Us Canada Germany France Spain Italy Uk And Australia Newzealand Automotive Collision Repair Market

Market Size in USD Billion

CAGR :

%

USD

33.97 Billion

USD

50.80 Billion

2025

2033

USD

33.97 Billion

USD

50.80 Billion

2025

2033

| 2026 –2033 | |

| USD 33.97 Billion | |

| USD 50.80 Billion | |

|

|

|

|

U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand Automotive Collision Repair Market Size

- The U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market size was valued at USD 33.97 billion in 2025 and is expected to reach USD 50.80 billion by 2033, at a CAGR of 5.3% during the forecast period

- The U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market is experiencing steady growth, due to rising vehicle population, higher road accident rates, and growing consumer and insurer expectations for quality repairs. Advances in vehicle technology, including electronics and safety systems, require specialized repairs. Urbanization and increased vehicle use further drive the need for timely and reliable collision repair services. Additionally, stricter regulations and the growth of insurance coverage promote vehicle repair post-accidents, boosting market growth in these countries.

U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand Automotive Collision Repair Market Analysis

- The automotive collision repair industry presents a dynamic landscape driven by the necessity to restore vehicles to their original condition post-accident or damage. This sector encompasses a broad spectrum of services and products, ranging from bodywork and painting to frame alignment and mechanical repairs.

- Key trends such as the adoption of Advanced Driver Assistance Systems (ADAS) and the integration of Virtual Reality (VR) and Augmented Reality (AR) for training and repair processes further underscore the industry's commitment to efficiency and quality. As vehicles become more complex and incorporate cutting-edge features, the automotive collision repair market remains essential in ensuring road safety and preserving the value of automotive investments.

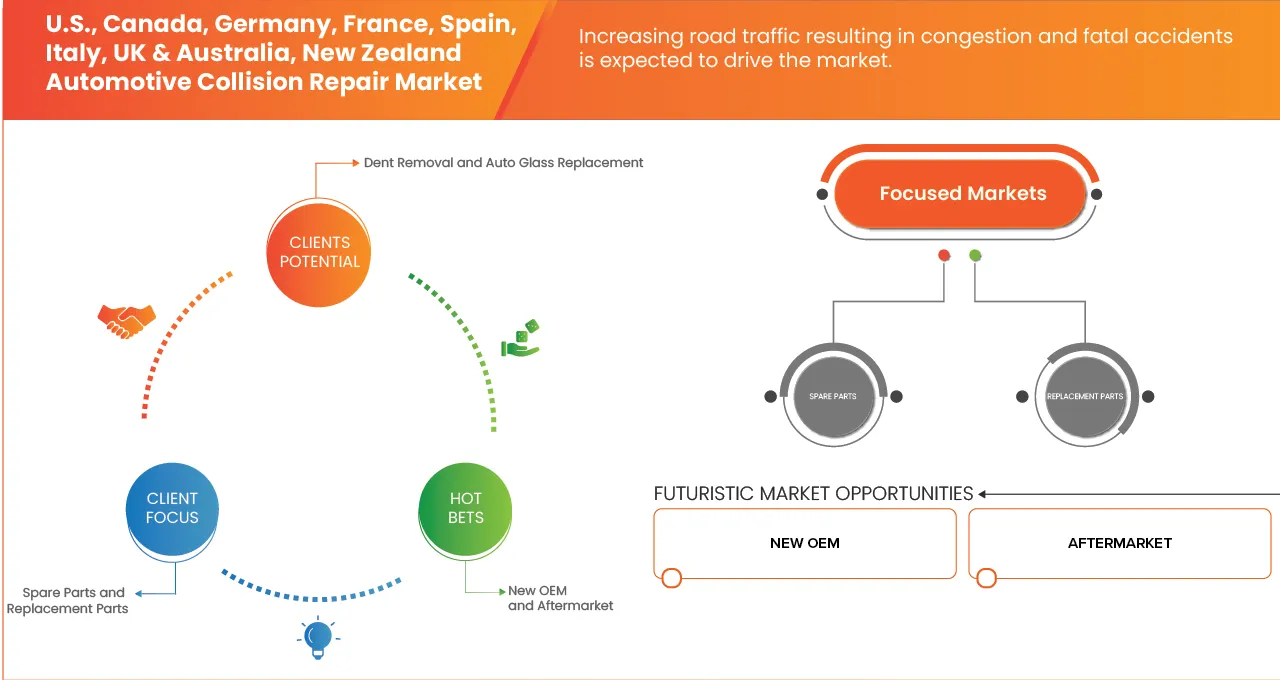

- On the basis of product, the automotive collision repair market has been segmented into spare parts, paints & coatings, replacement parts, consumables, and others. Spare parts, replacement parts, consumables, and others are further segmented by sales channel into new OEM, aftermarket, recycled, remanufactured, and salvage. Paintings & coatings are further segmented by sales channel into new OEM, aftermarket, and by type, which include basecoat, clearcoat, primer, thinners & solvents, and paint blending materials. Consumables are also sub-segmented by type into adhesives & sealants, body fillers, welding wire & gases, masking products, sandpaper & abrasives, and others. In 2025, spare parts have accounted for the largest market share due to the growing number of road accidents as well as rising sales for vehicles.

- On the basis of shop type, the automotive collision repair market has been segmented into auto body shops, dealer-owned shops, and independent repair shops. In 2025, the independent repair shop segment accounted for the largest market share as it offers comprehensive services and skilled technicians capable of handling a wide range of repair needs.

- On the basis of geography market is segmented into the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, and New Zealand. In 2025, US dominated the automotive collision repair market due high frequency of road accidents, combined with increasing vehicle complexity and the adoption of Advanced Driver Assistance Systems (ADAS).

Report Scope and U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand Automotive Collision Repair Market Segmentation

|

Attributes |

U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand Automotive Collision Repair Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand Automotive Collision Repair Market Trends

“Rising integration of ADAS and EV repairs due to increasing adoption of advanced vehicles, requiring specialized calibration and battery handling”

- Advanced Driver Assistance Systems (ADAS) demand precise recalibration after repairs to maintain safety and functionality, requiring skilled technicians and specialized tools.

- Electric Vehicles (EVs) incorporate complex high-voltage batteries and lightweight materials, necessitating strict safety protocols and expert handling to avoid hazards.

- Repair shops face challenges due to the need for ongoing training and investment in new diagnostic equipment to service these evolving technologies efficiently.

- The complexity of ADAS and EV systems extends repair times and costs, elevating the need for certified facilities that can manage sophisticated repairs reliably.

- The growing adoption of Industry 4.0 technologies is also enabling predictive maintenance and real-time production tracking, improving operational efficiency.

U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand Automotive Collision Repair Market Dynamics

Driver

“Progression in the Automobile Sector”

- The expansion of economies worldwide and the creation of numerous employment opportunities have driven an increase in per capita income, which in turn is fueling a growing demand for automobiles. The implementation of mass manufacturing techniques has also efficiently met this escalating demand without undue strain

- Further, automobiles were also used as personal or commercial vehicles, and various technological advancements came along the way. Although various environmental concerns were raised against emission-based fuels, the growth did not stop, as manufacturers found an alternative way to produce renewable-based and energy-efficient electric or solar-powered vehicles. This has contributed to the growth of digitalized services, such as on-demand vehicles and carpooling services like Uber, among others

- Manufacturers have also addressed vehicle sections for disabled drivers by introducing driverless and autonomous cars with advanced sensors and navigation systems. The growth of this industry has also trickled down to aftermarket service centers or repair outlets, where they are using superior materials and automated techniques to provide quality service. This has become especially important since users want to reduce the total cost of ownership of their vehicles by increasing their lifetime U.S.ge. Thus, the progression in the automobile industry, which drives the need for excellent aftermarket services, is fueling the growth of the automotive collision repair market

Restraint

“Increase in the Number of Safety Systems in Vehicles”

- Safety systems in vehicles are as old as the vehicle itself, and they have come a long way since the 1900s. Although basic safety features, such as seatbelts, were introduced as early as the 1940s, other features like active & passive safety systems (airbags, electronic stability control, and rearview cameras) were only introduced towards the end of the 20th century. After that, technology entered the picture, and automobile manufacturers began implementing it to enhance their safety systems. As they evolved, they developed newer safety systems, including Head-Up Display (HUD), Tire Pressure Monitoring System (TPMS), Adaptive Cruise Control (ACC), Driver Monitoring System (DMS), Night Vision System (NVS), and Blind Spot Detection (BSD), among others.

- This push ultimately led to the introduction of driverless or autonomous cars, which featured advanced navigation and sensor systems, including Advanced Collision Warning (ACW) and Automated Emergency Braking (AEB), among others. These systems were integrated with intelligent algorithms to prevent collisions. These enhanced systems have reduced the number of collisions, resulting in severe revenue crunches for the automobile aftermarket industry. Hence, improvements in vehicle safety systems, along with the development of autonomous cars, are helping to avoid collisions and reduce insurance claims, which are restraining the growth of the automotive collision repair market.

- For instance, in August 2025, Austroads, the association of Australian and New Zealand road transport and traffic agencies, launched a new ADAS Guidance Service to help drivers, assessors, licensing authorities, and the broader community better understand and safely use Advanced Driver Assistance Systems (ADAS)

- Thus, the development of autonomous vehicles along with superior safety systems in vehicles is acting as a significant factor that is restricting the growth of the automotive collision repair market.

U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand Automotive Collision Repair Market Scope

The U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market is segmented into six notable segments based on the product, repair type, service channel, sales channel, shop type, and vehicle type.

• By Product

On the basis of product, U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market has been segmented into spare parts, replacement parts, paintings & coatings, and consumables, and others. In 2026, spare parts segment is expected to dominate the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market with 36.90% market share due to surging road accidents damaging components, aging vehicle fleets needing frequent replacements, and advanced ADAS/EV tech requiring specialized OEM parts for reliable repairs.

Spare parts segment is estimated to grow with the highest CAGR of 5.7% due to due to frequent damage from accidents, aging fleets demanding replacements, and advanced ADAS/EV components requiring specialized OEM parts.

• By Repair Type

On the basis of repair type, U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market is segmented into dent removal, auto glass replacement, straightening out bent mental, replacing doors or panels, paint matching, scratch removal, auto detailing, and other. In 2026, dent removal segment is expected to dominate the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market with 27.38% market share owing to rising consumer preference for efficient, cost-effective, and non-invasive repair methods.

Dent Removal segment is estimated to grow with the highest CAGR of 6.1% due to increasing consumer preference for cost-effective, quick, and non-invasive paintless dent repair methods that preserve original paint, reduce repair time, and maintain vehicle resale value.

• By Service Channel

On the basis of service channel, U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market is segmented into OE, DIFM (do it for me) and DIY (do it yourself). In 2026, OE segment is expected to dominate the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market with 55.17% market share due to assured quality, perfect compatibility with vehicle systems, and preservation of manufacturer warranties, especially vital for advanced ADAS and EV repairs.

OE segment is estimated to grow with the highest CAGR of 5.6% in the forecast period due to vehicle complexity from ADAS/EV tech demanding OEM-approved repairs, long-term warranties fostering customer loyalty, and OEMs expanding parts supply to certified shops.

• By Sales Channel

On the basis of sales channel, U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market is segmented into new OEM, aftermarket, recycled, remanufactured and salvage. In 2026, the new OEM segment is expected to dominate the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market with 43.18% market share due to the increasing complexity of vehicles equipped with advanced technologies like ADAS and EV components.

New OEM segment is estimated to grow with the highest CAGR of 5.5% in the forecast period due to rising vehicle complexity from ADAS and EV technologies demanding manufacturer-approved repairs, expanding OEM-certified networks, and consumer preference for warranty-preserving quality services.

• By Shop Type

On the basis of shop type, U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market has been segmented into auto body shops, dealer owned shops, and independent repair shops. In 2026, auto body shops segment is expected to dominate the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand Automotive Collision Repair market with 46.85% market share due to widespread presence and cost-competitive services of independent shops.

Independent repair shops segment is estimated to grow with the highest CAGR of 5.6% in the forecast period due to due to cost advantages over dealerships, personalized customer service fostering loyalty, and rapid adoption of advanced technologies like ADAS calibration. Flexible operations and eco-friendly practices further attract consumers seeking quick, affordable repairs.

• By Vehicle Type

On the basis of vehicle type, U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market has been segmented into passenger cars, commercial vehicle, and two wheelers. In 2026, passenger cars segment is expected to dominate the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market with 64.36% market share owing to due to highest vehicle ownership and U.S.ge rates, leading to frequent collisions from urban traffic and congestion.

Passenger cars segment is estimated to grow with the highest CAGR of 5.4% in the forecast period due to surging ownership driven by urbanization and personal mobility demand, frequent urban collisions from traffic congestion, and complex ADAS/EV repairs requiring specialized services.

U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand Automotive Collision Repair Market Country Analysis

- US is expected to dominate the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market with the largest market share of 65.35% in 2026, due to its massive registered vehicle fleet, high collision frequency from dense urban traffic, and mature insurance ecosystem driving repair volumes

- Canada is expected to hold 10.58% of the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market share in 2026 due to rising vehicle ownership and fleet size, increasing adoption of Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS), which require specialized repair services.

- Germany is expected to hold 5.22% of the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market share in 2026 due to high vehicle density, premium automotive manufacturing, and strict safety regulations mandating certified services for aging fleets and complex technologies.

- UK is expected to hold 4.72% of the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market share in 2026 due to high vehicle ownership, growing traffic density, and increasing repair costs driven by advanced vehicle technologies.

- Australia is expected to hold 3.97% of the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market share in 2026 due to expanding vehicle numbers on roads, rising accident frequency from urbanization, and strong demand for professional restoration services.

- France is expected to hold 3.80% of the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market share in 2026 due to increasing vehicle ownership coupled with rising accident rates, and the growing complexity of vehicles requiring advanced repairs like ADAS calibration.

- Italy is expected to hold 3.15% of the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market share in 2026 due to increase in vehicle ownership and demand for high-quality collision repair services.

- Spain is expected to hold 2.16% of the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market share in 2026 due to increased traffic congestion and accident rates, rising repair costs from aging vehicle fleets, and stringent vehicle maintenance regulations.

- New Zealand is expected to hold 1.05% of the U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market share in 2026 due to growth in vehicle ownership, particularly passenger cars, and increasing collision incidents from urban expansion.

The U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand automotive collision repair market is primarily led by well-established companies, including:

- DENSO CORPORATION (Japan)

- Robert Bosch GmbH (Germany)

- 3M (U.S.)

- AISIN CORPORATION (Japan)

- VALEO S.A. (France)

- DuPont (U.S.)

- Nippon Paint Holdings Co., Ltd (Japan)

- Tenneco Inc. (U.S.)

- Henkel AG & Co. KGaA (Germany)

- Magna International Inc. (Canada)

- OPmobility SE (France)

- MANN+HUMMEL (Germany)

- Mitsuba Corp. (Japan)

- ABRA Auto Body Repair of America (U.S.)

- AMERICA'S AUTO BODY (U.S.)

- Caliber Holdings LLC (U.S.)

- Gerber Collision & Glass (Canada)

- ATP AUTOMOTIVE (U.S.)

- DANA INCORPORATED (U.S.)

- HYUNDAI MOTOR COMPANY (South Korea)

- MARTINREA INTERNATIONAL INC (Canada)

- Phinia Inc (U.S.)

- Jeff Schmitt Auto Group (U.S.)

- CONTINENTAL AG (Germany)

- FORVIA (France)

- CARDONE Industries (U.S.)

- Dayco Incorporated (U.S.)

Latest Developments in U.S., Canada, Germany, France, Spain, Italy, UK & Australia, New Zealand Automotive Collision Repair Market

- In September 2023, DENSO CORPORATION launched "Everycool," a commercial vehicle cooling system for trucks, improving cooling efficiency and reducing environmental impact. Everycool enhances driver comfort during hot seasons while lowering fuel consumption, contributing to energy efficiency. It's compact and lightweight, saving space and maintaining cargo capacity. Compatible with various vehicle types, Everycool addresses industry challenges and aligns with DENSO's vision for a well-being cycle society

- In April 2024, DENSO announces MobiQ: the company's new brand of aftermarket smart mobility and vehicle-to-everything (V2X) products and solutions. DENSO unveiled MobiQ today at the ITS America Conference & Expo 2024 in Phoenix

- In February 2022, Bosch announced that it will implement a new Bosch branded, automotive workshop franchise in the U.S. This workshop franchise will create a stronger link between the technical competence of Bosch in the OE sector and the enabling of workshops for future opportunities and challenges

- In December 2023, Robert Bosch joined CAPA's Tier 1 Replacement Parts Verification Program, aiming to submit its ultrasonic parking sensors for CAPA verification. This initiative ensures that Bosch's replacement parts meet the same quality standards as the car company's original parts, providing clarity and reliability for automotive repair professionals. By participating in this program, Bosch demonstrates its commitment to delivering high-quality replacement parts that comply with federal regulations

- In March 2024, DRiV expanded its product coverage in the Americas by introducing 181 new part numbers across its leading brands, including Monroe, MOOG, Walker, Wagner, and Beck-Arnley during the first two months of 2024. These additions provide millions of additional repair occasions, covering approximately 97 million vehicles on the road. This initiative demonstrates DRiV's commitment to providing comprehensive coverage and quality parts for shop owners and technicians

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET END-USER COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2 PENETRATION AND GROWTH POSPECT MAPPING

4.3 REGULATORY STANDARDS IN THE U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET

4.4 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

4.5 CONSUMER BEHAVIOR

4.5.1 BUYING PATTERN

4.5.2 USES ANALYSIS

4.6 TECHNOLOGY ANALYSIS

4.6.1 KEY TECHNOLOGIES

4.6.2 COMPLEMENTARY TECHNOLOGIES

4.6.3 ADJACENT TECHNOLOGIES

4.7 CHALLENGES

4.8 IN-HOUSE IMPLEMENTATION / OUTSOURCED (THIRD-PARTY) IMPLEMENTATION

4.8.1 CUSTOMER BASE

4.8.2 SERVICE POSITIONING

4.8.3 CUSTOMER FEEDBACK / RATING (B2B OR B2C)

4.8.4 APPLICATION REACH

4.8.5 SERVICE PLATFORM MATRIX

4.9 USED CASES & ITS ANALYSIS

4.1 PRICING ANALYSIS BASED ON SALES, MARKETING & CUSTOMER SERVICE

4.11 BRAND COMPARATIVE ANALYSIS

4.12 PORTER'S FIVE FORCES ANALYSIS

4.13 TARIFFS & IMPACT ON THE

4.13.1 TARIFF STRUCTURES

4.13.1.1 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, U.K. & AUSTRALIA, NEW ZEALAND VS. REGIONAL TARIFF STRUCTURES

4.13.1.2 UNITED STATES: ICT TARIFF POLICIES

4.13.1.3 EUROPEAN UNION: CROSS-BORDER TARIFF REGULATIONS, REIMBURSEMENT POLICIES

4.13.1.4 EMERGING MARKETS: CHALLENGES IN TARIFF IMPLEMENTATION

4.13.1.5 INCREASED COSTS

4.13.1.6 SUPPLY CHAIN DISRUPTIONS

4.13.1.7 UNCERTAINTY AND INVESTMENT

4.13.1.8 IMPACT ON INNOVATION

4.13.1.9 COMPETITION AND MARKET DYNAMICS

4.13.1.10 EFFECT ON SMALL AND MEDIUM ENTERPRISES (SMES)

4.13.1.11 DEPLOYMENT OF TELECOMMUNICATION INFRASTRUCTURE

4.13.1.12 STRATEGIC RESPONSES AND INDUSTRY OUTLOOK

4.13.1.13 DIVERSIFICATION OF SUPPLY CHAINS

4.13.1.14 LEVERAGING ADVANCED LOGISTICS

4.13.1.15 ADVOCACY FOR POLICY ADJUSTMENTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 PROGRESSION IN THE AUTOMOBILE SECTOR

5.1.2 RISING ADOPTION OF COLLISION INSURANCE & OWN DAMAGE INSURANCE

5.1.3 INCREASING ROAD TRAFFIC RESULTING IN CONGESTION AND FATAL ACCIDENTS

5.2 RESTRAINT

5.2.1 INCREASE IN THE NUMBER OF SAFETY SYSTEMS IN VEHICLES

5.3 OPPORTUNITIES

5.3.1 DELIVERY OF AUTHENTIC AND GENUINE SPARE PARTS BY AUTOMOBILE OEM AND OES TO COLLISION REPAIR CENTRES

5.3.2 ADVANCEMENTS IN AUTOMOTIVE REPAIR TECHNOLOGY

5.3.3 EXPANDING NETWORKS OF COLLISION REPAIR AND SERVICE CENTRE

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS

5.4.2 GROWING ENVIRONMENTAL CONCERNS

6 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 SPARE PARTS

6.2.1 SALES CHANNEL

6.2.1.1 AFTERMARKET

6.2.1.2 NEW OEM

6.2.1.3 RECYCLED

6.2.1.4 REMANUFACTURED

6.2.1.5 SALVAGE

6.3 REPLACEMENT PARTS

6.3.1 SALES CHANNEL

6.3.1.1 NEW OEM

6.3.1.2 AFTERMARKET

6.3.1.3 RECYCLED

6.3.1.4 REMANUFACTURED

6.3.1.5 SALVAGE

6.4 PAINTS AND COATINGS

6.4.1 SALES CHANNEL

6.4.1.1 NEW OEM

6.4.1.2 AFTERMARKET

6.4.2 TYPE

6.4.2.1 CLEARCOAT

6.4.2.2 BASECOAT

6.4.2.3 PRIMER

6.4.2.4 THINNERS & SOLVENTS

6.4.2.5 PAINT BLENDING MATERIALS

6.5 CONSUMABLES

6.5.1 SALES CHANNEL

6.5.1.1 NEW OEM

6.5.1.2 AFTERMARKET

6.5.1.3 RECYCLED

6.5.1.4 REMANUFACTURED

6.5.1.5 SALVAGE

6.5.2 TYPE

6.5.2.1 ADHESIVES & SEALANTS

6.5.2.2 SANDPAPER & ABRASIVES

6.5.2.3 BODY FILLERS

6.5.2.4 MASKING PRODUCTS

6.5.2.5 WELDING WIRE & GASES

6.5.2.6 OTHERS

6.6 OTHERS

6.6.1 SALES CHANNEL

6.6.1.1 NEW OEM

6.6.1.2 AFTERMARKET

6.6.1.3 RECYCLED

6.6.1.4 REMANUFACTURED

6.6.1.5 SALVAGE

7 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY REPAIR TYPE

7.1 OVERVIEW

7.2 DENT REMOVAL

7.3 AUTO GLASS REPLACEMENT

7.4 REPLACING DOORS OR PANELS

7.5 STRAIGHTENING BENT METAL

7.6 PAINT MATCHING

7.7 SCRATCH REMOVAL

7.8 AUTO DETAILING

7.9 OTHER

8 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY SERVICE CHANNEL

8.1 OVERVIEW

8.2 OE

8.3 DIFM (DO IT FOR ME)

8.4 DIY (DO IT YOURSELF)

9 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL

9.1 OVERVIEW

9.2 NEW OEM

9.3 AFTERMARKET

9.4 RECYCLED

9.5 REMANUFACTURED

9.6 SALVAGE

10 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY SHOP TYPE

10.1 OVERVIEW

10.2 INDEPENDENT REPAIR SHOPS

10.3 AUTO BODY SHOPS

10.4 DEALER-OWNED SHOPS

11 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PASSENGER CARS

11.2.1 TYPE

11.2.1.1 SUV

11.2.1.2 SEDAN

11.2.1.3 HATCHBACK

11.2.1.4 COUPE

11.2.1.5 MUV

11.2.1.6 CONVERTIBLES

11.2.1.7 SPORTS CAR

11.2.1.8 OTHERS

11.2.2 PRODUCT TYPE

11.2.2.1 SPARE PARTS

11.2.2.2 REPLACEMENT PARTS

11.2.2.3 PAINT & COATING

11.2.2.4 CONSUMABLES

11.2.2.5 OTHERS

11.3 COMMERCIAL VEHICLE

11.3.1 TYPE

11.3.1.1 LIGHT COMMERCIAL VEHICLE (LCV)

11.3.1.2 TYPE

11.3.1.2.1 PICK-UP TRUCKS

11.3.1.2.2 VAN

11.3.1.2.3 MINI BUS

11.3.1.2.4 OTHERS

11.3.1.3 HEAVY COMMERCIAL VEHICLE (HCV)

11.3.1.3.1 TYPE

11.3.1.3.1.1 TRUCK

11.3.1.3.1.2 BUSES

11.3.1.3.1.3 OTHERS

11.3.1.3.2 product TYPE

11.3.1.3.2.1 SPARE PARTS

11.3.1.3.2.2 REPLACEMENT PARTS

11.3.1.3.2.3 PAINT & COATING

11.3.1.3.2.4 CONSUMABLES

11.3.1.3.2.5 OTHERS

11.4 TWO WHEELERS

11.4.1 TYPE

11.4.1.1 MOTORCYCLE

11.4.1.2 SCOOTERS

11.4.1.3 OTHERS

11.4.2 PRODUCT TYPE

11.4.2.1 SPARE PARTS

11.4.2.2 REPLACEMENT PARTS

11.4.2.3 PAINT & COATING

11.4.2.4 CONSUMABLES

11.4.2.5 OTHERS

12 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET

12.1 U.S

12.2 CANADA

12.3 GERMANY

12.4 UK

12.5 AUSTRALIA

12.6 FRANCE

12.7 ITALY

12.8 SPAIN

12.9 NEW ZEALAND

13 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

13.2 COMPANY SHARE ANALYSIS: CANADA

13.3 COMPANY SHARE ANALYSIS: GERMANY

13.4 COMPANY SHARE ANALYSIS: UK

13.5 COMPANY SHARE ANALYSIS: AUSTRALIA

13.6 COMPANY SHARE ANALYSIS: FRANCE

13.7 COMPANY SHARE ANALYSIS: ITALY

13.8 COMPANY SHARE ANALYSIS: SPAIN

13.9 COMPANY SHARE ANALYSIS: NEW ZEALAND

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 AISIN CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 DENSO CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 MOBIS INDIA LIMITED (SUBSIDIARY OF HYUNDAI MOTOR COMPANY)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 ROBERT BOSCH GMBH

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 TENNECO INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.5.4 RECENT DEVELOPMENT

15.6 3M

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ABRA AUTO BODY REPAIR OF AMERICA

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AMERICA'S AUTO BODY

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 ATP AUTOMOTIVE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 CALIBER HOLDINGS LLC

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 CARDONE INDUSTRIES

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 CONTINENTAL AG

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 DANA LIMITED

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 DAYCO INCORPORATED

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 DUPONT

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 FORVIA

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 GERBER COLLISION & GLASS

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 HENKEL CORPORATION

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 JEFF SCHMITT AUTO GROUP

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 MAGNA INTERNATIONAL INC

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 MANN+HUMMEL

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 MARTINREA INTERNATIONAL INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENT

15.23 MITSUBA CORP

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENT

15.24 NIPPON PAINT HOLDINGS CO., LTD.

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 PHINIA INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENT

15.26 OPMOBILITY SE

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENT

15.27 VALEO

15.27.1 COMPANY SNAPSHOT

15.27.2 REVENUE ANALYSIS

15.27.3 SERVICE PORTFOLIO

15.27.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 TECHNOLOGY MATRIX

TABLE 2 USED CASE ANALYSIS

TABLE 3 AVERAGE EXPENDITURES FOR AUTO INSURANCE (2012 TO 2021)

TABLE 4 TOP 10 COUNTRIES BASED ON ROAD INJURY ACCIDENTS

TABLE 5 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 6 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND SPARE PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 7 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND REPLACEMENT PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 8 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 9 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 11 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND OTHERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 13 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY REPAIR TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY SERVICE CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 15 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 16 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY SHOP TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 27 U.S. AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 U.S. SPARE PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 29 U.S. REPLACEMENT PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 30 U.S. PAINTS AND COATINGS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 31 U.S. PAINTS AND COATINGS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 U.S. CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 33 U.S. CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 U.S. OTHERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 35 U.S. AUTOMOTIVE COLLISION REPAIR MARKET, BY REPAIR TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 U.S. AUTOMOTIVE COLLISION REPAIR MARKET, BY SERVICE CHANNEL , 2018-2033 (USD THOUSAND)

TABLE 37 U.S. AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 38 U.S. AUTOMOTIVE COLLISION REPAIR MARKET, BY SHOP TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 U.S. AUTOMOTIVE COLLISION REPAIR MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 U.S. PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 U.S. PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 U.S. COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 U.S. LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 U.S. HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 U.S. COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 U.S. TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 U.S. TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 CANADA AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 49 CANADA SPARE PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 50 CANADA REPLACEMENT PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 51 CANADA PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 52 CANADA PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 CANADA CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 54 CANADA CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 CANADA OTHERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 56 CANADA AUTOMOTIVE COLLISION REPAIR MARKET, BY REPAIR TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 CANADA AUTOMOTIVE COLLISION REPAIR MARKET, BY SERVICE CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 58 CANADA AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 59 CANADA AUTOMOTIVE COLLISION REPAIR MARKET, BY SHOP TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 CANADA AUTOMOTIVE COLLISION REPAIR MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 CANADA PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 CANADA PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 CANADA COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 CANADA LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 CANADA HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 CANADA COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 CANADA TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 CANADA TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 GERMANY AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 GERMANY SPARE PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 71 GERMANY REPLACEMENT PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 72 GERMANY PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 73 GERMANY PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 GERMANY CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 75 GERMANY CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 GERMANY OTHERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 77 GERMANY AUTOMOTIVE COLLISION REPAIR MARKET, BY REPAIR TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 GERMANY AUTOMOTIVE COLLISION REPAIR MARKET, BY SERVICE CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 79 GERMANY AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 80 GERMANY AUTOMOTIVE COLLISION REPAIR MARKET, BY SHOP TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 GERMANY AUTOMOTIVE COLLISION REPAIR MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 GERMANY PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 GERMANY PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 GERMANY COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 GERMANY LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 GERMANY HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 GERMANY COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 GERMANY TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 GERMANY TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 UK AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 UK SPARE PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 92 UK REPLACEMENT PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 93 UK PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 94 UK PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 UK CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 96 UK CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 UK OTHERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 98 UK AUTOMOTIVE COLLISION REPAIR MARKET, BY REPAIR TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 UK AUTOMOTIVE COLLISION REPAIR MARKET, BY SERVICE CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 100 UK AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 101 UK AUTOMOTIVE COLLISION REPAIR MARKET, BY SHOP TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 UK AUTOMOTIVE COLLISION REPAIR MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 UK PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 UK PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 UK COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 UK LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 UK HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 UK COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 UK TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 UK TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 AUSTRALIA AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 AUSTRALIA SPARE PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 113 AUSTRALIA REPLACEMENT PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 114 AUSTRALIA PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 115 AUSTRALIA PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 116 AUSTRALIA CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 117 AUSTRALIA CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 AUSTRALIA OTHERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 119 AUSTRALIA AUTOMOTIVE COLLISION REPAIR MARKET, BY REPAIR TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 AUSTRALIA AUTOMOTIVE COLLISION REPAIR MARKET, BY SERVICE CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 121 AUSTRALIA AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 122 AUSTRALIA AUTOMOTIVE COLLISION REPAIR MARKET, BY SHOP TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 AUSTRALIA AUTOMOTIVE COLLISION REPAIR MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 AUSTRALIA PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 AUSTRALIA PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 AUSTRALIA COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 AUSTRALIA LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 AUSTRALIA HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 AUSTRALIA COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 AUSTRALIA TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 AUSTRALIA TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 FRANCE AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 FRANCE SPARE PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 134 FRANCE REPLACEMENT PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 135 FRANCE PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 136 FRANCE PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 FRANCE CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 138 FRANCE CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 FRANCE OTHERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 140 FRANCE AUTOMOTIVE COLLISION REPAIR MARKET, BY REPAIR TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 FRANCE AUTOMOTIVE COLLISION REPAIR MARKET, BY SERVICE CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 142 FRANCE AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 143 FRANCE AUTOMOTIVE COLLISION REPAIR MARKET, BY SHOP TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 FRANCE AUTOMOTIVE COLLISION REPAIR MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 FRANCE PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 FRANCE PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 FRANCE COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 FRANCE LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 FRANCE HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 FRANCE COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 FRANCE TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 FRANCE TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 ITALY AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 ITALY SPARE PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 155 ITALY REPLACEMENT PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 156 ITALY PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 157 ITALY PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 ITALY CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 159 ITALY CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 ITALY OTHERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 161 ITALY AUTOMOTIVE COLLISION REPAIR MARKET, BY REPAIR TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 ITALY AUTOMOTIVE COLLISION REPAIR MARKET, BY SERVICE CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 163 ITALY AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 164 ITALY AUTOMOTIVE COLLISION REPAIR MARKET, BY SHOP TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 ITALY AUTOMOTIVE COLLISION REPAIR MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 ITALY PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 ITALY PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 ITALY COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 ITALY LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 ITALY HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 ITALY COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 ITALY TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 ITALY TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 SPAIN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 SPAIN SPARE PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 176 SPAIN REPLACEMENT PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 177 SPAIN PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 178 SPAIN PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 SPAIN CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 180 SPAIN CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 SPAIN OTHERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 182 SPAIN AUTOMOTIVE COLLISION REPAIR MARKET, BY REPAIR TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 SPAIN AUTOMOTIVE COLLISION REPAIR MARKET, BY SERVICE CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 184 SPAIN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 185 SPAIN AUTOMOTIVE COLLISION REPAIR MARKET, BY SHOP TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 SPAIN AUTOMOTIVE COLLISION REPAIR MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 SPAIN PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 SPAIN PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 SPAIN COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 SPAIN LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 SPAIN HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 SPAIN COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 SPAIN TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 SPAIN TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 NEW ZEALAND SPARE PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 197 NEW ZEALAND REPLACEMENT PARTS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 198 NEW ZEALAND PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 199 NEW ZEALAND PAINTS AND COATING IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 NEW ZEALAND CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 201 NEW ZEALAND CONSUMABLES IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 NEW ZEALAND OTHERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 203 NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY REPAIR TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY SERVICE CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 205 NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 206 NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY SHOP TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 NEW ZEALAND PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 NEW ZEALAND PASSENGER CARS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 NEW ZEALAND COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 NEW ZEALAND LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 NEW ZEALAND HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 NEW ZEALAND COMMERCIAL VEHICLE IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 NEW ZEALAND TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 NEW ZEALAND TWO WHEELERS IN AUTOMOTIVE COLLISION REPAIR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: SEGMENTATION

FIGURE 2 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: DATA TRIANGULATION

FIGURE 3 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: DROC ANALYSIS

FIGURE 4 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET ANALYSIS

FIGURE 5 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: MULTIVARIATE MODELLING

FIGURE 7 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: PRODUCT TIMELINE CURVE

FIGURE 8 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: DBMR MARKET POSITION GRID

FIGURE 10 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: APPLICATION COVERAGE GRID

FIGURE 12 THE U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: SEGMENTATION

FIGURE 13 RISING ADOPTION OF COLLISION INSURANCE & OWN DAMAGE INSURANCE IS EXPECTED TO DRIVE THE AUTOMOTIVE COLLISION REPAIR MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET IN 2025 & 2032

FIGURE 15 US IS EXPECTED TO DOMINATE, AND GERMANY IS THE FASTEST GROWING REGION IN THE U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 COMPANY EVALUATION QUADRANT

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET

FIGURE 18 BREAKDOWN OF 2021 AND 2022 PRODUCTION FIGURES ACROSS DIFFERENT WORLD REGIONS

FIGURE 19 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: BY PRODUCT, 2025

FIGURE 20 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: BY REPAIR TYPE, 2025

FIGURE 21 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: BY SERVICE CHANNEL, 2025

FIGURE 22 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: BY SALES CHANNEL, 2025

FIGURE 23 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: BY SHOP TYPE, 2025

FIGURE 24 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: BY VEHICLE TYPE, 2025

FIGURE 25 U.S., CANADA, GERMANY, FRANCE, SPAIN, ITALY, UK & AUSTRALIA, NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET, SNAPSHOT (2025)

FIGURE 26 U.S. AUTOMOTIVE COLLISION REPAIR MARKET: COMPANY SHARE 2024 (%)

FIGURE 27 CANADA AUTOMOTIVE COLLISION REPAIR MARKET: COMPANY SHARE 2024 (%)

FIGURE 28 GERMANY AUTOMOTIVE COLLISION REPAIR MARKET: COMPANY SHARE 2024 (%)

FIGURE 29 U.K. AUTOMOTIVE COLLISION REPAIR MARKET: COMPANY SHARE 2024 (%)

FIGURE 30 AUSTRALIA AUTOMOTIVE COLLISION REPAIR MARKET: COMPANY SHARE 2024 (%)

FIGURE 31 FRANCE AUTOMOTIVE COLLISION REPAIR MARKET: COMPANY SHARE 2024 (%)

FIGURE 32 ITALY AUTOMOTIVE COLLISION REPAIR MARKET: COMPANY SHARE 2024 (%)

FIGURE 33 SPAIN AUTOMOTIVE COLLISION REPAIR MARKET: COMPANY SHARE 2024 (%)

FIGURE 34 NEW ZEALAND AUTOMOTIVE COLLISION REPAIR MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.