Us Geogrid Market

Market Size in USD Million

CAGR :

%

USD

483.03 Million

USD

733.14 Million

2024

2032

USD

483.03 Million

USD

733.14 Million

2024

2032

| 2025 –2032 | |

| USD 483.03 Million | |

| USD 733.14 Million | |

|

|

|

|

U.S. Geogrid Market Size

- The U.S. Geogrid Market size was valued at USD 483.03 Million in 2024 and is expected to reach USD 733.14 Million by 2032, at a CAGR of 5.4% during the forecast period

- Increasing investment in highways, railways, and airport runways in the U.S. is driving demand for geogrids, which reinforce soil, improve stability, and extend pavement life.

- Geogrids are increasingly preferred in environmentally friendly projects for soil stabilization, erosion control, and reducing the need for natural materials, aligning with U.S. green building initiatives.

U.S. Geogrid Market Analysis

- Increasing infrastructure projects, including highways, railways, and airport expansions, have driven demand for high-strength geogrids, particularly those with enhanced tensile strength and long-term durability, improving soil stabilization and pavement longevity.

- Adoption of advanced polymer and composite geogrids, along with smart monitoring technologies, supports predictive maintenance of roads and embankments, reducing repair cycles and enhancing construction efficiency.

- Geogrids are playing a critical role in sustainable and green construction projects, including erosion control, slope stabilization, and environmentally friendly road reinforcement, aligning with U.S. initiatives for resilient and climate-adaptive infrastructure.

- Biaxial Geogrid segment dominated the U.S. Geogrid Market with a market share of 38.17%in 2024, driven due to its superior performance in a wide range of infrastructure applications. Unlike uniaxial geogrids, biaxial geogrids provide high tensile strength in both longitudinal and transverse directions.

Report Scope and U.S. Geogrid Market Segmentation

|

Attributes |

Geogrid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

U.S. Geogrid Market Trends

“Growing infrastructure investment”

- The U.S. Geogrid Market is shifting toward high-performance polymer and composite geogrids, driven by stricter environmental regulations and the need for durable, climate-resilient infrastructure solutions.

- Increasing industrialization and construction activities, along with the expansion of renewable energy projects, are fueling demand for advanced geogrid products that offer superior load distribution, long-term durability, and ease of installation.

- Sustainability considerations are increasingly influencing project specifications, prompting manufacturers to develop eco-friendly geogrid solutions, including recyclable materials and products that minimize resource consumption while maintaining performance.

U.S. Geogrid Market Dynamics

Driver

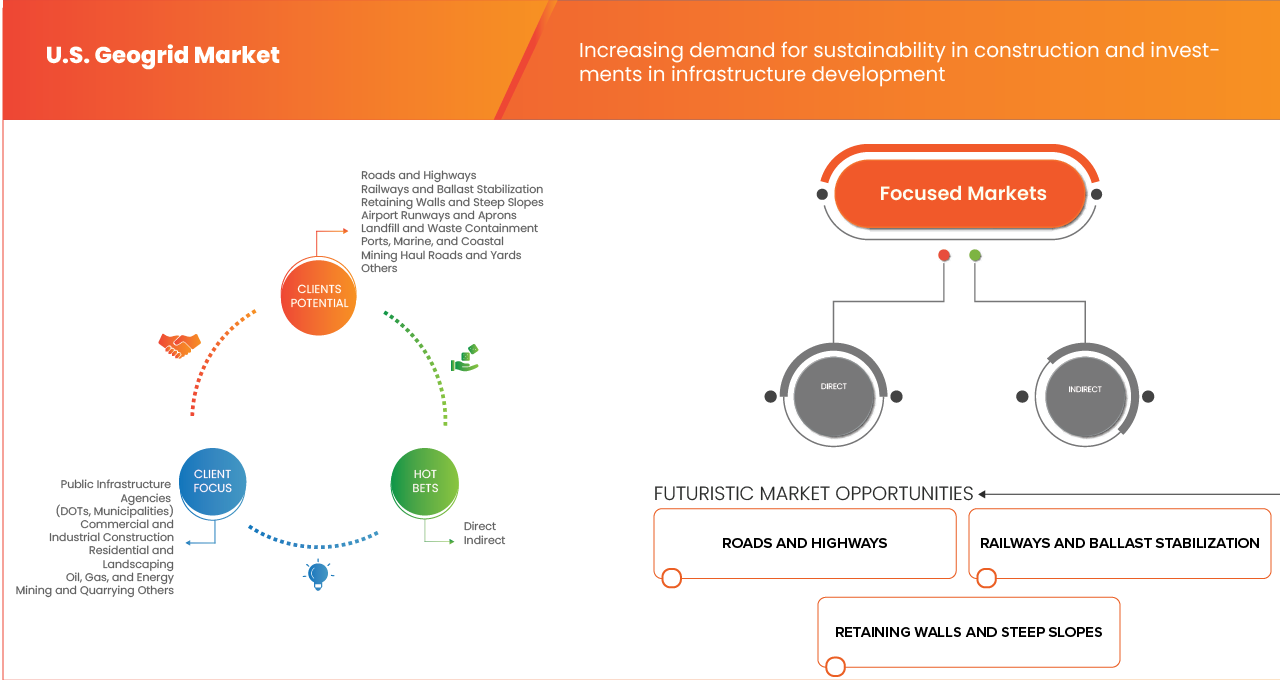

“Increasing Demand for Sustainability in Construction and Investments in Infrastructure Development”

The U.S. Geogrid Market is experiencing strong momentum driven by the growing emphasis on sustainability in construction practices and the rising investments in infrastructure development across the country. With an increasing focus on environmentally responsible building methods, geogrids are being widely adopted for their ability to enhance soil stabilization, reduce the need for raw materials, and extend the lifespan of structures such as roads, embankments, and retaining walls. Federal and state-level initiatives promoting sustainable infrastructure, along with funding for large-scale transportation and public works projects, are further propelling the use of advanced geosynthetic materials. The integration of geogrids supports durability and environmental compliance, making them a preferred choice for modern infrastructure projects. This growing alignment between sustainability goals and infrastructure investment directly drives the demand and expansion of the U.S. Geogrid Market.

For instance,

- In August 2024, according to an article published by Building Radar, Sustained growth in U.S. residential construction, driven by rising housing demand and favorable mortgage rates, is increasing the need for durable and sustainable building materials. As developers focus on long-lasting and eco-friendly infrastructure, geogrids are being adopted to enhance soil stability and reduce material usage. This trend significantly drives the growth of the U.S. Geogrid Market

- In April 2025, according to an article published by GEOFANTEX GEOSYNTHETICS, the U.S. Geogrid Market is witnessing a growing adoption of recycled geogrid materials, reflecting the construction industry’s shift toward sustainability and eco-friendly practices. Incorporating recycled content enhances the environmental profile of geogrids while supporting global sustainability goals. This growing focus on green construction solutions strengthens geogrid demand in sustainable infrastructure projects, driving market growth significantly

- In March 2025, in accordance with the article published by Brookings, the surge in U.S. federal infrastructure funding, including over USD 1 trillion from the IIJA and IRA, is driving extensive transportation, water, and energy projects nationwide. Growing public and private investments in durable and sustainable infrastructure are increasing the adoption of geogrids for soil stabilization and long-lasting construction. This sustained infrastructure development directly supports the growth of the U.S. Geogrid Market

- In June 2023, as published in an article by the U.S. Department of the Treasury, the U.S. has seen a remarkable surge in manufacturing construction spending, fueled by supportive policies such as the IIJA, IRA, and CHIPS Act. This growth in non-residential and infrastructure-related construction increases the demand for durable, sustainable materials, such as geogrids, for soil stabilization and the construction of long-lasting structures. These investments in modern construction directly drive the expansion of the U.S. Geogrid Market

The U.S. Geogrid Market is being strongly driven by the increasing emphasis on sustainability in construction and rising investments in infrastructure development. Growing residential construction, supported by favorable mortgage rates, is creating demand for durable and eco-friendly materials, with geogrids enhancing soil stabilization and reducing the use of raw materials. The adoption of recycled geogrid materials further aligns with sustainable building practices, strengthening the market’s environmental profile. Additionally, substantial federal infrastructure funding, exceeding USD 1 trillion through initiatives such as the IIJA, IRA, and CHIPS Act, is fueling large-scale transportation, water, energy, and manufacturing projects. These investments in long-lasting and resilient infrastructure require advanced geosynthetic solutions such as geogrids. Collectively, the focus on sustainable construction and robust infrastructure spending is significantly propelling the growth and expansion of the U.S. Geogrid Market.

Restraint/Challenge

“Lack of Installer Familiarity & Training”

Geogrid installation requires precision in placement, alignment, and tensioning to ensure structural integrity and long-term performance. However, many contractors, engineers, and construction professionals remain inadequately trained in geogrid design principles, soil interaction behavior, and best practices for installation. This knowledge gap often leads to suboptimal design integration, improper handling during site work, and performance issues such as uneven load distribution or premature material failure. Furthermore, the limited availability of certified training programs and technical workshops restricts the widespread adoption of geogrid technology across infrastructure and civil engineering projects. As a result, project developers and public agencies frequently prefer conventional reinforcement materials, which slows the implementation of geogrids in key applications such as road stabilization, retaining walls, and embankment reinforcement. This lack of technical expertise directly restrains the market’s growth by reducing end-user confidence, increasing maintenance risks, and limiting the scalability of advanced geogrid solutions in the U.S. construction sector.

For instance,

- In October 2024, according to an article published by Strata Global, Improper subgrade preparation, inadequate anchoring, and poor overlap integrity during geogrid installation reflect a lack of familiarity among installers and engineers in the U.S. market. Irregular surfaces, shifting grids, and weak overlaps compromise load distribution and structural performance. Such technical errors, resulting from insufficient training, reduce project reliability and confidence, thereby restraining the broader adoption of geogrids across infrastructure projects.

- In February 2025, according to an article published by Geofantex Geosynthesis, the use of geogrids for retaining walls requires precise installation, soil compatibility, proper anchorage, accurate layer spacing, and effective moisture management. However, limited training for installers and engineers often leads to misalignment, poor drainage, or inadequate anchoring, compromising structural stability and performance. Such execution errors reduce reliability, increase maintenance costs, and hinder broader adoption—acting as a key restraint on the U.S. Geogrid Market’s growth.

- In February 2025, in accordance with an article published by Redhammer Construction Management, Persistent workforce shortages in the U.S. construction sector highlight the limited availability of skilled and trained professionals for geogrid installation. With nearly 80–90% of contractors struggling to hire qualified workers, projects face delays, higher costs, and inconsistent quality. The shortage of experienced engineers and installers directly hampers the proper application of geogrids, restricting market efficiency and growth in infrastructure development.

- In May 2025, based on an article published by the American Institute of Constructors, the U.S. construction industry faces a severe skilled labor shortage, with an estimated gap of 500,000 workers lacking essential trade experience. This deficit affects builders, contractors, and engineers, reducing the availability of trained professionals for the design and installation of geogrids. The lack of skilled expertise leads to quality issues, delays, and inefficiencies, significantly restraining the growth and adoption of geogrid technology.

The U.S. Geogrid Market faces a persistent restraint due to the lack of familiarity among installers and engineers, coupled with a nationwide skilled labor shortage. Improper installation practices, inadequate training, and limited technical expertise continue to compromise structural performance and reliability. The shortage of qualified professionals further exacerbates the problem, leading to project delays, increased costs, and inconsistent results. Despite the growing demand for advanced reinforcement solutions, these workforce and knowledge gaps hinder the efficient application of geogrids across infrastructure projects. Consequently, the limited technical expertise and training availability act as a significant restraint, slowing the overall growth and adoption of geogrid technology.

U.S. Geogrid Market Scope

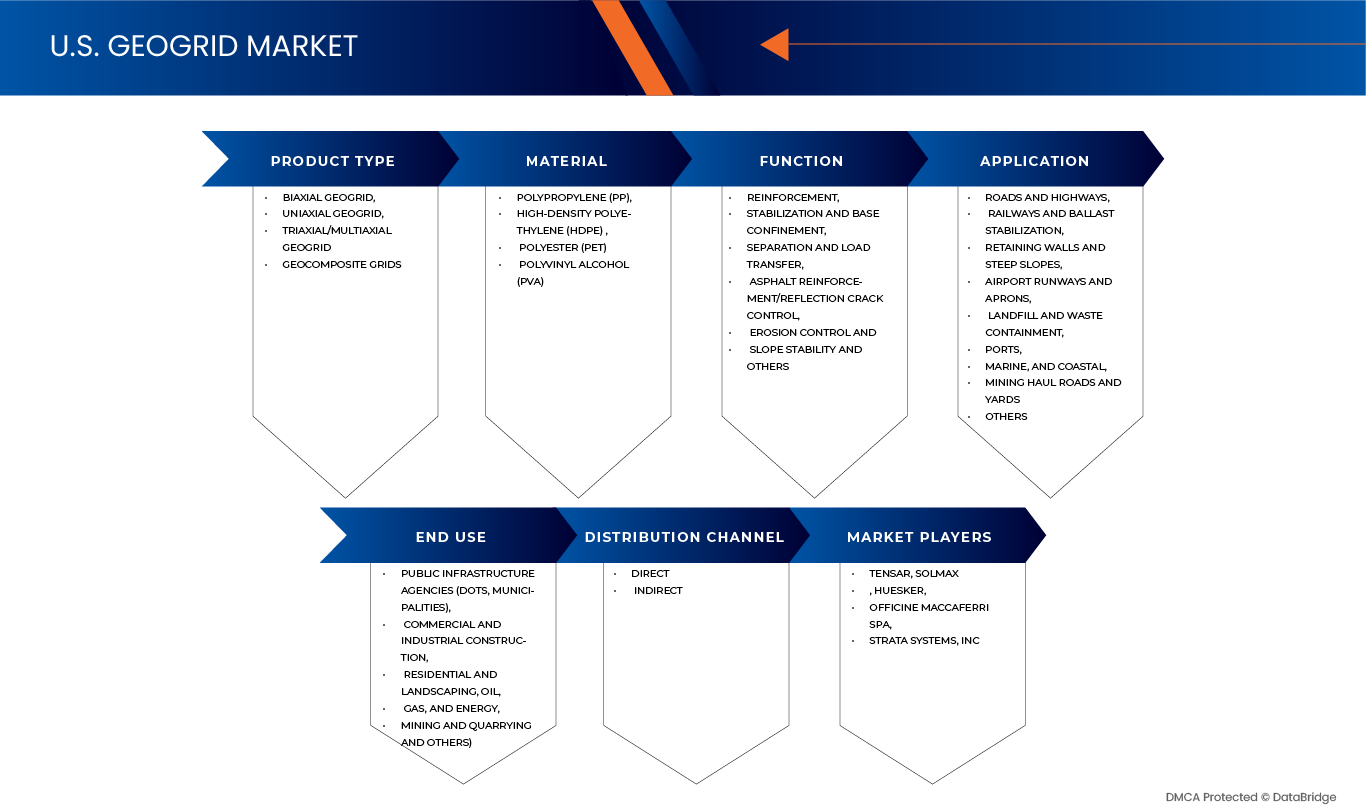

The U.S. Geogrid Market is segmented into six segments based on type, material, function, application, end use, and distribution channel.

- By Type

On the basis of type, the market is segmented into biaxial geogrid, uniaxial geogrid, triaxial/multiaxial geogrid and geocomposite grids. In 2025, the biaxial geogrid segment is expected to dominate the market with a market share of 38.28% due to its superior tensile strength in both longitudinal and transverse directions, making it ideal for reinforcing soils in roads, railways, and other infrastructure projects. Its ability to distribute loads evenly, enhance pavement longevity, and reduce maintenance costs drives preference among civil engineers and contractors. Additionally, the ease of installation and compatibility with various soil types further strengthens its adoption over uniaxial, triaxial, and geocomposite alternatives.

- By Material

On the basis of material, the market is segmented into polypropylene (PP), high-density polyethylene (HDPE), polyester (PET) and polyvinyl alcohol (PVA). In 2025, the polypropylene (PP) segment is expected to dominate the market with a market share of 44.66% due to its excellent chemical resistance, high tensile strength, and cost-effectiveness, making it highly suitable for soil reinforcement and stabilization applications. PP geogrids offer durability under harsh environmental conditions, ease of handling, and long-term performance, which drives their preference in roadways, railway embankments, and retaining walls. Additionally, their lightweight nature and adaptability to various construction requirements further enhance adoption over HDPE, PET, and PVA alternatives.

- By Function

On the basis of function, the market is segmented into reinforcement, stabilization and base confinement, separation and load transfer, asphalt reinforcement/reflection crack control, erosion control and slope stability, others. In 2025, the reinforcement segment is expected to dominate the market with a market share of 36.81% due to its critical role in enhancing the structural integrity of roads, highways, and railways by improving load-bearing capacity and reducing deformation. Reinforcement geogrids help distribute stresses evenly, minimize rutting, and extend the lifespan of pavements and embankments. Their ability to support heavy traffic loads, prevent soil displacement, and maintain slope stability makes them highly preferred in civil engineering projects compared to stabilization, separation, and erosion-control applications.

- By Application

On the basis of application, the market is segmented into roads and highways, railways and ballast stabilization, retaining walls and steep slopes, airport runways and aprons, landfill and waste containment, ports, marine and coastal, mining haul roads and yards, others. In 2025, the roads and highways segment is expected to dominate the market with a market share of 34.55% due to its extensive use in enhancing pavement strength, reducing rutting, and increasing the longevity of road infrastructure. Geogrids in this application improve load distribution, minimize maintenance costs, and provide effective reinforcement for flexible and rigid pavements. The growing investment in highway expansion, urbanization, and smart transportation projects across emerging and developed regions further drives the adoption of geogrid solutions in road and highway construction.

- By End Use

On the basis of end use, the market is segmented into public infrastructure agencies (dots, municipalities), commercial and industrial construction, residential and landscaping, oil, gas and energy, mining and quarrying, others. In 2025, the public infrastructure agencies (dots, municipalities) segment is expected to dominate the market with a market share of 44.62% due to its significant investment in large-scale transportation and civil engineering projects, including highways, bridges, railways, and retaining walls. Government initiatives to improve infrastructure durability, reduce maintenance costs, and enhance safety drive the adoption of geogrid solutions. Their ability to provide long-term soil reinforcement, load distribution, and slope stability makes them the preferred choice for public-sector construction projects over commercial, residential, or industrial applications.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct and indirect. In 2025, the direct segment is expected to dominate the market with a market share of 68.98% due to its ability to provide manufacturers and contractors with direct access to suppliers, ensuring better pricing, customized solutions, and faster delivery times. Direct sales channels facilitate stronger relationships, technical support, and after-sales service, which are critical for large-scale infrastructure and construction projects. Additionally, bypassing intermediaries reduces procurement complexities and allows end-users to obtain geogrids tailored to specific project requirements, driving preference over indirect distribution channels.

US U.S. Geogrid Market

The US U.S. Geogrid Market is primarily led by well-established companies, including:

- Tensar (U.S.)

- Officine Maccaferri Spa (Italy)

- Solmax (Canada)

- HUESKER (Germany)

- Strata Systems, Inc. (U.S.)

- WINFAB (U.S.)

- Cell-Tek Geosynthetics, LLC. (U.S.)

- Titan Environmental (U.S.)

- ACE Geosynthetics Inc (U.S.)

- Earth Retention (U.S.)

- Leggett & Platt (U.S.)

- Carthage Mills (U.S.)

- Ferguson Enterprises, LLC. (U.S.)

- White Cap Supply Holdings, LLC. (U.S.)

- US Fabrics, Inc. (U.S.)

- Lone Star Lining Company (U.S.)

- IWT Cargo-Guard (U.S.)

Latest Developments in the U.S. Geogrid Power Market

- In July 2024, Tensar, in partnership with Geofabrics Australasia, strengthened its long-standing collaboration by introducing the next generation of advanced product solutions to the Australian and New Zealand markets. The latest launch, the Tensar InterAx geogrid, delivers superior soil interaction and trafficking performance ideal for roads, railways, and working platforms.

- In July 2025, Maccaferri completed the acquisition of CPT Group, an Italian company specialised in advanced mechanised tunnelling technologies and robotic prefabrication systems for underground infrastructure.

- In September 2025, Maccaferri signed a distribution agreement with Tubosider to distribute Tubosider solutions on the global market, expanding and strengthening its infrastructure offering with high-performance products that are perfectly complementary to its engineering technologies.

- In June 2025, Solmax launched the Performance Materials platform, integrating the legacy and expertise of TenCate Geosynthetics and Propex into a unified platform that delivers high-performance technical textiles.

- In April 2025, HUESKER acquires Sineco International to strengthen its market position as the quality and technology leader for geosynthetic applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Us Geogrid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Geogrid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Geogrid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.