Uae Sandwich Panels Market

Market Size in USD Million

CAGR :

%

USD

254.38 Million

USD

414.67 Million

2024

2032

USD

254.38 Million

USD

414.67 Million

2024

2032

| 2025 –2032 | |

| USD 254.38 Million | |

| USD 414.67 Million | |

|

|

|

Sandwich Panels Market Analysis

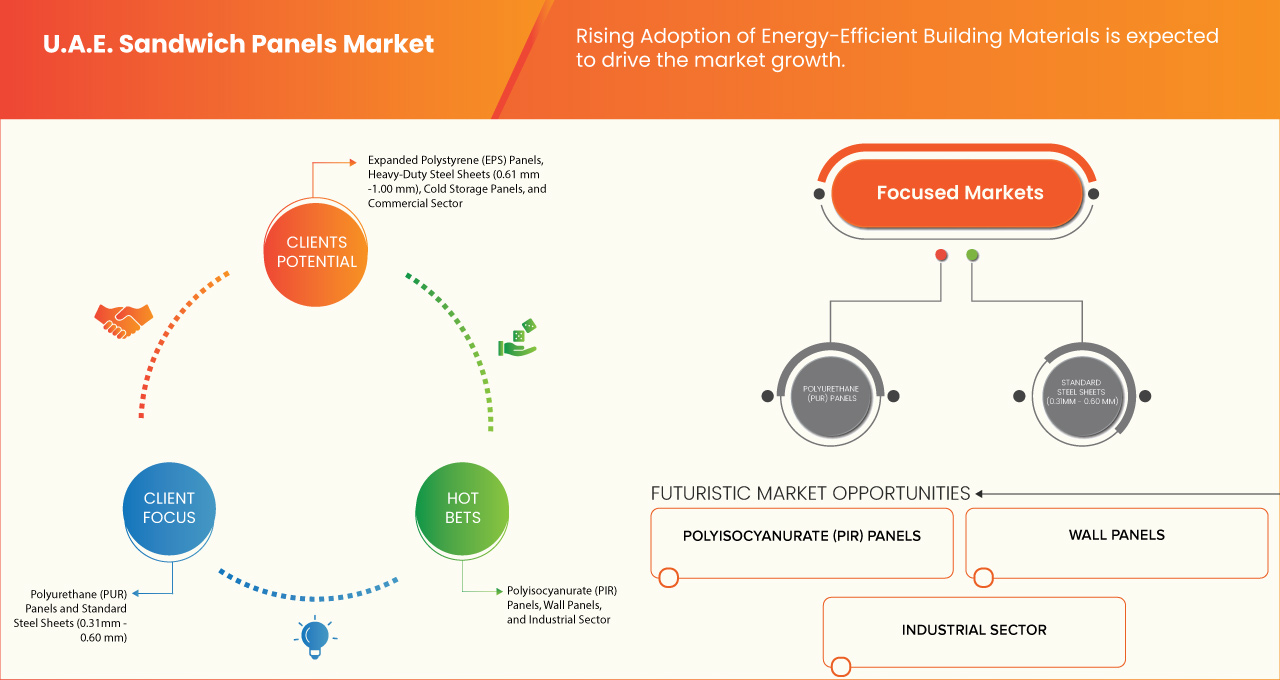

The U.A.E. sandwich panels market is witnessing substantial growth, driven by rising construction activities across residential, commercial, and industrial sectors. The increasing demand for energy-efficient and durable building materials has fueled the adoption of sandwich panels, known for their insulation properties and structural strength. Government initiatives promoting sustainable infrastructure and green building standards further accelerate market expansion. In addition, advancements in manufacturing technologies have improved product quality and cost efficiency, making sandwich panels a preferred choice for developers. With ongoing urbanization and infrastructure projects, the market is expected to experience sustained growth in the coming years.

Sandwich Panels Market Size

U.A.E. sandwich panels market size was valued at USD 414.67 million by 2032 from USD 254.38 million in 2024 growing with a CAGR of 6.4% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Sandwich Panels Market Trends

“Growing Demand for Energy-Efficient Building Solutions"

The U.A.E. sandwich panels market is experiencing a strong shift towards energy-efficient and eco-friendly construction materials. With the increasing emphasis on sustainable building practices, developers are prioritizing sandwich panels that offer superior thermal insulation, reducing energy consumption in residential, commercial, and industrial projects. Government regulations promoting green construction and energy efficiency further drive this trend, encouraging the use of materials that enhance sustainability. Manufacturers are responding by innovating with advanced insulation cores, recyclable materials, and improved fire-resistant properties. As the demand for environmentally responsible construction solutions grows, the market for high-performance sandwich panels is set to expand significantly.

Report Scope and Sandwich Panels Market Segmentation

|

Report Metric |

Sandwich Panels Key Market Insights |

|

Segments Covered |

|

|

Cities |

Dubai, Abu Dhabi, Sharjah, Ras Al Khaimah, Ajman, Fujairah, and Umm Al Quwain |

|

Key Market Players |

Kingspan Group (Ireland), TSSC (Part of Harwal Group of Companies) (U.A.E.), DANA Group of Companies (U.A.E.), Metal N Machine (U.A.E.), NAFFCO (U.A.E.), Aegis Roofing Company (U.A.E.), Ghosh Group (U.A.E.), NMSS METAL WORKS INDUS. LLC (U.A.E.), BAZ Metal Industry (U.A.E.), Integrated Industries (U.A.E.), Insultherm (U.A.E.), Emirates Industrial Panel (U.A.E.), Al Assri Ind. LLC (U.A.E.) and Isotherm (U.A.E.) among others |

|

Market Opportunities |

|

|

Value Added Data |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sandwich Panels Market Definition

The sandwich panels market refers to the industry involved in the production, distribution, and sales of composite panels composed of two outer layers of durable materials (such as steel, aluminum, or fiberglass) with a core material (such as polystyrene, polyurethane, or polyisocyanurate) used primarily in the construction and industrial sectors. These panels are widely employed in applications such as building facades, roofing, insulation, and cold storage facilities due to their high thermal efficiency, soundproofing capabilities, and lightweight yet strong structure. The market growth is driven by increasing demand for energy-efficient construction solutions, technological innovations in material performance, and sustainability regulations promoting eco-friendly building practices. Leading market players focus on enhancing panel performance, cost-effectiveness, and meeting industry standards for quality and safety.

Sandwich Panels Market Dynamics

Drivers

- Booming Construction Sector Fueling Demand for Sandwich Panels

Rapid infrastructure development across residential, commercial, and industrial segments in the U.A.E. is significantly increasing the demand for sandwich panels, driven by the country’s thriving construction sector. Mega projects such as high-rise buildings, smart cities, and large-scale industrial zones require efficient, lightweight, and durable building materials to enhance structural performance while reducing construction time and costs. Sandwich panels, known for their superior thermal insulation, fire resistance, and ease of installation, are becoming a preferred choice for contractors and developers aiming to meet the UAE’s stringent building regulations and sustainability goals.

In addition, the UAE’s focus on urban expansion, including the development of economic zones and logistics hubs, is further driving the adoption of sandwich panels in warehouses, factories, and cold storage facilities. With growing investments in green building initiatives and energy-efficient construction, demand for sandwich panels with eco-friendly insulation materials is surging. As a result, manufacturers are innovating with advanced panel technologies to cater to the evolving needs of the UAE’s dynamic construction landscape.

For instance,

In February 2022, according to TSSC, Sandwich panels are transforming the U.A.E. construction industry with their superior insulation, durability, and cost-effectiveness. As a leading player, TSSC Group offers customized high-performance panels tailored to diverse project requirements, enabling faster construction, enhanced thermal efficiency, and fire resistance. The surging growth of the UAE’s construction and real estate sectors is fueling demand for these panels, driven by their lightweight structure, affordability, and insulation benefits. With rising investments in warehouses, cold storage, and modern infrastructure, sandwich panels are emerging as a crucial solution for energy-efficient and durable building developments.

- Rising Adoption of Energy-Efficient Building Materials

Increasing awareness of energy conservation and sustainability in the U.A.E. is accelerating the adoption of energy-efficient building materials such as sandwich panels. With their superior thermal insulation properties, sandwich panels help reduce energy consumption for cooling systems, which is crucial in the region’s hot climate. Government initiatives promoting green building standards, such as the UAE’s Estidama and Dubai green building regulations, further drive the demand for these materials. As developers and contractors prioritize energy efficiency to meet regulatory requirements and lower operational costs, the use of advanced sandwich panels in residential, commercial, and industrial projects continues to grow.

For instance,

According to the article published by AAC Worldwide, the U.A.E. and GCC construction markets are increasingly adopting Autoclaved Aerated Concrete (AAC) for its lightweight, energy-efficient, and sustainable properties, replacing traditional materials such as CMUs and EPS. With demand aligning with local production, key markets such as Kuwait and Oman rely on U.A.E. and Saudi imports. AAC’s fire resistance, thermal insulation, and eco-friendliness support regional green building initiatives, driving international expansion. This shift towards sustainable materials is also boosting demand for high-performance insulated sandwich panels, as developers prioritize efficiency, safety, and cost-effectiveness, aligning with UAE Vision 2030 and sustainable infrastructure goals.

Opportunities

- Increasing Technological Advancements will Boost Efficiency and Durability

Automated production lines increase manufacturing speed and consistency, while advanced composite materials enhance thermal efficiency and durability. Innovations in bonding technologies, along with the use of 3D printing and CNC machining, allow for more precise and customizable designs. Energy-efficient manufacturing processes reduce production costs and minimize environmental impact, resulting in stronger, longer-lasting panels with improved product reliability.

For instance,

Kingspan announced that its QuadCore Technology became standard in all cold storage panels. This technology provides superior thermal efficiency with an R-value of R-9.0 per inch, outperforming both PIR and PUR insulation. The panels, available in various thicknesses, are also GREENGUARD Gold Certified, ensuring a safe indoor environment. This innovation highlights the continuous technological advancements in the sandwich panel market, offering improved energy efficiency and performance in cold storage applications.

- Growing Demand for Sustainable Construction Solutions

Sandwich panels enhance energy efficiency by providing superior thermal insulation, reducing the need for heating and cooling. This lowers energy consumption and carbon emissions. In addition, the use of recyclable materials such as recycled aluminum and eco-friendly foam cores supports sustainable construction practices.

For instance,

In June 2024, representatives from Ruukki, Isover/Saint Gobain, and SSAB gathered at Nordbygg 2024 to discuss the collaboration in creating sustainable building materials, including sandwich panels. The companies showcased how their combined efforts in using recyclable materials like emission-free recycled steel and glass wool made from over 70% recycled glass contribute to a fully circular product. This initiative not only reduces environmental impact but also boosts competitiveness in the sustainable construction market, offering energy-efficient, low-emission building solutions. The collaboration highlighted the growing demand for eco-friendly products in the sandwich panel market.

Restraints/Challenges

- Rising Raw Material Prices Impacting Panel Production Costs

Rising raw material prices, including polystyrene, polyurethane, and steel, have created challenges for sandwich panel manufacturers, significantly impacting their production costs. As these materials become more expensive, manufacturers face reduced profit margins, potentially affecting the affordability of panels in the market. This increase in costs could lead to higher prices for end consumers, making it difficult for some segments of the construction industry to adopt sandwich panels. Manufacturers could explore innovative sourcing strategies or invest in alternative, cost-effective materials. In addition, optimizing production processes and improving supply chain management may help mitigate cost increases and maintain competitiveness.

For instance,

In November 2024, Invespanel launched a new range of sandwich panels made with ArcelorMittal’s XCarb recycled steel, marking the first such production in Spain and Portugal. These panels, produced using 75% scrap steel and 100% renewable energy, combine high performance with sustainability. The use of recycled steel as a core material helps mitigate the challenges posed by rising raw material prices, such as steel, by reducing dependence on virgin steel and promoting cost-effective, environmentally-friendly alternatives. This initiative is a significant step toward reducing environmental impact, enhancing waste management, and addressing the rising raw material costs in the sandwich panel market.

- Challenges in Recycling and Managing Panel Waste

The disposal and recycling of sandwich panels, especially those with synthetic cores such as polyurethane, pose a significant environmental challenge. These panels take a long time to decompose and are difficult to recycle due to their complex composition. Research and development into alternative, more sustainable materials and advanced recycling techniques may play a key role in addressing these concerns. In addition, encouraging industry-wide collaboration could lead to the creation of effective recycling infrastructures.

For instance,

In August 2023, Kingspan introduced EcoPIR, a new product made from remanufactured production waste from scrap PIR insulated panels in Brazil. This innovation helped reduce waste sent to landfill, contributing to the company's goal of achieving zero waste by 2030. The process also led to the certification of their Araquari site as zero waste to landfill. The new EcoPIR product is expected to enhance waste management practices in the sandwich panel market, supporting sustainable construction practices.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Sandwich Panels Market Scope

The market is segmented six notable segments on the basis of product type, thickness, thickness of steel sheets, application, end-use industry, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Polyurethane (PUR) Panels

- High-Density Polyurethane Panels

- Low-Density Polyurethane Panels

- Polyisocyanurate (PIR) Panels

- Fire-Resistant PIR Panels

- Standard PIR Panels

- Expanded Polystyrene (EPS) Panels

- High-Performance EPS Panels

- Standard EPS Panels

- Aluminum Composite Panels

- Aluminum With Polymer Core Panels

- Solid Aluminum Panels

- Mineral Wool (Rock Wool) Panels

- Fire-Resistant Mineral Wool Panels

- Thermal Insulated Mineral Wool Panels

- Extruded Polystyrene (XPS) Panels

- Standard XPS Panels

- High-Strength XPS Panels

- Fiber Cement Panels

- Fire-Resistant Fiber Cement Panels

- Standard Fiber Cement Panels

- Glass Wool Panels

- Standard Glass Wool Panels

- Acoustic Glass Wool Panels

- Composite Panels

- Honey Comb Composite Panels

- Bamboo Composite Panels

- Others

Thickness

- 60 mm To 100 mm

- 100 mm To 140 mm

- Below 60 mm

- 140 mm To 180 mm

- Above 180 mm

- Others

Thickness of Steel Sheets

- Standard Steel Sheets (0.31 mm - 0.60 mm)

- Medium Thickness (0.46 mm - 0.60 mm)

- Low Medium Thickness (0.31 mm - 0.45 mm)

- Heavy-Duty Steel Sheets (0.61 mm -1.00 mm)

- Industrial Grade Steel Sheets (0.61 mm - 0.80 mm)

- Structural Steel Sheets (0.81 mm - 1.00 mm)

- Thin Steel Sheets (< 0.30 mm)

- Ultra-Thin Steel Sheets (<0.20 mm)

- Light Gauge Steel Sheets (0.21 - 0.30 mm)

- Extra-Heavy Steel Sheets (>1.00 Mm)

- High Strength Structural Steel Sheets (1.01 - 1.50 mm)

- Ultra-Heavy Duty Steel Sheets (>1.50 mm)

Application

- Wall Panels

- Exterior Wall Panels

- Interior Wall Panels

- Roof Panels

- Flat Roof Panels

- Pitched Roof Panels

- Cold Storage Panels

- Insulated Cold Storage Panels

- Non - Insulated Cold Storage Panels

- Partition Panels

- Temporary Partition Panels

- Permanent Partition Panels

- Floor Panels

- Raise Floor Panels

- Ground Floor Panels

- Clean Room Panels

- Modular Clean Room Panels

- Pre-Fabricated Clean Room Panels

- Specialty Panels

- Fire Resistant Panels

- Sound Proof Panels

- Thermal Insulated Panels

- Acoustic Insulated Panels

- Others

End-Use Industry

- Industrial Sector

- Factories

- Manufacturing Plants

- Production Facilities

- Others

- Warehouses

- Storage Facilities

- Distribution Centers

- Others

- Cold Storage Facilities

- Food Processing Plants

- Pharmaceutical Storage

- Others

- Factories

- Commercial Sector

- Office Buildings

- Corporate Offices

- Co-Working Spaces

- Business Complexes

- Others

- Retail Spaces

- Shopping Malls

- Supermarkets

- Department Stores

- Others

- Hotels and Hospitality

- Hotels

- Resorts

- Restaurants

- Others

- Educational Institutions

- Schools

- Universities & Colleges

- Training Centers

- Others

- Public Infrastructure

- Hospitals

- Airports

- Government Buildings

- Others

- Office Buildings

- Residential Sector

- Single-Family Homes

- Detached Houses

- Villas

- Bungalows

- Others

- Multi-Family Homes

- Apartments

- Townhouses

- Condominiums

- Others

- Affordable Housing Projects

- Low-Cost Housing Developments

- Social Housing

- Others

- Single-Family Homes

- Institutional & Infrastructure

- Hospitals & Healthcare Facilities

- Clinics

- Surgical Units

- Others

- Airports & Transport Facilities

- Passenger Terminals

- Cargo Terminals

- Others

- Sports Facilities

- Stadiums

- Sports Arenas

- Others

- Cultural & Educational Buildings

- Libraries

- Museums

- Others

- Hospitals & Healthcare Facilities

- Others

Distribution Channel

- Store-Based Retailers

- Building Material Retail Stores

- Home Improvement Stores

- Dedicated Construction Material Outlets

- Others

- Non-Store Based Channels

- E-Commerce Websites

- Company Owned Websites

- Outline Construction Market Place

Sandwich Panels Market Regional Analysis

The market is segmented into six notable segments on the basis of product type, thickness, thickness of steel sheets, application, end-use industry, and distribution channel.

The cities covered in the U.A.E. sandwich panels market report are Dubai, Abu Dhabi, Sharjah, Ras Al Khaimah, Ajman, Fujairah, and Umm Al Quwain.

Dubai is expected to dominate and fastest growing city in U.A.E. sandwich panels market due to rising adoption of energy-efficient building materials and increasing infrastructure development in free zones and industrial hubs.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe aerospace adhesive - sealants brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Sandwich Panels Market Share

Sandwich panels market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Sandwich Panels Market Leaders Operating in the Market are:

- Kingspan Group (Ireland)

- TSSC (Part of Harwal Group of Companies) (U.A.E.)

- DANA Group of Companies (U.A.E.)

- Metal N Machine (U.A.E.)

- NAFFCO (U.A.E.)

- Aegis Roofing Company (U.A.E.)

- Ghosh Group (U.A.E.)

- NMSS METAL WORKS INDUS. LLC (U.A.E.)

- BAZ Metal Industry (U.A.E.)

- Integrated Industries (U.A.E.)

- Insultherm (U.A.E.)

- Emirates Industrial Panel (U.A.E.)

- Al Assri Ind. LLC (U.A.E.)

- Isotherm (U.A.E.)

Latest Developments in Sandwich Panels Market

- In July 2024, Kingspan Group and LONGi Green Energy Technology Co., Ltd. announced a strategic partnership to integrate advanced solar technology with building materials. This collaboration aimed to develop and promote solar PV systems for the construction sector, helping customers achieve Net-Zero Energy targets. The partnership benefited Kingspan by enhancing their sustainable building solutions and expanding their energy-efficient product range. LONGi gained access to Kingspan's market leadership in building materials, strengthening their commitment to a sustainable future

- In December 2022, Dana Steel and Khalifa Economic Zones Abu Dhabi (KEZAD) signed a preliminary agreement to establish Dana Steel’s first hot and cold rolling steel complex in Abu Dhabi. The 50,000-square-meter facility, with a rolling capacity of 500,000 metric tonnes, will help increase production capacity in the GCC by substituting imported raw materials with locally produced supplies. This project marks Dana Steel’s ninth industrial facility in the U.A.E., benefiting from world-class infrastructure and easy access to key markets and natural gas at competitive prices

- In January 2025, NAFFCO signed a two-year strategic partnership with Borouge, valued at USD 54.45 Million (200 million AED). This collaboration, set to run from 2025 to 2026, aimed at supplying specialty products for major infrastructure projects globally. The partnership strengthens NAFFCO’s leadership in fire safety, innovation, and sustainability, reinforcing its commitment to providing exceptional solutions that enhance safety across the world

- In January 2025, NAFFCO Group signed a landmark MOU with Samsung E&A, led by Mr. Ahmed Al Khatib and Mr. ChangHeum Na. This agreement aimed at redefining fire safety and engineering solutions worldwide. The collaboration combines NAFFCO’s fire protection expertise with Samsung E&A’s construction and project management capabilities, enhancing the scope and impact of their safety solutions and driving innovation in modern infrastructure

- In October 2024, NAFFCO Group formed a strategic partnership with IVECO. This collaboration aims to enhance operational efficiency in the fire safety industry by incorporating IVECO’s certified vehicles into NAFFCO’s offerings. The partnership strengthens NAFFCO’s commitment to delivering high-quality safety solutions, benefiting from advanced manufacturing technologies like robotic automation to ensure flawless engineering and efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.A.E. SANDWICH PANELS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 DBMR TRIPOD DATA VALIDATION MODEL

2.4 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.5 DBMR MARKET POSITION GRID

2.6 VENDOR SHARE ANALYSIS

2.7 MULTIVARIATE MODELING

2.8 PRODUCT TYPE TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL

4.1.2 ECONOMIC

4.1.3 SOCIAL

4.1.4 TECHNOLOGICAL

4.1.5 LEGAL

4.1.6 ENVIRONMENTAL

4.2 RAW MATERIAL COVERAGE

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 VENDOR SELECTION CRITERIA – U.A.E. SANDWICH PANELS MARKET

4.5 TECHNOLOGICAL ADVANCEMENTS IN SANDWICH PANEL MANUFACTURING IN THE U.A.E. MARKET

4.6 VENDOR SELECTION CRITERIA – U.A.E. SANDWICH PANELS MARKET

4.7 LOCAL PRODUCTION IN U.A.E. (EVOLUTION OVER THE YEARS)

4.8 REGULATION COVERAGE

4.8.1 PRODUCT CODES

4.8.2 CERTIFIED STANDARDS

4.8.3 SAFETY STANDARDS

4.8.3.1 MATERIAL HANDLING & STORAGE

4.8.3.2 TRANSPORT & PRECAUTIONS

4.8.3.3 HARD IDENTIFICATION

4.9 PRICING ANALYSIS

4.9.1 INTRODUCTION

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTICS COST SCENARIO

4.10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.11 CLIMATE CHANGE SCENARIO

4.11.1 ENVIRONMENTAL CONCERNS IN SANDWICH PANEL MANUFACTURING IN THE U.A.E. MARKET

4.11.2 INDUSTRY RESPONSE

4.11.3 GOVERNMENT’S ROLE

4.11.4 ANALYST RECOMMENDATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 BOOMING CONSTRUCTION SECTOR FUELING DEMAND FOR SANDWICH PANELS

5.1.2 RISING ADOPTION OF ENERGY-EFFICIENT BUILDING MATERIALS

5.1.3 EXPANSION OF COLD STORAGE AND WAREHOUSING FACILITIES

5.1.4 INCREASING INFRASTRUCTURE DEVELOPMENT IN FREE ZONES AND INDUSTRIAL HUBS

5.2 RESTRAINTS

5.2.1 HIGH COMPETITION FROM ALTERNATIVE CONSTRUCTION MATERIALS

5.2.2 STRINGENT BUILDING CODES AND FIRE SAFETY REGULATIONS

5.3 OPPORTUNITIES

5.3.1 INCREASING TECHNOLOGICAL ADVANCEMENTS WILL BOOST EFFICIENCY AND DURABILITY

5.3.2 GROWING DEMAND FOR SUSTAINABLE CONSTRUCTION SOLUTIONS

5.3.3 GOVERNMENT INITIATIVES SUPPORTING GREEN BUILDING STANDARDS

5.4 CHALLENGES

5.4.1 RISING RAW MATERIAL PRICES IMPACTING PANEL PRODUCTION COSTS

5.4.2 CHALLENGES IN RECYCLING AND MANAGING PANEL WASTE

6 U.A.E. SANDWICH PANEL MARKET, PRODUCT TYPE

6.1 OVERVIEW

6.2 POLYURETHANE (PUR) PANELS

6.2.1 BY TYPE

6.2.1.1 HIGH-DENSITY POLYURETHANE PANELS

6.2.1.2 LOW-DENSITY POLYURETHANE PANELS

6.3 POLYISOCYANURATE (PIR) PANELS

6.3.1 BY TYPE

6.3.1.1 FIRE-RESISTANT PIR PANELS

6.3.1.2 STANDARD PIR PANELS

6.4 EXPANDED POLYSTYRENE (EPS) PANELS

6.4.1 BY TYPE

6.4.1.1 HIGH-PERFORMANCE EPS PANELS

6.4.1.2 STANDARD EPS PANELS

6.5 ALUMINIUM COMPOSITE PANELS

6.5.1 BY TYPE

6.5.1.1 POLYMER CORE PANELS

6.5.1.2 SOLID ALUMINUM PANELS

6.6 MINERAL WOOL (ROCK WOOL) PANELS

6.6.1 BY TYPE

6.6.1.1 FIRE-RESISTANT MINERAL WOOL PANELS

6.6.1.2 THERMAL INSULATED MINERAL WOOL PANELS

6.7 EXTRUDED POLYSTYRENE (XPS) PANELS

6.7.1 BY TYPE

6.7.1.1 STANDARD XPS PANELS

6.7.1.2 HIGH-STRENGTH XPS PANELS

6.8 FIBER CEMENT PANELS

6.8.1 BY TYPE

6.8.1.1 FIRE-RESISTANT FIBER CEMENT PANELS

6.8.1.2 STANDARD FIBER CEMENT PANELS

6.9 GLASS WOOL PANELS

6.9.1 BY TYPE

6.9.1.1 STANDARD GLASS WOOL PANELS

6.9.1.2 ACOUSTIC GLASS WOOL PANELS

6.1 COMPOSITE PANELS

6.10.1 BY TYPE

6.10.1.1 HONEY COMB COMPOSITE PANELS

6.10.1.2 BAMBOO COMPOSITE PANELS

6.11 OTHERS

7 U.A.E. SANDWICH PANEL MARKET, THICKNESS

7.1 OVERVIEW

7.2 60 MM TO 100 MM

7.3 100 MM TO 140 MM

7.4 BELOW 60 MM

7.5 140 MM TO 180 MM

7.6 ABOVE 180 MM

7.7 OTHERS

8 U.A.E. SANDWICH PANEL MARKET, THICKNESS OF STEEL SHEETS

8.1 OVERVIEW

8.2 STANDARD STEEL SHEETS (0.31MM - 0.60 MM)

8.2.1 BY TYPE

8.2.1.1 MEDIUM THICKNESS (0.46 MM - 0.60 MM)

8.2.1.2 LOW MEDIUM THICKNESS (0.31 MM - 0.45 MM)

8.3 HEAVY-DUTY STEEL SHEETS (0.61 MM -1.00 MM)

8.3.1 BY TYPE

8.3.1.1 INDUSTRIAL GRADE STEEL SHEETS (0.61MM - 0.80 MM)

8.3.1.2 STRUCTURAL STEEL SHEETS (0.81 MM - 1.00 MM)

8.4 THIN STEEL SHEETS (< 0.30 MM)

8.4.1 BY TYPE

8.4.1.1 ULTRA-THIN STEEL SHEETS (<0.20 MM) AND LIGHT)

8.4.1.2 GAUGE STEEL SHEETS (0.21 - 0.30 MM)

8.5 EXTRA-HEAVY STEEL SHEETS (>1.00 MM)

8.5.1 BY SERVICE

8.5.1.1 HIGH STRENGTH STRUCTURAL STEEL SHEETS (1.01 - 1.50 MM)

8.5.1.2 ULTRA-HEAVY DUTY STEEL SHEETS (>1.50 MM)

9 U.A.E. SANDWICH PANEL MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 WALL PANELS

9.2.1 BY TYPE

9.2.1.1 EXTERIOR WALL PANELS

9.2.1.2 INTERIOR WALL PANELS

9.3 ROOF PANELS

9.3.1 BY TYPE

9.3.1.1 FLAT ROOF PANELS

9.3.1.2 PITCHED ROOF PANELS

9.4 COLD STORAGE PANELS

9.4.1 BY TYPE

9.4.1.1 INTO INSULATED COLD STORAGE PANELS

9.4.1.2 NON - INSULATED COLD STORAGE PANELS

9.5 PARTITION PANELS

9.5.1 BY TYPE

9.5.1.1 TEMPORARY PARTITION PANELS

9.5.1.2 PERMANENT PARTITION PANELS

9.6 FLOOR PANELS

9.6.1 BY TYPE

9.6.1.1 RAISE FLOOR PANELS

9.6.1.2 GROUND FLOOR PANELS

9.7 CLEAN ROOM PANELS

9.7.1 BY TYPE

9.7.1.1 MODULAR CLEAN ROOM PANELS

9.7.1.2 PRE-FABRICATED CLEAN ROOM PANELS

9.8 SPECIALITY PANELS

9.8.1 BY TYPE

9.8.1.1 FIRE RESISTANT PANELS

9.8.1.2 SOUND PROOF PANELS

9.8.1.3 THERMAL INSULATED PANELS

9.8.1.4 ACOUSTIC INSULATED PANELS

10 U.A.E. SANDWICH PANEL MARKET, BY END-USE INDUSTRY

10.1 OVERVIEW

10.2 INDUSTRIAL SECTOR

10.2.1 FACTORIES

10.2.1.1 MANUFACTURING PLANTS

10.2.1.2 PRODUCTION FACILITIES

10.2.1.3 OTHERS

10.2.2 WAREHOUSES

10.2.2.1 STORAGE FACILITIES

10.2.2.2 DISTRIBUTION CENTERS

10.2.2.3 OTHERS

10.2.3 COLD STORAGE FACILITIES

10.2.3.1 FOOD PROCESSING PLANTS

10.2.3.2 PHARMACEUTICAL STORAGE

10.2.3.3 OTHERS

10.3 COMMERCIAL SECTOR

10.3.1 OFFICE BUILDINGS

10.3.1.1 CORPORATE OFFICES

10.3.1.2 CO-WORKING SPACES

10.3.1.3 BUSINESS COMPLEXES

10.3.1.4 OTHERS

10.3.2 RETAIL SPACES

10.3.2.1 SHOPPING MALLS

10.3.2.2 SUPERMARKETS

10.3.2.3 DEPARTMENTAL STORES

10.3.2.4 OTHERS

10.3.3 HOTELS AND HOSPITALITY

10.3.3.1 HOTELS

10.3.3.2 RESORTS

10.3.3.3 RESTAURANTS

10.3.3.4 OTHERS

10.3.4 EDUCATIONAL INSTITUTIONS

10.3.4.1 SCHOOLS

10.3.4.2 UNIVERSITIES & COLLEGES

10.3.4.3 TRAINING CENTERS

10.3.5 PUBLIC INFRASTRUCTURE

10.3.5.1 HOSPITALS

10.3.5.2 AIRPORTS

10.3.5.3 GOVERNMENT BUILDINGS

10.3.5.4 OTHERS

10.4 RESIDENTAL SECTOR

10.4.1 SINGLE-FAMILY HOMES

10.4.1.1 DETACHED HOUSES

10.4.1.2 VILLAS

10.4.1.3 BUNGALOWS

10.4.1.4 OTHERS

10.4.2 MULTI-FAMILY HOMES

10.4.2.1 APARTMENTS

10.4.2.2 TOWNHOUSES

10.4.2.3 CONDOMINIUMS

10.4.2.4 OTHERS

10.4.3 AFFORDABLE HOUSING PROJECT

10.4.3.1 LOW-COST HOUSING DEVELOPMENTS

10.4.3.2 SOCIAL HOUSING

10.4.3.3 OTHERS

10.5 INSTITUTIONAL & INFRASTRUCTURE

10.5.1 HOSPITALS & HEALTHCARE FACILITIES

10.5.1.1 CLINICS

10.5.1.2 SURGICAL UNITS

10.5.1.3 OTHERS

10.5.2 AIRPORTS & TRANSPORT FACILITIES

10.5.2.1 PASSENGER TERMINALS

10.5.2.2 CARGO TERMINALS

10.5.2.3 OTHERS

10.5.3 SPORTS FACILITIES

10.5.3.1 STADIUMS

10.5.3.2 SPORTS ARENAS

10.5.3.3 OTHERS

10.5.4 CULTURAL & EDUCATIONAL BUILDINGS

10.5.4.1 LIBRARIES

10.5.4.2 MUSEUMS

10.5.4.3 OTHERS

11 U.A.E. SANDWICH PANEL MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 STORE-BASED RETAILERS

11.2.1 BY TYPE

11.2.1.1 BUILDING MATERIAL RETAIL STORES

11.2.1.2 HOME IMPROVEMENT STORES

11.2.1.3 DEDICATED CONSTRUCTION MATERIAL OUTLETS

11.2.1.4 OTHERS

11.3 NON-STORE BASED CHANNELS

11.3.1 BY TYPE

11.3.1.1 E-COMMERCE WEBSITES

11.3.1.2 COMPANY OWNED WEBSITES

11.3.1.3 OUTLINE CONSTRUCTION MARKET PLACE

12 U.A.E. SANDWICH PANELS MARKET, BY COUNTRY

12.1 U.A.E

12.1.1 DUBAI

12.1.2 ABU DHABI

12.1.3 SHARJAH

12.1.4 RAS AL KHAIMAH

12.1.5 AJMAN

12.1.6 FUJAIRAH

12.1.7 UMM AL QUWAIN

13 U.A.E. SANDWICH PANELS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.A.E.

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 KINGSPAN GROUP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 BAZ METAL INDUSTRY

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 NMSS METAL WORKS INDUS. LLC

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 EMIRATES INDUSTRIAL PANEL

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 TSSC (PART OF HARWAL GROUP)

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 AEGIS ROOFING COMPANY

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AL ASSRI IND. LLC

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 DANA GROUP OF COMPANIES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 GHOSH GROUP

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 INSULTHERM

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 INTEGRATED INDUSTRIES

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 ISOTHERM

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 METAL N MACHINE

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 NAFFCO

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 CERTIFIED STANDARDS FOR U.A.E. SANDWICH PANELS

TABLE 2 PRICE COMPARISON BY PANEL TYPE

TABLE 3 U.A.E. SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 U.A.E. SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND SQUARE METERS)

TABLE 5 U.A.E. POLYURETHANE (PUR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 U.A.E. POLYISOCYANURATE (PIR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 U.A.E. EXPANDED POLYSTYRENE (EPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 U.A.E. ALUMINIUM COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 U.A.E. MINERAL WOOL (ROCK WOOL) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 U.A.E. EXTRUDED POLYSTYRENE (XPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 U.A.E. FIBER CEMENT PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 U.A.E. GLASS WOOL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 U.A.E. COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 U.A.E. SANDWICH PANEL MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 15 U.A.E. SANDWICH PANEL MARKET, BY THICKNESS OF STEEL SHEETS, 2018-2032 (USD THOUSAND)

TABLE 16 U.A.E. STANDARD STEEL SHEETS (0.31MM - 0.60 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 U.A.E. HEAVY-DUTY STEEL SHEETS (0.61 MM -1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 U.A.E. THIN STEEL SHEETS (< 0.30 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 U.A.E. EXTRA-HEAVY STEEL SHEETS (>1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 U.A.E. SANDWICH PANEL MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 21 U.A.E. WALL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 U.A.E. ROOF PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 U.A.E. COLD STORAGE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 U.A.E. PARTITION PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 U.A.E. FLOOR PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 U.A.E. CLEAN ROOM PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 U.A.E. SPECIALITY PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 U.A.E. SANDWICH PANEL MARKET, BY END-USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 29 U.A.E. INDUSTRIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 U.A.E. FACTORIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 U.A.E. WAREHOUSES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 U.A.E. COLD STORAGE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 U.A.E. COMMERCIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 U.A.E. OFFICE BUILDING IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 U.A.E. RETAIL SPACES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 U.A.E. HOTELS AND HOSPITALITY IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 U.A.E. EDUCATIONAL INSTITUTIONS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 U.A.E. PUBLIC INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 U.A.E. RESIDENTIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 U.A.E. SINGLE-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 U.A.E. MULTI-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 U.A.E. AFFORDABLE HOUSING PROJECT IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.A.E. INSTITUTIONAL & INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 U.A.E. HOSPITALS & HEALTHCARE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 U.A.E. AIRPORTS & TRANSPORT FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 U.A.E. SPORTS FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 U.A.E. CULTURAL & EDUCATIONAL BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 U.A.E. SANDWICH PANEL MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 49 U.A.E. STORE-BASED RETAILERS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 U.A.E. NON-STORE BASED CHANNELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 U.A.E. SANDWICH PANEL MARKET, BY CITIES, 2018-2032 (USD THOUSAND)

TABLE 52 DUBAI SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 DUBAI SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND SQUARE METERS)

TABLE 54 DUBAI POLYURETHANE (PUR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 DUBAI POLYISOCYANURATE (PIR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 DUBAI EXPANDED POLYSTYRENE (EPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 DUBAI ALUMINUM COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 DUBAI MINERAL WOOL (ROCK WOOL) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 DUBAI EXTRUDED POLYSTYRENE (XPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 DUBAI FIBER CEMENT PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 DUBAI GLASS WOOL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 DUBAI COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 DUBAI SANDWICH PANEL MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 64 DUBAI SANDWICH PANEL MARKET, BY THICKNESS OF STEEL SHEETS, 2018-2032 (USD THOUSAND)

TABLE 65 DUBAI STANDARD STEEL SHEETS (0.31MM - 0.60 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 DUBAI HEAVY-DUTY STEEL SHEETS (0.61 MM -1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 DUBAI THIN STEEL SHEETS (< 0.30 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 DUBAI EXTRA-HEAVY STEEL SHEETS (>1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 DUBAI SANDWICH PANEL MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 DUBAI WALL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 DUBAI ROOF PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 DUBAI COLD STORAGE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 DUBAI PARTITION PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 DUBAI FLOOR PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 DUBAI CLEAN ROOM PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 DUBAI SPECIALTY PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 DUBAI SANDWICH PANEL MARKET, BY END-USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 78 DUBAI INDUSTRIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 DUBAI FACTORIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 DUBAI WAREHOUSES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 DUBAI COLD STORAGE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 DUBAI COMMERCIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 DUBAI OFFICE BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 DUBAI RETAIL SPACES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 DUBAI HOTELS AND HOSPITALITY IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 DUBAI EDUCATIONAL INSTITUTIONS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 DUBAI PUBLIC INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 DUBAI RESIDENTIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 DUBAI SINGLE-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 DUBAI MULTI-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 DUBAI AFFORDABLE HOUSING PROJECTS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 DUBAI INSTITUTIONAL & INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 DUBAI HOSPITALS & HEALTHCARE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 DUBAI AIRPORTS & TRANSPORT FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 DUBAI SPORTS FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 DUBAI CULTURAL & EDUCATIONAL BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 DUBAI SANDWICH PANEL MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 98 DUBAI STORE-BASED RETAILERS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 DUBAI NON-STORE BASED CHANNELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 ABU DHABI SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 ABU DHABI SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND SQUARE METERS)

TABLE 102 ABU DHABI POLYURETHANE (PUR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 ABU DHABI POLYISOCYANURATE (PIR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 ABU DHABI EXPANDED POLYSTYRENE (EPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 ABU DHABI ALUMINUM COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 ABU DHABI MINERAL WOOL (ROCK WOOL) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 ABU DHABI EXTRUDED POLYSTYRENE (XPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 ABU DHABI FIBER CEMENT PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 ABU DHABI GLASS WOOL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 ABU DHABI COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 ABU DHABI SANDWICH PANEL MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 112 ABU DHABI SANDWICH PANEL MARKET, BY THICKNESS OF STEEL SHEETS, 2018-2032 (USD THOUSAND)

TABLE 113 ABU DHABI STANDARD STEEL SHEETS (0.31MM - 0.60 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 ABU DHABI HEAVY-DUTY STEEL SHEETS (0.61 MM -1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 ABU DHABI THIN STEEL SHEETS (< 0.30 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 ABU DHABI EXTRA-HEAVY STEEL SHEETS (>1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 ABU DHABI SANDWICH PANEL MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 118 ABU DHABI WALL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 ABU DHABI ROOF PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 ABU DHABI COLD STORAGE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 ABU DHABI PARTITION PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 ABU DHABI FLOOR PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 ABU DHABI CLEAN ROOM PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 ABU DHABI SPECIALTY PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 ABU DHABI SANDWICH PANEL MARKET, BY END-USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 126 ABU DHABI INDUSTRIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 ABU DHABI FACTORIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 ABU DHABI WAREHOUSES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 ABU DHABI COLD STORAGE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 ABU DHABI COMMERCIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 ABU DHABI OFFICE BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 ABU DHABI RETAIL SPACES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 ABU DHABI HOTELS AND HOSPITALITY IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 ABU DHABI EDUCATIONAL INSTITUTIONS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 ABU DHABI PUBLIC INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 ABU DHABI RESIDENTIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 ABU DHABI SINGLE-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 ABU DHABI MULTI-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 ABU DHABI AFFORDABLE HOUSING PROJECTS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 ABU DHABI INSTITUTIONAL & INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 ABU DHABI HOSPITALS & HEALTHCARE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 ABU DHABI AIRPORTS & TRANSPORT FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 ABU DHABI SPORTS FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 ABU DHABI CULTURAL & EDUCATIONAL BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 ABU DHABI SANDWICH PANEL MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 146 ABU DHABI STORE-BASED RETAILERS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 ABU DHABI NON-STORE BASED CHANNELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 SHARJAH SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 SHARJAH SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND SQUARE METERS)

TABLE 150 SHARJAH POLYURETHANE (PUR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SHARJAH POLYISOCYANURATE (PIR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SHARJAH EXPANDED POLYSTYRENE (EPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SHARJAH ALUMINUM COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SHARJAH MINERAL WOOL (ROCK WOOL) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SHARJAH EXTRUDED POLYSTYRENE (XPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 SHARJAH FIBER CEMENT PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SHARJAH GLASS WOOL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SHARJAH COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 SHARJAH SANDWICH PANEL MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 160 SHARJAH SANDWICH PANEL MARKET, BY THICKNESS OF STEEL SHEETS, 2018-2032 (USD THOUSAND)

TABLE 161 SHARJAH STANDARD STEEL SHEETS (0.31MM - 0.60 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 SHARJAH HEAVY-DUTY STEEL SHEETS (0.61 MM -1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 SHARJAH THIN STEEL SHEETS (< 0.30 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 SHARJAH EXTRA-HEAVY STEEL SHEETS (>1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 SHARJAH SANDWICH PANEL MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 166 SHARJAH WALL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 SHARJAH ROOF PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 SHARJAH COLD STORAGE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 SHARJAH PARTITION PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 SHARJAH FLOOR PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 SHARJAH CLEAN ROOM PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 SHARJAH SPECIALTY PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 SHARJAH SANDWICH PANEL MARKET, BY END-USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 174 SHARJAH INDUSTRIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 SHARJAH FACTORIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 SHARJAH WAREHOUSES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 SHARJAH COLD STORAGE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 SHARJAH COMMERCIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 SHARJAH OFFICE BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SHARJAH RETAIL SPACES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SHARJAH HOTELS AND HOSPITALITY IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 SHARJAH EDUCATIONAL INSTITUTIONS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SHARJAH PUBLIC INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 SHARJAH RESIDENTIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 SHARJAH SINGLE-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 SHARJAH MULTI-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 SHARJAH AFFORDABLE HOUSING PROJECTS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 SHARJAH INSTITUTIONAL & INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SHARJAH HOSPITALS & HEALTHCARE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SHARJAH AIRPORTS & TRANSPORT FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SHARJAH SPORTS FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SHARJAH CULTURAL & EDUCATIONAL BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SHARJAH SANDWICH PANEL MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 194 SHARJAH STORE-BASED RETAILERS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SHARJAH NON-STORE BASED CHANNELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 RAS AL KHAIMAH SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 RAS AL KHAIMAH SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND SQUARE METERS)

TABLE 198 RAS AL KHAIMAH POLYURETHANE (PUR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 RAS AL KHAIMAH POLYISOCYANURATE (PIR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 RAS AL KHAIMAH EXPANDED POLYSTYRENE (EPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 RAS AL KHAIMAH ALUMINUM COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 RAS AL KHAIMAH MINERAL WOOL (ROCK WOOL) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 RAS AL KHAIMAH EXTRUDED POLYSTYRENE (XPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 RAS AL KHAIMAH FIBER CEMENT PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 RAS AL KHAIMAH GLASS WOOL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 RAS AL KHAIMAH COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 RAS AL KHAIMAH SANDWICH PANEL MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 208 RAS AL KHAIMAH SANDWICH PANEL MARKET, BY THICKNESS OF STEEL SHEETS, 2018-2032 (USD THOUSAND)

TABLE 209 RAS AL KHAIMAH STANDARD STEEL SHEETS (0.31MM - 0.60 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 RAS AL KHAIMAH HEAVY-DUTY STEEL SHEETS (0.61 MM -1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 RAS AL KHAIMAH THIN STEEL SHEETS (< 0.30 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 RAS AL KHAIMAH EXTRA-HEAVY STEEL SHEETS (>1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 RAS AL KHAIMAH SANDWICH PANEL MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 214 RAS AL KHAIMAH WALL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 RAS AL KHAIMAH ROOF PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 RAS AL KHAIMAH COLD STORAGE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 RAS AL KHAIMAH PARTITION PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 RAS AL KHAIMAH FLOOR PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 RAS AL KHAIMAH CLEAN ROOM PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 RAS AL KHAIMAH SPECIALTY PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 RAS AL KHAIMAH SANDWICH PANEL MARKET, BY END-USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 222 RAS AL KHAIMAH INDUSTRIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 RAS AL KHAIMAH FACTORIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 RAS AL KHAIMAH WAREHOUSES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 RAS AL KHAIMAH COLD STORAGE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 RAS AL KHAIMAH COMMERCIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 RAS AL KHAIMAH OFFICE BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 RAS AL KHAIMAH RETAIL SPACES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 RAS AL KHAIMAH HOTELS AND HOSPITALITY IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 RAS AL KHAIMAH EDUCATIONAL INSTITUTIONS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 RAS AL KHAIMAH PUBLIC INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 RAS AL KHAIMAH RESIDENTIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 RAS AL KHAIMAH SINGLE-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 RAS AL KHAIMAH MULTI-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 RAS AL KHAIMAH AFFORDABLE HOUSING PROJECTS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 RAS AL KHAIMAH INSTITUTIONAL & INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 RAS AL KHAIMAH HOSPITALS & HEALTHCARE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 RAS AL KHAIMAH AIRPORTS & TRANSPORT FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 RAS AL KHAIMAH SPORTS FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 RAS AL KHAIMAH CULTURAL & EDUCATIONAL BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 RAS AL KHAIMAH SANDWICH PANEL MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 242 RAS AL KHAIMAH STORE-BASED RETAILERS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 RAS AL KHAIMAH NON-STORE BASED CHANNELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 AJMAN SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 AJMAN SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND SQUARE METERS)

TABLE 246 AJMAN POLYURETHANE (PUR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 AJMAN POLYISOCYANURATE (PIR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 AJMAN EXPANDED POLYSTYRENE (EPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 AJMAN ALUMINUM COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 AJMAN MINERAL WOOL (ROCK WOOL) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 AJMAN EXTRUDED POLYSTYRENE (XPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 AJMAN FIBER CEMENT PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 AJMAN GLASS WOOL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 AJMAN COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 AJMAN SANDWICH PANEL MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 256 AJMAN SANDWICH PANEL MARKET, BY THICKNESS OF STEEL SHEETS, 2018-2032 (USD THOUSAND)

TABLE 257 AJMAN STANDARD STEEL SHEETS (0.31MM - 0.60 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 AJMAN HEAVY-DUTY STEEL SHEETS (0.61 MM -1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 AJMAN THIN STEEL SHEETS (< 0.30 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 AJMAN EXTRA-HEAVY STEEL SHEETS (>1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 AJMAN SANDWICH PANEL MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 262 AJMAN WALL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 AJMAN ROOF PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 AJMAN COLD STORAGE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 AJMAN PARTITION PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 AJMAN FLOOR PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 AJMAN CLEAN ROOM PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 AJMAN SPECIALTY PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 AJMAN SANDWICH PANEL MARKET, BY END-USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 270 AJMAN INDUSTRIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 AJMAN FACTORIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 AJMAN WAREHOUSES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 AJMAN COLD STORAGE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 AJMAN COMMERCIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 AJMAN OFFICE BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 AJMAN RETAIL SPACES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 AJMAN HOTELS AND HOSPITALITY IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 AJMAN EDUCATIONAL INSTITUTIONS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 AJMAN PUBLIC INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 AJMAN RESIDENTIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 AJMAN SINGLE-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 AJMAN MULTI-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 AJMAN AFFORDABLE HOUSING PROJECTS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 AJMAN INSTITUTIONAL & INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 AJMAN HOSPITALS & HEALTHCARE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 AJMAN AIRPORTS & TRANSPORT FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 AJMAN SPORTS FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 AJMAN CULTURAL & EDUCATIONAL BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 AJMAN SANDWICH PANEL MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 290 AJMAN STORE-BASED RETAILERS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 AJMAN NON-STORE BASED CHANNELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 FUJAIRAH SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 FUJAIRAH SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND SQUARE METERS)

TABLE 294 FUJAIRAH POLYURETHANE (PUR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 FUJAIRAH POLYISOCYANURATE (PIR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 FUJAIRAH EXPANDED POLYSTYRENE (EPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 FUJAIRAH ALUMINUM COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 FUJAIRAH MINERAL WOOL (ROCK WOOL) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 FUJAIRAH EXTRUDED POLYSTYRENE (XPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 FUJAIRAH FIBER CEMENT PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 FUJAIRAH GLASS WOOL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 FUJAIRAH COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 FUJAIRAH SANDWICH PANEL MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 304 FUJAIRAH SANDWICH PANEL MARKET, BY THICKNESS OF STEEL SHEETS, 2018-2032 (USD THOUSAND)

TABLE 305 FUJAIRAH STANDARD STEEL SHEETS (0.31MM - 0.60 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 FUJAIRAH HEAVY-DUTY STEEL SHEETS (0.61 MM -1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 FUJAIRAH THIN STEEL SHEETS (< 0.30 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 FUJAIRAH EXTRA-HEAVY STEEL SHEETS (>1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 FUJAIRAH SANDWICH PANEL MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 310 FUJAIRAH WALL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 FUJAIRAH ROOF PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 FUJAIRAH COLD STORAGE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 FUJAIRAH PARTITION PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 FUJAIRAH FLOOR PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 FUJAIRAH CLEAN ROOM PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 FUJAIRAH SPECIALTY PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 FUJAIRAH SANDWICH PANEL MARKET, BY END-USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 318 FUJAIRAH INDUSTRIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 FUJAIRAH FACTORIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 FUJAIRAH WAREHOUSES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 FUJAIRAH COLD STORAGE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 FUJAIRAH COMMERCIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 FUJAIRAH OFFICE BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 FUJAIRAH RETAIL SPACES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 FUJAIRAH HOTELS AND HOSPITALITY IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 FUJAIRAH EDUCATIONAL INSTITUTIONS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 FUJAIRAH PUBLIC INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 FUJAIRAH RESIDENTIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 FUJAIRAH SINGLE-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 FUJAIRAH MULTI-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 FUJAIRAH AFFORDABLE HOUSING PROJECTS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 FUJAIRAH INSTITUTIONAL & INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 FUJAIRAH HOSPITALS & HEALTHCARE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 FUJAIRAH AIRPORTS & TRANSPORT FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 FUJAIRAH SPORTS FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 FUJAIRAH CULTURAL & EDUCATIONAL BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 FUJAIRAH SANDWICH PANEL MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 338 FUJAIRAH STORE-BASED RETAILERS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 FUJAIRAH NON-STORE BASED CHANNELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 UMM AL QUWAIN SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 UMM AL QUWAIN SANDWICH PANEL MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND SQUARE METERS)

TABLE 342 UMM AL QUWAIN POLYURETHANE (PUR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 UMM AL QUWAIN POLYISOCYANURATE (PIR) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 UMM AL QUWAIN EXPANDED POLYSTYRENE (EPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 UMM AL QUWAIN ALUMINUM COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 UMM AL QUWAIN MINERAL WOOL (ROCK WOOL) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 UMM AL QUWAIN EXTRUDED POLYSTYRENE (XPS) PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 UMM AL QUWAIN FIBER CEMENT PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 UMM AL QUWAIN GLASS WOOL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 UMM AL QUWAIN COMPOSITE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 UMM AL QUWAIN SANDWICH PANEL MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 352 UMM AL QUWAIN SANDWICH PANEL MARKET, BY THICKNESS OF STEEL SHEETS, 2018-2032 (USD THOUSAND)

TABLE 353 UMM AL QUWAIN STANDARD STEEL SHEETS (0.31MM - 0.60 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 UMM AL QUWAIN HEAVY-DUTY STEEL SHEETS (0.61 MM -1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 UMM AL QUWAIN THIN STEEL SHEETS (< 0.30 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 UMM AL QUWAIN EXTRA-HEAVY STEEL SHEETS (>1.00 MM) IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 UMM AL QUWAIN SANDWICH PANEL MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 358 UMM AL QUWAIN WALL PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 UMM AL QUWAIN ROOF PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 UMM AL QUWAIN COLD STORAGE PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 UMM AL QUWAIN PARTITION PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 UMM AL QUWAIN FLOOR PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 UMM AL QUWAIN CLEAN ROOM PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 UMM AL QUWAIN SPECIALTY PANELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 UMM AL QUWAIN SANDWICH PANEL MARKET, BY END-USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 366 UMM AL QUWAIN INDUSTRIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 UMM AL QUWAIN FACTORIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 UMM AL QUWAIN WAREHOUSES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 UMM AL QUWAIN COLD STORAGE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 370 UMM AL QUWAIN COMMERCIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 UMM AL QUWAIN OFFICE BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 UMM AL QUWAIN RETAIL SPACES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 UMM AL QUWAIN HOTELS AND HOSPITALITY IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 UMM AL QUWAIN EDUCATIONAL INSTITUTIONS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 UMM AL QUWAIN PUBLIC INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 376 UMM AL QUWAIN RESIDENTIAL SECTOR IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 UMM AL QUWAIN SINGLE-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 UMM AL QUWAIN MULTI-FAMILY HOMES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 UMM AL QUWAIN AFFORDABLE HOUSING PROJECTS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 UMM AL QUWAIN INSTITUTIONAL & INFRASTRUCTURE IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 UMM AL QUWAIN HOSPITALS & HEALTHCARE FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 UMM AL QUWAIN AIRPORTS & TRANSPORT FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 UMM AL QUWAIN SPORTS FACILITIES IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 UMM AL QUWAIN CULTURAL & EDUCATIONAL BUILDINGS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 UMM AL QUWAIN SANDWICH PANEL MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 386 UMM AL QUWAIN STORE-BASED RETAILERS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 UMM AL QUWAIN NON-STORE BASED CHANNELS IN SANDWICH PANEL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 U.A.E. SANDWICH PANELS MARKET: SEGMENTATION

FIGURE 2 U.A.E. SANDWICH PANELS MARKET: DATA TRIANGULATION

FIGURE 3 U.A.E. SANDWICH PANELS MARKET: DROC ANALYSIS

FIGURE 4 U.A.E. SANDWICH PANELS MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 U.A.E. SANDWICH PANELS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.A.E. SANDWICH PANELS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.A.E. SANDWICH PANELS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.A.E. SANDWICH PANELS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 U.A.E. SANDWICH PANELS MARKET: MULTIVARIATE MODELING

FIGURE 10 U.A.E. SANDWICH PANELS MARKET: PRODUCT TYPE TIMELINE CURVE

FIGURE 11 U.A.E. SANDWICH PANELS MARKET: APPLICATION COVERAGE GRID

FIGURE 12 U.A.E. SANDWICH PANELS MARKET: SEGMENTATION

FIGURE 13 TEN SEGMENTS COMPRISE THE U.A.E. SANDWICH PANELS MARKET, BY PRODUCT TYPE (2024)

FIGURE 14 U.A.E. SANDWICH PANELS MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 BOOMING CONSTRUCTION SECTOR FUELING DEMAND FOR SANDWICH PANELS IS EXPECTED TO DRIVE THE U.A.E. SANDWICH PANELS MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 POLYURETHANE (PUR) PANELS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.A.E. SANDWICH PANELS MARKET IN 2025 & 2032

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.A.E. SANDWICH PANELS MARKET

FIGURE 19 VALUE OF PROJECTS IN EXECUTION, BY EMIRATE AND SECTOR

FIGURE 20 U.A.E. SANDWICH PANEL MARKET: BY PRODUCT TYPE, 2024