Us Collagen Market

Market Size in USD Billion

CAGR :

%

USD

1.02 Billion

USD

1.82 Billion

2024

2032

USD

1.02 Billion

USD

1.82 Billion

2024

2032

| 2025 –2032 | |

| USD 1.02 Billion | |

| USD 1.82 Billion | |

|

|

|

|

Collagen Market Analysis

Collagen is the type of the substance which are used in the manufacturing of the skin and hair care products that provides smoothness and nourishment to the skin as well as hairs. Collagen has been widely used in the pharmaceuticals which helps in relieving body from joint pain and used in the heart health curing medicines. The collagen is extracted from the various types of animals. The major property of the collagen is that it binds the hydration level of the skin which minimizes the wrinkles from the skin. Collagen are used in bakery products, nutraceuticals supplements, beverages, and animal feeds among several other places with the aim to enhance the strength in the human body. Collagen are also used in the food stabilizers which helps in the boosting the skin structure. The collagen as a biomaterial in the laboratories are gaining prevalence among the researchers due to which the demand for collagen in U.S. collagen market is increasing at a higher rate.

Collagen Market Size

The U.S. Collagen market is expected to reach USD 1.82 billion by 2032 from USD 1.02 billion in 2024, growing with a substantial CAGR of 7.5% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Collagen Market Trends

“Increasing Usage Of Collagen Products In The Cosmetic Industry”

People want products that make their skin look young, smooth, and healthy. Collagen is a natural protein that helps keep skin firm and elastic. But as people age, their bodies make less collagen, which can cause wrinkles and sagging skin. Cosmetic brands are adding collagen to products like creams, serums, and masks to help fight these signs of aging. Many consumers are also using collagen supplements to improve skin health from the inside out. These supplements come in powders, capsules, and drinks, making it easy to add collagen to daily routines. Social media and celebrity endorsements have made collagen even more popular. People see influencers sharing their glowing skin and want to try collagen products for themselves. Beauty and wellness trends focused on natural ingredients also boost collagen’s appeal.

As more people seek ways to look and feel younger, the demand for collagen-based cosmetics will likely keep growing. This trend is helping shape the beauty and personal care industry, solidifying collagen’s role as a key ingredient in modern skincare routines.

Report Scope and Collagen Market Segmentation

|

Attributes |

Collagen Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S. |

|

Key Market Players |

dsm-firmenich (Netherlands), Darling Ingredients (Rousselot and GELNEX) (U.S.), GELITA AG (Germany), PB LEINER (A Part of Tessenderlo Group) (Belgium), Ashland Inc. (U.S.), Collagen Solutions (US) LLC (U.S.), Advanced BioMatrix (A Bico Company) (U.S.), ConnOils By Kraft (U.S.), KENNEY & ROSS LIMITED MARINE GELATIN (Canada), and COBIOSA (Spain) and among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Collagen Market Definition

Collagen is the kind of fibrous and hard protein which forms abundant protein in the human bones, skin, muscles as well as in tendons. The collagen is present in various kinds of products that are consumed or used by the humans in daily routine. The collagen is extracted from the connective tissues of animals such as cattles, chicken, marine fishes and from various other sources. It helps in providing the tensile strength as well as elasticity to the individual. Collagen are used in cosmetic products, food products, beverages, nutritional diets which are consumed by athletes and at several other places which has increases the preferences among consumers and retailers.

Collagen Market Dynamics

Drivers

- Substantial Demand for The Collagen Product As A Food Stabilizer

Collagen is becoming a popular ingredient in the food industry because of its ability to stabilize products and improve texture. It’s a natural protein that helps keep foods firm, smooth, and well-structured. When added to foods, collagen can prevent ingredients from separating, making products look and taste better for longer. Food manufacturers use collagen in items like yogurt, desserts, and processed meats to enhance quality and extend shelf life. In dairy products, collagen helps maintain a creamy texture, while in meat products, it improves juiciness and reduces moisture loss. This makes food more appealing and enjoyable to eat.

Collagen is also valued for its health benefits, which adds to its appeal as a food ingredient. It supports skin, joint, and bone health, making it a sought-after addition to functional foods. As people look for natural, multi-purpose ingredients, collagen stands out as a solution that enhances both nutrition and product performance

For instance, In November 2023, according to a review published by the National Library of Medicine, collagen's unique structural properties make it an effective food stabilizer, enhancing texture, consistency, and shelf life in various products. Its natural ability to form gels, retain water, and emulsify ingredients contributes to the growing demand for collagen in the food industry.

- Rising Collagen as Ingredients in Supplements for Sports Athletes

Collagen is becoming a popular ingredient in supplements for athletes because of its many benefits for performance and recovery. It’s a natural protein that helps support joint health, strengthens tendons and ligaments, and aids in muscle repair. For athletes pushing their bodies to the limit, collagen can help prevent injuries and speed up recovery time. Many sports supplements now include collagen in powders, drinks, and capsules, making it easy for athletes to add to their routines. Collagen peptides are especially popular because they’re easy to digest and quickly absorbed by the body. Athletes take collagen to improve flexibility, reduce joint pain, and enhance overall mobility.

Research shows that collagen can boost the production of important proteins like elastin and fibrillin, which contribute to strong, resilient connective tissues. This is especially valuable for endurance athletes and weightlifters who put repeated stress on their bodies.

Opportunities

- Rising Collagen Application as A Biomaterials in The Laboratories

Collagen is becoming more popular as a biomaterial in laboratories because it’s natural, safe, and helps cells grow. Scientists use collagen to create materials that act like real human tissues, making it easier to study how the body works and test new treatments. For example, collagen is used to make 3D scaffolds that help cells grow in a lab, just like they would in the body. This is really helpful for testing new drugs or researching diseases without needing human or animal testing. Collagen also helps build artificial skin and bones, which scientists use to study wound healing and bone repair.

Another exciting use of collagen is in regenerative medicine. Researchers are working on ways to use collagen to repair damaged tissues or even grow new organs. Because collagen is biocompatible — meaning the body accepts it without bad reactions — it’s a great choice for these advanced medical experiments.

For instance, In February 2022, according to a review published by IntechOpen, collagen was widely used in 3D bioprinting to create scaffolds that mimic natural tissues. These scaffolds support cell growth and help researchers study diseases, test drugs, and develop regenerative treatments. Collagen’s biocompatibility makes it a valuable tool for advancing tissue engineering and creating innovative medical solutions.

- Technological Innovations and Advancements in Collagen Extraction and Processing

New technologies are making collagen extraction and processing easier and more efficient! In the past, getting collagen from animal parts like skin, bones, and scales took a lot of time and energy. But now, scientists and engineers are developing smarter, faster ways to do it. For example, newer machines are helping companies extract collagen more quickly, reducing waste and costs. Some processes now use special enzymes that break down collagen more efficiently, making the whole process cleaner and safer. This means companies can produce high-quality collagen with fewer resources, which is better for the environment.

Another innovation is improving the purity of collagen. New filtering and purification methods help remove harmful substances from the raw materials, ensuring the final product is safe for use in food, supplements, or medical applications. This technology also makes collagen more consistent, so it’s easier to control the quality of each batch.

Restraints/Challenges

- Lack Of Proper Processing Technologies for Raw Materials of Collagen

Collagen comes from animal parts like skin, bones, and scales — but turning those materials into safe, high-quality collagen takes special equipment and careful handling. Without advanced technology, it’s harder to remove harmful substances or make sure the collagen stays pure. For example, if materials aren’t cleaned and processed correctly, the final product might not be safe to use. This can be risky, especially for medical or food-grade collagen. Smaller companies might struggle the most because high-tech processing machines can be expensive. If they can’t afford the right tools, it might limit their ability to create safe and effective collagen products. Plus, inefficient processing methods can waste valuable raw materials, driving up production costs.

However, this challenge also brings opportunity. Investing in better processing technologies can help companies produce higher-quality collagen, stand out from competitors, and meet growing consumer demand. As technology improves, processing collagen could become faster, safer, and more sustainable — leading to better products and a stronger market overall.

- High Cost Of Processing Expenditure In The Collagen Industry

Turning animal parts like skin, bones, and scales into safe, high-quality collagen isn’t easy — it takes special equipment, careful handling, and strict safety checks. All of this adds up, making collagen more expensive to produce. For example, cleaning and purifying collagen requires complex machines and chemicals to remove harmful substances. If the process isn’t done right, the final product might not be safe for people to use. Companies must also test their products regularly to make sure they meet safety and quality standards, which adds to the costs. Smaller businesses may struggle the most because they might not have enough money to buy advanced machines or run detailed safety tests. This can make it hard for them to compete with bigger companies that can afford better technology and larger production facilities.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, Source niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Collagen Market Scope

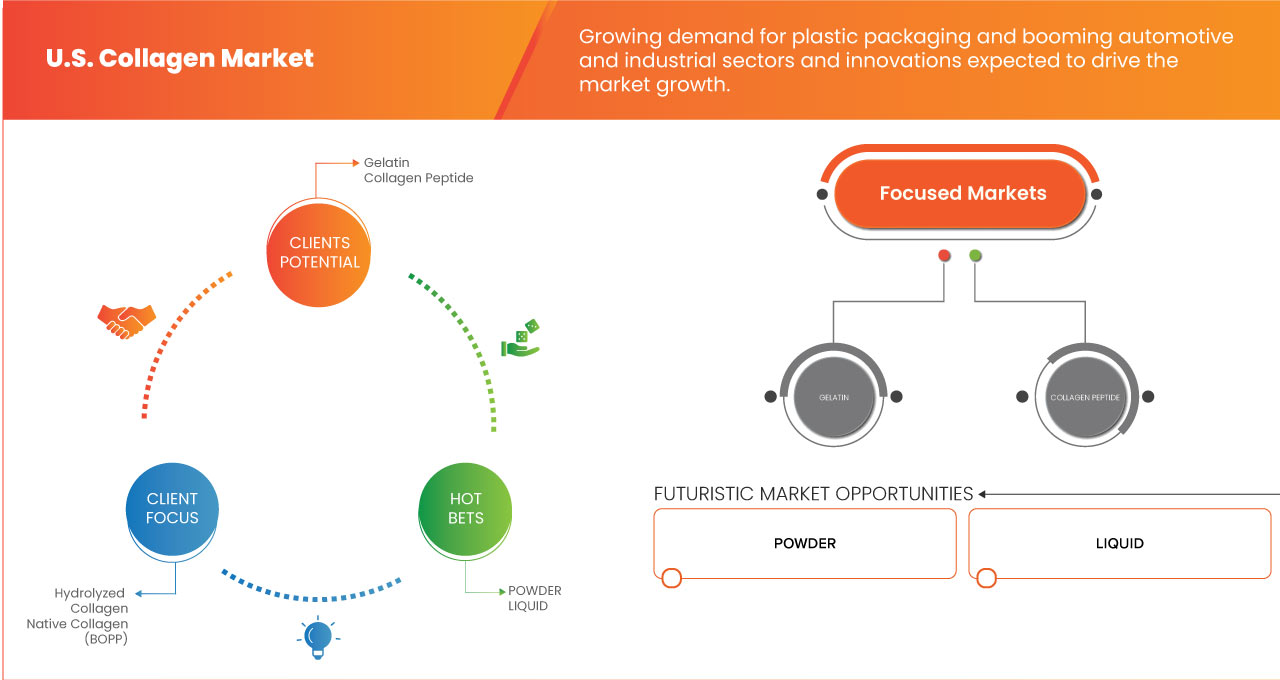

The market is segmented on the basis of Product Type, Type, Form, Source, end use, and Application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market Sources.

Product Type:

- Gelatin

- Hydrolyzed collagen

- Native collagen

- Collagen peptide

- Others

Type

- Type i

- Type ii

- Type iii

- Type iv

Form

- Powder

- Liquid

Source

- Bovine

- Cattle

- Buffaloes

- Yak

- Others

- poultry

- Chicken

- Duck

- Turkey

- Others

- Porcine

- Marine

- Marine fish

- Marine sponges

- Krill

- Squid

- Marine algae

- Others

- Others

Category

- GMO

- Non-GMO

Function

- Texture

- Stabilizer

- Emulsifier

- Finding

- Others

Application

- Food products

- Bakery products

- Cakes & pastries

- Cookies & biscuits

- Bread & rolls

- Donuts

- Others

- Chocolates & confectionery

- Chocolates

- Gummies/jellies

- Hard candies

- Sugar confectionery

- Others

- Processed food

- Pasta

- Noodles

- Extruded snacks

- Soups & sauces

- Others

- Bakery products

- Breakfast cereals

- Infant formula

- Meat & poultry products

- Dressings & seasonings

- Sports nutrition

- Sports nutrition bars

- sports protein powders

- Sports rtd beverages

- Cereal bars

- Dairy products

- Others

- Food products, by type

- Type i

- Type ii

- Type iii

- Type iv

Beverages

- Energy drinks

- Soft drinks

- Rtd coffee

- Functional drinks

- Flavoured drinks

- Honey

- Caramel

- Vanilla

- Chocolate

- Mocha

- Others

- Others

- Beverages, by type

- Type i

- Type ii

- Type iii

- Type iv

- Nutraceuticals & dietary supplements

- skin health

- Joint health

- Weight management

- Bone health

- Others

- Nutraceuticals & dietary supplements, by type

- Type i

- Type ii

- Type iii

- Type iv

- cosmetics & personal care

- Skin care

- Sun screen lotion

- Serum

- Moisturizer

- Scrub

- Lip care cream

- Others

- Hair care

- Shampoo

- Conditioner

- Hair oil& serum

- Others

- Skin care

- Soaps & body wash

- Others

- Cosmetics & personal care, by type

- Type i

- Type ii

- Type iii

- Type iv

- Animal feed

- ruminants

- Calves

- Dairy cattle

- Beef cattle

- Poultry

- Broilers

- Layers

- Breeders

- Swine

- Starters

- Growers

- Sows

- Pets

- Cats

- Dogs

- Rabbits

- Mice

- Others

- ruminants

- Aquatic animal

- Fish feed

- Carp

- Salmon

- Tilapia

- Catfish

- Others

- Mollusk feed

- Oyster

- Mussel

- Others

- Crustaceans

- shrimp

- Crab

- Others

- Other aquatic animal

- Fish feed

- Animal feed, by type

- Type i

- Type ii

- Type iii

- Type iv

- Laboratory tests

- Laboratory tests, by type

- Type i

- Type ii

- Type iii

- Type iv

- Laboratory tests, by type

- Others

- Others,by type

- Type i

- Type ii

- Type iii

- Type iv

- Others,by type

Collagen Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Source dominance. The above data points provided are only related to the companies' focus related to market.

Collagen Market Leaders Operating in the Market Are:

- dsm-firmenich (Netherlands)

- Darling Ingredients (Rousselot and GELNEX) (U.S.)

- GELITA AG (Germany)

- PB LEINER (A Part of Tessenderlo Group) (Belgium)

- Ashland Inc. (U.S.)

- Collagen Solutions (US) LLC (U.S.)

- Advanced BioMatrix (A Bico Company) (U.S.)

- ConnOils By Kraft (U.S.)

- KENNEY & ROSS LIMITED MARINE GELATIN (Canada)

- COBIOSA (Spain)

- among others

Latest Developments in Collagen Market

- In April 2020, DSM successfully completed the acquisition of Glycom to expand its business and strengthen its market position. This strategic move enhances DSM’s capabilities in human milk oligosaccharides (HMOs) and nutritional ingredients, driving innovation and growth. The acquisition plays a key role in boosting revenue and advancing DSM’s portfolio in the health and nutrition sector

- In November 2024, Rousselot, Darling Ingredients’ premier collagen and gelatin brand, and IamFluidics, a leader in microparticle innovation, announced the launch of a novel research grade dissolvable microcarrier for adherent cell culturing

- In November 2023, GELITA AG has launched a fast-setting gelatin that enables a breakthrough in fortified gummy production. Branded CONFIXX, the new gelatin allows for the starch-free production of gummies with a sensorial profile that has previously only been attainable with a starch-based manufacturing process

- In February 2025, Ashland, launched gafchromic film based advanced dosimetry solutions in-vivo dosimetry system, designed to support treatment accuracy in radiation therapy. This innovative system is intended for use as a quality control system as a secondary verification of the radiation dose. This system allows for near real-time reporting of radiation doses delivered to patients during treatment

- In November 2020, COBIOSA will attend an exhibition in-cosmetics Asia that is going to held in Bangkok with the aim to showcase the products. The exhibition helps in increasing consumer base and generates revenue of the business.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. COLLAGEN MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.1.7 CONCLUSION

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 BARGAINING POWER OF SUPPLIERS

4.2.5 COMPETITIVE RIVALRY

4.2.6 CONCLUSION

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 OVERVIEW

4.3.2 RAW MATERIAL SOURCING

4.3.3 PROCESSING & MANUFACTURING

4.3.4 DISTRIBUTION & LOGISTICS

4.3.5 END-USER APPLICATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING USAGE OF COLLAGEN PRODUCTS IN THE COSMETIC INDUSTRY

5.1.2 SUBSTANTIAL DEMAND FOR THE COLLAGEN PRODUCT AS A FOOD STABILIZER

5.1.3 RISING COLLAGEN AS INGREDIENTS IN SUPPLEMENTS FOR SPORTS ATHLETES

5.1.4 GROWTH IN THE USE OF COLLAGEN PROTEINS IN THE MEDICAL AND PHARMACEUTICAL INDUSTRY

5.2 RESTRAINTS

5.2.1 INCREASING STRINGENT REGULATION REGARDING USE OF FOOD ADDITIVES

5.2.2 RISK OF DISEASE TRANSFER FROM ANIMAL SOURCES

5.3 OPPORTUNITIES

5.3.1 RISING COLLAGEN APPLICATION AS A BIOMATERIALS IN THE LABORATORIES

5.3.2 TECHNOLOGICAL INNOVATIONS AND ADVANCEMENTS IN COLLAGEN EXTRACTION AND PROCESSING

5.3.3 THE GROWTH OF FISHING INDUSTRY TO USE FISH AS A RAW MATERIAL FOR GELATIN PRODUCTION

5.4 CHALLENGES

5.4.1 LACK OF PROPER PROCESSING TECHNOLOGIES FOR RAW MATERIALS OF COLLAGEN

5.4.2 HIGH COST OF PROCESSING EXPENDITURE IN THE COLLAGEN INDUSTRY

6 U.S. COLLAGEN MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 GELATIN

6.3 COLLAGEN PEPTIDE

6.4 HYDROLYZED COLLAGEN

6.5 NATIVE COLLAGEN

6.6 OTHERS

7 U.S. COLLAGEN MARKET, BY TYPE

7.1 OVERVIEW

7.2 TYPE I

7.3 TYPE III

7.4 TYPE II

7.5 TYPE IV

8 U.S. COLLAGEN MARKET, BY FORM

8.1 OVERVIEW

8.2 POWDER

8.3 LIQUID

9 U.S. COLLAGEN MARKET, BY SOURCE

9.1 OVERVIEW

9.2 BOVINE

9.3 MARINE

9.4 POULTRY

10 U.S. COLLAGEN MARKET, BY PRODUCT CATEGORY

10.1 OVERVIEW

10.2 NON-GMO

10.3 GMO

11 U.S. COLLAGEN MARKET, BY FUNCTION

11.1 OVERVIEW

11.2 STABILIZER

11.3 EMULSIFIER

11.4 TEXTURE

11.5 FINDING

11.6 OTHERS

12 U.S. COLLAGEN MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD PRODUCTS

12.3 COSMETICS AND PERSONAL CARE

12.4 NUTRACEUTICALS AND DIETARY SUPPLEMENTS

12.5 ANIMAL FEED

12.6 BEVERAGES

12.7 LABORATORY TESTS

12.8 OTHERS

13 U.S. COLLAGEN MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 DSM-FIRMENICH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 DARLING INGREDIENTS

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT/BRAND PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 GELITA AG

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT UPDATES

15.4 PB LEINER (A PART OF TESSENDERLO GROUP)

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 ASHLAND

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 ADVANCED BIOMATRIX.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 COBIOSA

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 COLLAGEN SOLUTIONS (US) LLC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CONNOILS BY KRAFT

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 KENNEY & ROSS LIMITED MARINE GELATIN

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 U.S. COLLAGEN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 U.S. COLLAGEN MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 U.S. COLLAGEN MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 4 U.S. COLLAGEN MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 5 U.S. BOVINE IN COLLAGEN MARKET, BY BOVINE SOURCE, 2018-2032 (USD THOUSAND)

TABLE 6 U.S. MARINE IN COLLAGEN MARKET, BY MARINE SOURCE, 2018-2032 (USD THOUSAND)

TABLE 7 U.S. POULTRY IN COLLAGEN MARKET, BY POULTRY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 8 U.S. COLLAGEN MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 9 U.S. COLLAGEN MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 10 U.S. COLLAGEN MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 11 U.S. FOOD PRODUCTS IN COLLAGEN MARKET, BY FOOD PRODUCTS APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 12 U.S. SPORTS NUTRITION IN COLLAGEN MARKET, BY SPORTS NUTRITION APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 13 U.S. PROCESSED FOOD IN COLLAGEN MARKET, BY PROCESSED FOOD APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 14 U.S. CHOCOLATES AND CONFECTIONARY IN COLLAGEN MARKET, BY CHOCOLATES AND CONFECTIONARY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 U.S. BAKERY PRODUCTS IN COLLAGEN MARKET, BY BAKERY PRODUCTS APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 16 U.S. FOOD PRODUCTS IN COLLAGEN MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. COSMETIC AND PERSONAL CARE IN COLLAGEN MARKET, BY COSMETIC AND PERSONAL CARE APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 U.S. SKIN CARE IN COLLAGEN MARKET, BY SKIN CARE APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 U.S. HAIR CARE IN COLLAGEN MARKET, BY HAIR CARE APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 U.S. COSMETIC AND PERSONAL CARE IN COLLAGEN MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 U.S. NUTRACEUTICALS AND DIETARY SUPPLEMENTS IN COLLAGEN MARKET, BY NUTRACEUTICALS AND DIETARY SUPPLEMENTS APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 U.S. NUTRACEUTICALS AND DIETARY SUPPLEMENTS IN COLLAGEN MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 U.S. ANIMAL FEED IN COLLAGEN MARKET, BY ANIMAL FEED APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 U.S. POULTRY IN COLLAGEN MARKET, BY POULTRY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 U.S. AQUATIC ANIMAL IN COLLAGEN MARKET, BY AQUATIC ANIMAL APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 26 U.S. FISH FEED IN COLLAGEN MARKET, BY FISH FEED APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 27 U.S. MOLLUSK FEED IN COLLAGEN MARKET, BY MOLLUSK FEED APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 28 U.S. CRUSTACEANS IN COLLAGEN MARKET, BY CRUSTACEANS APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 29 U.S. RUMINANTS IN COLLAGEN MARKET, BY RUMINANTS APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 U.S. SWINE IN COLLAGEN MARKET, BY SWINE APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 31 U.S. PETS IN COLLAGEN MARKET, BY PETS APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 32 U.S. ANIMAL FEED IN COLLAGEN MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 U.S. BEVERAGES IN COLLAGEN MARKET, BY BEVERAGES APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 U.S. FLAVORED DRINKS IN COLLAGEN MARKET, BY FLAVORED DRINKS APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 U.S. BEVERAGES IN COLLAGEN MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 U.S. LABORATORY TESTS IN COLLAGEN MARKET, BY LABORATORY TESTS TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 U.S. OTHERS IN COLLAGEN MARKET, BY OTHERS TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 U.S. COLLAGEN MARKET: SEGMENTATION

FIGURE 2 U.S. COLLAGEN MARKET: DATA TRIANGULATION

FIGURE 3 U.S. COLLAGEN MARKET: DROC ANALYSIS

FIGURE 4 U.S. COLLAGEN MARKET: U.S. VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. COLLAGEN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. COLLAGEN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. COLLAGEN MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. COLLAGEN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 U.S. COLLAGEN MARKET: SEGMENTATION

FIGURE 10 FIVE SEGMENTS COMPRISE THE U.S. COLLAGEN MARKET, BY PRODUCT TYPE

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 GROWTH IN THE USE OF COLLAGEN PROTEINS IN THE MEDICAL AND PHARMACEUTICAL INDUSTRY IS DRIVING THE U.S. COLLAGEN MARKET IN THE FORECAST PERIOD OF 2025-2032

FIGURE 13 GELATIN IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. COLLAGEN MARKET IN 2020 & 2027

FIGURE 14 PESTEL ANALYSIS

FIGURE 15 PORTER’S FIVE FORCES

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF U.S. COLLAGEN MARKET

FIGURE 17 U.S. COLLAGEN MARKET: BY PRODUCT TYPE, 2024

FIGURE 18 U.S. COLLAGEN MARKET, BY TYPE, 2024

FIGURE 19 U.S. COLLAGEN MARKET, BY FORM, 2024

FIGURE 20 U.S. COLLAGEN MARKET, BY SOURCE, 2024

FIGURE 21 U.S. COLLAGEN MARKET, BY PRODUCT CATEGORY, 2024

FIGURE 22 U.S. COLLAGEN MARKET, BY FUNCTION, 2024

FIGURE 23 U.S. COLLAGEN MARKET, BY APPLICATION, 2024

FIGURE 24 U.S. COLLAGEN MARKET: COMPANY SHARE 2024 (%)

Us Collagen Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Collagen Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Collagen Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.