Us Copper Cable Market

Market Size in USD Billion

CAGR :

%

USD

1.47 Billion

USD

2.35 Billion

2025

2033

USD

1.47 Billion

USD

2.35 Billion

2025

2033

| 2026 –2033 | |

| USD 1.47 Billion | |

| USD 2.35 Billion | |

|

|

|

|

U.S. Copper Cable Market Size

- The U.S. Copper Cable Market size was valued at USD 1.47 Billion in 2025 and is expected to reach USD 2.35 Billion by 2033, at a CAGR of 6.06% during the forecast period

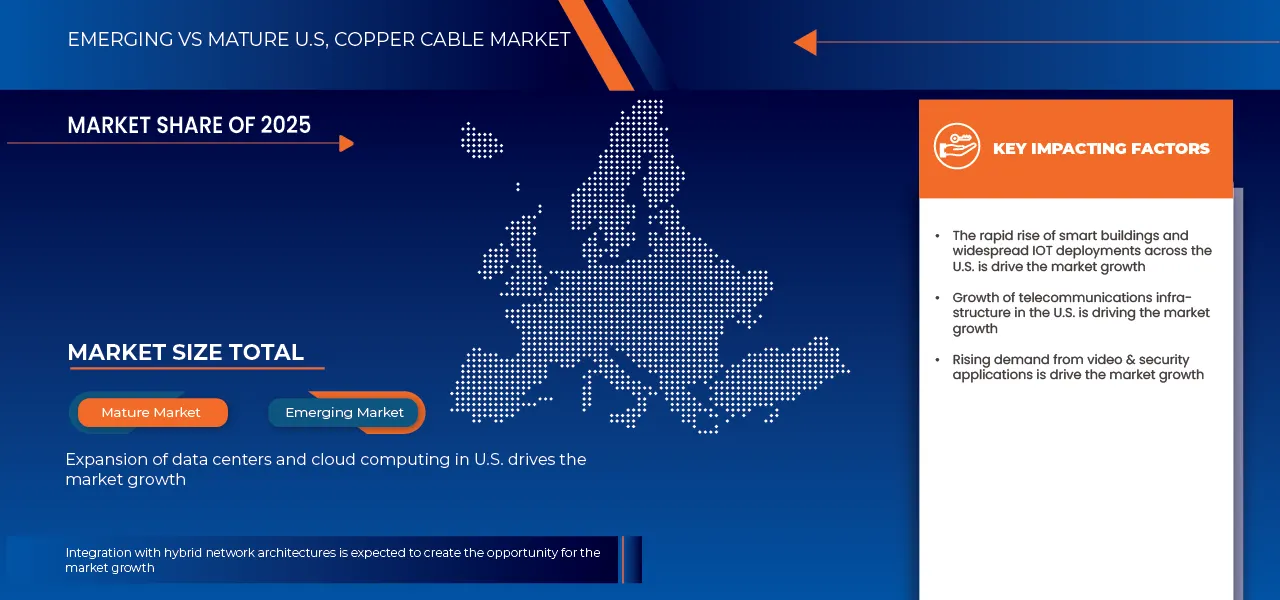

- The rapid expansion of data centers and cloud computing infrastructure in the U.S. is a major driver for the twisted pair Copper cable market. Accelerating adoption of cloud-based services across industries such as IT, finance, healthcare, retail, and government has led to large-scale investments in hyperscale and colocation data centers.

U.S. Copper Cable Market Analysis

- The U.S. Copper Cable market represents a critical segment within the North American electrical, telecom, and industrial infrastructure ecosystem, supporting applications across power transmission and distribution, telecommunications, data centers, construction, automotive, renewable energy, and industrial automation. Copper cables are valued for their high electrical conductivity, durability, flexibility, and reliability across both low- and high-voltage applications.

- Market growth is driven by rising investments in grid modernization, expansion of broadband and 5G networks, increasing construction activity, and growing electrification across transportation and industrial sectors. The transition toward renewable energy systems, electric vehicles, and smart infrastructure is further accelerating demand for high-performance copper cabling solutions.

- The power and energy sector is expected to remain the dominant end-use segment within the U.S. copper cable market, supported by upgrades to aging transmission and distribution networks and increasing deployment of renewable energy projects. Utilities benefit from copper cables’ superior current-carrying capacity, thermal performance, and long service life, particularly in critical and safety-sensitive installations.

- The California is projected to lead the U.S. copper cable market share 9.39% in 2026 and it is anticipated to show the fastest growth during the forecast period. due to strong domestic manufacturing, robust infrastructure spending, and sustained demand from construction, telecom, and industrial sectors.

- The Category 6 (Cat 6) copper cable segment is anticipated to hold a significant market share 46.88% by 2026 due to its high data transmission speeds, reduced crosstalk, and cost-effectiveness. Cat 6 cables are widely deployed in enterprise networking, data centers, and commercial buildings, making them a preferred solution for high-speed data and communication applications across the U.S.

Report Scope and U.S. Copper Cable Market Segmentation

|

Attributes |

U.S. Copper Cable Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S.

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

U.S. Copper Cable Market Trends

“Government Initiatives Supporting Network Modernization”

- Federal and state government initiatives across the U.S. are accelerating network modernization in commercial and public sector facilities, creating strong opportunities for the twisted pair copper cable market. Large-scale infrastructure programs focused on broadband expansion, digital government services, smart cities, and public safety upgrades require extensive upgrades to internal networking systems.

- Twisted pair copper cables play a critical role in these projects by supporting local area networks, Power over Ethernet (PoE) applications, and structured cabling within government buildings, schools, healthcare facilities, and transportation hubs.

- In June 2023, according to the article published by National Telecommunications and Information Administration, The NTIA’s USD 930 million Middle Mile Broadband Infrastructure Program is strengthening high-speed internet capacity across 35 U.S. states and Puerto Rico. These investments expand regional and local networks that require extensive internal connectivity within public and commercial facilities. As last-mile and internal networks are upgraded, demand for twisted pair copper cables for LAN and PoE applications rises, making government-led network modernization a strong growth opportunity for the market.

- In June 2023, as per the article published by U.S. Department of the Treasury, Under the American Rescue Plan’s Capital Projects Fund (CPF), the U.S. Treasury allocated approximately USD 6.7 billion for broadband, digital technology, and community center projects across 42 states, connecting over 1.88 million locations.

- These infrastructure upgrades drive the deployment of internal networking solutions, including twisted pair copper cables for LAN and PoE applications, positioning government-led modernization as a key growth opportunity for the U.S. copper cable market.

U.S. Copper Cable Market Dynamics

Driver

Expansion Of Data Centers and Cloud Computing In U.S.

- The rapid expansion of data centers and cloud computing infrastructure in the U.S. is a major driver for the twisted pair copper cable market. Accelerating adoption of cloud-based services across industries such as IT, finance, healthcare, retail, and government has led to large-scale investments in hyperscale and colocation data centers.

- These facilities require reliable, high-performance, and cost-efficient networking solutions to support high data traffic, low latency, and continuous connectivity.

- In January 2026, according to the article published by The Economic Times, Despite rising community opposition and regulatory scrutiny, U.S. tech companies continue proposing large-scale data center projects to support artificial intelligence and cloud computing, reflecting strong underlying demand for digital infrastructure. The scale and value of these projects highlight sustained investment in data centers. This continued expansion acts as a key driver for the market.

- In December 2025, in accordance with the article published by Versant Media, LLC. A surge in data center investment activity highlights the rapid expansion of cloud computing infrastructure, with over 100 data center transactions recorded in the first eleven months, surpassing the total deal value of the previous year. Most of these transactions occurred in the United States, indicating strong capacity expansion. This increased development and upgrading of facilities boosts demand for structured internal networking, acting as a key driver for the U.S. twisted pair copper cable market.

- The rapid expansion of U.S. data centers and cloud infrastructure, driven by AI and digital transformation, is significantly increasing demand for reliable and cost-effective structured cabling solutions. Continuous investments and facility upgrades strongly support growth of the U.S. twisted pair copper cable market.

Restraint/Challenge

Susceptibility To Electromagnetic Interference (Emi)

- Twisted pair copper cables are widely used in networking and security applications, but their susceptibility to electromagnetic interference (EMI) poses a significant challenge in certain environments. Unshielded twisted pair (UTP) cables, in particular, are vulnerable to interference from nearby electrical equipment, radio frequency signals, and high-voltage power lines, which can degrade signal quality and reduce network performance.

- In March 2022, according to the article published by Tech Target, In high-speed U.S. networks, EMI affects twisted pair copper cables, requiring separation of data and power lines and use of shielded cables for signal integrity. Alternatives like fiber optic cables or careful wireless network planning are often preferred in high-interference environments. This vulnerability to EMI limits adoption of twisted pair cables in certain applications, acting as a key restraint on market growth.

- In October 2025, as per the article published by Ampcom, Unshielded Twisted Pair (UTP) cables, widely used in. Ethernet networks for their affordability and flexibility, are vulnerable to electromagnetic interference (EMI) from industrial equipment, fluorescent lights, and other sources. Unlike shielded cables, UTP lacks additional protection, leading to potential signal degradation and transmission errors. This susceptibility to EMI restricts adoption in high-interference environments, acting as a key restraint on the market.

- Susceptibility to electromagnetic interference significantly limits the performance of twisted pair copper cables, particularly UTP, in high-speed and industrial environments. Signal degradation and transmission errors reduce reliability, encouraging adoption of shielded cables or fiber optics, thereby restraining overall market growth.

U.S. Copper Cable Market Scope

U.S. Copper cable market is categorized into five notable segments which are based on product, type, application, installation environment, and distribution channel.

- By Product

On the basis of product, the market is segmented into category 6 (cat 6), category 5e (cat 5e), category 6a (cat 6a), category 7 (cat 7), category 6e, and others. In 2026, Category 6 (Cat 6) segment is expected to dominate market share 46.88%. due to its balanced combination of cost-effectiveness, enhanced performance, and widespread adoption across commercial and residential applications. Cat 6 cables support higher data transfer speeds and improved bandwidth compared to older standards like Cat 5e, making them ideal for modern networking demands such as high-speed internet, VoIP, and multimedia streaming.

The Category 5e (Cat 5e) is anticipated to show the fastest growth CAGR 6.47%. Category 5e (Cat 5e) cables continue to witness steady demand due to their cost-effectiveness and sufficient bandwidth support up to 1 Gbps for small and medium-sized enterprises. Growing broadband penetration, increasing LAN deployments, and rising demand for affordable structured cabling solutions in residential and commercial buildings are key growth drivers.

- By type

On the basis of type, the market is segmented into unshielded, and shielded. In 2026, unshielded segment is expected to dominate the market share 72.75% due to its cost-effectiveness, ease of installation, and sufficient performance for most standard networking environments. Unshielded cables (UTP) are widely preferred in commercial and residential settings where electromagnetic interference (EMI) is minimal, reducing the need for additional shielding.

Shielded is anticipated to show the fastest growth CAGR 6.43%. Shielded cables are gaining traction due to increasing electromagnetic interference in industrial facilities, data centers, and high-density networking environments. Rising adoption of high-speed Ethernet, stricter performance standards, and the need for enhanced signal integrity are driving demand. Growth in smart manufacturing and automation further supports expansion of shielded cable installations.

- By application

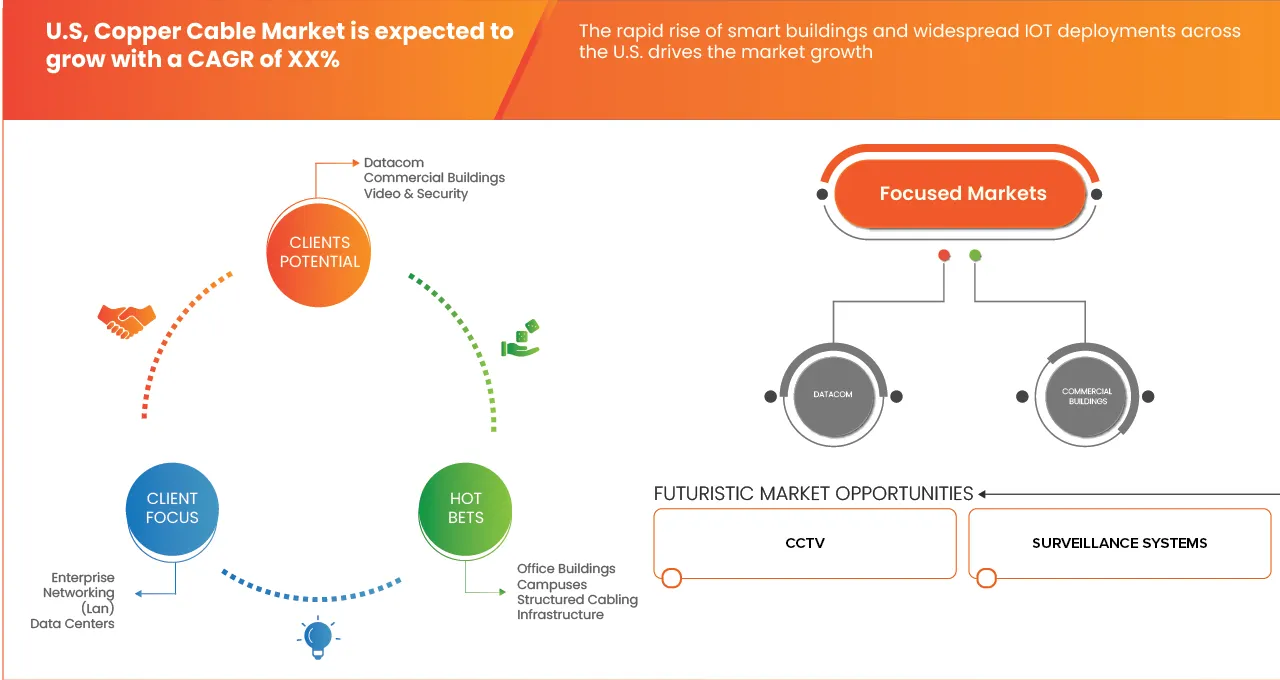

On the basis of application, the market is segmented into datacom, commercial buildings, video & security, and others. In 2026, Datacom segment is expected to dominate the market share 41.53% due to the rapid expansion of data centers, cloud computing, and high-speed internet infrastructure across the U.S. The growing demand for faster and more reliable data transmission to support bandwidth-intensive applications such as video streaming, online gaming, and large-scale enterprise networking drives the need for advanced copper cabling solutions in datacom environments.

Video & Security is anticipated to show the fastest growth CAGR 6.52%. The video and security segment is expanding rapidly due to rising investments in surveillance systems, smart cities, and commercial security infrastructure. Growing deployment of IP cameras, access control systems, and integrated monitoring networks requires reliable cabling solutions, thereby increasing demand for high-performance copper cables in residential, industrial, and public sectors.

- By installation environment

On the basis of installation environment, the market is segmented into indoor, and outdoor. In 2026, Indoor segment is expected to dominate the market share 71.82%. and it is anticipated to show the fastest growth during the forecast period. due to the increasing deployment of structured cabling systems within commercial buildings, data centers, and residential complexes. Indoor environments typically require extensive network infrastructure to support high-speed data communication, voice, and video services, driving demand for reliable and easy-to-install copper cables

- By distribution channel

On the basis of distribution channel, the market is segmented into direct tender, online, and offline. In 2026, Direct Tender segment is expected to dominate the market share 47.71% due to the increasing preference of large enterprises, government bodies, and infrastructure projects for bulk procurement through negotiated contracts. Direct tendering allows buyers to secure competitive pricing, ensure consistent supply, and customize orders according to specific technical requirements.

Online is anticipated to show the fastest growth CAGR 6.31%. The online distribution channel is growing due to increasing digitalization and preference for convenient procurement among enterprises and installers. E-commerce platforms offer competitive pricing, product variety, and quick delivery. Expansion of B2B marketplaces and direct-to-customer sales models further accelerates online sales of networking and cabling products globally.

U.S. Copper Cable Market Share

The U.S. Copper Cable Market is primarily led by well-established companies, including:

- 3M (U.S.)

- Alpha Wire (U.S.)

- AFL (U.S.)

- Belden Inc. (U.S.)

- CommScope (U.S.)

- Consolidated Electronic Wire & Cable (U.S.)

- Custom Wire Industries (U.S.)

- Gavitt Wire & Cable Company, Inc. (U.S.)

- General Wires Inc. (U.S.)

- ICE Cable Systems (Canada)

- Lake Cable (U.S.)

- Leviton Manufacturing Co., Inc. (U.S.)

- Micro-Tek Corporation (U.S.)

- New England Wire Technologies (U.S.)

- Nexans (Centelsa by Nexans) (France)

- Panduit Corp. (U.S.)

- Proterial Cable America, Inc. (U.S.)

- Prysmian (Italy)

- Remee Products Corporation (U.S.)

- Siemon (U.S.)

- Southwire Company, LLC (U.S.)

- Superior Essex International Inc. (U.S.)

- Vertical Cable (U.S.)

- Windy City Wire (U.S.)

- Y.C. Cable (Taiwan)

Latest Developments in U.S. Copper Cable Market

- In April 2024, CommScope launched its GigaREACH XL solution, extending Ethernet reach beyond the standard 100 meters to support emerging edge devices like security cameras and wireless access points. The solution enables up to 250 meters with PoE, reducing costs and complexity by eliminating extra telecom rooms or extenders. It offers reliable, longer-distance connectivity for modern enterprise networks.

- In August 2025, CommScope announced the sale of its Connectivity and Cable Solutions segment to Amphenol Corporation for USD 10.5 billion in cash, expected to close in the first half of 2026. The deal will generate approximately USD 10 billion in net proceeds, enabling significant shareholder dividends. CommScope will focus on its ANS and RUCKUS businesses post-sale to drive future network connectivity innovation.

- In March 2025, Prysmian announced the acquisition of U.S.-based connectivity solutions leader Channell for USD 950 million, with a potential USD 200 million earn-out. This marks Prysmian’s first major Digital Solutions acquisition, strengthening its North American presence, expanding its solutions portfolio beyond cables, and supporting growth in data centers, FTTX, 5G, and digital infrastructure.

- In December 2025, Nexans has completed the acquisition of Electro Cables Inc., a leading Canadian low-voltage cable manufacturer, enhancing its presence in North America’s growing infrastructure, data center, and energy markets. This strategic move adds around 200 skilled employees and €125 million in revenue, strengthening Nexans’ electrification portfolio and supporting accelerated growth in the region. The deal is cash-financed and EPS accretive from year one.

- In June 2025, Nexans has acquired Spanish low-voltage cable manufacturer Cables RCT, strengthening its electrification portfolio and footprint in Southern Europe. The deal expands Nexans’ fire-safety cable offerings, enhances production capacity, and supports growth in key markets through complementary assets, innovation capabilities, and operational synergies aligned with its pure electrification strategy.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES ANALYSIS

4.2 BRAND OUTLOOK

4.3 CONSUMER BUYING BEHAVIOUR

4.3.1 PERFORMANCE AND STANDARDS COMPLIANCE

4.3.2 SAFETY RATINGS AND REGULATORY CONFORMANCE

4.3.3 TOTAL COST OF OWNERSHIP OVER UNIT PRICE

4.3.4 RELIABILITY, BRAND REPUTATION, AND SUPPLIER TRUST

4.3.5 SUPPLY CHAIN RESILIENCE AND DELIVERY ASSURANCE

4.3.6 TECHNICAL SUPPORT AND AFTER-SALES SERVICES

4.3.7 CUSTOMIZATION AND FLEXIBILITY FOR PROJECT NEEDS

4.3.8 SUSTAINABILITY AND MATERIAL TRANSPARENCY (EMERGING FACTOR)

4.4 COST ANALYSIS BREAKDOWN

4.4.1 COPPER RAW MATERIAL COSTS

4.4.2 INSULATION AND JACKET MATERIAL COSTS

4.4.3 MANUFACTURING AND PROCESSING COSTS

4.4.4 SHIELDING AND COMPONENT COSTS

4.4.5 TESTING, CERTIFICATION, AND COMPLIANCE COSTS

4.4.6 LOGISTICS AND DISTRIBUTION COSTS

4.4.7 OVERHEAD AND ADMINISTRATIVE COSTS

4.4.8 PROFIT MARGIN AND MARKET PRICING PRESSURE

4.4.9 TOTAL COST TO BUYER (TCB) CONSIDERATIONS

4.5 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.5.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.5.1.1 JOINT VENTURES

4.5.1.2 MERGERS AND ACQUISITIONS

4.5.1.3 LICENSING AND PARTNERSHIP

4.5.1.4 TECHNOLOGY COLLABORATIONS

4.5.1.5 STRATEGIC DIVESTMENTS

4.5.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.5.3 STAGE OF DEVELOPMENT

4.5.4 TIMELINES AND MILESTONES

4.5.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.5.6 RISK ASSESSMENT AND MITIGATION

4.5.7 FUTURE OUTLOOK

4.6 PATENT ANALYSIS

4.6.1 PATENT LANDSCAPE ANALYSIS: COPPER TWISTED PAIR CABLE

4.6.2 APPLICANT CONCENTRATION AND COMPETITIVE OWNERSHIP

4.6.3 INVENTOR ACTIVITY AND INNOVATION DEPTH

4.6.4 TECHNOLOGY FOCUS: IPC CODE ANALYSIS

4.6.5 TEMPORAL TREND ANALYSIS (2017–2025)

4.6.6 STRATEGIC INTERPRETATION FOR THE COPPER TWISTED PAIR MARKET

4.7 PRICING ANALYSIS

4.8 PROFIT MARGINS SCENARIO

4.8.1 MANUFACTURER MARGINS AND RAW MATERIAL INFLUENCE

4.8.2 IMPACT OF PRODUCT MIX ON PROFITABILITY

4.8.3 EFFECTS OF TARIFFS AND TRADE POLICY

4.8.4 DISTRIBUTION AND CHANNEL PARTNER MARGINS

4.8.5 ECONOMIES OF SCALE AND OPERATIONAL EFFICIENCY

4.8.6 CUSTOMER PRICING SENSITIVITY AND COMPETITIVE PRESSURE

4.8.7 LONG-TERM CONTRACTS AND MARGIN STABILITY

4.8.8 INNOVATION AND VALUE-ADDED FEATURES

4.9 RAW MATERIAL COVERAGE

4.9.1 COPPER CONDUCTORS

4.9.2 COPPER WIRE RODS AND DRAWN WIRES

4.9.3 INSULATION MATERIALS

4.9.4 SHIELDING MATERIALS

4.9.5 JACKET COMPOUNDS

4.9.6 SEPARATOR AND FILLER MATERIALS

4.9.7 ADDITIVES AND FLAME RETARDANTS

4.9.8 RAW MATERIAL COST STRUCTURE AND IMPACT

4.9.9 STRATEGIC RAW MATERIAL TRENDS

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 UPSTREAM SUPPLY: RAW MATERIALS

4.10.2 MIDSTREAM PROCESSING: WIRE ROD CONVERSION AND CONDUCTOR PREPARATION

4.10.3 CABLE MANUFACTURING AND ASSEMBLY

4.10.4 TESTING, CERTIFICATION, AND COMPLIANCE

4.10.5 LOGISTICS AND WAREHOUSING

4.10.6 DISTRIBUTION CHANNELS

4.10.7 DOWNSTREAM INTEGRATION AND INSTALLATION

4.10.8 SUPPLY CHAIN RISKS AND CONSTRAINTS

4.10.9 STRATEGIC SUPPLY CHAIN TRENDS

4.11 TECHNOLOGICAL ADVANCEMENT

4.11.1 ENHANCED CATEGORY PERFORMANCE FOR HIGHER BANDWIDTHS

4.11.2 IMPROVED SHIELDING AND INSULATION MATERIALS

4.11.3 SMART MANUFACTURING AND INLINE QUALITY CONTROL

4.11.4 ADVANCED TESTING AND CERTIFICATION PROTOCOLS

4.11.5 INTEGRATION WITH CONVERGED NETWORK TECHNOLOGIES

4.11.6 OUTDOOR AND HARSH ENVIRONMENT DESIGNS

4.11.7 SUSTAINABLE AND RECYCLABLE MATERIAL DEVELOPMENT

4.12 VALUE CHAIN ANALYSIS

4.12.1 RAW MATERIAL SUPPLY

4.12.2 WIRE DRAWING AND ANNEALING

4.12.3 INSULATION AND TWISTING PROCESS

4.12.4 SHIELDING AND JACKET EXTRUSION

4.12.5 TESTING, CERTIFICATION, AND QUALITY ASSURANCE

4.12.6 PACKAGING AND DISTRIBUTION

4.12.7 INSTALLATION AND SYSTEM INTEGRATION

4.12.8 END USE AND LIFECYCLE SUPPORT

4.13 VENDOR SELECTION CRITERIA

4.13.1 COMPLIANCE WITH INDUSTRY STANDARDS

4.13.2 SAFETY CERTIFICATIONS AND CODE COMPLIANCE

4.13.3 PRODUCT QUALITY AND PERFORMANCE CONSISTENCY

4.13.4 SUPPLY RELIABILITY AND LEAD TIME ASSURANCE

4.13.5 REGULATORY AND PROCUREMENT ELIGIBILITY

4.13.6 TECHNICAL SUPPORT AND DOCUMENTATION

4.13.7 PRICING STRUCTURE AND TOTAL COST OF OWNERSHIP

4.13.8 BRAND REPUTATION AND MARKET TRACK RECORD

4.13.9 SUSTAINABILITY AND MATERIAL TRANSPARENCY (EMERGING CRITERION)

5 TARIFFS & IMPACT ON THE MARKET

5.1 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.2 VENDOR SELECTION CRITERIA DYNAMICS

5.3 IMPACT ON SUPPLY CHAIN

5.3.1 RAW MATERIAL PROCUREMENT

5.3.2 MANUFACTURING AND PRODUCTION

5.3.3 LOGISTICS AND DISTRIBUTION

5.3.4 PRICE PITCHING AND POSITION OF MARKET

5.4 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.4.1 SUPPLY CHAIN OPTIMIZATION

5.4.2 JOINT VENTURE ESTABLISHMENTS

5.5 IMPACT ON PRICES

5.6 REGULATORY INCLINATION

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVER

7.1.1 EXPANSION OF DATA CENTERS AND CLOUD COMPUTING IN U.S.

7.1.2 THE RAPID RISE OF SMART BUILDINGS AND WIDESPREAD IOT DEPLOYMENTS ACROSS THE U.S.

7.1.3 GROWTH OF TELECOMMUNICATIONS INFRASTRUCTURE IN THE U.S.

7.1.4 RISING DEMAND FROM VIDEO & SECURITY APPLICATIONS

7.2 RESTRAINTS

7.2.1 SUSCEPTIBILITY TO ELECTROMAGNETIC INTERFERENCE (EMI)

7.2.2 LIMITED DISTANCE CAPABILITY OF COPPER TWISTED PAIR CABLES

7.3 OPPORTUNITY

7.3.1 INTEGRATION WITH HYBRID NETWORK ARCHITECTURES

7.3.2 EXPANSION OF SMART HEALTHCARE AND EDUCATION FACILITIES IN U.S.

7.3.3 GOVERNMENT INITIATIVES SUPPORTING NETWORK MODERNIZATION

7.4 CHALLENGES

7.4.1 INTENSE COMPETITION FROM FIBER OPTIC SOLUTIONS

7.4.2 SKILLED WORKFORCE SHORTAGE IN U.S.

8 U.S. COPPER CABLE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 CATEGORY 6 (CAT 6)

8.3 CATEGORY 5E (CAT 5E)

8.4 CATEGORY 6A (CAT 6A)

8.5 CATEGORY 7 (CAT 7)

8.6 CATEGORY 6E

8.7 OTHERS

9 U.S. COPPER CABLE MARKET, BY TYPE

9.1 OVERVIEW

9.2 UNSHIELDED

9.3 SHIELDED

10 U.S. COPPER CABLE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 DATACOM

10.2.1 DATACOM, BY TYPE

10.2.1.1 ENTERPRISE NETWORKING (LAN)

10.2.1.2 DATA CENTERS

10.3 COMMERCIAL BUILDINGS

10.3.1 COMMERCIAL BUILDINGS, BY TYPE

10.3.1.1 OFFICE BUILDINGS

10.3.1.2 CAMPUSES

10.3.1.3 STRUCTURED CABLING INFRASTRUCTURE

10.4 VIDEO & SECURITY

10.4.1 VIDEO & SECURITY, BY TYPE

10.4.1.1 CCTV

10.4.1.2 SURVEILLANCE SYSTEMS

10.4.1.3 ACCESS CONTROL NETWORKS

10.5 OTHERS

11 U.S. COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT

11.1 OVERVIEW

11.2 INDOOR

11.3 OUTDOOR

12 U.S. COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 ONLINE

12.4 OFFLINE

13 U.S. COPPER CABLE MARKET STATE

13.1 CALIFORNIA

13.2 TEXAS

13.3 FLORIDA

13.4 NEW YORK

13.5 PENNSYLVANIA

13.6 ILLINOIS

13.7 VIRGINIA

13.8 OHIO

13.9 GEORGIA

13.1 NORTH CAROLINA

13.11 MICHIGAN

13.12 NEW JERSEY

13.13 WASHINGTON

13.14 ARIZONA

13.15 TENNESSEE

13.16 MASSACHUSETTS

13.17 LNDIANA

13.18 MARYLAND

13.19 MISSOURI

13.2 COLORADO

13.21 WISCONSIN

13.22 MINNESOTA

13.23 SOUTH CAROLINA

13.24 ALABAMA

13.25 KENTUCKY

13.26 LOUISIAN

13.27 OREGON

13.28 OKLAHOMA

13.29 CONNECTICUT

13.3 UTAH

13.31 NEVADA

13.32 LOWA

13.33 ARKANSAS

13.34 KENSAS

13.35 MISSISSIPPI

13.36 NEW MEXICO

13.37 LDAHO

13.38 NEBRASKA

13.39 WEST VIRGINIA

13.4 HAWAII

13.41 NEW HAMPSHIRE

13.42 MAINE

13.43 MONTANA

13.44 RHODE ISLAND

13.45 DELAWARE

13.46 SOUTH DAKOTA

13.47 NORTH DAKOTA

13.48 ALASKA

13.49 VERMONT

13.5 WYOMING

13.51 DISTRICT OF COLUMBIA

14 U.S. COPPER CABLE MARKET

14.1 COMPANY SHARE ANALYSIS: U.S.

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 COMMSCOPE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT/ NEWS

16.1.5 DBMR ANALYSIS

16.2 PRYSMIAN

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT/ NEWS

16.2.5 DBMR ANALYSIS

16.3 NEXANS (CENTELSA BY NEXANS)

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT/ NEWS

16.3.5 DBMR ANALYSIS

16.4 BELDEN INC,

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT/ NEWS

16.4.5 DBMR ANALYSIS

16.5 PANDUIT CORP.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT/ NEWS

16.5.4 DBMR ANALYSIS

16.6 3M

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT/SERVICE PORTFOLIO

16.6.4 RECENT DEVELOPMENT/NEWS

16.6.5 DBMR ANALYSIS

16.7 AFL

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT/ NEWS

16.7.4 DBMR ANALYSIS

16.8 ALPHA WIRE

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT/ NEWS

16.8.4 DBMR ANALYSIS

16.9 CONSOLIDATED ELECTRONIC WIRE & CABLE

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT/SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENT/ NEWS

16.9.4 DBMR ANALYSIS

16.1 CUSTOM WIRE INDUSTRIES

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT/SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.10.4 DBMR ANALYSIS

16.11 GAVITT WIRE & CABLE COMPANY, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.11.4 DBMR ANALYSIS

16.12 GENERAL WIRES INC

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.12.4 DBMR ANALYSIS

16.13 ICE CABLE SYSTEMS

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT/ NEWS

16.13.4 DBMR ANALYSIS

16.14 LAKE CABLE

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT/ NEWS

16.14.4 DBMR ANALYSIS

16.15 LEVITON MANUFACTURING CO., INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT/ NEWS

16.15.4 DBMR ANALYSIS

16.16 MICRO-TEK CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT/SERVICE PORTFOLIO

16.16.3 RECENT DEVELOPMENT/NEWS

16.16.4 DBMR ANALYSIS

16.17 NEW ENGLAND WIRE TECHNOLOGIES

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT/ NEWS

16.17.4 DBMR ANALYSIS

16.18 PROTERIAL CABLE AMERICA, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT/ NEWS

16.18.4 DBMR ANALYSIS

16.19 REMEE PRODUCTS CORPORATION

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT/ NEWS

16.19.4 DBMR ANALYSIS

16.2 SIEMON.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT/NEWS

16.20.4 DBMR ANALYSIS

16.21 SOUTHWIRE COMPANY, LLC.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT/NEWS

16.21.4 DBMR ANALYSIS

16.22 SUPERIOR ESSEX INTERNATIONAL INC.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT/NEWS

16.22.4 DBMR ANALYSIS

16.23 VERTICAL CABLE

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT/ NEWS

16.23.4 DBMR ANALYSIS

16.24 WINDY CITY WIRE

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT/ NEWS

16.24.4 DBMR ANALYSIS

16.25 Y.C. CABLE

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT/SERVICE PORTFOLIO

16.25.3 RECENT DEVELOPMENT/ NEWS

16.25.4 DBMR ANALYSIS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 U.S. COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 3 U.S. COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 4 U.S. COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 U.S. COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 6 U.S. DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 U.S. COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 U.S. VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 U.S. COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 10 U.S. COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 11 U.S. COPPER CABLE MARKET, BY STATES, 2018-2033 (USD THOUSAND)

TABLE 12 U.S. COPPER CABLE MARKET, BY STATES, 2018-2033 (TONS)

TABLE 13 U.S. COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 U.S. COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 15 U.S. COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 U.S. COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 17 U.S. DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 U.S. COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 U.S. VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 U.S. COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 21 U.S. COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 22 U.S. COPPER CABLE MARKET, BY STATES, 2018-2033 (USD THOUSAND)

TABLE 23 CALIFORNIA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 CALIFORNIA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 25 CALIFORNIA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 CALIFORNIA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 27 CALIFORNIA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 CALIFORNIA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 CALIFORNIA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 CALIFORNIA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 31 CALIFORNIA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 32 U.S. COPPER CABLE MARKET, BY STATES, 2018-2033 (USD THOUSAND)

TABLE 33 TEXAS COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 TEXAS COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 35 TEXAS COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 TEXAS COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 37 TEXAS DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 TEXAS COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 TEXAS VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 TEXAS COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 41 TEXAS COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 42 U.S. COPPER CABLE MARKET, BY STATES, 2018-2033 (USD THOUSAND)

TABLE 43 FLORIDA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 FLORIDA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 45 FLORIDA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 FLORIDA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 47 FLORIDA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 FLORIDA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 49 FLORIDA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 FLORIDA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 51 FLORIDA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 52 U.S. COPPER CABLE MARKET, BY STATES, 2018-2033 (USD THOUSAND)

TABLE 53 NEW YORK COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 NEW YORK COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 55 NEW YORK COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 56 NEW YORK COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 57 NEW YORK DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 NEW YORK COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 NEW YORK VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NEW YORK COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 61 NEW YORK COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 62 U.S. COPPER CABLE MARKET, BY STATES, 2018-2033 (USD THOUSAND)

TABLE 63 PENNSYLVANIA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 PENNSYLVANIA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 65 PENNSYLVANIA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 PENNSYLVANIA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 67 PENNSYLVANIA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 PENNSYLVANIA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 PENNSYLVANIA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 PENNSYLVANIA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 71 PENNSYLVANIA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 72 U.S. COPPER CABLE MARKET, BY STATES, 2018-2033 (USD THOUSAND)

TABLE 73 ILLINOIS COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 ILLINOIS COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 75 ILLINOIS COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 ILLINOIS COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 77 ILLINOIS DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 ILLINOIS COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 ILLINOIS VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 ILLINOIS COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 81 ILLINOIS COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 82 U.S. COPPER CABLE MARKET, BY STATES, 2018-2033 (USD THOUSAND)

TABLE 83 VIRGINIA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 VIRGINIA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 85 VIRGINIA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 VIRGINIA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 87 VIRGINIA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 VIRGINIA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 VIRGINIA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 VIRGINIA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 91 VIRGINIA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 92 U.S. COPPER CABLE MARKET, BY STATES, 2018-2033 (USD THOUSAND)

TABLE 93 OHIO COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 OHIO COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 95 OHIO COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 OHIO COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 97 OHIO DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 OHIO COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 OHIO VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 OHIO COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 101 OHIO COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 102 U.S. COPPER CABLE MARKET, BY STATES, 2018-2033 (USD THOUSAND)

TABLE 103 GEORGIA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 GEORGIA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 105 GEORGIA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 GEORGIA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 107 GEORGIA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 GEORGIA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 GEORGIA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 GEORGIA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 111 GEORGIA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 112 U.S. COPPER CABLE MARKET, BY STATES, 2018-2033 (USD THOUSAND)

TABLE 113 NORTH CAROLINA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 114 NORTH CAROLINA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 115 NORTH CAROLINA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 116 NORTH CAROLINA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 117 NORTH CAROLINA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 NORTH CAROLINA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 NORTH CAROLINA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NORTH CAROLINA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 121 NORTH CAROLINA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 122 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 123 MICHIGAN COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 MICHIGAN COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 125 MICHIGAN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 MICHIGAN COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 127 MICHIGAN DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 MICHIGAN COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 MICHIGAN VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 MICHIGAN COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 131 MICHIGAN COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 132 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 133 NEW JERSEY COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 NEW JERSEY COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 135 NEW JERSEY COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 NEW JERSEY COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 137 NEW JERSEY DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 NEW JERSEY COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 NEW JERSEY VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 NEW JERSEY COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 141 NEW JERSEY COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 142 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 143 WASHINGTON COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 WASHINGTON COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 145 WASHINGTON COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 WASHINGTON COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 147 WASHINGTON DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 WASHINGTON COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 WASHINGTON VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 WASHINGTON COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 151 WASHINGTON COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 152 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 153 ARIZONA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 ARIZONA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 155 ARIZONA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 ARIZONA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 157 ARIZONA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 ARIZONA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 ARIZONA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 ARIZONA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 161 ARIZONA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 162 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 163 TENNESSEE COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 TENNESSEE COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 165 TENNESSEE COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 TENNESSEE COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 167 TENNESSEE DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 TENNESSEE COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 TENNESSEE VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 TENNESSEE COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 171 TENNESSEE COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 172 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 173 MASSACHUSETTS COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 MASSACHUSETTS COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 175 MASSACHUSETTS COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 MASSACHUSETTS COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 177 MASSACHUSETTS DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 MASSACHUSETTS COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 MASSACHUSETTS VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 MASSACHUSETTS COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 181 MASSACHUSETTS COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 182 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 183 LNDIANA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 LNDIANA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 185 LNDIANA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 LNDIANA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 187 LNDIANA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 LNDIANA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 LNDIANA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 LNDIANA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 191 LNDIANA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 192 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 193 MARYLAND COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 MARYLAND COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 195 MARYLAND COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 MARYLAND COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 197 MARYLAND DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 MARYLAND COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 MARYLAND VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 MARYLAND COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 201 MARYLAND COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 202 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 203 MISSOURI COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 MISSOURI COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 205 MISSOURI COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 MISSOURI COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 207 MISSOURI DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 MISSOURI COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 MISSOURI VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 MISSOURI COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 211 MISSOURI COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 212 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 213 COLORADO COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 COLORADO COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 215 COLORADO COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 COLORADO COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 217 COLORADO DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 COLORADO COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 COLORADO VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 COLORADO COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 221 COLORADO COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 222 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 223 WISCONSIN COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 WISCONSIN COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 225 WISCONSIN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 WISCONSIN COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 227 WISCONSIN DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 WISCONSIN COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 WISCONSIN VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 WISCONSIN COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 231 WISCONSIN COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 232 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 233 MINNESOTA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 MINNESOTA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 235 MINNESOTA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 MINNESOTA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 237 MINNESOTA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 238 MINNESOTA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 MINNESOTA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 MINNESOTA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 241 MINNESOTA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 242 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 243 SOUTH CAROLINA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 244 SOUTH CAROLINA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 245 SOUTH CAROLINA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 SOUTH CAROLINA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 247 SOUTH CAROLINA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 SOUTH CAROLINA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 249 SOUTH CAROLINA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 SOUTH CAROLINA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 251 SOUTH CAROLINA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 252 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 253 ALABAMA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 ALABAMA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 255 ALABAMA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 ALABAMA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 257 ALABAMA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 ALABAMA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 ALABAMA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 ALABAMA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 261 ALABAMA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 262 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 263 KENTUCKY COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 KENTUCKY COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 265 KENTUCKY COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 266 KENTUCKY COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 267 KENTUCKY DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 KENTUCKY COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 269 KENTUCKY VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 KENTUCKY COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 271 KENTUCKY COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 272 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 273 LOUISIAN COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 274 LOUISIAN COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 275 LOUISIAN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 276 LOUISIAN COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 277 LOUISIAN DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 278 LOUISIAN COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 279 LOUISIAN VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 LOUISIAN COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 281 LOUISIAN COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 282 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 283 OREGON COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 284 OREGON COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 285 OREGON COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 286 OREGON COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 287 OREGON DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 OREGON COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 289 OREGON VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 OREGON COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 291 OREGON COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 292 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 293 OKLAHOMA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 294 OKLAHOMA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 295 OKLAHOMA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 296 OKLAHOMA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 297 OKLAHOMA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 298 OKLAHOMA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 299 OKLAHOMA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 OKLAHOMA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 301 OKLAHOMA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 302 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 303 CONNECTICUT COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 304 CONNECTICUT COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 305 CONNECTICUT COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 306 CONNECTICUT COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 307 CONNECTICUT DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 308 CONNECTICUT COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 309 CONNECTICUT VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 CONNECTICUT COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 311 CONNECTICUT COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 312 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 313 UTAH COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 314 UTAH COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 315 UTAH COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 316 UTAH COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 317 UTAH DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 318 UTAH COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 319 UTAH VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 UTAH COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 321 UTAH COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 322 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 323 NEVADA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 324 NEVADA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 325 NEVADA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 326 NEVADA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 327 NEVADA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 328 NEVADA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 329 NEVADA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 NEVADA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 331 NEVADA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 332 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 333 LOWA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 334 LOWA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 335 LOWA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 336 LOWA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 337 LOWA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 338 LOWA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 339 LOWA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 LOWA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 341 LOWA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 342 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 343 ARKANSAS COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 344 ARKANSAS COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 345 ARKANSAS COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 346 ARKANSAS COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 347 ARKANSAS DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 348 ARKANSAS COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 349 ARKANSAS VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 ARKANSAS COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 351 ARKANSAS COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 352 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 353 KENSAS COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 354 KENSAS COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 355 KENSAS COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 356 KENSAS COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 357 KENSAS DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 358 KENSAS COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 359 KENSAS VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 KENSAS COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 361 KENSAS COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 362 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 363 MISSISSIPPI COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 364 MISSISSIPPI COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 365 MISSISSIPPI COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 366 MISSISSIPPI COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 367 MISSISSIPPI DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 368 MISSISSIPPI COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 369 MISSISSIPPI VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 370 MISSISSIPPI COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 371 MISSISSIPPI COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 372 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 373 NEW MEXICO COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 374 NEW MEXICO COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 375 NEW MEXICO COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 376 NEW MEXICO COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 377 NEW MEXICO DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 378 NEW MEXICO COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 379 NEW MEXICO VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 NEW MEXICO COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 381 NEW MEXICO COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 382 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 383 LDAHO COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 384 LDAHO COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 385 LDAHO COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 386 LDAHO COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 387 LDAHO DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 388 LDAHO COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 389 LDAHO VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 LDAHO COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 391 LDAHO COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 392 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 393 NEBRASKA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 394 NEBRASKA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 395 NEBRASKA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 396 NEBRASKA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 397 NEBRASKA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 398 NEBRASKA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 399 NEBRASKA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 NEBRASKA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 401 NEBRASKA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 402 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 403 WEST VIRGINIA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 404 WEST VIRGINIA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 405 WEST VIRGINIA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 406 WEST VIRGINIA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 407 WEST VIRGINIA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 408 WEST VIRGINIA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 409 WEST VIRGINIA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 WEST VIRGINIA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 411 WEST VIRGINIA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 412 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 413 HAWAII COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 414 HAWAII COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 415 HAWAII COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 416 HAWAII COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 417 HAWAII DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 418 HAWAII COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 419 HAWAII VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 420 HAWAII COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 421 HAWAII COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 422 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 423 NEW HAMPSHIRE COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 424 NEW HAMPSHIRE COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 425 NEW HAMPSHIRE COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 426 NEW HAMPSHIRE COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 427 NEW HAMPSHIRE DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 428 NEW HAMPSHIRE COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 429 NEW HAMPSHIRE VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 430 NEW HAMPSHIRE COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 431 NEW HAMPSHIRE COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 432 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 433 MAINE COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 434 MAINE COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 435 MAINE COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 436 MAINE COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 437 MAINE DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 438 MAINE COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 439 MAINE VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 440 MAINE COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 441 MAINE COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 442 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 443 MONTANA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 444 MONTANA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 445 MONTANA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 446 MONTANA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 447 MONTANA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 448 MONTANA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 449 MONTANA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 450 MONTANA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 451 MONTANA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 452 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 453 RHODE ISLAND COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 454 RHODE ISLAND COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 455 RHODE ISLAND COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 456 RHODE ISLAND COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 457 RHODE ISLAND DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 458 RHODE ISLAND COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 459 RHODE ISLAND VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 460 RHODE ISLAND COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 461 RHODE ISLAND COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 462 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 463 DELAWARE COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 464 DELAWARE COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 465 DELAWARE COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 466 DELAWARE COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 467 DELAWARE DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 468 DELAWARE COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 469 DELAWARE VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 470 DELAWARE COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 471 DELAWARE COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 472 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 473 SOUTH DAKOTA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 474 SOUTH DAKOTA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 475 SOUTH DAKOTA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 476 SOUTH DAKOTA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 477 SOUTH DAKOTA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 478 SOUTH DAKOTA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 479 SOUTH DAKOTA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 480 SOUTH DAKOTA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 481 SOUTH DAKOTA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 482 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 483 NORTH DAKOTA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 484 NORTH DAKOTA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 485 NORTH DAKOTA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 486 NORTH DAKOTA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 487 NORTH DAKOTA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 488 NORTH DAKOTA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 489 NORTH DAKOTA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 490 NORTH DAKOTA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 491 NORTH DAKOTA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 492 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 493 ALASKA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 494 ALASKA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 495 ALASKA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 496 ALASKA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 497 ALASKA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 498 ALASKA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 499 ALASKA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 500 ALASKA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 501 ALASKA COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 502 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 503 VERMONT COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 504 VERMONT COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 505 VERMONT COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 506 VERMONT COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 507 VERMONT DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 508 VERMONT COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 509 VERMONT VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 510 VERMONT COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 511 VERMONT COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 512 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 513 WYOMING COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 514 WYOMING COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 515 WYOMING COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 516 WYOMING COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 517 WYOMING DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 518 WYOMING COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 519 WYOMING VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 520 WYOMING COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)

TABLE 521 WYOMING COPPER CABLE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 522 U.S. COPPER CABLE MARKET, BY STATE, 2018-2033 (USD THOUSAND)

TABLE 523 DISTRICT OF COLUMBIA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 524 DISTRICT OF COLUMBIA COPPER CABLE MARKET, BY PRODUCT TYPE, 2018-2033 (USD TONS)

TABLE 525 DISTRICT OF COLUMBIA COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 526 DISTRICT OF COLUMBIA COPPER CABLE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 527 DISTRICT OF COLUMBIA DATACOM IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 528 DISTRICT OF COLUMBIA COMMERCIAL BUILDINGS IN COPPER CABLE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 529 DISTRICT OF COLUMBIA VIDEO & SECURITY IN COPPER CABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 530 DISTRICT OF COLUMBIA COPPER CABLE MARKET, BY INSTALLATION ENVIRONMENT, 2018-2033 (USD THOUSAND)