Spain Accounts Receivable Automation Market Analysis and Size

Major factors expected to boost the growth of the accounts receivable automation market in the forecast period are the rise in several industry applications, including aerospace, steel, power, chemical, and others. Furthermore, the increased resistance to load variations is the benefit of Accounts Receivable Automation, which is further anticipated to propel the growth of the accounts receivable automation market.

Data Bridge Market Research analyses that Spain accounts receivable automation market is expected to reach the value of USD 234.76 million by 2030, at a CAGR of 12.6% during the forecast period. The accounts receivable automation market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Offering (Solutions and Services), Deployment Type (On Premise, Cloud), Enterprise Size (Large Enterprise and Small Enterprise), Operating System (Window, Mobile, Mac, and Linux), Automation Level (Basic Automation and Advanced Automation), Pricing Category (Subscription Based and Free), End User (Manufacturing, Food and Beverages, Energy and Utilities, Healthcare, Banking, Financial Services and Insurance, IT and Telecommunication, Government and Public Sector, Construction, Transportation and Logistics, Retail and Consumer Goods, Hospitality, and Others) |

|

Country Covered |

Spain |

|

Market Players Covered |

SAP, Sage Group plc, Esker, Quadient, celonis, EDICOM, BlackLine Inc., Certinia Inc., QUALCO Group of companies, Pagero, Iron Mountain, Inc., Zoho Corporation Pvt. Ltd., Serrala, Dynatos, and among others |

Spain Accounts Receivable Automation Market Definition

Cloud-based AR automation solutions typically reduce the need for extensive on-premises infrastructure and ongoing maintenance costs. This can particularly appeal to businesses looking to control expenses and allocate resources more strategically. The scalability of cloud solutions also allows companies to adapt to changing workloads and business needs without the constraints of traditional on-premises systems. Spanish businesses recognize the advantages of cloud-based AR automation is expected to drive market growth.

Spain Accounts Receivable Automation Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increasing Adoption of Cloud-Based AR Automation Solutions

Businesses in Spain are recognizing the advantages of cloud-based AR automation which offers flexibility, scalability, and accessibility. Companies can efficiently manage their AR processes from anywhere with an internet connection, facilitating remote work and enabling real-time access to financial data by leveraging cloud solutions. This enhances operational efficiency and contributes to better cash flow management and quicker decision-making, which are critical in today's dynamic business environment.

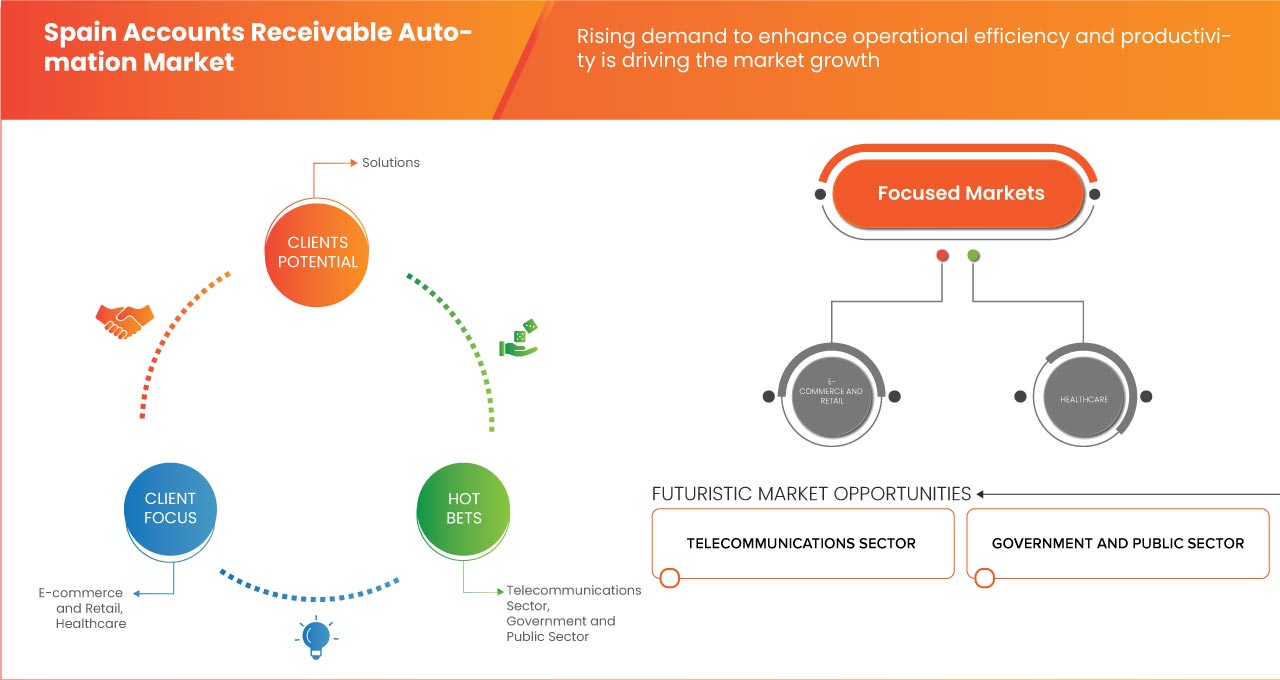

- Rising Demand to Enhance Operational Efficiency and Productivity

Companies recognize the value of automating their accounts receivable processes to streamline and optimize their financial operations. Embracing automation, businesses can significantly reduce manual workloads, minimize errors, and expedite invoice processing and payment collection tasks. This leads to improved operational efficiency and allows organizations to allocate their resources more strategically, enhancing overall productivity.

Opportunity

- Rising Spain Government Initiatives such as Promoting Digital Technologies

The Spanish government, or many other governments globally, may roll out initiatives promoting the adoption of digital technologies and automation in businesses. These initiatives can include tax incentives, subsidies, or grants to encourage companies to invest in AR automation solutions. The government aims to improve the overall efficiency and competitiveness of businesses, ultimately contributing to economic growth.

Restraints/Challenges

- Data Security Considerations Associated with Automated AR Processes

Businesses are entrusting sensitive financial data to these systems, making data security a paramount concern with the increasing adoption of automation solutions. Any perceived or actual vulnerabilities in the security of accounts receivable automation solutions can deter companies from embracing these technologies, especially in industries where data privacy and compliance with regulations such as GDPR are critical.

- High Cost of Implementation of AR Automation

The initial investment required can deter many businesses, particularly smaller enterprises while automation offers numerous benefits, including increased efficiency and improved cash flow. The expense encompasses software acquisition, integration with existing systems, and staff training, making it a substantial financial commitment that some companies may find prohibitive.

Recent Development

- In September 2023, SAP and LeanIX GmbH acquired LeanIX, a enterprise architecture management (EAM) software pioneer. SAP expanded its comprehensive transformation package to assist customers in effectively navigating change and permanently improving their business processes. LeanIX extended the transformation capabilities providing SAP customers with unique visibility on IT landscapes. That helped SAP expand its business transformation portfolio, giving customers access to the tools required for continuous business transformation and facilitating AI-enabled process optimization.

- In August 2023, Sage Group plc acquired Lockstep. Sage supported Lockstep's investment in creative solutions, its expansion of developer APIs and the development of accounting connectors for third parties to create new apps and drive choice. That acquisition brought Sage's resources to Lockstep, which accelerated its target of automating accounting operations across companies. It provided Sage with supporting tools and capabilities to deliver on its ambition of becoming the trusted network for SMBs. The company enhanced its portfolio of offerings, advancing its digital capabilities and facilitating automation and customization.

Spain Accounts Receivable Automation Market Scope

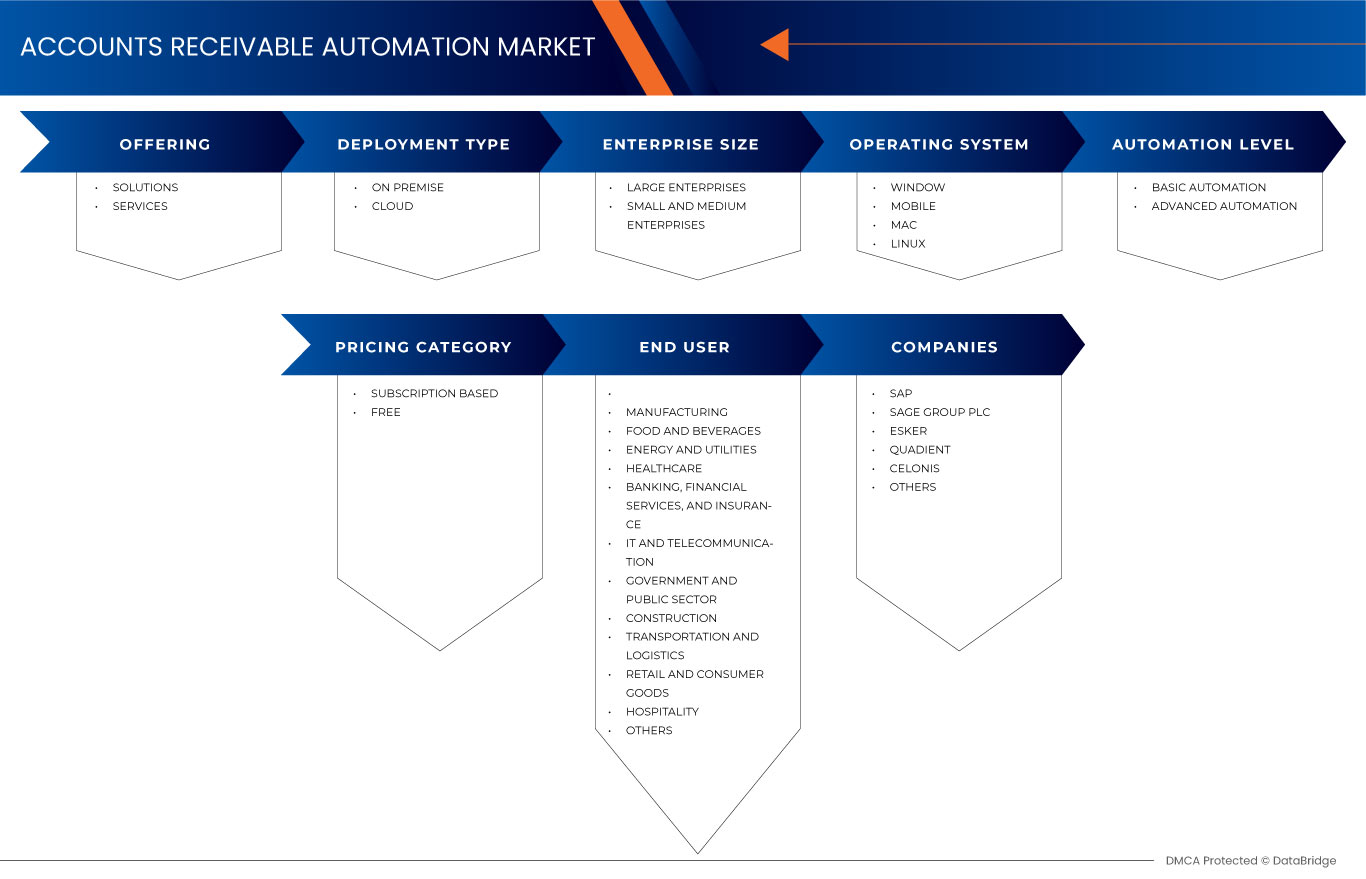

Spain accounts receivable automation market is segmented on the basis of offering, deployment type, enterprise size, operating system, automation level, pricing category, end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Solutions

- Services

On the basis of offering, the Spain accounts receivable automation market is segmented into solutions and services.

Deployment Type

- On Premise

- Cloud

On the basis of deployment type, the Spain accounts receivable automation market is segmented into on premise, and cloud.

Enterprise Size

- Large Enterprise

- Small Enterprise

On the basis of enterprise size, the Spain accounts receivable automation market is segmented into large enterprise, and small enterprise.

Operating System

- Window

- Mobile

- Mac

- Linux

On the basis of operating system, the Spain accounts receivable automation market is segmented into window, mobile, mac, and linux.

Automation Level

- Basic Automation

- Advanced Automation

On the basis of automation level, the Spain accounts receivable automation market is segmented into basic automation and advanced automation.

Pricing Category

- Subscription Based

- Free

On the basis of pricing category, the Spain accounts receivable automation market is segmented into subscription based, and free.

End User

- Manufacturing

- Food and Beverages

- Energy and Utilities

- Healthcare, Banking

- Financial Services and Insurance

- IT and Telecommunication

- Government and Public Sector

- Construction

- Transportation and Logistics

- Retail and Consumer Goods

- Hospitality

- Others

On the basis of end user, the Spain accounts receivable automation market is segmented into manufacturing, food and beverages, energy and utilities, healthcare, banking, financial services and insurance, it and telecommunication, government and public sector, construction, transportation and logistics, retail and consumer goods, hospitality, and others.

Competitive Landscape and Spain Accounts Receivable Automation Market Share Analysis

Spain accounts receivable automation market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the company’s focus related to Spain accounts receivable automation market.

Some of the major players operating in Spain accounts receivable automation market are SAP, Sage Group plc, Esker, Quadient, celonis, EDICOM, BlackLine Inc., Certinia Inc., QUALCO Group of companies, Pagero, Iron Mountain, Inc., Zoho Corporation Pvt. Ltd., Serrala, Dynatos, and among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 END USER COVERAGE GRID

2.8 MULTIVARIATE MODELLING

2.9 OFFERING TIME LINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES MODEL

4.2 TECHNOLOGICAL TRENDS

4.2.1 ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING

4.2.2 ROBOTIC PROCESS AUTOMATION (RPA)

4.2.3 BLOCKCHAIN TECHNOLOGY

4.2.4 CLOUD-BASED SOLUTIONS

4.2.5 MOBILE INTEGRATION

4.2.6 DATA ANALYTICS AND BUSINESS INTELLIGENCE

4.2.7 ELECTRONIC PAYMENTS AND E-INVOICING

4.2.8 INTEGRATION WITH ERP SYSTEMS

4.3 CASE STUDY

4.4 COMPANY COMPARATIVE ANALYSIS

4.5 PENETRATION BY SECTOR OF ACTIVITY

4.5.1 FOOD AND BEVERAGES SECTOR:

4.5.2 MANUFACTURING SECTOR:

4.5.3 ENERGY AND UTILITIES SECTOR:

4.5.4 HEALTHCARE SECTOR:

4.6 VALUE CHAIN ANALYSIS

4.6.1 INNOVATIVE TECHNOLOGY PROVIDERS

4.6.2 SYSTEM INTEGRATION, IMPLEMENTATION SERVICES, TRAINING, AND SUPPORT SERVICES

4.7 PRICING ANALYSIS

4.8 GENERAL DATA PROTECTION REGULATION (GDPR)

4.8.1 E-INVOICING DIRECTIVE

4.8.2 ANTI-MONEY LAUNDERING (AML) AND COUNTER-TERRORISM FINANCING (CTF) REGULATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF CLOUD-BASED AR AUTOMATION SOLUTIONS

5.1.2 RISING DEMAND TO ENHANCE OPERATIONAL EFFICIENCY AND PRODUCTIVITY

5.1.3 INCREASE IN THE USE OF AUTOMATED AR PLATFORMS

5.1.4 SURGING DIGITAL INFRASTRUCTURE ACROSS THE COUNTRY

5.2 RESTRAINTS

5.2.1 DATA SECURITY CONSIDERATIONS ASSOCIATED WITH AUTOMATED AR PROCESSES

5.2.2 HIGH COST OF IMPLEMENTATION OF AR AUTOMATION

5.3 OPPORTUNITIES

5.3.1 RISING SPAIN GOVERNMENT INITIATIVES SUCH AS PROMOTING DIGITAL TECHNOLOGIES

5.3.2 GROWING TREND OF COLLABORATION AND STRATEGIC ALLIANCES AMONG INDUSTRY STAKEHOLDERS

5.3.3 GROWING NEED FOR AR AUTOMATION SOLUTIONS IN VARIOUS INDUSTRIES

5.4 CHALLENGES

5.4.1 LESS AWARENESS OF AR AUTOMATION IN SMALLER BUSINESSES

5.4.2 INTEGRATION CONCERNS RELATED TO ACCOUNT RECEIVABLE PLATFORMS

6 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 BILLING AND INVOICING

6.2.2 CREDIT & RISK MANAGEMENT

6.2.3 CUSTOMER STATEMENT

6.2.4 RECEIVABLE LEDGER

6.2.5 COLLECTION MANAGEMENT

6.2.6 AGING TRACKING

6.2.7 ONLINE PAYMENTS

6.2.8 OTHERS

6.3 SERVICES

6.3.1 IMPLEMENTATION

6.3.2 CONSULTING

6.3.3 SUPPORT AND MAINTENANCE

7 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE

7.1 OVERVIEW

7.2 ON PREMISE

7.3 CLOUD

8 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY ENTERPRISE SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISE

8.2.1 BY DEPLOYMENT TYPE

8.2.1.1 ON PREMISE

8.2.1.2 CLOUD

8.3 SMALL AND MEDIUM ENTERPRISE

8.3.1 BY DEPLOYMENT TYPE

8.3.1.1 ON PREMISE

8.3.1.2 CLOUD

9 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OPERATING SYSTEM

9.1 OVERVIEW

9.2 WINDOWS

9.3 MOBILE

9.3.1 BY TYPE

9.3.1.1 ANDROID

9.3.1.2 IPHONE

9.3.1.3 IPAD

9.4 MAC

9.5 LINUX

10 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY AUTOMATION LEVEL

10.1 OVERVIEW

10.2 BASIC AUTOMATION

10.2.1 BY FUNCTION

10.2.1.1 INVOICE GENERATION

10.2.1.2 TRANSACTION TRACKING

10.2.1.3 PAYMENT REMINDER

10.3 ADVANCED AUTOMATION

11 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY PRICING CATEGORY

11.1 OVERVIEW

11.2 SUBSCRIPTION BASED

11.2.1 ANNUAL SUBSCRIPTION

11.2.2 MONTHLY SUBSCRIPTION

11.3 FREE

12 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY END USER

12.1 OVERVIEW

12.2 MANUFACTURING

12.2.1 BY OFFERING

12.2.1.1 SOLUTIONS

12.2.1.2 SERVICES

12.3 FOOD AND BEVERAGES

12.3.1 BY OFFERING

12.3.1.1 SOLUTIONS

12.3.1.2 SERVICES

12.4 ENERGY AND UTILITIES

12.4.1 BY OFFERING

12.4.1.1 SOLUTIONS

12.4.1.2 SERVICES

12.5 HEALTHCARE

12.5.1 BY OFFERING

12.5.1.1 SOLUTIONS

12.5.1.2 SERVICES

12.6 BANKING, FINANCIAL SERVICES, AND INSURANCE

12.6.1 BY OFFERING

12.6.1.1 SOLUTIONS

12.6.1.2 SERVICES

12.7 IT AND TELECOMMUNICATION

12.7.1 BY OFFERING

12.7.1.1 SOLUTIONS

12.7.1.2 SERVICES

12.8 GOVERNMENT AND PUBLIC SECTOR

12.8.1 BY OFFERING

12.8.1.1 SOLUTIONS

12.8.1.2 SERVICES

12.9 CONSTRUCTION

12.9.1 BY OFFERING

12.9.1.1 SOLUTIONS

12.9.1.2 SERVICES

12.1 TRANSPORTATION AND LOGISTICS

12.10.1 BY OFFERING

12.10.1.1 SOLUTIONS

12.10.1.2 SERVICES

12.11 RETAIL AND CONSUMER GOODS

12.11.1 BY OFFERING

12.11.1.1 SOLUTIONS

12.11.1.2 SERVICES

12.12 HOSPITALITY

12.12.1 BY OFFERING

12.12.1.1 SOLUTIONS

12.12.1.2 SERVICES

12.13 OTHERS

12.13.1 BY OFFERING

12.13.1.1 SOLUTIONS

12.13.1.2 SERVICES

13 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: SPAIN

14 SWOT ANALYSIS

15 COMPANY PROFILINGS

15.1 SAP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 SAGE GROUP PLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 SOLUTION PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 ESKER

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 SOLUTION PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 QUADIENT

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 SOLUTION PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 CELONIS

15.5.1 COMPANY SNAPSHOT

15.5.2 SOLUTION PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 BLACKLINE INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 SOLUTION PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 CERTINIA (BY FINANCIAL FORCE)

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTION PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 DYNATOS

15.8.1 COMPANY SNAPSHOT

15.8.2 SOLUTION PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 EDICOM

15.9.1 COMPANY SNAPSHOT

15.9.2 SOLUTION PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 IRON MOUNTAIN, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 SOLUTION PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 PAGERO

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 SOLUTION PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 QUALCO GROUP OF COMPANIES

15.12.1 COMPANY SNAPSHOT

15.12.2 SOLUTION PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 SERRALA

15.13.1 COMPANY SNAPSHOT

15.13.2 SOLUTION PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 ZOHO CORPORATION PVT. LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 BRAND PORTFOLIO

15.14.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 2 SPAIN SOLUTIONS IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY TYPE, 2020-2030

TABLE 3 SPAIN SERVICES IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY TYPE, 2020-2030

TABLE 4 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2020-2030 (USD MILLION)

TABLE 5 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY ENTERPRISE SIZE, 2020-2030 (USD MILLION)

TABLE 6 SPAIN LARGE ENTERPRISE IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2020-2030 (USD MILLION)

TABLE 7 SPAIN SMALL AND MEDIUM ENTERPRISE IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2020-2030 (USD MILLION)

TABLE 8 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OPERATING SYSTEM, 2020-2030 (USD MILLION)

TABLE 9 SPAIN MOBILE IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY TYPE, 2020-2030 (USD MILLION)

TABLE 10 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY AUTOMATION LEVEL, 2020-2030 (USD MILLION)

TABLE 11 SPAIN BASIC AUTOMATION IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY FUNCTION, 2020-2030 (USD MILLION)

TABLE 12 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY PRICING CATEGORY, 2020-2030 (USD MILLION)

TABLE 13 SPAIN SUBSCRIPTION BASED IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY TYPE, 2020-2030 (USD MILLION)

TABLE 14 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 15 SPAIN MANUFACTURING IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 16 SPAIN FOOD AND BEVERAGES IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 17 SPAIN ENERGY AND UTILITIES IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 18 SPAIN HEALTHCARE IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 19 SPAIN BANKING, FINANCIAL SERVICES, AND INSURANCE IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 20 SPAIN IT AND TELECOMMUNICATION IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 21 SPAIN GOVERNMENT AND PUBLIC SECTOR IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 22 SPAIN CONSTRUCTION IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 23 SPAIN TRANSPORTATION AND LOGISTICS IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 24 SPAIN RETAIL AND CONSUMER GOODS IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 25 SPAIN HOSPITALITY IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 26 SPAIN OTHERS IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

List of Figure

FIGURE 1 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: SEGMENTATION

FIGURE 2 SPAIN ACCOUNTS RECEIABLE AUTOMATION MARKET: DATA TRIANGULATION

FIGURE 3 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: END USER COVERAGE GRID ANALYSIS

FIGURE 9 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: MULTIVARIATE MODELLING

FIGURE 10 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: OFFERING TIME LINE CURVE

FIGURE 11 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: SEGMENTATION

FIGURE 12 INCREASING ADOPTION OF CLOUD-BASED AR AUTOMATION SOLUTIONS IS EXPECTED TO BE KEY DRIVER FOR SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SOLUTION IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 PORTER’S FIVE FORCES MODEL

FIGURE 15 PENETRATION BY SECTOR OF ACTIVITY FOR SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET

FIGURE 16 VALUE CHAIN FOR SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET

FIGURE 18 ADVANTAGES OF AUTOMATED ARM

FIGURE 19 USE OF AUTOMATED AR SOLUTIONS IN VARIOUS INDUSTRIES

FIGURE 20 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY OFFERING, 2022

FIGURE 21 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY DEPLOYMEN TYPE, 2022

FIGURE 22 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY ENTERPRISE SIZE, 2022

FIGURE 23 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY OPERATING SYSTEM, 2022

FIGURE 24 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY AUTOMATION LEVEL, 2022

FIGURE 25 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY PRICING CATEGORY, 2022

FIGURE 26 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY END USER, 2022

FIGURE 27 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: COMPANY SHARE 2022 (%)

Spain Accounts Receivable Automation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Spain Accounts Receivable Automation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Spain Accounts Receivable Automation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.