Switzerland France Italy And Germany Cpap Devices Market

Market Size in USD Million

CAGR :

%

USD

874.25 Million

USD

1,348.35 Million

2025

2033

USD

874.25 Million

USD

1,348.35 Million

2025

2033

| 2026 –2033 | |

| USD 874.25 Million | |

| USD 1,348.35 Million | |

|

|

|

|

Switzerland, France, Italy, and Germany CPAP Devices Market Size

- The Switzerland, France, Italy, and Germany CPAP Devices market was valued at USD 874.25 million in 2025 and is expected to reach USD 1,348.35 million by 2033

- During the forecast period of 2026 to 2033 the market is likely to grow at a CAGR of 5.6%, supported primarily driven by the rising prevalence of obstructive sleep apnea (OSA), increasing awareness of sleep-related disorders, and the growing diagnosis rate supported by improved access to sleep laboratories and home sleep testing.

- Sustained market growth is further supported by technological advancements in CPAP devices, including quieter motors, improved mask comfort, portable and travel-friendly designs, and the integration of digital health features such as remote monitoring and cloud-based compliance tracking. Additionally, expanding reimbursement coverage, the growth of home healthcare, and strong distribution through hospitals, sleep clinics, and online channels are strengthening overall market adoption across the region.

Switzerland, France, Italy, and Germany CPAP Devices Market Analysis

- The Switzerland, France, Italy, and Germany CPAP Devices market is witnessing steady advancement as manufacturers increasingly focus on technological innovation, patient comfort, and therapy optimization to address evolving sleep apnea management needs. CPAP device developers are leveraging quieter motor technologies, improved pressure algorithms, enhanced mask ergonomics, humidification systems, and portable designs to improve therapy adherence across hospitals, sleep clinics, and home-care settings. The integration of digital displays, cloud-based compliance tracking, mobile app connectivity, and telemedicine-enabled monitoring is further shaping product development strategies across the region.

- These advancements are strengthening the regional CPAP value chain by improving manufacturing efficiency, product reliability, and scalability, while supporting long-term cost optimization. Expanding direct-to-consumer channels, distributor networks, and partnerships with hospitals and sleep centers are enabling wider market penetration and improved patient access. Rising adoption of CPAP therapy across home healthcare environments, supported by favorable reimbursement frameworks, government sleep health initiatives, and the growing emphasis on chronic disease management, is further enhancing overall market accessibility.

- Germany is expected to dominate the Switzerland, France, Italy, and Germany CPAP Devices Market with the largest revenue share of 42.28% in 2026, supported by high awareness of sleep disorders, a well-established sleep medicine infrastructure, and continuous investments by manufacturers in product innovation, localized production, and brand expansion.

- France is projected to be the fastest-growing market, registering a CAGR of 6.2%, driven by increasing diagnosis rates of obstructive sleep apnea, expanding adoption of home-based respiratory care, growing telemedicine integration, and improved availability of CPAP devices through hospitals, pharmacies, online platforms, and specialized homecare providers.

- In 2026, the CPAP Device segment is expected to dominate the Switzerland, France, Italy, and Germany CPAP Devices market with a 62.52% share, reflecting strong demand for compact, user-friendly, and cost-effective therapy solutions. Widespread use across hospitals, sleep clinics, and home-care settings, combined with continuous innovation in digital monitoring and patient-centric design, continues to reinforce the segment’s leadership across the region.

Report Scope and Switzerland, France, Italy, and Germany CPAP Devices Market Segmentation

|

Attributes |

Switzerland, France, Italy, and Germany CPAP Devices Key Market Insights |

|

Segments Covered |

|

|

Country Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Switzerland, France, Italy, and Germany CPAP Devices Market Trends

“Expanding Telemedicine & Remote Monitoring”

- Expanding telemedicine and remote monitoring in Switzerland, France, Italy, and Germany presents a significant opportunity for CPAP devices by transforming how sleep apnea is managed and supported. With telehealth becoming more integrated into routine care, patients can be diagnosed, prescribed, and monitored for sleep-disordered breathing without frequent in-person visits. This convenience enhances accessibility, especially for individuals in rural or underserved areas who might otherwise delay seeking treatment. Remote monitoring features built into modern CPAP devices enable healthcare providers to track usage patterns, therapy effectiveness, and patient adherence in real time, allowing for timely adjustments and personalized support. Such connectivity strengthens the patient–clinician relationship and increases confidence in treatment outcomes. Additionally, telemedicine platforms support patient education and troubleshooting, reducing barriers to using CPAP machines effectively. By streamlining care delivery and improving long-term adherence, the expanding telehealth ecosystem drives greater acceptance and sustained demand for CPAP devices across these European healthcare markets.

- In July 2025, according to the International Trade Administration, the German telehealth market (excluding digital fitness products and health trackers) is predicted to grow from a revenue of USD USD 2.79B in 2024 to a projectedUSD USD 4.4B by 2030.

- In August 2025, according to the article published by Gleiss Lutz, Germany’s telemedical care infrastructure has seen substantial improvements and expansion in recent years. Previous statutory restrictions on the percentage of video consultations have been lifted, allowing the German medical profession greater flexibility and scope in offering such consultations.

- In November 2025, according to the National Library of Medicine, the French Ministry of Health funded 41 telehealth research projects between 2009 and 2022, amounting to USD 17.47 million or USD 17.5 million.

- Overall, the rapid expansion of telemedicine and remote monitoring across Switzerland, France, Italy, and Germany strengthens CPAP adoption by improving access, adherence, and clinical oversight. Digital connectivity allows continuous therapy optimization and patient engagement, turning CPAP into a more convenient, data-driven, and widely accepted solution for long-term sleep apnea management.

Switzerland, France, Italy, and Germany CPAP Devices Market Dynamics

Driver

“High Healthcare Spending”

- High healthcare spending in countries like Switzerland, France, Italy, and Germany creates a supportive environment that significantly boosts demand for continuous positive airway pressure (CPAP) devices. These countries allocate a substantial portion of their national budgets to health services, which translates into robust insurance coverage, advanced medical infrastructure, and a strong emphasis on preventive and chronic disease management. In such systems, sleep disorders like obstructive sleep apnea are increasingly recognized as serious health concerns rather than niche conditions. High healthcare expenditure often correlates with greater awareness campaigns, better diagnostic facilities, and more frequent screening, all of which lead to higher detection rates of sleep-related breathing disorders.

- Once diagnosed, patients in these nations are more likely to have access to subsidized or reimbursed medical devices, reducing financial barriers that might otherwise deter them from purchasing CPAP machines. Furthermore, well-funded healthcare systems tend to adopt and promote high-quality medical technologies, encouraging healthcare providers to prescribe CPAP therapy as a first-line treatment for sleep apnea. This not only raises clinician confidence in recommending these devices but also reassures patients about their effectiveness and safety. The combination of strong public and private insurance schemes, high per-capita medical spending, and a cultural focus on wellness and long-term health outcomes collectively drives sustained demand for CPAP devices. In essence, high healthcare spending doesn’t just improve access, it influences the entire care continuum, from diagnosis to treatment adherence, thereby elevating the demand for CPAP therapy across these European markets.

- In July 2025, Feather Insurance published a blog, stating that Germany allocates the highest share of GDP to healthcare in Europe, at 12.8%.

- In October 2025, according to Eurostat, among EU countries, Germany (11.7%), France (11.5%), Austria, and Sweden (both 11.2%) had the highest current healthcare expenditure relative to GDP in 2023.

- Overall, the consistently high healthcare spending across Switzerland, France, Italy, and Germany creates a financially and structurally supportive ecosystem for widespread CPAP adoption. Strong insurance coverage, government-backed reimbursement systems, and advanced hospital and sleep-care infrastructure ensure that diagnosis is followed by timely access to therapy. As sleep apnea is increasingly treated as a critical chronic condition rather than a lifestyle disorder, well-funded healthcare systems enable physicians to prescribe CPAP with confidence and patients to adhere to long-term treatment. This reduces cost sensitivity, accelerates technology uptake, and sustains recurring demand for CPAP devices and accessories, reinforcing steady market growth across these mature European healthcare systems

Restraints/Challenges

“High Device & Accessory Costs”

- High device and accessory costs significantly hamper demand for CPAP devices in Switzerland, France, Italy, and Germany by creating financial barriers that deter both patients and healthcare providers. Even in countries with relatively strong healthcare systems, expensive CPAP machines and the ongoing cost of accessories such as masks, tubing, and filters can make individuals reluctant to commit to treatment, particularly if insurance coverage is limited or reimbursement processes are complex. High upfront costs may lead patients to delay or forgo purchasing a CPAP device, especially those who are asymptomatic or perceive their sleep issues as non-urgent.

- Additionally, healthcare providers may face resistance when recommending long-term therapy due to concerns about patients’ ability to afford necessary replacements and upgrades. This results in lower adherence rates and reduced overall market penetration. Ultimately, when the economic burden of acquiring and maintaining CPAP equipment outweighs perceived benefits, demand softens, slowing market growth even in affluent healthcare markets.

- In December 2025, according to Sleep Doctor Holdings, LLC, the cost of a CPAP machine can range anywhere from USD 500 to USD 1,000 or more, with prices generally rising for CPAP machines with more advanced features. This is projected to hamper demand by increasing out-of-pocket costs for patients, particularly those without full insurance coverage.

- In December 2025, according to Sleep Doctor Holdings, LLC, CPAP air filters typically cost USD 5 or less per filter, depending on the type of machine. Air filters should be replaced monthly. Standard tubing may range from USD 5 to USD 35, and heated options are more expensive, ranging from USD 30 to USD 75. Tubing should be replaced every three months. Headgear and masks generally cost between USD 50 and USD 200, depending on the design. These components should be replaced every six months. This continuous cost is projected to hinder the market growth.

- Overall, high device and accessory costs remain a meaningful restraint on CPAP adoption across Switzerland, France, Italy, and Germany, even within well-funded healthcare systems. Large upfront investments combined with frequent replacement of masks, tubing, and filters increase the lifetime cost of therapy, making many patients hesitant to initiate or continue treatment. When reimbursement is partial or administratively complex, out-of-pocket expenses further discourage long-term adherence. This financial burden also makes clinicians more cautious when prescribing CPAP for mild or early-stage cases. As a result, despite strong clinical need, pricing pressure limits market penetration and slows the pace of CPAP device uptake across these mature European markets

Switzerland, France, Italy, and Germany CPAP Devices Market Scope

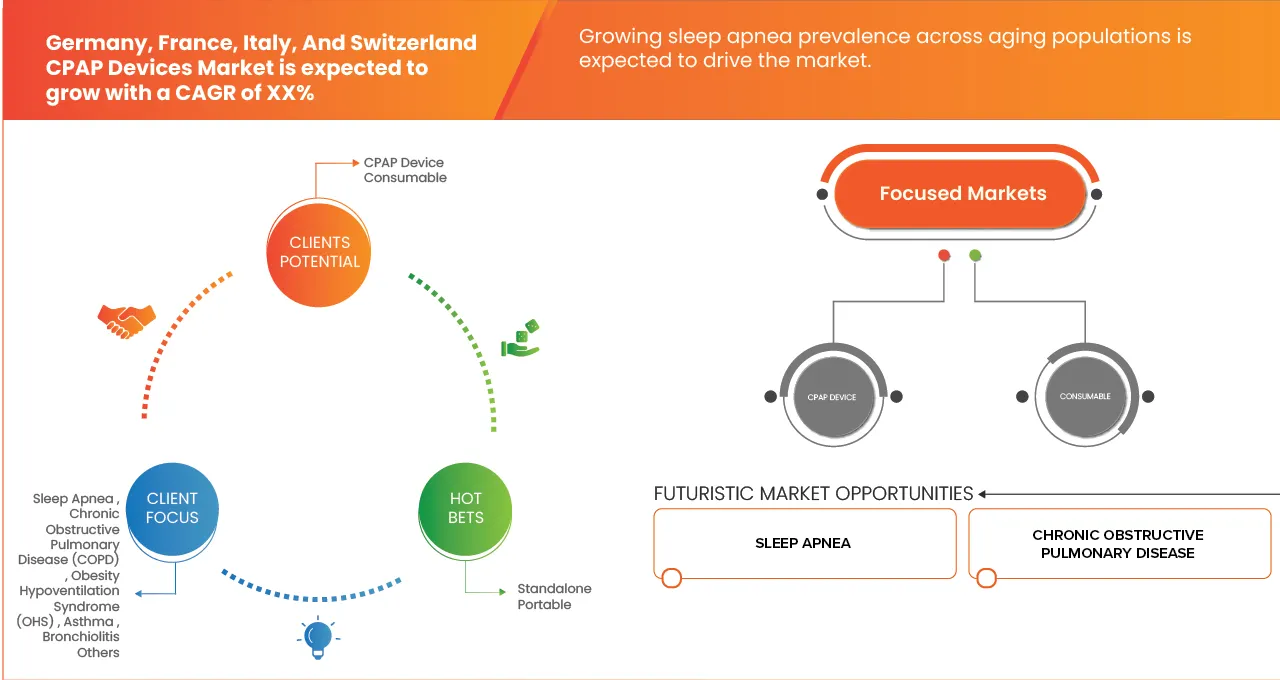

Germany, France, Italy, and Switzerland CPAP Devices market is categorized into five notable segments which are based on Product Type, Application Area, Modality, End User, Distribution Channel.

- By Product Type

On the basis of Product Type, Germany, France, Italy, and Switzerland CPAP Devices market is segmented into CPAP Device, Consumable. In 2026, the CPAP Device segment is expected to dominate the market with a 62.52% market share, driven by widespread adoption across hospitals, sleep clinics, community healthcare centers, and home-care settings. Strong replacement demand for aging devices, expanding diagnosis rates of obstructive sleep apnea, and the growing preference for portable, compact, and user-friendly CPAP systems are reinforcing the segment’s dominant position. Continuous innovation in pressure delivery algorithms, noise reduction, humidification, and digital compliance monitoring further supports sustained demand.

The Consumable segment is the fastest-growing in the Switzerland, France, Italy, and Germany CPAP Devices Market, with a CAGR of 5.9%, driven by recurring demand for masks, tubing, filters, headgear, and humidifier chambers, increasing long-term therapy adherence, and the rising shift toward home-based sleep apnea management. Expansion of direct-to-consumer sales, e-pharmacies, subscription-based replacement models, and retail distribution networks, along with ongoing improvements in mask comfort, durability, and material quality, is expected to further accelerate adoption across the region.

- By Application Area

On the basis of Application Area, the Germany, France, Italy, and Switzerland CPAP Devices market is segmented into Sleep Apnea, Chronic Obstructive Pulmonary Disease (COPD), Obesity Hypoventilation Syndrome (OHS), Asthma, Bronchiolitis, Others. In 2026, the Sleep Apnea segment is expected to dominate with a 84.52% market share, driven by the high prevalence of obstructive sleep apnea (OSA) and the widespread use of CPAP therapy as the first-line treatment. Strong adoption across hospitals, sleep clinics, specialized respiratory care centers, and home-care settings, along with proven clinical efficacy, long-term therapy requirements, and established reimbursement coverage, continues to support the segment’s dominance.

The Sleep Apnea segment is the fastest-growing segment in the Switzerland, France, Italy, and Germany CPAP Devices Market, with a CAGR of 5.7%, driven by rising diagnosis rates of sleep-disordered breathing, increasing awareness of the long-term cardiovascular and metabolic risks associated with untreated OSA, and the growing preference for portable, easy-to-use, and digitally enabled CPAP devices for home-based therapy. The integration of remote monitoring, cloud-based compliance tracking, and telemedicine-supported sleep care, along with expanding access through home healthcare providers and online distribution channels, is expected to further accelerate adoption across key regional markets.

- By Modality

On the basis of Modality, the Germany, France, Italy, and Switzerland CPAP Devices market is segmented into Standalone, Portable. In 2026, the Standalone segment is expected to dominate the market with 86.09% market share, driven by its widespread use for long-term, nightly sleep apnea therapy in both clinical and home-care settings. Standalone CPAP devices offer stable pressure delivery, advanced humidification, enhanced comfort features, and higher durability, making them well suited for continuous use. Their relatively lower cost per therapy cycle, ease of maintenance, and strong adoption across hospitals, sleep clinics, and residential home-care environments contribute to the segment’s leading position

Portable is the fastest-growing segment with a CAGR of 6.0% in the Switzerland, France, Italy, and Germany CPAP Devices Market driven by rising demand for lightweight, travel-friendly, and compact CPAP solutions, particularly among working professionals, frequent travelers, and patients requiring therapy continuity outside the home. Increasing preference for battery-operated and USB-compatible devices, along with the integration of mobile connectivity, remote compliance tracking, and telemedicine-supported sleep care, is further accelerating adoption across key regional markets.

- By End User

On the basis of End User, the Germany, France, Italy, and Switzerland CPAP Devices market is segmented into Home Care, Hospitals, Private Clinics, Others. In 2026, the Home Care segment is expected to dominate the market with 65.52% market share, driven by growing shift toward home-based management of sleep apnea and other chronic respiratory conditions. CPAP therapy in home-care settings offers greater patient convenience, improved therapy adherence, and long-term cost efficiency, supporting widespread adoption. Increased availability of user-friendly, digitally enabled CPAP devices, along with strong reimbursement support and expanding home healthcare services, continues to reinforce the segment’s leadership.

Home Care is the fastest-growing segment with CAGR of 5.9% in the Switzerland, France, Italy, and Germany CPAP Devices Market driven by rising diagnosis rates of obstructive sleep apnea, an aging population, and increasing preference for non-institutional, continuous therapy solutions. Advancements in remote patient monitoring, cloud-based compliance tracking, and telemedicine-supported sleep care, combined with the expansion of direct-to-consumer sales, e-pharmacies, and homecare provider networks, are further accelerating adoption across key regional markets.

- By Distribution Channel

On the basis of Distribution channel, the Germany, France, Italy, and Switzerland CPAP Devices Milk market is segmented into Direct Tender, Retail Sales, Others. In 2026, the Direct Tender segment is expected to dominate the market with 59.56% market share, driven by large-volume procurement by public hospitals, sleep clinics, and government-supported healthcare institutions. Direct tender mechanisms enable cost efficiency, standardized device deployment, and long-term supply contracts, making them the preferred channel for institutional CPAP procurement. Strong relationships between manufacturers, healthcare authorities, and group purchasing organizations, along with bundled offerings that include devices, consumables, and service contracts, continue to reinforce the segment’s leadership.

Retail Sales is the fastest-growing segment with CAGR of 5.9% in the Switzerland, France, Italy, and Germany CPAP Devices Market driven by increasing shift toward home-based sleep apnea management, rising patient awareness, and greater availability of CPAP devices through pharmacies, specialty medical equipment stores, e-commerce platforms, and homecare providers. Expansion of direct-to-consumer models, improved reimbursement clarity, and the availability of user-friendly, portable CPAP systems are further accelerating adoption across key regional markets.

Switzerland, Frnace, Italy, and Germany CPAP devices Market Regional Analysis

- Germany is expected to dominate the CPAP devices Market with the largest revenue share of 42.28% in 2026, supported by substantial investments in healthcare infrastructure, strong domestic diagnostic manufacturing capabilities, and a well-established point-of-care testing ecosystem.

- High awareness of preventive healthcare, increasing demand for rapid and reliable diagnostics, and broad availability of RDTs across hospitals, clinics, laboratories, pharmacies, and home-care channels continue to strengthen Germany’s leadership within the regional market.

France CPAP devices Market Insight

The France CPAP devices market is experiencing steady growth, driven by increasing awareness of sleep-related disorders, rising diagnosis rates of obstructive sleep apnea (OSA), and a well-established healthcare and reimbursement infrastructure. Growing preference for home-based sleep apnea management, supported by favorable insurance coverage and strong home healthcare networks, is significantly improving patient access and long-term therapy adherence. Widespread availability of CPAP devices through hospitals, sleep clinics, pharmacies, specialized homecare providers, and online channels is further supporting adoption. In addition, increasing integration of digital monitoring, telemedicine-supported sleep care, and connected CPAP platforms continues to strengthen France’s position within the European CPAP devices market.

Italy CPAP devices Market Insight

The Italy CPAP devices market is expected to expand steadily, supported by rising healthcare awareness, increasing prevalence of sleep apnea linked to aging and obesity, and gradual improvements in diagnostic and respiratory care access. Growing adoption of home-based CPAP therapy, along with expanding private sleep clinics and respiratory care providers, is contributing to market growth. The increasing presence of e-pharmacy platforms, direct-to-consumer sales models, and homecare service providers is improving device accessibility, particularly in urban and semi-urban areas. Furthermore, rising demand for affordable, reliable, and easy-to-use CPAP systems, combined with incremental advancements in device comfort, portability, and digital compliance tracking, is supporting sustained market development across Italy.

The Major Market Leaders Operating in the Market Are:

- ResMed Inc. (US.)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Koninklijke Philips N.V. (Netherlands)

- GE Healthcare (U.S.)

- Hamilton Medical (Switzerland)

- Nareena Lifesciences Private Limited (India)

- BMC Medical Co., Ltd. (China)

- Wellell Inc. (Taiwan)

- Fritz Stephan GmbH (Germany)

- Vygon (France)

- Löwenstein Medical SE & Co. KG (Germany)

- SOMNOmedics AG (Germany)

- CVR Medical Supply (Germany)

- Kranz GmbH (Germany)

- ECUMED GmbH (Germany)

- Boppel.Med, (Germany)

- Narang Medical Limited (India)

- Heyer Medical AG (Germany)

- Hunan Beyond Medical Technology Co., Ltd. (China)

- Nihon Kohden Corporation (Japan)

- WEINMANN Emergency Medical Technology (Germany)

- Sefam (France)

Latest Developments in Switzerland, France, Italy, and Germany CPAP Devices

- In September 2025, SOMNOmedics AG formed a strategic partnership with Cognision to integrate its advanced polysomnography (PSG) systems into pharmaceutical sponsored clinical trials, expanding use of their sleep architecture measurement technology in regulated research settings.

- In July 2024, WEINMANN Emergency released software update 3.9 for its MEDUCORE Standard² monitor/defibrillator, introducing a range of enhancements to improve usability, performance, and connectivity. The update enables users to configure Wi Fi settings directly on the device, adds support for Indonesian and Romanian languages, and supports automatic daylight saving time adjustments with central synchronization via WEINMANN Connect. Additional upgrades include faster session archive access, improved user guidance for exiting AED mode, automatic detection of SpO₂ cable issues, and automatic uploading of service data for newly registered devices, all designed to streamline operation and support reliable emergency care.

- In March 2022, Vygon, a specialist single-use medical devices group, announced the acquisition of Macatt Medica, a distribution company located in Lima, Peru. The company distributes the majority of Vygon’s products in Peru, including a wide range of enteral nutrition products.

- In September 2022, Sefam Medical introduced a new approach to sleep apnea treatment with the Sefam S.Box by Starck, combining advanced CPAP therapy with digital connectivity and patient-centric design. The platform integrates wireless connectivity and companion apps for patients and clinicians, enabling real-time monitoring of therapy adherence, sleep quality, and treatment effectiveness. By supporting remote follow-up, personalized care, and improved patient engagement, the S.Box aims to enhance therapy outcomes while reducing healthcare burden and overall treatment costs.

- In December 2025, ResMed received U.S. FDA clearance for Personalized Therapy Comfort Settings (PTCS), to be marketed as Smart Comfort, the first AI enabled digital medical device designed to recommend personalized comfort settings for CPAP therapy to help people with obstructive sleep apnea start and stay on treatment. Smart Comfort uses machine learning algorithms trained on over 100 million nights of real world sleep data to tailor settings such as pressure ramp and exhale relief for individual users of AirSense 11 devices through the myAir app, and will launch in early 2026 with a phased U.S. rollout. This clearance reinforces ResMed’s focus on data driven, personalized sleep health solutions that improve comfort and adherence.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 OPPORTUNITY MAP ANALYSIS

4.2.1 INTRODUCTION

4.2.2 HEALTHCARE EXPENDITURE

4.2.3 CAPITAL EXPENDITURE

4.2.4 CAPEX TRENDS

4.2.5 CAPEX ALLOCATION

4.2.6 FUNDING SOURCES

4.2.7 INDUSTRY BENCHMARKS

4.2.8 HEALTHCARE SPENDING AS RATIO OF OVERALL GDP

4.2.9 HEALTHCARE SYSTEM STRUCTURE

4.2.10 GOVERNMENT POLICIES

4.2.11 ECONOMIC DEVELOPMENT

4.3 INDUSTRY INSIGHTS

4.3.1 MICRO AND MACRO ECONOMIC FACTORS

4.3.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3.3 KEY PRICING STRATEGIES

4.3.4 INTERVIEWS WITH SPECIALISTS

4.3.5 ANALYSIS AND RECOMMENDATIONS

4.4 COST ANALYSIS BREAKDOWN

4.4.1 INTRODUCTION

4.4.2 MARKET COST STRUCTURE OVERVIEW

4.4.3 DEVICE ACQUISITION COST ANALYSIS

4.4.4 MASK AND CONSUMABLES COST DYNAMICS

4.4.5 SERVICE AND FOLLOW-UP COST ASSESSMENT

4.4.6 REIMBURSEMENT IMPACT ON NET COST

4.4.7 TOTAL COST OF OWNERSHIP (TCO) ANALYSIS

4.4.8 STRATEGIC MARKET IMPLICATIONS

4.4.9 CONCLUSION

4.5 OPPORTUNITY MAP ANALYSIS

4.5.1 INTRODUCTION

4.5.2 OPPORTUNITY LANDSCAPE ACROSS DISEASE AWARENESS AND DIAGNOSIS PATHWAYS

4.5.3 OPPORTUNITY MAPPING BY THERAPY ADHERENCE AND LONG-TERM COMPLIANCE GAPS

4.5.4 OPPORTUNITY MAPPING BY HOMECARE AND DECENTRALIZED CARE EXPANSION

4.5.5 OPPORTUNITY MAPPING BY TECHNOLOGY DIFFERENTIATION AND DIGITAL INTEGRATION

4.5.6 OPPORTUNITY MAPPING BY REIMBURSEMENT EVOLUTION AND VALUE-BASED CARE

4.5.7 CONCLUSION

4.6 REIMBURSEMENT FRAMEWORK FOR CPAP DEVICES

4.6.1 INTRODUCTION

4.6.2 ELIGIBILITY CRITERIA AND DIAGNOSTIC PATHWAYS

4.6.3 DEVICE COVERAGE STRUCTURE AND COST COMPONENTS

4.6.4 ROLE OF HEALTHCARE PROVIDERS AND DISTRIBUTION CHANNELS

4.6.5 ADHERENCE MONITORING AND CONDITIONAL REIMBURSEMENT

4.6.6 PATIENT COST SHARING AND FINANCIAL RESPONSIBILITY

4.6.7 CONCLUSION

4.7 SUPPLY CHAIN ECOSYSTEM

4.7.1 PROMINENT COMPANIES

4.7.2 SMALL & MEDIUM SIZE COMPANIES

4.7.3 END USERS

4.8 TECHNOLOGY ROADMAP

4.8.1 INTRODUCTION

4.8.2 SHORT-TERM ROADMAP (2024–2026): CONNECTIVITY, COMFORT, AND COMPLIANCE

4.8.2.1 CORE TECHNOLOGY TRENDS

4.8.2.2 DIGITAL CONNECTIVITY INTEGRATION

4.8.2.3 COUNTRY DIFFERENTIATION

4.8.3 MID-TERM ROADMAP (2026–2029): AI-DRIVEN THERAPY OPTIMIZATION AND ECOSYSTEM INTEGRATION

4.8.3.1 ARTIFICIAL INTELLIGENCE AND PREDICTIVE ANALYTICS

4.8.3.2 INTEGRATION WITH DIGITAL HEALTH ECOSYSTEMS

4.8.3.3 REMOTE CARE AND HOMECARE AUTOMATION

4.8.3.4 COUNTRY DIFFERENTIATION

4.8.4 LONG-TERM ROADMAP (2029–2035): PREVENTIVE SLEEP MEDICINE AND THERAPY CONVERGENCE

4.8.4.1 THERAPY CONVERGENCE AND HYBRID DEVICES

4.8.4.2 PREDICTIVE POPULATION HEALTH APPLICATIONS

4.8.4.3 MINIATURIZATION AND LIFESTYLE INTEGRATION

4.8.5 REGULATORY AND REIMBURSEMENT INFLUENCE ON THE ROADMAP

4.8.6 STRATEGIC IMPLICATIONS FOR MANUFACTURERS

4.8.7 CONCLUSION

4.9 COMPANY EVALUATION QUADRANT

4.1 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.10.1 INTRODUCTION

4.10.2 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.10.2.1 JOINT VENTURES

4.10.2.2 MERGERS AND ACQUISITIONS

4.10.2.3 LICENSING AND PARTNERSHIPS

4.10.2.4 TECHNOLOGY COLLABORATIONS

4.10.2.5 STRATEGIC DIVESTMENTS

4.10.3 NUMBER OF PRODUCTS IN DEVELOPMENT

4.10.4 STAGE OF DEVELOPMENT

4.10.5 TIMELINES AND MILESTONES

4.10.6 INNOVATION STRATEGIES AND METHODOLOGIES

4.10.7 RISK ASSESSMENT AND MITIGATION

4.10.8 FUTURE OUTLOOK

5 SALES VOLUME PER PLAYER IN THE SWITZERLAND, FRANCE, ITALY AND GERMANY (UNIT)

6 REGULATORY COMPLIANCE ANALYSIS

6.1 INTRODUCTION

6.2 REGULATORY AUTHORITIES

6.3 REGULATORY CLASSIFICATIONS

6.4 REGULATORY SUBMISSIONS

6.5 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF SLEEP APNEA AND COPD

7.1.2 HIGH HEALTHCARE SPENDING

7.1.3 RISING AGING DEMOGRAPHICS

7.2 RESTRAINTS

7.2.1 HIGH DEVICE & ACCESSORY COSTS

7.2.2 REGULATORY COMPLEXITY & APPROVAL DELAYS

7.3 OPPORTUNITIES

7.3.1 EXPANDING TELEMEDICINE & REMOTE MONITORING

7.3.2 GROWING HOMECARE & OUTPATIENT CLINICS NETWORK

7.3.3 TECHNOLOGICAL ADVANCEMENTS IN CPAP DEVICES

7.4 CHALLENGES

7.4.1 SUPPLY CHAIN & COMPONENT SHORTAGES

7.4.2 PATIENT NON-ADHERENCE

8 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 CPAP DEVICE

8.2.1 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICE IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.2.1.1 AUTO-ADJUSTING CPAP DEVICES

8.2.1.1.1 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2018-2033 (USD THOUSAND)

8.2.1.1.1.1 AUTOMATIC

8.2.1.1.1.2 MANUAL

8.2.1.2 FIXED PRESSURE CPAP DEVICES

8.2.1.3 TRAVEL CPAP DEVICES

8.3 CONSUMABLE

8.3.1 GERMANY, FRANCE, ITALY, AND SWITZERLAND CONSUMABLE IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.3.1.1 CPAP MASK

8.3.1.1.1 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP MASK IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.3.1.1.1.1 NASAL MASKS

8.3.1.1.1.2 FULL-FACE MASKS

8.3.1.1.1.3 NASAL PILLOW MASKS

8.3.1.2 CPAP HOSES

8.3.1.3 HUMIDIFIER WATER CHAMBERS

8.3.1.4 CPAP FILTERS

8.3.1.4.1 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP FILTERS IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.3.1.4.1.1 DISPOSABLE FILTERS

8.3.1.4.1.2 REUSABLE FILTERS

8.3.1.5 CPAP MOTORS

8.3.1.6 CHIN STRAPS

8.3.1.7 OTHERS

9 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY APPLICATION AREA

9.1 OVERVIEW

9.2 SLEEP APNEA

9.2.1 GERMANY, FRANCE, ITALY, AND SWITZERLAND SLEEP APNEA IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.2.1.1 OBSTRUCTIVE SLEEP APNEA

9.2.1.2 CENTRAL SLEEP APENA

9.2.1.3 MIXED SLEEP APENA

9.3 CHRONIC OBSTRUCTIVE PULMONARY DISEASE (COPD)

9.4 OBESITY HYPOVENTILATION SYNDROME (OHS)

9.5 ASTHMA

9.6 BRONCHIOLITIS

9.7 OTHERS

10 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY MODALITY

10.1 OVERVIEW

10.2 STANDALONE

10.3 PORTABLE

11 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY END USER

11.1 OVERVIEW

11.2 HOME CARE

11.2.1 SWITZERLAND, FRANCE, ITALY, AND GERMANY HOME CARE IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

11.2.1.1 STANDALONE

11.2.1.2 PORTABLE

11.3 HOSPITALS

11.3.1 SWITZERLAND, FRANCE, ITALY, AND GERMANY HOSPITALS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

11.3.1.1 STANDALONE

11.3.1.2 PORTABLE

11.4 PRIVATE CLINICS

11.4.1 SWITZERLAND, FRANCE, ITALY, AND GERMANY PRIVATE CLINICS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

11.4.1.1 STANDALONE

11.4.1.2 PORTABLE

11.5 OTHERS

11.5.1 SWITZERLAND, FRANCE, ITALY, AND GERMANY OTHERS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

11.5.1.1 STANDALONE

11.5.1.2 PORTABLE

12 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.3.1 GERMANY, FRANCE, ITALY, AND SWITZERLAND RETAIL SALES IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.3.1.1 OFFLINE

12.3.1.2 ONLINE

12.4 OTHERS

13 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET, BY COUNTRY

13.1 OVERVIEW

13.2 GERMANY

13.3 FRANCE

13.4 ITALY

13.5 SWITZERLAND

14 GERMANY, SWITZERLAND, FRANCE, ITALY CPAP DEVICES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GERMANY, SWITZERLAND, FRANCE, ITALY

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 RESMED

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT UPDATES

16.2 FISHER & PAYKEL HEALTHCARE LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 KONINKLIJKE PHILIPS N.V.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 GE HEALTHCARE

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 WELLELL INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 BMC MEDICAL CO., LTD

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 BOPPEL.MED

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 CVR MEDICAL SUPPLY.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ECUMED GMBH.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 FRITZ STEPHAN GMBH

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 HAMILTON MEDICAL

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 HEYER MEDICAL AG

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 HUNAN BEYOND MEDICAL TECHNOLOGY CO., LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 KRANZ GMBH.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 LÖWENSTEIN MEDICAL SE & CO. KG.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 NARANG MEDICAL LIMITED

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 NAREENA LIFESCIENCES PVT.LIMITED

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 NIHON KOHDEN CORPORATION

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT UPDATES

16.19 SEFAM

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT UPDATES

16.2 SOMNOMEDICS AG.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 VYGON

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 WEINMANN EMERGENCY MEDICAL TECHNOLOGY GMBH

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 STRATEGIC OPPORTUNITY HEAT MAP FOR CPAP DEVICES MARKET IN SWITZERLAND, FRANCE, ITALY, AND GERMANY

TABLE 2 COUNTRY-SPECIFIC STRATEGIC OPPORTUNITY MATRIX FOR CPAP DEVICES MARKET

TABLE 3 COUNTRY-WISE REIMBURSEMENT COMPARISON (CPAP DEVICES)

TABLE 4 REGULATORY–REIMBURSEMENT CROSS-IMPACT ANALYSIS

TABLE 5 PAYER-CENTRIC RISK AND OPPORTUNITY MATRIX

TABLE 6 COUNTRY-WISE REGULATORY REQUIREMENTS FOR CPAP DEVICES

TABLE 7 REGULATORY RISK HEAT MAP FOR CPAP MANUFACTURERS

TABLE 8 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICE IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 11 GERMANY, FRANCE, ITALY, AND SWITZERLAND CONSUMABLE IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP MASK IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP FILTERS IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 15 GERMANY, FRANCE, ITALY, AND SWITZERLAND SLEEP APNEA IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 17 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 18 SWITZERLAND, FRANCE, ITALY, AND GERMANY HOME CARE IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 19 SWITZERLAND, FRANCE, ITALY, AND GERMANY HOSPITALS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 20 SWITZERLAND, FRANCE, ITALY, AND GERMANY PRIVATE CLINICS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 21 SWITZERLAND, FRANCE, ITALY, AND GERMANY OTHERS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 22 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 23 GERMANY, FRANCE, ITALY, AND SWITZERLAND RETAIL SALES IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 25 GERMANY CPAP DEVICES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 GERMANY CPAP DEVICE IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 GERMANY CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 28 GERMANY CONSUMABLE IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 GERMANY CPAP MASK IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 GERMANY CPAP FILTERS IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 GERMANY CPAP DEVICES MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 32 GERMANY SLEEP APNEA IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 GERMANY CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 34 GERMANY CPAP DEVICES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 35 GERMANY HOME CARE IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 36 GERMANY HOSPITALS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 37 GERMANY PRIVATE CLINICS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 38 GERMANY OTHERS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 39 GERMANY CPAP DEVICES MARKET, BY DISTRIBUTION CHANNEL , 2018-2033 (USD THOUSAND)

TABLE 40 GERMANY RETAIL SALES IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 FRANCE CPAP DEVICES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 FRANCE CPAP DEVICE IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 FRANCE CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 44 FRANCE CONSUMABLE IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 FRANCE CPAP MASK IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 FRANCE CPAP FILTERS IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 FRANCE CPAP DEVICES MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 48 FRANCE SLEEP APNEA IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 49 FRANCE CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 50 FRANCE CPAP DEVICES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 51 FRANCE HOME CARE IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 52 FRANCE HOSPITALS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 53 FRANCE PRIVATE CLINICS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 54 FRANCE OTHERS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 55 FRANCE CPAP DEVICES MARKET, BY DISTRIBUTION CHANNEL , 2018-2033 (USD THOUSAND)

TABLE 56 FRANCE RETAIL SALES IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 ITALY CPAP DEVICES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 ITALY CPAP DEVICE IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 ITALY CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 60 ITALY CONSUMABLE IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 ITALY CPAP MASK IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 ITALY CPAP FILTERS IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 ITALY CPAP DEVICES MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 64 ITALY SLEEP APNEA IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 ITALY CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 66 ITALY CPAP DEVICES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 67 ITALY HOME CARE IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 68 ITALY HOSPITALS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 69 ITALY PRIVATE CLINICS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 70 ITALY OTHERS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 71 ITALY CPAP DEVICES MARKET, BY DISTRIBUTION CHANNEL , 2018-2033 (USD THOUSAND)

TABLE 72 ITALY RETAIL SALES IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 SWITZERLAND CPAP DEVICES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 SWITZERLAND CPAP DEVICE IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 SWITZERLAND CPAP DEVICE IN CPAP DEVICES MARKET, BY AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 76 SWITZERLAND CONSUMABLE IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 SWITZERLAND CPAP MASK IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 SWITZERLAND CPAP FILTERS IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 SWITZERLAND CPAP DEVICES MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 80 SWITZERLAND SLEEP APNEA IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 SWITZERLAND CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 82 SWITZERLAND CPAP DEVICES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 83 SWITZERLAND HOME CARE IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 84 SWITZERLAND HOSPITALS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 85 SWITZERLAND PRIVATE CLINICS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 86 SWITZERLAND OTHERS IN CPAP DEVICES MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 87 SWITZERLAND CPAP DEVICES MARKET, BY DISTRIBUTION CHANNEL , 2018-2033 (USD THOUSAND)

TABLE 88 SWITZERLAND RETAIL SALES IN CPAP DEVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET: SEGMENTATION

FIGURE 2 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET: DROC ANALYSIS

FIGURE 4 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 5 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 TWO SEGMENT COMPRISE THE GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET, BY PRODUCT TYPE (2025)

FIGURE 13 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET: SEGMENTATION

FIGURE 14 RISING PREVALENCE OF SLEEP APNEA AND COPD EXPECTED TO DRIVE THE GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 15 CPAP DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET IN 2026 & 2033

FIGURE 16 DRIVER, RESTRAINTS, OPPORTUNITIES, CHALLENGES ANALYSIS OF SWITZERLAND, FRANCE, ITALY AND GERMANY CPAP DEVICES MARKET

FIGURE 17 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY PRODUCT TYPE, 2025

FIGURE 18 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET: BY PRODUCT TYPE, 2026-2033 (USD THOUSAND)

FIGURE 19 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET: BY PRODUCT TYPE, CAGR (2026-2033)

FIGURE 20 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 21 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY APPLICATION AREA, 2025

FIGURE 22 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET: BY APPLICATION AREA, 2026-2033 (USD THOUSAND)

FIGURE 23 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET: BY APPLICATION AREA, CAGR (2026-2033)

FIGURE 24 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET: BY APPLICATION AREA, LIFELINE CURVE

FIGURE 25 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY MODALITY, 2025

FIGURE 26 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY MODALITY, 2026-2033 (USD THOUSAND)

FIGURE 27 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY MODALITY, CAGR (2026-2033)

FIGURE 28 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY MODALITY, LIFELINE CURVE

FIGURE 29 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY END USER, 2025

FIGURE 30 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY END USER, 2026-2033 (USD THOUSAND)

FIGURE 31 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY END USER, CAGR (2026-2033)

FIGURE 32 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY END USER, LIFELINE CURVE

FIGURE 33 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2025

FIGURE 34 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2026-2033 (USD THOUSAND)

FIGURE 35 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY DISTRIBUTION CHANNEL, CAGR (2026-2033)

FIGURE 36 SWITZERLAND, FRANCE, ITALY, AND GERMANY CPAP DEVICES MARKET, BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 GERMANY, FRANCE, ITALY, AND SWITZERLAND CPAP DEVICES MARKET: SNAPSHOT (2025)

FIGURE 38 GERMANY, SWITZERLAND, FRANCE, ITALY CPAP DEVICES MARKET: COMPANY SHARE 2025 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.