Us Fractional Horsepower Fhp Motors Market

Market Size in USD Billion

CAGR :

%

USD

3.67 Billion

USD

6.59 Billion

2024

2032

USD

3.67 Billion

USD

6.59 Billion

2024

2032

| 2025 –2032 | |

| USD 3.67 Billion | |

| USD 6.59 Billion | |

|

|

|

|

Fractional Horsepower (FHP) Motors Market Analysis

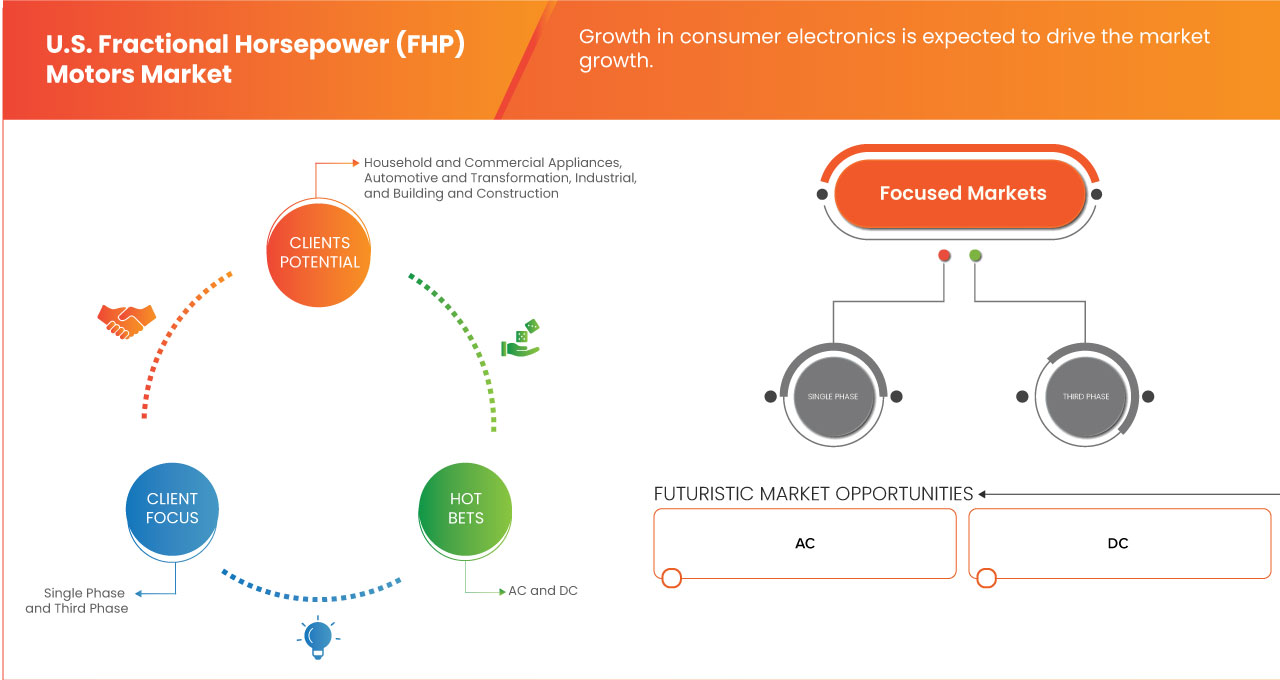

U.S. Fractional Horsepower (FHP) motors market is experiencing transformative growth driven by the rise in robotics for both home and industrial use is transforming various sectors, from household automation to advanced manufacturing. As humanoid robots such as Tesla’s Optimus and Agibot’s Yuanzheng A2 enter the market, the demand for compact, energy-efficient fractional horsepower motors continues to surge. Key market dynamics include Competition from low-cost imports continues to restrain the growth of the fractional horsepower (FHP) motors market. The steady influx of cheaper products, particularly from countries like China and India, puts significant pressure on domestic manufacturers to lower prices, often at the expense of quality, innovation, and profitability.

Prominent challenges include facing significant challenges related to the environmental impact of manufacturing processes. As regulations around sustainability and emissions become stricter, companies must find ways to balance environmental responsibility with cost-efficiency and performance.

Fractional Horsepower (FHP) Motors Market Size

U.S. Fractional Horsepower (FHP) motors market size was valued at USD 3.67 billion in 2024 and is projected to reach USD 6.59 billion by 2032, with a CAGR of 7.6% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Fractional Horsepower (FHP) Motors Market Trends

“Electric Drones and UAV Applications Expanding Rapidly”

The rapid expansion of electric drones and Unmanned Aerial Vehicles (UAVs) is creating new opportunities for the U.S. Fractional Horsepower (FHP) motors market. As industries such as agriculture, defense, logistics, and infrastructure inspection increasingly adopt drones for precision tasks, the demand for lightweight, high-efficiency motors is rising. FHP motors play a critical role in enabling precise control, extended flight durations, and enhanced energy efficiency in electric UAVs, making them an essential component in this growing sector.

With advancements in battery technology and regulatory support for commercial drone applications, the adoption of electric UAVs is expected to accelerate further. This presents a lucrative opportunity for FHP motor manufacturers to develop specialized, high-performance motors tailored for drone propulsion, gimbal stabilization, and payload operations. Companies that innovate to meet the evolving needs of drone manufacturers will gain a competitive advantage, this trend, positioning themselves at the forefront of this rapidly expanding market.

Report Scope and Fractional Horsepower (FHP) Motors Market Segmentation

|

Attributes |

Fractional Horsepower (FHP) Motors Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Nidec Motor Corporation (Part of Nidec Corporation) (U.S.), Regal Rexnord Corporation (U.S.), BODINE ELECTRIC COMPANY (U.S.), ElectroCraft, Inc. (U.S.), ABB (Switzerland), Robert Bosch GmbH (Germany), MOLON Motor and Coil Corporation (U.S.), AMETEK.Inc. (U.S.), DR. Fritz Faulhaber GmbH & Co. KG (Germany), ARC Systems Inc. (U.S.), Carter Motor Company (U.S.), and Electric Motor Solutions (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Fractional Horsepower (FHP) Motors Market Definition

The U.S. Fractional Horsepower (FHP) motors market refers to the industry segment that manufactures, distributes, and sells electric motors with power ratings of less than one horsepower. These motors are widely used in various applications, including household appliances, HVAC systems, automotive components, medical devices, and industrial machinery. The market is driven by advancements in energy-efficient motor technologies, regulatory standards, and increasing demand for automation. Key players in this market focus on innovation, cost-effective production, and compliance with industry standards such as NEMA and IEEE to meet diverse consumer and industrial needs.

Fractional Horsepower (FHP) Motors Market Dynamics

Drivers

- Growth in Consumer Electronics

The growth in consumer electronics has significantly driven the U.S. Fractional Horsepower (FHP) motors market. As demand for smaller, more efficient electronic devices such as home appliances, personal gadgets, and automotive technologies increases, the need for fractional horsepower motors typically ranging from a fraction of a horsepower to one horsepower has grown substantially. These motors are essential in powering various devices such as fans, pumps, compressors, and small machinery, owing to their compact size, energy efficiency, and reliability. The expansion of the consumer electronics sector has thus accelerated the adoption of these motors, contributing to the overall market growth.

For instance,

According to the blog published by Oberlo, smartphones are the most popular electronic devices in the U.S., with 97.6% of consumers owning one, reflecting a 1.2% increase from the previous year. Laptops/desktops (68.3%) and tablets (48.4%) follow closely, alongside rising ownership of smartwatches (37.2%) and smart home devices (26.7%). This growing adoption of consumer electronics, particularly devices requiring compact, energy-efficient components, is driving demand in the U.S. Fractional Horsepower (FHP) motors market. These motors power critical functions in gadgets such as smartphones, smart home devices, and wearables, aligning with the steady growth in electronics usage.

- Rise in Robotics for Home and Industrial Use

The rise in robotics for both home and industrial use is a key driver of the U.S. Fractional Horsepower (FHP) motors market. From household appliances such as robotic vacuum cleaners and lawnmowers to advanced industrial robots used in manufacturing, automation relies heavily on compact, efficient motors to perform precise, repetitive tasks. Fractional horsepower motors are ideal for these applications due to their small size, energy efficiency, and reliability. As demand for automation and smart technologies continues to grow across various sectors, the need for these specialized motors is expected to surge, fueling market expansion.

For instance,

- In December 2024, according to the blog published by Businesskorea Co., Ltd., LG Electronics unveiled its first home butler robot, Q9, which is set for release next year. This robot is designed to serve as an AI home hub, performing tasks such as controlling home appliances and enhancing emotional interaction with users. Equipped with advanced features such as a gravity compensation device and OpenAI’s GPT-4, Q9 marks a significant leap in home robotics. As robotics in the home sector gains momentum, there is an increasing need for fractional horsepower motors to power the precise, energy-efficient movements of these robots. With more robotics solutions entering both home and industrial markets, the demand for fractional horsepower motors is expected to surge, supporting the growth of this technology-driven market.

Opportunity

- Growth in Automated Agriculture Technologies Using FHP Motors

The increasing adoption of automated agriculture technologies presents a significant opportunity for the U.S. Fractional Horsepower (FHP) motors market. Precision farming, robotic harvesters, automated irrigation systems, and smart greenhouse solutions are increasingly integrating compact and energy-efficient FHP motors to enhance efficiency and productivity. These motors enable precise control over farming equipment, reducing labor dependency and optimizing resource usage. As farmers shift towards automation to address workforce shortages and improve yield, the demand for FHP motors in agricultural applications is expected to grow steadily.

Moreover, advancements in IoT and AI-driven agricultural machinery further accelerate this trend. Automated drones for crop monitoring, self-driving tractors, and robotic milking systems rely on FHP motors for smooth operation and energy efficiency. The push for sustainable and smart farming practices, supported by government incentives for agri-tech innovations, will drive further investments in FHP motor-powered solutions. This creates a strong market potential for manufacturers to develop durable, high-performance motors tailored to the evolving needs of modern agriculture.

For instance,

- In December 2023, according to the article published by HowToRobot, the growing adoption of agricultural robots, such as harvesting, weeding, and autonomous tractors, is revolutionizing farming by improving efficiency, precision, and sustainability while reducing labor costs. This surge in automated farming technologies creates a significant opportunity for the U.S. Fractional Horsepower (FHP) Motors Market, as the demand for compact, energy-efficient FHP motors to power these advanced machines increases, driving innovation and expanding market prospects for motor manufacturers in the agriculture sector.

Restraints/Challenges

- Compliance with Evolving U.S. Energy Standards Adds Cost and Complexity

Compliance with evolving U.S. energy standards presents a significant challenge for manufacturers in the fractional horsepower motors market, adding both cost and complexity to production. Stricter efficiency regulations require continuous design modifications, material upgrades, and advanced manufacturing processes, increasing overall operational expenses. Companies must invest in research and development to meet higher energy efficiency benchmarks while ensuring their motors remain cost-competitive in a market already facing pricing pressures.

In addition, adapting to these evolving standards can lead to supply chain disruptions as manufacturers source specialized materials and components that comply with regulatory requirements. The need for extensive testing and certification further prolongs product development cycles, delaying time-to-market for new motor models. As these regulations continue to evolve, manufacturers must navigate an increasingly complex compliance landscape, which could limit the entry of smaller players and favor companies with greater financial and technical resources.

For instance,

In June 2021, the U.S. Department of Energy (DOE) has issued a final rule on testing procedures for small electric motors, effective from February 3, 2021, with mandatory product testing starting on July 6, 2021. This rule, developed over more than a decade, aligns test conditions with industry standards and applies to small electric motors defined by the Energy Policy and Conservation Act (EPCA). Compliance with this updated rule will present challenges for the U.S. Fractional Horsepower (FHP) Motors Market, as manufacturers must adjust their processes and testing methods to meet evolving energy standards. This will likely lead to higher production costs and operational complexities. Continued changes in regulations will also require sustained investments to maintain compliance, placing additional strain on companies in the sector.

- Competition from Low-Cost Imports

Competition from low-cost imports acts as a restraint on the U.S. Fractional Horsepower (FHP) motors market. The availability of cheaper alternatives from countries with lower production costs, such as China, makes it difficult for domestic manufacturers to remain competitive without sacrificing quality or significantly reducing prices. This situation limits the potential for growth, as U.S. manufacturers face pressure to match lower prices, which can erode profit margins and hinder investment in innovation. As a result, the dominance of low-cost imports restricts the market's ability to expand and achieve sustainable growth in the long term.

For instance,

According to the blog published by Volza's, India exported 10,554 shipments of electric motors to the U.S. from March 2023 to February 2024, despite a -21% decline compared to the previous year. However, February 2024 saw a 23% year-on-year growth in shipments, indicating a rebound in exports. India ranks as the third-largest global exporter of electric motors, following China and Vietnam, with 303,990 shipments. The dominance of these low-cost exporters poses a significant restraint on the U.S. Fractional Horsepower (FHP) motors market. The affordable electric motors from countries such as India and China intensifies price competition, making it difficult for U.S. manufacturers to maintain profit margins while competing on cost, thereby hindering market growth and innovation.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Fractional Horsepower (FHP) Motors Market Scope

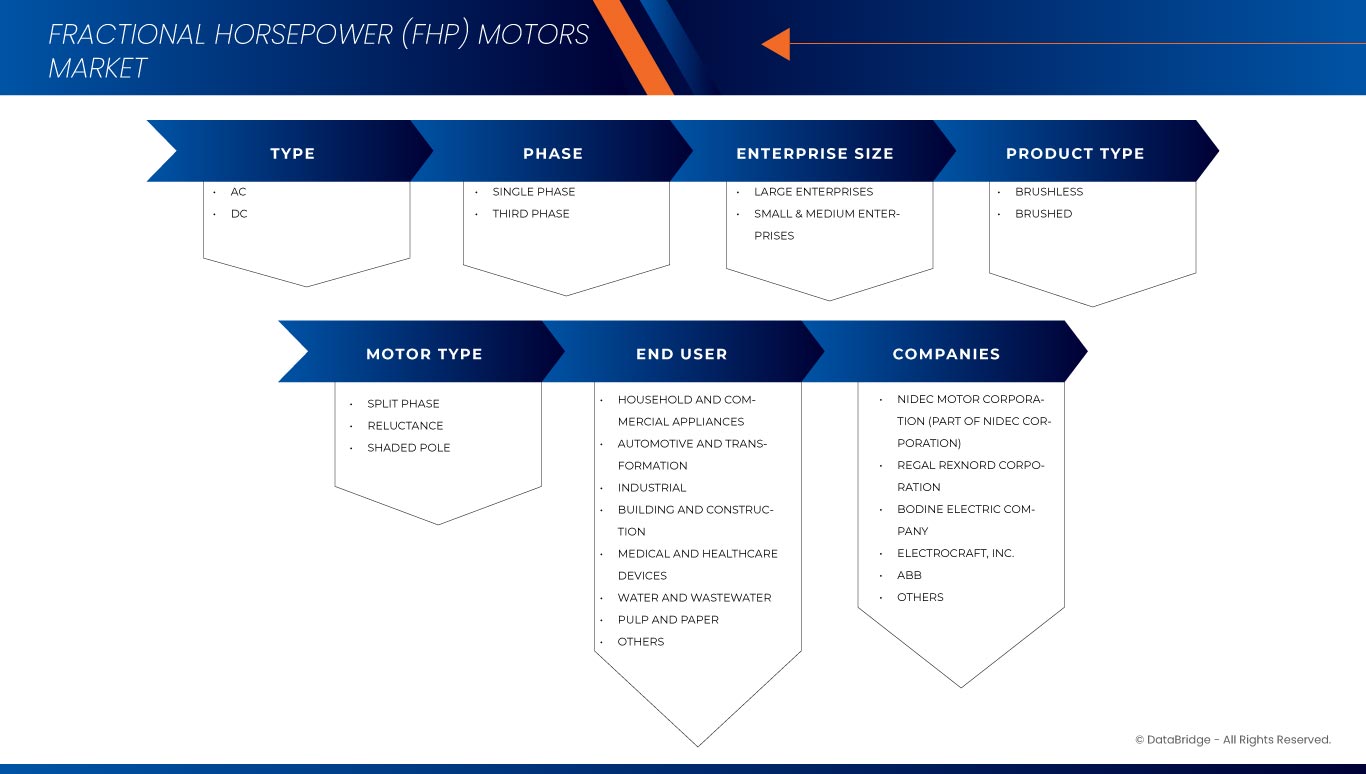

The market is segmented into six notable segments based on the type, phase, enterprise size, product type, motor type, and end user. The growth amongst these segments will help analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- AC

- DC

Phase

- Single Phase

- Third Phase

Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

Product Type

- Brushed

- Brushless

Motor Type

- Split Phase

- Shaded Pole

- Reluctance

End User

- Automotive and Transportation

- AC

- DC

- Household and Commercial Appliances

- AC

- DC

- Medical and Healthcare Devices

- AC

- DC

- Industrial

- AC

- DC

- Building and Construction

- AC

- DC

- Water and Wastewater

- AC

- DC

- Pulp and Paper

- AC

- DC

- Others

Fractional Horsepower (FHP) Motors Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Fractional Horsepower (FHP) Motors Market Leaders Operating in the Market Are:

- Nidec Motor Corporation (U.S.)

- Regal Rexnord Corporation (U.S)

- Bodine Electric Company (U.S)

- ElectroCraft, Inc (U.S)

- ABB (Switzerland)

- Robert Bosch GmbH (Germany)

- MOLON Motor and Coil Corporation (U.S)

- AMETEK.INC. (U.S)

- DR. FRITZ FAULHABER GMBH & CO. KG (Germany)

- ARC SYSTEMS INC (U.S)

- Carter Motor Company (U.S)

- Electric Motor Solutions (U.S)

Latest Developments in Fractional Horsepower (FHP) Motors Market

- In October 2024, Nidec Motor Corporation (“Nidec”), a 100%-owned subsidiary of Nidec Corporation, has announced a supply partnership agreement with leading Indian commercial vehicle manufacturer, Ashok Leyland (“AL”), the Indian flagship of the Hinduja group, to provide an electric motor-controller system (“E-Drive”) as vehicle electrification gains momentum globally and in India

- In Feb 2025, Regal Rexnord’s latest innovation in small frame ECM’s, the HILO and HILO MAXX family of motors and fan packs offer a robust, versatile design with a compact low profile form factor, IP66/67 ingress protection, universal voltage and multiple mounting options for flexible motor placement in a variety of Commercial Refrigeration applications within the Food Retail and Food Service vertical markets

- In November 2024, Bodine Electric Company recently upgraded the design of many of our type WX gearmotors to increase the output torque ratings while maintaining the same long-life rating. Two parts in the gearhead design were changed to accomplish the higher torque ratings: the rotor/armature shaft and the first stage gear. The rotor is the name for the rotating part in an AC Induction motor or a Brushless DC motor. The armature is the name for the rotating part in a Brushed DC motor. Regardless of what it’s called, that rotating part, when in a parallel shaft gearmotor like Bodine’s type WX gearmotor, has a shaft with a pinion cut on the end that engages with the first stage gear in the gearhead

- In September 2024, ElectroCraft, launch of the new "EZ Drive", a cutting-edge motor drive designed specifically for use with brushless DC motors. This innovative product is set to redefine efficiency and ease-of-use in a wide range of applications, from industrial automation to medical and laboratory equipment

- In Oct 2024, ABB expanded the Baldor-Reliance SP4 motor line, which offers up to 20% higher efficiency compared to conventional AC induction motors. These motors are designed as drop-in replacements, facilitating easy upgrades to more efficient systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 DBMR TRIPOD DATA VALIDATION MODEL

2.4 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.5 DBMR MARKET POSITION GRID

2.6 MARKET END USER COVERAGE GRID

2.7 MULTIVARIATE MODELING

2.8 TYPE TIMELINE CURVE

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES MODEL

4.2 QUALITY MANAGEMENT IN A FRACTIONAL HORSEPOWER ELECTRICAL MOTOR INDUSTRY: A CASE STUDY

4.3 CHALLENGE MATRIX

4.4 ADVANTAGES OF FRACTIONAL HORSEPOWER (FHP) MOTORS FOR DIFFERENT APPLICATIONS

4.5 VALUE CHAIN ANALYSIS

4.6 REGULATORY STANDARDS

4.7 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.8 PENETRATION AND GROWTH PROSPECT MAPPING

4.8.1 AUTOMOTIVE & TRANSPORTATION INDUSTRY:

4.8.1.1 MARKET PENETRATION

4.8.1.2 KEY DRIVERS

4.8.2 HOME APPLIANCES

4.8.2.1 MARKET PENETRATION

4.8.2.2 KEY DRIVERS

4.8.3 MEDICAL & HEALTHCARE DEVICES

4.8.3.1 MARKET PENETRATION

4.8.3.2 KEY DRIVERS

4.8.4 WATER & WASTEWATER MANAGEMENT

4.8.4.1 MARKET PENETRATION

4.8.4.2 KEY DRIVERS

4.9 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

4.1 USE CASE AND ITS ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWTH IN CONSUMER ELECTRONICS

5.1.2 RISE IN ROBOTICS FOR HOME AND INDUSTRIAL USE

5.1.3 SURGE IN ELECTRIC SCOOTERS AND EV ADOPTION

5.1.4 GROWTH IN 3D PRINTING AND PROTOTYPING INDUSTRIES

5.2 RESTRAINTS

5.2.1 DEPENDENCE ON RARE-EARTH MATERIALS HEIGHTENS SUPPLY CHAIN RISKS

5.2.2 COMPETITION FROM LOW-COST IMPORTS

5.3 OPPORTUNITIES

5.3.1 GROWTH IN AUTOMATED AGRICULTURE TECHNOLOGIES USING FHP MOTORS

5.3.2 GOVERNMENT INITIATIVES TO BOOST DOMESTIC PRODUCTION REDUCE RELIANCE ON IMPORTS

5.3.3 ELECTRIC DRONES AND UNMANNED AERIAL VEHICLES (UAV) APPLICATIONS EXPANDING RAPIDLY

5.4 CHALLENGES

5.4.1 COMPLIANCE WITH EVOLVING U.S. ENERGY STANDARDS ADDS COST AND COMPLEXITY

5.4.2 ENVIRONMENTAL IMPACT CONCERNS OF MANUFACTURING PROCESSES

5.5 TECHNOLOGY ANALYSIS

5.5.1 KEY TECHNOLOGIES

5.5.1.1 BRUSHLESS DC (BLDC) MOTORS

5.5.1.2 PERMANENT MAGNET SYNCHRONOUS MOTORS (PMSM)

5.5.2 COMPLIMENTARY TECHNOLOGIES

5.5.2.1 SMART SENSORS & IOT INTEGRATION

5.5.3 ADJACENT TECHNOLOGIES

5.5.3.1 ELECTRIC VEHICLE (EV) POWERTRAINS

5.6 COMPANY COMPARATIVE ANALYSIS

5.7 CASE STUDY

5.7.1 CASE STUDY-1

5.7.2 CASE STUDY-2

6 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY TYPE

6.1 OVERVIEW

6.2 AC

6.3 DC

7 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY PHASE

7.1 OVERVIEW

7.2 SINGLE PHASE

7.3 THIRD PHASE

8 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY ENTERPRISE SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISES

8.3 SMALL & MEDIUM ENTERPRISES

9 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 BRUSHLESS

9.3 BRUSHED

10 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY MOTOR TYPE

10.1 OVERVIEW

10.2 SPLIT PHASE

10.3 RELUCTANCE

10.4 SHADED POLE

11 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOUSEHOLD AND COMMERCIAL APPLIANCES

11.2.1 HOUSEHOLD AND COMMERCIAL APPLIANCES, BY TYPE

11.2.1.1 AC

11.2.1.2 DC

11.3 AUTOMOTIVE AND TRANSFORMATION

11.3.1 AUTOMOTIVE AND TRANSFORMATION, BY TYPE

11.3.1.1 AC

11.3.1.2 DC

11.4 INDUSTRIAL

11.4.1 INDUSTRIAL, BY TYPE

11.4.1.1 AC

11.4.1.2 DC

11.5 BUILDING AND CONSTRUCTION

11.5.1 BUILDING AND CONSTRUCTION, BY TYPE

11.5.1.1 AC

11.5.1.2 DC

11.6 MEDICAL AND HEALTHCARE DEVICES

11.6.1 MEDICAL AND HEALTHCARE DEVICES, BY TYPE

11.6.1.1 AC

11.6.1.2 DC

11.7 WATER AND WASTEWATER

11.7.1 WATER AND WASTEWATER, BY TYPE

11.7.1.1 AC

11.7.1.2 DC

11.8 PULP AND PAPER

11.8.1 PULP AND PAPER, BY TYPE

11.8.1.1 AC

11.8.1.2 DC

11.9 OTHERS

12 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: U.S.

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 NIDEC MOTOR CORPORATION (PART OF NIDEC CORPORATION)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 REGAL REXNORD CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 BODINE ELECTRIC COMPANY

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 ELECTROCRAFT, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENTS

14.5 ABB

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 AMETEK.INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 ARC SYSTEMS INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CARTER MOTOR COMPANY

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 DR. FRITZ FAULHABER GMBH & CO. KG

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 ELECTRIC MOTOR SOLUTIONS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 MOLON MOTOR AND COIL CORPORATION

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 ROBERT BOSCH GMBH

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 ENERGY-EFFICIENT MOTOR CONTROL FOR HOME APPLIANCES

TABLE 2 REGULATORY FRAMEWORK

TABLE 3 USED CASE ANALYSIS

TABLE 4 COMPANY COMPARATIVE ANALYSIS

TABLE 5 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY PHASE, 2018-2032 (USD THOUSAND)

TABLE 7 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 8 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY MOTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 11 U.S. HOUSEHOLD AND COMMERCIAL APPLIANCES IN FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 U.S. AUTOMOTIVE AND TRANSFORMATION IN FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY TYPE 2018-2032, (USD THOUSAND)

TABLE 13 U.S. INDUSTRIAL IN FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY TYPE 2018-2032, (USD THOUSAND)

TABLE 14 U.S. BUILDING AND CONSTRUCTION IN FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY TYPE 2018-2032, (USD THOUSAND)

TABLE 15 U.S. MEDICAL AND HEALTHCARE DEVICES IN FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY TYPE 2018-2032, (USD THOUSAND)

TABLE 16 U.S. WATER AND WASTEWATER IN FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY TYPE 2018-2032, (USD THOUSAND)

TABLE 17 U.S. PULP AND PAPER IN FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY TYPE 2018-2032, (USD THOUSAND)

List of Figure

FIGURE 1 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: SEGMENTATION

FIGURE 2 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: DATA TRIANGULATION

FIGURE 3 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: DROC ANALYSIS

FIGURE 4 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: SEGMENTATION

FIGURE 10 TWO SEGMENTS COMPRISE THE U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET, BY TYPE (2024)

FIGURE 11 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 GROWTH IN CONSUMER ELECTRONICS IS EXPECTED TO DRIVE THE U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 AC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET IN 2025 & 2032

FIGURE 15 DROC ANALYSIS

FIGURE 16 U.S. ELECTRONICS AND APPLIANCE SALES (USD MILLION)

FIGURE 17 MOST POPULAR ELECTRONIC DEVICES IN THE U.S.

FIGURE 18 ANNUAL INSTALLATIONS OF INDUSTRIAL ROBOTS (U.S.) THOUSAND UNITS

FIGURE 19 U.S. DOCKED BIKES SHARE AND E-SCOOTER SYSTEM

FIGURE 20 ELECTRIC VEHICLE REGISTRATIONS BY STATE (2023)

FIGURE 21 U.S. LOW HORSEPOWER IMPORTS BY SHIPPING TYPE

FIGURE 22 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: BY TYPE, 2024

FIGURE 23 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: BY PHASE, 2024

FIGURE 24 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: BY ENTERPRISE SIZE, 2024

FIGURE 25 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: BY PRODUCT TYPE, 2024

FIGURE 26 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: BY MOTOR TYPE, 2024

FIGURE 27 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: BY END USER, 2024

FIGURE 28 U.S. FRACTIONAL HORSEPOWER (FHP) MOTORS MARKET: COMPANY SHARE 2024 (%)

Us Fractional Horsepower Fhp Motors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Fractional Horsepower Fhp Motors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Fractional Horsepower Fhp Motors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.