Uk Cat Litter Market

Market Size in USD Million

CAGR :

%

USD

217.18 Million

USD

301.05 Million

2024

2032

USD

217.18 Million

USD

301.05 Million

2024

2032

| 2025 –2032 | |

| USD 217.18 Million | |

| USD 301.05 Million | |

|

|

|

|

Cat Litter Market Size

- The U.K. cat litter market is expected to reach USD 301.05 million by 2032 from USD 217.18 million in 2024, growing at a CAGR of 4.2% in the forecast period of 2025 to 2032

- This growth in the U.K. cat litter market is primarily fueled by increasing pet ownership, a surge in premium product demand, and a growing preference for eco-friendly and natural alternatives

- Additionally, the expansion of product offerings, such as biodegradable and silica gel-based litters, along with increasing awareness of sustainability, is significantly contributing to market expansion

Cat Litter Market Analysis

- A litter box, also known as a sandbox, cat box, litter tray, cat pan, pot, or litter pan, is an indoor feces and urine collection box for cats and other pets that instinctively or through training will use such a repository.

- Rising awareness regarding the health of the pet has enhanced the market demand. The rising healthcare expenditure for better health services also contributes to the market's growth.

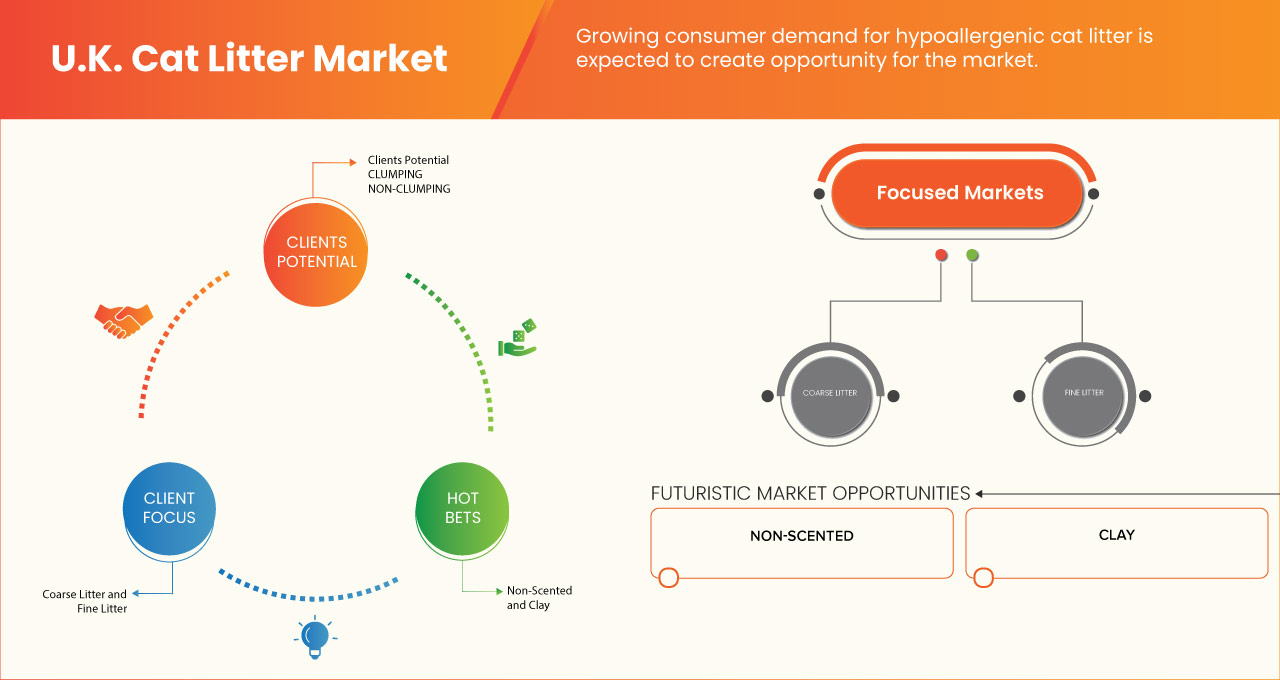

- In 2025, the clumping segment is projected to dominate the U.K. cat litter market with the largest share of 63.71% in the product type segment.

- This dominance is driven by the growing preference for clumping cat litter due to its superior odor control, ease of cleaning, and cost-effectiveness.

- Consumers increasingly value convenience, and clumping litters offer significant benefits for both pet owners and cats, contributing to their widespread adoption across various pet care segments.

Report Scope and Cat Litter Market Segmentation

|

Attributes |

Cat Litter Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cat Litter Market Trends

“Veterinary Recommendations Influence Litter Brand Preferences”

- Veterinary recommendations play a crucial role in shaping cat litter brand preferences in the U.K. market. As pet owners prioritize the health and well-being of their cats, they often turn to veterinarians for guidance on suitable products, including litter

- Many veterinary professionals recommend litter brands that offer superior odor control, clumping ability, and low dust levels to reduce respiratory issues in both cats and owners. Products like unscented and hypoallergenic options are becoming increasingly popular as they cater to the needs of sensitive cats

- Furthermore, veterinarians often emphasize the importance of easy-to-clean litters that can contribute to a cleaner environment, improving overall pet hygiene. As a result, cat litter brands that align with these professional recommendations gain trust and credibility, making them preferred choices among U.K. pet owners

For instance,

- In January 2025, a report published by Cliverse Media DAO LTD reveals that veterinary recommendations are significantly influencing cat litter choices in the U.K.. Leading products, such as World’s Best Cat Litter and Amazon Lifelong Bentonite, are favored due to their superior absorbency and odor control. Experts recommend these litters for their dust-free properties, which promote better respiratory health in both cats and owners, highlighting a shift toward healthier, more eco-conscious choices

- Veterinary recommendations are a driving force in the U.K. cat litter market, influencing consumer choices. As more pet owners seek professional advice, brands that emphasize odor control, ease of use, and health benefits are gaining popularity, further shaping the competitive landscape

Cat Litter Market Dynamics

Driver

“Eco-Friendly and Biodegradable Litter Gaining Strong Traction”

- The U.K. cat litter market is experiencing a significant shift toward eco-friendly and biodegradable alternatives, driven by growing environmental awareness and consumer demand for sustainable products

- Traditional clay-based litters, often derived from strip-mined materials, are being replaced by options made from renewable resources such as corn, wood, walnut, and grass

- These natural litters offer various benefits, including biodegradability, reduced dust, and minimal environmental impact. Leading brands like Ökocat provide clumping wood-based litters that are both effective in odor control and safe for the environment.

- As more cat owners prioritize eco-conscious products, these biodegradable litters are becoming the preferred choice, appealing to environmentally aware consumers and contributing to a more sustainable future for the pet care industry

For instance,

- In April 2025, Insider Inc. reported that natural cat litters made from sustainable materials like corn, wood, walnut, and grass are gaining strong traction in the U.K.. These biodegradable, dust-free options offer significant environmental benefits over traditional strip-mined clay.

- Dr. Zay Satchu from Bond Vet highlighted how these eco-friendly alternatives, such as Ökocat’s wood-based clumping litter, reduce irritation for both cats and owners, aligning with the growing demand for more sustainable and biodegradable solutions in the market

- The U.K. cat litter market is seeing a clear trend toward eco-friendly and biodegradable options. With their numerous environmental and health benefits, these sustainable alternatives are expected to continue gaining traction, shaping the future of pet care products

Opportunity

“Growing Consumer Demand for Hypoallergenic Cat Litter”

- The demand for hypoallergenic cat litter is steadily rising in the U.K. as more consumers prioritize health and comfort for both their pets and themselves. Many cats and their owners suffer from allergies triggered by dust, artificial fragrances, or harsh chemicals commonly found in traditional litter products.

- In response, shoppers are actively seeking low-dust, fragrance-free, and natural formulations that minimize irritation and respiratory issues. This shift in preferences presents an opportunity for manufacturers to stand out by offering specialized hypoallergenic options.

- Brands that focus on safe, gentle ingredients are more likely to attract health-conscious pet owners and gain loyalty in this growing niche

For instance,

- In December 2021, as per JESP, the rising consumer interest in hypoallergenic cat litter stems from a desire to reduce allergic reactions associated with pet ownership. With many individuals allergic to the Fel d1 protein in cats, hypoallergenic litter helps mitigate allergens in the home environment, offering relief for sensitive individuals without compromising pet car

- This trend not only enhances feline and human health but also opens a lucrative niche for brands that innovate with proven allergen-reducing technologies. Ultimately, tailored hypoallergenic formulations promise to foster stronger customer loyalty and market differentiation

Restraint/Challenge

“Rising Competition from DIY and Bulk Alternatives”

- The U.K. cat litter market is facing increasing pressure from non-traditional alternatives, as a segment of consumers shift toward Do-it-Yourself (DIY) and bulk options for economic reasons.

- Cost-conscious buyers are increasingly opting for low-cost substitutes like wood stove pellets, chicken feed, or shredded newspaper, which can be purchased in large quantities at significantly lower prices than commercial litters.

- These alternatives appeal particularly to multi-cat households and rural consumers looking to reduce recurring pet care expenses. While these substitutes may lack the performance or odor control of branded products, their affordability continues to draw attention, thereby reducing the growth potential of the formal cat litter market

For instance,

- In April 2025, as per cats.com an increasing number of U.K. cat owners are turning to affordable, eco-friendly alternatives like corn, paper, and pine-based litter instead of traditional clay options

- These bulk or DIY choices appeal to cost-conscious consumers and environmentally aware households, posing a growing threat to the commercial cat litter market's value growth

-

The growing shift toward DIY and bulk cat litter alternatives marks a significant evolution in consumer behavior within the U.K. market.

Cat Litter Market Scope

The market is segmented on the basis of product type, nature, raw material, type, form, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Nature |

|

|

By Raw Material |

|

|

By Type |

|

|

By Form |

|

|

By Distribution Channel |

|

|

By End User |

|

In 2025, the clumping segment is projected to dominate the market with a largest share in product type segment

The clumping segment is projected to dominate the U.K. cat litter market with the largest share of 63.71% in the product type segment in 2025. This dominance is driven by the growing preference for clumping cat litter due to its superior odor control, ease of cleaning, and cost-effectiveness. Consumers increasingly value convenience, and clumping litters offer significant benefits for both pet owners and cats, contributing to their widespread adoption across various pet care segments.

The non-scented is expected to account for the largest share during the forecast period in type market

In 2025, the non-scented segment is projected to dominate the U.K. cat litter market in the type segment with the largest share of 66.95%. This growth is fueled by due to the increasing popularity of pet-friendly housing and workplaces.

Cat Litter Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Church & Dwight Co., Inc. (U.S.)

- Nestlé Purina Petcare (Switzerland)

- The Clorox Company (U.S.)

- Mars, Incorporated (U.S.)

- Oil-Dri Corporation of America (U.S.)

- Pettex Limited (U.K.)

- Tolsa - Sanicat (Spain)

- Bob Martin (U.K.)

- AllPetSolutions (U.K.)

- Breeder Celect (U.K.)

- Dr. Elsey's (U.S.)

- Omlet (U.K.)

- 3F Trading Ltd (U.K.)

- Intersand (Canada)

- Sinchem Silica Gel Co., Ltd. (China)

- Bentaş (Turkey)

- Pestell Pet Products (Canada)

- Macromin Ltd (U.K.)

Latest Developments in U.K. Cat Litter Market

- In May 2024, Oil-Dri Corporation of America finalized its USD 46 million acquisition of Ultra Pet Company, a key supplier of silica gel-based crystal cat litter. Funded through cash and credit, the deal boosts Oil-Dri’s position in the crystal litter segment. Leaders from both firms will unify strategies and operations, with shared values driving growth, innovation, and expansion. Additional details will be shared during Oil-Dri’s June earnings webcast

- In February 2023, Nestlé Purina PetCare announced plans to acquire Red Collar Pet Foods' Miami, Oklahoma pet treats factory from Arbor Investments, with an anticipated closing in March. The addition of the Miami factory to Purina's North American production footprint will mark the 22nd Purina owned and operated facility nationwide and expand in-house capabilities for dog and cat treats innovation and production. This has helped the company to expand globally

- In November 2022, Mars Petcare, part of Mars, Incorporated, announced that it has signed a definitive agreement to acquire Champion Petfoods, a leading global pet food maker, from an investor group led by Bedford Capital and Healthcare of Ontario Pension Plan. This has helped the company to expand globally

- In February 2021, Dr. Elsey's, a veterinarian-owned cat product brand, has finished completion on a production facility in the state capital of Wyoming. Located at Swan Ranch in Cheyenne, Wyoming, the brand's new facility offers closer access to the source of silver sodium bentonite clay and better access to the railroad system used for product transportation. This has helped the company to expand globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.K. CAT LITTER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF BUYERS

4.1.3 BARGAINING POWER OF SUPPLIERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 COMPETITIVE RIVALRY

4.2 BRAND OUTLOOK

4.2.1 PRODUCT VS BRAND OVERVIEW

4.2.1.1 PRODUCT OVERVIEW

4.2.1.2 BRAND OVERVIEW

4.3 CONSUMER BUYING BEHAVIOUR FOR U.K. CAT LITTER MARKET

4.3.1 PREFERENCE FOR ECO-FRIENDLY AND SUSTAINABLE PRODUCTS

4.3.2 DEMAND FOR ODOUR CONTROL AND HYGIENE

4.3.3 PRICING SENSITIVITY AND VALUE-ORIENTED SHOPPING

4.3.4 INFLUENCE OF ONLINE REVIEWS, PEER RECOMMENDATIONS, AND DIGITAL RETAIL

4.3.5 CONCLUSION

4.4 FACTORS AFFECTING BUYING DECISION FOR U.K. CAT LITTER MARKET

4.4.1 PRICE SENSITIVITY AND VALUE PERCEPTION

4.4.2 ODOR CONTROL AND ABSORBENCY PERFORMANCE

4.4.3 ENVIRONMENTAL SUSTAINABILITY AND ECO-CONSCIOUSNESS

4.4.4 CONVENIENCE AND AVAILABILITY

4.4.5 CONCLUSION,

4.5 IMPACT OF ECONOMIC SLOWDOWN ON THE U.K. CAT LITTER MARKET

4.5.1 IMPACT ON PRICE

4.5.2 IMPACT ON SUPPLY CHAIN

4.5.3 IMPACT ON SHIPMENT

4.5.4 IMPACT ON DEMAND

4.5.5 IMPACT ON STRATEGIC DECISIONS

4.6 IMPORT EXPORT SCENARIO

4.7 PRICING ANALYSIS

4.8 PRODUCT ADOPTION SCENARIO FOR U.K. CAT LITTER MARKET

4.8.1 CONSUMER AWARENESS AND INITIAL ADOPTION

4.8.2 DIFFUSION AMONG EARLY MAJORITY

4.8.3 LATE MAJORITY AND PRICE SENSITIVITY

4.8.4 RESISTANCE TO ADOPTION AND LAGGING SEGMENTS

4.8.5 CONCLUSION

4.9 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTIC COST SCENARIO

4.10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.11 RAW MATERIAL SOURCING ANALYSIS FOR U.K. CAT LITTER MARKET

4.11.1 CLAY-BASED MATERIAL DEPENDENCE (BENTONITE)

4.11.2 RENEWABLE AND BIODEGRADABLE MATERIAL SOURCING

4.11.3 AGRICULTURAL WASTE INTEGRATION

4.11.4 PACKAGING MATERIALS AND SUSTAINABILITY CONSIDERATIONS

4.11.5 SUPPLIER RISK MANAGEMENT AND DIVERSIFICATION

4.11.6 IMPACT OF LEGISLATION AND TRADE POLICY

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 ECO-FRIENDLY AND BIODEGRADABLE LITTER GAINING STRONG TRACTION

6.1.2 INNOVATION IN ODOR CONTROL AND CLUMPING ENHANCES APPEAL

6.1.3 VETERINARY RECOMMENDATIONS INFLUENCE LITTER BRAND PREFERENCES

6.1.4 RISING UK CAT OWNERSHIP INCREASES LITTER PRODUCT DEMAND

6.2 RESTRAINTS

6.2.1 GROWTH OF CAT LITTER ALTERNATIVES LIKE REUSABLE TRAYS

6.2.2 HIGH COST OF PREMIUM AND NATURAL LITTER OPTIONS

6.3 OPPORTUNITY

6.3.1 GROWING CONSUMER DEMAND FOR HYPOALLERGENIC CAT LITTER

6.3.2 CROSS-SELLING THROUGH MULTI-PET PRODUCT PACKAGES

6.3.3 EMBEDDING SMART SENSORS AND ROBOTICS IN CAT LITTER

6.4 CHALLENGE

6.4.1 RISING COMPETITION FROM DIY AND BULK ALTERNATIVES

6.4.2 STRONG BRAND LOYALTY IN CAT LITTER LIMITS CONSUMER SWITCHING

7 U.K. CAT LITTER MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CLUMPING

7.3 NON-CLUMPING

7.4 CRYSTALS

7.5 DEODORANT LITTERS

7.6 CONVENTIONAL

7.7 OTHERS

8 U.K. CAT LITTER MARKET, BY NATURE

8.1 OVERVIEW

8.2 INORGANIC

8.3 ORGANIC

9 U.K CAT LITTER MARKET, BY RAW MATERIAL

9.1 OVERVIEW

9.2 CLAY

9.3 PLANT FIBERS

9.3.1 PAPER/WOOD

9.3.2 CORN

9.3.3 WHEAT

9.3.4 PINE

9.3.5 WALNUT

9.3.6 OTHERS

9.4 SILICA

9.5 OYSTER SHELL-BASED

10 U.K. CAT LITTER MARKET, BY TYPE

10.1 OVERVIEW

10.2 NON-SCENTED

10.3 SCENTED

11 U.K. CAT LITTER MARKET, BY FORM

11.1 OVERVIEW

11.2 FINE LITTER

11.3 COARSE LITTER

12 U.K. CAT LITTER MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 HYPERMARKETS/SUPERMARKETS

12.3 SPECIALIZED PET SHOPS

12.4 E-COMMERCE

12.5 OTHERS

13 U.K. CAT LITTER MARKET, BY END USER

13.1 OVERVIEW

13.2 ADULT CATS

13.3 KITTENS

14 U.K. CAT LITTER MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: U.K.

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 CHURCH & DWIGHT CO., INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 NESTLÉ PURINA PETCARE (SUBSIDIARY OF NESTLE)

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENTS

16.3 THE CLOROX COMPANY

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 MARS, INCORPORATED

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENTS

16.5 OIL-DRI CORPORATION OF AMERICA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT/NEWS

16.6 ALLPETSOLUTIONS

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BENTAS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 BOB MARTIN

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BREEDER CELECT

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DR. ELSEY'S.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 INTERSAND

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 MACROMIN LTD

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 OMLET

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 PESTELL PET PRODUCTS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 PETTEX LIMITED

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 SINCHEM SILICA GEL CO., LTD.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 TOLSA - SANICAT

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 3F TRADING LTD

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 BRAND COMPARATIVE ANALYSIS OF U.K. CAT LITTER MARKET

TABLE 2 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 3 REGULATORY COVERAGE

TABLE 4 U.K. CAT LITTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 5 U.K. CAT LITTER MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION KG)

TABLE 6 U.K. CAT LITTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD/KG)

TABLE 7 U.K. CAT LITTER MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 8 U.K. CAT LITTER MARKET, BY RAW MATERIAL, 2018-2032 (USD MILLION)

TABLE 9 U.K PLANT FIBERS IN CAT LITTER MARKET, BY RAW MATERIAL, 2018-2032 (USD MILLION)

TABLE 10 U.K CAT LITTER MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 11 U.K. CAT LITTER MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 12 U.K. CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 13 U.K. CAT LITTER MARKET, BY END USER, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 U.K. CAT LITTER MARKET: SEGMENTATION

FIGURE 2 U.K. CAT LITTER MARKET: DATA TRIANGULATION

FIGURE 3 U.K. CAT LITTER MARKET: DROC ANALYSIS

FIGURE 4 U.K. CAT LITTER MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 U.K. CAT LITTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.K. CAT LITTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.K. CAT LITTER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.K. CAT LITTER MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 U.K. CAT LITTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.K. CAT LITTER MARKET: SEGMENTATION

FIGURE 11 SIX SEGMENTS COMPRISE THE U.K. CAT LITTER MARKET, BY PRODUCT TYPE

FIGURE 12 U.K. CAT LITTER MARKET EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 ECO-FRIENDLY AND BIODEGRADABLE LITTER GAINING STRONG TRACTION IS EXPECTED TO DRIVE THE U.K. CAT LITTER MARKET IN THE FORECAST PERIOD

FIGURE 15 THE CLUMPING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.K. CAT LITTER MARKET IN 2025 & 2032

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 U.K. CAT LITTER MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 19 DROC ANALYSIS

FIGURE 20 U.K. CAT LITTER MARKET, BY PRODUCT TYPE, 2024

FIGURE 21 U.K. CAT LITTER MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

FIGURE 22 U.K. CAT LITTER MARKET, BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 23 U.K. CAT LITTER MARKET, BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 24 U.K. CAT LITTER MARKET, BY NATURE, 2024

FIGURE 25 U.K. CAT LITTER MARKET, BY NATURE, 2025-2032 (USD MILLION)

FIGURE 26 U.K. CAT LITTER MARKET, BY NATURE, CAGR (2025-2032)

FIGURE 27 U.K. CAT LITTER MARKET, BY NATURE, LIFELINE CURVE

FIGURE 28 U.K. CAT LITTER MARKET, BY RAW MATERIAL, 2024

FIGURE 29 U.K. CAT LITTER MARKET, BY RAW MATERIAL, 2025-2032 (USD MILLION)

FIGURE 30 U.K. CAT LITTER MARKET, BY RAW MATERIAL, CAGR (2025-2032)

FIGURE 31 U.K. CAT LITTER MARKET, BY RAW MATERIAL, LIFELINE CURVE

FIGURE 32 U.K CAT LITTER MARKET, BY TYPE, 2024

FIGURE 33 U.K CAT LITTER MARKET, BY TYPE, 2025-2032 (USD MILLION)

FIGURE 34 U.K CAT LITTER MARKET, BY TYPE, CAGR (2025-2032)

FIGURE 35 U.K CAT LITTER MARKET, BY TYPE, LIFELINE CURVE

FIGURE 36 U.K CAT LITTER MARKET, BY FORM, 2024

FIGURE 37 U.K CAT LITTER MARKET BY FORM, 2025-2032 (USD MILLION)

FIGURE 38 U.K CAT LITTER MARKET, BY FORM, CAGR (2025-2032)

FIGURE 39 U.K CAT LITTER MARKET, BY FORM, LIFELINE CURVE

FIGURE 40 U.K CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, 2024

FIGURE 41 U.K CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 42 U.K CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 43 U.K CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 U.K. CAT LITTER MARKET, BY END USER, 2024

FIGURE 45 U.K. CAT LITTER MARKET, BY END USER, 2025-2032 (USD MILLION)

FIGURE 46 U.K. CAT LITTER MARKET, BY END USER, CAGR (2025-2032)

FIGURE 47 U.K. CAT LITTER MARKET, BY END USER, LIFELINE CURVE

FIGURE 48 U.K. CAT LITTER MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.