U.S. Hotel Market from B2B Corporate Spending Analysis and Insights

The U.S. hotel market from B2B corporate spending is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyzes that the market is growing with a CAGR of 3.7% in the forecast period of 2022 to 2029 and is expected to reach USD 22,640.46 million by 2029. The major factor driving the growth of the market is the adoption of innovative marketing strategies and practices in the hospitality industry in the forecast period. The shifting preference of corporates to online events and digitalization is expected to restrain market growth.

Increase in different types of platforms for booking hotel spaces is expected to provide the market with great opportunities. However, the outbreak of COVID-19 pandemic has resulted in the cancellation of various corporate events and B2B spending is projected to challenge the market growth.

The U.S. hotel market from B2B corporate spending report provides details of market share, new developments, the impact of domestic and localized market players, analysis of opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Chain (Luxury, Upper Upscale, Upscale, Upper Midscale, Midscale and Economy), Domain (International and Domestic), Sector (BFSI, Manufacturing, Healthcare, IT Services, Government and Others), Booking Channel (Direct Bookings, Online Travel Agencies (OTAS) and Travel Management Companies (TMC)) |

|

Countries Covered |

U.S. |

|

Market Players Covered |

Marriott International Inc., Hyatt Hotel Corp., Hilton Worldwide Holdings Inc., Wyndham Hotels & Resorts Inc., Radisson Hotel Group MARRIOTT, Rosewood Hotel Group |

Market Definition

B2B corporate spending in hotels can be defined as spending on events such as gatherings organized by business owners in hotels to focus on employees and customers and further strengthen the clientele, as well as stays for company employees in various events. Various businesses and corporates organize events for many reasons. They may want to educate, reward, motivate, celebrate, mark key milestones, manage organizational change or encourage collaboration.

U.S. Hotel Market from B2B Corporate Spending Market Dynamics

Drivers

- Adoption of innovative marketing strategies and practices in the hospitality industry

Virtual Reality (VR) has become one of the biggest emerging hospitality technology and marketing trends of recent times. VR tours of the space and hotels provide the ultimate means of experiencing a location from afar, recreating the environment in a way that allows for some degree of exploration and immersion. For corporate event customers, it means the chance to explore event venues without needing to travel there for viewing physically. This is especially valuable at a time when travel is restricted. In addition, various hotel groups and brands are advertising their brands and hotel chains through videos on social media platforms, using hashtags and brand engagement campaigns implemented on digital platforms are considered the best practice in the hospitality sector. Therefore, with such innovative practices by the hospitality sector, B2B spending for corporates is expected to increase, which will drive market growth.

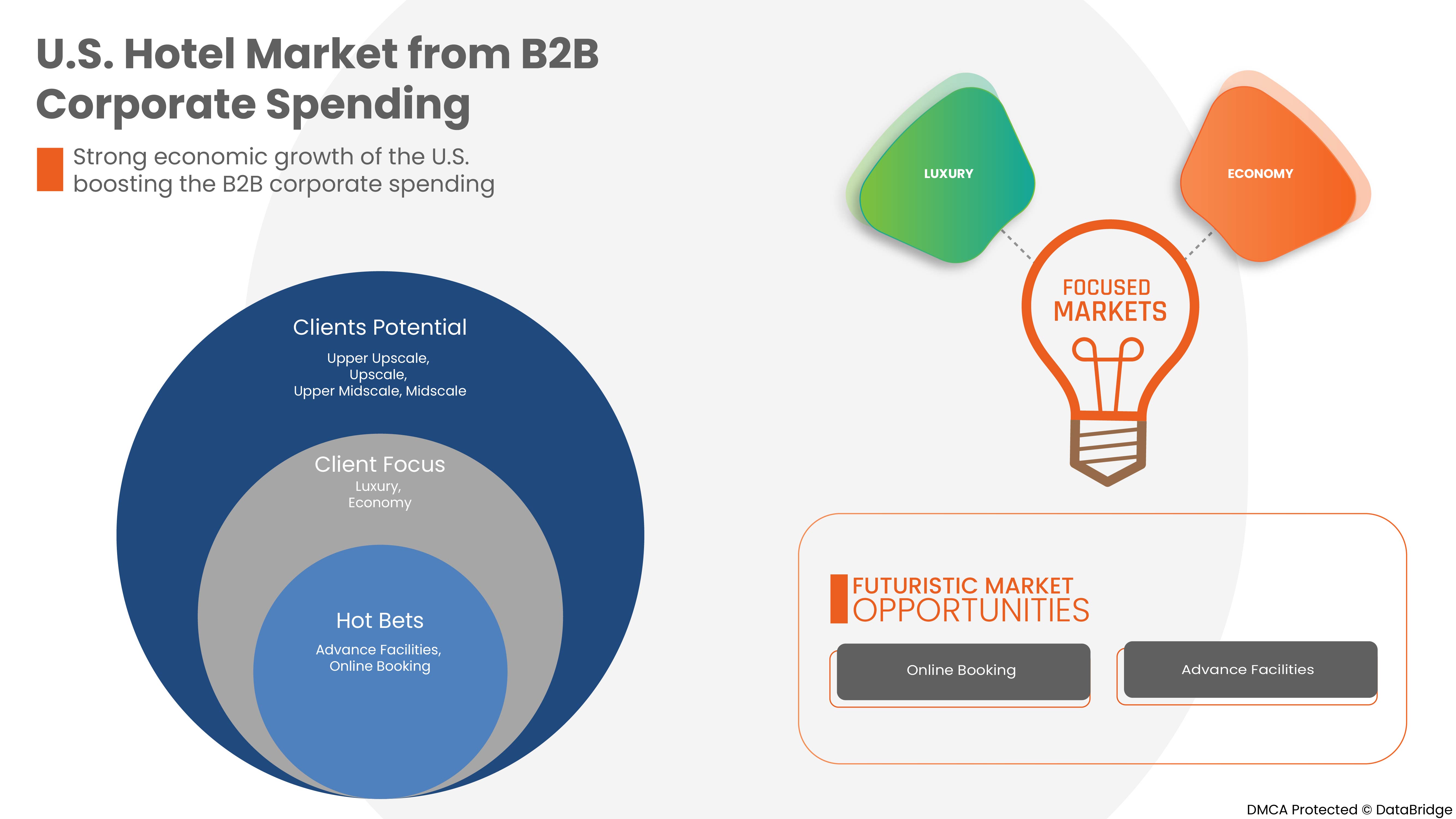

- Strong economic growth of the U.S. boosting the B2B corporate spending

With the growth in country's economy, every business and startup needs branding and promotion. Therefore, B2B corporate spending in hotels in terms of events is the best platform for them to market their business by sponsoring some entertainment event shows like live music events, sports events and many more. Companies across the region are increasingly looking to introduce new products and technology to the market to gain a higher competitive edge. This results in various trade shows, new product launch events, product exhibitions and others on a large scale to facilitate the interaction of potential customers and investors. Due to this, the B2B corporate spending in the hotel industry is experiencing strong growth.

Apart from this, the increasing number of corporate companies in healthcare and IT sector and rising spending on trade shows, conferences and seminars by corporate companies are boosting the market growth.

Opportunity

- Increase in different types of platforms for booking hotel spaces

Travel agencies are one of the most vital distribution channels within hospitality marketing. In recent years, the number of travel agencies has increased enormously. This enables customers to search for travel products or services online rather than going to individual company websites. Therefore, it is of utmost importance to partner up with travel agencies. The presence of a huge variety of booking channels for bookings in the hospitality industry offers a lucrative opportunity for the growth and development of the market.

Restraint/Challenge

- Shifting preference of corporates to online events and digitalization

Hopin has now become a popular platform for conducting events and conferences. Many such companies focus on bridging the gap between live and online events. All such initiatives are estimated to generate huge growth potential in the events industry. However, such initiatives are estimated to limit B2B corporate spending on hotels and negatively affect the market growth as COVID-19 restrictions have forced corporate companies to rely on technology to connect with people to conduct seminars and corporate events. Zoom, a communications platform, has become quite popular in achieving this.

- The outbreak of COVID-19 pandemic has resulted in the cancellation of various corporate events and B2B spending

Given the widespread reduction in corporate and business group spending across the U.S., the hotel industry has been one of the hardest-hit sectors by COVID-19 pandemic. Moreover, chain-managed hotels are the most affected by the COVID-19 pandemic compared to the franchise and independent hotels. The challenges created by COVID-19 impacted almost every part of a hotel's operations, from room occupancy levels and staffing plans to food and beverage provisioning. The pandemic has the potential to have far-reaching effects on the industry, creating a challenge for market growth.

Post COVID-19 Impact on U.S. Hotel Market from B2B Corporate Spending

COVID-19 pandemic badly affected the hospitality industry due to community lockdowns, social distancing, stay-at-home orders, travel and mobility restrictions that resulted in temporary closure of many hospitality businesses and significantly decreased the demand for businesses that were allowed to shut down. Restrictions placed on travel and stay-at-home orders issued by the authorities led to a sharp decline in hotel occupancies and revenues while the hospitality industry is slowly recovering which will increase the market growth.

Recent Development

- In September 2022, Hyatt Hotels Corporation’s Mark Hoplamazian, President and Chief Executive Officer, presented at the Bank of America Securities 2022 Gaming & Lodging Conference in New York, on Thursday, September 8, 2022

U.S. Hotel Market from B2B Corporate Spending Market Scope

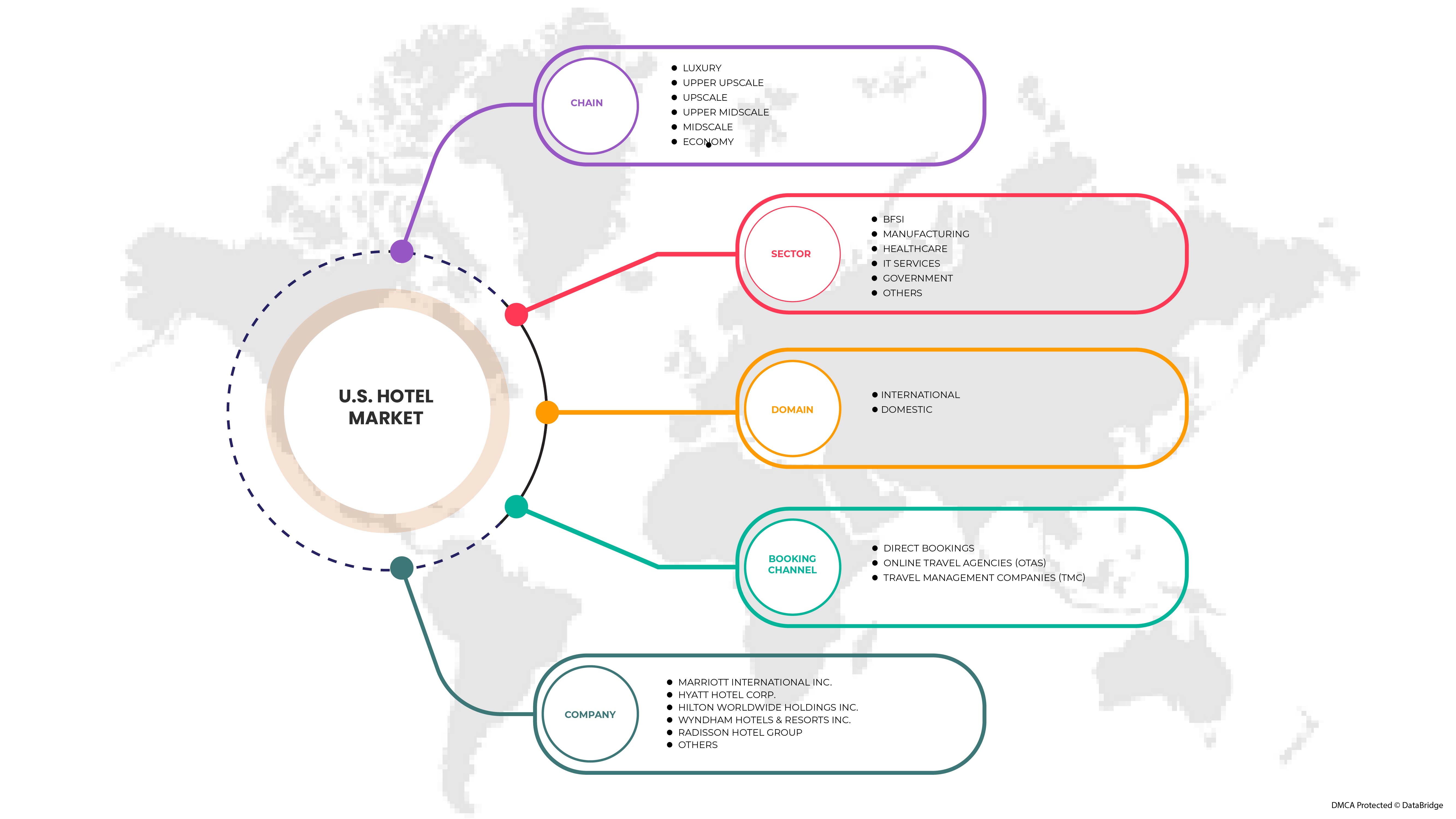

The U.S. hotel market from B2B corporate spending is categorized into four notable segments based on chain, domain, sector and booking channel.

The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Chain

- Luxury

- Upper Upscale

- Upscale

- Upper Midscale

- Midscale

- Economy

Based on chain, the market is segmented into luxury, upper upscale, upscale, upper midscale, midscale and economy

Domain

- International

- Domestic

Based on domain, the market is segmented into international and domestic

Sector

- BFSI

- Manufacturing

- Healthcare

- ITServices

- Government

- Others

Based on sector, the market is segmented into BFSI, manufacturing, healthcare, IT services, government and others

Booking Channel

- Direct Bookings

- Online Travel Agencies (OTAS)

- Travel Management Companies (TMC)

Based on booking channel, the market is segmented into direct bookings, Online Travel Agencies (OTAS) and Travel Management Companies (TMC)

U.S. Hotel Market from B2B Corporate Spending Country Regional Analysis/Insights

The U.S. hotel market from B2B corporate spending is analyzed and market size insights and trends are provided based on chain, domain, sector and booking channel.

The states covered in this market report are California, Florida, New York, Texas, Illinois, Georgia, Pennsylvania, Ohio and rest of U.S. In 2022, California State is expected to dominate the U.S. hotel market from B2B corporate spending.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data point’s downstream and upstream value chain analysis, technical trends and porter's five forces analysis and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of U.S. brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and U.S. Hotel Market from B2B Corporate Spending Share Analysis

U.S. hotel market from B2B corporate spending competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the prominent participants operating in the market are Marriott International Inc., Hyatt Hotel Corp., Hilton Worldwide Holdings Inc., Wyndham Hotels & Resorts Inc., Radisson Hotel Group MARRIOTT and Rosewood Hotel Group.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, U.S. Vs Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 CHAIN LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET CHALLENGE MATRIX

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 OVERVIEW: U.S. LEISURE SPENDING BY THE CONSUMERS

4.2 REGULATORY COVERAGE

4.3 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: COMPANY LANDSCAPE

4.3.1 COMPANY SHARE ANALYSIS: U.S.

4.4 U.S. HOTEL MARKET, BRAND SHARE ANALYSIS, 2021, (%)

4.4.1 MARRIOTT

4.4.2 HYATT

4.4.3 HILTON

4.4.4 WYNDHAM

4.4.5 RADISSON

4.4.6 ROSEWOOD

4.5 RECENT DEVELOPMENT AND BRAND STRATEGIES

4.5.1 HYATT

4.5.2 RADDISON

4.5.3 MARRIOTT

4.5.4 FOUR SEASONS HOTELS AND RESORTS

4.5.5 HILTON

4.5.6 WYNDHAM HOTELS

4.6 CONSUMERS’ TRENDS/ RESPONSE

4.7 U.S. HOTEL MARKET, MARKET ANALYSIS

5 U.S. HOTEL MARKET: LUXURY SEGMENT, BRAND SHARE ANALYSIS, 2021, (%)

6 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN

6.1 OVERVIEW

6.2 UPSCALE

6.3 UPPER UPSCALE

6.4 UPPER MIDSCALE

6.5 MIDSCALE

6.6 ECONOMY

6.7 LUXURY

6.7.1 INTERNATIONAL

6.7.2 DOMESTIC

6.7.2.1 IT SERVICES

6.7.2.2 BFSI

6.7.2.3 MANUFACTURING

6.7.2.4 HEALTHCARE

6.7.2.5 GOVERNMENT

6.7.2.6 OTHERS

6.7.2.6.1 DIRECT BOOKINGS

6.7.2.6.2 ONLINE TRAVEL AGENCIES (OTAS)

6.7.2.6.3 TRAVEL MANAGEMENT COMPANIES (TMC)

7 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN

7.1 OVERVIEW

7.2 INTERNATIONAL

7.3 DOMESTIC

8 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR

8.1 OVERVIEW

8.2 IT SERVICES

8.3 BFSI

8.4 MANUFACTURING

8.5 HEALTHCARE

8.6 GOVERNMENT

8.7 OTHERS

9 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL

9.1 OVERVIEW

9.2 DIRECT BOOKINGS

9.3 ONLINE TRAVEL AGENCIES (OTAS)

9.4 TRAVEL MANAGEMENT COMPANIES (TMC)

10 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY STATE

10.1 CALIFORNIA

10.2 FLORIDA

10.3 NEW YORK

10.4 TEXAS

10.5 ILLINOIS

10.6 GEORGIA

10.7 PENNSYLVANIA

10.8 OHIO

10.9 REST OF U.S.

11 SWOT

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Table

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 3 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 4 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 5 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 6 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 7 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 8 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 9 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY STATE, 2018-2029 (USD MILLION)

TABLE 10 CALIFORNIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 11 CALIFORNIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 12 CALIFORNIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 13 CALIFORNIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 14 CALIFORNIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 15 CALIFORNIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 16 CALIFORNIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 17 FLORIDA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 18 FLORIDA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 19 FLORIDA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 20 FLORIDA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 21 FLORIDA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 22 FLORIDA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 23 FLORIDA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 24 NEW YORK HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 25 NEW YORK LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 26 NEW YORK LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 27 NEW YORK LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 28 NEW YORK HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 29 NEW YORK HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 30 NEW YORK HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 31 TEXAS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 32 TEXAS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 33 TEXAS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 34 TEXAS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 35 TEXAS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 36 TEXAS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 37 TEXAS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 38 ILLINOIS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 39 ILLINOIS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 40 ILLINOIS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 41 ILLINOIS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 42 ILLINOIS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 43 ILLINOIS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 44 ILLINOIS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 45 GEORGIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 46 GEORGIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 47 GEORGIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 48 GEORGIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 49 GEORGIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 50 GEORGIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 51 GEORGIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 52 PENNSYLVANIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 53 PENNSYLVANIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 54 PENNSYLVANIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 55 PENNSYLVANIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 56 PENNSYLVANIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 57 PENNSYLVANIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 58 PENNSYLVANIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 59 OHIO HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 60 OHIO LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 61 OHIO LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 62 OHIO LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 63 OHIO HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 64 OHIO HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 65 OHIO HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 66 REST OF U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

List of Figure

FIGURE 1 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: SEGMENTATION

FIGURE 2 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: DATA TRIANGULATION

FIGURE 3 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: DROC ANALYSIS

FIGURE 4 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: U.S. MARKET ANALYSIS

FIGURE 5 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: THE CHAIN LIFE LINE CURVE

FIGURE 7 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: MULTIVARIATE MODELLING

FIGURE 8 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: THE MARKET CHALLENGE MATRIX

FIGURE 10 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: SEGMENTATION

FIGURE 11 STRONG ECONOMIC GROWTH OF THE U.S. BOOSTING THE B2B CORPORATE SPENDING IS EXPECTED TO DRIVE U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING IN THE FORECAST PERIOD

FIGURE 12 UPSCALE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING IN 2022 & 2029

FIGURE 13 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: COMPANY SHARE 2021 (%)

FIGURE 14 MARRIOTT: BRAND ANALYSIS

FIGURE 15 MARRIOTT: SELECT SEGMENT

FIGURE 16 MARRIOTT: PREMIUM SEGMENT

FIGURE 17 MARRIOTT: LUXURY SEGMENT

FIGURE 18 HYATT: BRAND ANALYSIS

FIGURE 19 HYATT: UPPER-UPSCALE

FIGURE 20 HYATT: UPSCALE

FIGURE 21 HYATT: LUXURY

FIGURE 22 HILTON: BRAND ANALYSIS

FIGURE 23 HILTON: UPPER-UPSCALE

FIGURE 24 HILTON: UPSCALE

FIGURE 25 HILTON: LUXURY

FIGURE 26 WYNDHAM: BRAND ANALYSIS

FIGURE 27 WYNDHAM: ECONOMY

FIGURE 28 WYNDHAM: MID-SCALE

FIGURE 29 WYNDHAM: UPSCALE

FIGURE 30 WYNDHAM: LIFESTYLE

FIGURE 31 WYNDHAM: EXTENDED STAY

FIGURE 32 RADISSON: BRAND ANALYSIS

FIGURE 33 RADISSON: UPPER UPSCALE

FIGURE 34 RADISSON: UPSCALE

FIGURE 35 RADISSON: MID-SCALE

FIGURE 36 RADISSON: LUXURY

FIGURE 37 ROSEWOOD: BRAND ANALYSIS

FIGURE 38 U.S. HOTEL MARKET, (USD BILLION)

FIGURE 39 LUXURY HOTELS: BRAND ANALYSIS

FIGURE 40 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY CHAIN, 2021

FIGURE 41 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY DOMAIN, 2021

FIGURE 42 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY SECTOR, 2021

FIGURE 43 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY BOOKING CHANNEL, 2021

FIGURE 44 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: SNAPSHOT (2021)

FIGURE 45 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY STATE (2021)

FIGURE 46 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY STATE (2022 & 2029)

FIGURE 47 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY STATE (2021 & 2029)

FIGURE 48 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY CHAIN (2022-2029)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.