Us Hematology Oncology Market

Market Size in USD Billion

CAGR :

%

USD

3.39 Billion

USD

8.86 Billion

2024

2032

USD

3.39 Billion

USD

8.86 Billion

2024

2032

| 2025 –2032 | |

| USD 3.39 Billion | |

| USD 8.86 Billion | |

|

|

|

|

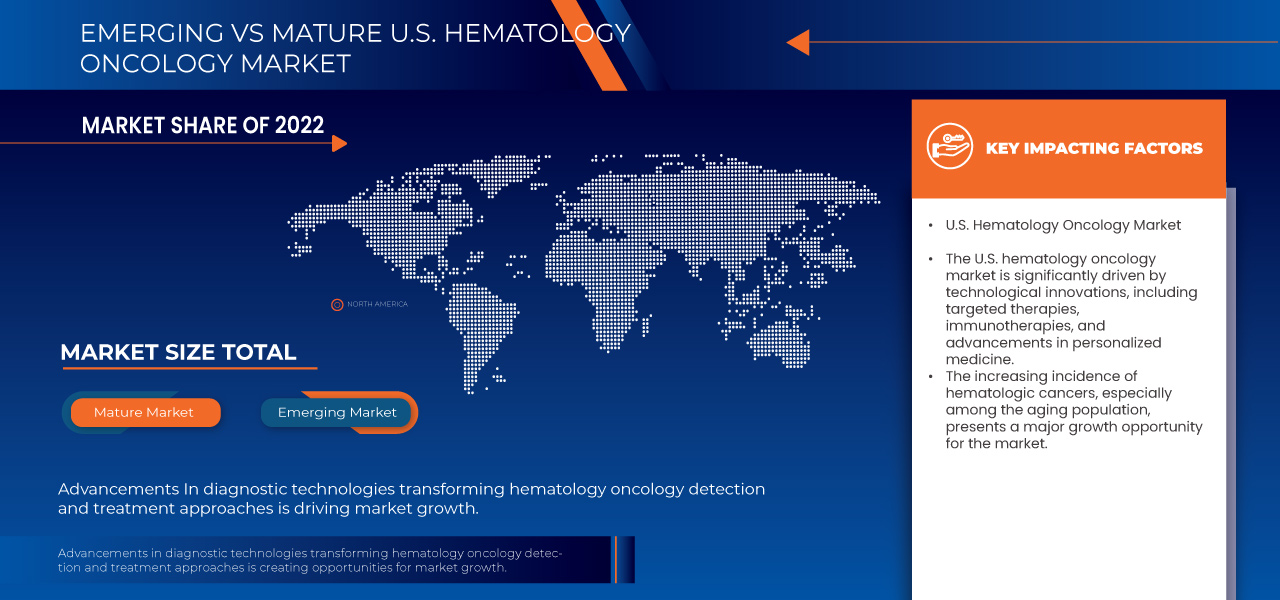

U.S. Hematology Oncology Market Analysis

The U.S. hematology oncology market is experiencing significant growth, driven by the rising prevalence of blood cancers such as acute myeloid leukemia (AML), acute lymphoblastic leukemia (ALL), multiple myeloma, and myelodysplastic syndromes (MDS). Advances in targeted therapies, immunotherapies, and personalized medicine have enhanced treatment outcomes, leading to increased adoption of innovative drugs and treatment approaches. The growing geriatric population, which is more susceptible to hematologic malignancies, further fuels market expansion. The market is characterized by a shift from academic medical centers to community-based care, enabling broader patient access to specialized hematology oncology treatments. Many community hospitals and specialized clinics are now equipped to administer complex therapies, reducing the burden on large academic institutions. Additionally, value-based care models and reimbursement reforms have encouraged healthcare providers to adopt cost-effective yet high-quality treatment solutions.

U.S. Hematology Oncology Market Size

U.S. Hematology Oncology Market is expected to reach USD 8.86 billion by 2032 from USD 3.39 billion in 2024, growing with a CAGR of 9.2% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

U.S. Hematology Oncology Market Trends

“Increasing Integration of Artificial Intelligence (AI)”

One key trend shaping the U.S. hematology oncology market is the increasing integration of artificial intelligence (AI) in cancer diagnostics and treatment planning. AI-powered tools leverage vast amounts of data, including imaging, pathology reports, and genomic information, to enhance early detection and improve treatment precision. These advanced technologies enable oncologists to identify cancer at earlier stages with higher accuracy, leading to improved patient outcomes. AI-driven predictive analytics also play a crucial role in personalized medicine by identifying the most effective treatment options based on a patient's unique genetic profile. This helps in reducing trial-and-error approaches and minimizing adverse effects. Additionally, AI is being used to streamline drug discovery and development processes, accelerating the identification of novel hematology oncology therapies. AI-assisted automation in pathology and radiology further improves diagnostic efficiency, reducing the burden on healthcare professionals. The adoption of AI in hematology oncology is driven by the growing need for precision medicine, the increasing availability of big data, and advancements in machine learning algorithms. As AI continues to evolve, its role in hematology oncology will expand, ultimately leading to more targeted therapies, faster diagnoses, and improved survival rates for patients battling blood cancers such as leukemia, lymphoma, and multiple myeloma.

Report Scope and U.S. Hematology Oncology Market Segmentation

|

Attributes |

U.S. Hematology Oncology Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Gilead Sciences, Inc. (U.S.), AbbVie Inc (U.S.), Takeda Pharmaceutical Company Limited (Japan), AstraZeneca (U.K.), Sanofi (France), Dana-Farber Cancer Institute, Inc. (U.S.), The Johns Hopkins University (U.S.), The Johns Hopkins Hospital (U.S.), Johns Hopkins Health System (U.S.), UCLA Health (U.S.), Stanford Medicine (U.S.), The University of Texas MD Anderson Cancer Center (U.S.), Memorial Sloan Kettering Cancer Center (U.S.), CITY OF HOPE (U.S.), The Children's Hospital of Philadelphia (U.S.), Fred Hutchinson Cancer Center (U.S.), Vertex Pharmaceuticals Incorporated (U.S.), CRISPR Therapeutics (Switzerland), Regeneron Pharmaceuticals Inc. (U.S.), bluebird bio, Inc. (U.S.), Editas Medicine (U.S.), Novartis AG (Switzerland), Merck & Co., Inc. (U.S.), Cleveland Clinic (U.S.), Lilly (U.S.), Astellas Pharma Inc. (Japan), Bayer AG (Germany), Mayo Foundation for Medical Education and Research (MFMER) (U.S.), DKMS Group gGmbH (Germany), The University of Chicago Medical Center (U.S.), Roswell Park Comprehensive Cancer Center (U.S.), University of Utah Health (U.S.), USC Norris Comprehensive Cancer Center (U.S.), Vanderbilt University Medical Center (U.S.), Moffitt Cancer Center (U.S.), and Fred Hutchinson Cancer Center (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

U.S. Hematology Oncology Market Definition

Hematology oncology is a specialized field of medicine that focuses on the diagnosis, treatment, and management of blood disorders and blood-related cancers. It combines hematology, which deals with blood and its components, with oncology, the study of cancer. Hematology oncologists treat a wide range of conditions, including leukemia, lymphoma, multiple myeloma, and myelodysplastic syndromes, as well as non-cancerous blood disorders like anemia, hemophilia, and clotting disorders. These specialists use various treatment approaches, such as chemotherapy, immunotherapy, targeted therapy, and bone marrow transplants, to manage and improve patient outcomes. Advances in precision medicine and genetic research have also enabled more personalized treatment strategies tailored to individual patients. The goal of hematology oncology is not only to treat cancerous and non-cancerous blood conditions but also to enhance the quality of life for patients through innovative therapies and comprehensive care.

U.S. Hematology Oncology Market Dynamics

Drivers

- Advancements in Diagnostic Technologies Transforming Hematology Oncology Detection and Treatment Approaches

Advancements in diagnostic technologies have significantly impacted the field of hematology oncology, particularly through innovations like genetic sequencing and Artificial Intelligence (AI). Genetic sequencing allows for a detailed analysis of a patient’s DNA, identifying specific genetic mutations responsible for blood cancers like leukemia and lymphoma. This enables clinicians to diagnose cancers more accurately and tailor treatment plans based on individual genetic profiles, enhancing the effectiveness of therapies while minimizing side effects. AI, on the other hand, leverages machine learning algorithms to analyze vast datasets, including medical images and genomic information. AI can detect patterns and anomalies that should be overlooked by human clinicians, leading to earlier and more accurate diagnoses. It also helps predict disease progression and supports decision-making, facilitating timely interventions. These technologies work in tandem to not only improve early detection but also enable more personalized treatment strategies, which is crucial for improving patient outcomes. The combination of genetic sequencing and AI allows for a more precise, targeted approach to treatment, ultimately increasing survival rates and the quality of life for patients. As these innovations continue to develop, they promise even greater advancements in diagnosing and treating hematologic cancers, ensuring better care and outcomes for patients.

For instance,

- In January 2023, according to the article published by NCBI, multi-parameter Flow Cytometry (FCM) enables simultaneous detection of numerous cell markers, intracellular antigens, and DNA content, enhancing the accuracy of diagnosing and staging hematological malignancies. It provides reliable, reproducible analysis at the single-cell level, surpassing immunohistochemistry in diagnosing liquid cancers, such as hairy cell leukemia and acute lymphoblastic leukemia

- In February 2023, according to the article published by NCBI, advancements in cancer diagnostics, including PET, CT, MRS, and molecular techniques, have significantly improved early detection and therapeutic management. These technologies enhance identification of precursor lesions, enabling earlier treatment and reducing invasive cancer incidence. Despite challenges like high cost and diagnostic limitations, they offer crucial opportunities for better cancer care globally

- In February 2024, according to the article published by MDPI, 18F-FDG PET/CT, liquid biopsy, molecular diagnostics, and AI-based imaging, have enhanced the accuracy of CUP diagnosis. These innovative techniques address challenges like tumor heterogeneity and small metastasis, providing comprehensive, evidence-based support for diagnosis and treatment, despite some limitations in clinical application

The integration of genetic sequencing and artificial intelligence in hematology oncology has revolutionized the approach to diagnosing and treating blood cancers. These advancements enable more accurate, early detection and facilitate personalized treatment plans tailored to each patient's unique genetic profile. As a result, patients benefit from more effective therapies with fewer side effects, leading to improved outcomes and survival rates. The continued development and application of these technologies hold great potential for further enhancing patient care and transforming the future of hematology oncology, ensuring a more precise, targeted approach to cancer treatment.

- Development of Targeted Therapies and Immunotherapies in Hematology Oncology Care

The development of targeted therapies and immunotherapies has transformed the landscape of hematology oncology, particularly in the U.S., where cancer treatment is constantly evolving. Targeted therapies focus on specific molecular targets that are involved in the growth and spread of cancer cells. These therapies, such as tyrosine kinase inhibitors and monoclonal antibodies, have shown remarkable effectiveness in treating hematologic cancers like Chronic Myelogenous Leukemia (CML) and non-Hodgkin lymphoma. By targeting the genetic mutations or proteins specific to cancer cells, targeted therapies spare healthy cells, leading to fewer side effects compared to traditional chemotherapy. Immunotherapy, on the other hand, leverages the body's immune system to fight cancer. Checkpoint inhibitors, CAR-T cell therapy, and monoclonal antibodies are examples of immunotherapies that have shown promising results in treating cancers like Acute Lymphoblastic Leukemia (ALL) and multiple myeloma. These therapies stimulate or enhance the immune response, helping the body to recognize and destroy cancer cells more effectively.

For instance,

- In May 2021, according to the article published by NCBI, immune-checkpoint inhibitors and CAR T cells, is transforming oncology and hematology. Intratumoral delivery and tumor tissue-targeted compounds offer solutions to address biodistribution challenges, improving the efficacy and safety of immunotherapies. Ongoing clinical trials explore these strategies for better therapeutic

- In January 2021, according to the article published by NCBI, advancements in cancer immunotherapy focus on enhancing cytotoxic T cells, particularly CD8+ T cells, to target tumors more effectively. Immune-checkpoint inhibitors and adoptive cell-transfer therapies, including chimeric antigen receptor (CAR) T cells, are being developed and evaluated to optimize immune responses and improve treatment outcomes with fewer adverse events

- In February 2023, according to the article published by NCBI, modulating myeloid cell populations within the tumor microenvironment. By targeting monocytes, macrophages, and other myeloid subsets, therapies aim to alter their recruitment, survival, and activity, improving cancer treatment outcomes. Genetic engineering of myeloid cells further enhances therapeutic potential for cancer therapy

- In March 2020, according to the article published by NCBI, the development of targeted therapies and immunotherapies is expanding with the investigation of γδT cells, which offer potent cytotoxicity against a wide range of tumors without relying on tumor-specific antigens. Research focuses on overcoming challenges in understanding γδT cell mechanisms and improving their clinical application for more effective cancer treatments

The development of targeted therapies and immunotherapies has significantly advanced the treatment of hematologic cancers in the U.S., offering patients more personalized and effective options. By focusing on specific molecular targets and enhancing the body's immune response, these therapies have improved outcomes, minimized side effects, and increased survival rates. The continuous growth of this field, driven by ongoing research and clinical trials, holds great promise for future advancements. As new therapies emerge, the landscape of hematology oncology continues to evolve, providing hope for patients with previously difficult-to-treat cancers and improving their overall quality of life.

Opportunities

- Rising Incidence of Cancer Leads to Increased Demand For Treatments

As more individuals are diagnosed with various types of cancers, there is an urgent need for innovative therapies, targeted treatments, and effective management strategies. This growing patient population presents a substantial opportunity for hematology oncology companies to develop and deliver new therapies that can address the complexities of cancer treatment and improve patient outcomes.

For instance,

- In January 2024, according to an article published by the American Cancer Society, it is estimated that almost 5,500 cancers are diagnosed per day. This trend is largely affected by the aging and growth of the population and by a rise in the most common cancers—breast, prostate, endometrial, pancreatic, kidney, and melanoma

- In May 2024, according to an article published by the National Cancer Institute, in 2024, it is estimated that 2,001,140 new cases of cancer would be diagnosed in the U.S. and 611,720 people will die from the disease. This substantial increase in cancer cases and mortality rates underscores the urgent need for innovative therapies and effective treatment solutions, thereby creating a significant opportunity for the U.S. hematology oncology market to expand its offerings and address the complexities of a growing patient population

Additionally, the heightened need for effective cancer therapies leads to an expansion in research and development activities, fostering innovation within the field. As healthcare systems adapt to the increasing burden of cancer, investment in new therapies such as immunotherapies, targeted treatments, and personalized medicine will gain momentum. This not only benefits patients through improved therapeutic options but also creates a lucrative environment for pharmaceutical companies and biotech firms, further catalyzing advancements in hematology oncology.

- Increase in the Number Of Collaborative Partnerships That Accelerating Advancements in Cancer Treatments

The increase in collaborative partnerships among academia, biotech companies, and pharmaceutical firms is poised to accelerate advancements in cancer treatments, presenting a significant opportunity for the U.S. hematology oncology market. These collaborations leverage shared expertise, resources, and innovative research capabilities, facilitating the development of novel therapies and clinical trials that can lead to breakthroughs in treatment options. As a result, they not only enhance the speed and efficacy of bringing new medications to market but also foster a more integrated approach to patient care, ultimately improving outcomes for hematology oncology patients while driving growth in the market.

For instance,

- In April 2023, according to an article published by the National Library of Medicine, the collaborative cancer research between U.S. and U.K. is focused on haematology–oncology and breast cancer where U.S. is relatively stronger in research on brain and pancreatic cancers, whereas the UK is stronger in colorectal and oesophageal cancer research

- In August 2023, Verily and OneOncology announced collaboration to Advance Cancer Research. The partnership will provide community OneOncology Research Network sites with new tools to accelerate clinical trials and enhance their delivery of high-quality cancer care

- In October 2024, according to an article published by the National Cancer Institute, The National Cancer Institute (NCI) Cancer Community Partnership was created by the NCI Center for Cancer Training in 2020 to connect the scientific and medical community with individuals personally affected by cancer. These partnerships create advancements in the sector, leading to creating opportunities for U.S. hematology oncology market

Moreover, collaborative efforts can significantly reduce costs associated with research and development. By pooling resources and expertise, partners can share the financial burden of costly clinical trials and regulatory processes. This collaboration not only enhances the likelihood of successfully bringing effective treatments to patients more quickly but also encourages a more robust pipeline of innovative therapies in hematology oncology. As a result, patients benefit from increased access to cutting-edge treatments, and companies can capitalize on the enhanced market potential driven by these partnerships.

Restraints/Challenges

- Patient Non-Compliance with Treatment Regimens in Hematology Oncology Care

Hematology oncology treatments often require long-term management and consist of complex regimens involving multiple medications, infusions, radiation therapy, and frequent follow-up visits. These treatments are not only physically demanding but also emotionally taxing, as patients have to cope with potential side effects, which can range from nausea, fatigue, and immune suppression to more severe outcomes like organ damage or infections. These side effects can be overwhelming and may lead to a loss of motivation to continue the treatment or to follow the prescribed regimen diligently.

Financial constraints further exacerbate this issue. Many hematology oncology therapies, especially newer treatments like immunotherapies and targeted therapies, are extremely expensive. Even though some treatments are covered by insurance, the high out-of-pocket costs, co-pays, and co-insurance amounts can be a significant burden for patients, especially those with limited financial resources. This can discourage them from adhering to prescribed treatment plans, or it may lead them to delay or skip treatments altogether due to the financial strain.

For instance,

- In January 2022, according to the article published by NCBI, Non-compliance with treatment regimens in hematology oncology care is a critical issue. Factors such as side effects, financial constraints, complex treatment schedules, and emotional distress often hinder patients’ adherence to prescribed therapies. This results in suboptimal treatment outcomes, increased disease progression, and ultimately poorer survival rates for patients.

- In May 2023, according to the article published by NCBI, Non-compliance with cancer treatment regimens, particularly with oral anti-cancer medications (OAM), is a significant issue, with nonadherence rates ranging from 16–100%. In breast cancer, up to 50% of patients discontinue or misuse adjuvant endocrine therapy. Despite recognition, nonadherence remains poorly understood, complicating efforts to improve patient outcomes.

Patient non-compliance with treatment regimens in hematology oncology represents a substantial barrier to effective disease management and market growth. Addressing this issue requires a multifaceted approach, including improving patient education, reducing financial barriers, enhancing patient support systems, and providing personalized treatment options to better manage side effects. Ensuring that patients remain engaged with their treatment plans is essential not only for improving individual health outcomes but also for maximizing the effectiveness and efficiency of healthcare delivery in hematology oncology.

- Lack of Early Detection in Hematology Oncology Impeding Progress

Many blood cancers, such as leukemia, lymphoma, and myeloma, are often diagnosed at later stages, when they are more difficult to treat and have a lower chance of successful outcomes. Unlike other cancers, such as breast or colorectal cancer, which have established and widely-used screening methods, hematological cancers do not yet have effective early detection tools or routine screening programs. This absence of early diagnostic options means that by the time a diagnosis is made, the disease may have progressed to a more advanced, complex stage, requiring more aggressive and costly treatment interventions. These late-stage diagnoses lead to poorer survival rates, reduced quality of life for patients, and an increase in the financial burden on healthcare systems. This, in turn, inhibits the overall growth of the market, as the focus shifts to managing advanced cases rather than investing in prevention and early-stage treatment options.

For instance,

- In April 2023, according to the article published by NCBI, blood cancers are difficult to diagnose due to non-specific and varied symptoms, leading to misinterpretations by patients and healthcare providers. These misinterpretations contribute to delays in seeking help, highlighting the need for improved understanding and timely follow-up from healthcare professionals to support earlier diagnosis and intervention.

The lack of early detection tools for hematological cancers significantly restrains the U.S. hematology oncology market. Delayed diagnoses lead to more advanced stages of disease, requiring more complex treatments, lower survival rates, and higher healthcare costs. To overcome this restraint, there is a need for the development of effective early screening and diagnostic tools. Improved early detection can enhance treatment outcomes, lower costs, and ultimately drive market growth by enabling more efficient management of blood cancers at earlier, more treatable stages.

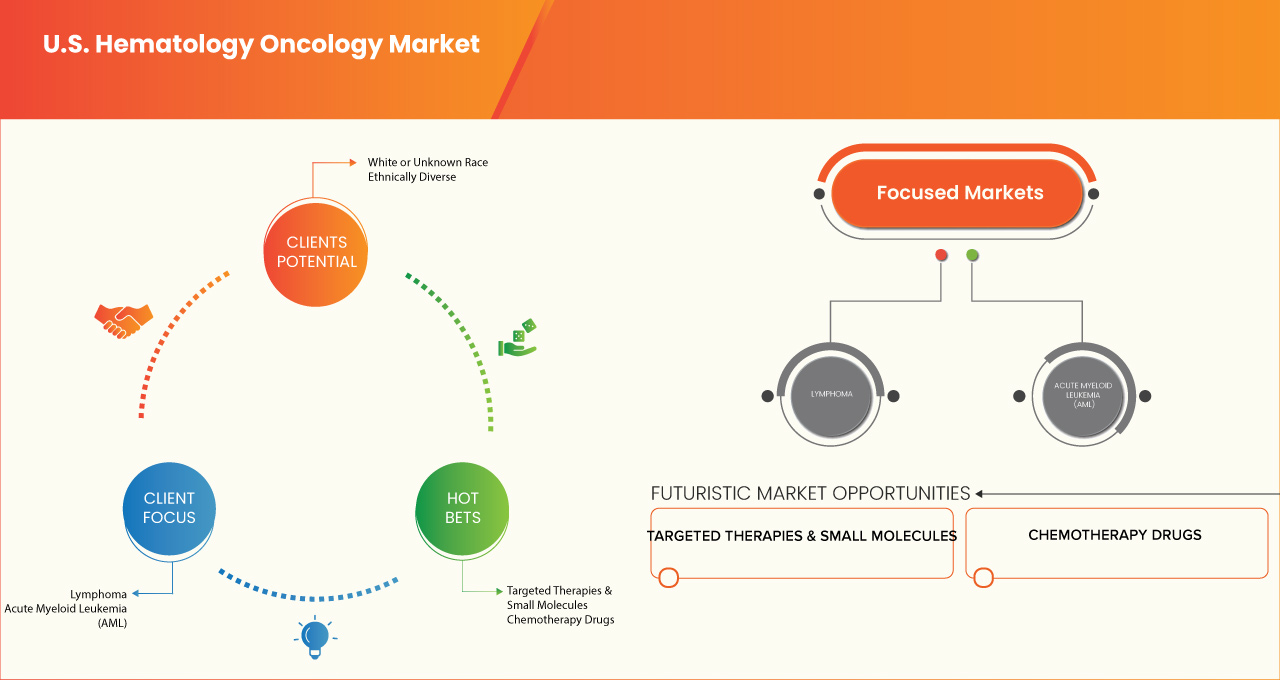

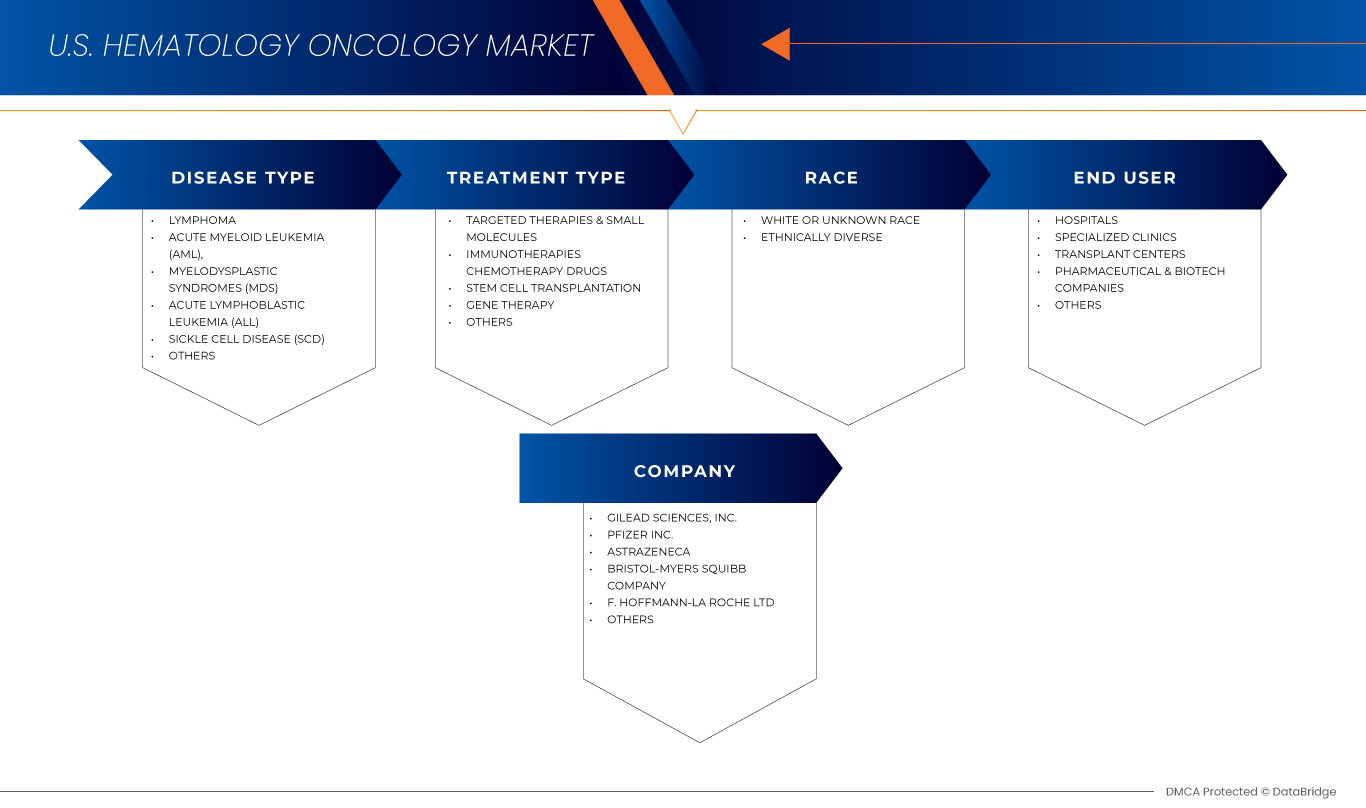

U.S. Hematology Oncology Market Scope

The market is segmented on the basis of disease type, treatment type, race, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Disease Type

- Lymphoma

- Acute Myeloid Leukemia (AML)

- Myelodysplastic Syndromes (MDS)

- Acute Lymphoblastic Leukemia (ALL)

- Sickle Cell Disease (SCD)

- Others

Treatment Type

- Targeted Therapies & Small Molecules

- Tyrosine Kinase Inhibitors (TKIS)

- Imatinib

- DASATINIB

- Nilotinib

- Ibrutinib

- Acalabrutinib

- Monoclonal Antibodies

- Rituximab

- Obinutuzumab

- Ofatumumab

- Daratumumab

- ELOTUZUMAB

- Proteasome Inhibitors

- Bortezomib

- Carfilzomib

- IXAZOMIB

- Bcl2 Inhibitors

- Flt3 Inhibitors

- MIDOSTAURIN

- GILTERITINIB

- IDH Inhibitors

- Jak Inhibitors

- Others

- Tyrosine Kinase Inhibitors (TKIS)

- Immunotherapies

- Cart Cell Therapy

- TISAGENLECLEUCEL

- AXICABTAGENE CILOLEUCEL

- BREXUCABTAGENE AUTOLEUCEL

- LISOCABTAGENE MARALEUCEL

- Immune Checkpoint Inhibitors

- Pembrolizumab

- Nivolumab

- Bispecific Antibodies

- Blinatumomab

- MOSUNETUZUMAB

- Cytokine Therapy

- Interferons

- Interleukins

- Others

- Cart Cell Therapy

- Chemotherapy Drugs

- Alkylating Agents

- Cyclophosphamide

- Chlorambucil

- BENDAMUSTINE

- Antimetabolites

- Cytarabine (Ara C)

- Methotrexate

- Fludarabine

- 6-Mercaptopurine

- Anthracyclines

- Doxorubicin

- Daunorubicin

- Idarubicin

- Topoisomerase Inhibitors

- Etoposide

- Topotecan

- Vinca Alkaloids

- Vincristine

- Vinblastine

- Others

- Alkylating Agents

- Stem Cell Transplantation

- Autologous Stem Cell Transplantation

- Allogeneic Stem Cell Transplantation

- Matched Related Donor (MRD)

- Matched Unrelated Donor (MUD)

- Haploidentical Donor

- Others

- Gene Therapy

- Crispr-Cas9 Based Therapies

- LENTIGLOBIN Bb305

- Others

- Others

Race

- White or Unknown Race

- Ethnically Diverse

- Black or African American

- Hispanic

- Asian Or Pacific Islander (Including Hawaiian)

- American Indian Or Alaska Native

- Multiple Race

End User

- Hospitals

- Specialized Clinics

- Transplant Centers

- Pharmaceutical & Biotech Companies

- Others

U.S. Hematology Oncology Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

U.S. Hematology Oncology Market Leaders Operating in the Market Are:

- Gilead Sciences, Inc. (U.S.)

- AbbVie Inc (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- AstraZeneca (U.K.)

- Sanofi (France)

- Dana-Farber Cancer Institute, Inc. (U.S.)

- The Johns Hopkins University (U.S.)

- The Johns Hopkins Hospital (U.S.)

- Johns Hopkins Health System (U.S.)

- UCLA Health (U.S.)

- Stanford Medicine (U.S.)

- The University of Texas MD Anderson Cancer Center (U.S.)

- Memorial Sloan Kettering Cancer Center (U.S.)

- CITY OF HOPE (U.S.)

- The Children's Hospital of Philadelphia (U.S.)

- Fred Hutchinson Cancer Center (U.S.)

- Vertex Pharmaceuticals Incorporated (U.S.)

- CRISPR Therapeutics (Switzerland)

- Regeneron Pharmaceuticals Inc. (U.S.)

- bluebird bio, Inc. (U.S.)

- Editas Medicine (U.S.)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- Cleveland Clinic (U.S.)

- Lilly (U.S.)

- Astellas Pharma Inc. (Japan)

- Bayer AG (Germany)

- Mayo Foundation for Medical Education and Research (MFMER) (U.S.)

- DKMS Group gGmbH (Germany)

- The University of Chicago Medical Center (U.S.)

- Roswell Park Comprehensive Cancer Center (U.S.)

- University of Utah Health (U.S.)

- USC Norris Comprehensive Cancer Center (U.S.)

- Vanderbilt University Medical Center (U.S.)

- Moffitt Cancer Center (U.S.)

- Fred Hutchinson Cancer Center (U.S.)

Latest Developments in U.S. Hematology Oncology Market

- In December 2024, AbbVie Clinical trial result for Epcoritamab (DuoBody CD3xCD20) is a bispecific T-cell-engaging antibody developed by AbbVie. Recent data analyses from clinical trials have shown that Epcoritamab induces durable complete responses both as a monotherapy and in combination with other treatments in patients with diffuse large B-cell lymphoma (DLBCL). In the Phase 1b/2 EPCORE NHL-2 trial, Epcoritamab combined with rituximab, cyclophosphamide, doxorubicin, vincristine, and prednisone (R-CHOP) achieved an overall response rate (ORR) of 100% and a complete response (CR) rate of 87%. Additionally, the Phase 2 EPCORE NHL-1 trial demonstrated that 41% of patients achieved a CR, with an estimated 52% still responding after three years

- In December 2024, AbbVie Clinical trial result for Epcoritamab (DuoBody CD3xCD20) is an investigational bispecific T-cell-engaging antibody developed by AbbVie. Recent clinical trial results have shown high response rates in patients with relapsed or refractory (R/R) follicular lymphoma (FL). In the Phase 1b/2 EPCORE NHL-2 trial, Epcoritamab combined with lenalidomide and rituximab (R²) achieved an overall response rate (ORR) of 96% and a complete response (CR) rate of 87% among 111 patients with a median follow-up of over two years. These results highlight the potential benefits of Epcoritamab in treating patients with R/R FL and support its ongoing evaluation in a pivotal Phase 3 trial

- In December 2022, Yescarta (axicabtagene ciloleucel) was approved in Japan for the initial treatment of relapsed/refractory large B-cell lymphoma. This approval expands the use of Yescarta to patients who have not responded to prior treatments. Yescarta is a CAR T-cell therapy that modifies the patient’s T cells to target and destroy cancerous B cells. The approval provides a promising treatment option for patients with this aggressive form of lymphoma, offering the potential for improved outcomes by targeting cancer cells more effectively, thus helping to address a significant unmet need in oncology care

- In December 2022, Kite announced its acquisition of Tmunity Therapeutics to advance the development of next-generation CAR T-cell therapies in cancer treatment. This acquisition aims to enhance Kite’s capabilities in innovative cancer therapies, particularly focusing on improving the effectiveness and accessibility of CAR T-cell treatments. By integrating Tmunity's expertise in immunotherapy and cell-based therapies, the collaboration seeks to address challenges in solid tumor treatment and expand therapeutic options for cancer patients, offering hope for more personalized, durable, and effective treatments in oncology. This move reinforces Kite’s leadership in cancer immunotherapy

- In December 2022, Data from the ZUMA-7 study reinforced the potential of Yescarta (axicabtagene ciloleucel) as an initial treatment for relapsed or refractory large B-cell lymphoma. The study demonstrated that Yescarta, a CAR T-cell therapy, significantly improved progression-free survival compared to standard chemotherapy. These findings support the use of Yescarta as an effective first-line treatment, offering a new option for patients with aggressive lymphoma who have limited treatment alternatives. The growing body of evidence highlights the therapy’s potential to improve patient outcomes and change the treatment landscape for this challenging cancer

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. HEMATOLOGY ONCOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 U.S. HEMATOLOGY ONCOLOGY MARKET: GEOGRAPHICAL SCOPE

2.3 U.S. HEMATOLOGY ONCOLOGY MARKET: YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 U.S. HEMATOLOGY ONCOLOGY MARKET: MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 INDUSTRY INSIGHTS

4.4 RWE/RWD PRACTICE, EREGISTERS, EHEALTH PROGRAMS FOR ONCO/AID/RARE DISEASES

4.4.1 PROMOTIONAL ACTIVITIES OF COMPANIES

4.5 TENDER SYSTEM AND CLINICAL GUIDELINES

4.5.1 ORGANIZATION OF THE TENDER SYSTEM

4.5.2 CLINICAL GUIDELINES (NATIONAL/REGIONAL/LOCAL HOSPITAL)

4.5.2.1 NATIONAL GUIDELINES (STANDARDIZED ACROSS THE U.S.)

4.5.2.2 REGIONAL GUIDELINES (STATE-LEVEL & RESEARCH INSTITUTION-BASED)

4.5.2.3 LOCAL HOSPITAL GUIDELINES (INSTITUTION-SPECIFIC PROTOCOLS)

4.6 MARKET CHARACTERISTICS (DECENTRALIZED/ HIGHLY FRAGMENTED)

5 NUMBER OF ONGOING CLINICAL TRIALS FOR EACH TREATMENT TYPE

5.1 TARGETED THERAPIES & SMALL MOLECULES

5.1.1 TYROSINE KINASE INHIBITORS (TKIS)

5.1.2 MONOCLONAL ANTIBODIES

5.2 IMMUNOTHERAPIES

5.2.1 CART CELL THERAPY

5.2.2 IMMUNE CHECKPOINT INHIBITORS

5.2.3 CYTOKINE THERAPY

5.3 CHEMOTHERAPY DRUGS

5.3.1 ALKYLATING AGENTS

5.3.2 ANTHRACYCLINES

5.3.3 TOPOISOMERASE INHIBITORS

5.3.4 VINCA ALKALOIDS

5.4 STEM CELL TRANSPLANTATION

5.4.1 AUTOLOGOUS STEM CELL TRANSPLANTATION

5.4.2 ALLOGENEIC STEM CELL TRANSPLANTATION

5.5 GENE THERAPY

5.6 EXTRA DRUGS AS PER REQUIREMENT

5.6.1 VENETECLAX HMA

5.6.2 CAR NK CELLS

5.6.3 MENIN INHIBITORS

6 CUSTOMIZATION

6.1 THERAPY CLASSIFICATION

6.1.1 THERAPY PURPOSE

6.1.1.1 THERAPIES DELAYING TRANSPLANT

6.1.1.2 THERAPIES EXPANDING INDICATION FOR TRANSPLANT

6.1.2 COST ANALYSIS

6.2 MARKET INDUSTRY TRENDS AND FORECAST

6.3 SHIFT IN CARE SETTINGS

6.4 TREATMENT TYPES AS PER REQUIREMENT

6.4.1 VENETOCLAX (HMA) COMBINATION

6.4.2 CAR NK CELLS

6.5 HEALTHCARE PROVIDERS AND FACILITIES

6.5.1 PROVIDER MARKET:

6.5.1.1 TOTAL ADDRESSABLE PROVIDER MARKET FOR HEMATOLOGIC MALIGNANCIES (AML, ALL, MDS, APLASTIC ANEMIA, SICKLE CELL DISEASE)

6.5.1.2 NUMBER OF HEMATOLOGISTS/ONCOLOGISTS TREATING THESE CONDITIONS

6.5.1.3 GEOGRAPHIC DISTRIBUTION OF THESE PROVIDERS

6.5.1.4 PROVIDERS PRACTICING AT NON-TRANSPLANT CENTERS NEEDING TO REFER PATIENTS EXTERNALLY FOR TRANSPLANTS

6.5.2 HEALTHCARE FACILITIES TRENDS:

6.5.2.1 NUMBER OF HEALTHCARE FACILITIES EQUIPPED TO DELIVER EACH TREATMENT

6.5.2.2 GEOGRAPHIC TRENDS IN THE NUMBER OF HEALTHCARE FACILITIES OVER DEFINED YEARS

6.5.3 TRANSPLANT CENTERS

7 U.S. HEMATOLOGY ONCOLOGY MARKET: REGULATIONS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 ADVANCEMENTS IN DIAGNOSTIC TECHNOLOGIES TRANSFORMING HEMATOLOGY ONCOLOGY DETECTION AND TREATMENT APPROACHES

8.1.2 DEVELOPMENT OF TARGETED THERAPIES AND IMMUNOTHERAPIES IN HEMATOLOGY ONCOLOGY CARE

8.1.3 CONSOLIDATION OF HEMATOLOGY ONCOLOGY PRACTICES IMPROVING TREATMENT EFFICIENCY AND PATIENT OUTCOMES

8.2 RESTRAINTS

8.2.1 PATIENT NON-COMPLIANCE WITH TREATMENT REGIMENS IN HEMATOLOGY ONCOLOGY CARE

8.2.2 LACK OF EARLY DETECTION IN HEMATOLOGY ONCOLOGY IMPEDING PROGRESS

8.3 OPPORTUNITIES

8.3.1 RISING INCIDENCE OF CANCER LEADS TO INCREASED DEMAND FOR TREATMENTS

8.3.2 INCREASE IN THE NUMBER OF COLLABORATIVE PARTNERSHIPS THAT ACCELERATE ADVANCEMENTS IN CANCER TREATMENTS

8.4 CHALLENGES

8.4.1 RISING COSTS ASSOCIATED WITH THE CANCER TREATMENTS

8.4.2 SHORTAGE OF THE HEALTHCARE PROFESSIONALS TRAINED IN HEMATOLOGY ONCOLOGY

9 U.S. HEMATOLOGY ONCOLOGY MARKET, BY DISEASE TYPE

9.1 OVERVIEW

9.2 LYMPHOMA

9.3 ACUTE MYELOID LEUKEMIA (AML)

9.4 MYELODYSPLASTIC SYNDROMES (MDS)

9.5 ACUTE LYMPHOBLASTIC LEUKEMIA (ALL)

9.6 SICKLE CELL DISEASE (SCD)

9.7 OTHERS

10 U.S. HEMATOLOGY ONCOLOGY MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 SPECIALIZED CLINICS

10.4 TRANSPLANT CENTERS

10.5 PHARMACEUTICAL & BIOTECH COMPANIES

10.6 OTHERS

11 U.S. HEMATOLOGY ONCOLOGY MARKET, BY RACE

11.1 OVERVIEW

11.2 WHITE OR UNKNOWN RACE

11.3 ETHNICALLY DIVERSE

11.3.1 BLACK OR AFRICAN AMERICAN

11.3.2 HISPANIC

11.3.3 ASIAN OR PACIFIC ISLANDER (INCLUDING HAWAIIAN)

11.3.4 AMERICAN INDIAN OR ALASKA NATIVE

11.3.5 MULTIPLE RACE

12 U.S. HEMATOLOGY ONCOLOGY MARKET, BY TREATMENT TYPE

12.1 OVERVIEW

12.2 TARGETED THERAPIES & SMALL MOLECULES

12.2.1 TYROSINE KINASE INHIBITORS (TKIS)

12.2.1.1 IMATINIB

12.2.1.2 DASATINIB

12.2.1.3 NILOTINIB

12.2.1.4 IBRUTINIB

12.2.1.5 ACALABRUTINIB

12.2.2 MONOCLONAL ANTIBODIES

12.2.2.1 RITUXIMAB

12.2.2.2 OBINUTUZUMAB

12.2.2.3 OFATUMUMAB

12.2.2.4 DARATUMUMAB

12.2.2.5 ELOTUZUMAB

12.2.3 PROTEASOME INHIBITORS

12.2.3.1 BORTEZOMIB

12.2.3.2 CARFILZOMIB

12.2.3.3 IXAZOMIB

12.2.4 FLT3 INHIBITORS

12.2.4.1 MIDOSTAURIN

12.2.4.2 GILTERITINIB

12.3 IMMUNOTHERAPIES

12.3.1 CART CELL THERAPY

12.3.1.1 TISAGENLECLEUCEL

12.3.1.2 AXICABTAGENE CILOLEUCEL

12.3.1.3 BREXUCABTAGENE AUTOLEUCEL

12.3.1.4 LISOCABTAGENE MARALEUCEL

12.3.2 IMMUNE CHECKPOINT INHIBITORS

12.3.2.1 PEMBROLIZUMAB

12.3.2.2 NIVOLUMAB

12.3.3 BISPECIFIC ANTIBODIES

12.3.4 CYTOKINE THERAPY

12.3.4.1 INTERFERONS

12.3.4.2 INTERLEUKINS

12.3.4.3 OTHERS

12.4 CHEMOTHERAPY DRUGS

12.4.1 ALKYLATING AGENTS

12.4.1.1 CYCLOPHOSPHAMIDE

12.4.1.2 CHLORAMBUCIL

12.4.1.3 BENDAMUSTINE

12.4.2 ANTIMETABOLITES

12.4.2.1 CYTARABINE (ARA C)

12.4.2.2 METHOTREXATE

12.4.2.3 FLUDARABINE

12.4.2.4 MERCAPTOPURINE

12.4.3 ANTHRACYCLINES

12.4.3.1 DOXORUBICIN

12.4.3.2 DAUNORUBICIN

12.4.3.3 IDARUBICIN

12.4.4 TOPOISOMERASE INHIBITORS

12.4.4.1 ETOPOSIDE

12.4.4.2 TOPOTECAN

12.4.5 VINCA ALKALOIDS

12.4.5.1 VINCRISTINE

12.4.5.2 VINBLASTINE

12.5 STEM CELL TRANSPLANTATION

12.5.1 AUTOLOGOUS STEM CELL TRANSPLANTATION

12.5.2 ALLOGENEIC STEM CELL TRANSPLANTATION

12.5.2.1 MATCHED RELATED DONOR (MRD)

12.5.2.2 MATCHED UNRELATED DONOR (MUD)

12.5.2.3 HAPLOIDENTICAL DONOR

12.5.2.4 OTHERS

12.6 GENE THERAPY

12.6.1 CRISPR-CAS9 BASED THERAPIES

12.6.2 LENTIGLOBIN BB305

12.6.3 OTHERS

13 U.S. HEMATOLOGY ONCOLOGY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 GILEAD SCIENCE, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 ABBVIE INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 TAKEDA PHARMACEUTICAL COMPANY LIMITED.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PIPELINE PRODUCT PORTFOLIO

15.3.4 RECENT/NEWS

15.4 ASTRAZENECA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 SANOFI

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ASTELLAS PHARMA INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BAYER AG

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 BLUEBIRD BIO, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BRISTOL-MYERS SQUIBB COMPANY

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT NEWS

15.1 CITY OF HOPE.

15.10.1 COMPANY SNAPSHOT

15.10.2 SERVICE PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 CLEVELAND CLINIC TAUSSIG CANCER

15.11.1 COMPANY SNAPSHOT

15.11.2 SERVICES PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 CRISPR THERAPEUTICS

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 DANA-FARBER CANCER INSTITUTE, INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 SERVICE PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 DKMS GROUP GGMBH

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 EDITAS MEDICINE

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT NEWS

15.16 ELI LILLY AND COMPANY

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 F. HOFFMANN-LA ROCHE LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 FRED HUTCHINSON CANCER CENTER

15.18.1 COMPANY SNAPSHOT

15.18.2 SERVICE PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 MAYO FOUNDATION FOR MEDICAL EDUCATION AND RESEARCH (MFMER)

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT/NEWS

15.2 MEMORIAL SLOAN KETTERING CANCER CENTER

15.20.1 COMPANY SNAPSHOT

15.20.2 SERVICE PORTFOLIO

15.20.3 RECENT UPDATES

15.21 MERCK & CO., INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 MOFFITT CANCER CENTER

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT/NEWS

15.23 NOVARTIS AG

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENT

15.24 PFIZER INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 REGENERON PHARMACEUTICALS INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENT

15.26 ROSEWELL PARK COMPREHENSIVE CANCER CENTER

15.26.1 COMPANY SNAPSHOT

15.26.2 SERVICE PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 STANFORD MEDICINE

15.27.1 COMPANY SNAPSHOT

15.27.2 SERVICE PORTFOLIO

15.27.3 RECENT UPDATES

15.28 THE JOHNS HOPKINS UNIVERSITY, THE JOHNS HOPKINS HOSPITAL, AND JOHNS HOPKINS HEALTH SYSTEM

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENTS

15.29 THE UNIVERSITY OF CHICAGO MEDICAL CENTER

15.29.1 COMPANY SNAPSHOT

15.29.2 SERVICE PORTFOLIO

15.29.3 RECENT DEVELOPMENT

15.3 THE UNIVERSITY OF TEXAS MD ANDERSON CANCER CENTER

15.30.1 COMPANY SNAPSHOT

15.30.2 SERVICE PORTFOLIO

15.30.3 RECENT UPDATES/NEWS

15.31 THE CHILDREN'S HOSPITAL OF PHILADELPHIA

15.31.1 COMPANY SNAPSHOT

15.31.2 SERVICE PORTFOLIO

15.31.3 RECENT DEVELOPMENT

15.32 UCLA HEALTH

15.32.1 COMPANY SNAPSHOT

15.32.2 PRODUCT PORTFOLIO

15.32.3 RECENT DEVELOPMENT/NEWS

15.33 UNIVERSITY OF UTAH HEALTH

15.33.1 COMPANY SNAPSHOT

15.33.2 SERVICE PORTFOLIO

15.33.3 RECENT DEVELOPMENT

15.34 USC NORRIS COMPREHENSIVE CANCER

15.34.1 COMPANY SNAPSHOT

15.34.2 PRODUCT PORTFOLIO

15.34.3 RECENT DEVELOPMENT/NEWS

15.35 VANDERBILT-INGRAM CANCER CENTER

15.35.1 COMPANY SNAPSHOT

15.35.2 PRODUCT PORTFOLIO

15.35.3 RECENT DEVELOPMENT

15.36 VERTEX PHARMACEUTICALS INCORPORATED

15.36.1 COMPANY SNAPSHOT

15.36.2 REVENUE ANALYSIS

15.36.3 PRODUCT PORTFOLIO

15.36.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 U.S. HEMATOLOGY ONCOLOGY MARKET, BY DISEASE TYPE, 2018-2035 (USD MILLION)

TABLE 2 U.S. HEMATOLOGY ONCOLOGY MARKET, BY END USER, 2018-2035 (USD MILLION)

TABLE 3 U.S. HEMATOLOGY ONCOLOGY MARKET, BY RACE, 2018-2035 (USD MILLION)

TABLE 4 U.S. ETHNICALLY DIVERSE IN HEMATOLOGY ONCOLOGY MARKET, BY CATEGORY, 2018-2035 (USD MILLION)

TABLE 5 U.S. HEMATOLOGY ONCOLOGY MARKET, BY TREATMENT TYPE, 2018-2035 (USD MILLION)

TABLE 6 U.S. TARGETED THERAPIES & SMALL MOLECULES IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 7 U.S. TYROSINE KINASE INHIBITORS (TKIS) IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 8 U.S. MONOCLONAL ANTIBODIES IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 9 U.S. PROTEASOME INHIBITORS IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 10 U.S. FLT3 INHIBITORS IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 11 U.S. IMMUNOTHERAPIES IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 12 U.S. CART CELL THERAPY IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 13 U.S. IMMUNE CHECKPOINT INHIBITORS IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 14 U.S. BISPECIFIC ANTIBODIES IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 15 U.S. CYTOKINE THERAPY IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 16 U.S. CHEMOTHERAPY DRUGS IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 17 U.S. ALKYLATING AGENTS IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 18 U.S. ANTIMETABOLITES IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 19 U.S. ANTHRACYCLINES IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 20 U.S. TOPOISOMERASE INHIBITORS IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 21 U.S. VINCA ALKALOIDS IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 22 U.S. STEM CELL TRANSPLANTATION IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 23 U.S. ALLOGENEIC STEM CELL TRANSPLANTATION IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 24 U.S. GENE THERAPY IN HEMATOLOGY ONCOLOGY MARKET, BY TYPE, 2018-2035 (USD MILLION)

List of Figure

FIGURE 1 U.S. HEMATOLOGY ONCOLOGY MARKET: SEGMENTATION

FIGURE 2 U.S. HEMATOLOGY ONCOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 U.S. HEMATOLOGY ONCOLOGY MARKET: DROC ANALYSIS

FIGURE 4 U.S. HEMATOLOGY ONCOLOGY MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 U.S. HEMATOLOGY ONCOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. HEMATOLOGY ONCOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. HEMATOLOGY ONCOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. HEMATOLOGY ONCOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 U.S. HEMATOLOGY ONCOLOGY MARKET: SEGMENTATION

FIGURE 10 ADVANCEMENTS IN DIAGNOSTIC TECHNOLOGIES TRANSFORMING HEMATOLOGY ONCOLOGY DETECTION AND TREATMENT APPROACHES ARE DRIVING THE GROWTH OF THE U.S. HEMATOLOGY ONCOLOGY MARKET FROM 2025 TO 2035

FIGURE 11 THE LYMPHOMA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. HEMATOLOGY ONCOLOGY MARKET IN 2025 AND 2035

FIGURE 12 U.S. HEMATOLOGY ONCOLOGY MARKET EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 SIX SEGMENTS COMPRISE THE U.S. HEMATOLOGY ONCOLOGY MARKET, BY DISEASE TYPE (2024)

FIGURE 15 DROC ANALYSIS

FIGURE 16 U.S. HEMATOLOGY ONCOLOGY MARKET: BY DISEASE TYPE, 2024

FIGURE 17 U.S. HEMATOLOGY ONCOLOGY MARKET: BY DISEASE TYPE, 2025 TO 2035 (USD MILLION)

FIGURE 18 U.S. HEMATOLOGY ONCOLOGY MARKET: BY DISEASE TYPE, CAGR (2025-2035)

FIGURE 19 U.S. HEMATOLOGY ONCOLOGY MARKET: BY DISEASE TYPE, LIFELINE CURVE

FIGURE 20 U.S. HEMATOLOGY ONCOLOGY MARKET: BY END USER, 2024

FIGURE 21 U.S. HEMATOLOGY ONCOLOGY MARKET: BY END USER, 2025 TO 2035 (USD MILLION)

FIGURE 22 U.S. HEMATOLOGY ONCOLOGY MARKET: BY END USER, CAGR (2025- 2035)

FIGURE 23 U.S. HEMATOLOGY ONCOLOGY MARKET: BY END USER, LIFELINE CURVE

FIGURE 24 U.S. HEMATOLOGY ONCOLOGY MARKET: BY RACE, 2024

FIGURE 25 U.S. HEMATOLOGY ONCOLOGY MARKET: BY RACE, 2025 - 2035 (USD MILLION)

FIGURE 26 U.S. HEMATOLOGY ONCOLOGY MARKET: BY RACE, CAGR (2025- 2035)

FIGURE 27 U.S. HEMATOLOGY ONCOLOGY MARKET: BY RACE, LIFELINE CURVE

FIGURE 28 U.S. HEMATOLOGY ONCOLOGY MARKET: BY TREATMENT TYPE, 2024

FIGURE 29 U.S. HEMATOLOGY ONCOLOGY MARKET: BY TREATMENT TYPE, 2025-2035 (USD MILLION)

FIGURE 30 U.S. HEMATOLOGY ONCOLOGY MARKET: BY TREATMENT TYPE, CAGR (2025-2035)

FIGURE 31 U.S. HEMATOLOGY ONCOLOGY MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 32 U.S. HEMATOLOGY ONCOLOGY MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.