanced refrigerant blends is transforming the refrigerant systems market in the region, driving greater efficiency, sustainability, and system intelligence. These innovations enable real-time performance tracking, predictive maintenance, and optimized energy consumption, fundamentally reshaping how cooling systems operate and are maintained

- The synergy between smart technologies and eco-friendly refrigerants is enhancing system reliability and environmental compliance, meeting the growing demand for greener and smarter cooling solutions across commercial, industrial, and residential sectors

- The market is also benefiting from advancements in natural refrigerants like ammonia and CO₂, coupled with improved system designs that reduce leakage and increase lifespan, appealing to a wide range of end-users focused on sustainability and cost-effectiveness. These technological innovations support the shift toward energy-efficient and environmentally responsible cooling infrastructure, contributing significantly to market expansion

- As technological progress accelerates, the evolving landscape of intelligent and eco-conscious refrigerant systems is expected to be a key driver of growth in the refrigerant market, reinforcing the region’s commitment to sustainable development and climate goals

Restraint/Challenge

“High Initial Investment in Transitioning to New Refrigerants and Equipment”

- High initial investment costs for adopting new refrigerants and upgrading equipment present a significant restraint for the refrigerant market, especially among small and medium enterprises. Despite the long-term benefits of energy efficiency and regulatory compliance, the upfront capital required for retrofitting or installing modern systems can be prohibitive

- The diverse economic landscape in the region includes businesses with varying financial capabilities, making it essential to balance technological advancement with cost-effectiveness. High transition costs may limit market penetration of eco-friendly refrigerants, deterring companies that prioritize immediate operational budgets over long-term sustainability goals. This cost sensitivity highlights the need for financing solutions, incentives, or phased implementation strategies to ease the burden on end-users

- Effectively addressing this financial barrier is critical for accelerating the adoption of next-generation refrigerant technologies and ensuring broader market growth across commercial and industrial sectors

- The significant capital expenditure required for new refrigerants and equipment remains a key challenge, particularly for businesses operating in price-sensitive or resource-constrained environments, potentially slowing the pace of market expansion

Southeast Asia Refrigerant Market Scope

The market is segmented on the basis of treatment type, type, surgical type and gender

- By Product

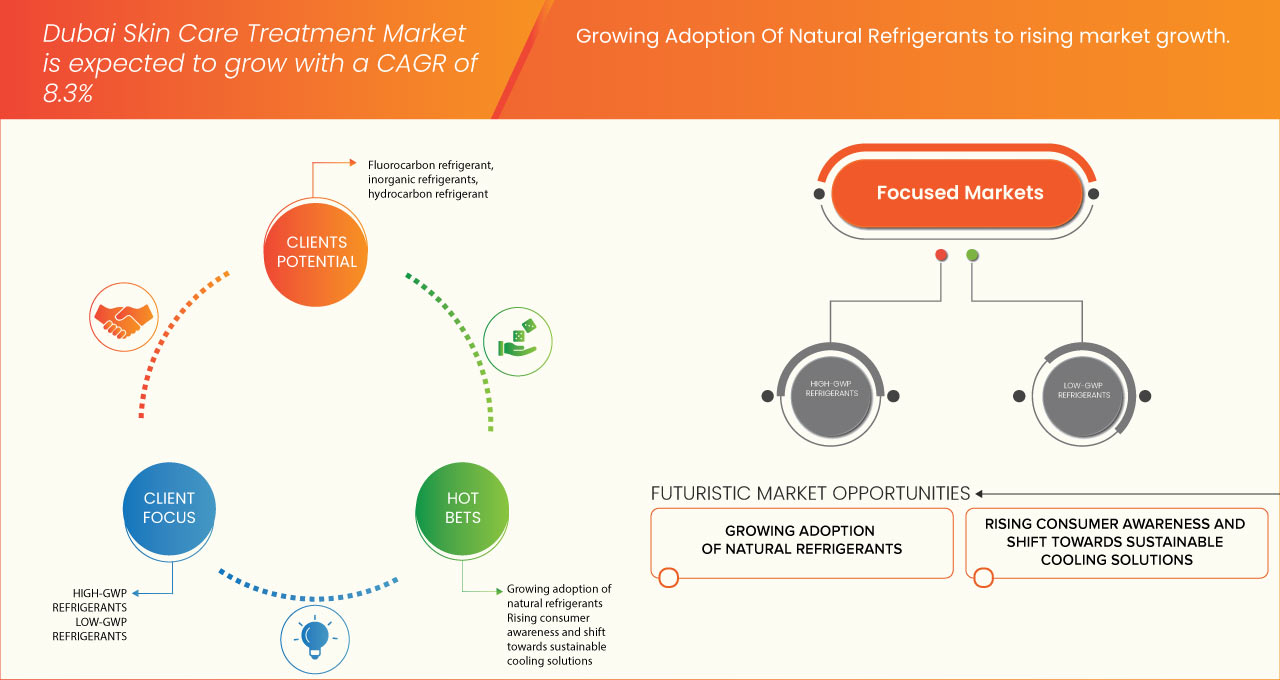

On the basis of Product, the Southeast Asia refrigerant market is segmented into fluorocarbon refrigerant, inorganic refrigerants, hydrocarbon refrigerant. In 2024, the Fluorocarbon Refrigerant segment dominated the market with a 50.48% market share growing with the CAGR of 5.1% in the forecast period 2025 to 2032 and fastest growing segment.

Fluorocarbon Refrigerant is also expected to witness the fastest CAGR of 9.6% from 2025 to 2032 driven by the market is expected to witness technological advancements in refrigerant systems and stringent environmental regulations promoting low- GWP refrigerants.

- By GWP Category

On the basis of type, the Southeast Asia refrigerant market is segmented into High-GWP Refrigerants, Low-GWP Refrigerants. In 2024, the High-GWP Refrigerants segment dominated the market with a 60.43% market share growing with the CAGR of 56.16% in the forecast period due to their superior cooling efficiency, widespread industrial and commercial use, and slower adoption of low-GWP alternatives.

Low-GWP Refrigerants is also expected to witness the fastest CAGR 5.1% in the forecast period 2025 to 2032 driven by the market is expected to witness technological advancements in refrigerant systems and stringent environmental regulations promoting low- GWP refrigerants.

- By Application

On the basis of surgical type, the Southeast asia refrigerant market is segmented into Air conditioning, refrigeration, chillers, heat pumps and others. in 2024, the Air Conditioning dominated the market with a 45.33% market share and is expected to witness the fastest CAGR of 5.2% from 2025 to 2032, driven by the market is expected to witness technological advancements in refrigerant systems and stringent environmental regulations promoting low- GWP refrigerants.

- By End Use

On the basis of end use, the Southeast asia refrigerant market is segmented into commercial refrigeration, industrial refrigeration, domestic/household refrigeration. In 2024, the Commercial Refrigeration segment dominated the market with a 63.60% market and is expected to witness the fastest CAGR 5.0% from 2025 to 2032, driven by the market is expected to witness technological advancements in refrigerant systems and stringent environmental regulations promoting low- GWP refrigerants.

Southeast Asia Refrigerant Market Regional Analysis

- Indonesia refrigerant market is expected to reach USD 449.49 million by 2032, from 320.02 million USD in 2024, growing at the CAGR of 4.5% in the forecast period of 2025 to 2032

- Indonesia is allocating an increasing portion of its national budget toward industrial development and environmental sustainability, which includes investments in eco-friendly refrigerants and advanced cooling technologies. Growing awareness of climate change, energy efficiency, and environmental regulations is driving both public and private sector funding to support the transition to low-GWP (Global Warming Potential) refrigerants. This financial backing plays a crucial role in expanding access to sustainable refrigerant solutions across the country.

- In Indonesia, the refrigerant market is experiencing rapid growth, fueled by urbanization, industrial expansion, and rising demand for air conditioning and refrigeration systems. As the country’s HVAC and cooling industries become more centralized and increasingly open to private sector involvement, there is a notable increase in investment in advanced and environmentally responsible refrigerant technologies. These trends are contributing to significant market growth and enhancing the accessibility and adoption of modern refrigerant solutions nationwide.

Thailand Southeast Asia Refrigerant Market Insight

The Thailand refrigerant market is expected to register the CAGR of 5.4% from 2025 to 2032 in the Southeast Asia region in 2025, driven by market is expected to witness technological advancements in refrigerant systems and stringent environmental regulations promoting low- GWP refrigerants.

Vietnam Southeast Asia Refrigerant Market Insight

The Vietnam refrigerant market is expected to register the CAGR of 5.3% from 2025 to 2032, driven by market is expected to witness technological advancements in refrigerant systems and stringent environmental regulations promoting low- GWP refrigerants.

Southeast Asia Refrigerant Market Share

The Southeast Asia Refrigerant industry is Primarily led by well- established Companies:

- Linde PLC (U.K.)

- AIR LIQUIDE (France)

- The Chemours Company (U.S.)

- DAIKIN INDUSTRIES, Ltd (Japan)

- Arkema (France)

- Honeywell International Inc. (U.S.)

- SOL Spa (Italy)

- DONGYUE GROUP (China)

- National Refrigerants Ltd (U.K.)

- GTS SPA (Italy)

Latest Developments in Southeast Asia Refrigerant Market

- In 2024, The Company design and supply refrigeration, liquefaction, cryogenic fluid storage and distribution systems for laboratories and large scientific equipment. We address the specific needs of each customer using a global approach that combines consulting, design, commissioning, testing, and maintenance.

- In May 2205, Arkema has expanded its portfolio of lower Global Warming Potential (GWP) refrigerants, now offering a range of HFO (Hydrofluoroolefin) blends, including Forane 454B (R-454B), Forane 448A (R-448A), Forane 449A (R-449A), Forane 452A (R-452A), and Forane 513A (R-513A). This expansion is a result of a commercial agreement with Honeywell International Inc. and aims to strengthen global supply chains for sustainable HVACR solutions, meeting increased demand driven by HFC phasedown regulations.

- In April 2025, A-Gas Singapore has become the sole company in Singapore licensed by the National Environmental Agency (NEA) to collect and handle spent refrigerants as toxic industrial waste. This establishes A-Gas as the leading and only fully compliant provider for responsible refrigerant lifecycle management in the country, promoting environmental protection.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 CLIMATE CHANGE SCENARIO

4.4 IMPORT EXPORT SCENARIO

4.5 PRICING ANALYSIS

4.6 PRODUCTION CAPACITY ANALYSIS

4.7 PRODUCTION CONSUMPTION ANALYSIS

4.8 RAW MATERIAL COVERAGE –

4.9 SUPPLY CHAIN ANALYSIS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURER

4.11 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN COLD CHAIN LOGISTICS, PHARMACEUTICALS, AND FOOD PROCESSING INDUSTRIES

6.1.2 INCREASING DEMAND FOR ENERGY-EFFICIENT AND ECO-FRIENDLY REFRIGERATION SOLUTIONS

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN REFRIGERANT SYSTEMS

6.1.4 STRINGENT ENVIRONMENTAL REGULATIONS PROMOTING LOW-GWP REFRIGERANTS

6.2 RESTRAINTS

6.2.1 HIGH INITIAL INVESTMENT IN TRANSITIONING TO NEW REFRIGERANTS AND EQUIPMENT

6.2.2 SAFETY CONCERNS RELATED TO FLAMMABLE OR TOXIC REFRIGERANTS

6.3 OPPORTUNITIES

6.3.1 GROWING ADOPTION OF NATURAL REFRIGERANTS

6.3.2 GOVERNMENT INCENTIVES FOR GREEN AND ENERGY-EFFICIENT REFRIGERATION TECHNOLOGIES

6.3.3 RISING CONSUMER AWARENESS AND SHIFT TOWARDS SUSTAINABLE COOLING SOLUTIONS

6.4 CHALLENGES

6.4.1 HIGH COSTS OF R&D IN SUSTAINABLE REFRIGERANT

6.4.2 COMPLEX RETROFITTING REQUIREMENTS FOR EXISTING REFRIGERATION SYSTEMS

7 SOUTHEAST ASIA REFRIGERANT MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLUOROCARBON REFRIGERANT

7.2.1 FLUOROCARBON REFRIGERANT, BY PRODUCT

7.2.1.1 HYDROFLUOROCARBONS (HFCS)

7.2.1.2 HYDROCHLOROFLUOROCARBONS HCFCS)

7.2.1.3 HYDROFLUOROOLEFINS (HFOS)

7.2.1.4 OTHERS

7.2.1.5 HYDROFLUOROOLEFINS (HFOS), BY PRODUCT

7.2.1.5.1 R-1234ZE

7.2.1.5.2 R-1234YF

7.3 INORGANIC REFRIGERANTS

7.3.1 INORGANIC REFRIGERANT, BY PRODUCT

7.3.1.1 AMMONIA

7.3.1.2 CARBON DIOXIDE

7.3.1.3 WATER

7.3.1.4 OTHERS

7.4 HYDROCARBON REFRIGERANT

7.4.1 HYDROCARBON REFRIGERANT, BY PRODUCT

7.4.1.1 PROPANE (R-290)

7.4.1.2 ISO-BUTANE (R-600A)

7.4.1.3 PROPYLENE

7.4.1.4 BUTANE (R-600)

7.4.1.5 METHANE

7.4.1.6 ETHANE

7.4.1.7 ETHYLENE

7.4.1.8 OTHERS

8 SOUTHEAST ASIA REFRIGERANT MARKET, BY GWP CATEGORY

8.1 OVERVIEW

8.2 HIGH-GWP REFRIGERANTS

8.3 LOW-GWP REFRIGERANTS

9 SOUTHEAST ASIA REFRIGERANT MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 AIR CONDITIONING

9.2.1 AIR CONDITIONING, BY TYPE

9.2.1.1 STATIONARY AIR CONDITIONING

9.2.1.2 MOBILE AIR CONDITIONING

9.2.1.3 OTHERS

9.3 REFRIGERATION

9.4 CHILLERS

9.5 HEAT PUMPS

9.6 OTHERS

10 SOUTHEAST ASIA REFRIGERANT MARKET, BY END USE

10.1 OVERVIEW

10.2 COMMERCIAL REFRIGERATION

10.2.1 COMMERCIAL REFRIGERATION, BY TYPE

10.2.1.1 HOTELS & RESTAURANTS

10.2.1.2 OFFICE SPACES

10.2.1.3 SUPERMARKETS/HYPERMARKETS

10.2.1.4 OTHERS

10.3 INDUSTRIAL REFRIGERATION

10.3.1 INDUSTRIAL REFRIGERATION, BY TYPE

10.3.1.1 CHEMICAL & PETROCHEMICAL

10.3.1.2 PHARMACEUTICALS

10.3.1.3 FOOD & BEVERAGE

10.3.1.4 AUTOMOTIVE

10.3.1.5 HEALTHCARE

10.3.1.6 OTHERS

10.3.1.7 AUTOMOTIVE, BY TYPE

10.3.1.7.1 PASSENGER VEHICLES

10.3.1.7.2 COMMERCIAL VEHICLES

10.4 DOMESTIC/HOUSEHOLD REFRIGERATION

11 SOUTHEAST ASIA REFRIGERANT MARKET BY COUNTRIES

11.1 SOUTHEAST ASIA

11.1.1 INDONESIA

11.1.2 THAILAND

11.1.3 VIETNAM

11.1.4 MALAYSIA

11.1.5 PHILIPPINES

11.1.6 SINGAPORE

11.1.7 MYANMAR

11.1.8 REST OF SOUTHEAST ASIA

12 SOUTHEAST ASIA REFRIGERANT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LINDE PLC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 AIR LIQUIDE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 THE CHEMOURS COMPANY

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT/NEWS

14.4 DAIKIN INDUSTRIES, LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 ARKEMA

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT/NEWS

14.6 A-GAS INTERNATIONAL LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 DONGYUE GROUP

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 EASTERN WINTER TRADING PTE LTD

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ENTALPIA EUROPE

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 GLOBAL GASES GROUP THAILAND CO LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 GTS SPA

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 HONEYWELL INTERNATIONAL INC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 PVCK.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 RHODIA CHEMICALS LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SRF

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 SUMMARY OF PRODUCTION CAPACITY:

TABLE 2 REGIONAL COMPARISON:

TABLE 3 THE REFRIGERANTS USED ACROSS SOUTHEAST ASIA:

TABLE 4 REGIONAL PRODUCTION VS. IMPORT DEPENDENCY

TABLE 5 REGULATORY COVERAGE

TABLE 6 SOUTHEAST ASIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 7 SOUTHEAST ASIA FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 SOUTHEAST ASIA HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 9 SOUTHEAST ASIA INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 10 SOUTHEAST ASIA HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 11 SOUTHEAST ASIA REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 12 SOUTHEAST ASIA REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 13 SOUTHEAST ASIA AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 SOUTHEAST ASIA REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 15 SOUTHEAST ASIA COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 SOUTHEAST ASIA INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 SOUTHEAST ASIA AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 SOUTHEAST ASIA REFRIGERANT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 19 INDONESIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 20 INDONESIA FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 21 INDONESIA HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 22 INDONESIA INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 23 INDONESIA HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 24 INDONESIA REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 25 INDONESIA REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 26 INDONESIA AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 INDONESIA REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 28 INDONESIA COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 INDONESIA INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 INDONESIA AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 THAILAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 32 THAILAND FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 33 THAILAND HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 34 THAILAND INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 35 THAILAND HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 36 THAILAND REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 37 THAILAND REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 38 THAILAND AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 THAILAND REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 40 THAILAND COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 THAILAND INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 THAILAND AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 VIETNAM REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 44 VIETNAM FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 45 VIETNAM HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 46 VIETNAM INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 47 VIETNAM HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 48 VIETNAM REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 49 VIETNAM REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 VIETNAM AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 VIETNAM REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 52 VIETNAM COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 VIETNAM INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 VIETNAM AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MALAYSIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 56 MALAYSIA FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 57 MALAYSIA HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 58 MALAYSIA INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 59 MALAYSIA HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 60 MALAYSIA REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 61 MALAYSIA REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 MALAYSIA AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MALAYSIA REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 64 MALAYSIA COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 MALAYSIA INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MALAYSIA AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 PHILIPPINES REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 68 PHILIPPINES FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 69 PHILIPPINES HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 70 PHILIPPINES INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 71 PHILIPPINES HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 72 PHILIPPINES REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 73 PHILIPPINES REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 74 PHILIPPINES AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 PHILIPPINES REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 76 PHILIPPINES COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 PHILIPPINES INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 PHILIPPINES AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 SINGAPORE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 80 SINGAPORE FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 81 SINGAPORE HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 82 SINGAPORE INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 83 SINGAPORE HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 84 SINGAPORE REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 85 SINGAPORE REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 86 SINGAPORE AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 SINGAPORE REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 88 SINGAPORE COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 SINGAPORE INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 SINGAPORE AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MYANMAR REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 92 MYANMAR FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 93 MYANMAR HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 94 MYANMAR INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 95 MYANMAR HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 96 MYANMAR REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 97 MYANMAR REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 MYANMAR AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MYANMAR REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 100 MYANMAR COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MYANMAR INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MYANMAR AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 REST OF SOUTHEAST ASIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 SOUTHEAST ASIA REFRIGERANT MARKET

FIGURE 2 SOUTHEAST ASIA REFRIGERANT MARKET: DATA TRIANGULATION

FIGURE 3 SOUTHEAST ASIA REFRIGERANT MARKET: DROC ANALYSIS

FIGURE 4 SOUTHEAST ASIA REFRIGERANT MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 SOUTHEAST ASIA REFRIGERANT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SOUTHEAST ASIA REFRIGERANT MARKET: MULTIVARIATE MODELLING

FIGURE 7 SOUTHEAST ASIA REFRIGERANT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SOUTHEAST ASIA REFRIGERANT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SOUTHEAST ASIA REFRIGERANT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 SOUTHEAST ASIA REFRIGERANT MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 THREE SEGMENTS COMPRISE THE SOUTHEAST ASIA REFRIGERANT MARKET, BY PRODUCT (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWTH IN COLD CHAIN LOGISTICS, PHARMACEUTICALS, AND FOOD PROCESSING INDUSTRIES IS EXPECTED TO DRIVE THE SOUTHEAST ASIA REFRIGERANT MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 15 THE FLUOROCARBON REFRIGERANT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SOUTHEAST ASIA REFRIGERANT MARKET IN 2025 AND 2032

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF SOUTHEAST ASIA REFRIGERANT MARKET

FIGURE 19 SOUTHEAST ASIA REFRIGERANT MARKET: BY PRODUCT, 2024

FIGURE 20 SOUTHEAST ASIA REFRIGERANT MARKET, BY GWP CATEGORY, 2024

FIGURE 21 SOUTHEAST ASIA REFRIGERANT MARKET: BY APPLICATION, 2024

FIGURE 22 SOUTHEAST ASIA REFRIGERANT MARKET: BY END USE, 2024

FIGURE 23 SOUTHEAST ASIA REFRIGERANT MARKET: SNAPSHOT (2024)

FIGURE 24 SOUTHEAST ASIA REFRIGERANT MARKET: COMPANY SHARE 2024 (%)

Southeast Asia Refrigerant Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Southeast Asia Refrigerant Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Southeast Asia Refrigerant Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.