U.S. Osteonecrosis Market Analysis and Insights

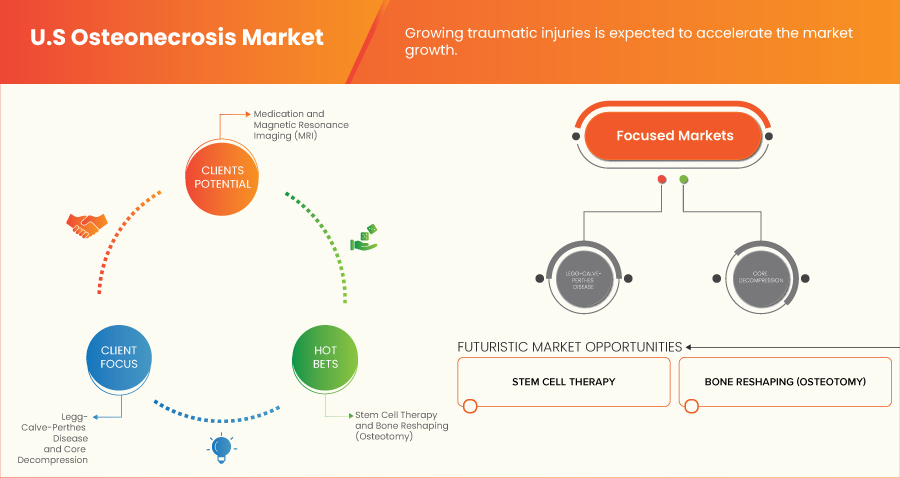

The increasing number of traumatic injuries among the United States population is expected to boost the growth of the U.S. osteonecrosis market. The rising government initiatives and funding for drug discovery and related research programs also contribute to market growth. The major market players focus on various service launches and approvals during this crucial period. In addition, the increase in improved advancement of imaging techniques for the diagnostic purpose of osteonecrosis is also driving the growth of the market in the forecasted period.

The U.S. osteonecrosis market is expected to grow in the forecast year due to the rise in the number of market players and the availability of advanced technological diagnostic and surgical devices. The increasing development in the field of advanced techniques is further expected to boost market growth. However, difficulties such as the stringent regulations for producing and commercializing treatment drugs and medical devices for diagnosis and surgery are expected to restrain market growth in the forecast period.

Various companies are taking initiatives that gradually lead to market growth:

For instance,

- In January 2021, Stryker announced the acquisition of OrthoSensor, a market player which applies digital technology and big data to total joint replacements. The acquisition would help the company to purchase the digital technologies of OrthoSensor for the use in diagnosis and treatment technologies for osteonecrosis.

- In March 2020, Sciegen Pharmaceuticals received ANDA Approval for Naproxen Tablets USP 250mg, 375mg and 500mg. The approval will further help in the growth of the product portfolio of the company.

Data Bridge Market Research analyzes that the U.S. osteonecrosis market is expected to reach the value of USD 843,039.67 thousand by 2030, at a CAGR of 5.9% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in Thousand, Volumes in Units, Pricing in USD |

|

Segments Covered |

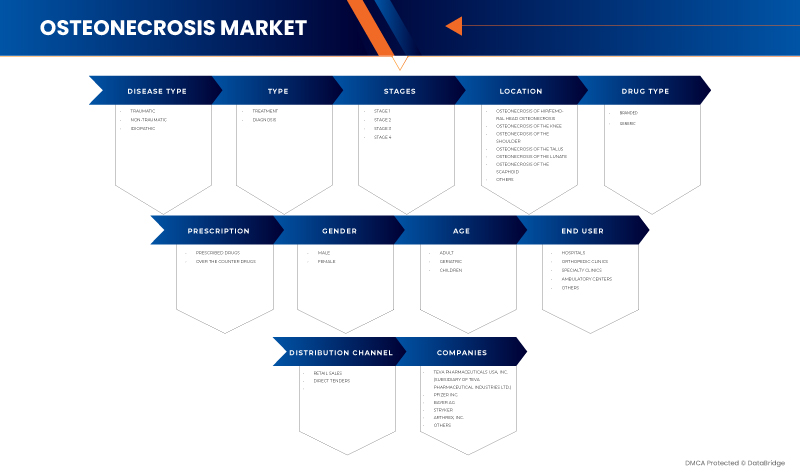

Disease Type (Traumatic, Non-Traumatic, and Idiopathic), Type (Diagnosis, and Treatment), Stages (Stage 1, Stage 2, Stage 3, and Stage 4), Location (Osteonecrosis of Hip/Femoral Head Osteonecrosis, Osteonecrosis of the Knee, Osteonecrosis of the Shoulder, Osteonecrosis of the Talus, Osteonecrosis of the Lunate, Osteonecrosis of the Scaphoid, and Others), Drug Type (Branded and Generic), Prescription (Over the Counter Drugs and Prescribed Drugs), Gender (Male and Female), Age (Children, Adult, and Geriatric), End User (Hospitals, Specialty Clinics, Orthopedic Clinics, Ambulatory Centers, and Others), Distribution Channel (Direct Tender and Retail Sales) |

|

Country Covered |

U.S. |

|

Market Players Covered |

Sciegen Pharmaceuticals, Almatica Pharma, Dr. Reddy's Laboratories Ltd., Bayer AG, Pfizer Inc., Haleon Group of Companies, Zimmer Biomet, Stryker, Teva Pharmaceuticals USA, Inc. (Subsidiary of Teva Pharmaceutical Industries Ltd.), and Arthrex, Inc., among others. |

U.S. Osteonecrosis Market Definition

Osteonecrosis, also referred to as avascular necrosis or aseptic necrosis, is a condition characterized by the death or deterioration of bone tissue due to an inadequate blood supply. It can occur in various bones in the body, but it most commonly affects the hip joint. The compromised blood flow deprives the bone cells of essential oxygen and nutrients, leading to their death and subsequent damage to the affected bone. As a result, the bone structure weakens, becomes less able to withstand normal stress, and may eventually collapse or become deformed. Osteonecrosis can cause pain, limited range of motion, and functional impairment. Common causes of osteonecrosis include trauma, corticosteroid use, excessive alcohol consumption, certain medical conditions, and underlying factors that affect blood circulation. Early diagnosis and appropriate management are essential in preventing further bone damage and preserving joint function. Treatment options for osteonecrosis may include conservative measures to manage symptoms and slow disease progression and surgical interventions to relieve pain and restore joint function.

U.S. Osteonecrosis Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Driver

- Increasing number of traumatic injuries

The increasing number of traumatic injuries in the U.S. is a significant driver for the U.S. osteonecrosis market. Traumatic injuries, caused by various factors such as accidents, sports-related incidents, falls, and workplace injuries, have become more prevalent in recent years. These injuries can profoundly impact bone health, often resulting in fractures, dislocations, and joint instability. When the blood supply to the affected bone is compromised during the injury, it sets the stage for the potential development of osteonecrosis. The damaged blood vessels disrupt the essential supply of oxygen and nutrients to the bone tissue, leading to the death of bone cells. Post-traumatic osteonecrosis is a well-recognized consequence of severe traumatic injuries. Not promptly diagnosed and managed can lead to complications such as joint collapse, chronic pain, and reduced joint function.

A traumatic injury can damage the blood vessels that deliver oxygen and nutrients to the bone tissue. This disruption leads to a decreased or blocked blood flow, resulting in cellular death and the development of osteonecrosis. Additionally, the trauma can increase pressure on the bone or joint, compromising blood flow and causing ischemia. The resulting lack of blood supply and cellular damage can trigger an inflammatory response, further exacerbating the condition. The increasing number of road and sport-related accidents are increasing, leading to an increase in osteonecrosis.

Restraint

- High cost associated with the diagnosis and treatment of osteonecrosis

The advancements in diagnostic techniques and treatment options have improved patient outcomes. Still, the financial burden of managing osteonecrosis remains a significant challenge for patients, healthcare providers, and the healthcare system. The key factors determining the cost of diagnosis and treatment of osteonecrosis include the medical institution or clinic finalized for the procedure, treatment area, complexity, and chosen specialist among others.

Accurate diagnosis of osteonecrosis often requires specialized imaging techniques, such as magnetic resonance imaging (MRI), computed tomography (CT) scans, or bone scans. These diagnostic procedures are expensive, requiring specialized equipment, trained personnel, and interpretation by skilled radiologists. The high cost of these imaging procedures limits access to timely and accurate diagnosis, leading to delayed treatment and potential complications. The cost of the treatment proportionally gets escalated, so the high cost of treatment may hamper the market's demand.

Opportunity

-

Advancements in medical technology for osteonecrosis

Advancements in medical technology present significant opportunities in the U.S. osteonecrosis market. These innovations enhance the accuracy of diagnosis, offer regenerative treatment options, enable minimally invasive procedures, facilitate personalized care, and improve patient outcomes. Continued investment in research and development, collaboration between industry and healthcare professionals, and regulatory support for innovative technologies are vital to harness the full potential of medical advancements and drive progress in osteonecrosis. Therefore is expected to act as an opportunity in the market.

Challenge

- Availability of limited treatment options

The absence of therapeutic alternatives in the U.S. osteonecrosis market hampers optimal patient care and outcomes. Osteonecrosis, commonly called avascular necrosis, is a disorder where bone tissue perishes due to inadequate blood flow. Although there are various therapeutic options, the choices are frequently constrained based on osteonecrosis's stage, location, and underlying etiology.

Recent Developments

- In January 2023, Zimmer Biomet announced that it had reached a definitive agreement to acquire Embody, Inc., a privately-held medical device company focused on soft tissue healing, for $155 thousand at closing. The acquisition includes Embody's complete portfolio of collagen-based biointegrative solutions to support healing in the most challenging orthopedic soft tissue injuries – including the TAPESTRY biointegrative implant for tendon healing and TAPESTRY RC, one of the first arthroscopic implant systems for rotator cuff repair. This acquisition will help the company in its product portfolio and business expansion.

- In July 2022, the Haleon Group of Companies announced the completion of the demerger of the Consumer Healthcare business from the GSK Group to form the Haleon Group. This demerges helped the company to take control over the whole business of consumer health and expand it.

U.S. Osteonecrosis Market Scope

The U.S. osteonecrosis market is segmented into ten notable segments based on disease type, type, stages, location, drug type, prescription, gender, age, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Disease Type

- Traumatic

- Non-Traumatic

- Idiopathic

On the basis of disease type, the market is segmented into traumatic, non-traumatic, and idiopathic.

Type

- Diagnosis

- Treatment

On the basis of type, the market is segmented into diagnosis and treatment.

Stages

- Stage 1

- Stage 2

- Stage 3

- Stage 4

On the basis of stages, the market is segmented into stage 1, stage 2, stage3, and stage 4.

Location

- Osteonecrosis of the Hip/ Femoral Head Osteonecrosis

- Osteonecrosis of the Knee

- Osteonecrosis of the Shoulder

- Osteonecrosis of the Talus

- Osteonecrosis of the Lunate

- Osteonecrosis of the Scaphoid

- Others

On the basis of location, the market is segmented into osteonecrosis of hip/femoral head osteonecrosis, osteonecrosis of the knee, osteonecrosis of the shoulder, osteonecrosis of the talus, osteonecrosis of the lunate, osteonecrosis of the scaphoid, and others.

Drug Type

- Branded

- Generic

On the basis of drug type, the market is segmented into branded and generic.

Prescription

- Over the Counter Drugs

- Prescribed Drugs

On the basis of prescription, the market is segmented into over the counter drugs and prescribed drugs.

Gender

- Male

- Female

On the basis of gender, the market is segmented into male and female.

Age

- Children

- Adult

- Geriatric

On the basis of age, the market is segmented into children, adult, and geriatric.

End User

- Hospitals

- Speciality Clinics

- Orthopedic Clinics

- Ambulatory Centers

- Others

On the basis of end user, the market is segmented into hospitals, specialty clinics, orthopedic clinics, ambulatory centers, and others.

Distribution Channel

- Direct Tender

- Retail Sales

On the basis of distribution channel, the market is segmented into direct tender and retail sales.

U.S. Osteonecrosis Market Analysis/Insights

The U.S. osteonecrosis market is categorized into ten notable segments based on disease type, type, stages, location, drug type, prescription, gender, age, end user, and distribution channel.

The countries covered in this market report U.S.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of U.S. brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and U.S. Osteonecrosis Market Share Analysis

The U.S. osteonecrosis market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breath, application dominance, and product type lifeline curve. The above data points provided are only related to the company’s focus on the U.S. osteonecrosis market.

Some of the major market players operating in the U.S. osteonecrosis market are Sciegen Pharmaceuticals, Almatica Pharma, Dr. Reddy's Laboratories Ltd., Bayer AG, Pfizer Inc., Haleon Group of Companies, Zimmer Biomet, Stryker, Teva Pharmaceuticals USA, Inc. (Subsidiary of Teva Pharmaceutical Industries Ltd.), and Arthrex, Inc. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. OSTEONECROSIS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 DISEASE TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRY INSIGHTS

4.3.1 DEMOGRAPHIC TRENDS: IMAPCTS ON ALL INCIDENCE RATES

4.3.2 PATIENT FLOW DIAGRAM

4.3.3 KEY PRICING STRATEGIES

4.4 HEALTHCARE ECONOMY

4.4.1 HEALTHCARE EXPENDITURE

4.4.2 CAPITAL EXPENDITURE

4.4.3 CAPEX TRENDS

4.4.4 CAPEX ALLOCATION

4.4.5 FUNDING SOURCES

4.4.6 INDUSTRY BENCHMARKS

4.4.7 GDP RATIO IN OVERALL GDP

4.4.8 HEALTHCARE SYSTEM STRUCTURE

4.4.9 GOVERNMENT POLICIES

4.4.10 ECONOMIC DEVELOPMENT

4.5 PIPELINE ANALYSIS

4.6 REIMBURSEMENT FRAMEWORK

4.7 TECHNOLOGY ROADMAP

4.8 VALUE CHAIN ANALYSIS

5 EPIDEMIOLOGY

6 REGULATIONS

6.1 REGULATORY APPROVAL PROCESS AND PATHWAYS:

6.2 LICENSING AND REGISTRATION:

6.3 POST-MARKETING SURVEILLANCE:

6.4 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES:

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING NUMBER OF TRAUMATIC INJURIES

7.1.2 INCREASING CONSUMPTION OF STEROIDS AND RELATED DRUGS

7.1.3 INCREASING INCIDENCE OF OSTEONECROSIS

7.2 RESTRAINTS

7.2.1 HIGH COST ASSOCIATED WITH THE DIAGNOSIS AND TREATMENT OF OSTEONECROSIS

7.2.2 PROGNOSTIC AND DIAGNOSTIC CHALLENGES

7.3 OPPORTUNITIES

7.3.1 ADVANCEMENTS IN MEDICAL TECHNOLOGY FOR OSTEONECROSIS

7.3.2 INCREASING REIMBURSEMENTS SCENARIOS

7.4 CHALLENGES

7.4.1 AVAILABILITY OF LIMITED TREATMENT OPTIONS

7.4.2 CHALLENGING LONG-TERM MANAGEMENT AND FOLLOW UP

8 U.S. OSTEONECROSIS MARKET, BY DISEASE TYPE

8.1 OVERVIEW

8.2 TRAUMATIC

8.3 NON-TRAUMATIC

8.4 IDIOPATHIC

9 U.S. OSTEONECROSIS MARKET, BY TYPE

9.1 OVERVIEW

9.2 TREATMENT

9.2.1 SURGERY

9.2.1.1 CORE DECOMPRESSION

9.2.1.2 BONE RESHAPING (OSTEOTOMY)

9.2.1.3 BONE TRANSPLANT

9.2.1.4 JOINT REPLACEMENT THERAPY

9.2.1.5 STEM CELL THERAPY

9.2.2 MEDICATION

9.2.2.1 NSAIDS

9.2.2.1.1 IBUPROFEN

9.2.2.1.2 ASPIRIN

9.2.2.1.3 NAPROXEN

9.2.2.1.4 DICLOFENAC

9.2.2.1.5 OTHERS

9.2.2.2 BLOOD THINNERS

9.2.2.2.1 WARFARIN

9.2.2.2.2 HEPARIN

9.2.2.2.3 ENOXAPARIN

9.2.2.2.4 ARGATROBAN

9.2.2.2.5 DICOUMARAL

9.2.2.2.6 FONDAPARINUX

9.2.2.2.7 XIMELAGATRAN

9.2.2.3 OSTEOPOROSIS DRUGS

9.2.2.3.1 ALENDRONATE

9.2.2.3.2 RISEDRONATE

9.2.2.3.3 IBANDRONATE

9.2.2.3.4 ZOLEDRONIC ACID

9.2.2.3.5 DENOSUMAB

9.2.2.3.6 OTHERS

9.2.2.4 CHOLESTEROL-LOWERING DRUGS

9.2.2.4.1 ATORVASTATIN

9.2.2.4.2 PRAVASTATIN

9.2.2.4.3 FLUVASTATIN

9.2.2.4.4 ROSUVASTATIN

9.2.2.4.5 SIMVASTATIN

9.2.2.4.6 PITAVASTATIN

9.2.2.4.7 LOVASTATIN

9.2.2.5 OTHERS

9.2.3 PHYSICAL THERAPY

9.2.3.1 CRUTCHES

9.2.3.1.1 AXILLA CRUTCHES

9.2.3.1.1.1 METAL ALLOY

9.2.3.1.1.2 WOOD

9.2.3.1.1.3 CARBON OR GLASS FIBER REINFORCED COMPOSITE

9.2.3.1.1.4 OTHERS

9.2.3.1.2 ELBOW CRUTCHES

9.2.3.1.2.1 OPEN-CUFF ELBOW CRUTCHES

9.2.3.1.2.1.1 METAL ALLOY

9.2.3.1.2.1.2 WOOD

9.2.3.1.2.1.3 CARBON OR GLASS FIBER REINFORCED COMPOSITE

9.2.3.1.2.1.4 OTHERS

9.2.3.1.2.2 CLOSED-CUFF ELBOW CRUTCHES

9.2.3.1.2.2.1 METAL ALLOY

9.2.3.1.2.2.2 WOOD

9.2.3.1.2.2.3 CARBON OR GLASS FIBER REINFORCED COMPOSITE

9.2.3.1.2.2.4 OTHERS

9.2.3.1.3 GUTTER CRUTCHES

9.2.3.1.3.1 METAL ALLOY

9.2.3.1.3.2 WOOD

9.2.3.1.3.3 CARBON OR GLASS FIBER REINFORCED COMPOSITE

9.2.3.1.3.4 OTHERS

9.2.3.2 CASTING AND BRACING

9.2.3.2.1 NEWINGTON BRACE

9.2.3.2.2 TORONTO ORTHOSIS

9.2.3.2.3 SCOTTISH RITE ORTHOSIS

9.2.3.2.4 BROOMSTICK PLASTERS

9.2.3.2.5 BIRMINGHAM ORTHOSIS

9.2.3.3 OTHERS

9.2.3.3.1 CONVENTIONAL CALIPERS

9.2.3.3.2 SNYDER SLINGS

9.2.3.3.3 SLINGS WITH CRUTCHES

9.2.3.3.4 TRACTION

9.2.3.3.5 OTHERS

9.3 DIAGNOSIS

9.3.1 IMAGING TEST

9.3.1.1 MAGNETIC RESONANCE IMAGING (MRI)

9.3.1.1.1 CLOSED BORE

9.3.1.1.1.1 LOW FIELD STRENGTH

9.3.1.1.1.2 MID FIELD STRENGTH

9.3.1.1.1.3 HIGH FIELD STRENGTH

9.3.1.1.2 OPEN BORE

9.3.1.1.2.1 LOW FIELD STRENGTH

9.3.1.1.2.2 MID FIELD STRENGTH

9.3.1.1.2.3 HIGH FIELD STRENGTH

9.3.1.2 COMPUTED TOMOGRAPHY SCANNING

9.3.1.2.1 HIGH END SLICE

9.3.1.2.2 MID END SLICE

9.3.1.2.3 LOW END SLICE

9.3.1.2.4 CONE BEAN

9.3.1.3 X-RAY IMAGING

9.3.1.3.1 RADIOGRAPHY

9.3.1.3.1.1 DIGITAL IMAGING

9.3.1.3.1.2 FILM-BASED IMAGING

9.3.1.3.2 FLUOROSCOPY

9.3.1.3.2.1 DIGITAL IMAGING

9.3.1.3.2.2 FILM-BASED IMAGING

9.3.1.3.3 OTHERS

9.3.1.4 OTHERS

9.3.1.4.1 BONE SCAN

9.3.1.4.2 ULTRASOUND

9.3.1.4.2.1 2D ULTRASOUND

9.3.1.4.2.1.1 B/W ULTRASOUND

9.3.1.4.2.1.2 COLOURED

9.3.1.4.2.2 DOPPLER ULTRASOUND

9.3.1.4.2.2.1 B/W ULTRASOUND

9.3.1.4.2.2.2 COLOURED

9.3.1.4.2.3 3D & 4D ULTRASOUND

9.3.1.4.2.3.1 B/W ULTRASOUND

9.3.1.4.2.3.2 COLOURED

9.3.1.4.3 OTHERS

9.3.2 BIOPSY

9.3.2.1 NEEDLE BIOPSY

9.3.2.2 OPEN BIOPSY

9.3.2.3 OTHERS

9.3.3 OTHERS

10 U.S. OSTEONECROSIS MARKET, BY STAGES

10.1 OVERVIEW

10.2 STAGE 2

10.3 STAGE 3

10.4 STAGE 4

10.5 STAGE 1

11 U.S. OSTEONECROSIS MARKET, BY LOCATION

11.1 OVERVIEW

11.2 OSTEONECROSIS OF HIP/FEMORAL HEAD OSTEONECROSIS

11.2.1 TRAUMATIC

11.2.2 NON-TRAUMATIC

11.2.3 IDIOPATHIC OSTEONECROSIS

11.2.3.1 LEGG-CALVE-PERTHES DISEASE

11.2.3.1.1 TREATMENT

11.2.3.1.1.1 NON-SURGICAL

11.2.3.1.1.1.1 ANTI-INFLAMMATORY MEDICATION

11.2.3.1.1.1.1.1 IBUPROFEN

11.2.3.1.1.1.1.2 ASPIRIN

11.2.3.1.1.1.1.3 NAPROXEN SODIUM

11.2.3.1.1.1.1.4 NABUMETONE

11.2.3.1.1.1.1.5 OTHERS

11.2.3.1.1.1.2 BISPHOSPHONATES MEDICATIONS

11.2.3.1.1.1.2.1 ALENDRONATE

11.2.3.1.1.1.2.2 RISEDRONATE

11.2.3.1.1.1.2.3 IBANDRONATE

11.2.3.1.1.1.2.4 ZOLEDRONIC ACID

11.2.3.1.1.1.2.5 PAMIDRONATE

11.2.3.1.1.1.2.6 OTHERS

11.2.3.1.1.1.3 CRUTCHES

11.2.3.1.1.1.3.1 AXILLA CRUTCHES

11.2.3.1.1.1.3.2 ELBOW CRUTCHES

11.2.3.1.1.1.3.3 GUTTER CRUTCHES

11.2.3.1.1.1.4 CASTINGS & BRACINGS

11.2.3.1.1.1.4.1 NEWINGTON BRACE

11.2.3.1.1.1.4.2 TORONTO ORTHOSIS

11.2.3.1.1.1.4.3 SCOTTISH RITE ORTHOSIS

11.2.3.1.1.1.4.4 BROOMSTICK PLASTERS

11.2.3.1.1.1.4.5 BIRMINGHAM ORTHOSIS

11.2.3.1.1.2 SURGICAL

11.2.3.1.1.2.1 FEMORAL OSTEOTOMY

11.2.3.1.1.2.1.1 FEMORAL DEROTATION OSTEOTOMY

11.2.3.1.1.2.1.2 VARUS DEROTATION OSTEOTOMY

11.2.3.1.1.2.2 INNOMINATE OSTEOTOMY

11.2.3.1.1.2.2.1 SALTER (SINGLE INNOMINATE OSTEOTOMY)

11.2.3.1.1.2.2.2 SUTHERLAND (DOUBLE INNOMINATE OSTEOTOMY)

11.2.3.1.1.2.2.3 STEEL, TONNIS OR CARLOS (TRIPLE INNOMINATE OSTEOTOMY)

11.2.3.1.1.2.2.4 GANZ (PERIACETABULAR)

11.2.3.1.1.2.3 SHELF ARTHROPLASTY

11.2.3.1.1.2.4 OTHERS

11.2.3.1.2 DIAGNOSIS

11.2.3.1.2.1 MAGNETIC RESONANCE IMAGING (MRI)

11.2.3.1.2.1.1 CLOSED BORE

11.2.3.1.2.1.1.1 LOW FIELD STRENGTH

11.2.3.1.2.1.1.2 MID FIELD STRENGTH

11.2.3.1.2.1.1.3 HIGH FIELD STRENGTH

11.2.3.1.2.1.2 OPEN BORE

11.2.3.1.2.1.2.1 LOW FIELD STRENGTH

11.2.3.1.2.1.2.2 MID FIELD STRENGTH

11.2.3.1.2.1.2.3 HIGH FIELD STRENGTH

11.2.3.1.2.2 COMPUTED TOMOGRAPHY SCANNING

11.2.3.1.2.2.1 HIGH END SLICE

11.2.3.1.2.2.2 MID END SLICE

11.2.3.1.2.2.3 LOW END SLICE

11.2.3.1.2.2.4 CONE BEAN

11.2.3.1.2.3 X-RAY IMAGING

11.2.3.1.2.3.1 RADIOGRAPHY

11.2.3.1.2.3.1.1 DIGITAL IMAGING

11.2.3.1.2.3.1.2 FILM-BASED IMAGING

11.2.3.1.2.3.2 FLUOROSCOPY

11.2.3.1.2.3.2.1 DIGITAL IMAGING

11.2.3.1.2.3.2.2 FILM-BASED IMAGING

11.2.3.1.2.3.3 OTHERS

11.2.3.1.2.4 OTHERS

11.2.3.2 OTHERS

11.3 OSTEONECROSIS OF THE KNEE

11.3.1 TRAUMATIC

11.3.2 NON-TRAUMATIC

11.3.3 IDIOPATHIC OSTEONECROSIS

11.4 OSTEONECROSIS OF THE SHOULDER

11.4.1 TRAUMATIC

11.4.2 NON-TRAUMATIC

11.4.3 IDIOPATHIC OSTEONECROSIS

11.5 OSTEONECROSIS OF THE TALUS

11.5.1 TRAUMATIC

11.5.2 NON-TRAUMATIC

11.5.3 IDIOPATHIC OSTEONECROSIS

11.6 OSTEONECROSIS OF THE LUNATE

11.6.1 TRAUMATIC

11.6.2 NON-TRAUMATIC

11.6.3 IDIOPATHIC OSTEONECROSIS

11.7 OSTEONECROSIS OF THE SCAPHOID

11.7.1 TRAUMATIC

11.7.2 NON-TRAUMATIC

11.7.3 IDIOPATHIC OSTEONECROSIS

11.8 OTHERS

12 U.S. OSTEONECROSIS MARKET, BY DRUG TYPE

12.1 OVERVIEW

12.2 BRANDED

12.2.1 ORAL

12.2.1.1 TABLETS

12.2.1.2 CAPSULES

12.2.2 PARENTERAL

12.2.3 OTHERS

12.3 GENERIC

12.3.1 ORAL

12.3.1.1 TABLETS

12.3.1.2 CAPSULES

12.3.2 PARENTERAL

12.3.3 OTHERS

13 U.S. OSTEONECROSIS MARKET, BY PRESCRIPTION

13.1 OVERVIEW

13.2 PRESCRIBED DRUGS

13.3 OVER THE COUNTER DRUGS

14 U.S. OSTEONECROSIS MARKET, BY GENDER

14.1 OVERVIEW

14.2 MALE

14.3 FEMALE

15 U.S. OSTEONECROSIS MARKET, BY AGE

15.1 OVERVIEW

15.2 ADULT

15.3 GERIATRIC

15.4 CHILDREN

16 U.S. OSTEONECROSIS MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.2.1 PUBLIC

16.2.2 PRIVATE

16.3 ORTHOPEDIC CLINICS

16.4 SPECIALTY CLINICS

16.5 AMBULATORY CENTERS

16.6 OTHERS

17 U.S. OSTEONECROSIS MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 RETAIL SALES

17.2.1 HOSPITAL PHARMACY

17.2.2 RETAIL PHARMACY

17.2.3 ONLINE PHARMACY

17.3 DIRECT TENDER

18 U.S. OSTEONECROSIS MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: U.S.

19 SWOT ANALYSIS

20 U.S. OSTEONECROSIS MARKET, CPS

20.1 TEVA PHARMACEUTICALS USA, INC. (SUBSIDIARY OF TEVA PHARMACEUTICAL INDUSTRIES LTD.)

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 PFIZER INC. (2022)

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 BAYER AG (2022)

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 STRYKER

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 ARTHREX, INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 PRODUCT PORTFOLIO

20.5.3 RECENT DEVELOPMENT

20.6 ALMATICA PHARMA

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 DR. REDDY'S LABORATORIES LTD. (2022)

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENT

20.8 HALEON GROUP OF COMPANIES

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENT

20.9 SCIEGEN PHARMACEUTICALS.

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 ZIMMER BIOMET

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 COST OF OSTEONECROSIS TREATMENT SURGERIES

TABLE 2 U.S. OSTEONECROSIS MARKET, PIPELINE ANALYSIS

TABLE 3 U.S. OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 U.S. OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 U.S. TREATMENT IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 U.S. SURGERY IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 7 U.S. MEDICATION IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 8 U.S. NSAIDS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 9 U.S. BLOOD THINNERS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 10 U.S. OSTEOPOROSIS DRUGS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 11 U.S. CHOLESTEROL-LOWERING DRUGS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 12 U.S. PHYSICAL THERAPY IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 13 U.S. CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 14 U.S. AXILLA CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 15 U.S. ELBOW CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 16 U.S. OPEN-CUFF ELBOW CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 17 U.S. CLOSED-CUFF ELBOW CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 18 U.S. GUTTER CRUTCHES IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 19 U.S. CASTING AND BRACING IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 20 U.S. OTHERS IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 21 U.S. DIAGNOSIS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 U.S. IMAGING TEST IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 U.S. MAGNETIC RESONANCE IMAGING (MRI) IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 U.S. CLOSED BORE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 U.S. OPEN BORE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 U.S. COMPUTED TOMOGRAPHY SCANNING IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 U.S. X-RAY IMAGING IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 U.S. RADIOGRAPHY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 U.S. FLUOROSCOPY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 U.S. OTHERS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 U.S. ULTRASOUND IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 U.S. 2D ULTRASOUND IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 U.S. DOPPLER ULTRASOUND IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 U.S. 3D & 4D ULTRASOUND IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 U.S. BIOPSY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 U.S. OSTEONECROSIS MARKET, BY STAGES, 2021-2030 (USD THOUSAND)

TABLE 37 U.S. OSTEONECROSIS MARKET, BY LOCATION, 2021-2030 (USD THOUSAND)

TABLE 38 U.S. OSTEONECROSIS OF HIP/FEMORAL HEAD OSTEONECROSIS IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.S. IDIOPATHIC OSTEONECROSIS IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 U.S. LEGG-CALVE-PERTHES DISEASE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 U.S. TREATMENT IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 U.S. NON-SURGICAL IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 U.S. ANTI-INFLAMMATORY MEDICATIONS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 U.S. BISPHOSPHONATES MEDICATIONS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 U.S. CRUTCHES IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. CASTING AND BRACING IN OSTEONECROSIS MARKET, BY TREATMENT, 2021-2030 (USD THOUSAND)

TABLE 47 U.S. SURGICAL IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 U.S. FEMORAL OSTEOTOMY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 U.S. INNOMINATE OSTEOTOMY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 U.S. DIAGNOSIS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 U.S. MAGNETIC RESONANCE IMAGING (MRI) IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 U.S. CLOSED BORE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 U.S. OPEN BORE IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 U.S. COMPUTED TOMOGRAPHY SCANNING IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 U.S. X-RAY IMAGING IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 U.S. RADIOGRAPHY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 U.S. FLUOROSCOPY IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 U.S. OSTEONECROSIS OF THE KNEE IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 U.S. OSTEONECROSIS OF THE SHOULDER IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 U.S. OSTEONECROSIS OF THE TALUS IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 U.S. OSTEONECROSIS OF THE LUNATE IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 U.S. OSTEONECROSIS OF THE SCAPHOID IN OSTEONECROSIS MARKET, BY DISEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 U.S. OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 U.S. BRANDED IN OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 U.S. ORAL IN OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 U.S. GENERIC IN OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 U.S. ORAL IN OSTEONECROSIS MARKET, BY DRUG TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 U.S. OSTEONECROSIS MARKET, BY PRESCRIPTION, 2021-2030 (USD THOUSAND)

TABLE 69 U.S. OSTEONECROSIS MARKET, BY GENDER, 2021-2030 (USD THOUSAND)

TABLE 70 U.S. OSTEONECROSIS MARKET, BY AGE, 2021-2030 (USD THOUSAND)

TABLE 71 U.S. OSTEONECROSIS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 72 U.S. HOSPITALS IN OSTEONECROSIS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 U.S. OSTEONECROSIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 74 U.S. RETAIL SALES IN OSTEONECROSIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 U.S. OSTEONECROSIS MARKET: SEGMENTATION

FIGURE 2 U.S. OSTEONECROSIS MARKET: DATA TRIANGULATION

FIGURE 3 U.S. OSTEONECROSIS MARKET: DROC ANALYSIS

FIGURE 4 U.S. OSTEONECROSIS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. OSTEONECROSIS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. OSTEONECROSIS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. OSTEONECROSIS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. OSTEONECROSIS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 U.S. OSTEONECROSIS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.S. OSTEONECROSIS MARKET: SEGMENTATION

FIGURE 11 INCREASING NUMBER OF TRAUMATIC INJURIES IS EXPECTED TO DRIVE THE GROWTH OF THE U.S. OSTEONECROSIS MARKET IN THE FORECAST PERIOD

FIGURE 12 THE TRAUMATIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. OSTEONECROSIS MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC KNEE CARTILAGE REPAIR MARKET

FIGURE 14 U.S. OSTEONECROSIS MARKET: BY DISEASE TYPE, 2022

FIGURE 15 U.S. OSTEONECROSIS MARKET: BY DISEASE TYPE, 2023-2030 (USD THOUSAND)

FIGURE 16 U.S. OSTEONECROSIS MARKET: BY DISEASE TYPE, CAGR (2023-2030)

FIGURE 17 U.S. OSTEONECROSIS MARKET: BY DISEASE TYPE, LIFELINE CURVE

FIGURE 18 U.S. OSTEONECROSIS MARKET: BY TYPE, 2022

FIGURE 19 U.S. OSTEONECROSIS MARKET: BY TYPE, 2023-2030 (USD THOUSAND)

FIGURE 20 U.S. OSTEONECROSIS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 21 U.S. OSTEONECROSIS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 U.S. OSTEONECROSIS MARKET: BY STAGES, 2022

FIGURE 23 U.S. OSTEONECROSIS MARKET: BY STAGES, 2023-2030 (USD THOUSAND)

FIGURE 24 U.S. OSTEONECROSIS MARKET: BY STAGES, CAGR (2023-2030)

FIGURE 25 U.S. OSTEONECROSIS MARKET: BY STAGES, LIFELINE CURVE

FIGURE 26 U.S. OSTEONECROSIS MARKET: BY LOCATION, 2022

FIGURE 27 U.S. OSTEONECROSIS MARKET: BY LOCATION, 2023-2030 (USD THOUSAND)

FIGURE 28 U.S. OSTEONECROSIS MARKET: BY LOCATION, CAGR (2023-2030)

FIGURE 29 U.S. OSTEONECROSIS MARKET: BY LOCATION, LIFELINE CURVE

FIGURE 30 U.S. OSTEONECROSIS MARKET: BY DRUG TYPE, 2022

FIGURE 31 U.S. OSTEONECROSIS MARKET: BY DRUG TYPE, 2023-2030 (USD THOUSAND)

FIGURE 32 U.S. OSTEONECROSIS MARKET: BY DRUG TYPE, CAGR (2023-2030)

FIGURE 33 U.S. OSTEONECROSIS MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 34 U.S. OSTEONECROSIS MARKET: BY PRESCRIPTION, 2022

FIGURE 35 U.S. OSTEONECROSIS MARKET: BY PRESCRIPTION, 2023-2030 (USD THOUSAND)

FIGURE 36 U.S. OSTEONECROSIS MARKET: BY PRESCRIPTION, CAGR (2023-2030)

FIGURE 37 U.S. OSTEONECROSIS MARKET: BY PRESCRIPTION, LIFELINE CURVE

FIGURE 38 U.S. OSTEONECROSIS MARKET: BY GENDER, 2022

FIGURE 39 U.S. OSTEONECROSIS MARKET: BY GENDER, 2023-2030 (USD THOUSAND)

FIGURE 40 U.S. OSTEONECROSIS MARKET: BY GENDER, CAGR (2023-2030)

FIGURE 41 U.S. OSTEONECROSIS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 42 U.S. OSTEONECROSIS MARKET: BY AGE, 2022

FIGURE 43 U.S. OSTEONECROSIS MARKET: BY AGE, 2023-2030 (USD THOUSAND)

FIGURE 44 U.S. OSTEONECROSIS MARKET: BY AGE, CAGR (2023-2030)

FIGURE 45 U.S. OSTEONECROSIS MARKET: BY AGE, LIFELINE CURVE

FIGURE 46 U.S. OSTEONECROSIS MARKET: BY END USER, 2022

FIGURE 47 U.S. OSTEONECROSIS MARKET: BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 48 U.S. OSTEONECROSIS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 49 U.S. OSTEONECROSIS MARKET: BY END USER, LIFELINE CURVE

FIGURE 50 U.S. OSTEONECROSIS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 51 U.S. OSTEONECROSIS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD THOUSAND)

FIGURE 52 U.S. OSTEONECROSIS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 53 U.S. OSTEONECROSIS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 54 U.S. OSTEONECROSIS MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.