Market Analysis and Insights

Food product testing is an important step, for defining the safety of food for its use. Food product testing is important, to confirm that the food is free of physical, chemical, and biological contaminants. The common examples of food contaminants are bacteria and viruses such as Escherichia coli, Salmonella, preservatives, and pesticides. Food testing and food safety is done, to scientifically analyse the nutrient contents in the food. It is done to provide information about multiple characteristics of food, such as understanding the structure, composition, and physicochemical properties. Other reasons why food testing is done are also, to test the quality of food products, quality control, and food inspection and grading. The type of tests that are implemented for food testing is food authenticity testing and food shelf-life testing.

In the U.K. the surge in cases of foodborne diseases, caused by pathogens, viruses, or spoilage, has serious consequences among the consumers and the known brands. Hence, to protect the health of the public and follow the food safety regulations, testing for the presence and detection of harmful micro-organisms is vital

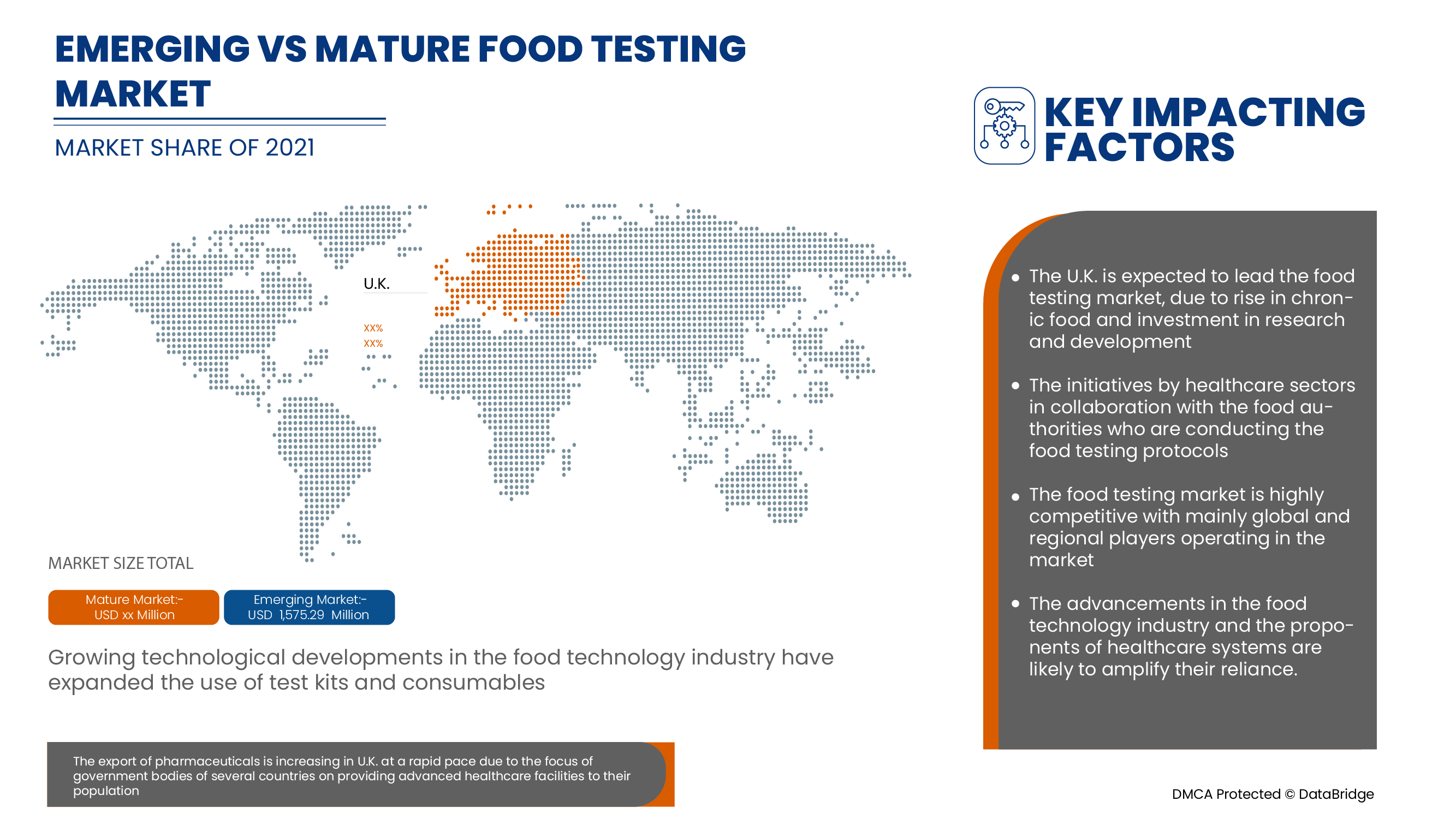

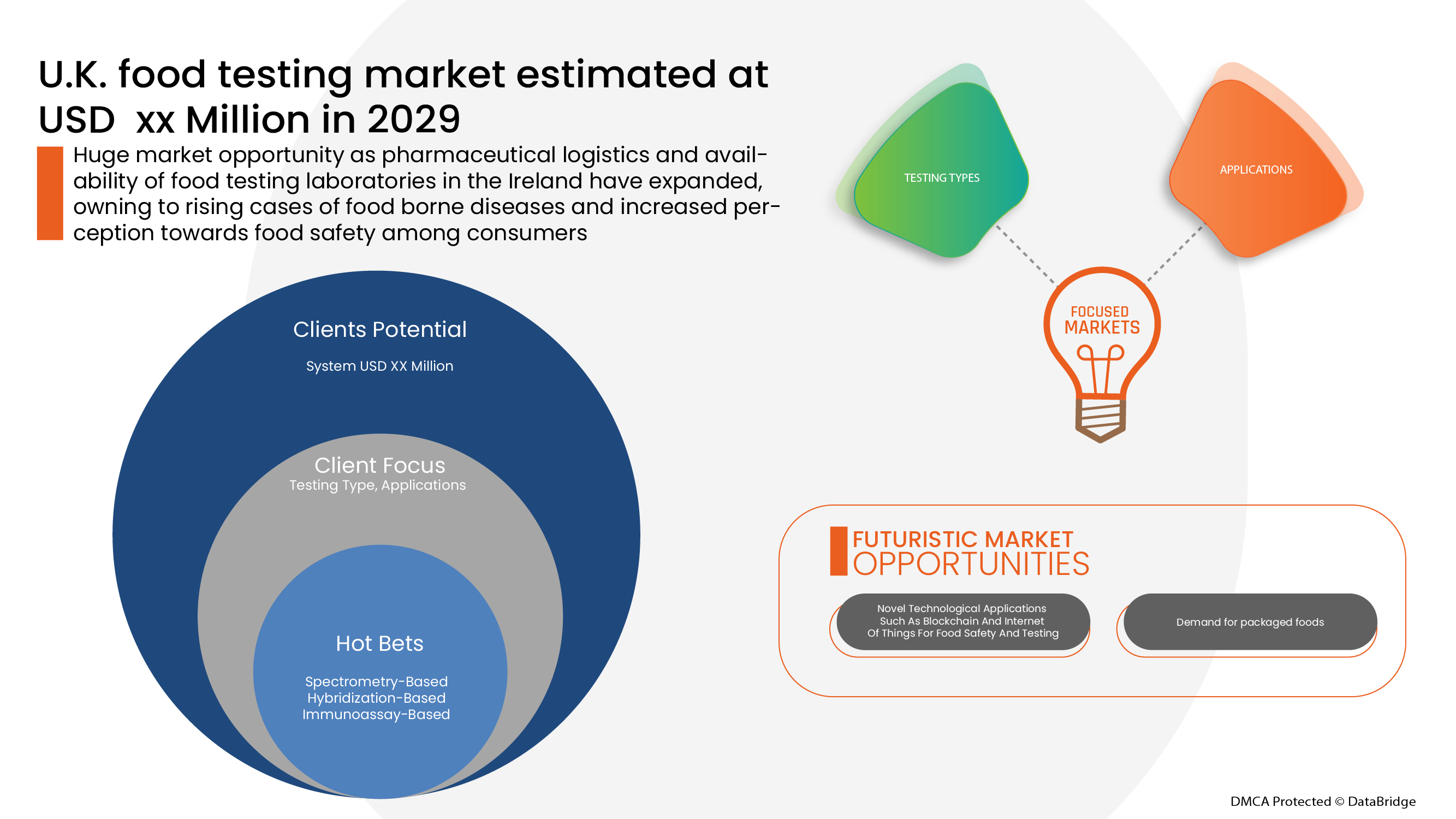

The U.K. food testing is supportive and aims to reduce the severity of the symptoms. Data Bridge Market Research analyses that the U.K. food testing market will grow at a CAGR of 7.7% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Forecast Period |

2022 - 2029 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

By Testing Type (System, Test Kits, Consumables and Others), Type of Tests (Food Safety Testing, Food Shelf Life Testing, Food Authenticity Testing and Others), Site (In-house/Internal Lab, Outsourcing Facility), Application (Food, Cereals and Grains, Oilseeds and Pulses, Nuts and Beverages), |

|

Country Covered |

U.K. |

|

Market Players Covered |

Thermo Fisher Scientific Inc., Intertek Group plc, Reading Scientific Services Ltd., ALS Limited, Premier Analytics Servies, Campden BRI, Bia Analytical, Eurofins Scientific, Food Forensics Limited, SGS SA, Bureau Veritas, TUV SUD, NEOGEN Corporation, NSF International and Romer Labs Division Holding GmbH |

U.K. food testing Market Dynamics

Drivers

- Rise in incidence of foodborne diseases in the U.K.

. Food borne illness also occur due to a variation of bacteria, parasites and viruses, examples being Salmonella, Cryptosporidium. The Food Standards Agency states that in 2021, around 2.4 million cases of foodborne diseases occurred in the U.K.

For instance,

- The data by the National Center of Biotechnology Information (NCBI) states that campylobacter and norovirus, causes maximum number of foodborne diseases in the U.K., followed by Salmonella and Clostridium perfringens

Surge in cases of foodborne diseases in the U.K., would create consumer awareness about the importance of food safety and testing. The concept would allow government organizations to partner with market industries for the development of food testing laboratories in developing states in the U.K.

- Rise in consumer awareness about food safety

Food safety refers to the proper handling and storage of food to avoid the onset of food-borne disease which result from consuming adulterated food. Awareness about food safety and hygiene is of vital importance to food business industries, to safeguard the health of the consumers from foodborne diseases.

For instance,

- In April 2021, a survey conducted by the British Standards Institution (BSI), stated that around 2,182 consumers in the U.K., were concerned about food safety and hygiene, due to Covid-19 pandemic in the U.K.

From the above points we can established that increased consumer awareness is expected to create partnerships with government and market players, based in food industry, regarding food safety and testing. The rise in awareness would allow ways to disseminate the food safety principles for food service providers that can be easily interpreted and implemented which is expected to drive the growth of food testing market.

Opportunities

- Strategic Initiatives By Market Players

The requirement for food testing laboratories for the U.K. food testing has increased due to rise in prevalence and incidence of foodborne diseases, rise in consumer awareness in England and Ireland for food safety.

Major players are also trying to device specific strategies, such as product launch, acquisitions, approvals, expansions, and partnerships, to ensure the smooth running of the business, avoid risks, and increase the long-term growth in the sales of the market.

The major players are also trying to devise specific strategies, such as product launches, acquisitions, approvals, expansions, and partnerships, to ensure the smooth running of the business, avoid risks, and increase the long-term growth in the sales of the market.

For instance,

- In July 2021, Bureau Veritas and The Ascott Limited (Ascott), which is one of the leading international lodging owner-operators had signed a global agreement to provide audits and certification for the hygiene and safety standards of Ascott's properties worldwide. This agreement helped the company in strengthening its business

- In April 2021, Thermo Fisher Scientific Inc. announced a definitive agreement with PPD, Inc. a leading global provider of clinical research services to the pharma and biotech industry. This will help the company to provide customers with important clinical research services and help them in new ways as they move a scientific idea to an approved medicine quickly

The growth of technological advancements in the food testing industry

The hindrance in the food supply chain, due to restrictions, were imposed to control the pandemic. Suppliers and manufacturers at each stage of the supply chain, be it raw ingredients or manufactured goods, are legally responsible for ensuring that there are no unintended constituents or contaminants present in their products. There is consecutive demand for sensitive and reliable analytical techniques across the food and drink industry. The technological advancements in the food testing industry are spectroscopy, chromatography, and immunoassays. Hence, to overcome the hurdles, latest technological developments are needed in the food testing systems to overcome these aberrant processes.

For instance,

- In July 2016, Intertek Group plc had developed a unique technique for reliable honey authenticity testing, in collaboration with the Botanical, zoological and geographical identification (BoogIH) of honeydew honey. The innovative technology developed by Intertek Group plc, would aim to standardize the uniform reference methods and support technical expertise and leadership, across the company’s Food Services network.

The use of novel technological developments, is expected to improve diagnosis, risk stratification and disease monitoring of the food samples. The innovative novel technologies is expected to play a significant role in food safety testing as they directly impact the costs associated with the food testing. Hence, the use of novel technologies and advancements in the food testing industry is expected to create lucrative opportunity for the U.K. food testing market

Restraints/Challenges

- Complexity in Testing Methods

Food testing laboratories provide an authenticity check which ensures the quality of the contents of the food product. In this way, food testing ensures that consumers don't become a victim of economic fraud and that contest among food manufacturers is reasonable.

For instance,

- The lack of human resources and outdated infrastructure

- The shortage of chemicals, which are used to carry out testing of food samples

- The sample load is relatively high and most of the labs are not equipped to perform tests to check the presence of microbes, pesticides or metals

The complexities faced in the testing methods would result in less availability of testing laboratories and facilities in the U.K. It would result in rise in cases of food borne diseases and late treatment. Therefore, the complexities in testing methods are expected to hinder the market growth.

The U.K. food testing market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on U.K. food testing market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Patient Epidemiology Analysis

U.K. food testing is a chronic foot disorder that is relatively uncommon and whose incidence is unknown. The study by the National Center of Biotechnology Information (NCBI) states that there are 566 000 cases, 74 000 general practitioner presentations and 7600 hospital admissions related to foodborne disease from 13 known pathogens in the UK.

U.K. food testing market also provides you with detailed market analysis for patient analysis, prognosis and cures. Prevalence, incidence, mortality, adherence rates are some of the data variables that are available in the report. Direct or indirect impact analyses of epidemiology to market growth are analysed to create a more robust and cohort multivariate statistical model for forecasting the market in the growth period.

Covid-19 Impact on the U.K. Food Testing Market

The COVID-19 has negatively affected the market. Lockdowns and isolation during pandemics complicate the diagnosis management and treatment. The lack of access to health-care facilities and food testing laboratories for food testing will further affect the market. Social isolation increases stress, despair, and social support, all of which may cause a reduction in the testing of food samples during the pandemic.

Recent Development

- In March 2022, ALS Limited had announced the expansion of its business in Europe (the U.K. and Ireland), with the acquisition of Controlvet. The acquisition would, improve the food testing services in the U.K. and Ireland region and would emphasize the commitment of ALS towards the strategic plan for the growth of Food and Pharmaceutical business as a global market leader

U.K. Food Testing Market Scope

The U.K. food testing market is segmented on the basis of testing type, type pf tests, site and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Testing Type

- Systems

- Test Kits

- Consumables

- Others

On the basis of testing type, the market is segmented into system, test kits, consumables, and others

Type Of Tests

- Food Safety Testing

- Food Shelf-Life Testing

- Food Authenticity Testing

- Others.

On the basis of drugs, the market segmented into food safety testing, food shelf-life testing, food authenticity testing, and others.

Site

- In-House And Internal Lab

- Outsourcing Facility.

On the basis of site, the market is segmented into in-house and internal lab and outsourcing facility.

Application

- Food

- Cereals And Grains

- Oilseeds And Pulses

- Nuts And Beverages

On the basis of route of application, the U.K. food testing market is segmented into food, cereals and grains, oilseeds and pulses and nuts and beverages.

Competitive Landscape and U.K. Food Testing Market Share Analysis

The U.K. food testing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, the global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the U.K. food testing market.

Some of the major players operating in the U.K. food testing market are Thermo Fisher Scientific Inc., Intertek Group plc, Reading Scientific Services Ltd., ALS Limited, Premier Analytics Servies, Campden BRI, Bia Analytical, Eurofins Scientific, Food Forensics Limited, SGS SA, Bureau Veritas, TUV SUD, NEOGEN Corporation, NSF International and Romer Labs Division Holding GmbH, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.K. FOOD TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 U.K. FOOD TESTING MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 OVERVIEW OF RISK PARTNERSHIP SERVICES

4.1.1 CONSULTANCY ADVICE

4.1.2 RISK-BASED TOOLS

4.1.3 SUPPLY CHAIN MANAGEMENT

4.1.4 AUDIT AND TRAINING

4.2 BREAKOUT OF SMALL, MEDIUM, AND LARGE MANUFACTURERS TO UNDERSTAND MARKET DYNAMICS IN THE U.K. FOOD TESTING MARKET

4.3 EMERGING TREND ANALYSIS IN THE U.K. FOOD TESTING MARKET

4.4 INTERNAL FOOD TESTING LABORATORY IN THE U.K. FOOD TESTING MARKET

4.5 LAST FIVE YEARS OF ACQUIRED INTERNAL FOOD TESTING LABORATORIES

4.6 SUPPLY CHAIN ANALYSIS IN U.K. FOOD SAFETY TESTING MARKET

4.7 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF THE U.K. FOOD TESTING TECHNOLOGIES

4.8 TECHNOLOGICAL TRENDS IN U.K. FOOD TESTING MARKET

4.9 THE U.K. FOOD SAFETY TESTING MARKET- GROWING FOOD ADULTERATION CASES IN THE U.K.

4.1 U.K. FOOD TESTING MARKET- GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.11 U.K. FOOD TESTING MARKET- INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.12 MANUFACTURER AND RETAIL ASSESSMENTS IN TERMS OF CATEGORY GROWTH/TRENDS,

4.12.1 KEY INNOVATIONS, SPECIFIC GROWTH/STAGNATION/DECLINE CATEGORIES IN THE U.K. FOOD TESTING MARKET

5 REGULATORY FRAMEWORK AND GUIDELINES

5.1 FOOD AND BEVERAGES SAFETY AND QUALITY REGULATIONS

5.2 FOODBORNE ILLENESS OUTBREAK AND RELEVANT ACTIONS TAKEN BY GOVERNMENT BODIES

5.3 FOOD PRODUCTS RECALLS/WITHDRAWLS

5.4 ANALYSIS OF LAW SUITS RELATED TO FOOD SAFETY TESTING

5.5 RECNTLY FORMED LAWS FOR FOOD SAFETY TESTING BY GOVERNMENT BODIES

5.6 CHANGES IN GLOBAL FOOD SAFETY REGULATIONS

6 SUMMARY WRITE UP (U.K.)

6.1 OVERVIEW

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN CASES OF FOODBORNE DISEASES IN THE U.K.

7.1.2 INCREASED CONSUMER AWARENESS ABOUT FOOD SAFETY

7.1.3 ROLE OF GOVERNMENT ON FOOD SAFETY

7.1.4 INCREASE IN DEMAND FOR PACKAGED FOODS

7.1.5 STRICT REGULATIONS FOR FOOD SAFETY

7.2 RESTRAINTS

7.2.1 COMPLEXITY IN TESTING METHODS

7.2.2 LACK OF MAINTENANCE ON SAFETY UNIFORM STANDARDS

7.2.3 RISE IN FOOD RECALLS

7.2.4 HIGH COST ASSOCIATED WITH THE FOOD SAFETY TESTING EQUIPMENT

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

7.3.2 RISE IN EXPENDITURE

7.3.3 THE GROWTH OF TECHNOLOGICAL ADVANCEMENTS IN THE FOOD TESTING INDUSTRY

7.4 CHALLENGES

7.4.1 LACK OF AWARENESS AND EXPERTISE ON FOOD SAFETY REGARDING HAZARDOUS EFFECTS OF AVOIDING FOOD SAFETY TESTS

7.4.2 LACK OF FOOD MANAGEMENT INFRASTRUCTURE IN THE U.K.

8 U.K. FOOD TESTING MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 SYSTEM

8.2.1 SPECTROMETRY-BASED

8.2.2 HYBRIDIZATION -BASED

8.2.2.1 POLYMERASE CHAIN REACTION (PCR)

8.2.2.2 MICROARRAYS

8.2.2.3 GENE AMPLIFIERS

8.2.2.4 SEQUENCERS

8.2.3 IMMUNOASSAY-BASED

8.2.4 CHROMATOGRAPHY-BASED

8.2.4.1 LIQUID CHROMATOGRAPHY

8.2.4.2 GAS CHROMATOGRAPHY

8.2.4.3 COLUMN CHROMATOGRAPHY

8.2.4.4 THIN LAYER CHROMATOGRAPHY

8.2.4.5 PAPER CHROMATOGRAPHY

8.2.5 BIOSENSORS/BIOCHIP

8.2.6 ISOTOPE METHODS

8.2.7 OTHERS

8.3 TEST KITS

8.4 CONSUMABLES

8.5 OTHERS

9 U.K. FOOD TESTING MARKET, BY TYPE OF TESTS

9.1 OVERVIEW

9.2 FOOD SAFETY TESTING

9.2.1 ALLERGEN TESTING

9.2.1.1 PEANUT & SOY

9.2.1.2 GLUTEN

9.2.1.3 MILK

9.2.1.4 EGG

9.2.1.5 TREE NUTS

9.2.1.6 SEAFOOD

9.2.1.7 OTHERS

9.2.2 PATHOGEN TESTING

9.2.2.1 SALMONELLA SPP

9.2.2.2 E. COLI

9.2.2.3 LISTERIA SPP

9.2.2.4 VIBRIO SPP

9.2.2.5 CAMPYLOBACTER

9.2.2.6 OTHERS

9.2.3 GMO TESTING

9.2.3.1 STACKED

9.2.3.2 INSECT RESISTANCE

9.2.3.3 HERBICIDE TOLERANCE

9.2.4 MYCOTOXINS TESTING

9.2.4.1 AFLATOXINS

9.2.4.2 OCHRATOXINS

9.2.4.3 FUMONISINS

9.2.4.4 TRICHOTHECENES

9.2.4.5 DEOXYNIVALENOL

9.2.4.6 ZEARALENONE

9.2.4.7 PATULIN

9.2.5 NUTRITIONAL LABELLING

9.2.6 HEAVY METALS TESTING

9.2.6.1 ARSENIC

9.2.6.2 CADMIUM

9.2.6.3 LEAD

9.2.6.4 MERCURY

9.2.6.5 OTHERS

9.2.7 PESTICIDES TESTING

9.2.7.1 HERBICIDES

9.2.7.2 INSECTICIDES

9.2.7.3 FUNGICIDES

9.2.7.4 OTHERS

9.2.8 ORGANIC CONTAMINANTS TESTING

9.2.9 OTHERS

9.3 FOOD SHELF LIFE TESTING

9.3.1 MICROBIAL CONTAMINATION

9.3.2 CHEMICAL TESTS

9.3.3 RANCIDITY

9.3.3.1 PEROXIDE VALUE (PV)

9.3.3.2 P-ANISIDINE (P-AV)

9.3.3.3 FREE FATTY ACIDS (FFA)

9.3.4 ACIDITY LEVEL

9.3.5 NUTRIENT STABILITY

9.3.6 ORGANOLEPTIC APPEARANCE

9.3.6.1 COLOR

9.3.6.2 TEXTURE

9.3.6.3 AROMA

9.3.6.4 TASTE

9.3.6.5 PACKAGING

9.3.6.6 SEPARATION

9.3.6.7 STRATIFICATION

9.3.7 BROWNING

9.3.7.1 ENZYMATIC BROWNING

9.3.7.2 CHEMICAL BROWNING

9.3.8 FOOD SHELF LIFE TESTING, BY METHOD

9.3.8.1 REAL-TIME SHELF LIFE TESTING

9.3.8.2 ACCELERATED SHELF-LIFE TESTING

9.3.9 FOOD SHELF LIFE TESTING, BY PACKAGED FOOD CONDITION

9.3.9.1 FROZEN (-15°C TO -20°C )

9.3.9.2 REFRIGERATED (2°C TO 8°C )

9.3.9.3 AMBIENT (25°C/60%RH)

9.3.9.4 INTERMEDIATE (30°C/65%RH)

9.3.9.5 ACCELERATED (40°C/75%RH)

9.3.9.6 TROPICAL (30°C/75%RH)

9.3.9.7 OTHERS

9.4 FOOD AUTHENTICITY TESTING

9.4.1.1 ADULTERATION TESTS

9.4.1.2 ORGANIC

9.4.1.3 ALLERGEN TESTING

9.4.1.4 MEAT SPECIATION

9.4.1.5 GMO TESTING

9.4.1.6 HALAL VERIFICATION

9.4.1.7 KOSHER VERIFICATION

9.4.1.8 PROTECTED GEOGRAPHICAL INDICATION (PGI)

9.4.1.9 PROTECTED DENOMINATION OF ORIGIN (PDO)

9.4.1.10 FALSE LABELING

9.5 OTHERS

10 U.K. FOOD TESTING MARKET, BY SITE

10.1 OVERVIEW

10.2 INHOUSE/INTERNAL LAB

10.3 OUTSOURCING FACILITY

11 U.K. FOOD TESTING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD

11.2.1 FOOD, BY TYPE

11.2.1.1 EDIBLE OILS

11.2.1.1.1 SUNFLOWER OIL

11.2.1.1.2 PEANUT OIL

11.2.1.1.3 SOYBEAN OIL

11.2.1.1.4 OLIVE OIL

11.2.1.1.5 COCONUT OIL

11.2.1.1.6 OTHERS

11.2.1.2 EDIBLE OILS, BY TESTING TYPE

11.2.1.2.1 FOOD SAFETY TESTING

11.2.1.2.2 FOOD AUTHENTICITY TESTING

11.2.1.2.3 FOOD SHELF LIFE TESTING

11.2.1.3 SPICES

11.2.1.3.1 SPICES, BY TYPE OF TESTS

11.2.1.3.1.1 FOOD SAFETY TESTING

11.2.1.3.1.2 FOOD AUTHENTICITY TESTING

11.2.1.3.1.3 FOOD SHELF LIFE TESTING

11.2.1.4 DAIRY PRODUCTS

11.2.1.4.1 DAIRY PRODUCTS, BY TYPE

11.2.1.4.1.1 CHEESE

11.2.1.4.1.1.1 CHEESE CAKE

11.2.1.4.1.1.2 CHEESE CREAM

11.2.1.4.1.1.3 CHEESE BASED DESSERTS

11.2.1.4.1.1.4 CHEESE PUDDING

11.2.1.4.1.1.5 OTHERS

11.2.1.4.1.2 PROCESSED CHEESES

11.2.1.4.1.3 ICE CREAM

11.2.1.4.1.4 YOGURT

11.2.1.4.1.5 MILK DESSERT

11.2.1.4.1.6 PUDDING

11.2.1.4.1.7 CUSTARD

11.2.1.4.1.8 OTHERS

11.2.1.5 DAIRY PRODUCTS, BY TYPE OF TESTS

11.2.1.5.1 FOOD SAFETY TESTING

11.2.1.5.2 FOOD AUTHENTICITY TESTING

11.2.1.5.3 FOOD SHELF LIFE TESTING

11.2.1.6 CONFECTIONARY

11.2.1.6.1 CONFECTIONARY, BY TYPE

11.2.1.6.1.1 JAMS AND JELLIES

11.2.1.6.1.2 CANDY BARS

11.2.1.6.1.3 JELLY CANDIES

11.2.1.6.1.4 MARMALADES

11.2.1.6.1.5 FRUIT JELLY DESSERT

11.2.1.6.1.6 MERINGUES

11.2.1.6.1.7 OTHERS

11.2.1.7 CONFECTIONARY, BY TYPE OF TESTS

11.2.1.7.1 FOOD SAFETY TESTING

11.2.1.7.2 FOOD AUTHENTICITY TESTING

11.2.1.7.3 FOOD SHELF LIFE TESTING

11.2.1.8 HERBAL EXTRACTS AND HERBS

11.2.1.8.1 HERBAL EXTRACTS AND HERBS, BY TYPE OF TESTS

11.2.1.8.1.1 FOOD SAFETY TESTING

11.2.1.8.1.2 FOOD AUTHENTICITY TESTING

11.2.1.8.1.3 FOOD SHELF LIFE TESTING

11.2.1.9 MEAT & POULTRY PRODUCTS

11.2.1.9.1 MEAT & POULTRY PRODUCTS, BY TYPE

11.2.1.9.1.1 CHICKEN

11.2.1.9.1.1.1 FROZEN

11.2.1.9.1.1.2 FRESH

11.2.1.9.1.2 PORK

11.2.1.9.1.2.1 FROZEN

11.2.1.9.1.2.2 FRESH

11.2.1.9.1.3 SEAFOOD

11.2.1.9.1.3.1 FROZEN

11.2.1.9.1.3.2 FRESH

11.2.1.9.1.4 BEEF

11.2.1.9.1.4.1 FROZEN

11.2.1.9.1.4.2 FRESH

11.2.1.9.1.5 LAMB

11.2.1.9.1.5.1 FROZEN

11.2.1.9.1.5.2 FRESH

11.2.1.9.1.6 OTHERS

11.2.1.9.1.6.1 FROZEN

11.2.1.9.1.6.2 FRESH

11.2.1.9.2 MEAT AND POULTRY PRODUCTS, BY TYPE OF TESTS

11.2.1.9.2.1 FOOD SAFETY TESTING

11.2.1.9.2.2 FOOD AUTHENTICITY TESTING

11.2.1.9.2.3 FOOD SHELF LIFE TESTING

11.2.1.10 PROCESSED FOOD

11.2.1.10.1.1 CANNED FRUITS & VEGETABLES

11.2.1.10.1.2 JAMS, PRESERVES & MARMALADES

11.2.1.10.1.3 FRUIT & VEGETABLE PUREE

11.2.1.10.1.4 SAUCES, DRESSINGS AND CONDIMENTS

11.2.1.10.1.5 READY MEALS

11.2.1.10.1.6 PICKLES

11.2.1.10.1.7 SOUPS

11.2.1.10.2 PROCESSED FOOD , BY TYPE OF TESTS

11.2.1.10.2.1 FOOD SAFETY TESTING

11.2.1.10.2.2 FOOD AUTHENTICITY TESTING

11.2.1.10.2.3 FOOD SHELF LIFE TESTING

11.2.1.11 HONEY

11.2.1.11.1 HONEY, BY TYPE OF TESTS

11.2.1.11.1.1 FOOD SAFETY TESTING

11.2.1.11.1.2 FOOD AUTHENTICITY TESTING

11.2.1.11.1.3 FOOD SHELF LIFE TESTING

11.2.1.12 BABY FOODS

11.2.1.12.1 BABY FOODS, BY TYPE OF TESTS

11.2.1.12.1.1 FOOD SAFETY TESTING

11.2.1.12.1.2 FOOD AUTHENTICITY TESTING

11.2.1.12.1.3 FOOD SHELF LIFE TESTING

11.2.1.13 PLANT BASED MEAT AND MEAT ALTERNATIVES

11.2.1.13.1 PLANT BASED MEAT AND MEAT ALTERNATIVES, BY TYPE

11.2.1.13.1.1 BURGER & PATTIES

11.2.1.13.1.2 SAUSAGES

11.2.1.13.1.3 STRIPS & NUGGETS

11.2.1.13.1.4 MEATBALLS

11.2.1.13.1.5 TEMPEH

11.2.1.13.1.6 TOFU

11.2.1.13.1.7 SEITEN

11.2.1.13.1.8 OTHERS

11.2.1.13.2 PLANT BASED MEAT AND MEAT ALTERNATIVES, BY TYPE OF TESTS

11.2.1.13.2.1 FOOD SAFETY TESTING

11.2.1.13.2.2 FOOD AUTHENTICITY TESTING

11.2.1.13.2.3 FOOD SHELF LIFE TESTING

11.2.1.14 TOBACCO

11.2.1.14.1 TOBACCO, BY TYPE OF TESTS

11.2.1.14.1.1 FOOD SAFETY TESTING

11.2.1.14.1.2 FOOD AUTHENTICITY TESTING

11.2.1.14.1.3 FOOD SHELF LIFE TESTING

11.2.1.15 CBD PRODUCTS

11.2.1.15.1 CBD, BY TYPE OF TESTS

11.2.1.15.1.1 FOOD SAFETY TESTING

11.2.1.15.1.2 FOOD AUTHENTICITY TESTING

11.2.1.15.1.3 FOOD SHELF LIFE TESTING

11.3 CEREALS & GRAINS

11.3.1 CEREALS & GRAINS, BY TYPE

11.3.1.1 WHEAT

11.3.1.2 MAIZE

11.3.1.3 BARLEY

11.3.1.4 RICE

11.3.1.5 OAT

11.3.1.6 SORGHUM

11.3.1.7 OTHERS

11.3.2 CEREALS & GRAINS, BY TYPE OF TESTS

11.3.2.1 FOOD SAFETY TESTING

11.3.2.2 FOOD AUTHENTICITY TESTING

11.3.2.3 FOOD SHELF LIFE TESTING

11.4 OIL SEEDS & PULSES

11.4.1 OILSEEDS & PULSES, BY TYPE

11.4.1.1 GRAM

11.4.1.2 PEA

11.4.1.3 LENTILS

11.4.1.4 SUNFLOWER

11.4.1.5 SOYABEAN

11.4.1.6 GROUNDNUT

11.4.1.7 SESAME

11.4.1.8 COTTON SEED

11.4.1.9 PALM

11.4.1.10 OTHERS

11.4.2 OILSEEDS & PULSES, BY TYPE OF TESTS

11.4.2.1 FOOD SAFETY TESTING

11.4.2.2 FOOD AUTHENTICITY TESTING

11.4.2.3 FOOD SHELF LIFE TESTING

11.5 NUTS

11.5.1 NUTS, BY TYPE

11.5.1.1 ALMOND

11.5.1.2 WALNUT

11.5.1.3 CASHEW NUT

11.5.1.4 BRAZIL NUT

11.5.1.5 MACADAMIA NUT

11.5.1.6 OTHERS

11.5.2 NUTS, BY TYPE OF TESTS

11.5.2.1 FOOD SAFETY TESTING

11.5.2.2 FOOD AUTHENTICITY TESTING

11.5.2.3 FOOD SHELF LIFE TESTING

11.6 BEVERAGES

11.6.1 BEVERAGES, BY TYPE

11.6.1.1 ALCOHOLIC

11.6.1.1.1 BEER

11.6.1.1.2 WINE

11.6.1.1.3 WHISKY

11.6.1.1.4 VODKA

11.6.1.1.5 TEQUILA

11.6.1.1.6 GIN

11.6.1.1.7 OTHERS

11.6.1.2 NON-ALCOHOLIC

11.6.1.2.1 CARBONATED DRINKS

11.6.1.2.2 MINERAL WATER

11.6.1.2.3 COFFEE

11.6.1.2.4 JUICES

11.6.1.2.5 SMOOTHIES

11.6.1.2.5.1 TEA

11.6.1.2.6 PLANT-BASED MILK

11.6.1.2.6.1 SOY MILK

11.6.1.2.6.2 ALMOND MILK

11.6.1.2.6.3 OAT MILK

11.6.1.2.6.4 CASHEW MILK

11.6.1.2.6.5 RICE MILK

11.6.1.2.6.6 OTHERS

11.6.1.2.7 SPORTS DRINKS

11.6.1.2.8 NUTRITIONAL DRINKS

11.6.1.2.9 OTHERS

11.6.2 BEVERAGES, BY TYPE OF TESTS

11.6.2.1 FOOD SAFETY TESTING

11.6.2.2 FOOD AUTHENTICITY TESTING

11.6.2.3 FOOD SHELF LIFE TESTING

12 U.K. FOOD TESTING MARKET BY COUNTRY

12.1.1 U.K.

13 U.K. FOOD TESTING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.K.

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 EUROFINS SCIENTIFIC (2021)

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 THERMO FISCHER SCIENTIFIC ( (2021)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 INTERTEK GROUP PLC (2021)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 BUREAU VERITAS

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 TÜV SÜD (2021)

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ALS LIMITED (2021)

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 SGS SA (2021)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 NEOGEN CORPORATION (2021)

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 CAMPDEN BRI (2021)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 ROMER LABS DIVISION HOLDING GMBH (A SUBSIDIARY OF DSM) (2021)

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 READING SCIENTIFIC SERVICES LIMITED (2021)

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 PREMIER ANALYTICS SERVIES (2021)

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 NSF INTERNATIONAL (2021)

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 ADVANCED LABORATORY TESTING (2021)

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 BIA ANALYTICAL (2021)

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 FOOD FORENSICS LIMITED (2021)

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 MICROLABS LTD (2021)

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 THE MARKET PLAYERS WHICH ARE UNDER THE CATEGORY OF LARGE SCALE MANUFACTURERS

TABLE 2 THE MARKET PLAYERS WHICH ARE UNDER THE CATEGORY OF SMALL AND MEDIUM SCALE MANUFACTURERS

TABLE 3 NAME OF BUSINESSES, LIKELY SCALE OF TESTING/VALUE BASED ON T/O OF BUSINESS, LOCATIONS

TABLE 4 U.K. FOOD TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 U.K. SYSTEM IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 U.K. HYBRIDIZATION -BASED IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 U.K. CHROMATOGRAPHY -BASED IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 U.K. FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD THOUSAND)

TABLE 9 U.K. FOOD SAFETY TESTING IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 10 U.K. ALLERGEN TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 U.K. PATHOGEN TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.K. MYCOTOXINS TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 U.K. HEAVY METALS TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 U.K. PESTICIDE TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 U.K. FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 U.K. RANCIDITY IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 U.K. ORGANOLEPTIC APPEARANCE IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 U.K. BROWNING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.K. FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 22 U.K. FOOD AUTHENTICITY TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 U.K. FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 U.K. FOOD IN FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 U.K. EDIBLE OILS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.K. EDIBLE OILS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 28 U.K. SPICES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 29 U.K. DAIRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.K. CHEESE IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 U.K. DAIRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 32 U.K. CONFECTIONARY IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.K. CONFECTIONARY IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 34 U.K. HERBAL EXTRACTS AND HERBS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 35 U.K. MEAT AND POULTRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 U.K. CHICKEN IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.K. PORK IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.K. SEAFOOD IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.K. BEEF IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.K. LAMB IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.K. OTHERS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.K. MEAT AND POULTRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 43 U.K. PROCESSED FOOD IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.K. PROCESSED FOOD IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 45 U.K. HONEY IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 46 U.K. BABY FOODS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 47 U.K. PLANT BASED MEAT AND MEAT ALTERNATIVES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.K. PLANT BASED MEAT AND MEAT ALTERNATIVES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 49 U.K. TOBACCO IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 50 U.K. CBD IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 2 U.K. CEREALS AND GRAINS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 3 U.K. OILSEEDS & PULSES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 U.K. OILSEEDS & PULSES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 5 U.K. NUTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 U.K. NUTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 7 U.K. BEVERAGES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 U.K. ALCOHOLIC IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 U.K. NON-ALCOHOLIC IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 U.K. PLANT-BASED MILK IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 U.K. NUTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 12 U.K. FOOD TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.K. SYSTEM IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 U.K. HYBRIDIZATION-BASED IN FOOD TESTING MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 15 U.K. CHROMATOGRAPHY-BASED IN FOOD TESTING MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 16 U.K. FOOD TESTING MARKET, BY TYPE OF TESTS , 2020-2029 (USD MILLION)

TABLE 17 U.K. FOOD SAFETY TESTING IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 18 U.K. ALLERGEN TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 U.K. PATHOGEN TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.K. GMO TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 U.K. MYCOTOXINS TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 U.K. HEAVY METALS TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 U.K. PESTICIDES TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 U.K. FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 U.K. ORGANOLEPTIC AND APPEARANCE IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 U.K. RANCIDITY IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.K. BROWNING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 U.K. FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 29 U.K. FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY PACKAGED FOOD CONDITION, 2020-2029 (USD MILLION)

TABLE 30 U.K. FOOD AUTHENTICITY TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 U.K. FOOD TESTING MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 32 U.K. FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 U.K. FOOD IN FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 U.K. EDIBLE OILS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 U.K. EDIBLE OILS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 36 U.K. SPICES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 37 U.K. DAIRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.K. CHEESE IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.K. DAIRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 40 U.K. CONFECTIONERY IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.K. CONFECTIONERY IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 42 U.K. HERBAL EXTRACTS AND HERBS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 43 U.K. MEAT AND POULTRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.K. CHICKEN IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.K. PORK IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.K. SEAFOOD IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.K. BEEF IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.K. LAMB IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.K. OTHERS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.K. MEAT AND POULTRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 51 U.K. PROCESSED FOOD IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.K. PROCESSED FOOD IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 53 U.K. HONEY IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 54 U.K. BABY FOOD IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 55 U.K. PLANT BASED MEAT AND MEAT ALTERNATIVES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.K. PLANT BASED MEAT AND MEAT ALTERNATIVES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 57 U.K. TOBACCO IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 58 U.K. CBD PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 59 U.K. CEREALS AND GRAINS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.K. CEREALS AND GRAINS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 61 U.K. OILSEED AND PULSES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.K. OILSEED AND PULSES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 63 U.K. NUTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.K. NUTS IN FOOD TESTING MARKET, B TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 65 U.K. BEVERAGES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.K. NON-ALCOHOLIC IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.K. PLANT-BASED MILK IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.K. ALCOHOLIC IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.K. BEVERAGES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 U.K. FOOD TESTING MARKET: SEGMENTATION

FIGURE 2 U.K. FOOD TESTING MARKET: DATA TRIANGULATION

FIGURE 3 U.K. FOOD TESTING MARKET: DROC ANALYSIS

FIGURE 4 U.K. FOOD TESTING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.K. FOOD TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.K. FOOD TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.K. FOOD TESTING MARKET: DBMR POSITION GRID

FIGURE 8 U.K. FOOD TESTING MARKET: APPLICATION COVERAGE GRID

FIGURE 9 U.K. FOOD TESTING MARKET: SEGMENTATION

FIGURE 10 RISE IN CASES OF FOOD BORNE ILLNESS IN THE U.K., RISE IN TECHNOLOGICAL DEVELOPMENTS IN FOOD TESTING KITS AND RISE IN CONSUMER CONSCIOUSNESS ABOUT FOOD TESTING AND SAFETY IS EXPECTED TO DRIVE U.K. FOOD TESTING MARKET FROM 2022 TO 2029

FIGURE 11 TESTING TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE U.K. FOOD TESTING MARKET FROM 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.K. FOOD TESTING MARKET

FIGURE 13 NUMBER OF CASES CAUSED DUE TO FOODBORNE PATHOGENS IN THE U.K. IN 2016

FIGURE 14 NUMBER OF CASES CAUSED DUE TO FOODBORNE PATHOGENS IN IRELAND IN 2021

FIGURE 15 U.K. FOOD TESTING MARKET: BY TESTING TYPE, 2021

FIGURE 16 U.K. FOOD TESTING MARKET: BY TESTING TYPE, 2022-2029 (USD THOUSAND)

FIGURE 17 U.K. FOOD TESTING MARKET: BY TESTING TYPE, CAGR (2022-2029)

FIGURE 18 U.K. FOOD TESTING MARKET: BY TESTING TYPE, LIFELINE CURVE

FIGURE 19 U.K. FOOD TESTINGMARKET: BY TYPE OF TESTS, 2021

FIGURE 20 U.K. FOOD TESTINGMARKET: BY TYPE OF TESTS, 2022-2029 (USD THOUSAND)

FIGURE 21 U.K. FOOD TESTINGMARKET: BY TYPE OF TESTS, CAGR (2022-2029)

FIGURE 22 U.K. FOOD TESTINGMARKET: BY TYPE OF TESTS, LIFELINE CURVE

FIGURE 23 U.K. FOOD TESTING MARKET: BY SITE, 2021

FIGURE 24 U.K. FOOD TESTING MARKET: BY SITE, 2022-2029 (USD MILLION)

FIGURE 25 U.K. FOOD TESTING MARKET: BY SITE, CAGR (2022-2029)

FIGURE 26 U.K. FOOD TESTING MARKET: BY SITE, LIFELINE CURVE

FIGURE 27 U.K. FOOD TESTING MARKET: BY APPLICATION, 2021

FIGURE 28 U.K. FOOD TESTING MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 U.K. FOOD TESTING MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 U.K. FOOD TESTING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 U.K. FOOD TESTING MARKET: COMPANY SHARE 2021 (%)

Uk Food Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Uk Food Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Uk Food Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.