Switzerland Industrial Gases Market

Market Size in USD Million

CAGR :

%

USD

381.37 Million

USD

489.34 Million

2024

2032

USD

381.37 Million

USD

489.34 Million

2024

2032

| 2025 –2032 | |

| USD 381.37 Million | |

| USD 489.34 Million | |

|

|

|

|

Industrial Gases Market Size

- The Switzerland industrial gases market was valued at USD 381.37 million in 2024 and is expected to reach 489.34 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.3%, primarily driven by the accelerated digitalization across industries, and rising cybersecurity threats and data breaches

- This growth is driven by factors such as rising demand for industrial oxygen across various applications

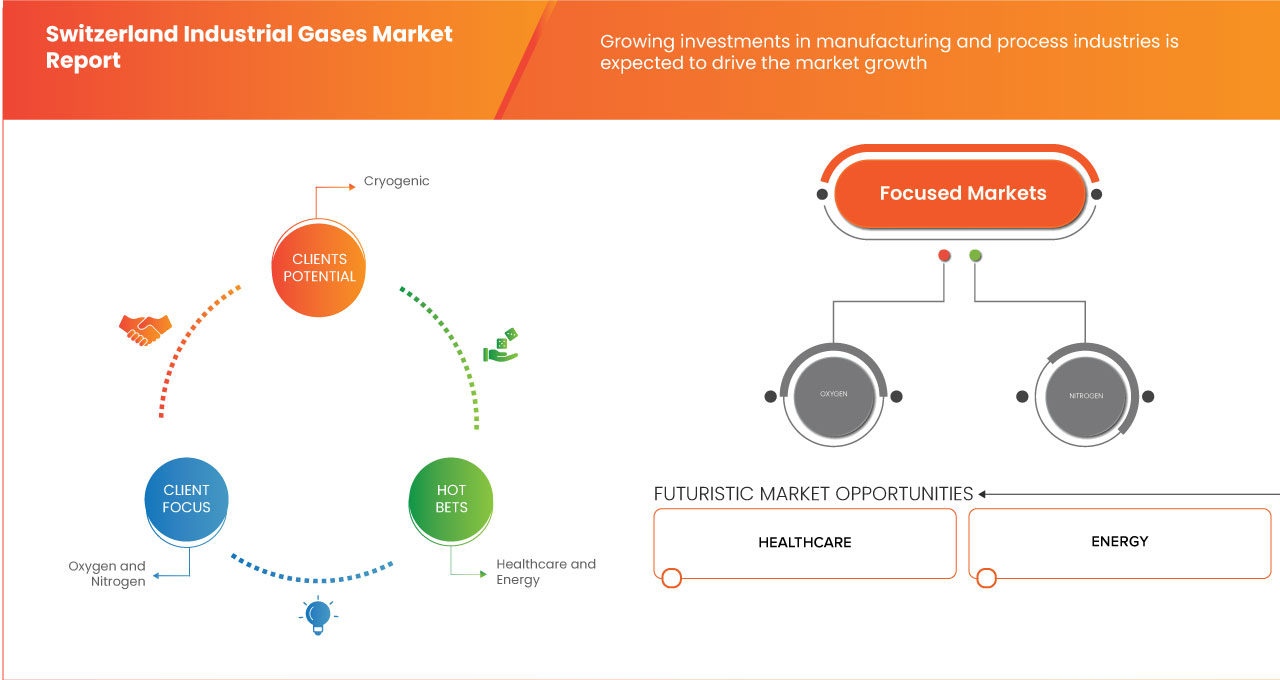

Switzerland Industrial Gases Market Analysis

- Industrial gases are critical computing systems used across various industries, providing high-performance processing, security, and reliability for complex operations. They are extensively utilized in Banking, Financial Services, and Insurance (BFSI), healthcare, and government sectors

- The growing emphasis on environmental sustainability is also driving demand for industrial oxygen

- For instance, the Swiss Federal Office for the Environment (FOEN) published a report on the country's efforts to meet carbon reduction targets. The report highlighted the role of oxygen in cleaner energy production, particularly in oxy-fuel combustion systems used in power plants

- The increased use of industrial oxygen for efficient energy generation is contributing to Switzerland's environmental goals, and this demand is expected to grow as the country continues to prioritize green technologies

Report Scope and Market Segmentation

|

Attributes |

Switzerland Industrial Gases Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Switzerland industrial gases market Trends

“Increasing Demand for Sustainable and Green Energy Solutions”

- The increasing demand for sustainable and green energy solutions is a significant driver for the market, as the country strives to meet its ambitious environmental goals and transition to a low-carbon economy

- The rise of industrial gases like hydrogen is set to increase significantly as Switzerland scales up its green hydrogen production capacity

- For instance, In June 2024, Synhelion, a Switzerland-based company, inaugurated the world's first demonstration plant for producing solar fuels—a carbon-neutral alternative to fossil fuels. This plant, located in Germany, operates fully and aims to produce 1 million tons of solar fuel annually by 2033. SWISS, the national airline, has partnered with Synhelion to incorporate solar kerosene into its flights, marking a significant step toward sustainable aviation fuels

- As Switzerland continues to prioritize decarbonization and energy sustainability, the demand for industrial gases will continue to rise, positioning the country at the forefront of the green energy revolution in Europe

Switzerland industrial gases market Dynamics

Drivers

“Rising Demand for Industrial Oxygen Across Various Applications”

- The increasing use of industrial oxygen is driven by technological advancements, the expansion of industrial activities, and the growing need for oxygen in medical treatments and environmental solutions

- In healthcare, the rising number of patients requiring respiratory support, particularly due to the aging population and increasing prevalence of chronic respiratory diseases, has significantly boosted the demand for medical oxygen

- Switzerland's advanced manufacturing industry, particularly in sectors like automotive, aerospace, and electronics, is increasingly reliant on industrial gases like oxygen for precision processes

- With an aging population, the push for greener industrial practices, and the ongoing demand for advanced manufacturing processes, the demand for industrial oxygen is expected to continue growing, driving further expansion in Switzerland's industrial gases market

For instance,

- In August 2019, the Swiss Federal Office for the Environment (FOEN) published a report on the country's efforts to meet carbon reduction targets. The report highlighted the role of oxygen in cleaner energy production, particularly in oxy-fuel combustion systems used in power plants. The increased use of industrial oxygen for efficient energy generation is contributing to Switzerland's environmental goals, and this demand is expected to grow as the country continues to prioritize green technologies

- In March 2025, an article published by The Lancet Global Health highlighted the growing need for medical oxygen in Switzerland due to the aging population and the increased incidence of respiratory diseases. The article underscored that healthcare providers are facing increased demand for oxygen therapy, particularly in the context of treating chronic conditions such as COPD and asthma. This demand has led to an uptick in the use of industrial oxygen in both hospitals and home-care settings across Switzerland

Opportunities

“Rising Investment in Clean Energy and Industrial Decarbonization”

- The rising investment in clean energy and industrial decarbonization presents significant opportunities for Switzerland’s industrial gases market

- With growing demand for hydrogen and carbon-reducing technologies, industrial gas companies can leverage innovation and sustainability-driven initiatives to expand their market presence and contribute to Switzerland’s long-term environmental goals

- Switzerland's industrial gases market is set for significant growth due to rising investments in clean energy and industrial decarbonization

- Moreover, Switzerland's strong research ecosystem and technological advancements in cryogenic gas separation and gas recycling are enhancing industrial gas applications

For instance,

- In December 2024, As per Green Hydrogen Organisation, Axpo and partners broke ground on a 2 MW green hydrogen plant in Bürglen, Switzerland. Set to launch in 2026, it will produce 260 tonnes annually, powering Lake Lucerne’s first hydrogen passenger vessel and reducing diesel use by over one million liters with renewable hydropower

- In March 2025, according to Swiss Federal Office of Energy SFOE, in December 2024, Switzerland's Federal Council adopted a national hydrogen strategy, establishing a framework for developing a domestic hydrogen market to achieve net-zero greenhouse gas emissions by 2050. This initiative underscores the anticipated significant role of hydrogen and Power-to-X technologies in Switzerland's energy transition

Restraints/Challenges

“Stringent Regulatory Framework and Compliance Challenges”

- Switzerland has some of the most rigorous environmental and safety regulations in the world, which industrial gas companies must comply with when producing, distributing, and utilizing gases in various sectors, such as healthcare, manufacturing, and energy

- While Switzerland’s strong regulatory environment ensures high levels of safety and environmental protection, it also poses challenges for industrial gas companies

- Strict compliance with environmental, safety, and product approval regulations adds to operational costs, delays product development, and requires continuous investment in technology and safety measures, limiting flexibility and increasing the financial burden for businesses in the industrial gases sector

For instance,

- In November 2024, Switzerland's Federal Council adopted the Climate and Innovation Act, aiming for net-zero greenhouse gas emissions by 2050. This act sets sector-specific targets, including a 50% reduction in industrial emissions by 2040 compared to 1990 levels. To achieve these goals, industrial gas companies must invest in emissions reduction technologies, increasing operational costs

- In May 2024, a study highlighted that the Swiss CO2 Act aims to reduce carbon emissions, which affects industries using gases like carbon dioxide (CO2), such as beverage carbonation and oil and gas operations. As a result, businesses must invest in advanced technologies to mitigate environmental risks, increasing operational costs

- In June 2021, the European Chemicals Agency (ECHA) announced an enforcement project focusing on the compliance of imported products with REACH obligations. This initiative, running from 2023 to 2025, involves increased customs checks on imported products, including industrial gases, necessitating enhanced safety protocols and compliance measures from companies

Industrial Gases Market Scope

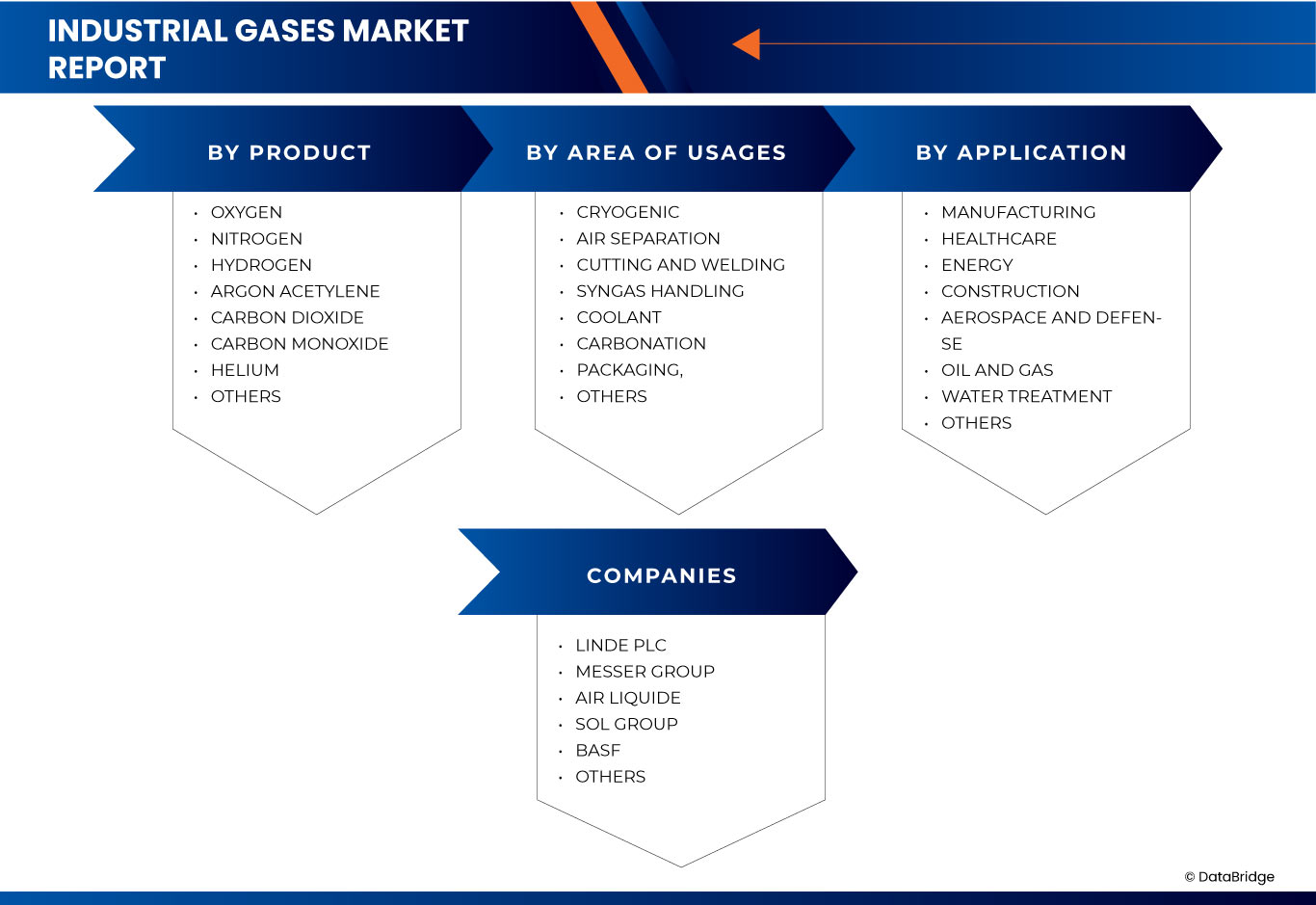

The market is segmented on the basis of product, area of usages, and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Area Of Usages |

|

|

By Application |

|

Industrial Gases Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, local presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Linde PLC (Ireland)

- Messer Group (Germany)

- Air Liquide (France)

- SOL Group (Italy)

- BASF (Germany)

Latest Developments in Switzerland Industrial Gases Market

- In June 2024, Messer SE & CO. KGaA is expanding its industrial gas production capacity in Spain to meet rising demand. The new facilities will enhance the company’s ability to supply a variety of gases, including oxygen, nitrogen, and argon, to industries such as healthcare, food processing, and manufacturing. This expansion supports Messer's commitment to improving supply reliability across Europe

- In November 2023, Messer SE & CO. KGaA has completed the acquisition of its joint venture, Messer Industries, and now GIC is its new strategic partner. This move strengthens Messer’s position in the industrial gases sector, enhancing its capabilities in supply and services. The acquisition reflects Messer's continued expansion and commitment to improving its global market presence

- In July 2022, Messer SE & CO. KGaA focuses on leveraging the potential of industrial gases to create sustainable ecosystems and drive future advancements. The company is committed to using its expertise in gases to contribute to environmental sustainability and future generations' needs, aiming to shape industries and communities in a responsible manner

- In September 2021, Messer SE & CO. KGaA has opened an on-site plant at Steklarna Hrastnik, a glass manufacturer in Slovenia, to supply industrial gases and support the company's operations. This move aims to enhance supply reliability and sustainability for the glass production process

- In November 2024, Air Liquide has announced a new renewable hydrogen production project in partnership with TotalEnergies at the La Mède biorefinery in France. This project will produce 25,000 tonnes of renewable hydrogen per year, using biogenic by-products as feedstock instead of fossil hydrocarbons. The hydrogen will be primarily used for biofuel and Sustainable Aviation Fuel (SAF) production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 DBMR VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.2.6 CONCLUSION

4.3 VENDOR SELECTION CRITERIA

4.3.1 QUALITY AND CONSISTENCY

4.3.2 TECHNICAL EXPERTISE

4.3.3 SUPPLY CHAIN RELIABILITY

4.3.4 COMPLIANCE AND SUSTAINABILITY

4.3.5 COST AND PRICING STRUCTURE

4.3.6 FINANCIAL STABILITY

4.3.7 FLEXIBILITY AND CUSTOMIZATION

4.3.8 RISK MANAGEMENT AND CONTINGENCY PLANS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR INDUSTRIAL OXYGEN ACROSS VARIOUS APPLICATIONS

5.1.2 EXPANDING USE OF INDUSTRIAL GASES IN THE OIL AND GAS INDUSTRY

5.1.3 INCREASING DEMAND FOR SUSTAINABLE AND GREEN ENERGY SOLUTIONS

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATORY FRAMEWORK AND COMPLIANCE CHALLENGES

5.2.2 HIGH OPERATIONAL COSTS DUE TO LABOR AND INFRASTRUCTURE EXPENSES

5.3 OPPORTUNITIES

5.3.1 RISING INVESTMENT IN CLEAN ENERGY AND INDUSTRIAL DECARBONIZATION

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN INDUSTRIAL GAS APPLICATIONS

5.4 CHALLENGES

5.4.1 HIGH INITIAL CAPITAL REQUIREMENT

5.4.2 ENERGY SUPPLY DEPENDENCE AND VULNERABILITY TO MARKET FLUCTUATIONS

6 SWITZERLAND INDUSTRIAL GASES MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 OXYGEN

6.3 NITROGEN

6.4 HYDROGEN

6.5 ARGON

6.6 ACETYLENE

6.7 CARBON DIOXIDE

6.8 CARBON MONOXIDE

6.9 HELIUM

6.1 OTHERS

7 SWITZERLAND INDUSTRIAL GASES MARKET, BY AREA OF USAGES

7.1 OVERVIEW

7.2 CRYOGENIC

7.3 AIR SEPARATION

7.4 CUTTING AND WELDING

7.5 SYNGAS HANDLING

7.6 COOLANT

7.7 CARBONATION

7.8 PACKAGING

7.9 OTHERS

8 SWITZERLAND INDUSTRIAL GASES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 MANUFACTURING

8.3 HEALTHCARE

8.4 ENERGY

8.5 CONSTRUCTION

8.6 AEROSPACE AND DEFENSE

8.7 OIL AND GAS

8.8 WATER TREATMENT

8.9 OTHERS

9 SWITZERLAND INDUSTRIAL GASES MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: U.S.

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 LINDE

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 MESSER SE & CO. KGAA

11.2.1 COMPANY SNAPSHOTS

11.2.2 PRODUCT PORTFOLIO

11.2.3 RECENT DEVELOPMENT/NEWS

11.3 AIR LIQUID

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 SOL GROUP

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 RECENT DEVELOPMENT/NEWS

11.5 BASF

11.5.1 COMPANY SNAPSHOTS

11.5.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Figure

FIGURE 1 SWITZERLAND INDUSTRIAL GASES MARKET

FIGURE 2 SWITZERLAND INDUSTRIAL GASES MARKET: DATA TRIANGULATION

FIGURE 3 SWITZERLAND INDUSTRIAL GASES MARKET: DROC ANALYSIS

FIGURE 4 SWITZERLAND INDUSTRIAL GASES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 SWITZERLAND INDUSTRIAL GASES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SWITZERLAND INDUSTRIAL GASES MARKET: MULTIVARIATE MODELLING

FIGURE 7 SWITZERLAND INDUSTRIAL GASES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SWITZERLAND INDUSTRIAL GASES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SWITZERLAND INDUSTRIAL GASES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 SWITZERLAND INDUSTRIAL GASES MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 NINE SEGMENTS COMPRISE THE SWITZERLAND INDUSTRIAL GASES MARKET, BY PRODUCT (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING DEMAND FOR INDUSTRIAL OXYGEN ACROSS VARIOUS APPLICATIONS IS EXPECTED TO DRIVE THE SWITZERLAND INDUSTRIAL GASES MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 15 THE OXYGEN IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SWITZERLAND INDUSTRIAL GASES MARKET IN 2025 AND 2032

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SWITZERLAND INDUSTRIAL GASES MARKET

FIGURE 20 SWITZERLAND INDUSTRIAL GASES MARKET: BY PRODUCT, 2024

FIGURE 21 SWITZERLAND INDUSTRIAL GASES MARKET: BY AREA OF USAGE, 2024

FIGURE 22 SWITZERLAND INDUSTRIAL GASES MARKET: BY APPLICATION, 2024

FIGURE 23 SWITZERLAND: COMPANY SHARE 2024 (%)

Switzerland Industrial Gases Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Switzerland Industrial Gases Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Switzerland Industrial Gases Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.